Chapter 1: Introduction to Etoro Copy Trading

Overview of eToro as a Trading Platform

Introduction: Since its inception in 2007, eToro has emerged as a dominant force in global trading, renowned for its user-friendly interface and extensive array of trading tools. While providing access to traditional markets like forex, stocks, and commodities, eToro distinguishes itself as a pioneer in social trading and investment networks, exemplified by its hallmark feature, Etoro Copy Trading. This innovative approach fosters inclusivity, particularly appealing to novice traders seeking simplicity and reduced risk. With a manageable minimum deposit and intuitive platform design, eToro empowers beginners to embark on their trading journey confidently.

What is Copy Trading?

Copy trading is an innovation in the world of investing that allows users to mirror the trading strategies and actions of experienced traders. This approach is particularly beneficial for beginners who may not yet have the depth of knowledge or experience to make informed trading decisions on their own.

> "Copy trading democratizes access to the forex markets by allowing newcomers to benefit from the experience of seasoned traders."

At its core, copy trading involves selecting a trader to follow, after which the platform automatically replicates the chosen trader’s positions in your account. This process is not only about copying; it’s about learning. Beginners get to see the trading strategies in action and can gain insights into market analysis and decision-making processes.

eToro’s copy trading feature stands out due to its transparency and the breadth of its trader community. Users can review detailed trading statistics, risk scores, and historical performance to choose the best traders to copy. This level of detail ensures that even those new to forex trading can make educated decisions about who to follow.

By providing a straightforward entry point into the often complex world of forex trading, eToro’s copy trading service exemplifies how modern platforms are making trading more accessible and less intimidating for newcomers.

Chapter 2: Getting Started with eToro

How to Set Up an eToro Account

Setting up an account with eToro is a straightforward process designed to guide you smoothly from sign-up to trading. Here’s a simple step-by-step guide to help you get started:

- Visit the eToro Website: Go to eToro.com and click on the ‘Join Now’ or ‘Sign Up’ button.

- Fill in Your Details: You’ll need to provide some basic information like your name, email address, and phone number. You’ll also be asked to create a password.

- Verify Your Identity: To comply with financial regulations, eToro requires you to verify your identity. This usually means uploading a copy of your ID (passport or driver’s license) and a recent utility bill or bank statement as proof of address.

- Complete a Questionnaire: This is about your trading experience and financial literacy. This step is crucial as it helps eToro assess your trading knowledge and tailor its services to fit your needs.

Once these steps are completed, your account will be set up, and you’ll be ready to start exploring the features of eToro.

Navigating the eToro Interface

The eToro interface is designed with user-friendliness in mind, ensuring that even beginners can navigate through it with ease. Here are key areas to familiarize yourself with:

- Dashboard: This is your home base where you can view your portfolio, see market trends, access news feeds, and manage your trades.

- Market Pages: Here you can view the various markets eToro offers, including stocks, currencies, cryptocurrencies, and commodities.

- Copy People: This section lets you explore and choose expert traders to copy.

Funding Your Account and Managing Your Financial Information

Funding your eToro account is essential to begin trading. You can add funds using various methods including bank transfer, credit/debit card, PayPal, or e-wallets. Here’s how you can fund your account:

- Log in to Your Account: Access your dashboard.

- Navigate to ‘Deposit Funds’: This option is typically found at the bottom left of the screen.

- Choose Your Payment Method: Select your preferred method and fill in the necessary details.

- Enter the Amount: Decide how much money you want to deposit and confirm the transaction.

It is important to manage your financial information carefully:

- Set Up Payment Limits: This can help you manage how much money you are transferring into your trading account.

- Monitor Transactions: Regularly check your transaction history to keep track of your deposits, withdrawals, and trading performance.

> "eToro not only simplifies the initial setup process but also empowers you to manage your investments actively and responsibly."

By ensuring your account is set up correctly and you are familiar with navigating the interface, eToro provides a robust foundation for engaging with the forex market.

