Overview of EightCap as a Forex Broker

EightCap Trading Platform stands out as a premier destination for beginner forex traders, offering a blend of user-friendly interfaces, robust educational resources, and customer support designed to streamline the trading experience. Established with the aim of providing transparent and straightforward access to the global forex markets, EightCap has rapidly emerged as a trusted partner for new traders navigating the complexities of currency trading.

Why Choose EightCap?

EightCap distinguishes itself through several key features:

- Regulation and Security: Fully regulated by major financial authorities, ensuring a secure trading environment.

- Competitive Spreads: Attractive pricing with low spreads that enhance trading profitability for beginners.

- Customer Support: Dedicated support team available 24/5, providing assistance and guidance to ensure a smooth trading journey.

Introduction to EightCap Trading Platform

EightCap caters to both novice and experienced traders by offering two of the most acclaimed EightCap Trading Platform in the forex industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaTrader 4 (MT4)

MetaTrader 4 remains the gold standard for forex trading platforms, known for its reliability, ease of use, and comprehensive analytical tools. Key benefits for beginners include:

- User-Friendly Interface: Simplifies the trading process with an intuitive layout and clear, actionable information.

- Advanced Charting Tools: Equips traders with a range of technical analysis tools to help predict market movements and identify trading opportunities.

- Automated Trading: Supports the use of trading robots (Expert Advisors) to automate trading strategies, reducing the need for constant market monitoring.

MetaTrader 5 (MT5)

Building on the success of MT4, MetaTrader 5 offers enhanced features for those looking to expand their trading into other financial markets like commodities and indices. MT5 provides:

- Additional Technical Indicators: Greater analytical diversity allows for more refined strategies.

- Improved Trading System: Supports more order types and has a built-in economic calendar.

- Enhanced Charting Tools: Offers more timeframes and technical indicators, improving on MT4’s already robust offerings.

By providing these sophisticated yet accessible EightCap Trading Platform, EightCap empowers beginners with the tools necessary to develop, test, and refine their trading strategies in real-time market environments.

Getting Started with EightCap Trading Platform

Step-by-Step Guide on Setting Up an Account

Starting your trading journey with EightCap is straightforward, ensuring that even those new to forex trading can quickly set up their trading environment. Here’s how you can get started:

1: Registration

Visit the EightCap website and click on the ‘Sign Up’ button. You will need to provide some basic information such as your name, email address, country of residence, and phone number. This step also involves agreeing to the terms and conditions of the service.

2: Verification

To comply with regulatory requirements, EightCap requires you to verify your identity and residence. This can typically be done by uploading copies of your government-issued ID (such as a passport or driver’s license) and a recent utility bill or bank statement showing your address.

3: Funding Your Account

Once your account is verified, you can proceed to fund it. EightCap supports multiple funding methods, including bank transfers, credit cards, and e-wallets like PayPal and Skrill. Choose the method that best suits your convenience and deposit the amount you wish to trade with.

4: Setting Trading Preferences

Before you start trading, you can set your trading preferences, such as leverage levels and stop-loss orders, to match your risk tolerance and trading strategy.

How to Download, Install, and Access the Trading EightCap Trading Platform

EightCap provides access to its trading platforms primarily through MetaTrader 4 and MetaTrader 5. Here’s how you can download, install, and start trading on these platforms:

MetaTrader 4 (MT4)

- Download: Navigate to the EightCap trading platform section and select MetaTrader 4. Click on the download link suitable for your operating system (Windows, Mac, or Linux).

- Install: Run the downloaded file and follow the on-screen instructions to install MT4 on your computer.

- Log In: Once installed, open MT4 and enter your EightCap account details to log in. You will now have access to real-time market data, can execute trades, and analyze the forex market using various tools.

MetaTrader 5 (MT5)

- Download: Similar to MT4, find the MT5 download link on the EightCap platform section and download it for your operating system.

- Install: Execute the downloaded file and follow the prompts to install the platform.

- Log In: Launch MT5 and log in with your EightCap credentials to access broader market functionalities and enhanced trading features.

Both platforms offer demo accounts where you can practice trading with virtual money, which is highly recommended for beginners to gain confidence before trading with real funds.

Navigating the User Interface on EightCap Trading Platform

Detailed Tour of the Trading Platform Interfaces

EightCap’s use of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offers a powerful yet user-friendly experience for beginners. This chapter will guide you through the key components of these platforms, ensuring you understand the layout, tools, and features available to optimize your trading experience.

