FXCM, established in 1999, offers a robust FXCM demo account that stands as a beacon for novices in the complex world of forex trading. Renowned for its integrity and reliability, FXCM guides beginners through the intricacies of currency trading with ease. Why is this important for someone just starting out? Engaging with a demo account is a fundamental step for any rookie trader. Let’s delve into the benefits of utilizing these accounts in forex trading.

What is FXCM?

FXCM, or Forex Capital Markets, is not just a platform; it’s a gateway to the dynamic forex markets. Known for its user-friendly interface and comprehensive educational resources, FXCM ensures that beginners are not only welcomed but are also well-equipped to start their trading journey.

- Trusted Brokerage: A track record of over two decades in the financial services industry.

- Regulated and Secure: Complies with major regulatory bodies, ensuring a secure trading environment.

- Resource-Rich: Offers extensive learning materials, including webinars, tutorials, and live seminars.

Why Start with a Demo Account?

Starting with a demo account is like taking your first swimming lessons in a safe, shallow pool before diving into the deep ocean. It’s about getting a feel for the market mechanics without the risk of losing real money.

- Risk-Free Learning: Experiment with different trading strategies and learn the ropes without financial jeopardy.

- Market Familiarity: Understand market volatility and the factors that influence currency movements.

- Tool Proficiency: Master the use of FXCM’s trading platforms and tools, essential for real-world trading.

“A demo account simulates real trading with zero risk, making it an indispensable tool for every beginner.” – Expert opinion on the importance of demo accounts in forex trading.

As we progress, remember, the goal is not just to trade but to trade with knowledge and foresight. Using a demo account through FXCM can significantly demystify the complexities of forex trading for beginners, setting them up for potential success in the real markets.

Setting Up Your FXCM Demo Account

Embarking on your forex trading journey with FXCM begins with setting up a demo account. This chapter provides a detailed, step-by-step guide to help beginners navigate the setup process seamlessly. By following these steps, you’ll not only activate your demo account but also position yourself to make the most of FXCM’s learning resources.

Step 1: Visit the FXCM Website

The first step to starting your forex trading journey is to visit the FXCM website. Here’s how:

- Navigate to the Homepage: Open your preferred web browser and go to FXCM’s official website.

- Locate the Demo Account Section: Often featured prominently on the homepage, look for a button or link labeled “Demo Account” or “Try a Free Demo.”

Step 2: Fill Out the Registration Form

Once you find the demo account section, you’ll need to provide some basic information:

- Personal Details: Enter your name, email address, and contact number.

- Account Preferences: Choose your preferred trading platform and the type of demo account you wish to open.

Step 3: Verify Your Email

After submitting the registration form, FXCM will send a verification email to the address you provided. Here’s what to do next:

- Check Your Inbox: Locate the email from FXCM, which should arrive within a few minutes.

- Follow the Verification Link: Click on the link in the email to verify your account and activate your demo access.

Step 4: Access Your Demo Account

With your email verified, you are now ready to log into your demo account:

- Log In: Return to the FXCM website and log in using the credentials you set up during registration.

- Explore the Platform: Familiarize yourself with the interface, tools, and features available on your chosen platform.

Step 5: Start Practicing

Now that your account is set up, it’s time to dive into the world of forex trading:

- Practice Trades: Use the virtual funds provided to practice trading.

- Utilize Resources: Take advantage of FXCM’s educational materials to enhance your trading skills.

“The best way to learn is by doing. A demo account provides the perfect sandbox for experimentation and learning.” — Forex trading expert.

By following these steps, you can ensure that your initiation into forex trading is smooth and informative. A demo account with FXCM not only allows you to practice trading but also gives you a crucial understanding of market dynamics and trading strategies.

Features of the FXCM Demo Account

Delving into the FXCM demo account reveals a treasure trove of features and tools designed to mimic real-world trading environments closely. This chapter explores these features in detail, providing beginners with insights into how they can leverage these tools to enhance their trading skills before entering the live markets.

Comprehensive Trading Platforms

FXCM offers a variety of platforms, each with unique features to cater to different trading preferences:

- Trading Station: Known for its intuitive interface and robust functionality, Trading Station is FXCM’s flagship platform.

- MetaTrader 4 (MT4): Popular among forex traders, MT4 offers advanced charting tools, automated trading capabilities, and a vast ecosystem of plugins.

