Introduction

Trading 212 Review has distinguished itself as a leading fintech company, aiming to democratize the financial markets with its user-friendly and accessible trading platform. Offering a comprehensive suite of trading and investment services, Trading 212 Review enables individuals to trade forex, stocks, commodities, and more, without the traditional barriers of high fees and complex interfaces. This chapter provides an overview of Trading 212, highlighting its mission, regulatory compliance, innovative platform features, and the diverse range of tradable instruments available to its users.

Company Mission and Overview

- Innovative Approach: Since its inception, Trading 212 Review has focused on making financial trading and investing accessible to a broader audience, leveraging technology to simplify the trading experience and reduce costs.

Regulatory Framework

- Robust Regulatory Oversight: Trading 212 Review operates under stringent regulatory oversight by reputable authorities, including the UK’s Financial Conduct Authority (FCA), ensuring a secure and transparent trading environment for its clients.

Trading Platforms and Tools

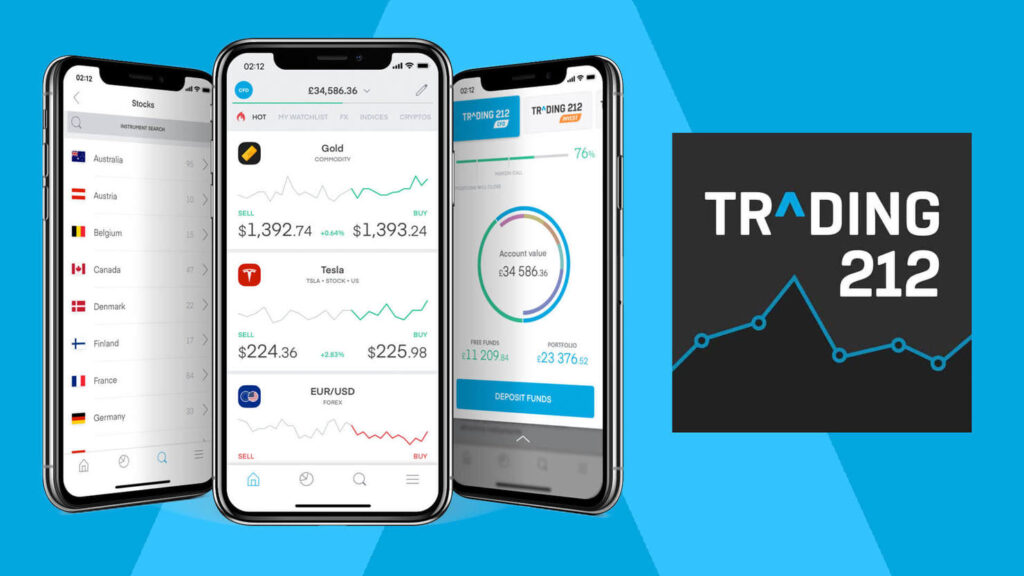

- Proprietary Trading Platform: Trading 212 Review offers its proprietary trading platform, available on both desktop and mobile devices, designed for intuitive trading and equipped with powerful analytical tools, real-time data, and seamless execution capabilities.

Markets and Instruments

- Wide Array of Tradable Assets: Clients have access to a diverse range of financial instruments, including stocks, ETFs, forex, commodities, and cryptocurrencies, allowing for comprehensive portfolio diversification and investment strategies.

Educational Resources and Support

- Commitment to Education: Trading 212 Review invests in trader education, providing an extensive library of tutorials, articles, and videos designed to enhance trading knowledge and skills for investors at all levels.

Weighing the Advantages and Drawbacks of Trading 212 Review

Tickmill stands out in the forex and CFD trading sphere for its competitive offerings and client-centric services. However, like any broker, it has its own set of advantages and limitations. This chapter aims to provide a balanced view of Tickmill’s services, helping traders to understand what to expect when choosing Tickmill as their trading partner.

Pros of Trading with Trading 212 Review

- Competitive Spreads: Trading 212 Review is known for its tight spreads, starting from 0.0 pips on major forex pairs, which can significantly reduce trading costs for active traders.

