Long-term investing is a strategy focused on holding assets for an extended period, typically years or decades, to capitalize on the growth potential of markets or individual assets. This approach contrasts with short-term trading, where the aim is to generate profits from market fluctuations over a shorter timeframe. Understanding the principles and benefits of long-term investing, including the power of compounding interest, is essential for anyone looking to build wealth over time.

Definition of Long-term Investing

Long-term investing involves buying and holding assets with the expectation that they will appreciate in value over many years. This strategy is often associated with a less active trading stance, where investors are not swayed by short-term market volatility but instead focus on the potential for steady, incremental growth.

Key Characteristics:

- Patience: Long-term investors are patient, willing to ride out the ups and downs of the market with an eye on their long-term goals.

- Research: Investments are chosen based on thorough research and a belief in the asset’s long-term growth potential.

- Diversification: A diversified portfolio is common in long-term investing to spread risk across various assets and sectors.

Benefits of Long-Term Investing

Reduced Impact of Market Volatility

By holding investments for many years, long-term investors can lessen the impact of short-term market fluctuations on their portfolio. This approach acknowledges that while markets can be volatile in the short term, they have historically trended upwards over the long term.

Lower Transaction Costs

Frequent trading incurs costs that can eat into profits. Long-term investing minimizes these costs since transactions are less frequent, allowing more of the investment to grow.

Tax Advantages

In many jurisdictions, long-term investments benefit from favorable tax treatment. Capital gains on assets held for longer periods may be taxed at a lower rate than short-term gains, providing a tax-efficient way to build wealth.

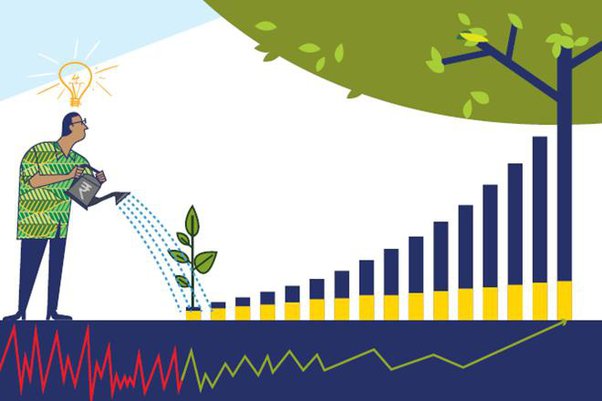

Understanding the Power of Compounding Interest

Compounding interest is often referred to as the “eighth wonder of the world” for its ability to exponentially increase the value of an investment over time. It occurs when the earnings on an investment, both capital gains, and interest, are reinvested to generate their own earnings.

Example:

If you invest $10,000 with an annual return of 5%, the first year’s earnings are $500, making the total $10,500. If those earnings are reinvested, the next year’s return is calculated on $10,500, leading to earnings of $525 and a total of $11,025. Over many years, this compounding effect can lead to significant growth in the investment value.

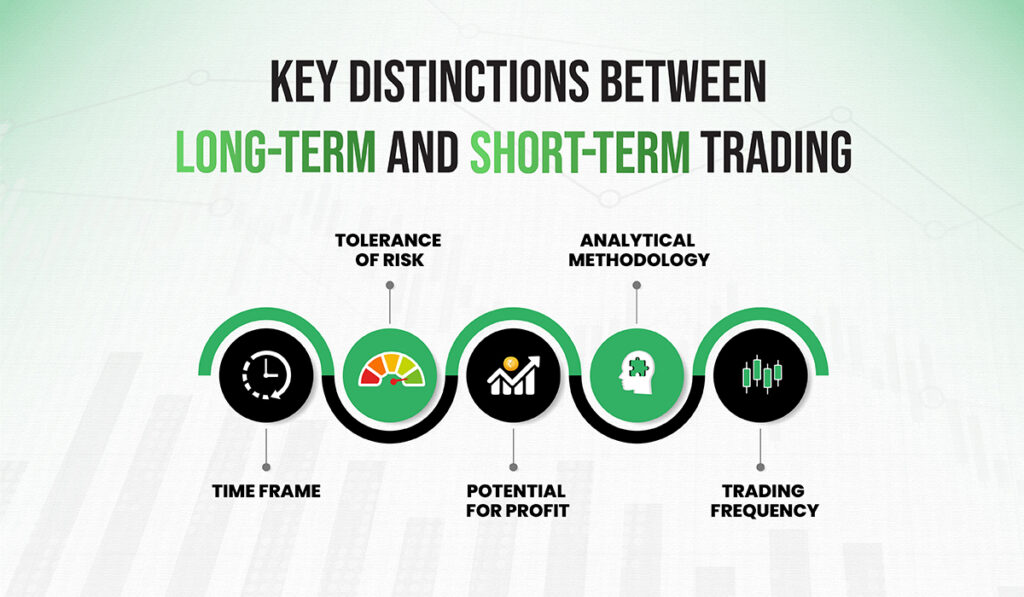

Long-Term Investing vs. Short-term Trading

While short-term trading focuses on exploiting market movements for quick gains, long-term investing is about building wealth steadily over time. Short-term trading requires a significant time commitment and expertise to predict market movements accurately, often involving higher risk. In contrast, long-term investing is generally more accessible to a wider range of investors, relying on the market’s overall upward trend and the power of compounding to grow investments.

