Cryptocurrency trading has emerged as a vibrant and dynamic segment of the financial markets, offering unique opportunities and challenges distinct from traditional markets. Understanding the basics of cryptocurrencies and how crypto trading operates is crucial for anyone looking to navigate this relatively new trading space.

Basics of Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks based on blockchain technology. Unlike traditional currencies, they are not controlled by any central authority, making them inherently resistant to government interference or manipulation.

Key Features of Cryptocurrencies:

- Decentralization: Most cryptocurrencies operate on a decentralized network using blockchain technology, a distributed ledger enforced by a disparate network of computers.

- Limited Supply: Many cryptocurrencies have a cap on the total supply, making them deflationary by nature. For example, the total supply of Bitcoin is capped at 21 million coins.

- Anonymity and Transparency: Transactions made with cryptocurrencies can be simultaneously anonymous and transparent, meaning the transaction history is public, but the identities of the parties involved are hidden.

How Crypto Trading Differs from Traditional Markets

Crypto trading shares some similarities with traditional financial markets, such as forex and stock trading, but also exhibits several key differences:

Market Hours

Unlike traditional markets, which have set trading hours, cryptocurrency markets operate 24/7, allowing traders to buy and sell cryptocurrencies at any time of the day or week.

Volatility

Cryptocurrencies are known for their high volatility, which can lead to significant price swings within short periods. While this volatility can present increased opportunities for profit, it also comes with increased risk.

Accessibility

Crypto trading is relatively accessible, with a simple internet connection and a cryptocurrency exchange account being the primary requirements to start trading. This accessibility has contributed to the rapid growth of the cryptocurrency trading community.

Regulation

The regulatory environment for cryptocurrencies is still evolving. While some countries have started to establish guidelines and regulations for cryptocurrencies, the global regulatory landscape remains fragmented, affecting how cryptocurrencies are traded in different jurisdictions.

Most Traded Cryptocurrencies

Several cryptocurrencies dominate the market in terms of trading volume, market capitalization, and user interest:

- Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold. Bitcoin dominates the market cap in the crypto world and is widely traded across various exchanges.

- Ethereum (ETH): Known for its smart contract functionality, Ethereum facilitates not only currency exchange but decentralized applications (dApps) on its network.

- Ripple (XRP): Designed for digital payment networks, XRP aims to enable fast, cross-border transactions between financial institutions.

- Litecoin (LTC): Similar to Bitcoin but with faster transaction confirmation times and a different hashing algorithm.

- Binance Coin (BNB), Cardano (ADA), and Polkadot (DOT): Other notable cryptocurrencies that have gained popularity for trading due to their unique features and robust ecosystems.

Choosing a Crypto Exchange

Selecting the right crypto exchange is a pivotal decision for anyone involved in crypto trading. A crypto exchange not only serves as the gateway to buying and selling digital currencies but also significantly influences your trading experience. Factors such as security, fees, the range of available coins, and the user interface play crucial roles in determining the suitability of an exchange for your trading needs. Here’s what to consider when choosing a crypto exchange for trading:

Security

Given the digital nature of cryptocurrencies, exchanges are prime targets for cyberattacks. The security measures an exchange implements are paramount to protecting your assets.

- What to Look For: Look for exchanges with robust security features such as two-factor authentication (2FA), cold storage options for customer funds, insurance against theft, and a track record of handling security breaches effectively.

Fees

Transaction fees can vary widely between exchanges, affecting the overall profitability of your trading activities. Understanding the fee structure is essential for cost-effective trading.

- What to Consider: Evaluate the exchange’s fee structure, including trading fees, withdrawal fees, and any other hidden costs. Some exchanges offer lower fees for higher volume trades or for holding the exchange’s native tokens.

Available Coins

Diversity in available cryptocurrencies can provide more trading opportunities. An exchange that offers a wide selection of coins and tokens gives traders the flexibility to trade in major cryptocurrencies as well as altcoins.

- What to Look For: Consider your trading strategy and ensure that the exchange supports the cryptocurrencies you are interested in trading. Some traders might prioritize exchanges that frequently list new and emerging coins for speculative trading.

