Overview of the Role of Bonuses in Forex Trading

Bonuses in Forex trading, like the FP Markets Bonus, serve as a significant incentive for both new and existing traders. They are tools brokers use to attract new clients, retain existing ones, and boost trading volumes. At FP Markets, bonuses can take various forms, such as no-deposit bonuses, deposit match bonuses, and loyalty rewards, each designed to enhance the trading experience by increasing trading capital, allowing for more substantial positions and more extended trading without immediate additional personal investment.

Brief Introduction to FP Markets and Its Reputation in the Market

FP Markets, established in 2005, is a respected entity in the world of Forex and CFD trading, known for its commitment to providing superior trading solutions. It operates under strict regulation by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring high standards of transparency and client security.

FP Markets is celebrated for its deep liquidity, real-time price transparency, and low-latency trading environments. Numerous awards and consistent positive feedback from the trading community bolster its reputation, reflecting its commitment to excellence and client satisfaction.

The introduction of bonuses by FP Markets further solidifies its position as a trader-centric broker, aiming to offer more value and enhance trading outcomes for its clients.

Types of Bonuses Offered by FP Markets

Description of Various Bonus Types

FP Markets offers a range of bonus types designed to meet the diverse needs of its clients, from newcomers to seasoned traders. Here’s an overview of the most common types of bonuses that FP Markets typically offers:

Welcome Bonus:

- Description: This bonus is offered to new clients as a thank you for joining the broker. It often comes in the form of a percentage of their first deposit, providing additional funds to trade with.

Deposit Bonus:

- Description: Deposit bonuses are available to all traders who fund their accounts. Similar to welcome bonuses, these typically match a percentage of the deposit amount and aim to enhance the trader’s trading volume capability.

No Deposit Bonus:

- Description: Aimed primarily at new traders, the no deposit bonus allows individuals to start trading without the need to commit any personal funds initially. This can be particularly attractive for those new to Forex trading who wish to test the platform and their trading skills before investing.

Specific Promotions Currently Available

As of the most recent update, here are some specific promotions that FP Markets is offering:

- Welcome Bonus: New traders can receive a 20% bonus on their initial deposit, up to a maximum of $500. This offer is designed to give new users an increased capacity to trade and explore FP Markets’ diverse offering.

- Deposit Bonus: FP Markets may offer periodic deposit bonuses that could match up to 50% of the deposit amount during special promotional periods or for subsequent deposits beyond the initial.

- No Deposit Bonus: Occasionally, FP Markets offers a no deposit bonus where new clients can receive a small trading fund to start without any initial deposit. These promotions are subject to availability and often tied to specific marketing campaigns.

“Bonuses like these not only provide additional trading leverage but also enhance the overall trading experience by allowing clients to engage with a broader range of financial instruments and trading strategies.” – FP Markets Representative

Eligibility for Bonuses

Criteria to Qualify for Different Types of Bonuses

FP Markets designs its bonus schemes to accommodate various types of traders, each with specific eligibility criteria to ensure fair distribution and compliance with regulatory standards. Understanding these criteria is crucial for traders who want to take full advantage of the bonuses offered.

Welcome Bonus:

- Eligibility Criteria:

- Only new clients who have never registered with FP Markets before.

- A verified trading account.

- A minimum initial deposit, often specified in the promotion details.

Deposit Bonus:

- Eligibility Criteria:

- Available to both new and existing clients.

- A minimum deposit amount as specified in the promotion terms.

- The account must be in good standing, with no ongoing disputes or compliance issues.

No Deposit Bonus:

- Eligibility Criteria:

- Typically for new clients only.

- Completion of the registration process and account verification.

- Sometimes you must meet a basic level of trading activity to unlock the bonus for withdrawal.