Chapter 3: Understanding eToro’s Copy Trading Feature

Detailed Exploration of What Etoro Copy Trading is and How it Works on eToro

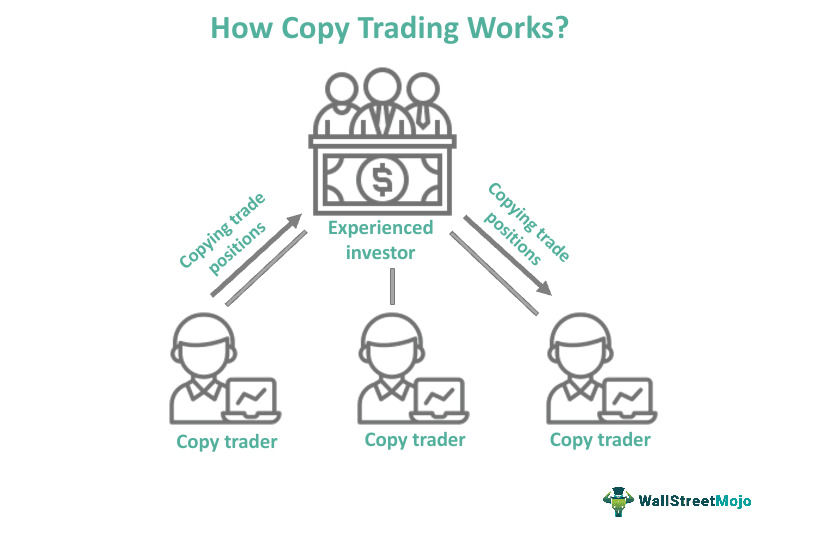

Etoro Copy Trading is not just about replicating the trades of others; it’s a dynamic tool that facilitates active learning and engagement in trading strategies. Here’s a closer look at how it functions:

- Choosing a Trader to Copy: eToro provides a vast array of trader profiles which you can browse. These profiles include detailed track records, risk scores, and the number of copiers.

- Copying a Trader: Once you’ve selected a trader, you can set the amount you wish to allocate to copying them. eToro then automates the replication of the trader’s positions in real-time in your account.

- Managing Your Copy: You can stop copying a trader at any time or pause it temporarily. You can also manage your investment, adding more funds or reducing the amount allocated without closing the positions.

Benefits of Copy Trading

Copy trading offers numerous advantages, especially for beginners:

- Educational Value: It allows new traders to learn by watching and understanding the decisions made by seasoned traders.

- Diversification: By copying several traders, you can spread your risk across various assets and trading strategies.

- Time Efficiency: It saves time as you do not need to monitor the markets constantly.

> "Copy trading can significantly demystify the complex world of forex trading, providing a hands-on learning experience with minimized risk."