User Interface

A user-friendly interface can significantly enhance your trading experience, especially for beginners. An intuitive platform can help traders make timely decisions and execute trades efficiently.

- What to Consider: Look for exchanges that offer a clean, easy-to-navigate interface with customizable charts, adequate tools for technical analysis, and straightforward order placement procedures. Mobile app availability is also a plus for trading on the go.

Additional Considerations

Liquidity

High liquidity ensures that orders can be filled quickly and at predictable prices. An exchange with high trading volumes typically offers better liquidity, minimizing the spread between buy and sell orders.

Customer Support

Responsive and helpful customer support is crucial, especially in resolving account or trading issues swiftly. Evaluate the exchange’s reputation for customer service, including the availability of support channels and response times.

Regulatory Compliance

Trading on an exchange that complies with regulatory requirements can offer additional protections for traders. Regulatory compliance indicates that the exchange adheres to specific standards and practices, reducing the risk of fraudulent activity.

Fundamentals of Crypto Trading

Crypto trading, while sharing some similarities with traditional financial markets, introduces unique concepts and practices that traders must understand to navigate the market effectively. Among these are the types of orders that can be placed, such as market orders and limit orders, which are crucial for executing trades according to a trader’s strategy and market conditions. Here’s a primer on these fundamental trading concepts specific to the crypto market.

Market Orders

A market order is a request to buy or sell a cryptocurrency immediately at the best available current price. It is executed based on the prevailing market conditions and is typically filled quickly, making it a popular choice for traders looking to enter or exit the market promptly.

- Advantages: Market orders are simple to execute and are almost guaranteed to be filled, barring extreme market volatility.

- Disadvantages: The main downside is slippage, which occurs when the price at which the order is executed differs from the price when the order was placed, especially in fast-moving markets.

Limit Orders

Limit orders allow traders to specify the price at which they wish to buy or sell a cryptocurrency, giving them control over the execution price. A buy limit order will be executed at the specified price or lower, while a sell limit order will be executed at the specified price or higher.

- Advantages: Limit orders provide price certainty and can help manage risks associated with slippage. They are ideal for traders who have a specific entry or exit target in mind.

- Disadvantages: There’s no guarantee the order will be filled if the market does not reach the specified price. This might result in missed opportunities in fast-moving markets.

Stop Orders

Stop orders, including stop-loss orders and stop-entry orders, are designed to limit potential losses or enter the market at a more favorable price once a certain price level is reached.

- Stop-Loss Orders: Placed to sell a cryptocurrency when its price falls to a certain level, minimizing potential losses.

- Stop-Entry Orders: Used to buy or sell a cryptocurrency when its price surpasses a certain level, targeting favorable market movements.

Other Trading Concepts

Leverage and Margin Trading

Leverage allows traders to borrow funds to increase their trading position beyond what would be possible with their current account balance. While it can amplify profits, it also significantly increases the risk of losses.

Short Selling

Short selling involves selling a cryptocurrency that you do not own at a high price, with the intention of buying it back later at a lower price. It’s a strategy used to profit from an anticipated decline in the cryptocurrency’s price.

Liquidity

Liquidity refers to the ease with which a cryptocurrency can be bought or sold in the market without affecting its price. High liquidity is crucial for executing large trades quickly and at stable prices.

Technical Analysis in Crypto Trading

Technical analysis plays a crucial role in crypto trading by providing traders with tools and indicators to predict future price movements based on past market data. Unlike fundamental analysis, which looks at external factors and intrinsic value, technical analysis focuses on price movements, volume, and other market indicators. Understanding how to utilize technical analysis tools, read crypto charts, and interpret patterns can significantly enhance your trading decisions in the volatile crypto market.

Tools and Indicators Used in Crypto Trading

Moving Averages

Moving averages are among the most commonly used indicators in crypto trading. They smooth out price data over a specified period to show a trend direction. The two main types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

- SMA gives equal weighting to all values.

- EMA gives more weight to recent prices, making it more responsive to new information.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a cryptocurrency. An RSI above 70 typically indicates that an asset may be overbought, while an RSI below 30 suggests that it may be oversold.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a cryptocurrency’s price. It consists of the MACD line, signal line, and histogram, which can signal changes in trend and momentum.

