Equity investing represents a fundamental component of the financial world, offering individuals the opportunity to own a share of a company’s future earnings and growth. Unlike debt investments, which provide a fixed return, equities offer the potential for significant appreciation, albeit with higher risk. Understanding the basics of how equities work as investment vehicles and how they differ from other types of investments is crucial for anyone looking to navigate the stock market successfully.

Basics of Equity Investing

At its core, equity investing involves purchasing shares or stock in a company, making the investor a partial owner of that company. Ownership of a company’s stock means that you, as an investor, have a claim on the company’s assets and earnings. The more shares you own, the larger the portion of the company that belongs to you.

Investors typically buy and sell equities on stock exchanges, where prices fluctuate based on supply and demand dynamics. The value of your equity investment can increase for several reasons, including company growth, increased earnings, or broader market trends. Conversely, your investment’s value can decrease if the company underperforms or if there’s a market downturn.

Income and Growth

Equity investors can earn returns in two primary ways: through capital gains and dividends. Capital gains occur when you sell your shares for more than you paid for them, realizing a profit on your investment. On the other hand, companies make payments to their shareholders out of profits in the form of dividends.

Equity Investing vs. Other Types of Investments

Equity investing differs from other investment vehicles like bonds or savings accounts primarily in terms of risk and potential return. Bonds, for example, are debt investments where the investor lends money to an entity (corporate or governmental) that borrows the funds for a defined period at a variable or fixed interest rate. Investors generally consider bonds less risky than stocks because bonds offer fixed interest payments and return the principal at maturity.However, the trade-off is that bonds typically offer lower returns compared to equities, which have the potential for substantial growth.

Savings accounts, while offering liquidity and security, provide very low returns, often not enough to outpace inflation. These accounts are suitable for short-term financial needs rather than long-term growth objectives.

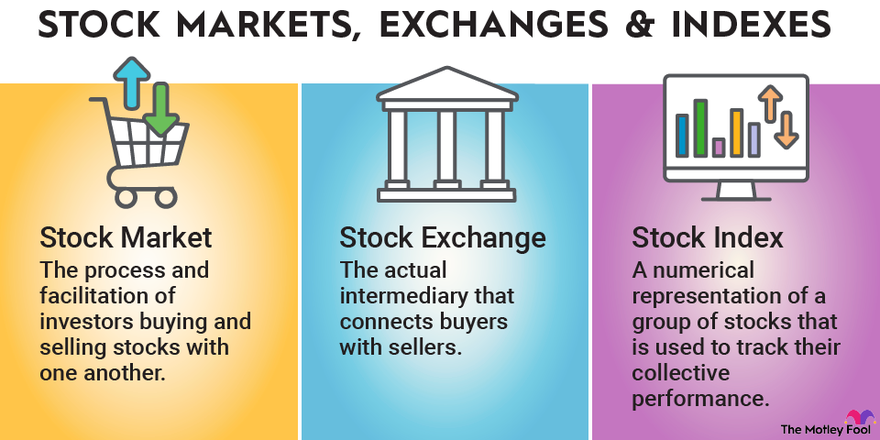

Understanding Stock Markets and Exchanges

In the realm of equity investing, stock markets and exchanges play a pivotal role, acting as the heartbeats of the financial world. These platforms serve as venues for buying and selling shares of publicly traded companies, facilitating the seamless exchange of equity between investors. Anyone engaged in equity investing needs to understand how these markets operate, the major exchanges around the globe, and the mechanics of trading stocks.

Overview of Major Stock Markets and Exchanges

Globally, several key stock markets and exchanges dominate equity trading, each with its unique characteristics and listings of public companies.

- The New York Stock Exchange (NYSE): Based in the United States, the NYSE is one of the largest and most well-known stock exchanges globally, hosting the shares of major corporations across a broad spectrum of industries.

- The Nasdaq, also situated in the U.S., earns renown for its high concentration of tech companies, including giants like Apple, Amazon, and Google’s parent company, Alphabet.

- The London Stock Exchange (LSE): Serving as the hub for European trading, the LSE lists numerous multinational corporations and is one of the oldest exchanges in the world.

