Overview of FP Markets as a Broker

FP Markets, established in 2005, is a well-regarded broker in the global financial markets, offering diverse FP Markets Account Types for trading across Forex, CFDs, stocks, commodities, and cryptocurrencies. Based in Australia, FP Markets is renowned for its commitment to providing superior trading technology, advanced trading platforms, and a robust trading environment.

Core Offerings:

- Forex Trading: FP Markets offers a wide range of currency pairs, including major, minor, and exotic pairs, facilitating forex trading through sophisticated platforms like MetaTrader 4, MetaTrader 5, and IRESS.

- In CFD Trading, traders can engage in contracts for difference (CFDs) on various asset classes, including indices, stocks, commodities, and cryptocurrencies. Importantly, these opportunities allow for speculation on the price movements without owning the underlying assets. Consequently, this provides a flexible and diverse trading experience that can be tailored to meet individual investment strategies.

- Direct Market Access (DMA): For traders interested in stocks, FP Markets provides direct market access, enabling them to trade directly into the order books of global stock exchanges.

Trading Infrastructure:

- FP Markets prides itself on its state-of-the-art trading infrastructure which includes ultra-low latency trade execution, exceptional liquidity, and transparent pricing. This is supported by a network of data centers located in key financial hubs around the world.

Educational Resources:

- The broker offers extensive educational resources aimed at traders of all levels. These include webinars, e-books, and tutorial videos designed to enhance trading knowledge and skills.

Explanation of Its Standing in the Forex Market

Reputation:

- FP Markets enjoys a strong reputation in the Forex market due to its regulatory compliance and customer-centric approach. Furthermore, it offers a wide range of trading tools that cater to both novice and experienced traders, thereby enhancing its appeal across different levels of trading expertise. It is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring high standards of corporate governance and consumer protection.

Awards and Recognition:

- Over the years, FP Markets has been recognized with numerous industry awards that highlight its reliability, service quality, and innovative technology. These accolades reinforce its position as a leading broker in the competitive Forex market.

Client Services:

- FP Markets differentiates itself with exceptional client service, offering multilingual support 24/5, dedicated account managers, and a client-oriented approach that ensures a responsive, informative, and helpful service to its traders.

Technology and Innovation:

- The broker continuously invests in technology and innovation to ensure its platforms and tools meet the evolving needs of modern traders. FP Markets’ clients benefit from advanced charting tools, risk management features, and automated trading capabilities.

Competitive Spreads and Low Fees:

- FP Markets offers some of the most competitive spreads in the industry and maintains transparency with its pricing structure. Consequently, this is particularly advantageous for scalpers and high-volume traders who benefit from lower trading costs.

Overview of Account Types Offered

FP Markets caters to a diverse clientele by offering a variety of FP Markets Account Types designed to meet different trading preferences and requirements. Each account type is specifically tailored to support various trading strategies and levels of experience. Consequently, there are suitable options available for both novice and experienced traders.

Standard Account

Purpose: The Standard Account is designed for traders who prefer a simple and straightforward trading experience without additional commissions on trades.

To enhance the flow and readability of your text, incorporating more transition words can be quite effective. Here’s a revised version of your sentence using additional transition words:

“This approach is particularly well-suited to beginners and, additionally, to those who trade smaller volumes.”

In this revision, “additionally” serves as a transition word, linking the two related ideas and improving the cohesiveness of the sentence.

Target User:

- Beginners who are new to Forex trading and want to keep cost calculations straightforward.

- Furthermore, traders who prefer longer-term positions find that the slightly wider spreads are less impactful compared to the commission costs.

Features:

- Access to all trading platforms offered by FP Markets.

- No commission on trades; costs are included in the spreads.

- Moreover, there are higher spreads compared to other account types.

Raw Account

The Raw Account is specifically designed for experienced traders. Consequently, these traders can benefit from tighter spreads while additionally paying a commission per trade. This setup therefore provides a more cost-effective trading environment for those who trade frequently. This account type is ideal for scalping and high-frequency trading strategies where low spread is crucial.