Volume

Volume, the number of coins or tokens traded in a given period, is a vital indicator of the strength behind price movements. High volume during a price increase suggests strong buying pressure, while high volume during a price decrease indicates strong selling pressure.

Reading Crypto Charts and Patterns

Candlestick Charts

Candlestick charts are widely used in crypto trading for their ability to display a vast amount of information in a single view. Each candlestick shows the open, high, low, and close prices for a specific period. Patterns within candlesticks can indicate potential market movements.

Chart Patterns

Chart patterns, such as head and shoulders, triangles, and flags, can signal continuation or reversal of trends. Recognizing these patterns helps traders anticipate potential market movements.

- Head and Shoulders: Indicates a reversal of a current trend.

- Triangles (ascending, descending, and symmetrical): Can signal continuation or reversal, depending on the breakout direction.

- Flags and Pennants: Typically indicate continuation of the current trend.

Support and Resistance Levels

Support and resistance levels are key concepts in technical analysis.

- Support is a price level where a downtrend can be expected to pause due to a concentration of demand.

- Resistance is a price level where a trend can pause or reverse due to a concentration of selling interest.

Understanding these levels helps traders identify potential entry and exit points.

Risk Management Strategies in Crypto Trading

In the volatile world of crypto trading, effective risk management is not just a best practice—it’s essential for survival. The rapid price movements characteristic of cryptocurrency markets can offer substantial rewards, but they also come with significant risks. Implementing robust risk management strategies can help traders protect their capital and navigate the unpredictable waters of crypto trading more confidently. Here are key techniques to mitigate risks in crypto trading.

Setting Stop-Loss Orders

A stop-loss order is a crucial risk management tool that automatically sells a cryptocurrency when it reaches a specified price, limiting potential losses if the market moves against your position.

- Implementation: Determine the maximum amount of capital you’re willing to risk on a trade and set your stop-loss level accordingly. A common approach is to place a stop-loss order just below a significant support level for long positions, or just above a resistance level for short positions.

Managing Portfolio Exposure

Diversifying your trading portfolio can spread risk across different assets, reducing the impact of a poor performance by any single cryptocurrency.

- Diversification: Avoid concentrating your capital in a single coin or a group of similar cryptocurrencies. Instead, spread your investments across different asset types, including coins from various sectors (e.g., DeFi, NFTs, smart contracts platforms).

- Position Sizing: Allocate only a portion of your total trading capital to any single trade. A common rule of thumb is not to risk more than 1-2% of your trading capital on a single trade.

Using Leverage Cautiously

Leverage can amplify gains but also magnifies losses, making it a double-edged sword in crypto trading.

- Caution: Be conservative with the use of leverage, especially if you are a novice trader. High leverage can lead to rapid losses, particularly in the highly volatile crypto market.

- Margin Requirements: Understand the margin requirements of your trading platform and ensure you have adequate funds to cover potential margin calls.

Regularly Reviewing and Adjusting Strategies

Market conditions change, and what works today may not work tomorrow. Regular review and adjustment of your trading strategies and risk management practices are vital.

- Performance Review: Analyze the performance of your trades to identify what’s working and what’s not. Use this information to refine your strategies and risk management techniques.

- Stay Informed: Keep up to date with market trends and news that could impact the cryptocurrency markets. Adjust your trading strategies and risk management measures in response to changing market dynamics.