Understanding the Layout

Both MT4 and MT5 feature a similar structure, which includes several primary areas:

- Main Menu and Toolbars: Located at the top of the screen, these contain shortcuts to most of the platform’s features, including chart settings, adding indicators, and accessing trading robots.

- Market Watch Window: This section displays a list of available trading instruments along with real-time quotes. Right-clicking on any instrument allows you to open a new chart window or place a trade.

- Navigator Window: Situated below the Market Watch, the Navigator allows you to quickly access your accounts, indicators, expert advisors, and scripts.

- Terminal Window: Found at the bottom of the platform, the Terminal provides information about open trades, order history, account balance, and access to the news and alerts system.

Tools and Features Available

Charts

Charts are the heart of forex trading platforms, and both MT4 and MT5 provide robust charting capabilities. Users can:

- Customize Timeframes: From one minute to one month, adapt the chart to reflect different time periods.

- Apply Technical Indicators: Over 30 built-in indicators are available, such as Moving Averages and MACD, which can be dragged onto the chart for technical analysis.

- Create and Save Templates: Customize and save your chart setup, including indicators and graphical objects, to easily apply to other charts.

Trading Operations

Executing trades on EightCap through MT4 and MT5 is efficient and user-friendly:

- Order Execution: Both platforms support multiple order types, including market orders, pending orders, and stop orders, which can be accessed through the ‘Order’ window from the chart or the Market Watch.

- Risk Management Tools: Features like stop-loss and take-profit orders help manage risk by automatically closing trades at specified price levels.

Analytical Tools

Both platforms offer a range of tools to help analyze the markets and plan trades:

- Technical Analysis Tools: Comprehensive suite of drawing tools such as trend lines, Fibonacci retracements, and support/resistance levels to annotate charts.

- Economic Calendar: MT5 integrates an economic calendar to keep traders informed of major economic events directly through the platform.

Understanding how to navigate and utilize these interfaces effectively will greatly enhance your trading efficiency and effectiveness, providing a solid foundation for a successful forex trading career with EightCap.

Key Features of EightCap Trading Platform

Explanation of Important Features

EightCap Trading Platform, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offer an array of features designed to enhance the trading experience. This chapter delves into some of the most critical aspects, such as charting tools, technical indicators, and automated trading options, which are instrumental for traders at all levels, especially beginners.

Charting Tools

The charting capabilities of MT4 and MT5 are comprehensive and versatile, enabling traders to:

- Multiple Chart Setup: Display multiple charts simultaneously, each can be configured independently, allowing for comparison and multitasking.

- Customizable Charts: Extensive customization options for colors and styles, as well as the ability to add graphical objects like shapes and arrows to highlight key trading signals.

Technical Indicators

Both platforms come equipped with a vast array of technical indicators, which are vital for conducting technical analysis:

- Standard Indicators: Includes commonly used indicators like Moving Averages, Bollinger Bands, RSI, and Stochastics.

- Custom Indicators: Traders can also install custom indicators, either developed independently or downloaded from the vast MetaTrader community.

Automated Trading Options

Automated trading is another cornerstone feature of EightCap’s platforms, facilitated primarily through the use of Expert Advisors (EAs):

- Expert Advisors (EAs): These are programs that automate trading and analytical tasks on MT4 and MT5. EAs can analyze market conditions and automatically execute trades according to predefined parameters.

- Strategy Tester: This tool allows traders to test and optimize their EAs before employing them in live trading, ensuring that the strategies are effective under past market conditions.

Benefits of Using These Features for EightCap Trading Platform Strategies

Employing the aforementioned features can significantly bolster a trader’s strategy:

Enhanced Market Analysis

The combination of multiple chart setups and technical indicators allows traders to perform detailed market analyses. These tools help identify trends, measure market volatility, and pinpoint entry and exit points, which are crucial for developing informed trading strategies.

Efficiency and Precision

Automated trading options like EAs enable traders to execute trades at optimal times without the need to monitor the markets continuously. This not only saves time but also increases the precision of trades by eliminating the emotional aspect of trading decisions.

Strategy Optimization

The ability to test strategies through the Strategy Tester provides invaluable feedback on the effectiveness of a trading strategy, allowing traders to fine-tune their approaches based on historical data before risking real capital.