Risks of Copy Trading

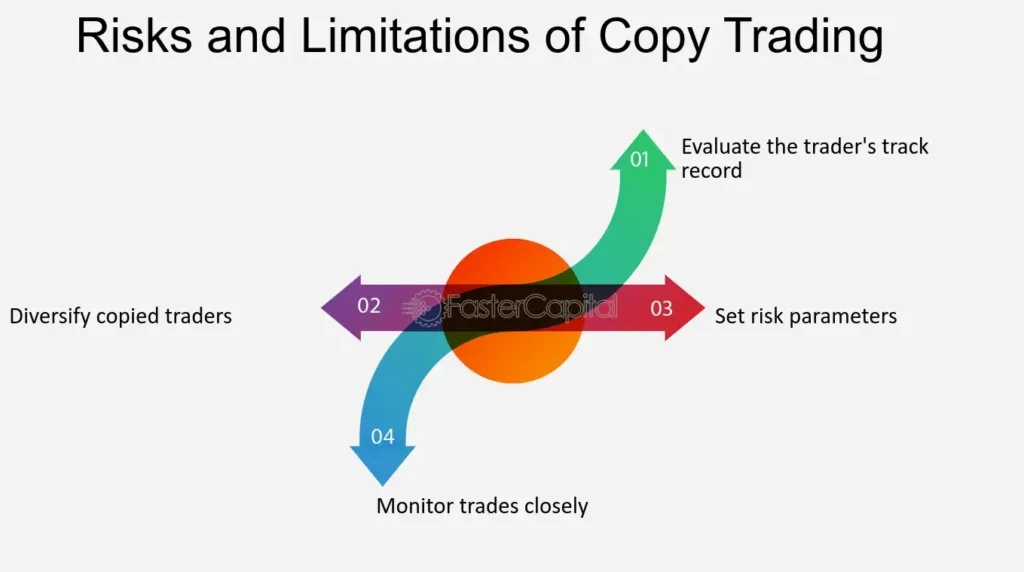

While copy trading can be incredibly beneficial, it is not without risks:

- Market Risk: The performance of traders you are copying can be affected by volatile market conditions.

- Managerial Risk: Dependence on the decisions of another trader means their mistakes could affect your investment.

- Over-reliance: There’s a risk of becoming too reliant on the abilities of others without developing your own trading skills.

How to Mitigate Risks in Copy Trading

To mitigate these risks, consider the following strategies:

- Choose Wisely: Select traders who have a proven track record and whose trading strategies you understand.

- Start Small: Begin with a small amount and increase your investment as you gain more confidence and understanding.

- Stay Informed: Keep yourself updated on market trends and adjustments in your copied traders’ strategies.

By thoroughly understanding the mechanisms and strategic applications of eToro’s copy trading feature, you can maximize its benefits while managing potential risks effectively.

Chapter 4: Selecting Traders to Copy

How to Find and Evaluate Top Traders on eToro

Finding and evaluating top traders on eToro involves a strategic approach to ensure you are making informed decisions. The platform offers several tools and metrics to aid in this process:

- Use the Search and Filter Tools: eToro’s platform allows you to filter traders by performance, risk level, and more. This helps narrow down your options to those that best meet your investment goals and risk tolerance.

- Examine Trader Profiles: Each trader on eToro has a detailed profile that includes their trading history, risk score, and success rate. Spend time reviewing these profiles to understand their trading style and performance.

What Metrics to Consider

When evaluating traders to copy, consider the following key metrics:

- Performance: Look at the historical performance over a significant period. Consistency is key in trading.

- Risk Score: eToro assigns a risk score to each trader based on the volatility of their trading strategies. A lower score indicates less risk.

- Number of Copiers: A higher number of copiers can be an indicator of trust and success, but it should not be the sole criterion.

- Trading Strategy: Understand the types of assets they trade and their approach to entering and exiting trades. Compatibility with your own risk tolerance and interest is crucial.

> "Selecting the right trader is not just about finding the highest earners but aligning their strategies with your financial goals and risk appetite."

Importance of Diversification in Copy Trading

Diversification is a critical strategy in managing risk and enhancing potential returns, particularly in copy trading:

- Spread Your Investments: Do not put all your funds into copying a single trader. Spread your investments across different traders to mitigate risk.

- Vary Strategies: Choose traders with varying strategies and specialties to reduce potential losses from any single approach.

- Monitor and Adjust: Regularly review and adjust whom you copy based on performance and changes in the market.

Diversification not only helps in risk management but also exposes you to different trading styles and strategies, enriching your trading experience and knowledge.

By carefully selecting which traders to copy and employing a diversified approach, you can significantly improve your chances of success on eToro, making Etoro Copy Trading an invaluable tool for beginners in the forex market.

Chapter 5: The Copy Trading Process

Step-by-Step Guide on How to Start Copying a Trader

Initiating the Etoro Copy Trading process on eToro is designed to be user-friendly, allowing beginners to get started with minimal fuss. Here’s how you can begin:

- Identify a Trader: After evaluating and selecting a trader based on the criteria discussed in the previous chapter, visit their profile page.