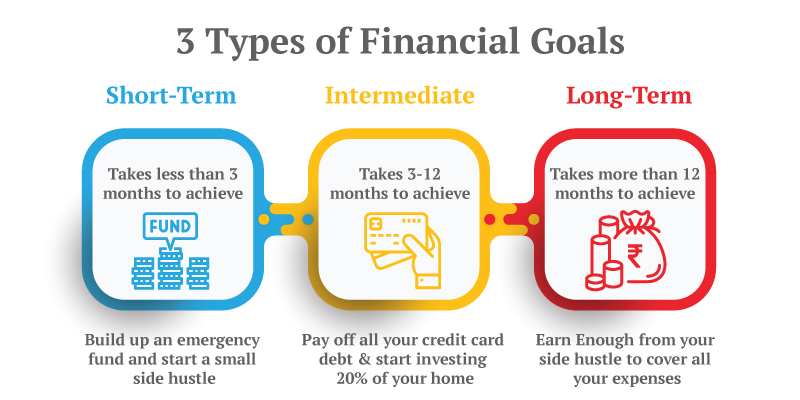

Setting Financial Goals

Defining clear and realistic financial goals is a cornerstone of successful long-term investing. These goals not only provide direction and purpose to your investment activities but also help tailor your financial strategies to meet specific life objectives. Whether it’s planning for retirement, saving for a child’s education, or purchasing a home, setting well-defined financial goals allows you to create a roadmap for your financial future.

Importance of Defining Clear, Realistic Financial Goals

Direction and Motivation

Clear financial goals give you something concrete to aim for, making it easier to stay motivated and focused on your long-term objectives. They act as benchmarks for measuring progress and can help keep you on track during times of market volatility or personal uncertainty.

Informed Decision Making

Understanding what you’re working towards allows you to make more informed decisions about your investment choices. Different goals require different strategies and risk tolerances, influencing how you allocate your resources.

Stress Reduction

Having a plan in place can significantly reduce financial stress by providing a sense of control over your future. Knowing that you’re actively working towards your financial objectives can bring peace of mind.

How to Plan for Major Life Events

Retirement

Planning for retirement is perhaps the most significant financial goal for many individuals. It requires a long-term strategy that accounts for your expected lifestyle, potential healthcare costs, and the length of time your savings will need to last.

- Action Steps: Estimate your retirement needs based on your current lifestyle, inflation rates, and expected lifespan. Utilize retirement accounts that offer tax advantages, such as 401(k)s or IRAs, and consider diversifying your investment portfolio to manage risk.

Education

Saving for education, whether it’s for yourself or a family member, is another common financial goal. With the cost of education rising, early planning is crucial.

- Action Steps: Explore education savings accounts like 529 plans or Coverdell ESA that offer tax benefits. Start saving early to take advantage of compounding interest, and consider riskier investments initially, moving towards safer options as the goal approaches.

Home Purchase

Buying a home is a major milestone that requires substantial upfront capital for the down payment and additional funds for ongoing maintenance and mortgage payments.

- Action Steps: Determine how much home you can afford, considering additional costs like taxes, insurance, and maintenance. Save for a down payment in a high-yield savings account or short-term investments to maintain liquidity. Improve your credit score to get the best mortgage rates.

Setting and Achieving Your Financial Goals for Long-Term Investing

- Be Specific: Define what you want to achieve, including the amount needed and the time frame.

- Make it Measurable: Break your goal down into manageable steps and track your progress.

- Ensure it’s Achievable: Set realistic goals based on your income, expenses, and saving capacity.

- Relevant: Your goals should align with your values and long-term vision for your life.

- Time-Bound: Set a deadline to keep yourself accountable.

Fundamentals of Asset Allocation

Asset allocation is a fundamental strategy in long-term investing that involves spreading investments across various asset classes to optimize the balance between risk and return. It’s grounded in the principles of diversification and tailored to an individual’s risk tolerance and investment horizon. Understanding how to effectively allocate assets can significantly impact the success of your investment strategy over time.

Principles of Diversification and Asset Allocation

Diversification

Diversification is the practice of spreading investments across various financial instruments, industries, and other categories to reduce exposure to any single asset or risk. The rationale is that a portfolio of different kinds of investments will, on average, yield higher long-term returns and pose a lower risk than any individual investment found within the portfolio.

