Overview of FP Markets as a Forex Broker

FP Markets stands out as a premier choice for beginners entering the dynamic world of Forex trading, particularly with its attractive FP Markets Minimum Deposit requirements. Established in 2005, FP Markets has been at the forefront of delivering exceptional trading environments with a focus on Forex and CFDs. The broker’s commitment to transparency, robust technology, and customer-focused solutions makes it a standout candidate for those starting their trading journey, ensuring they can begin with a manageable initial deposit.

Regulation and Safety of Funds

One of the most critical factors in choosing a Forex broker is the security of funds. FP Markets excels in this area through stringent regulation and oversight. It is licensed by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring it adheres to the highest standards of corporate governance, financial reporting, and disclosure.

Safety of funds is further enhanced by the use of tier-1 banks for holding client funds. Moreover, FP Markets provides an additional layer of security through its membership in the Financial Ombudsman Service (FOS), which offers traders an extra avenue for resolving potential disputes.

FP Markets also employs state-of-the-art encryption technologies to safeguard traders’ data and transactions, ensuring that the trading environment is not only effective but also secure.

“Regulation is not just about compliance; it’s about building a foundation of trust with traders.” – FP Markets Representative

With these measures in place, FP Markets ensures that the beginner’s first foray into Forex trading is both secure and supported by a reliable infrastructure.

Understanding FP Markets Minimum Deposit

What is a FP Markets Minimum Deposit?

A minimum deposit in the context of Forex trading refers to the smallest amount of money that traders are required to deposit into their trading account before they can start trading. This deposit acts as a trader’s capital and is used to make trades in the market. FP Markets caters to a wide range of traders by offering a low minimum deposit, making it accessible for beginners who might not want to risk a large amount of capital initially.

Importance of Minimum Deposits in Forex Trading

The minimum deposit is a crucial factor for beginners in Forex trading for several reasons:

- Risk Management: It allows new traders to start trading with a lower risk level. Trading with only as much money as one can afford to lose is a fundamental risk management strategy, especially important in the volatile Forex market.

- Accessibility: By requiring a smaller minimum deposit, brokers like FP Markets open the market to a broader audience who may not have large amounts of capital available but are eager to learn and participate in trading.

- Learning Opportunity: A lower entry barrier gives beginners the chance to experience trading in a real-world environment with less financial pressure. This practical exposure is invaluable as theoretical knowledge alone cannot fully prepare a trader for the realities of market fluctuations.

- Confidence Building: Starting with a smaller deposit can help new traders build confidence without the overwhelming fear of significant losses. This step-by-step approach helps in gradually increasing one’s investment as they become more comfortable and proficient in trading.

“The lower the barrier to entry, the more inclusive the market becomes. This inclusivity can foster a new generation of skilled traders.” – Financial Expert

FP Markets supports its clients not only by offering a manageable minimum deposit but also through educational resources and customer support designed to help beginners navigate their initial trading experiences effectively.

FP Markets Minimum Deposit Requirements

Detailed Breakdown of the FP Markets Minimum Deposit Amounts

FP Markets offers one of the most competitive minimum deposit requirements in the industry, tailored to cater to both novice and experienced traders. The flexibility in deposit amounts allows traders to choose a level of investment that aligns with their trading strategy and financial capacity.

Standard Account:

- Minimum Deposit: $100 AUD or equivalent in other currencies.

- Features: This account provides access to MT4 and MT5 platforms, offering spreads from 1.0 pips without any commission. It’s ideal for traders who prefer a simple fee structure.

Raw Account:

- FP Markets Minimum Deposit: $100 AUD or equivalent.

- Features: Targeted at more experienced traders, this account offers spreads from 0.0 pips and a commission of $3 per lot per side. This account uses ECN pricing to provide tighter spreads.

These accounts are designed to accommodate the needs of various traders, from those looking to minimize costs to those seeking more advanced trading conditions.