- The Tokyo Stock Exchange (TSE): The TSE is Japan’s premier stock exchange and is pivotal in the Asian equity markets, listing many of Japan’s largest companies.

- The Shanghai Stock Exchange (SSE) and The Shenzhen Stock Exchange: These exchanges are central to China’s stock market, reflecting the rapid growth and increasing global influence of Chinese businesses.

How Stocks are Traded

Investors trade stocks in several ways, but most commonly, they conduct trading through stock exchanges using electronic trading platforms. These platforms match buyers with sellers, facilitating the exchange of stocks at market prices.

The Role of Brokers

Brokers play a crucial role in the trading process. They act as intermediaries between investors and the stock market, executing buy or sell orders on behalf of their clients. Here’s how they facilitate trades:

- Access to Markets: Individual investors typically cannot directly access stock exchanges. Brokers provide the necessary platform and tools for trading.

- Expertise and Advice: Many brokers offer research, analysis, and recommendations to help investors make informed decisions. This service is particularly valuable for individuals new to equity investing.

- Order Execution: Brokers execute trades efficiently, ensuring that investors get the best possible market price for their transactions.

- Portfolio Management: Some brokerage firms offer managed accounts, where they make investment decisions on behalf of the investor, based on the investor’s goals and risk tolerance.

Choosing the Right Brokerage for Equity Investing

In the journey of equity investing, selecting the right brokerage can significantly influence your investment experience and outcomes. A brokerage acts as the gateway to the stock markets, providing the tools, resources, and support necessary for trading. With myriad options available, investors must carefully evaluate several key factors to ensure their chosen brokerage aligns with their investment strategy, goals, and preferences. Here’s what to consider when choosing a brokerage for equity investing.

Fees and Commissions

Understanding the cost structure of a brokerage is paramount. Fees can take various forms, including trade commissions, account maintenance fees, and charges for inactivity or withdrawals. Some brokerages offer commission-free trading, particularly appealing for active traders. However, always look beyond headline rates to understand the full cost picture, including any hidden fees.

- Tip: Compare fee structures across brokerages, considering your expected trading volume and pattern to estimate the total cost of trading.

Platform Usability and Access

The trading platform is your primary tool for managing investments, so its usability is crucial. A good platform provides a balance of sophistication and simplicity, catering to both novice and experienced investors.

- Ease of Use: The platform should offer an intuitive interface, allowing you to execute trades quickly, access your portfolio effortlessly, and find essential features without difficulty.

- Accessibility: Ensure the platform is accessible on your preferred devices, whether desktop, web, or mobile, and check for seamless integration across these platforms.

Research Tools and Resources

Access to comprehensive research tools and resources can significantly enhance your equity investing strategy, helping you make informed decisions.

- Market Analysis: Look for brokerages that offer detailed market analysis, including economic reports, sector trends, and company-specific research.

- Analytical Tools: Advanced charting capabilities, technical indicators, and portfolio analysis tools are valuable for assessing investment opportunities and risks.

- Educational Content: Especially for newer investors, a library of educational materials on equity investing basics, strategies, and market concepts can be incredibly beneficial.

Customer Support

Reliable customer support is essential, particularly for investors who may need assistance navigating the platform, understanding features, or resolving issues.

- Availability: Consider the support hours and ensure they align with your likely trading times. 24/7 support is ideal, but not always necessary.

- Channels: Multiple channels for support (phone, email, live chat) can enhance the convenience and speed of obtaining assistance.

- Quality: The responsiveness, knowledgeability, and helpfulness of the support team are critical. Look for brokerages with a reputation for excellent customer service.

Regulation and Security in Equity Investing

Trading with a regulated brokerage provides peace of mind, knowing that the broker adheres to strict financial standards and practices to protect investors.

- Ensure that reputable bodies such as the SEC, FINRA, or equivalent authorities in your jurisdiction regulate the brokerage for regulatory compliance.

- Security Measures: Investigate the brokerage’s security protocols, including data encryption, two-factor authentication, and insurance against fraud or insolvency.