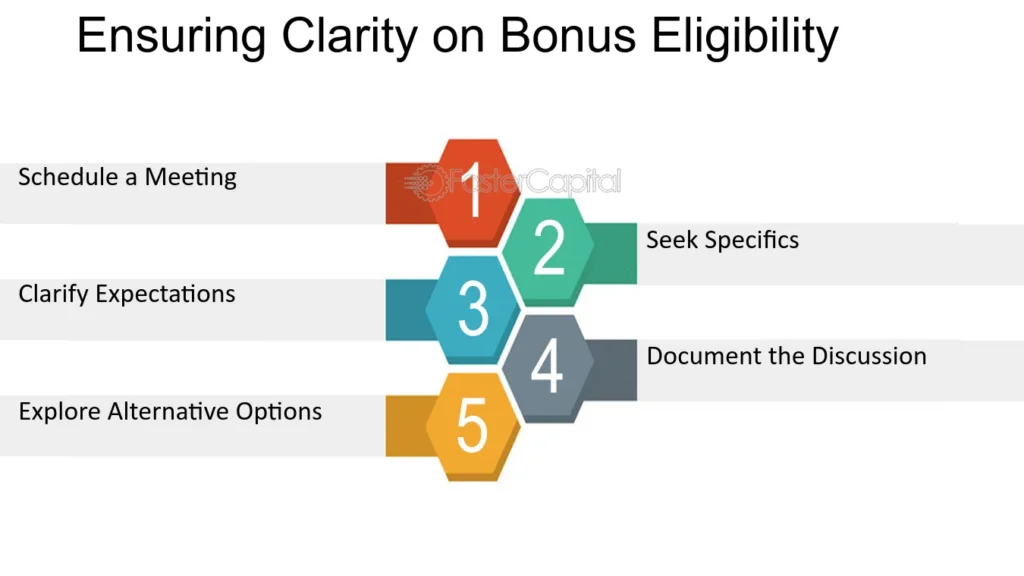

How to Ensure You Are Eligible for Bonuses

To maximize your chances of being eligible for bonuses and successfully claim them, follow these steps:

- Read the Terms and Conditions: Before opting into any bonus, thoroughly read the terms and conditions associated with it. This will help you understand the eligibility requirements, as well as any obligations you need to fulfill to make use of the bonus effectively.

- Complete Account Verification: Ensure your account is fully verified by submitting all required documents, such as ID proof and proof of residence. This is often a prerequisite for claiming bonuses.

- Meet Deposit Requirements: For bonuses that require a deposit, ensure that you meet the minimum deposit amount specified in the bonus terms. This amount may vary between different types of bonuses.

- Stay Informed: Keep an eye on communications from FP Markets, such as emails or notifications within the trading platform, to stay updated on current and upcoming bonuses.

- Contact Support: If you are unsure about your eligibility or have any questions regarding a specific bonus, don’t hesitate to contact FP Markets’ customer support. They can provide guidance and help you understand any aspect of the bonus processes.

“Ensuring eligibility for bonuses requires attention to detail and a proactive approach to compliance with the broker’s policies. Traders who do this can significantly enhance their trading experience with the added benefits these bonuses offer.” – Forex Trading Consultant

How to Claim Bonuses

Step-by-Step Guide on How to Apply for and Receive Bonuses at FP Markets

FP Markets designs its bonus claiming process to be straightforward, enabling traders to easily access benefits as soon as they qualify. Here’s a detailed guide on how to apply for and receive bonuses:

1: Review Available Bonuses

- Action: Regularly check the FP Markets website or your email for information on current bonuses. Promotions can vary throughout the year, and understanding their specifics is crucial.

2: Verify Your Eligibility

- Ensure you meet all the criteria for the bonus that interests you. This includes aspects like account type, deposit size, and any specific trading activity requirements.

3: Complete Account Verification

- Action: If not already verified, submit necessary documents to complete your account verification. This often includes proof of identity (passport or ID card) and proof of residence (recent utility bill or bank statement).

4: Apply for the Bonus

- Action: For some bonuses, you may need to manually apply through the FP Markets client portal or by contacting customer support. Ensure you follow the specific application process detailed in the bonus terms.

5: Make the Qualifying Deposit

- Ensure you deposit the minimum required amount using an approved payment method if the bonus requires a deposit.

6: Confirm Bonus Receipt

- After you apply and make any necessary deposits, check your account to confirm that you have received the bonus. This should align with the timelines stipulated in the bonus terms.

7: Start Trading

- Action: Utilize the bonus according to the terms set out. Be mindful of any trading volume requirements or time constraints to fully benefit from the bonus.

Documentation and Verification Processes

Proper documentation and successful verification are fundamental to the bonus claim process at FP Markets:

- Identity Verification: Typically requires a clear copy of your government-issued ID card, passport, or driver’s license.