Comparison with Industry Standards

When compared to other brokers in the Forex industry, FP Markets Minimum Deposit requirements are quite reasonable. Many brokers require deposits ranging from $200 to $500, which can be a barrier for beginners just starting out.

FP Markets’ approachable entry level is part of its commitment to making Forex trading accessible to a wider audience. The broker’s lower deposit requirement, coupled with its robust regulatory framework and comprehensive trading tools, makes it an attractive option for beginners.

“By setting a lower minimum deposit, FP Markets not only lowers the entry barrier but also democratizes access to the Forex markets.” – Industry Analyst

This strategic positioning helps FP Markets stand out among its peers, particularly in attracting novices who may be cautious about the initial investment required to start trading.

Account Types and Deposit Requirements

Types of Trading Accounts Offered by FP Markets

FP Markets provides a variety of account types designed to meet the diverse needs of traders at all levels. Each account type is structured to optimize the trading experience based on the trader’s expertise, trading style, and financial goals.

1. Standard Account

- Platform: Available on both MetaTrader 4 and MetaTrader 5.

- Trading Instruments: Offers Forex, Indices, Commodities, and Cryptocurrencies.

- Execution Type: Market execution with no requotes.

- Spread: Starts from 1.0 pips.

2. Raw Account

- Platform: Available on MetaTrader 4 and MetaTrader 5.

- Trading Instruments: Includes all offerings available in the Standard Account.

- Execution Type: ECN pricing for faster and direct market access.

- Spread: As low as 0.0 pips with a commission.

FP Markets Minimum Deposit for Each Account Type

Both the Standard and Raw accounts at FP Markets have the same approachable minimum deposit requirement:

- FP Markets Minimum Deposit: $100 AUD or equivalent in other currencies.

This low minimum deposit is intended to make it easier for beginners to start trading without a significant financial burden.

Benefits and Limitations of Each Account

Standard Account:

- Benefits:

- No commission on trades, making it cost-effective for beginners.

- Wider spreads can be easier to understand and manage for new traders.

- Access to a wide range of trading instruments.

- Limitations:

- Higher spreads compared to the Raw account can mean slightly higher trading costs over time.

Raw Account:

- Benefits:

- Ultra-low spreads for cost-efficient trading.

- Suitable for scalpers and high-volume traders who can take advantage of tight spreads.

- ECN execution provides transparency and faster trade execution.

- Limitations:

- Commissions on trades might complicate cost calculations for new traders.

- More suitable for traders with a bit more experience or those who prefer technical trading.

“Choosing the right account type is as crucial as selecting the broker itself. It can significantly impact your trading effectiveness and satisfaction.” – Trading Specialist

FP Markets’ structured account options ensure that traders can select a model that best suits their trading strategy and experience level, making it a top choice for beginners who need flexibility and support as they build their trading skills.

Deposit Methods

Various Methods to FP Markets Minimum Deposit Funds

FP Markets offers a range of deposit methods to accommodate the preferences and geographical locations of its clients. Understanding these options can help traders manage their finances more efficiently and choose the most convenient and cost-effective method for funding their accounts.

1. Bank Transfers

- Description: Transfer funds directly from your bank account to your FP Markets trading account.

- Geographical Availability: Widely available globally.

2. Credit and Debit Cards

- Description: Use Visa, MasterCard, or other major credit and debit cards to make deposits.

- Geographical Availability: Available in most countries.

3. E-Wallets

- Description: Includes popular services like PayPal, Neteller, and Skrill.

- Geographical Availability: Depends on the e-wallet service; generally available in many countries.

Pros and Cons of Each Deposit Method

Bank Transfers:

- Pros:

- Secure and trusted by most traders.

- Suitable for larger transfers.

- Cons:

- Can take several business days to process.

- May involve higher fees compared to other methods.

Credit and Debit Cards:

- Pros:

- Instant deposits, allowing traders to start trading almost immediately.