Types of Stocks and Equity Securities

In the vast landscape of equity investing, understanding the various types of stocks and equity securities is crucial for building a diversified and resilient portfolio. From common stocks to preferred stocks, ETFs (Exchange-Traded Funds), and mutual funds, each type of security offers different characteristics, risks, and benefits. By differentiating between these options, investors can tailor their equity portfolios to match their investment goals, risk tolerance, and market outlook.

Common Stocks

Common stocks represent ownership shares in publicly traded companies, granting holders voting rights and a claim on a portion of the company’s profits through dividends. However, companies do not guarantee dividends and can fluctuate them based on their performance and dividend policy.

- Risk and Reward: Common stockholders are last in line during liquidation, after bondholders and preferred shareholders, making these shares riskier. However, they also offer significant upside potential through capital appreciation.

- Suitability: Ideal for investors seeking growth and willing to accept higher volatility for the potential of higher returns over the long term.

Preferred Stocks

Preferred stocks offer a hybrid blend of characteristics from both stocks and bonds. They provide investors with features unique to each type of investment. For instance, preferred shareholders receive dividends before common stockholders, often at a fixed rate. Additionally, in the event of liquidation, preferred shareholders may have priority over common stockholders.

- Stability and Income: Preferred stocks typically provide more stable dividends, making them attractive for income-focused investors. However, they usually offer less capital appreciation potential than common stocks.

- Suitability: Suited for conservative investors seeking regular income with lower risk compared to common stocks.

ETFs (Exchange-Traded Funds)

ETFs, similar to individual stocks, are investment funds that trade on stock exchanges.They hold assets such as stocks, commodities, or bonds and typically track an index, sector, commodity, or other assets.

- Diversification: ETFs offer instant diversification across the assets they hold, reducing the risk of investing in individual securities.

- Flexibility and Liquidity: Traded throughout the day on stock exchanges, ETFs offer flexibility and liquidity. They often come with lower expense ratios than mutual funds, making them cost-effective for investors.

- Suitability: Ideal for investors seeking diversification and flexibility, from beginners to experienced market participants.

Mutual Funds

Mutual funds pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. Unlike ETFs, mutual funds are priced at the end of the trading day and can be actively or passively managed.

- Professional Management: Mutual funds offer access to professional fund managers who make investment decisions, which can be particularly beneficial for investors who prefer a hands-off approach.

- Diversification and Accessibility: Like ETFs, mutual funds provide diversification. They can be an accessible entry point for investors with smaller amounts of capital.

- Suitability: Suitable for investors who value professional management and are comfortable with the trading limitations inherent in mutual funds’ structure.

Diversifying Your Equity Portfolio

Diversification across different types of equities, sectors, and industries can mitigate risk and enhance the potential for returns. Consider incorporating a mix of common stocks for growth, preferred stocks for income stability, and ETFs or mutual funds for broad market exposure. Monitoring economic trends, sector performance, and individual investment goals will guide ongoing adjustments to your equity portfolio.

Fundamental vs. Technical Analysis in Equity Investing

Equity investing encompasses a broad spectrum of strategies and approaches, with fundamental and technical analysis standing out as two principal methodologies investors use to make informed decisions. Understanding the distinctions between these analyses can empower investors to navigate the stock market more effectively, tailoring their investment strategies to match their goals, risk tolerance, and investment horizon.

Fundamental Analysis: Evaluating a Company’s Financial Health

Fundamental analysis delves into a company’s financial statements, market position, industry health, and economic factors to determine its intrinsic value. This method is based on the premise that a stock’s current price may not reflect its true value, and by conducting thorough research, investors can uncover stocks that are undervalued or have strong growth potential.

Key Components of Fundamental Analysis

- Financial Statements: Analysis of income statements, balance sheets, and cash flow statements to assess a company’s profitability, debt levels, and liquidity.

- Earnings: Examination of a company’s earnings reports to evaluate its profitability and potential for future growth.

- Ratios: Utilization of financial ratios, such as price-to-earnings (P/E), debt-to-equity, and return on equity, to compare companies within the same industry.

- Economic Indicators: Consideration of broader economic factors, including interest rates, inflation, and GDP growth, which can impact a company’s performance.