- Click on ‘Copy’: You’ll find a “Copy” button on their profile. Clicking this initiates the process.

- Set Your Investment Amount: Decide how much money you want to allocate to copying this trader. eToro has a minimum amount requirement for Etoro Copy Trading.

- Customize Settings: Adjust settings like stop losses, which help protect your investment.

- Start Copying: Confirm all selections and start the copying process. The trades will automatically begin mirroring in your account.

Setting Up Copy Amounts and Managing Stop Losses

Managing your investments actively is crucial for maintaining control over your financial exposure:

- Copy Amounts: Setting the right amount to copy someone with should reflect your overall investment strategy and how much risk you’re willing to take.

- Stop Losses: This crucial feature helps limit potential losses. Set a stop loss at a point that reflects your risk tolerance.

> "Setting a stop loss is not just about minimizing losses, but about peace of mind. It lets you copy trade with less stress, knowing there's a safety net."

Adjusting Copy Settings and Pausing or Stopping Copy Relationships

Flexibility is key in Etoro Copy Trading, and eToro provides several options to manage ongoing copy relationships:

- Adjust Copy Settings: You can adjust your investment amount or change your stop loss settings at any time to adapt to new financial situations or market conditions.

- Pausing Copying: If you’re unsure about the trader’s recent performance or if market conditions are unstable, you can pause copying. This stops new trades from being copied until you decide to resume.

- Stopping Copying: If you no longer wish to copy a trader, you can stop the copying relationship altogether. This closes all the copied trades, and the funds are returned to your account balance.

By understanding and utilizing these features, you can maintain a level of personal control over your copy trading activities, allowing for a tailored and responsive investment strategy.

Chapter 6: Risk Management in Copy Trading

How to Assess and Manage Risks When Copying Trades

Effective risk management is fundamental to successful copy trading, especially for beginners. Here are key strategies to help you assess and manage risks:

- Understand the Trader’s Risk Level: Before copying, analyze the trader’s risk score and trading history on eToro. Opt for traders whose risk levels align with your comfort zone.

- Use Stop-Loss Orders: As discussed earlier, setting stop-loss orders for each copied trade helps limit potential losses without needing to monitor positions constantly.

- Monitor Regularly: Stay updated with the market conditions and the performance of your copied traders. eToro provides notifications and tools to help keep track of these factors effectively.

Importance of Portfolio Diversification

Diversification within copy trading acts as a risk buffer and can enhance returns under varying market conditions:

- Spread Your Investments: Do not rely on a single trader. Copy several traders who employ different strategies and trade different assets.

- Diverse Market Exposure: Ensure that your chosen traders are investing in different markets (e.g., forex, stocks, commodities) to spread risk further.

> "Diversification is not just a risk management technique; it's an essential approach to achieving more stable and potentially higher returns."

Tips for Setting Reasonable Expectations and Investment Goals

Setting realistic expectations and clear investment goals is crucial in navigating the complexities of copy trading:

- Set Achievable Goals: Define what you aim to achieve through copy trading, whether it’s learning, earning, or both. Keep your financial goals realistic based on your investment and risk tolerance.

- Expect Market Fluctuations: Understand that all trading involves risks and that market conditions can change rapidly. Returns are not guaranteed, and patience is often required.

- Educate Yourself Continuously: The more you know, the better your chances of success. Use resources available on eToro and other platforms to keep learning about trading and investment strategies.

By implementing these risk management strategies, you can create a more resilient trading approach, reducing potential losses while maximizing learning and growth opportunities in copy trading.

Chapter 7: Legal and Ethical Considerations

Understanding the Legal Implications of Copy Trading

Copy trading, while innovative and accessible, operates within a framework of legal standards that protect both the trader and the copier. Here’s what you need to consider:

- Regulatory Compliance: Platforms like eToro are regulated by multiple financial authorities (such as CySEC in Cyprus, FCA in the UK, and ASIC in Australia), ensuring they adhere to strict standards of operation.