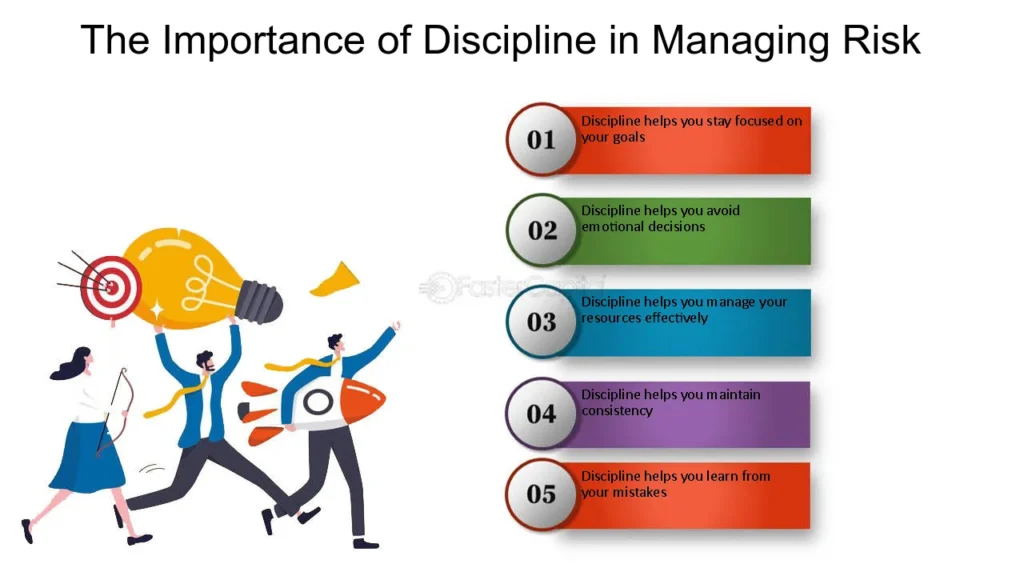

Psychological Discipline

Maintaining emotional control is an often overlooked aspect of risk management. Emotional decisions can lead to mistakes, such as chasing losses or taking on too much risk.

- Discipline: Stick to your trading plan and resist the urge to make impulsive decisions based on short-term market movements.

- Patience: Be patient and wait for the trading setups that meet your criteria, rather than forcing trades in unfavorable conditions.

Developing a Crypto Trading Strategy

Crafting a well-thought-out crypto trading strategy is pivotal for navigating the volatile and unpredictable cryptocurrency market. Trading strategies such as day trading, swing trading, and scalping can offer diverse opportunities for traders, but they require a disciplined approach and the flexibility to adapt to changing market conditions. Here’s an exploration of these strategies and insights on maintaining discipline and adaptability.

Crypto Trading Strategies

Day Trading

Day trading in the crypto space involves entering and exiting positions within the same trading day. This strategy aims to capitalize on short-term price movements and requires a significant time commitment to monitor the markets and execute trades promptly.

- Key Components: Utilize technical analysis and real-time news to make informed decisions. Day traders often rely on chart patterns, technical indicators, and liquidity analysis to spot trading opportunities.

- Risk Management: Due to the short-term nature of trades, day trading requires strict risk management practices, including the use of stop-loss orders and position sizing to protect trading capital.

Swing Trading

Swing trading is a medium-term strategy where positions are held for several days to weeks, aiming to profit from price “swings.” This approach is less time-intensive than day trading and is suited to traders looking to leverage the momentum of market trends.

- Key Components: Swing traders combine technical analysis with fundamental insights to identify potential entry and exit points. Understanding market sentiment and macroeconomic trends can also inform swing trading decisions.

- Adaptability: Flexibility in adjusting positions based on market analysis and trends is crucial. Swing traders need to be vigilant about market changes that could affect ongoing trades.

Scalping

Scalping is a strategy focused on making numerous small profits on minor price changes throughout the day. This high-volume trading approach requires quick decision-making and execution.

- Key Components: Scalpers rely on liquidity, volatility, and speed. They often use order book analysis, bid-ask spreads, and leverage to maximize profit opportunities from small price movements.

- Risk Management: Effective scalping involves setting tight stop-losses and having a clear exit strategy for each trade to minimize potential losses.

The Importance of a Disciplined Approach

Discipline is key to successful crypto trading, irrespective of the strategy chosen. A disciplined approach involves:

- Sticking to Your Trading Plan: Define your trading goals, risk tolerance, entry and exit criteria, and adhere to them meticulously.

- Emotional Control: Maintain emotional equilibrium by avoiding impulsive decisions driven by fear or greed. Emotional discipline helps in executing trades based on analysis rather than sentiment.

- Continuous Learning: The crypto market is constantly evolving. Stay informed about market developments, new trading tools, and strategies to refine your approach.

Adapting Strategies Based on Market Conditions

Market conditions in the cryptocurrency world can change rapidly. Successful traders are those who can adapt their strategies in response to these changes.

- Market Analysis: Regularly analyze market trends, sentiment, and potential impact of news events on the cryptocurrency market.