- NinjaTrader: Ideal for active traders looking for advanced charting and automated strategy development.

Virtual Funds for Realistic Trading

One of the standout features of the FXCM demo account is the provision of virtual funds:

- Substantial Virtual Capital: Start with a significant amount of virtual money, allowing you to experiment with trading strategies under realistic market conditions.

- Risk-Free Trading: Practice trading without the fear of actual financial losses, a perfect setup for beginners.

Real-Time Market Data

Access to real-time market data is crucial for effective trading practice:

- Live Quotes: Experience real-time pricing on FXCM’s demo accounts, mirroring the live market conditions.

- Market Analysis: Utilize FXCM’s expert analysis and market news to make informed trading decisions.

Educational Resources

FXCM enriches its demo accounts with extensive educational resources to help traders grow their knowledge:

- Webinars and Seminars: Regularly scheduled educational sessions cover a range of topics from trading strategies to market analysis.

- Tutorials and Guides: Comprehensive guides and video tutorials designed to help new traders navigate the platforms and master trading techniques.

“Harnessing the power of a demo account lies in using its features to simulate not just trades but real trading strategies and reactions to market events.” — Trading mentor.

Advanced Trading Tools

For those looking to dive deeper, FXCM’s demo accounts offer advanced tools:

- Technical Analysis Tools: A wide array of indicators and charting tools helps simulate various trading scenarios.

- Automated Trading: Test automated trading systems in a controlled environment to refine their effectiveness.

By exploring the extensive features available in the FXCM demo account, beginners can gain a profound understanding and practical experience in forex trading without the risks associated with real funds. This preparatory step is invaluable, as it equips new traders with the confidence and skills needed to transition to live trading.

Navigating the FXCM Trading Platform

Mastering the FXCM trading platform is a crucial step for any beginner aspiring to become a proficient forex trader. This chapter is dedicated to providing you with essential tips and highlighting unique aspects of the platform to enhance your trading effectiveness. Understanding these nuances will help you navigate the platform more efficiently, allowing you to focus on developing robust trading strategies.

Getting Started: User Interface Overview

The first step to becoming proficient with the FXCM trading platform is familiarizing yourself with its layout:

- Dashboard: Your central hub for operations, displaying your balances, positions, and important notifications.

- Navigation Menus: Easily access different sections such as charts, news feeds, and trading instruments.

- Toolbars: Quick access to trading tools and features like order placement, indicators, and analysis tools.

Essential Trading Tools and Features

FXCM’s platform is equipped with a variety of tools designed to assist traders in making informed decisions:

- Charting Capabilities: Utilize customizable charts to view historical data and perform technical analysis.

- Order Execution: Learn the differences between market orders, limit orders, and stop orders. Practice using each to understand how they influence your trading strategy.

- Risk Management Tools: Familiarize yourself with tools like stop-loss orders and take-profit levels to manage your trading risks effectively.

Unique Aspects of the FXCM Platform

Several features set the FXCM trading platform apart, making it a preferred choice for many traders:

- One-Click Trading: Speed is crucial in forex trading, and FXCM’s one-click trading allows you to execute trades instantly, which is vital during volatile market conditions.

- Integrated News and Analysis: Stay updated with real-time news and expert analysis directly on the platform, helping you make informed decisions based on the latest market dynamics.

- Automated Trading Support: FXCM supports automated trading strategies through its integration with platforms like MetaTrader 4 and NinjaTrader, allowing for customized algorithms and bots.

“Efficiency in trading comes from understanding and utilizing your platform’s features to their fullest potential.” — Experienced FXCM user.

Tips for Effective Platform Use

To maximize your trading effectiveness on FXCM, consider the following tips:

- Regular Practice: Spend time daily navigating and practicing on the platform. The more familiar you are, the quicker you can react to market changes.

- Utilize Demos: Continue using your demo account to try out advanced features before applying them in live trading.

- Educational Resources: Take advantage of FXCM’s tutorials and webinars specifically designed to help you better understand and use the platform.

By taking the time to thoroughly understand and effectively navigate the FXCM trading platform, you position yourself to manage and execute trades more proficiently. This knowledge not only helps in optimizing your trading approach but also builds a solid foundation for future trading success.