- Residence Verification: A recent utility bill, bank statement, or government-issued document showing your name and current address, usually not older than three months.

These documents are essential not only for regulatory compliance but also to protect against fraud and ensure the integrity of the financial transactions.

“Prompt and accurate submission of required documents can significantly streamline the bonus claim process, ensuring you gain access to your benefits without unnecessary delays.” – FP Markets Compliance Officer

Terms and Conditions of Bonuses

Detailed Examination of the Terms Associated with Each Bonus

Understanding the terms and conditions associated with each bonus at FP Markets is crucial to ensure that traders can effectively utilize these incentives without misunderstanding their implications. Here’s a breakdown of typical terms attached to bonuses:

Trading Volume Requirements:

- Many bonuses require traders to trade a certain volume before withdrawing bonus funds. This volume, measured in lots, varies according to the bonus and the account type.

Time Restrictions:

- Explanation: Bonuses often come with a time limit within which you must complete the trading volume requirements or simply use the bonus funds before they expire.

Withdrawal Conditions:

- Explanation: There might be restrictions on withdrawing the bonus itself, the profits made from trading with the bonus, or both. Understanding these conditions is essential to plan your trading and withdrawal strategy.

Eligibility Restrictions:

- Explanation: Some bonuses are only available to traders in certain countries or those who use specific account types. Ensure that you are eligible before attempting to claim a bonus.

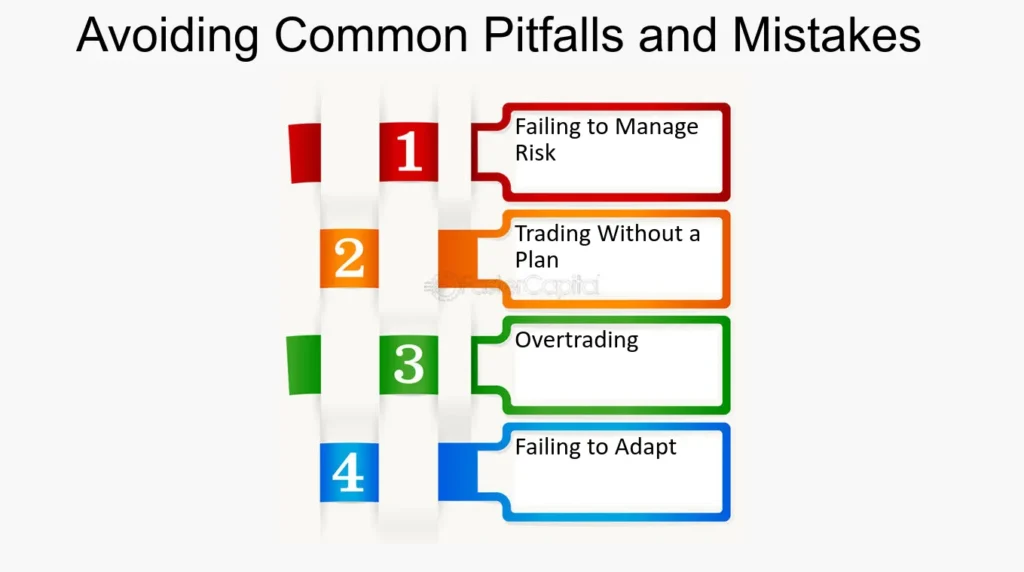

Common Pitfalls and Things to Watch Out For

When dealing with bonuses, some common pitfalls can hinder your ability to benefit fully from these offers:

Overlooking the Fine Print:

- Pitfall: Failing to read the detailed terms and conditions can lead to misunderstandings about how and when the bonus can be used or withdrawn.

- Advice: Always take the time to thoroughly review the terms associated with any bonus. If anything is unclear, do not hesitate to contact customer support for clarification.

Misjudging Volume Requirements:

- Pitfall: Underestimating the trading volume needed to unlock a bonus can result in unexpected challenges in meeting these criteria within the required timeframe.

- Advice: Calculate whether the required trading volume is achievable based on your usual trading frequency and strategy before committing to a bonus.

Ignoring Time Limits:

- Pitfall: Not keeping track of the expiration date for bonus usage or completion of trading requirements can lead to losing the bonus funds.

- Advice: Set reminders for key dates related to your bonus, such as when the trading volume needs to be completed and when the bonus expires.