By leveraging the robust features of EightCap’s trading platforms, beginners can significantly enhance their trading acumen, gain confidence, and increase their chances of success in the forex market.

How to Execute Trades on EightCap

Instructions on How to Place Market Orders, Limit Orders, and Stop Orders

Trading on EightCap using the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) EightCap Trading Platform involves several types of orders, each catering to different trading strategies and risk management approaches. Understanding how to execute these orders is crucial for effective trading.

Placing Market Orders

A market order is executed at the best available current price. It is the simplest way to enter or exit a position in the forex market.

- Open the Order Window: Right-click on the desired currency pair in the Market Watch window or on an active chart and select ‘New Order’.

- Specify the Order Details: In the order window, ensure ‘Market Execution’ is selected from the dropdown menu. Enter the volume of your trade.

- Execute the Trade: Click ‘Buy’ or ‘Sell’ depending on your trading decision. The trade will be executed instantly at the current market price.

Placing Limit Orders

Limit orders allow you to specify the price at which you want to buy or sell, enabling you to enter the market at a more favorable price.

- Set the Order Type: In the order window, select ‘Pending Order’ instead of ‘Market Execution’.

- Specify the Order Details: Choose ‘Buy Limit’ or ‘Sell Limit’, set the price at which you want the order to be executed, and define the volume.

- Place the Order: Confirm the details and place your limit order. The order will be executed if the market reaches your specified price.

Placing Stop Orders

Stop orders are used to limit losses or lock in profits by closing a position when the market moves against a trade by a specified amount.

- Choose the Order Type: In the order window, select ‘Pending Order’.

- Set Up the Order: Choose ‘Buy Stop’ or ‘Sell Stop’, depending on whether you anticipate the price will rise or fall. Set the stop price level and the volume.

- Activate the Order: Confirm and place your stop order. It will activate when the price reaches your specified level.