- Regulatory Assurance: Operating under the regulation of reputable authorities like the FCA, CySEC, and FSA provides traders with a layer of security and trust in Tickmill’s operations.

- Rapid Execution Speeds: Trading 212 Review prides itself on offering fast execution speeds, minimizing slippage and ensuring traders can enter and exit the markets at their preferred prices.

- No Requotes: The broker’s policy of no requotes ensures that trades are executed without delay or adjustment, providing transparency and reliability in trade execution.

- Diverse Trading Instruments: With access to a wide range of markets, including forex, indices, commodities, and bonds, Tickmill allows traders to diversify their investment strategies.

- Comprehensive Educational Resources: Tickmill offers a robust selection of educational materials and webinars, catering to both novice and experienced traders looking to enhance their trading knowledge.

Cons of Trading with Trading 212 Review

- Limited Platform Choice: Trading 212 Review primarily offers the MetaTrader 4 platform. While MT4 is highly acclaimed, some traders might prefer access to other platforms like MetaTrader 5 or proprietary trading software.

- Restricted Product Portfolio in Some Jurisdictions: Depending on the trader’s location, the range of products and instruments available for trading might be limited due to regulatory restrictions.

- No Cryptocurrency Trading: As of the latest update, Tickmill does not offer direct cryptocurrency trading, which might be a drawback for traders interested in the crypto market.

- Inactivity Fees: Trading 212 Review charges an inactivity fee for accounts that have not conducted any trading activity for a prolonged period, which traders need to consider when managing their accounts.

Weighing the Benefits and Drawbacks: A Comprehensive Trading 212 Review

Trading 212 has emerged as a significant player in the online brokerage space, attracting traders and investors with its user-friendly platform, extensive asset offerings, and innovative features. Like any trading platform, it presents a unique set of advantages and potential limitations. This chapter delves into the pros and cons of using Trading 212, providing an objective analysis to help users make informed decisions.

Pros of Trading 212 Review

- Zero Commission Trading: Trading 212 offers zero commission trading on a wide range of assets, including stocks, ETFs, and forex pairs, making it an attractive option for cost-conscious traders.

- No Minimum Deposit: The platform allows traders to start with any amount, eliminating barriers to entry for novice investors and those looking to start small.

- User-Friendly Interface: Trading 212 is known for its intuitive and sleek interface, suitable for both beginners and experienced traders, facilitating easy navigation and trade execution.

- Extensive Asset Offerings: With access to thousands of tradable assets across stocks, ETFs, forex, commodities, and cryptocurrencies, Trading 212 caters to a diverse investment appetite.

- Practice with a Demo Account: The platform provides a fully-featured demo account, enabling users to practice trading strategies with virtual money, risk-free.

- Innovative Trading Tools: Features like fractional shares allow investors to buy portions of expensive stocks, making it easier to diversify portfolios without significant capital.

Cons of Trading 212 Review

- Limited Advanced Features for Professional Traders: Some advanced traders may find the platform lacks certain sophisticated tools and functionalities found in more specialized trading software.

- Customer Support Response Times: During peak times, customer support response can be slower than some users might expect, potentially leading to frustration for traders needing immediate assistance.

- Withdrawal and Deposit Options: While Trading 212 offers various funding methods, the availability of certain options like PayPal can be limited, depending on the user’s location.

- Market Coverage: Despite a wide range of assets, some niche markets and instruments may not be available, which could limit trading strategies for certain investors.

- Regulatory Restrictions: Depending on the trader’s country of residence, some of Trading 212’s features and instruments might be restricted due to local regulatory frameworks.

Navigating Trading 212’s Fee Structure

Trading 212 Review is celebrated for its commitment to providing a transparent and cost-effective trading environment. This dedication is evident in its straightforward fee structure, designed to empower traders and investors by minimizing costs and maximizing investment potential. This chapter delves into the specifics of Trading 212’s fees, including commission charges, spread details, and any other relevant costs, providing a clear overview for users to manage their trading finances effectively.