Target User:

- Experienced traders who look for low spreads and are comfortable with commission-based pricing.

- Scalpers and day traders who benefit from lower transaction costs on large volumes of trades.

Features:

- Very tight spreads starting from 0.0 pips.

- Commission fee charged per trade.

- Best suited for use with automated trading strategies and high volume trades.

Islamic Account

The Islamic Account, also known as a Swap-Free account, is specifically designed for traders who must adhere to Sharia law. Importantly, this law prohibits the earning of interest on trades held overnight. Consequently, the Islamic Account ensures that such interest does not accrue, thereby aligning with the ethical and religious requirements of its users. Furthermore, this adaptation not only respects the cultural values but also facilitates an inclusive trading environment.

Target User:

- Traders who need to adhere to Islamic finance principles.

- Suitable for traders who often hold positions open overnight and want to avoid swap fees.

Features:

- No swap or rollover interest on overnight positions.

- Slightly wider spreads or commissions to compensate for the absence of swap fees.

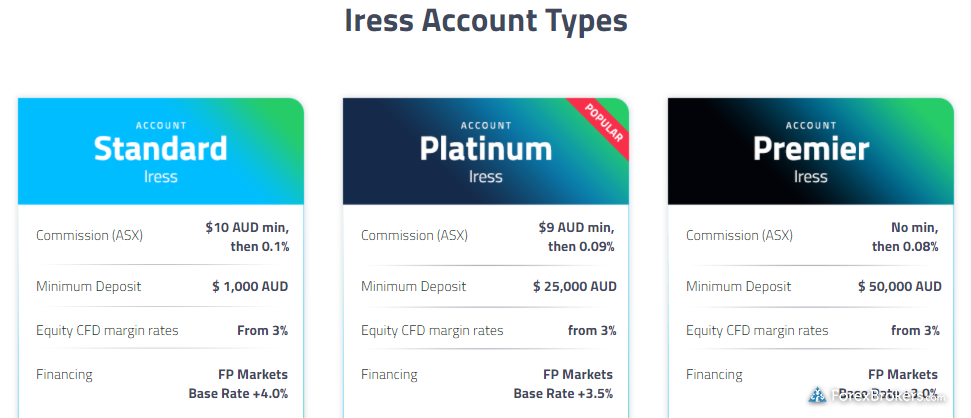

IRESS Account

Purpose: The IRESS Account is designed for traders who want direct market access to stocks and CFDs. It’s suitable for professional traders who require more sophisticated trading tools and functionalities.

Target User:

- Professional and experienced traders who need access to a broader range of financial instruments, including global stocks.

- Traders who prefer a more robust trading platform with advanced features.

Features:

- Access to IRESS platform, offering extensive tools and advanced charting.

- Commission-based structure with access to DMA (Direct Market Access).

- Monthly platform fee which may be waived based on trading activity.

Standard Account

Features of the Standard Account

The Standard Account provided by FP Markets is designed to cater primarily to retail traders who are looking for an easy-to-manage trading platform with straightforward costs. Here are the primary features of the Standard Account:

- No Commission: Trades are executed without any commission fees, which simplifies the cost structure for traders. The broker’s fees are included within the spreads.

- Furthermore, traders have access to both MetaTrader 4 and MetaTrader 5 platforms. These platforms are renowned for their user-friendly interfaces and robust trading tools. Additionally, incorporating more transition words can significantly improve the readability and coherence of your writing.

- Spreads: The account features slightly higher spreads starting from 1.0 pips, which incorporates all trading costs without separate commissions.

- Regarding leverage, investors can access up to 1:500 leverage, which offers substantial potential for profit maximization. However, it is crucial to note that while this high degree of leverage can amplify returns, it correspondingly escalates the risk. Therefore, careful consideration and prudent risk management strategies are imperative to mitigate potential losses and capitalize on the opportunities presented by such significant leverage.

- Minimum Deposit: The minimum deposit to open a Standard Account is typically accessible, making it easier for new traders to get started.