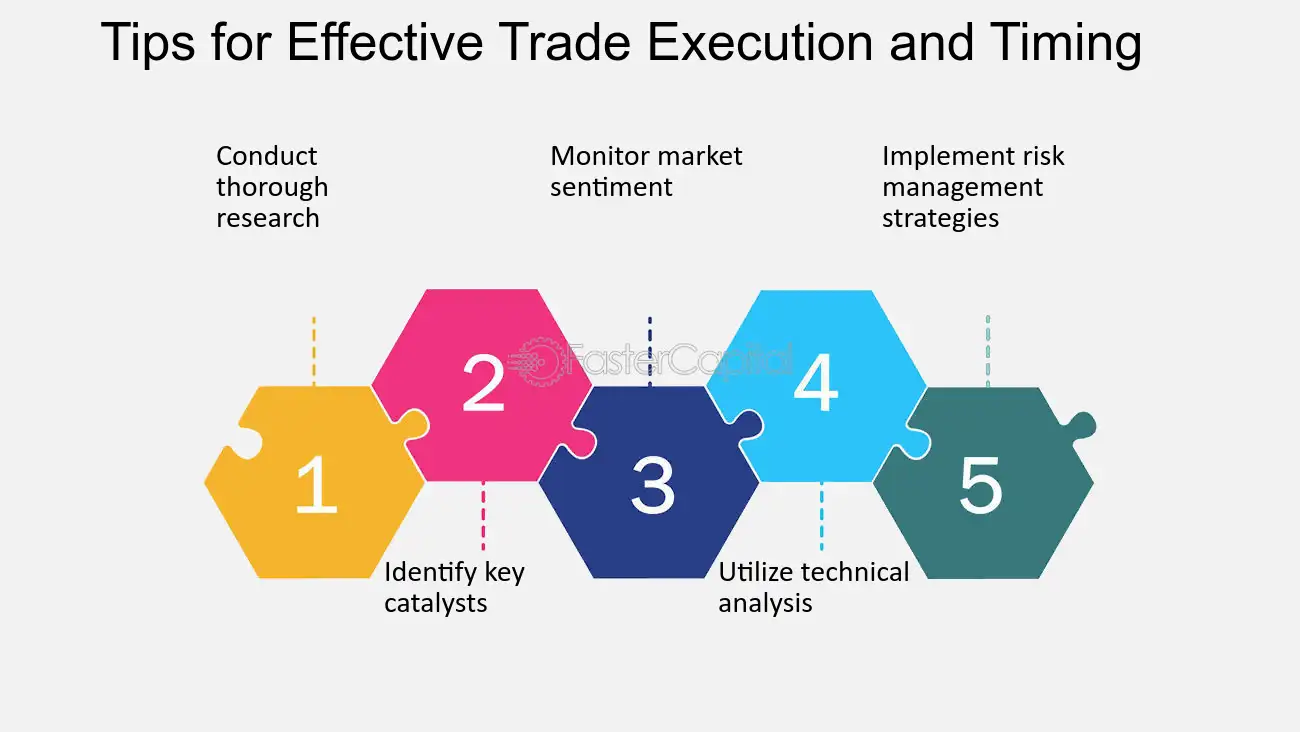

Tips for Effective Trade Execution and Management

Understand the EightCap Trading Platform

Familiarize yourself with the MT4 or MT5 interface in detail. Knowing where to find and how to use different tools and options will speed up your trading activities and reduce mistakes.

Use Stop-Loss and Take-Profit

Always set stop-loss and take-profit orders with your trades. These tools help manage risk by automatically closing positions at predetermined price levels, protecting against unexpected market movements.

Monitor Your Trades

Regularly review open positions and adjust your strategies as necessary. Market conditions can change rapidly, and staying informed will help you make better trading decisions.

Practice with a Demo Account

Before executing real trades, practice with a demo account on EightCap. This will help you get comfortable with order execution and platform navigation without any financial risk.

By following these guidelines and utilizing the powerful features of EightCap’s trading platforms, you can execute and manage your trades more effectively and confidently.

Using Technical Analysis Tools

Guide on Utilizing Built-in Technical Analysis Tools for Market Analysis

EightCap’s platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are equipped with an extensive suite of technical analysis tools. These tools are designed to help traders analyze market trends, identify trading opportunities, and make informed trading decisions.

Overview of Key Technical Analysis Tools

Indicators

Both MT4 and MT5 offer a broad range of indicators, including:

- Trend Indicators like Moving Averages and Bollinger Bands, which help identify the direction and stability of market trends.

- Oscillators such as the Relative Strength Index (RSI) and Stochastic, which are crucial for identifying overbought or oversold conditions.

Analytical Objects

These platforms also provide tools to draw on charts, such as:

- Lines like trendlines and horizontal lines to mark levels of support and resistance.

- Shapes such as rectangles and ellipses to highlight areas of interest on the chart.

How to Access and Apply These Tools

To apply an indicator:

- Open the Chart: Select the asset you want to analyze.

- Add the Indicator: Navigate to the ‘Insert’ menu, choose ‘Indicators’, and then select the desired indicator. Customize the settings according to your analysis needs.

To add analytical objects:

- Activate the Drawing Tool: Click on the ‘Line Studies’ toolbar or select it from the ‘Insert’ menu.

- Draw on the Chart: Click and drag on the chart to draw lines or shapes as needed.

Examples of Applying These Tools to Real-World Trading Scenarios

Example 1: Trend Analysis Using Moving Averages

Imagine you are analyzing the EUR/USD currency pair. By applying a Moving Average:

- Set Up the Indicator: Add a 50-day Moving Average to identify the medium-term trend direction.

- Interpret the Chart: A rising Moving Average indicates an uptrend, suggesting a potential buying opportunity when the price dips but remains above the Moving Average.

Example 2: Identifying Market Reversals with RSI

If you’re looking to catch potential reversals:

- Apply the RSI: Set the RSI period to 14 and add levels at 30 (oversold) and 70 (overbought).

- Look for Signals: An RSI moving above 30 can indicate a buying signal as the market moves out of oversold conditions. Conversely, an RSI falling below 70 might be a selling signal as it leaves overbought conditions.

By integrating these tools into your trading strategy on EightCap, you can enhance your ability to analyze and interpret market dynamics, leading to more calculated and informed trading decisions.

Automated Trading and Expert Advisors (EAs)

Overview of Using Automated Trading Systems on EightCap Trading Platform

EightCap’s adoption of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms not only caters to manual trading but also fully supports automated trading through the use of Expert Advisors (EAs). These automated systems enable traders to set up trading strategies that execute trades automatically, based on predefined conditions.

Benefits of Automated Trading

- Efficiency: Trades are executed at the best possible times without the need for constant monitoring.

- Consistency: Removes emotional decision-making and maintains trading discipline.