Zero Commission Trading

- Equities and ETFs: Trading 212 offers zero commission trading on stocks and ETFs, enabling traders to execute transactions without incurring additional costs, a significant advantage for cost-sensitive investors.

Spreads

- Competitive Spreads: For forex, commodities, and indices trading, Trading 212 maintains competitive spreads, ensuring traders can execute orders at prices close to market rates. The platform’s transparency about its spread costs aids traders in making informed decisions.

No Account Fees

- Maintenance and Inactivity: Trading 212 does not charge account maintenance or inactivity fees, furthering its appeal to casual investors and those taking a break from trading activities.

Currency Conversion Fees

- Foreign Exchange Transactions: When trading assets in a currency different from the account’s base currency, Trading 212 applies a currency conversion fee. This fee is competitive within the industry, but traders should consider it when planning trades involving foreign currencies.

Deposit and Withdrawal Fees

- Funding the Account: It allows for free deposits and withdrawals, although users should be aware of potential charges from payment providers or banks, especially for international bank transfers.

CFD Trading Charges

- Overnight Fees: For traders using the CFD platform, overnight fees or swap rates apply to positions held open overnight, reflecting the cost of leverage. This provides a clear schedule of these rates on its website.

Additional Charges

- Professional Account Fees: Traders classified as professional clients may encounter different fee structures, including potential leverage costs and margin rates, tailored to the advanced services and features they access.

Empowering Traders: Trading 212’s Educational Initiatives and Innovative Features

Trading 212 distinguishes itself in the competitive landscape of online brokerage firms by prioritizing trader education and integrating innovative features into its service offerings. This approach not only enhances the trading experience but also equips users with the knowledge and tools needed for successful market engagement. This chapter explores Trading 212’s commitment to trader education, its innovative trading features, and the overall value these elements bring to the trading community.

Comprehensive Educational Resources

Trading 212 believes in empowering its users through education, offering a wide array of resources designed to elevate traders’ understanding of the markets:

- Extensive Video Library: Trading 212’s YouTube channel and platform-hosted tutorials provide in-depth lessons on trading basics, technical analysis, and advanced strategies, catering to learners at all levels.

- Interactive Courses: Users can access interactive courses and quizzes on the Trading 212 app and website, offering a structured learning path from novice to advanced trading concepts.

- Real-time Market Analysis: Beyond theoretical knowledge, Trading 212 offers real-time market analysis, helping traders apply learning to live market conditions, fostering a practical understanding of trading dynamics.

Innovative Trading Features

Trading 212’s platform is replete with innovative features that streamline the trading process and enhance decision-making:

- Fractional Shares: One of Trading 212’s standout features is the ability to buy fractional shares, allowing traders to invest in high-value stocks with smaller amounts of capital, democratizing access to expensive market assets.

- AutoInvest & Pies: The AutoInvest feature and the concept of ‘Pies’ enable users to automate their investment strategies and manage portfolios with ease, promoting a disciplined and long-term investment approach.

User-Centric Platform Design

The design philosophy behind Trading 212’s platform emphasizes user engagement and satisfaction:

- Simplified User Interface: The platform’s interface is designed for clarity and ease of use, ensuring that traders of all experience levels can navigate and execute trades efficiently.

- Customization Options: Trading 212 offers various customization options, allowing users to tailor their dashboards and settings to fit their trading preferences and monitor their investments effectively.

Community Engagement and Support

Trading 212 fosters a vibrant community of traders, encouraging knowledge sharing and support:

- Active User Forums: The platform hosts user forums and discussion boards where traders can exchange ideas, strategies, and experiences, building a supportive trading community.

- Feedback Loop: It actively solicits user feedback to continually refine its offerings, demonstrating a commitment to innovation and customer satisfaction.