- Instruments: Traders can access a wide range of trading instruments, including Forex pairs, metals, indices, commodities, and cryptocurrencies.

Pros and Cons for Retail Traders

Pros:

- Simplicity: The lack of commission and the inclusion of costs within the spreads make it simpler for new traders to understand and calculate their trading expenses.

- Accessibility: A relatively low entry requirement in terms of initial deposit and straightforward fee structure make this account appealing to newcomers in the forex market.

- Educational Resources: FP Markets provides excellent educational support, which is beneficial for traders using the Standard Account to learn the ropes of Forex and CFD trading.

- Technology: Access to advanced trading platforms like MT4 and MT5 allows retail traders to utilize professional-grade tools to analyze markets and execute trades.

Cons:

- However, while the absence of a commission is advantageous, the higher spreads can become costly. This is particularly true for traders who operate with high trading volumes or who trade frequently.

- Limited Customization: Compared to more advanced accounts, the Standard Account offers fewer customization options for trading conditions and may not cater to more experienced traders seeking tighter spreads or specialized order types.

- Original: High leverage of up to 1:500 can pose significant risks, especially for inexperienced traders who might not fully understand how to manage leverage properly. Revised: Significantly, high leverage of up to 1:500 presents considerable risks, particularly for inexperienced traders who may not fully comprehend the intricacies of managing leverage effectively. Consequently, it is crucial to approach leverage cautiously and seek guidance to mitigate potential financial losses.

Raw Account

Explanation of the Raw Account Specifics

The Raw Account offered by FP Markets is tailored for traders who seek minimal trading costs on spreads and are comfortable paying a commission on trades. This FP Markets Account Types is particularly popular among scalpers and high-volume traders. Consequently, those individuals can benefit from tighter spreads.

Features of the Raw Account:

- This FP Markets Account Types is particularly popular among scalpers and high-volume traders who can benefit from tighter spreads. Additionally, with spreads starting from as low as 0.0 pips, it offers a competitive advantage compared to standard accounts. This lower spread can be especially advantageous for traders who engage in frequent, short-term trading strategies.

- Commission Fees: There is a commission fee on trades, typically around $3 per lot per side, which compensates for the lower spreads.

- Trading Platforms: Like the Standard Account, the Raw Account provides access to MetaTrader 4 and MetaTrader 5, which offer advanced charting, analysis tools, and automated trading capabilities.

- This FP Markets Account Type is particularly popular among scalpers and high-volume traders who can benefit from tighter spreads. Additionally, with spreads starting from as low as 0.0 pips, significantly lower than those offered in the Standard Account, traders gain a competitive edge. Moreover, the account also allows up to 1:500 leverage, giving traders the potential to maximize returns on their trades.

- Minimum Deposit: The minimum deposit requirement is similar to the Standard Account, making it relatively accessible.

- Market Execution: The Raw Account uses market execution, ensuring rapid trade execution without requotes.

Comparison with the Standard Account

Spreads:

- Raw Account: Spreads from 0.0 pips.

- Standard Account: Spreads from 1.0 pips.

- The Raw Account, in particular, is more suitable for trading strategies that require tight spreads, such as scalping and high-frequency trading. With spreads starting as low as 0.0 pips, this account type offers a competitive advantage compared to standard accounts. Additionally, for traders who engage in frequent, short-term trading strategies, the lower spread can be especially advantageous.

Commissions:

- Raw Account: Charges a commission of approximately $3 per lot per side.

- Standard Account: No commission is charged as all trading costs are included in the spread.

- The commission on the Raw Account compensates for the ultra-low spreads, which can be beneficial for those trading larger volumes or looking to capitalize on small price movements.

Suitability for Different Trader Types:

- Beginners: The Standard Account is generally more suitable for beginners because of its simpler cost structure. The wider spreads without additional commission fees make it easier for new traders to understand and calculate their trading costs.

- Experienced Traders: The Raw Account is better suited for experienced traders, particularly those who trade frequently or with high volumes. The lower spreads allow for a more cost-effective execution of such strategies as scalping or day trading.