- Backtesting: Allows traders to test their strategies using historical data before applying them in live markets.

How to Set Up and Optimize Expert Advisors for Automated Trading

Setting up and optimizing EAs involves several steps to ensure they function effectively and align with your trading objectives.

Setting Up Expert Advisors (EAs)

- Choose or Develop an EA: Select an existing EA from the MetaTrader Market or develop a custom one if you have programming skills.

- Install the EA: Copy the EA file into the ‘Experts’ or ‘Indicators’ directory of your MT4 or MT5 platform.

- Activate the EA: Open the platform, find the EA in the ‘Navigator’ pane, drag it onto the desired chart, and ensure that automated trading is enabled in your platform settings.

Optimizing Expert Advisors

- Access the Strategy Tester: Use MT4 or MT5’s built-in Strategy Tester to evaluate the performance of the EA under historical market conditions.

- Configure the Tester Settings: Select the appropriate currency pair, a significant historical period, and the parameters you want to optimize.

- Run the Test: Analyze the EA’s performance over the selected period. Adjust the parameters and run the test again to compare results and optimize performance.

Tips for Effective Use of EAs

- Understand the Strategy: Know how and why your EA makes trades. Understanding its strategy is crucial for managing it effectively.

- Monitor Performance: Regularly check the EA’s performance and adjust settings as market conditions change.

- Risk Management: Implement risk management strategies within the EA settings, such as setting stop-loss orders and choosing appropriate lot sizes to protect your capital.

Automated trading via Expert Advisors on EightCap’s MT4 and MT5 platforms can significantly enhance your trading strategy by providing high precision and efficiency. However, it is vital to continuously monitor and optimize these tools to align with evolving market conditions and your trading goals.

Risk Management Features

Detailed Look at Risk Management Tools Available on the EightCap Trading Platform

Risk management is a critical aspect of trading, especially in the volatile forex market. EightCap’s platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offer several tools designed to help traders manage and mitigate risk effectively. These tools include stop-loss orders, take-profit levels, and margin monitoring.

Stop-Loss Orders

A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. It is designed to limit an investor’s loss on a position in a security. On MT4 and MT5, setting a stop-loss order follows these steps:

- Open the Order Window: Right-click on the asset you are trading in the Market Watch or directly on an active chart.

- Set the Stop-Loss Level: When placing a new trade, enter the price at which you want the stop-loss to trigger in the ‘Stop Loss’ field.

- Modification: You can also add or modify stop-loss orders on existing positions by right-clicking the trade in the ‘Terminal’ window and selecting ‘Modify or Delete Order’.

Margin Levels

Margin levels are a percentage value that indicates the amount of available funds for new trades. EightCap and the MT platforms provide real-time monitoring of your margin levels to ensure you do not exceed your trading capacity.

- Monitor Your Margin: Keep an eye on the ‘Margin Level’ displayed in the Terminal window. It helps you understand how much of your funds are engaged in trades and how much is available.

- Margin Call Alert: If your margin level approaches a critical low point, it’s a signal to either close some positions or add funds to meet margin requirements and avoid a margin call.

Best Practices for Managing Risks While Trading

Effective risk management is not just about setting up the right tools but also about adopting best practices that protect your investments.

Balance Leverage

Leverage can amplify your earnings but also your losses. It’s essential to use leverage wisely:

- Adjust Leverage According to Risk Appetite: Choose a level of leverage that fits your risk tolerance. More conservative traders should opt for lower leverage to minimize risks.

Regularly Review and Adjust Stop-Loss Orders

Market conditions change, and what may have been a sensible stop-loss yesterday may not be adequate today:

- Dynamic Management: Regularly update your stop-loss levels to reflect changes in the market volatility and your trading strategy.

Diversify Your Portfolio

Do not put all your eggs in one basket:

- Spread Your Risk: Diversify your investments across different instruments to reduce risk. If one investment fails, others in your portfolio can absorb the impact.

Continuous Education

Stay informed about market conditions, economic events, and trading techniques:

- Stay Updated: Regular learning and adaptation to new market conditions can significantly enhance your ability to manage risks.

By integrating these risk management tools and practices, traders using EightCap can safeguard their investments against unexpected market movements and enhance their overall trading performance.