Inadequate Risk Management:

- Pitfall: The additional funds from a bonus might lead some traders to take larger or more risky trades than they normally would.

- Advice: Maintain your regular trading discipline and risk management strategies, even when trading with bonus funds. Treat the bonus as part of your capital and protect it as diligently as you would your own money.

“Bonuses can significantly enhance your trading capacity, but they come with obligations that need to be carefully managed to maximize their benefits.” – Financial Expert

Impact of Bonuses on Trading Decisions

How Bonuses Can Affect Trading Strategies and Risk Management

Bonuses, while beneficial, can significantly influence trading decisions and strategies, particularly in how traders manage their risks. Understanding these impacts is crucial for effective trading.

Increased Trading Capital:

- Effect: Bonuses increase the overall capital available for trading, allowing traders to open larger positions or multiple trades simultaneously.

- Risk Management Implication: While this can amplify profits, it also increases potential losses. Traders need to adjust their risk management strategies accordingly, possibly employing tighter stop-loss orders or diversifying trades to manage the increased exposure.

Leverage Effects:

- Effect: With more capital from bonuses, traders might be tempted to use higher leverage to maximize gains.

- Risk Management Implication: Increased leverage can lead to higher volatility in account balances. Traders should consider whether they are comfortable with potentially faster and larger swings in account values and adjust their leverage use based on their risk tolerance.

Meeting Volume Requirements:

- Effect: Bonuses with volume requirements may push traders to trade more frequently or maintain open positions for longer than they might otherwise, in order to meet bonus conditions.

- Risk Management Implication: This can lead to taking less-than-ideal trades just to increase volume, which can be contrary to sound trading practices. It’s important to maintain a strategy that prioritizes quality of trades over quantity.

Psychological Aspects of Trading with Bonus Funds

Trading with bonus funds also introduces several psychological factors that can affect decision-making:

Sense of Safety:

- Psychological Effect: Traders often view bonus funds as “extra” or “free” money, which can lead to a perceived safety net. This might encourage taking risks they would typically avoid.

- Advice: It’s crucial to remember that all funds in a trading account should be considered equally valuable. Effective risk management should still apply, regardless of the source of the funds.

Pressure to Perform:

- Psychological Effect: The requirements to unlock or withdraw bonuses can put pressure on traders to perform within a certain timeframe, potentially leading to stress and hasty decisions.

- Advice: Traders should remain focused on their long-term trading objectives and not let short-term bonus conditions overly influence their strategies.

Overconfidence:

- Psychological Effect: Bonuses can lead to overconfidence, where traders might believe they can beat the market thanks to the additional funds.

- Advice: Keeping a level head and adhering to established trading plans is key. Regularly reviewing and assessing trading decisions can help maintain discipline.

“While bonuses can provide a significant boost to trading capital, they should not fundamentally alter the principles of effective trading strategies and risk management.” – Trading Psychology Expert

Case Studies: Effective Use of FP Markets Bonuses

Examples of How Real Traders Have Utilized FP Markets Bonuses Effectively

By examining real-world examples, traders can glean valuable insights into how to utilize bonuses from FP Markets effectively. Here are two case studies illustrating successful strategies employed by traders using FP Markets bonuses.

Case Study 1: Conservative Trading Approach

- Trader Profile: Emily, a beginner Forex trader.

- Strategy: Emily used her welcome bonus to experiment with trading without risking her initial deposit. She focused on low-leverage trades in major currency pairs.

- Outcome: By using her bonus to understand market movements and refine her trading strategy, Emily managed to turn a profit without depleting her initial deposit. Her conservative approach minimized losses and provided practical trading experience.

- Lesson Learned: Bonuses can serve as a valuable learning tool for new traders, allowing them to gain market experience without the immediate risk of losing personal capital.

Case Study 2: Strategic Leverage Use

- Trader Profile: Mark, an experienced trader with a background in commodity trading.

- Strategy: Mark applied his deposit bonus towards trading CFDs on precious metals, leveraging his knowledge of commodity markets. He strategically increased his position sizes while managing risks with strict stop-loss orders.

- Outcome: The increased capital from the bonus allowed Mark to enhance his profits from successful trades. His familiarity with commodities minimized his risks, while the bonus funds provided additional buffer against losses.