- Generally accepted and easy to use.

- Cons:

- May incur additional fees from the card issuer.

- Some banks may restrict their cards from being used for Forex trading.

E-Wallets:

- Pros:

- Fast processing times, often instant.

- Lower fees compared to bank transfers and sometimes credit cards.

- Cons:

- Not all e-wallets are available in every country.

- May have limits on the amount that can be deposited per transaction.

Any Associated Fees and Processing Times

FP Markets strives to keep deposit fees low, but fees can vary depending on the method used:

- Bank Transfers: May include a fee charged by the trader’s bank. Processing can take 1-3 business days.

- Credit and Debit Cards: No deposit fee charged by FP Markets, but card issuers might charge a fee. Deposits are usually instant.

- E-Wallets: No deposit fee charged by FP Markets. Deposits are typically instant.

FP Markets makes every effort to process deposits as quickly as possible, ensuring traders can capitalize on market opportunities without unnecessary delays.

“The right deposit method balances speed, cost, and convenience to meet the specific needs of the trader.” – Finance Expert

How to Make Your First Deposit

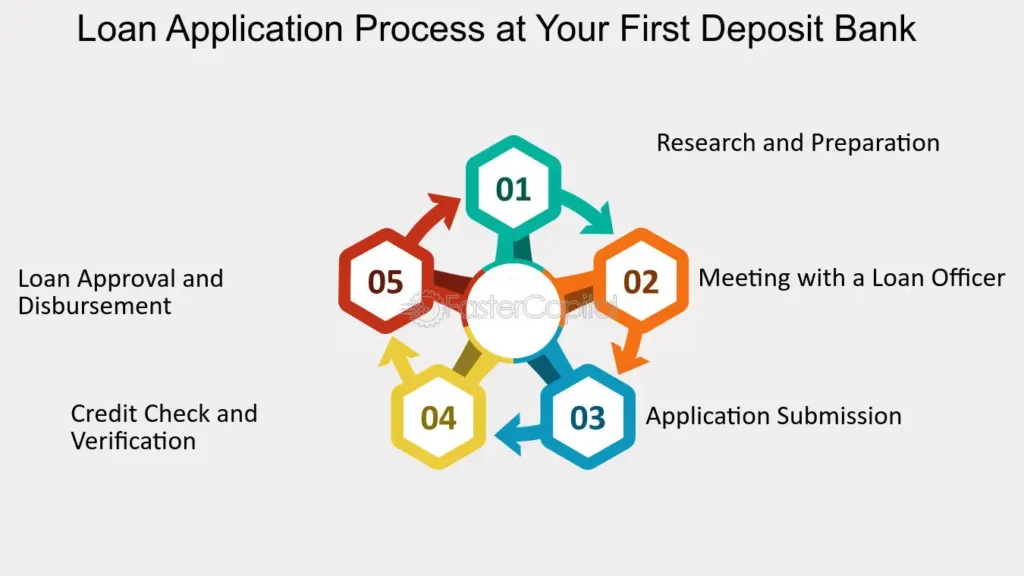

Step-by-Step Guide on Funding an Account at FP Markets

Making your first deposit at FP Markets is a straightforward process designed to get you trading as quickly as possible. Here’s a simple guide to help you through each step:

1: Account Verification

- Description: Before making a deposit, ensure your account is fully verified to comply with financial regulations. This involves submitting proof of identity (e.g., passport or driver’s license) and proof of residence (e.g., utility bill or bank statement).

2: Log In to Your Account

- Description: Access your FP Markets client area with your login credentials.

3: Navigate to the Deposit Section

- Description: Once logged in, locate the ‘Deposit’ or ‘Funding’ section within the dashboard.

4: Select Your Deposit Method

- Description: Choose from the available deposit methods (bank transfer, credit/debit card, or e-wallet) the one that best suits your needs.