Customizing the Trading Experience

How to Customize and Personalize the EightCap Trading Platform to Fit Individual Trading Needs and Preferences

EightCap, through its use of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, offers extensive customization options that allow traders to tailor their trading environment to their specific needs and preferences. This flexibility can enhance trading efficiency and make the trading experience more comfortable and personalized.

Customizing the Layout and Settings

- Changing the Visuals: Both MT4 and MT5 allow users to customize the appearance of charts and the overall interface. Traders can change colors of various elements such as background, foreground, grid, and bar charts to suit their visual preferences.

- Setting Up the Workspace: Traders can arrange the windows and panels within the platform to create a workspace that best suits their trading style. This might include having multiple charts open simultaneously, or having certain data feeds and analytical tools more readily accessible.

Configuring Market Watch and Navigator Windows

- Market Watch Customization: Traders can add or remove trading instruments from the Market Watch window to keep only those they are interested in monitoring.

- Navigator Adjustments: Users can organize their frequently used scripts, indicators, and Expert Advisors (EAs) in the Navigator for quick access.

Creating and Saving Custom Templates and Profiles

Custom templates and profiles save time and ensure consistency in trading, which is crucial for maintaining an effective trading strategy.

Creating Custom Templates

A template in MT4 or MT5 is a preset configuration of settings that can be applied to new charts. This can include configured indicators, color schemes, and objects.

- Set Up a Chart: Configure a chart with your preferred setup, including indicators, graphical objects, and color settings.

- Save the Template: Right-click on the chart, select ‘Template’, and then ‘Save Template’. Give it a name that you will remember.

- Applying Templates: To apply a saved template to a new chart, right-click on the chart, select ‘Template’, and then choose your saved template from the list.

Managing Profiles

Profiles in MetaTrader allow you to save the entire layout of your workspace.

- Arrange Your Workspace: Set up your workspace with the desired combination and arrangement of charts and indicators.

- Save the Profile: From the main menu, choose ‘File’, then ‘Profiles’, and ‘Save As’. Enter a name for your profile.

- Switching Between Profiles: You can switch between saved profiles by going to ‘File’, ‘Profiles’, and selecting the desired profile from the list.

These customization options not only make the trading process more efficient but also allow traders to quickly adapt to changes in the market or in their trading strategies by switching between various presets and layouts.

By personalizing your trading environment, you can streamline your operations, focus better on your trading activities, and potentially increase your trading success.

Troubleshooting and Support on EightCap Trading Platform

Common Issues Traders Might Encounter and How to Resolve Them

Trading on advanced platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) through EightCap can sometimes lead to technical or operational issues. Understanding how to address these common problems enhances the trading experience and minimizes downtime.

Connectivity Issues

Problem: Difficulty connecting to the server which can result in delays or inability to trade.

Solution: Check your internet connection and ensure it is stable and fast. Restart your router if necessary. If the problem persists, verify the server details in MT4 or MT5 are correct and that there are no server-side issues by contacting EightCap support.

Platform Freezes or Crashes

Problem: The trading platform stops responding or closes unexpectedly.

Solution: Close unnecessary programs to free up system resources. Ensure your trading platform is updated to the latest version. Reinstall the platform if issues continue.

Problems with Expert Advisors (EAs)

Problem: EAs not executing trades as expected.

Solution: Check the EA settings and ensure they are correct. Verify that automated trading is enabled both on the platform and the specific chart the EA is applied to. Review the log files for error messages that might explain why the EA is not functioning as intended.

Information on Accessing Customer Support and Educational Resources

EightCap provides comprehensive support and educational resources to assist traders in maximizing their EightCap Trading Platform use and trading strategies.

Customer Support

EightCap offers several channels for support:

- Live Chat: Available directly on their website for real-time assistance.

- Email: You can send detailed queries to their support email address.

- Phone: For urgent support needs, EightCap provides phone numbers which can be used to speak directly with a customer service representative.

Educational Resources

EightCap is committed to trader education and offers a variety of resources:

- Webinars and Seminars: Regularly scheduled online and sometimes in-person sessions that cover a range of topics from EightCap Trading Platform tutorials to advanced trading strategies.

- Guides and Articles: Comprehensive guides and articles are available on their website, covering both basic and advanced topics.

- Demo Accounts: Practice your trading strategies in a risk-free environment with a demo account that simulates real-market conditions.

These support structures ensure that traders at EightCap can not only resolve technical and operational issues quickly but also continue to develop their trading skills and knowledge effectively.