Asset Allocation

Asset allocation takes diversification a step further by systematically distributing investments across major asset classes such as stocks, bonds, and cash. The process involves deciding how much of your portfolio to allocate to each asset class based on your risk tolerance, investment objectives, and time frame.

Balancing a Portfolio According to Risk Tolerance and Investment Horizon

Assessing Risk Tolerance

Risk tolerance is the degree of variability in investment returns that an investor is willing to withstand. It is a crucial factor in determining your asset allocation strategy and is influenced by your financial situation, investment objectives, and emotional capacity to endure losses.

- Conservative Investors: Prefer to minimize risk, even if it means accepting lower returns. Suitable for those with a short investment horizon or a low tolerance for volatility.

- Moderate Investors: Seek a balance between risk and return, willing to accept moderate levels of risk for potentially higher returns. Often have a medium-term investment horizon.

- Aggressive Investors: Aim for higher returns by accepting higher levels of risk. Suitable for those with a long investment horizon and a higher tolerance for market fluctuations.

Investment Horizon

Your investment horizon, or the expected time frame until you need to access your investment, also plays a critical role in determining your asset allocation.

- Short-Term Horizon: Investors with a time frame of less than three years typically favor lower-risk investments, such as cash or short-term bonds, to preserve capital.

- Medium-Term Horizon: Those investing for three to ten years may opt for a mix of bonds and stocks, with the allocation leaning towards less volatile assets.

- Long-Term Horizon: Investors with more than ten years until they need to access their funds can afford to take on more risk, often allocating a larger portion of their portfolio to stocks, which have the potential for higher long-term returns.

Implementing Asset Allocation

- Define Objectives: Clearly outline your investment goals, considering factors like retirement, education funding, or purchasing a home.

- Choose an Asset Allocation Model: Select a model that matches your risk tolerance and investment horizon. Use it as a guide to distribute your investments across asset classes.

- Rebalance Regularly: Market movements can shift your initial asset allocation. Regular rebalancing ensures your portfolio remains aligned with your strategy. This could mean selling some assets that have performed well to buy more of those that have underperformed.

Choosing the Right Investments for Long-Term Investors

For long-term investors, selecting the right investments is crucial for building a portfolio that grows over time and meets future financial goals. A well-considered choice of investments should not only align with your risk tolerance and investment horizon but also have the potential for solid growth. Here’s an overview of popular investment options for long-term investors, along with criteria to help select growth-oriented investments.

Investment Options for Long-term Investors

Stocks

Owning shares of companies offers the potential for significant growth, particularly if you invest in well-managed companies with strong growth prospects. However, stocks are subject to market volatility, making them more suitable for investors with a higher risk tolerance and a longer time horizon.

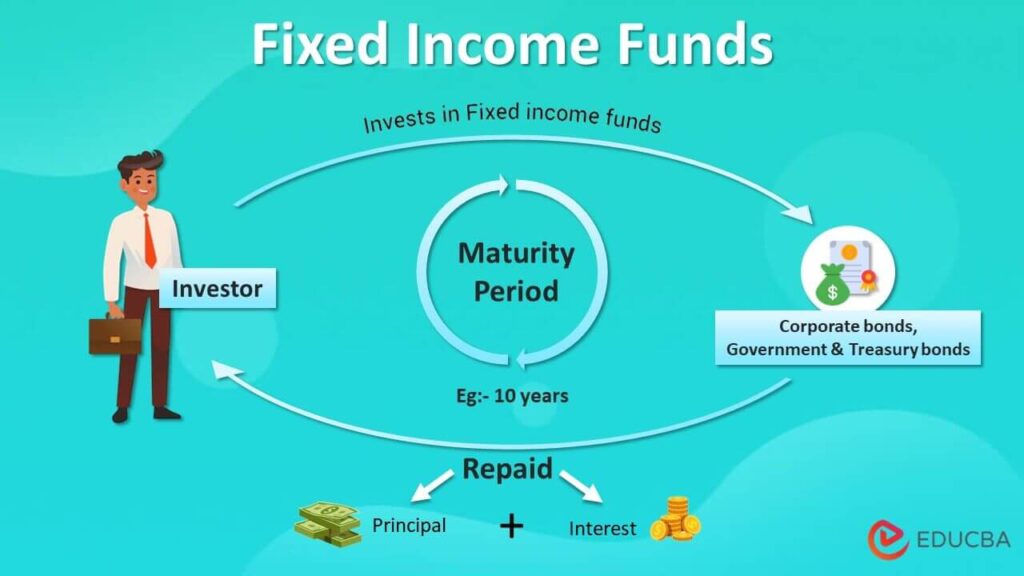

Bonds

Bonds are fixed-income investments where you lend money to an issuer (government, municipality, corporation) in exchange for periodic interest payments and the return of the bond’s face value at maturity. They tend to be less volatile than stocks, providing a steadier stream of income, making them appealing for more conservative investors.