Fundamental analysis is typically favored by long-term investors and value investors who seek to build a portfolio of solid companies with the potential for sustained growth.

Technical Analysis: Analyzing Stock Price Movements and Trends

In contrast, technical analysis focuses on patterns in stock price movements, trading volumes, and other market indicators to forecast future price trends. Technical analysts, or chartists, believe that historical trading activity and price changes are indicators of future performance.

Key Components of Technical Analysis

- Price Charts: Examination of price charts to identify patterns and trends that may indicate future movements.

- Technical Indicators: Use of indicators such as moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence) to assess market sentiment and potential price reversals.

- Volume Analysis: Analysis of trading volume as a confirmation of trends, with high volume often seen as a validation of the current price trend.

Technical analysis is commonly used by traders and short-term investors who look for opportunities to profit from price volatility in the market, rather than the long-term potential of the underlying company.

Combining Fundamental and Technical Analysis

While fundamental and technical analysis are often viewed as distinct and separate approaches, many successful investors blend these methodologies to enhance their investment strategy. For example, an investor may use fundamental analysis to select companies with strong growth potential and then apply technical analysis to determine the optimal timing for buying or selling those stocks.

Developing an Equity Investing Strategy

Crafting a robust equity investment strategy is pivotal for navigating the complexities of the stock market and achieving financial objectives. Investors can choose from various strategies, such as long-term growth, income investing through dividends, and short-term trading. Each approach requires a nuanced understanding of market dynamics, individual financial goals, risk tolerance, and the critical importance of risk management and portfolio diversification. Let’s explore these strategies within the framework of equity investing.

Strategies for Long-Term Growth

Long-term growth investing focuses on acquiring stocks that are expected to grow at an above-average rate compared to their sector or the overall market. Investors in this category are typically less concerned with short-term fluctuations and more focused on the potential for substantial returns over years or even decades.

- Selecting Growth Stocks: Look for companies with strong potential for revenue and earnings growth, innovative products or services, and competitive advantages in their industry.

- Patience is Key: Commit to holding these investments through market volatility to realize significant gains as the companies grow.

Income Investing Through Dividends

Income investing targets stocks that pay regular dividends, providing a steady income stream to investors. This strategy is particularly appealing to those seeking to generate cash flow from their investments, such as retirees.

- Identifying Dividend Stocks: Focus on companies with a history of paying and increasing dividends, financial stability, and strong cash flows.

- Diversification Within Income Stocks: Incorporate a mix of high-yield and dividend-growth stocks to balance the potential for immediate income and long-term dividend appreciation.

Short-Term Trading

Short-term trading strategies, including day trading and swing trading, aim to capitalize on market volatility by buying and selling stocks over shorter periods. This approach requires a keen understanding of market trends, technical analysis, and a high tolerance for risk.

- Market Analysis: Utilize technical analysis to identify short-term trading opportunities based on stock price movements and patterns.

- Set Clear Goals and Limits: Establish predetermined entry and exit points for trades to manage risk effectively.

Risk Management

Regardless of the chosen investment strategy, effective risk management is crucial. It involves understanding the potential for loss in your investments and taking steps to mitigate that risk.

- Stop-Loss Orders: Use stop-loss orders to automatically sell stocks at a predetermined price limit to prevent significant losses.

- Regular Portfolio Review: Continuously monitor and reassess your investment portfolio to ensure it aligns with your risk tolerance and financial goals.

The Importance of a Diversified Portfolio

Diversification is the foundation of risk management in equity investing. By spreading investments across various sectors, industries, and geographies, investors can reduce the impact of a poor performance in any single area on their overall portfolio.

- Broad Market Exposure: Include a mix of growth stocks, income stocks, and possibly even some defensive stocks to weather different market conditions.

- Asset Allocation: Consider incorporating other asset classes, such as bonds or real estate, to further diversify and balance your investment portfolio.