- Scalpers and High-Frequency Traders: These traders particularly benefit from the Raw Account due to the minimal spreads, which can significantly reduce transaction costs over a large number of trades.

Islamic Account

Description of the Islamic Account

The Islamic Account, also known as a Swap-Free Account, offered by FP Markets is specifically designed to meet the requirements of Muslim traders who follow Sharia law. Sharia law prohibits the accumulation of interest, which means traditional trading accounts with overnight swap fees (interest payments) do not comply with these principles. The Islamic Account addresses this by eliminating swap fees on overnight positions, ensuring compliance with Islamic finance rules.

How It Adheres to Sharia Law

To adhere to Sharia law, the Islamic Account at FP Markets is structured to avoid any transactions considered “riba” (interest). This is achieved through the following modifications:

- No Swap Fees: Islamic Accounts do not incur rollover or swap fees when positions are held overnight, which is considered a form of interest and is prohibited under Sharia law.

- No Riba: The account ensures that no interest is paid on trades, in compliance with the prohibition of riba.

- Immediate Transaction Settlement: Each trade is settled immediately, and no cost is deferred, in compliance with Islamic principles of economic activity.

Unique Features and Conditions of This Account Type

Unique Features:

- Swap-Free Trading: Positions can be held overnight without incurring any swap fees, which is particularly beneficial for traders who employ long-term trading strategies.

- Access to All Trading Instruments: Like the other FP Markets Account Types, the Islamic Account offers access to a full range of trading instruments provided by FP Markets, including Forex, commodities, indices, and more.

- Same Trading Platforms: Islamic Account holders have access to the same advanced trading platforms as other accounts, such as MetaTrader 4 and MetaTrader 5.

Conditions:

- Account Verification: Traders wishing to open an Islamic Account must go through a verification process that includes documentation to prove their identity and address. This is standard across all FP Markets Account Types but is also required to ensure the account meets the specific needs of Sharia-compliant trading.

- Administration Fee: While there are no swap fees, FP Markets might charge an administration fee on certain positions that remain open for an extended period to cover the costs that the swap would typically cover. This fee is not interest-based but is a service charge, which is permissible under Sharia law.

- Limited Leverage: Depending on the region and regulatory requirements, leverage might be lower than that offered in other accounts, reflecting the reduced risk tolerance associated with Sharia-compliant financial practices.

Demo Account

Benefits of Using a Demo Account for Practice and Strategy Development

Demo accounts, like the one offered by FP Markets, are an invaluable tool for traders of all experience levels, particularly those new to the Forex and CFD markets. Here are some key benefits of utilizing a demo account for practice and strategy development:

Risk-Free Learning Environment:

- Demo accounts provide a safe space for beginners to learn the basics of trading without the risk of losing real money. Users can experiment with different trading strategies, learn how to use trading platforms, and understand market dynamics without financial consequences.

Testing and Refining Trading Strategies:

- Even experienced traders use demo accounts to test new trading strategies before applying them in live markets. This allows traders to evaluate the effectiveness of strategies and make adjustments in a controlled environment.

Familiarization with Trading Platforms:

- FP Markets offers advanced platforms like MetaTrader 4 and MetaTrader 5. A demo account helps users become proficient in these platforms’ features, including the use of automated trading systems, advanced charting tools, and various market indicators.

Understanding Market Conditions:

- Traders can use demo accounts to study market behavior under various conditions without the anxiety of incurring losses. This experience is crucial for developing a robust trading psyche and decision-making skills.

Limitations of Demo Accounts and Comparison to Live Trading Accounts

While demo accounts offer numerous advantages, they also have limitations that traders should be aware of:

Absence of Real Money Emotions:

- Trading with a demo account does not involve real money, which significantly reduces the psychological impact of trading. Emotional responses such as fear, greed, and stress play a crucial role in trading decisions; these are not fully experienced in a demo environment.

Market Conditions and Execution:

- Demo accounts may not always accurately reflect live market conditions, especially regarding trade execution. Slippage and order fills can vary in a real environment due to market liquidity and volatility.