Harnessing the Power of Trading 212’s Platforms and Tools

Trading 212 distinguishes itself in the online brokerage space with its powerful, user-friendly trading platforms and a suite of innovative tools designed to enhance the trading experience. From novice investors to seasoned traders, Trading 212’s offerings cater to a wide audience by providing the necessary resources for informed decision-making and strategic trading. This chapter explores the functionalities and benefits of Trading 212’s trading platforms and tools, highlighting how they contribute to a comprehensive and efficient trading process.

Trading 212 Platform Overview

- Web-Based Platform: Trading 212 offers a robust web-based trading platform that combines ease of use with deep functionality. Traders can access a wide range of markets and execute trades directly from their web browser without the need for downloads or installations.

- Mobile App: Recognized for its intuitiveness and comprehensive features, the Trading 212 mobile app allows traders to manage their portfolios, execute trades, and monitor the markets on the go, ensuring they never miss a trading opportunity.

Key Features and Tools

- Advanced Charting: Trading 212’s platforms provide advanced charting capabilities, including a variety of technical indicators, chart types, and drawing tools, enabling detailed market analysis and strategy development.

- Demo Account: The platform offers a fully functional demo account, allowing users to practice trading strategies in a risk-free environment with virtual funds, an invaluable resource for beginners and experienced traders looking to test new approaches.

- Risk Management Tools: With features such as stop loss and take profit orders, traders can effectively manage risk, protecting their capital and locking in profits by setting predetermined exit levels for their trades.

Real-Time Market Data and Analysis

- Live Market Updates: Trading 212 ensures traders have access to real-time market data and financial news, keeping them informed of the latest market developments and economic events that could impact their trading decisions.

- Economic Calendar: The economic calendar feature provides an overview of upcoming economic events, earnings reports, and indicators, allowing traders to anticipate market movements and plan their trades accordingly.

Educational Resources

- Comprehensive Learning Materials: Trading 212 invests in trader education through a variety of learning materials, including video tutorials, articles, and webinars, covering trading basics, advanced strategies, and market analysis techniques.

Customization and Personalization

- Personalized Trading Experience: The platform allows for significant customization, enabling traders to tailor the interface to their preferences, create custom watchlists, and set up personalized alerts for price movements, news, and economic events.

Ensuring Trust and Security: Trading 212’s Regulatory Compliance and Safeguards

In the digital era of finance, regulatory compliance and robust security measures stand as pillars of trust and reliability for online brokers. Trading 212, cognizant of these critical aspects, adheres to stringent regulatory standards and employs advanced security protocols to protect its clients’ interests. This chapter outlines Trading 212’s regulatory framework and the comprehensive security measures it has in place, showcasing the broker’s commitment to providing a secure and trustworthy trading environment.

Regulatory Compliance

- Strictly Regulated: Trading 212 is authorized and regulated by several of the world’s most respected financial authorities, including the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies ensure that Trading 212 operates within strict financial and ethical standards, providing traders with peace of mind regarding the safety of their funds and the integrity of their trades.

- Investor Protection: As part of its regulatory compliance, Trading 212 adheres to investor protection schemes like the Financial Services Compensation Scheme (FSCS) in the UK and the Investor Compensation Fund (ICF) in Cyprus, offering an additional layer of security to its clients’ capital.

Client Fund Security

- Segregated Accounts: In line with regulatory requirements, Trading 212 keeps clients’ funds in segregated bank accounts, ensuring that clients’ investments are kept separate from the company’s own funds, safeguarding against misappropriation.

Advanced Security Protocols

- Data Encryption: Trading 212 employs state-of-the-art encryption technologies to secure clients’ personal and financial information, protecting against unauthorized access and data breaches.

- Two-Factor Authentication (2FA): To enhance account security, Trading 212 supports Two-Factor Authentication, adding an extra layer of protection to the login process and preventing unauthorized account access.

Continuous Monitoring and Updates

- Regular Security Audits: Trading 212 undergoes regular security audits to identify and rectify potential vulnerabilities, ensuring the platform’s defenses remain impervious to emerging threats.