5: Enter Deposit Amount

- Description: Input the amount you wish to deposit, ensuring it meets the minimum deposit requirements of your chosen account type.

6: Confirm the Details

- Description: Double-check the deposit details, and confirm the transaction. Depending on the method, you may be redirected to a payment gateway or online banking service.

7: Wait for Funds to Reflect

- Description: The time it takes for your funds to be credited to your trading account can vary based on the deposit method. Credit cards and e-wallets are generally instant, while bank transfers may take a few days.

Tips for a Smooth Deposit Process

- Ensure Account Verification: Complete all verification steps before initiating your first deposit to avoid any delays.

- Check for Fees: Be aware of any potential fees associated with your chosen deposit method to avoid surprises.

- Use the Same Name: Ensure that the name on your FP Markets account matches the name on your payment method to prevent issues with fund transfers.

- Start Small: If you’re new to Forex trading, consider starting with a small deposit to familiarize yourself with the process and the trading platform.

- Keep Records: Maintain records of your deposit confirmations and any correspondence with the broker for future reference.

“A smooth deposit process is your first step towards a successful trading journey. Ensuring all preliminary steps are handled with care can set a positive tone for your trading activities.” – FP Markets Customer Support

Impact of FP Markets Minimum Deposit on Trading Strategy

How the Deposit Amount Affects Trading Choices and Risks

The amount of money you initially deposit into your Forex trading account can significantly influence your trading decisions and the associated risks. Here’s how the minimum deposit impacts your trading approach:

Influence on Risk Management:

- Lower Deposits: Smaller deposits are generally less risky, suitable for beginners who are still learning and may not want to commit a large financial resource. This can limit exposure but also restrict potential returns.

- Higher Deposits: Larger initial deposits enable more significant positions and potentially higher returns. However, this comes with increased risk, which requires sophisticated risk management strategies to safeguard investments.

Access to Trading Instruments and Leverage:

- Variety of Instruments: Some brokers may restrict access to certain high-value instruments to accounts with larger deposits.

- Leverage Options: Higher deposits might provide access to more leverage options, amplifying both potential profits and losses.

Strategies for Trading with Different Deposit Levels

Strategy for Low FP Markets Minimum Deposit:

- Conservative Trading: Focus on low-risk investments and small trades. Utilize tight stop-loss orders to protect your capital.

- Diversification: Spread your trades across different instruments to mitigate risks. Even with small amounts, you can explore diversification within accessible markets.

Strategy for Higher Deposits:

- Aggressive Trading: If you’re more experienced and can afford to risk more, consider taking positions in volatile markets or using higher leverage.

- Hedging: Use part of your deposit to hedge investments as a protective measure against market volatility.

General Tips:

- Education: Regardless of your deposit size, continually educate yourself about Forex markets, analysis techniques, and trading strategies.

- Trial Runs: Use demo accounts to practice and refine strategies before applying them in live trading scenarios.

“Your initial deposit should match your trading style, risk tolerance, and financial goals. Adjusting your strategies according to your deposit size can lead to a more tailored and effective trading experience.” – Trading Analyst

Bonuses and Promotions Related to Deposits

Current Bonuses for New and Existing Traders

FP Markets offers a variety of bonuses and promotions designed to enhance the trading experience for both new and existing clients. These incentives not only serve as a welcome boost to trading capitals but also provide traders with additional opportunities to explore the markets. Let’s explore some of the current offerings:

Welcome Bonus:

- Description: New traders who open an account and make their first deposit might receive a welcome bonus, typically a percentage of their initial deposit.

- Eligibility: Available to new clients upon their first deposit within a specified period after account registration.

Deposit Bonus:

- Description: A deposit bonus rewards traders with additional funds based on the amount they deposit into their trading account.

- Eligibility: Often available to all traders during promotional periods. The bonus amount may vary based on the deposit size.