Overconfidence:

- Success in a demo account might lead to overconfidence for new traders. Without the real financial risks, traders might take larger or riskier positions than they would in a live account, potentially fostering habits that could lead to significant losses in real trading.

Comparison to Live Trading Accounts:

- Financial Commitment: Live accounts require a financial deposit, which introduces financial risk management into trading decisions.

- Emotional Investment: The psychological aspect of trading with real money can dramatically change a trader’s approach. Stress management and emotional control are critical skills developed primarily through live trading.

- Market Dynamics: Live accounts provide a more accurate reflection of market dynamics, including aspects like liquidity, slippage, and execution speed, which are crucial for realistic trading practice.

Professional Account

Criteria to Qualify as a Professional Trader

FP Markets offers a Professional Account designed for experienced traders who meet specific criteria demonstrating their expertise and financial capability. The criteria to qualify as a professional trader often include:

Significant Trading Volume:

- Traders must show a high volume of trading activity in the last 12 months. This typically means frequent trades each quarter.

Financial Industry Experience:

- Professional traders are expected to have substantial experience in the financial sector, particularly in positions that require knowledge of trading and investment.

Financial Assets:

- Prospective professional account holders must possess a considerable portfolio of investments, including financial instruments and cash deposits, exceeding a certain threshold, which usually aligns with regulatory standards.

Benefits of Professional Accounts

Professional Accounts come with several benefits tailored to the needs of experienced traders who can handle greater risks and more complex trading strategies:

Higher Leverage:

- One of the primary benefits is access to higher leverage ratios. While this increases the potential for higher profits, it also raises the risk profile of trading activities.

Lower Margin Requirements:

- Professional accounts may have lower margin requirements, allowing traders to open larger positions with less capital.

Advanced Trading Tools:

- Professional traders gain access to more sophisticated trading tools and platforms. These might include advanced charting packages, more comprehensive market data, direct market access, and higher-speed executions.

Dedicated Support:

- FP Markets provides professional account holders with dedicated account managers and sometimes more personalized customer service, including direct lines to trading desks and tailored consultancy services.

Flexible Transaction Limits:

- Professional accounts often come with fewer restrictions on transaction sizes and increased flexibility in terms of trading limits and exposures.

Higher Risks Associated with Professional Accounts

With greater benefits come higher risks, particularly due to the complex nature of the instruments and strategies typically employed by professional traders:

Increased Leverage:

- The higher leverage available in professional accounts can amplify gains but also losses, potentially leading to rapid financial deterioration if not managed properly.

Complex Instruments:

- Professional accounts may have access to more complex financial instruments, which can carry higher risks due to their intricate structures and market behaviors.

Market Volatility:

- Professional traders are often engaged in markets or with strategies that can be highly sensitive to market volatility, increasing the risk of substantial financial changes over short periods.

Corporate Account

Necessary Conditions and Documents for Opening a Corporate Account

Corporate Accounts at FP Markets are tailored for institutional traders, corporations, and larger entities that require robust trading capabilities. Opening a Corporate Account involves more stringent documentation and verification processes to meet regulatory and corporate governance standards.

Key Conditions:

- Entity Type: The account must be opened in the name of a legally recognized entity, such as a corporation, trust, or partnership.

- Regulatory Compliance: The entity must be in good standing with relevant regulatory bodies and comply with all applicable financial regulations.

Required Documents:

- Corporate Documentation: This includes incorporation certificates, articles of association, or similar documents that verify the legal status of the entity.

- Identity Verification of Directors/Signatories: Personal identification documents like passports or national IDs for all authorized signatories and major directors of the company.

- Proof of Registered Address: Documents such as recent utility bills or bank statements showing the company’s operating address.

- Board Resolution: A resolution from the board of directors authorizing the opening of the trading account and the designation of individuals authorized to trade on behalf of the company.

- Financial Statements: Recent financial statements to assess the financial health of the entity and ensure it meets any requisite financial thresholds.