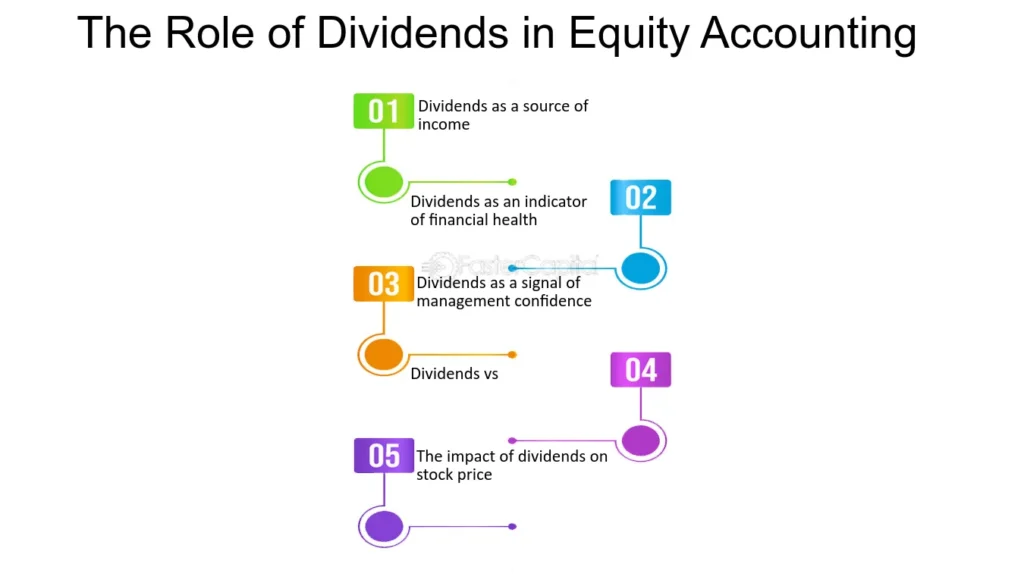

The Role of Dividends in Equity Investing

Dividends play a crucial role in equity investing, serving as a tangible return on investment that can significantly contribute to an investor’s income and overall returns. Understanding how dividends work, their importance in generating investment income, and how to evaluate dividend-paying stocks is essential for anyone involved in equity investing. Here, we delve into the mechanics of dividends, their benefits, and key metrics like dividend yield that investors use to assess the attractiveness of dividend-paying stocks.

How Dividends Work

Dividends are payments made by a corporation to its shareholders, usually derived from the company’s profits. While not all companies pay dividends, those that do typically make these payments quarterly. Dividends can be paid in cash or as additional shares of stock. The decision to pay dividends, the amount, and the frequency are determined by the company’s board of directors.

The Significance of Dividends

- Income Generation: For many investors, especially those seeking steady income or in the retirement phase, dividends provide a reliable source of cash flow.

- Reinvestment: Dividends can also be reinvested to purchase additional shares, compounding returns over time.

- Signal of Financial Health: Regular, consistent dividend payments are often viewed as a sign of a company’s financial stability and profitability.

Evaluating Dividend-Paying Stocks

Not all dividend-paying stocks are created equal, and investors need to evaluate several factors to identify those with the best potential for sustainable income and capital appreciation.

Dividend Yield

Dividend yield is a key metric for assessing dividend-paying stocks, representing the ratio of a company’s annual dividend payments to its share price. It’s calculated as follows:

[ \text{Dividend Yield} = \left( \frac{\text{Annual Dividends Per Share}}{\text{Price Per Share}} \right) \times 100 ]

- A higher dividend yield can be attractive, indicating that the stock provides a good income relative to its price. However, an exceptionally high yield may warrant caution, as it could signal potential problems with the company or an unsustainable dividend.

Dividend Growth

Another crucial aspect to consider is the company’s dividend growth history. Companies that consistently increase their dividends over time can offer investors a growing income stream, potentially outpacing inflation and increasing the total return on investment.

Payout Ratio

The payout ratio, the percentage of earnings paid out as dividends, can provide insights into the sustainability of those dividends. A payout ratio that is too high may indicate that the company is paying out more than it can afford, which might not be sustainable in the long run.

Tax Implications of Equity Investing

Equity investing not only offers the potential for growth and income but also carries certain tax implications that can affect overall returns. Understanding how capital gains and dividends are taxed, as well as implementing tax-efficient investing strategies, is crucial for maximizing the benefits of equity investing. Here, we’ll explore the taxation of capital gains and dividends, and highlight strategies to help investors navigate the tax landscape effectively.