- System Updates: The broker continuously updates its trading platforms and security systems to incorporate the latest security features and technologies, keeping pace with the evolving cybersecurity landscape.

Educating Traders on Security

- Awareness and Best Practices: Trading 212 actively educates its clients on cybersecurity best practices, including how to recognize phishing attempts, secure their trading environment, and protect their personal information.

Navigating Customer Support at Trading 212

In the dynamic world of online trading, access to responsive and effective customer support is crucial for a seamless trading experience. Trading 212 understands this necessity and offers a robust support system designed to assist traders with various inquiries and challenges efficiently. This chapter explores the dimensions of Trading 212’s customer support, underscoring the broker’s dedication to providing timely and proficient assistance to its clients.

Diverse Channels for Support

Trading 212 ensures that clients can easily access support through various means, catering to different preferences and ensuring timely assistance:

- 24/7 Support Availability: Trading 212 distinguishes itself by offering around-the-clock customer support, acknowledging that financial markets operate globally and clients may require assistance at any time.

- Live Chat Service: For quick queries and instant resolutions, Trading 212’s live chat feature connects traders directly with knowledgeable support representatives in real time.

- Email Support: Clients preferring to communicate via email can expect detailed and thoughtful responses to their inquiries, with Trading 212 committed to providing comprehensive answers to support requests.

Dedicated Account Assistance

- Personalized Service: While Trading 212 emphasizes efficiency and accessibility in its support services, clients with specific account management needs can receive tailored assistance, ensuring their trading activities are supported adequately.

Extensive Online Resources and FAQs

Complementing its direct support channels, Trading 212 offers a wealth of online resources and FAQs, empowering clients to find answers independently:

- Help Center: A comprehensive knowledge base covers a wide range of topics, from account setup and platform usage to trading strategies and technical issues.

- Educational Resources: Trading 212 provides an extensive array of learning materials, including articles, video tutorials, and webinars, catering to traders at all levels of experience and enhancing their trading knowledge.

Multilingual Support

- Global Accessibility: Reflecting its international client base, Trading 212’s customer support is available in multiple languages, ensuring traders worldwide receive assistance in their preferred language, enhancing clarity and understanding.

Feedback and Continuous Improvement

- Client Feedback Mechanism: Trading 212 values client feedback as an integral part of its service improvement strategy. Traders are encouraged to share their support experiences, which Trading 212 uses to continually refine its customer support offerings.

Simplifying Financial Transactions: Trading 212’s Deposits and Withdrawals

For traders and investors, the efficiency and security of depositing and withdrawing funds are pivotal elements that influence the choice of an online broker. Trading 212 has streamlined its processes for financial transactions, ensuring that clients can manage their funds easily and securely. This chapter provides a detailed look at the procedures, options, and considerations for making deposits and withdrawals with Trading 212, underscoring the platform’s commitment to user convenience and financial safety.

Deposit Methods

Trading 212 offers a variety of deposit methods to accommodate clients’ preferences and ensure quick account funding:

- Bank Transfers: Secure and straightforward, allowing for direct transfers from clients’ bank accounts to their Trading 212 accounts.

- Credit/Debit Cards: Instant deposits are facilitated through major credit and debit cards, providing immediate access to funds for trading.

- E-Wallets: Trading 212 supports deposits via popular e-wallets such as PayPal, Skrill, and Neteller, offering an efficient and flexible way to fund trading accounts.

Withdrawal Procedures

Trading 212 has simplified the withdrawal process, enabling clients to access their funds with ease:

- Withdrawal to Original Funding Source: In line with anti-money laundering policies, withdrawals are typically processed back to the original source of funds, whether it be a bank account, credit card, or e-wallet.

- Timely Processing: Trading 212 aims to process withdrawal requests swiftly, often within a few business days, ensuring clients can access their funds without unnecessary delays.

Security Measures

To ensure the security of financial transactions, Trading 212 employs several protective measures:

- Verification Process: Clients are required to undergo a verification process, confirming their identity and preventing unauthorized access to funds.