Advantages for Institutional Traders or Larger Entities

Higher Trading Limits:

- Corporate Accounts often come with higher trading limits, allowing for larger transactions that are typical in institutional trading settings.

Customized Trading Conditions:

- FP Markets offers customized trading conditions for Corporate Accounts, which can include tailored spreads, commission rates, and leverage based on the entity’s trading strategy and volume.

Dedicated Account Management:

- Corporate clients receive dedicated account managers who provide personalized service and understand the specific needs and challenges of institutional trading.

Advanced Trading Tools and Access:

- Institutional accounts may have access to advanced trading platforms and tools, including APIs for integration with proprietary trading systems, comprehensive market data feeds, and algorithmic trading capabilities.

Enhanced Liquidity and Execution:

- Corporate Accounts benefit from enhanced liquidity, ensuring large volume trades are executed efficiently without significant slippage.

Risk Management Solutions:

- FP Markets provides sophisticated risk management tools and support to help institutional traders monitor and manage their market exposure effectively.

Account Features Comparison at FP Markets

Below is a detailed comparison of the main account types offered by FP Markets, highlighting their differences in leverage, minimum deposit, spreads, and commissions. This comparison will help traders choose the account that best fits their trading style and financial goals.

| Feature | Standard Account | Raw Account | Islamic Account | Professional Account | Corporate Account |

|---|---|---|---|---|---|

| Minimum Deposit | $100 AUD | $100 AUD | $100 AUD | Typically higher | Varies |

| Spreads | From 1.0 pips | From 0.0 pips | From 1.0 pips | Lower spreads | Customizable |

| Commissions | None | $3 per lot per side | None (or admin fee) | Varies | Negotiable |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 | Higher than standard | Customizable |

| Platform Access | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5, IRESS | MT4, MT5, IRESS |

| Swap-Free | No | No | Yes | No | Optional |

| Target Users | Beginners, Casual traders | Experienced, High-volume traders | Traders requiring Sharia-compliant features | Experienced, Professional traders | Institutional traders, Large entities |

| Special Features | User-friendly for newcomers | Ideal for scalping and high-frequency trading | Complies with Islamic finance laws | Access to more complex instruments, higher limits | Tailored services, higher transaction limits |

Key Differences and Considerations:

- Minimum Deposit: All accounts start with a relatively accessible minimum deposit requirement of $100 AUD, making FP Markets attractive for new traders. Professional and Corporate accounts might require a higher initial investment, reflecting the more sophisticated needs and higher financial capabilities of their target users.

- Spreads and Commissions: The Standard Account is best for those who prefer a simple fee structure with no commissions, while the Raw Account appeals to those looking for tighter spreads and are okay with paying commissions on trades. This is crucial for strategies like day trading or scalping, where the cost of spreads can significantly impact profitability.

- Leverage: High leverage up to 1:500 is available for retail accounts, which can increase profit potential but also comes with higher risk. Professional Accounts may offer even higher leverage, suitable for experienced traders who understand how to manage such risk effectively.

- Islamic Account: Specifically designed to meet the needs of Muslim traders, this account ensures that trading activities are in line with Sharia laws, particularly the prohibition of interest (riba).

- Professional and Corporate Accounts: These accounts are customized to meet the needs of high-net-worth individuals and institutional traders, offering more robust services, and potentially better trading conditions, including personalized support and negotiation on fees and commissions.

How to Choose the Right Account

Choosing the right trading account is crucial for aligning with your trading style, experience, and financial goals. Here are some guidelines and tips to help you select the most suitable FP Markets Account Types and advice on how to upgrade or switch accounts as your trading needs evolve.

Guidance on Selecting the Account Type

Assess Your Trading Style and Frequency

- High-Frequency Trading, Scalping: If your strategy involves frequent, small trades to capitalize on minor price changes, consider the Raw Account due to its low spreads and competitive commissions.

- Long-term Trading, Swing Trading: For less frequent trades that remain open for days or weeks, the Standard Account or Islamic Account (if requiring swap-free conditions) might be more appropriate due to the absence of commission fees.