- Risk Disclosure: Legally, platforms are required to disclose the risks associated with trading activities clearly. This ensures that all participants make informed decisions.

- Data Protection: Your financial and personal data are protected under privacy laws. eToro and similar platforms must comply with data protection regulations to safeguard your information.

Ethical Considerations and Best Practices in Social Trading

Ethical trading practices are essential not just for legal compliance, but also for maintaining a trustworthy trading environment:

- Transparency: Traders should provide honest and clear information about their trading strategies and results. Misleading followers with exaggerated claims can lead to significant losses and ethical breaches.

- Responsibility: Both copiers and those being copied should practice responsible trading. This includes setting realistic expectations, using risk management tools, and not manipulating market conditions.

- Respect for Privacy: While social trading platforms operate on transparency, it’s important to maintain confidentiality and respect the privacy of all users.

> "Adhering to ethical trading practices enhances the integrity of the trading platform and fosters a community of trust and respect among users."

Best Practices for Participants in Copy Trading

To ensure a positive and productive experience in copy trading, consider these best practices:

- Continuous Learning: Stay informed about the latest regulatory changes and trading strategies. Knowledge is a key defense against potential legal and ethical issues.

- Due Diligence: Regularly review the performance and strategies of the traders you follow. This helps in making informed decisions and prevents reliance on outdated or inaccurate information.

- Engage with the Community: Participate in discussions and forums to share experiences and learn from others. This can provide insights into the ethical practices of successful traders.

Understanding these legal and ethical considerations will not only help you navigate the complexities of copy trading more effectively but also enable you to trade with confidence and integrity.

Chapter 8: Advanced Strategies in Copy Trading

Strategies for More Experienced Users to Maximize Returns

For traders who have mastered the basics of copy trading and are looking to enhance their returns, here are some advanced strategies to consider:

- Proactive Portfolio Rebalancing: Regularly assess and adjust your portfolio based on performance and market conditions. This might mean reallocating funds among different traders or changing the amount invested in specific traders.

- Leverage Advanced Risk Management Tools: Utilize tools such as conditional orders beyond basic stop losses to better manage the risks associated with volatile markets.

- Utilize Leveraged Trades Cautiously: Experienced traders can use leverage to increase potential returns on successful trades, but it should be used judiciously as it also increases risk.

Using Market Trends and Trader Insights to Adjust Copy Trading Tactics

Understanding and reacting to market trends is crucial for advanced copy trading:

- Stay Informed on Market Conditions: Use eToro’s news and analysis features to stay updated on global financial markets. Anticipating market movements can help you adjust your copy trading decisions effectively.

- Analyze Trader Insights: Follow the thought processes of the traders you copy. Many share insights about their strategies and market views, which can provide valuable information on how they might react to future events.

> "Adapting your strategy based on market trends and individual trader insights can significantly enhance your ability to maximize returns in copy trading."

Best Practices for Implementing Advanced Copy Trading Strategies

Implementing more complex strategies requires a thorough understanding of both the market and the platform’s features:

- Diversify Across Strategies: Just as diversifying across different markets is crucial, so is diversifying across different trading strategies. This can help mitigate risks if one approach underperforms.

- Engage with Other Advanced Traders: Networking with other experienced traders can provide deeper insights and new strategies. eToro’s social network is ideal for this purpose.

- Continuous Education: Keep updating your knowledge about both trading and the specific features of the eToro platform. The more you know, the better equipped you’ll be to implement advanced strategies.

By integrating these advanced strategies into your copy trading practice, you can not only improve your potential returns but also enhance your understanding of the market dynamics and decision-making processes in trading.