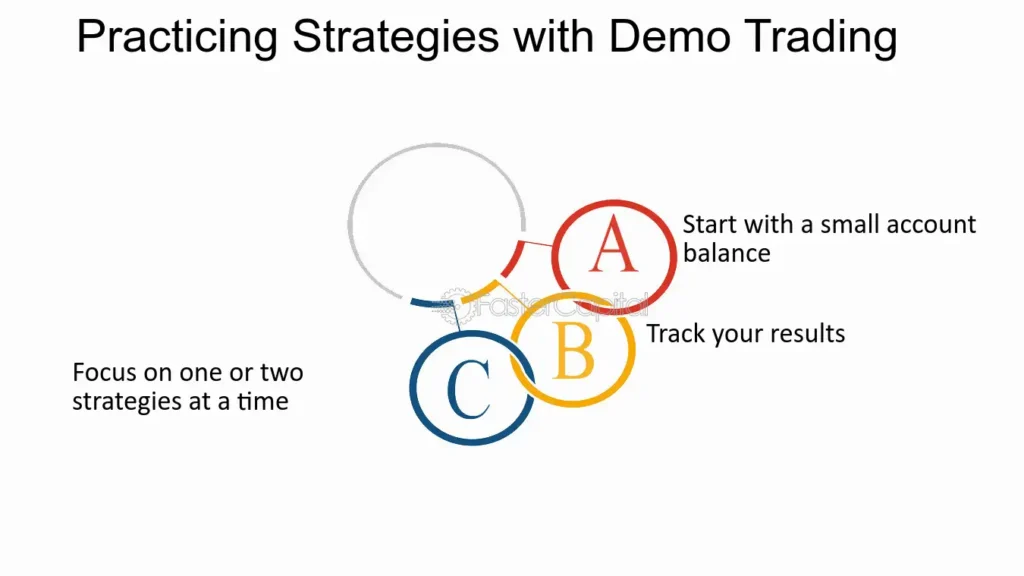

Practicing Trading Strategies with the Demo Account

A critical aspect of learning forex trading is the ability to practice and refine trading strategies without financial risk. This chapter focuses on how beginners can use the FXCM demo account to experiment with various trading strategies and learn effective risk management techniques. The goal is to build confidence and proficiency before transitioning to live trading.

Why Practice with a Demo Account?

Practicing with a demo account offers numerous advantages:

- Risk-Free Environment: Allows for testing strategies without the fear of losing real money.

- Understanding Market Mechanics: Helps beginners understand how different market conditions affect trading.

- Skill Development: Provides a platform to refine trading techniques and learn from mistakes without financial consequences.

Experimenting with Different Trading Strategies

The FXCM demo account is an ideal testing ground for experimenting with various trading strategies. Here’s how you can approach this:

- Technical Analysis: Use FXCM’s advanced charting tools to practice technical analysis. Experiment with indicators like moving averages, RSI, and MACD to understand market trends and make informed trading decisions.

- Fundamental Analysis: Apply fundamental analysis by keeping track of economic indicators, news releases, and other macroeconomic factors that influence currency movements.

- Scalping and Day Trading: Test short-term trading strategies like scalping and day trading to understand how to profit from small price changes over short periods.

Learning Risk Management

Effective risk management is crucial for successful forex trading. Here are some key practices to learn and apply:

- Setting Stop-Loss and Take-Profit: Learn how to set stop-loss orders to minimize losses and take-profit orders to lock in profits.

- Managing Leverage: Understand the implications of leverage in forex trading. Practice using leverage wisely to avoid significant losses.

- Portfolio Diversification: Experiment with diversifying trades across different currencies and financial instruments to reduce risk.

“The key to successful trading lies not just in making profitable trades but in effectively managing risks.” — Forex trading expert.

Practical Exercises for Beginners

To fully leverage the FXCM demo account, engage in practical exercises:

- Simulate Realistic Trading: Treat your demo account as if it were a real account with actual money. This mindset will help you make more thoughtful and disciplined trading decisions.

- Keep a Trading Journal: Document all your trades, including the strategy used, the outcome, and any lessons learned. This practice will help you analyze your performance and improve over time.

- Regular Review and Adjustment: Periodically review your trading strategies and risk management practices. Adjust them based on the outcomes and insights gained from your journal.