Mutual Funds

Mutual funds pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer diversification and professional management but come with management fees. They’re suitable for investors looking for a hands-off approach to investing in a mix of assets.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they offer diversified exposure to a portfolio of assets but are traded on stock exchanges like individual stocks. They often have lower fees than mutual funds and offer greater flexibility in trading. ETFs can be an excellent way for long-term investors to gain exposure to specific sectors, indices, or asset classes.

Real Estate

Investing in real estate can offer both income (through rental income) and capital growth (through appreciation). It requires more capital and management than other investment types but can provide diversification and a hedge against inflation.

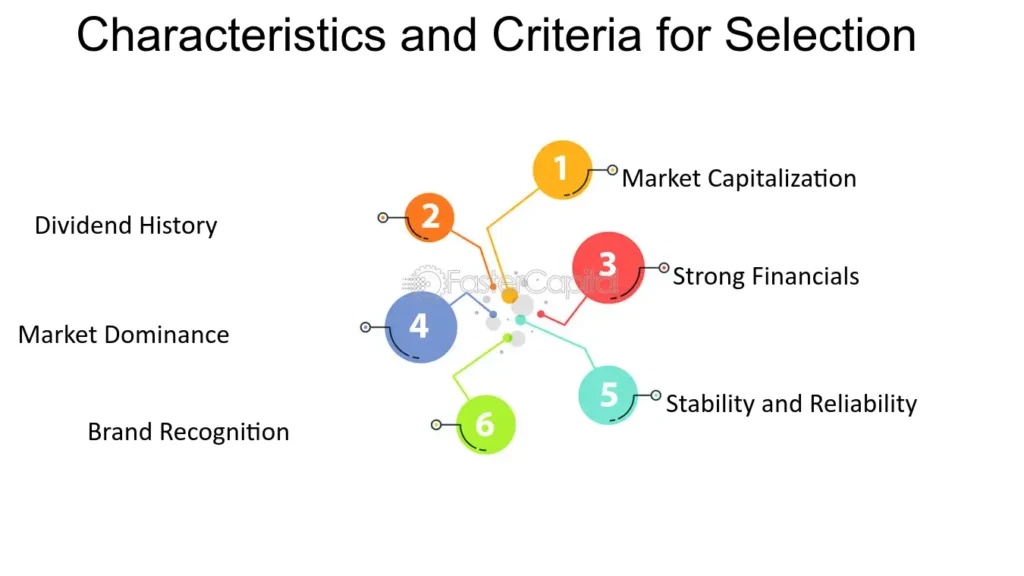

Criteria for Selecting Solid, Growth-oriented Investments

Historical Performance

While past performance is not indicative of future results, analyzing historical performance can provide insights into how an investment fares during different market conditions. Look for consistent performance over long periods.

Growth Potential

Consider the future growth prospects of the investment. For stocks, this might involve analyzing the company’s business model, industry position, and expansion plans. For real estate, consider location and market trends.

Risk Assessment

Assess the risk associated with each investment, considering volatility, credit risk (for bonds), or market risk. Ensure the risk level aligns with your risk tolerance and investment goals.

Costs and Fees

Understand all associated costs, including management fees for mutual funds and ETFs, transaction costs, and maintenance costs for real estate investments. Lower costs can significantly impact investment growth over time.

Diversification

Ensure your chosen investments contribute to the diversification of your portfolio. Diversification can reduce risk by spreading investments across different asset classes, sectors, and geographies.

Tax Implications

Consider the tax implications of your investments, including capital gains tax, dividend tax, and any tax advantages certain accounts might offer (such as IRAs for retirement savings).

The Role of the Stock Market in Long-term Investing

The stock market plays a pivotal role in long-term investing, offering opportunities for growth that are difficult to match with other investment types. Investing in stocks for the long term involves understanding not just the potential for appreciation but also navigating market cycles and volatility. Here’s how you can leverage the stock market for long-term growth and what you need to understand about market dynamics.

Investing in Stocks for Long-term Growth

Start with a Solid Foundation

Before diving into stock investments, ensure you have a solid understanding of how the stock market works, the types of stocks available (such as growth stocks, dividend stocks, value stocks), and the risk associated with stock market investments.

Diversification

One of the fundamental principles of investing in the stock market for the long term is diversification. By spreading investments across various sectors, industries, and geographies, you can reduce risk and capitalize on different growth opportunities. Consider a mix of small-cap, mid-cap, and large-cap stocks to balance the potential for growth with stability.

Quality over Quantity

Focus on investing in high-quality companies with strong business models, good governance, and the potential for sustained growth. Look for companies with competitive advantages, healthy balance sheets, and robust cash flows. Sometimes, a few well-chosen stocks can provide better long-term growth than a large portfolio of average ones.

Reinvest Dividends

Many stocks pay dividends, which can be reinvested to purchase additional shares, compounding growth over time. Opting for dividend reinvestment plans (DRIPs) can automate this process, accelerating the growth of your investment.