Chapter 9: Common Pitfalls and How to Avoid Them

Common Mistakes in Copy Trading and How to Avoid Them

Copy trading, while a powerful tool for both novice and experienced traders, is not without its pitfalls. Awareness of these common mistakes can greatly enhance your trading outcomes:

- Over-reliance on Top Performers: Many beginners make the mistake of copying a trader solely based on past returns. This can be risky as past performance is not always indicative of future results.

- Ignoring Risk Management: Failing to set appropriate stop-loss orders or investing too much in a single trader can lead to significant losses, particularly during volatile market periods.

- Lack of Research: Not doing enough research on the traders being copied or the assets they trade is a common oversight that can lead to poorly informed decisions.

To avoid these pitfalls:

- Diversify Your Copies: Spread your investments across several traders who employ different strategies.

- Implement Strong Risk Management: Always use stop-losses and consider setting lower copy amounts until you fully understand a trader’s strategy.

- Conduct Thorough Research: Regularly review the performance, trading style, and risk score of the traders you copy.

Learning from Case Studies and Real-World Examples

Examining real-world examples of both successful and unsuccessful copy trading scenarios can provide valuable lessons:

- Case Study 1: A beginner investor copies a high-risk trader without setting a stop loss and loses a significant portion of their investment when a sudden market downturn occurs. Lesson: Always use risk management tools.

- Case Study 2: An experienced trader diversifies their copy portfolio across five different traders with varying risk levels and strategies, effectively mitigating losses during a forex market fluctuation. Lesson: Diversification can protect and stabilize your investments.

> "Learning from the successes and failures of others can dramatically cut down your learning curve and help you make more informed decisions."

Best Practices to Enhance Copy Trading Success

To further safeguard your investment and enhance your trading success, consider these best practices:

- Stay Updated: Keep abreast of market trends and how they might affect the strategies of the traders you are copying.

- Be Patient and Stay Committed: Copy trading requires a commitment to learning and understanding. It’s not about quick wins but long-term growth and learning.

- Regularly Review and Adjust: Be proactive in managing your copy trading activities. Review and adjust your portfolio based on performance and changing market conditions.

By understanding these common pitfalls and how to avoid them, coupled with learning from real-world examples, you can significantly improve your proficiency and success in copy trading.

Chapter 10: Future of Copy Trading

Trends and Future Developments in Copy Trading

Copy trading is poised to continue evolving, influenced by both market demands and technological innovations. Here are some emerging trends that are shaping the future of copy trading:

- Increased Regulatory Oversight: As copy trading gains popularity, expect more comprehensive regulations to ensure transparency and protect investors.

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): These technologies are starting to play a significant role in enhancing the algorithms behind copy trading, making them more adaptive to changing market conditions.

- Greater Customization: Future platforms may offer more personalized copy trading experiences, allowing users to fine-tune whose trades they copy based on specific criteria beyond just performance metrics.

How Technological Advancements Might Influence Copy Trading Strategies

Technology continues to be a significant driver in the evolution of copy trading:

- Predictive Analytics: Advanced analytics could provide deeper insights into trader performance and potential market movements, helping copiers make more informed decisions.

- Enhanced Risk Management Tools: Future developments may include more sophisticated risk assessment tools that can better predict and mitigate potential losses in volatile markets.

- Blockchain and Decentralization: These technologies might introduce new ways to secure transactions and enhance the transparency of copy trading activities.

> "The integration of cutting-edge technologies promises not only to enhance the efficiency and effectiveness of copy trading but also to democratize access to financial markets further."

Preparing for the Future of Copy Trading

To stay ahead in the rapidly evolving field of copy trading, traders should:

- Continuously Learn and Adapt: Stay informed about new technologies and methodologies in financial trading.

- Embrace Innovation: Be open to testing new features and tools that enhance trading strategies.

- Engage with the Community: Participate in forums and discussions to share insights and learn from others about emerging trends and tools.

The future of copy trading looks promising, with advancements that could make trading more accessible, more efficient, and potentially more profitable for those who are willing to stay informed and adapt.