By methodically using the FXCM demo account to practice trading strategies and learn risk management, beginners can significantly enhance their trading skills and readiness for the real markets.

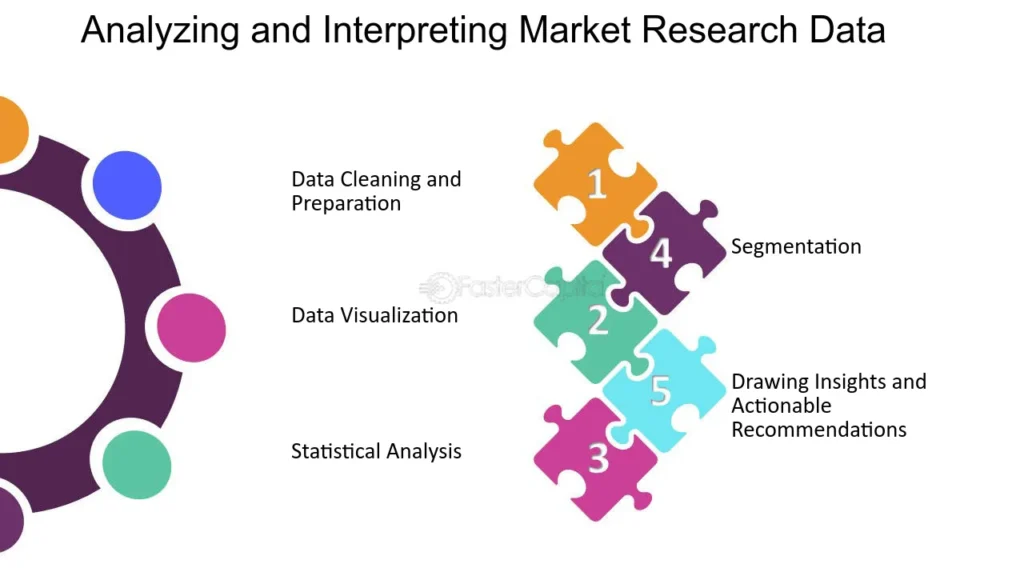

Analyzing and Interpreting Market Data

Understanding and effectively interpreting market data are crucial skills for any forex trader. This chapter provides guidance on how to approach market analysis within the FXCM demo environment, focusing on the types of data available and how to leverage this information to make informed trading decisions.

Importance of Market Data

Market data encompasses a range of information that can influence trading decisions, including price movements, volume statistics, and economic indicators. Here’s why it’s vital:

- Informed Decisions: Data provides the groundwork for all trading decisions, helping to predict possible market movements.

- Strategy Enhancement: Regular analysis helps refine and adapt trading strategies to changing market conditions.

Types of Market Data Available on FXCM

FXCM provides access to various types of market data that are essential for conducting thorough analysis:

- Real-Time Price Feeds: View live currency price movements to gauge market sentiment and immediate trading opportunities.

- Historical Data: Access past market data to perform back-tests of trading strategies, ensuring they are robust across different market conditions.

- Economic Calendar: Keep track of economic announcements and indicators, such as GDP, employment rates, and inflation, which can significantly affect currency values.

Tools for Data Analysis on FXCM

FXCM’s demo account offers several analytical tools that can enhance your understanding of market dynamics:

- Charts and Indicators: Utilize advanced charting tools with a variety of technical indicators like Fibonacci retracements, Bollinger Bands, and oscillators.

- News and Analysis Reports: Benefit from expert analyses and commentary provided directly on the platform, offering insights into current market trends and future outlooks.

“Market data is not just numbers and charts—it’s the story of the market, revealing the past, describing the present, and often predicting the future.” — Financial Analyst.

Analyzing Market Data: A Step-by-Step Approach

- Identify Key Indicators: Determine which indicators are most relevant to the markets and currency pairs you are interested in. Focus on those that align with your trading strategy.

- Use Technical Analysis: Apply technical analysis tools to interpret price action and volume, helping to identify trends and potential reversal points.

- Incorporate Fundamental Analysis: Assess how economic reports, news events, and financial indicators impact the markets. This can provide a broader perspective beyond just technical signals.

- Synthesize Information: Combine insights from various sources and tools to form a cohesive trading decision. Balancing technical and fundamental analysis can yield more robust outcomes.