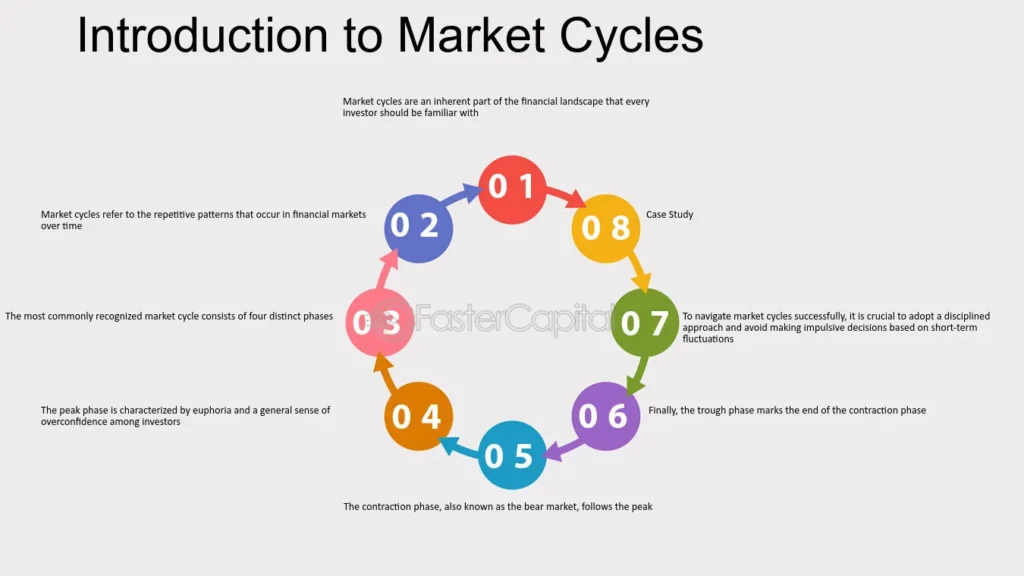

Understanding Market Cycles and Volatility

Market Cycles

The stock market moves in cycles, including periods of expansion (bull markets) and contraction (bear markets). Long-term investors need to understand these cycles, recognizing that downturns are normal and can present buying opportunities for undervalued stocks.

Volatility

Stock market volatility refers to the fluctuations in stock prices within short periods. While volatility can be unsettling, it’s a natural aspect of the stock market. Long-term investors benefit from viewing volatility as a part of the investment process, focusing instead on the underlying value and growth prospects of their investments.

Staying the Course

It’s crucial for long-term investors to maintain perspective during periods of market volatility or downturns. Avoid making impulsive decisions based on short-term market movements. History shows that the stock market has a tendency to increase in value over the long term, despite short-term fluctuations.

Continuous Learning and Adaptation

Stay informed about market trends, economic indicators, and developments in your invested companies. However, avoid reacting to every piece of news. Instead, use this information to make informed adjustments to your portfolio, always aligning with your long-term investment goals.

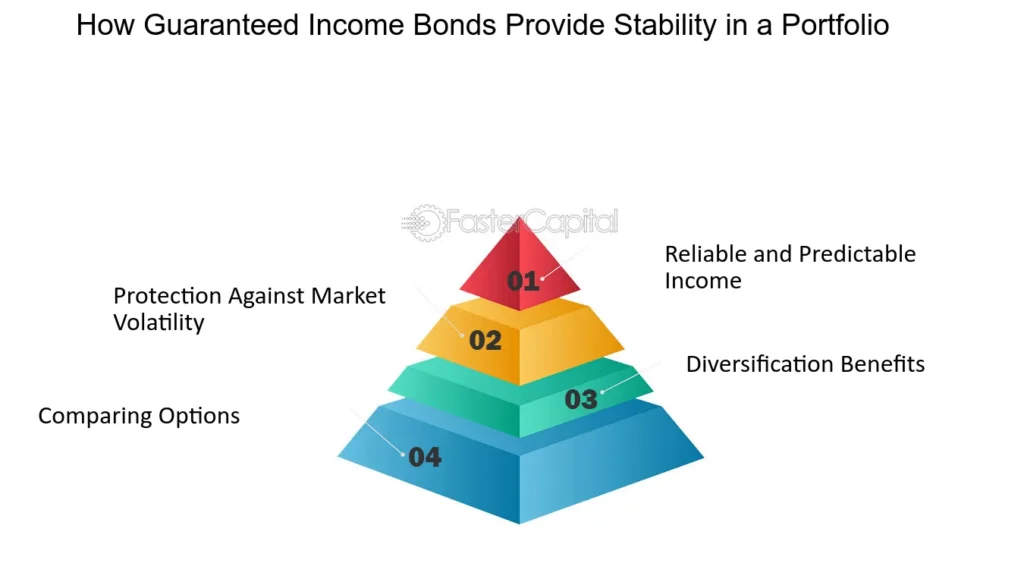

Bonds and Fixed Income Securities in Long-term Investing

Bonds and other fixed-income securities play a crucial role in long-term investment strategies, offering a balance to the volatility of stock investments and contributing to the overall stability and diversification of an investment portfolio. Understanding the different types of bonds and how they can be used effectively is essential for any long-term investor seeking to manage risk while pursuing steady returns.