Consider Your Experience Level

- Beginners: New traders should start with a Standard Account as it offers a straightforward fee structure that’s easier to manage when learning how to trade.

- Experienced Traders: If you have a solid understanding of forex markets and risk management, the Raw Account or a Professional Account could provide the advanced features and lower costs you need.

Evaluate Financial Goals and Investment Size

- Small to Medium Investments: The Standard and Raw accounts are suitable for traders who are starting with smaller investments but aim for regular trading gains.

- Large Investments and Institutional Needs: The Corporate Account is designed for entities or individuals with significant capital, offering customized solutions and services.

Tips on Upgrading or Switching Account Types

Monitor Your Trading Performance and Needs

- Regularly review your trading performance. Are the costs associated with your current FP Markets Account Types eating too much into your profits? Is your trading strategy being limited by your current account features?

Understand the Criteria for Each Account

- Each higher-level account at FP Markets has specific requirements. Make sure you meet these in terms of trading volume, financial assets, and experience before attempting to upgrade.

Consult with Account Managers

- FP Markets provides account managers who can offer personalized advice based on your trading activity and needs. Discussing your trading strategy and goals with them can provide insights into whether an account upgrade or switch might benefit you.

Consider the Implications of Changing Accounts

- Switching accounts might involve new terms and conditions, different fee structures, or additional verification processes. Understand these fully to ensure there are no surprises.

Plan the Transition

- If you decide to switch or upgrade, plan the transition carefully. Consider the best time to make the change without disrupting your trading activities, such as at the end of a trading cycle or when you have fewer open positions.

FAQs and Account Opening Process

Q1: What is the minimum deposit required to open an account at FP Markets?

- Answer: The minimum deposit for most FP Markets accounts, such as the Standard and Raw accounts, is typically around $100 AUD. This may vary for more specialized accounts like Professional or Corporate accounts.

Q2: Can I hold multiple account types at FP Markets?

- Answer: Yes, FP Markets allows clients to open and maintain multiple types of accounts. This can be beneficial for traders who wish to manage different trading strategies separately.

Q3: Are there any fees for account inactivity at FP Markets?

- Answer: FP Markets generally does not charge an inactivity fee, but it’s always good to review the latest account terms and conditions on their website as these policies can change.

Q4: How does FP Markets handle client funds?

- Answer: Client funds at FP Markets are held in segregated accounts with top-tier banks, ensuring they are kept separate from the company’s own funds. This is a standard regulatory requirement that provides a higher level of security for client assets.

Q5: Is there a demo account available and how can I access it?

- Answer: Yes, FP Markets offers a demo account for traders to practice their trading strategies in a risk-free environment. You can easily register for a demo account via their website, which typically requires only some basic information and no financial commitment.

Step-by-Step Guide on How to Open an Account at FP Markets

1: Choose the Account Type

- Determine which FP Markets Account Types best suits your trading style and financial goals. Consider factors like minimum deposits, spreads, commission fees, and available trading platforms.

2: Register Online

- Visit the FP Markets website and navigate to the account registration page. Fill out the registration form with your personal information, including name, email address, and phone number.

3: Complete the Application

- Provide further details required to complete your application, such as your trading experience, financial status, and employment information. This helps FP Markets ensure they offer you services suitable to your experience level.

4: Verify Your Identity

- To comply with financial regulations, you’ll need to verify your identity and residence. This typically involves uploading copies of your government-issued ID (passport or driver’s license) and a recent utility bill or bank statement that confirms your address.

5: Fund Your Account

- Once your account is approved, you can fund it using one of the several payment methods offered by FP Markets. These can include bank transfers, credit cards, and e-wallets.

6: Download Trading Platform

- Download and install the trading platform associated with your chosen FP Markets Account Types, such as MetaTrader 4 or MetaTrader 5.

7: Start Trading

- With your account set up and funded, you are now ready to start trading. Utilize the resources available through FP Markets to maximize your trading success.