Capital Gains Taxes

Capital gains taxes are levied on the profit realized from the sale of non-inventory assets, including stocks, when these assets are sold for more than their purchase price. The rate at which capital gains are taxed depends on how long the asset was held before being sold.

- Short-Term Capital Gains: Profits from assets held for one year or less are considered short-term and are taxed at ordinary income tax rates, which can be higher.

- Long-Term Capital Gains: Profits from assets held for more than one year benefit from reduced tax rates, encouraging long-term investment.

Understanding the holding period of your investments can help in planning when to sell and potentially reduce tax liability.

How Dividends are Taxed

Dividends are typically taxed in one of two ways, depending on their classification as qualified or non-qualified dividends.

- Qualified Dividends: These are dividends paid by U.S. corporations or qualified foreign corporations that meet specific criteria set by the IRS. Qualified dividends are taxed at the lower long-term capital gains tax rates.

- Non-Qualified (Ordinary) Dividends: These dividends do not meet the criteria for qualified dividends and are taxed at the individual’s ordinary income tax rate, which can be higher.

Investors should pay attention to the source of their dividend income to understand the tax implications and plan accordingly.

Tax-Efficient Investing Strategies

Several strategies can help investors minimize their tax liability and enhance after-tax returns from their equity investments.

- Hold Investments Longer: By holding investments for more than a year, investors can benefit from the lower long-term capital gains tax rates.

- Use Tax-Advantaged Accounts: Investing through accounts like IRAs, Roth IRAs, and 401(k)s can offer tax benefits, either by deferring taxes until retirement or, in the case of Roth accounts, potentially providing tax-free growth.

- Harvesting Losses: Tax-loss harvesting involves selling investments at a loss to offset capital gains taxes. This strategy can help reduce your taxable income, but it’s important to be aware of wash-sale rules.

- Consider Dividend Yield and Growth: Investing in companies that offer qualified dividends can result in lower tax rates on dividend income. Balancing dividend yield with growth potential can also optimize after-tax returns.

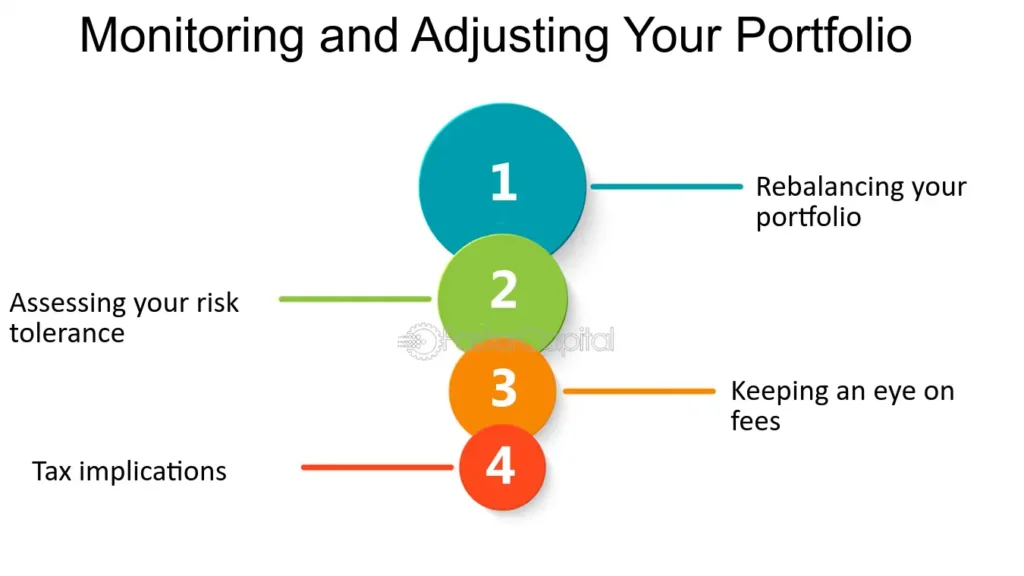

Monitoring and Adjusting Your Equity Portfolio

Effective equity investing requires not only a strategic approach to building a portfolio but also diligent monitoring and timely adjustments to ensure it remains aligned with your investment goals. Market conditions, economic indicators, and personal financial objectives can all change, necessitating a review and possible rebalancing of your equity portfolio. This ongoing process is crucial for optimizing investment returns and managing risk over time.