The Importance of Bonds in a Long-term Investment Strategy

Income Generation

Bonds provide regular income through interest payments, making them an attractive option for investors seeking steady cash flow. This feature is particularly valuable for retirees or those planning for retirement.

Risk Management

The inclusion of bonds in a portfolio can help mitigate risk. Generally, bonds are less volatile than stocks and can offer a measure of protection against the ups and downs of the equity market, preserving capital during downturns.

Diversification

Adding bonds to a portfolio of stocks and other assets can enhance diversification, reducing the impact of poor performance by any single investment. Because bonds often move inversely to stocks, they can provide balance and stability.

Different Types of Bonds

Government Bonds

Issued by national governments, government bonds are considered low-risk investments. U.S. Treasury securities, for example, are backed by the full faith and credit of the U.S. government, offering safety and reliability, albeit with lower yields compared to riskier assets.

Corporate Bonds

Issued by companies, corporate bonds typically offer higher yields than government bonds, reflecting the greater risk associated with the issuing corporation’s ability to repay the debt. They range from investment-grade (lower risk, lower yield) to high-yield or “junk” bonds (higher risk, higher yield).

Municipal Bonds

Issued by states, cities, or other local government entities, municipal bonds offer tax advantages to investors, such as tax-exempt interest income at the federal level and, in some cases, state and local levels as well. They can be a valuable component of a tax-efficient investment strategy.

International and Emerging Market Bonds

Bonds issued by foreign governments or corporations can offer diversification beyond domestic markets. However, they come with additional risks, including currency risk, political risk, and the economic stability of the issuing country.

How Bonds Contribute to Portfolio Stability

Predictable Returns

The fixed interest payments and principal repayment at maturity of bonds provide predictable returns, offering a counterbalance to the uncertainties of the stock market.

Interest Rate Sensitivity

Understanding the relationship between bond prices and interest rates is vital. Typically, bond prices move inversely to interest rates: when interest rates rise, bond prices fall, and vice versa. This sensitivity can be managed by diversifying across different types of bonds and maturity dates.

Inflation-Protected Securities

Some bonds, such as Treasury Inflation-Protected Securities (TIPS) in the U.S., offer protection against inflation, adjusting the principal value of the bond to reflect changes in the inflation rate, thereby safeguarding the purchasing power of the investor’s income.

Mutual Funds and ETFs in Long-term Investing

Mutual funds and exchange-traded funds (ETFs) have become cornerstones of long-term investing strategies, primarily due to their ability to provide diversification, which is crucial for managing risk and enhancing potential returns over time. Understanding the benefits of these investment vehicles and the difference between active and passive fund management can help investors make informed decisions that align with their financial goals.

Benefits of Investing in Mutual Funds and ETFs

Diversification

One of the primary advantages of investing in mutual funds and ETFs is instant diversification. By pooling money from many investors, these funds can invest across a wide range of securities, spreading out risk that might be concentrated in individual investments. This diversification can help mitigate the impact of poor performance by any single security on the overall portfolio.

Accessibility

Mutual funds and ETFs offer access to a broad spectrum of assets and investment strategies, including stocks, bonds, commodities, and international markets, which might be difficult or expensive for individual investors to access directly.

Professional Management

Mutual funds are typically managed by professional fund managers who make investment decisions on behalf of the fund’s investors. This expertise can be particularly beneficial for investors who prefer a hands-off approach to investing or lack the time and resources to manage their portfolios actively.

Cost-Effective

Especially with ETFs, which often have lower expense ratios than mutual funds, investing in these vehicles can be a cost-effective way to gain exposure to a diversified portfolio. Additionally, the ability to trade ETFs on exchanges like stocks offers flexibility and liquidity.

Active versus Passive Fund Management

Active Management

Entailing a fund manager or management team making individual investment decisions within the fund’s portfolio, active management aims to outperform a specific benchmark index. This approach contrasts with passive management, where investments mirror a predetermined index. This approach can potentially offer higher returns but often comes with higher fees due to the research and expertise required.

- Pros: Potential to outperform the market; tailored investment strategies.

- Cons: Higher fees; risk of underperformance relative to the benchmark.

Passive Management

Passive management, commonly associated with ETFs and index funds, aims to replicate the performance of a specific benchmark index by holding all or a representative sample of the securities in the index. The goal is not to outperform the index but to mirror its performance.

- Pros: Lower fees; transparent investment strategy; typically lower turnover rates, leading to potential tax efficiency.