- Lesson Learned: For experienced traders, bonuses can amplify profits in familiar markets. However, careful risk management remains crucial to protect against potential losses.

Lessons Learned and Tips from Experienced Traders

From these case studies, several key tips emerge that can help traders leverage FP Markets bonuses effectively:

- Understand the Terms and Conditions: Always start by fully understanding the bonus terms. Knowing the requirements and restrictions can help you plan your trading strategy accordingly.

- Use Bonuses to Diversify: Bonuses can be used to explore markets or instruments that you are less familiar with, without risking your own funds. This can broaden your trading experience and potentially uncover profitable new strategies.

- Maintain Trading Discipline: Do not let the presence of bonus funds tempt you into making irrational or overly risky trades. Stick to your trading plan and use the same criteria for entering and exiting trades as you would with your own money.

- Plan for Volume Requirements: If your bonus comes with volume requirements, plan your trades in such a way that you can meet these without overtrading. Look for high-probability trades that align with your usual trading strategy.

- Leverage Educational Resources: Use any additional profits from bonus funds to invest in furthering your trading education. This can include attending workshops, purchasing courses, or subscribing to advanced trading platforms.

“Bonuses are a tool, not a free pass. The best traders use them to enhance their strategies, not to replace them.” – Senior Forex Analyst

Comparing FP Markets Bonuses to Other Brokers

Comparative Analysis of FP Markets’ Bonuses Against Other Leading Brokers

To understand the value of FP Markets’ bonuses, it’s essential to compare them with those offered by other leading brokers in the Forex industry. This comparison will consider aspects such as the size of the bonuses, the conditions attached, and the variety of bonuses available.

Comparison with Broker A:

- Bonus Variety: Broker A offers a similar range of bonuses, including welcome, deposit, and no deposit bonuses. However, FP Markets often provides more flexible terms regarding how bonuses can be used and the trading instruments they apply to.

- Bonus Size: While Broker A might offer higher bonus amounts, they often come with more stringent conditions, such as higher minimum trading volumes or shorter expiration times.

- User Experience: Broker A’s bonuses, although larger, may not contribute to a better trading experience due to these restrictive terms.

Comparison with Broker B:

- Bonus Accessibility: Broker B restricts its most attractive bonuses to high-volume or premium account holders. In contrast, FP Markets provides bonuses that are more accessible to a broader range of traders, including those with smaller account balances.

- Conditions and Flexibility: Broker B’s bonuses might have fewer restrictions related to trading volumes but could require longer periods before withdrawal is possible, which can be a significant limitation for some traders.

Pros and Cons of FP Markets Bonuses in the Context of the Overall Trading Experience

Pros:

- Accessibility: FP Markets makes its bonuses accessible to a wide range of traders, not just those with large balances or high trading volumes.

- Flexibility: The terms and conditions of FP Markets’ bonuses are generally more flexible, allowing traders to use bonus funds across a variety of trading instruments.

- Supportive of Trading Strategy Development: Bonuses at FP Markets can be used as a tool to explore and develop trading strategies without risking personal capital, particularly beneficial for new traders.

Cons:

- Volume Requirements: Like many brokers, FP Markets attaches volume requirements to some of its bonuses, which might encourage overtrading in some instances.

- Potential for Misuse: Without proper risk management, the additional leverage provided by bonuses can lead to significant losses, especially if traders do not adhere strictly to their trading strategies.

Overall Context

When comparing FP Markets’ bonuses with those from other brokers, it’s clear that while some brokers may offer larger bonuses, the flexibility and terms provided by FP Markets are generally more beneficial in the long term. This aligns with FP Markets’ focus on supporting sustainable trading practices and providing a user-friendly experience.

Withdrawal of Profits from Bonus Trading

Rules and Procedures for Withdrawing Money Earned Through Bonus Trading

Withdrawing profits made from trading with bonus funds at FP Markets follows specific rules and procedures designed to ensure compliance and fair play. Understanding these is crucial for managing your expectations and planning your trading and withdrawal strategy effectively.

Step-by-Step Withdrawal Procedure:

- Meet the Trading Requirements: Before profits from bonuses can be withdrawn, all trading volume requirements associated with the bonus must be met. These are usually detailed in the bonus terms and conditions and often involve trading a certain number of lots.