- Encryption and Data Protection: Advanced encryption techniques safeguard personal and financial information during transactions, adhering to strict data protection standards.

No Hidden Fees

- Transparent Fee Structure: Trading 212 prides itself on transparency, disclosing any potential fees associated with deposits and withdrawals upfront, ensuring clients are fully informed.

Currency Conversion

- Competitive Conversion Rates: For transactions involving different currencies, Trading 212 offers competitive currency conversion rates, minimizing the cost impact on clients.

Special Considerations

- Minimum and Maximum Limits: Trading 212 may impose minimum and maximum transaction limits for deposits and withdrawals, clearly communicated within the platform’s terms and conditions.

- Regulatory Compliance: Clients should be aware of any regulatory requirements that might affect deposit and withdrawal processes, including proof of funds and anti-money laundering checks.

Exploring Trading 212’s Account Types and Terms

Trading 212 stands out for its flexible approach to catering to a diverse clientele, offering a variety of account types designed to meet the needs of different investors and traders. From those taking their first steps in the financial markets to experienced traders looking for advanced features, Trading 212 provides tailored solutions. This chapter delves into the specific account types available on Trading 212, highlighting the terms and conditions associated with each, to help users make an informed choice that best suits their trading style and goals.

Account Types Overview

Trading 212 simplifies its offering into two primary account types, each with distinct features and benefits, ensuring traders can select the option that aligns with their investment strategy and experience level.

CFD Account

- For Speculative Trading: The CFD account is designed for traders who wish to speculate on the price movements of various financial instruments without owning the underlying assets. It offers access to leverage, enabling traders to open larger positions with a smaller capital outlay.

- Features and Terms: Includes competitive spreads, zero commission on trades (excluding shares), and access to a wide range of markets including forex, stocks, commodities, and indices.

Invest Account

- Long-term Investing: Tailored for investors looking to build a portfolio of stocks and ETFs, the Invest account offers direct ownership of assets with zero commission on trades, making it ideal for building and holding investments over time.

- Features and Terms: Provides access to global stock exchanges and a wide selection of ETFs, with no limit on trading volume and no maintenance fees, facilitating a straightforward approach to investing.

Practice Account (Demo Account)

- Risk-free Trading Environment: Trading 212 also offers a demo account loaded with virtual funds, allowing beginners to practice trading strategies and experienced traders to test new ideas without any financial risk.

- Features and Terms: Mirrors the live trading environment, offering a valuable tool for learning and experimentation.

Special Features Across Accounts

- Fractional Shares: Both account types offer the option to invest in fractional shares, enabling traders and investors to purchase portions of high-value stocks with smaller amounts of capital.

- Automatic Investing: The Invest account provides features for setting up automatic investment plans, allowing users to automate their investment strategy based on specific criteria and goals.

Regulatory Compliance and Protection

- Client Fund Security: Trading 212 adheres to regulatory requirements, ensuring client funds are held in segregated accounts for added security.

- Regulatory Bodies: Trading 212 is regulated by the Financial Conduct Authority (FCA) in the UK, among other regulatory bodies, offering a high level of investor protection and compliance with financial regulations.

Dispelling Myths: Is Trading 212 a Scam?

In an era where digital finance platforms proliferate, distinguishing reputable brokers from fraudulent ones is crucial for traders and investors. Concerns about the legitimacy of online brokers, including Trading 212, often arise among potential users. This chapter aims to address these concerns by examining Trading 212’s regulatory compliance, security measures, and overall reputation, providing a clear perspective on its legitimacy and reliability.

Regulatory Compliance and Oversight

- Regulated and Authorized: Trading 212 is authorized and regulated by the Financial Conduct Authority (FCA) in the UK, one of the most stringent financial regulatory bodies globally. This ensures that Trading 212 adheres to strict operational standards, client fund protection, and fair trading practices.

- Global Regulation: In addition to FCA regulation, Trading 212 adheres to regulations in other jurisdictions, further affirming its commitment to compliance and investor protection.