- Cons: No potential to outperform the index; fully exposed to market downturns without the possibility of mitigating losses through active management.

Tax Considerations and Efficient Investing in Long-term Investing

Tax considerations are a crucial aspect of long-term investing, as the tax implications of investment decisions can significantly impact overall returns. By understanding the tax implications of different investments and employing strategies for tax-efficient investing, investors can maximize their after-tax returns, which is critical for achieving long-term financial goals.

Understanding Tax Implications of Investments

Capital Gains Tax

Capital gains tax is levied on the profit from the sale of investments held longer than a certain period. Long-term capital gains, which apply to investments held for more than a year, often benefit from lower tax rates compared to short-term gains (investments held for one year or less).

Dividends and Interest Income

Dividend income from stocks and interest income from bonds may also be subject to taxation at varying rates depending on whether dividends are qualified or non-qualified and the investor’s overall income level.

Taxation of Mutual Funds and ETFs

Mutual funds and ETFs can generate capital gains distributions as the fund sells securities. These distributions are taxable to the fund’s shareholders. However, ETFs often have lower capital gains distributions due to their structure and trading mechanism.

Strategies for Tax-efficient Investing

Utilize Tax-advantaged Accounts

Investing through tax-advantaged accounts such as IRAs, Roth IRAs, and 401(k)s can significantly enhance tax efficiency. These accounts offer various tax benefits, including tax-deferred growth or tax-free withdrawals, which can help maximize long-term returns.

Hold Investments Long-term

By holding investments for more than a year, investors can benefit from lower long-term capital gains tax rates. This strategy not only promotes tax efficiency but also aligns with the principles of long-term investing.

Consider Tax-efficient Investment Vehicles

Index funds and ETFs are generally more tax-efficient than actively managed mutual funds due to lower turnover rates, which result in fewer taxable capital gains distributions. Choosing tax-efficient vehicles can help minimize the tax impact on your investment returns.

Tax-loss Harvesting

Tax-loss harvesting involves selling investments at a loss to offset capital gains on other investments. This strategy can help reduce your overall capital gains tax liability. It’s important to be aware of the IRS’s “wash sale” rule, which disallows a tax deduction for a security sold at a loss and repurchased within 30 days before or after the sale.

Asset Location

Asset location involves strategically placing investments in different types of accounts based on their tax treatment. For example, placing high-growth investments in Roth IRAs where withdrawals are tax-free, and investments generating taxable income in tax-deferred accounts to minimize current tax liability.

Reviewing and Adjusting Your Portfolio

Periodic reviews and adjustments of your investment portfolio are crucial practices in long-term investing. As markets fluctuate and personal circumstances change, your initial asset allocation may no longer align with your current financial goals or risk tolerance. Regular reviews ensure that your investment strategy remains on track to meet your objectives, while rebalancing helps maintain the desired level of risk and return.

Importance of Periodic Portfolio Reviews

Alignment with Financial Goals

Over time, your financial goals may evolve due to changes in personal circumstances such as marriage, the birth of a child, career progression, or nearing retirement. Regular portfolio reviews allow you to adjust your investments to reflect these changing goals and timelines.

Risk Management

Market dynamics can shift the composition of your portfolio. For example, a bull market in stocks may increase the proportion of equities in your portfolio, exposing you to higher risk than intended. Reviewing your portfolio helps identify such shifts and enables you to take corrective actions to manage risk.

Performance Evaluation

Regular reviews provide an opportunity to assess the performance of individual investments and the overall portfolio against benchmarks and expectations. This evaluation can highlight underperforming assets that may need to be replaced or rebalanced.

Rebalancing Your Portfolio

Rebalancing involves buying or selling assets in your portfolio to restore your original asset allocation. This practice is essential for keeping your investment strategy aligned with your risk tolerance and investment goals.

When to Rebalance

- Scheduled Reviews: Many investors choose to rebalance at regular intervals, such as annually or semi-annually.

- Threshold Rebalancing: Some investors rebalance when the actual allocation of an asset class deviates by a certain percentage (e.g., 5%) from the target allocation.

How to Rebalance

- Direct Adjustments: Sell overrepresented assets and buy underrepresented ones to return to your target allocation.

- Cash Flows: Use new contributions or dividends to purchase underrepresented assets, avoiding the need to sell overrepresented assets.

Adjusting Your Investment Strategy as You Approach Financial Goals

Shortening Time Horizons

As you approach a financial goal, such as retirement, consider shifting towards more conservative investments to reduce the risk of significant losses. For example, gradually increasing the bond allocation while reducing exposure to volatile stocks can preserve capital.

Locking in Gains

Consider taking profits from high-performing investments to secure gains, especially if you’ve reached or are nearing your financial objectives. This strategy can help ensure that you have the necessary funds to meet your goals.