- Verify Account Compliance: Ensure that your trading account is fully verified and in compliance with all regulatory requirements. This includes having up-to-date identification and residency documents filed with FP Markets.

- Submit a Withdrawal Request: Once you have met the necessary conditions, you can submit a withdrawal request through the FP Markets client portal. You will need to select a withdrawal method, which ideally should be the same as your deposit method to simplify processing and adhere to anti-money laundering policies.

- Processing of the Withdrawal: Withdrawal requests are typically processed by FP Markets within 1-2 business days. However, the time it takes for the funds to reach your account can vary depending on the withdrawal method used.

Documentation and Verification:

- You may be required to submit additional documentation during the withdrawal process, especially if large sums are involved or if the withdrawal method differs from the deposit method.

How Bonuses Affect Withdrawal Limits and Processing Times

Impact on Withdrawal Limits:

- Increased Scrutiny: Withdrawals of profits derived from bonus trading might be subject to increased scrutiny. This is because brokers need to ensure that all trading activity meets the terms of the bonus and that no manipulative trading practices have been used to generate the profits.

- Withdrawal Caps: Some bonuses might have a cap on the amount of profit that can be withdrawn. This cap is usually specified in the terms of the bonus and is designed to limit the broker’s risk associated with offering the bonus.

Effect on Processing Times:

- Potential Delays: If profits from bonus trading are involved, the withdrawal process might take longer than usual due to the additional checks and verifications needed to ensure compliance with bonus conditions.

- Regulatory Compliance: Delays may also occur as a result of the need to comply with regulatory standards, especially concerning anti-money laundering and fraud prevention.

“While bonuses can enhance your trading capacity and potential profits, they also come with conditions that can affect how and when you can withdraw those profits. Understanding these rules is vital for effective capital management.” – Financial Compliance Officer

FAQs and Troubleshooting: FP Markets Bonuses

Frequently Asked Questions Regarding FP Markets Bonuses

Q1: What types of bonuses does FP Markets offer?

- Answer: FP Markets offers a variety of bonuses, including welcome bonuses for new clients, deposit bonuses for existing clients, and occasionally no deposit bonuses. These bonuses are designed to enhance trading capital and provide new opportunities for traders.

Q2: How can I claim a bonus at FP Markets?

- Answer: To claim a bonus at FP Markets, you typically need to register an account, verify your identity, make the required deposit (if applicable), and then apply for the bonus through the client portal or by contacting customer support, depending on the specific bonus terms.

Q3: Are there any restrictions on withdrawing profits from bonus trading?

- Answer: Yes, there are usually trading volume requirements that must be met before profits from bonus trading can be withdrawn. These requirements ensure that the bonuses are used for trading purposes. Additionally, there might be restrictions on the amount of profit that can be withdrawn if it was earned using bonus funds.

Q4: Can I use bonuses from FP Markets in all trading instruments?

- Answer: Generally, yes, but it depends on the specific terms of the bonus. Some bonuses may be restricted to certain instruments or markets. Always check the terms and conditions of the specific bonus to understand where and how it can be applied.

Guidance on Resolving Common Issues Related to Bonus Claims

1: Bonus Not Credited to Account

- Solution: If you believe you have met all the criteria for a bonus but have not seen it credited to your account, first check the terms and conditions to ensure all requirements have been fulfilled. If everything is in order, contact FP Markets customer support for assistance.

2: Difficulty Meeting Trading Volume Requirements

- Solution: If you’re struggling to meet the trading volume requirements associated with a bonus, consider adjusting your trading strategy to include slightly higher volume trades that remain within your risk tolerance. Be careful not to overtrade just to meet the volume requirements, as this could lead to unnecessary losses.

3: Confusion Over Bonus Terms

- Solution: Bonuses can come with complex terms and conditions. If you find the terms confusing or unclear, do not hesitate to reach out to customer support for clarification. It’s important to fully understand the terms before you begin trading with bonus funds.

4: Withdrawal Delays

- Solution: Withdrawal delays can occur if there are discrepancies in meeting bonus conditions or due to compliance checks. Ensure all trading activity is compliant with terms, and provide any additional documentation requested by FP Markets promptly to facilitate the withdrawal process.

“Proper understanding and management of bonuses can significantly enhance your trading experience. However, always ensure compliance with the terms to avoid issues with claims or withdrawals.” – FP Markets Risk Management Specialist