Client Fund Security

- Segregated Client Accounts: Trading 212 ensures the security of client funds by holding them in segregated accounts with reputable banking institutions. This separation protects clients’ investments from being used for any other purpose.

Transparency and Fairness

- Clear Fee Structure: Trading 212 is known for its transparent fee policy, with clear disclosure of any charges that might apply, ensuring traders can make informed decisions without concerns about hidden costs.

- Public Disclosure: The platform provides extensive information about its operations, regulatory status, and risk warnings, promoting transparency and fostering trust with its clients.

Security Measures

- Advanced Data Protection: Trading 212 employs state-of-the-art encryption technologies to secure clients’ personal and financial information, safeguarding against unauthorized access and data breaches.

- Two-Factor Authentication (2FA): For enhanced account security, Trading 212 supports 2FA, requiring users to provide two forms of identification before accessing their accounts, significantly reducing the risk of unauthorized use.

Customer Feedback and Reviews

- Positive Client Testimonials: Numerous positive reviews from clients highlight Trading 212’s reliable platform, customer service, and user-friendly interface, reflecting a high level of client satisfaction.

- Addressing Complaints: Trading 212’s actively addresses and resolves client complaints and queries, demonstrating its dedication to maintaining strong customer relations and improving its services based on feedback.

Clarifying Common Queries: Trading 212 Frequently Asked Questions

When considering or actively using Trading 212’s platform, users often have a variety of questions about its services, features, and policies. Addressing these inquiries is essential for ensuring a smooth and informed trading experience. This chapter aims to answer some of the most frequently asked questions about Trading 212, providing clear and concise information to assist users in navigating the platform effectively.

1) How Do I Open an Account with Trading 212?

Opening an account with Trading 212 involves a simple online registration process. Prospective users need to fill out an application form on the Trading 212 website or mobile app, providing personal details and verifying their identity and address as part of the regulatory requirements. The process typically concludes with the activation of the account once all necessary documentation is approved.

2) What Types of Accounts Does Trading 212 Offer?

Trading 212 offers two primary account types: the CFD account, for trading contracts for differences across a wide range of financial instruments, and the Invest account, designed for purchasing and holding stocks and ETFs commission-free. Additionally, Trading 212 provides a Practice (Demo) account loaded with virtual funds for users to experiment with trading strategies risk-free.

3) Can I Trade Cryptocurrencies on Trading 212?

Yes, Trading 212 allows trading in cryptocurrency CFDs, enabling users to speculate on the price movements of popular cryptocurrencies without owning the underlying assets. It’s important to note that cryptocurrency CFDs are available in the CFD account and subject to the platform’s terms and conditions.

4) What Trading Platforms Are Available at Trading 212?

Trading 212 offers a proprietary trading platform accessible via a web browser or through its highly-rated mobile app. The platform features a user-friendly interface, advanced charting tools, and a range of analytical instruments designed to cater to both novice and experienced traders.

5) How Does Trading 212 Handle Deposits and Withdrawals?

Trading 212 supports various methods for deposits and withdrawals, including bank transfers, credit/debit cards, and e-wallets like PayPal. The platform aims to process withdrawals swiftly, with most requests completed within a few business days. Trading 212 prides itself on not charging any fees for deposits or withdrawals, although users should be aware of potential third-party fees.

6) Is Trading 212 Regulated?

Yes, Trading 212 is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring a high standard of consumer protection and compliance with financial laws and regulations. The platform’s regulatory status contributes significantly to its reputation as a reliable and trustworthy broker.

7) Does Trading 212 Offer Educational Resources?

Trading 212 offers a comprehensive suite of educational materials, including articles, videos, and webinars designed to enhance traders’ knowledge and skills. These resources cover a wide range of topics, from basic trading concepts to more advanced strategies and market analysis techniques.

8) How Can I Contact Trading 212’s Customer Support?

Trading 212’s customer support can be reached via email and live chat. The support team is available to address any questions or issues, offering assistance in multiple languages to accommodate the platform’s diverse user base.