Guidelines for Reviewing Your Portfolio

Set Regular Review Intervals

Consistency is key in portfolio review. Establish a regular schedule, such as quarterly or semi-annually, to assess your portfolio’s performance against your financial goals and the broader market. This helps in making informed decisions without reacting impulsively to short-term market volatility.

Assess Performance Against Benchmarks

Evaluate the performance of your equity investments in comparison to relevant benchmarks, such as the S&P 500 or other indices that reflect your portfolio’s composition. This assessment can help identify underperforming assets that may need to be reconsidered.

Analyze Diversification

A well-diversified portfolio is essential for managing risk in equity investing. During your review, analyze the diversification across different sectors, industries, and geographical regions to ensure it matches your risk tolerance and investment horizon. Overconcentration in any area can expose your portfolio to higher volatility.

Evaluate Alignment with Investment Goals

As personal circumstances and financial goals evolve, your equity portfolio should adapt accordingly. Whether saving for retirement, generating income, or funding specific expenses, ensure your investment strategy remains aligned with these objectives.

Rebalancing Your Portfolio

Rebalancing involves buying or selling assets in your portfolio to maintain your original asset allocation and risk level. This process is critical for long-term investment success and risk management.

Recognizing When to Rebalance

- Significant shifts in the market may skew your portfolio’s asset allocation. Rebalancing helps realign it with your target allocation.

- Changes in your risk tolerance or investment goals may necessitate portfolio adjustments to better suit your current financial situation.

Implementing Rebalancing Strategies

- Sell High, Buy Low: Rebalancing allows you to capitalize on market fluctuations by selling assets that have appreciated and buying those that are undervalued.

- Tax Considerations: Be mindful of the tax implications of selling assets. Consider using tax-advantaged accounts or employing strategies like tax-loss harvesting to offset capital gains.

The Importance of Staying Informed

Market Trends and Economic Indicators

Keeping abreast of market trends and economic indicators is vital for informed equity investing. Factors such as interest rates, inflation, GDP growth, and geopolitical events can significantly impact market performance and investment opportunities.

Continuous Learning

The financial markets are constantly evolving. Engage in continuous learning through financial news, investment courses, and reputable financial analysis to enhance your understanding of equity investing and market dynamics.

FAQs:

- What Is Equity Investing?

- Equity investing involves purchasing shares in companies to own a portion of the business, with the potential for income through dividends and capital gains.

- How Do I Choose a Brokerage for Equity Investing?

- Consider factors such as commission fees, access to research and educational resources, platform ease of use, and customer service quality.

- What’s the Difference Between Common and Preferred Stocks?

- Common stocks offer ownership with voting rights but variable dividends, while preferred stocks provide fixed dividends without voting rights.

- How Important Is Diversification in Equity Investing?

- Diversification is crucial to minimize risk by spreading investments across various sectors, industries, and geographic locations.

- What Is Fundamental Analysis?

- It’s the process of evaluating a company’s financial health and operational efficiency to determine its intrinsic value.

- Can I Make Money with Dividend Stocks?

- Yes, dividend stocks can provide a steady income stream in addition to potential capital gains from stock price increases.

- What Are the Tax Implications of Equity Investing?

- Investors are subject to capital gains tax on profits from selling stocks and may also pay taxes on dividends received.

- How Often Should I Check My Equity Portfolio?

- While frequent monitoring isn’t necessary, regular reviews (e.g., quarterly or annually) are essential to ensure alignment with your investment goals.

- Is It Possible to Lose Money in Equity Investing?

- Yes, equity investing carries the risk of loss if stock prices decline, highlighting the importance of informed investing and risk management.

- How Do I Start Investing in Equities?

- Begin by researching and selecting a reputable brokerage, setting an investment budget, and choosing stocks based on your investment strategy and risk tolerance.