Loyalty Program:

- Description: Rewards long-term traders with points or credits that can be converted into trading capital or used for other benefits.

- Eligibility: Available to traders who have maintained an active trading account for a certain period.

Terms and Conditions for Eligibility and Withdrawal of Bonuses

Understanding the terms and conditions associated with any trading bonus is crucial as they dictate how you can use these bonuses and when you can withdraw them:

Minimum Trading Volume:

- Requirement: Most bonuses come with a requirement to trade a minimum volume before the bonus can be withdrawn. This is usually a multiple of the bonus amount.

Time Restrictions:

- Requirement: Some bonuses must be utilized or released within a specific timeframe. Failing to meet this deadline can result in the forfeiture of the bonus.

Withdrawal Conditions:

- Requirement: Apart from trading volume, there may be other conditions to meet before you can withdraw the bonus, such as verification procedures or funding the account with a minimum amount of capital.

Eligibility:

- Requirement: Bonuses are typically available only to traders in certain jurisdictions, depending on the regulatory guidelines that FP Markets adheres to.

“While bonuses can significantly enhance your trading capacity, it’s important to understand the associated terms to fully benefit from them.” – FP Markets Support Team

Withdrawing Funds

How to Withdraw Your Profits from FP Markets

Withdrawing your profits from FP Markets is designed to be a straightforward and secure process, ensuring that traders can access their funds efficiently. Here is a step-by-step guide to help you navigate the withdrawal process:

1: Verify Account Compliance

- Description: Ensure your trading account is fully compliant with all required verification procedures. This typically involves having your identity, residence, and payment methods fully verified.

2: Access Your Trading Account

- Description: Log in to your FP Markets client area using your secure credentials.

3: Navigate to the Withdrawal Section

- Description: Find the ‘Withdrawal’ option within the dashboard. This section allows you to manage and initiate withdrawals.

4: Choose Your Withdrawal Method

- Description: Select a withdrawal method. It’s generally advisable to use the same method used for deposits to simplify the process and meet anti-money laundering regulations.

5: Enter Withdrawal Amount

- Description: Specify the amount you wish to withdraw. Ensure it does not exceed the balance available in your account after accounting for any open positions or margin requirements.

6: Confirm and Submit Your Request

- Description: Double-check all the details, then confirm and submit your withdrawal request. You may need to provide additional documentation if prompted.

Withdrawal Limits and Procedures

- Minimum and Maximum Limits: FP Markets sets minimum and maximum withdrawal limits depending on the chosen method. These limits are in place to ensure security and regulatory compliance.

- Frequency of Withdrawals: While there are no limits on the number of withdrawals, frequent withdrawals might attract additional scrutiny under financial regulations.

Withdrawal Procedure:

- Processing Times: Withdrawal requests at FP Markets are processed within 1-2 business days. However, the time it takes for funds to appear in your account will depend on the withdrawal method.

- Fees: While FP Markets does not typically charge fees for withdrawals, the payment service provider might apply charges.

- Regulatory Compliance: All withdrawals are subject to regulatory checks for anti-money laundering purposes, which may affect the speed of processing.

“The ease of withdrawing profits is a key consideration for traders. Ensuring a smooth process not only enhances the trading experience but also builds trust in the broker’s operational integrity.” – Financial Consultant

FAQs and Troubleshooting

Common Questions About Deposits and Account Funding

When new traders begin funding their accounts or setting up deposits at FP Markets, they often have several questions. Below are some of the most frequently asked questions along with their answers to help clarify the deposit process:

Q1: What are the accepted currencies for deposits at FP Markets?

- Answer: FP Markets accepts several major currencies including AUD, USD, EUR, GBP, and more. This allows traders from various regions to fund their accounts without incurring currency conversion fees.

Q2: Can I use multiple deposit methods?

- Answer: Yes, FP Markets allows the use of multiple deposit methods. However, for security and regulatory compliance, withdrawals must be made through the same methods and proportions as the deposits were received.