Practical Application Within the Demo Account

Experiment with these techniques in the demo account setting:

- Regular Monitoring: Regularly track market data and news to see how different events influence the markets.

- Scenario Analysis: Create hypothetical trading scenarios based on historical or current market data to see how well your strategies perform under different conditions.

- Feedback Loop: Use the outcomes of your trades and analysis as feedback to fine-tune your approach to market data interpretation.

By actively engaging with and interpreting market data within the FXCM demo account, traders can develop a deeper understanding of market forces and improve their predictive capabilities, thereby enhancing their overall trading strategy.

Transitioning from a Demo to a Real Account

The transition from a demo to a real trading account marks a significant milestone in a trader’s journey. This chapter offers practical advice on when and how to make this shift, ensuring that you are fully prepared to trade with real money on FXCM. The process involves not just technical readiness but also psychological preparation to handle the pressures of real-market trading.

Knowing When You’re Ready

Before moving to a real account, it’s crucial to assess your readiness. Here are some indicators that you might be ready to make the transition:

- Consistent Profitability: You have consistently generated profits in your demo account over an extended period.

- Mastery of Trading Platform: You feel comfortable navigating FXCM’s trading platform and utilizing its tools and features efficiently.

- Understanding Risk Management: You have a solid grasp of risk management strategies and consistently apply them in your demo trades.

Preparing for the Transition

Preparation is key to a smooth transition from demo trading to real trading. Here’s how to prepare:

- Set Realistic Goals: Establish clear, achievable goals for your trading to help guide your decisions and track your progress.

- Develop a Trading Plan: Create a comprehensive trading plan that includes your strategy, risk tolerance, and criteria for entering and exiting trades.

- Start Small: When you first move to real trading, consider starting with smaller amounts to minimize risk as you adjust to the psychological aspects of trading real money.

“The leap from demo to real trading is not just about skill but also about mindset. The psychological shift when real money is at stake is the true test of a trader.” — Trading Coach.

Steps to Open a Real Account with FXCM

Transitioning to a real account involves several practical steps:

1: Application

- Complete the Application: Fill out the online application on FXCM’s website, providing all necessary personal and financial information.

2: Documentation

- Verify Identity and Residence: Submit required documents to verify your identity and residence, such as a passport and utility bill.

3: Funding

- Deposit Funds: Once your account is approved, deposit funds using one of the methods provided by FXCM, such as bank transfer or credit card.

4: Trading

- Start Trading: Begin trading with real funds. Remember to apply the strategies and risk management techniques you practiced in your demo account.

Embracing Real Trading

As you begin trading with real money, keep the following in mind:

- Monitor Your Emotions: Real trading can evoke stronger emotions, which can impact decision-making. Stay disciplined and adhere to your trading plan.

- Continuous Learning: Treat each trading day as an opportunity to learn. Regularly review your trades to refine your strategies and improve your performance.

- Seek Support: Take advantage of FXCM’s customer support and resources to assist you in your new phase of trading.

By carefully planning your transition from a demo to a real account, you equip yourself with the best chance for success in the competitive world of forex trading.