Estate Planning and Gifting

For long-term goals related to estate planning or charitable giving, consider strategies that offer tax advantages and align with your legacy objectives, such as establishing trusts or making charitable contributions in a tax-efficient manner.

Starting Your Long-term Investment Journey

Embarking on a long-term investment journey can be one of the most significant steps towards achieving your financial goals, whether it’s building wealth, preparing for retirement, or saving for a major purchase. Starting with a clear strategy and awareness of common pitfalls can set the foundation for successful long-term investing. Here are essential steps to begin your investment journey, along with common mistakes to avoid and best practices for ensuring success.

Steps to Begin Investing with a Long-term Perspective

Define Your Financial Goals

Start by clearly defining what you hope to achieve through your investments. Are you saving for retirement, a child’s education, or a home purchase? Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals can guide your investment decisions and strategy.

Understand Your Risk Tolerance

Assess your comfort level with risk, as this will significantly influence your investment choices and asset allocation. Factors to consider include your investment timeline, financial situation, and how you might react to market volatility.

Educate Yourself

Gain a basic understanding of investment principles, types of investments (stocks, bonds, mutual funds, ETFs, real estate, etc.), and how markets operate. Knowledge is power, and the more you know, the better equipped you’ll be to make informed decisions.

Start Small and Diversify

You don’t need a large sum of money to start investing. Begin with an amount you’re comfortable with and focus on building a diversified portfolio that spreads risk across different asset classes and sectors.

Choose the Right Investment Platform

Select a brokerage or investment platform that aligns with your needs, considering factors such as fees, available investment options, educational resources, and ease of use. Many platforms offer low-cost index funds and ETFs, which are excellent for beginners.

Set Up Automatic Contributions

Consider setting up automatic contributions to your investment account to cultivate a habit of regular investing. This approach also leverages the power of dollar-cost averaging, reducing the impact of market volatility over time.

Common Mistakes to Avoid

Trying to Time the Market

Attempting to buy low and sell high based on market predictions is incredibly difficult, even for professional investors. A long-term perspective and consistent investment approach tend to be more effective.

Ignoring Fees

Even small fees can compound over time, significantly impacting your investment returns. Pay attention to fund management fees, transaction fees, and any other costs associated with your investments.

Reacting to Short-term Market Volatility

Market fluctuations are normal, and reacting emotionally to short-term volatility can lead to poor investment decisions. Stay focused on your long-term goals and maintain your investment strategy during market ups and downs.

Overlooking Tax Implications

Be aware of the tax implications of your investments and consider strategies for tax-efficient investing, such as utilizing tax-advantaged accounts (e.g., IRAs, 401(k)s) for retirement savings.

Best Practices for Success

Regularly Review and Rebalance Your Portfolio

Conduct annual reviews of your investment portfolio to assess its performance against your goals and rebalance as needed to maintain your desired asset allocation.

Stay Informed

Keep abreast of financial news and market trends, but avoid making impulsive decisions based on short-term market movements. Continuous learning and adapting your strategy based on new information can contribute to long-term success.

Be Patient and Disciplined

Long-term investing is a marathon, not a sprint. Patience, discipline, and a consistent investment approach are key to navigating market cycles and achieving your financial objectives.

FAQs:

- What Is Long-term Investing?

- Long-term investing involves holding onto investments for several years or decades to benefit from compound returns and growth over time.

- Why Is Setting Financial Goals Important?

- Clear financial goals help tailor your investment strategy to meet specific future needs, whether it’s retirement, buying a home, or funding education.

- How Do I Allocate My Assets?

- Asset allocation involves distributing your investments across various asset classes (stocks, bonds, real estate) to balance risk and return according to your goals and risk tolerance.

- Which Investments Are Best for Long-term Growth?

- Historically, stocks have offered the most potential for long-term growth, although mutual funds, ETFs, and real estate also play vital roles in a diversified portfolio.

- How Does the Stock Market Affect Long-term Investing?

- While short-term market volatility can affect portfolio values, long-term investing focuses on the overarching trend of market growth over decades.

- What Role Do Bonds Play in a Long-term Portfolio?

- Bonds provide income and stability, acting as a counterbalance to the volatility of stocks, which is crucial for risk management over the long term.

- Mutual Funds vs. ETFs: Which Is Better for Long-term Investing?

- Both can be suitable for long-term investing; the choice depends on personal preference, cost considerations, and whether you favor active or passive management.

- How Can I Invest Tax-Efficiently?

- Utilize tax-advantaged accounts like IRAs and 401(k)s, consider the tax implications of selling investments, and choose tax-efficient funds to minimize tax liabilities.

- When Should I Review My Investment Portfolio?

- Regularly, at least annually, or when your financial situation or goals change significantly, to ensure your investments remain aligned with your long-term objectives.

- How Do I Start Long-term Investing?

- Begin by setting financial goals, educating yourself on investment options, choosing a diversified mix of assets, and consistently investing over time, regardless of market fluctuations.