Q3: How long does it take for deposited funds to be available in my trading account?

- Answer: Deposit times vary by method. E-wallets and credit/debit cards usually offer instant deposits, while bank transfers may take a few business days.

Q4: Are there any deposit bonuses available for new traders?

- Answer: FP Markets occasionally offers deposit bonuses for new traders. These promotions are typically time-limited and subject to specific terms and conditions, so it’s advisable to check the latest offers on the FP Markets website or contact customer support.

Troubleshooting Deposit Issues

Even with a streamlined deposit process, issues can sometimes arise. Here’s how you can troubleshoot some common deposit problems:

1: Deposit Not Reflected in Trading Account

- Solution: Confirm that the funds have left your bank account or payment service. Check for any emails or notifications from FP Markets regarding the status of your deposit. If there is a significant delay, contact customer support with transaction details for assistance.

2: Deposit Rejected

- Solution: Ensure that all information entered is correct and matches your registered account details. Rejected deposits could be due to incorrect account information, insufficient funds, or bank restrictions on international or online transactions.

3: Restricted Access to Certain Deposit Methods

- Solution: Some deposit methods may not be available in your country due to local regulations or payment network policies. Check for alternative methods that are supported both by FP Markets and in your region.

4: Concerns Over Deposit Fees

- Solution: Review the terms and conditions on the FP Markets website for any applicable fees associated with your chosen deposit method. If fees are higher than expected, consider switching to a more cost-effective payment method.

“Having a clear understanding of how to address deposit issues effectively ensures a smoother, more confident trading experience.” – FP Markets Customer Support

Conclusion and Next Steps

Recap of Key Points

Throughout this comprehensive guide on FP Markets, we’ve covered essential aspects that beginners should consider when choosing a Forex broker, particularly focusing on FP Markets for its favorable conditions for newcomers. Here’s a quick recap of the main points:

- FP Markets Overview: Established in 2005, FP Markets is highly regulated by reputable organizations like ASIC and CySEC, ensuring a secure trading environment.

- Account Types and FP Markets Minimum Deposit: FP Markets offers versatile account types such as the Standard and Raw accounts, both with a competitive minimum deposit requirement of $100 AUD.

- Deposit Methods: A variety of convenient deposit methods are available, including bank transfers, credit/debit cards, and e-wallets, each with its own pros and cons regarding fees, processing times, and ease of use.

- Bonuses and Promotions: FP Markets provides attractive bonuses and promotions, enhancing the trading experience for both new and existing traders.

- Withdrawal Processes: The withdrawal process is straightforward, aiming to ensure traders can access their profits with ease while adhering to regulatory requirements.

- Troubleshooting and FAQs: Addressing common issues and questions helps traders manage their accounts efficiently and with confidence.

How to Proceed with Opening an Account and Making the FP Markets Minimum Deposit

For those ready to start trading with FP Markets, here are the steps to proceed:

- Visit the FP Markets Website: Go to FP Markets and navigate to the account registration page.

- Complete the Registration Form: Fill out the form with your personal and financial information as accurately as possible to avoid delays in account verification.

- Verify Your Account: Submit the required documents to verify your identity and residence. This step is crucial for meeting regulatory requirements and ensuring the security of your account.

- Make Your First Deposit: Choose your preferred deposit method and fund your account with at least the minimum required deposit. Remember to check if there are any ongoing promotions you could benefit from.

- Start Trading: Once your deposit is reflected in your account, you can start trading. Utilize the educational resources provided by FP Markets to enhance your trading knowledge and skills.

- Utilize Support: If you encounter any issues or have questions, FP Markets’ customer support is available to assist you. They provide support through live chat, email, and phone, ensuring you can get help whenever needed.

“Taking the first step into Forex trading with a reliable and supportive broker like FP Markets can set the foundation for a successful and enriching trading journey.” – Financial Expert