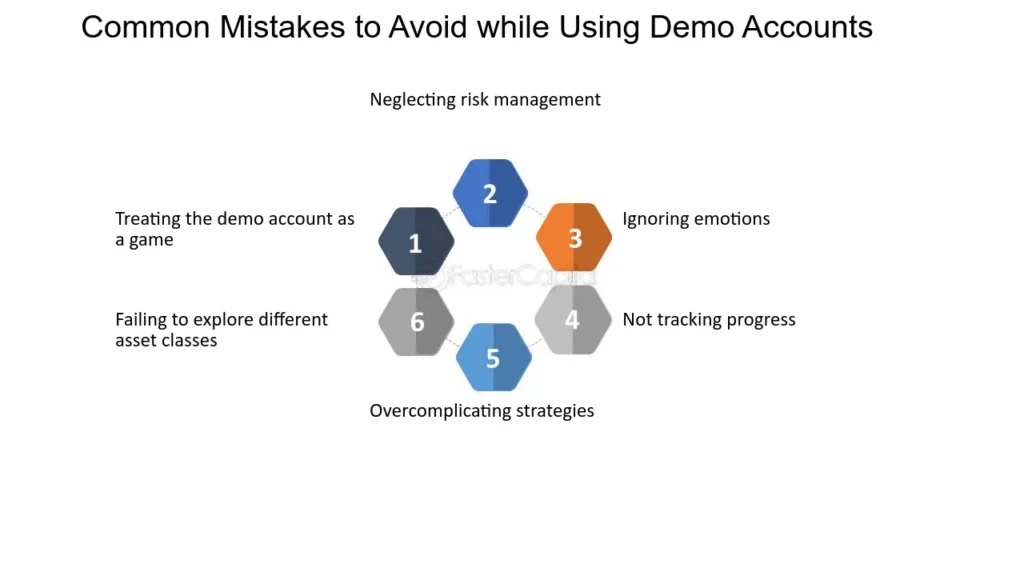

Common Pitfalls to Avoid While Using Demo Accounts

While demo accounts are invaluable for learning and experimenting in a risk-free environment, traders often encounter specific pitfalls that can skew their learning experience or impede their progress. This chapter discusses common mistakes traders make while using demo accounts and offers strategies to avoid these pitfalls, ensuring a more effective and realistic practice environment.

Pitfall 1: Not Treating the Demo Account as Real

One of the most frequent mistakes is treating the demo account too casually, not considering the trades and decisions as seriously as they would with real money.

How to Avoid:

- Set Realistic Conditions: Trade with an amount of virtual money that you would realistically expect to start with in a real account.

- Follow Your Trading Plan: Use the demo account to practice your trading plan rigorously, just as you would in real trading.

- Simulate Real Trading Environment: Include transaction costs and realistic slippage in your practice sessions to mimic real-market conditions closely.

Pitfall 2: Overtrading

Because there is no real money at risk, demo traders might make an unusually high number of trades or take risks they wouldn’t normally take, which doesn’t reflect realistic trading behavior.

How to Avoid:

- Maintain Discipline: Stick to the trading strategy and risk management rules you’ve set for yourself, just as if your capital were at risk.

- Record and Review: Keep a trading journal, noting why you entered and exited each trade, which can help in refining strategies and sticking to guidelines.

Pitfall 3: Ignoring Emotional Preparation

Trading with real money can evoke strong emotions, which might be absent in demo trading. This lack of emotional pressure can lead to a false sense of confidence.

How to Avoid:

- Emotional Training: Try to emotionally invest in the outcomes of your demo trades to simulate the stress and excitement of real trading.

- Mindfulness and Reflection: Develop techniques such as mindfulness to manage emotions and stress, preparing for the emotional aspects of live trading.

Pitfall 4: Not Using Demo Account Long Enough

Some traders might rush to open a real account after only a short period of successful trading in the demo account, which might not adequately prepare them for varying market conditions.

How to Avoid:

- Comprehensive Testing: Use the demo account through different market conditions to see how your strategies perform over time.

- Achieve Consistent Results: Ensure that you can achieve consistent profitability for an extended period before considering moving to a real account.

“The goal of a demo account is not just to learn how to use the trading platform, but also to master yourself, your strategies, and your emotions.” — Experienced Trader.

Pitfall 5: Neglecting to Learn from Mistakes

Because no real money is lost, traders might neglect the learning opportunity that comes from analyzing mistakes.

How to Avoid:

- Detailed Analysis: Treat losses in the demo account as seriously as you would in a real account. Analyze what went wrong and how similar mistakes can be avoided.

- Continuous Improvement: Use mistakes as learning tools to continuously improve and refine your trading approach.

By being aware of and actively avoiding these common pitfalls, traders can make the most of their experience with demo accounts, setting a strong foundation for successful real money trading.

Testimonials and Success Stories

Transitioning from demo to real trading is a significant step for any forex trader. In this chapter, we explore inspiring stories from FXCM users who have successfully made this leap. These testimonials not only underscore the effectiveness of using FXCM’s trading platform and resources but also serve as motivational guides for new traders embarking on this journey.

From Practice to Proficiency: John’s Journey

John’s Background:

John started his trading journey with an FXCM demo account in early 2020. With a background in data analysis but new to forex, he was cautious about entering the financial markets.

John’s Strategy:

He used the demo account to familiarize himself with FXCM’s tools, especially focusing on understanding market trends and risk management techniques. John practiced consistently, treating his demo trades with the same seriousness as he would with real trades.

Success Story:

After six months of consistent profitability and feeling confident in his trading plan, John transitioned to a real account. By starting small and gradually increasing his investment as he gained more confidence, John managed to grow his initial deposit by 50% within the first year.

“The demo account was invaluable. It helped me understand the nuances of forex trading without the pressure of losing real money. Transitioning to real trading felt like a natural next step.” — John.

Mastering Emotions: Lisa’s Experience

Lisa’s Background:

Lisa, a former psychologist, was intrigued by the psychological aspects of trading. She started with an FXCM demo account to test her ability to manage emotions and make disciplined trading decisions.

Lisa’s Approach:

She used psychological techniques to handle the emotional ups and downs of trading, which she practiced rigorously in the demo account. Lisa also kept a detailed journal of all her trades, including her emotional state and decision-making process.

Success Story:

When Lisa moved to a real account, she was well-prepared to manage the stresses of real trading. Within several months, she was not only profitable but also able to maintain her discipline and emotional control, key factors in her ongoing success.

“Understanding your own psychology is as important as understanding the markets. The demo account is a safe space to learn this.” — Lisa.

Risk Management Wins: Ahmed’s Tale

Ahmed’s Background:

With a keen interest in economics, Ahmed was drawn to forex trading to apply his theoretical knowledge practically. He started with an FXCM demo account to learn how economic events influence currency movements.

Ahmed’s Focus:

He focused heavily on risk management, using the demo account to experiment with various strategies for setting stop-losses and take-profits.

Success Story:

Ahmed’s careful approach paid off when he transitioned to real trading. His strong focus on managing risk helped him avoid significant losses during market volatility, and he consistently achieved a steady growth in his investments.

“The demo account taught me how to protect my investments. It’s not just about making money; it’s about keeping it.” — Ahmed.

These stories highlight the importance of a structured and disciplined approach to learning and trading. FXCM’s demo account serves as an excellent platform for traders to hone their skills, develop their strategies, and prepare psychologically for the challenges of real forex trading.

Conclusion and Additional Resources

Throughout this guide, we have explored the various aspects of beginning your forex trading journey with FXCM, focusing on the pivotal role of the demo account. As we conclude, let’s recap the benefits of using the FXCM demo account and highlight additional resources that can further enhance your trading knowledge and skills.

Key Benefits of the FXCM Demo Account

- Risk-Free Environment: The FXCM demo account provides a safe space where beginners can learn the fundamentals of forex trading without the risk of losing real money.

- Realistic Market Conditions: Traders can experience real-time market conditions, allowing them to test strategies and make decisions as if they were operating a live account.

- Access to Advanced Tools and Resources: The demo account comes equipped with the same tools, charts, and data analytics available to live account holders, ensuring a comprehensive learning experience.

Harnessing the Full Potential of FXCM

To truly benefit from what FXCM offers, make full use of the following strategies:

- Continuous Practice: Use the demo account to continually refine your trading strategies and techniques.

- Educational Resources: FXCM provides an array of educational materials, including webinars, e-books, and tutorials, which are invaluable for both new and experienced traders.

- Community and Support: Engage with the community forums and customer support provided by FXCM to get answers to your questions and insights from other traders.

Additional Resources for Ongoing Learning

To further your education in forex trading, consider exploring these resources:

- FXCM Insights: Visit the FXCM Insights page for expert analysis and commentary on market dynamics and trading strategies.

- Online Trading Courses: Enroll in courses available on platforms like Udemy, Coursera, or Khan Academy that focus on forex trading and financial markets.

- Books and Journals: Read books like “Currency Trading for Dummies” by Brian Dolan or “The Art of Currency Trading” by Brent Donnelly for deeper insights into forex trading.

- Professional Networking: Join professional networks and groups on LinkedIn or local clubs that focus on trading and investment to connect with experienced traders.

“The journey of a thousand miles begins with a single step. The FXCM demo account is that first step towards becoming a proficient forex trader.” — Trading Educator.

By leveraging these resources and consistently applying the lessons learned through the FXCM demo account, you can significantly improve your trading skills and prepare for successful real-world trading.

This guide has laid the groundwork for your forex trading adventure with FXCM. Your next steps are to apply what you’ve learned, continue exploring, and develop into a savvy forex trader. Remember, every expert was once a beginner.