- Flexibility: Be prepared to adjust your trading strategy, whether it means taking a break during high volatility or shifting from day trading to swing trading based on market analysis.

- Review and Adjust: Regularly review your trading performance and strategy effectiveness. Use insights gained from past trades to make informed adjustments.

The Psychological Aspects of Crypto Trading

Crypto trading, with its notorious volatility and unpredictability, can exert significant psychological pressures on traders. The emotional rollercoaster of witnessing rapid gains or losses requires a strong mental approach to maintain discipline, patience, and sound decision-making. Understanding and managing these psychological aspects are crucial for long-term success in the crypto markets.

Managing Emotions

The high stakes and fast pace of crypto trading can trigger a range of emotions, from the exhilaration of a winning streak to the despair of a sudden market downturn.

Strategies for Emotional Management:

- Set Clear Goals: Establish what you aim to achieve with your trading and remind yourself of these goals during times of high emotional stress.

- Maintain a Work-Life Balance: Ensure that trading does not consume all your time and energy. Engage in activities outside of trading to maintain mental and emotional well-being.

Psychological Pressures of Trading

Trading psychology involves the mindset and emotions that traders experience during the trading process. Two common psychological pressures in crypto trading are fear and greed.

- Fear: Can lead to panic selling during market dips or the fear of missing out (FOMO) on potential gains. Combat this by sticking to your trading plan and avoiding impulsive decisions based on market noise.

- Greed: May tempt traders to take excessive risks or remain in trades longer than their strategy dictates, hoping for higher profits. Counteract greed by setting and adhering to predefined profit targets and stop-loss orders.

Avoiding Common Pitfalls

Several psychological pitfalls can ensnare crypto traders, including overtrading, revenge trading, and confirmation bias.

- Overtrading: Occurs when traders, driven by emotion or the desire for action, make more trades than their strategy advises.

- Revenge Trading: Trying to recoup losses quickly by making hasty, ill-considered trades often leads to further losses.

- Confirmation Bias: The tendency to favor information that confirms pre-existing beliefs or biases, leading to skewed decision-making.

Strategies to Avoid Pitfalls:

- Stick to Your Trading Plan: A well-thought-out trading plan acts as a guardrail against emotional decision-making and impulsive reactions to market movements.

- Use a Trading Journal: Documenting your trades, including the emotional state during each trade, can help identify patterns in emotional responses and decision-making.

The Importance of Patience and Discipline

Patience and discipline are vital traits for any trader, but they are especially critical in the volatile crypto market.

- Patience: Allows traders to wait for the right trading opportunities that fit their strategy instead of chasing the market.

- Discipline: Helps traders stick to their trading plan, manage risks effectively, and avoid the temptation of emotional trading.

Staying Informed: News and Market Trends in Crypto Trading

In the rapidly evolving world of cryptocurrency, staying informed about news, global events, and market trends is crucial for making informed trading decisions. The decentralized nature of cryptocurrencies means they can be significantly influenced by a wide range of factors, from regulatory changes to technological advancements and market sentiment shifts. Understanding the impact of these elements and knowing where to find reliable information can help traders navigate the volatile crypto market more effectively.

The Impact of News and Global Events on Cryptocurrency Prices

Regulatory Announcements

Regulatory news, whether it’s the imposition of new regulations or clarity on existing ones, can have a profound impact on cryptocurrency prices. Positive regulatory developments can lead to price surges, while announcements of bans or stringent regulations in major markets can cause prices to tumble.

Technological Advancements and Updates

Technological updates, such as upgrades to blockchain protocols or the launch of new features, can influence investor sentiment and, subsequently, cryptocurrency prices. For instance, a successful upgrade that improves a network’s scalability or security can bolster investor confidence and drive up prices.

Market Sentiment and Speculation

The sentiment within the crypto community, often fueled by speculation or influential figures’ opinions, can lead to rapid price movements. News events that alter the general mood or outlook on the market can result in swift price changes.

Resources for Staying Updated on Cryptocurrency Developments

Cryptocurrency News Websites

Websites dedicated to cryptocurrency news, such as CoinDesk, Cointelegraph, and CryptoSlate, offer timely updates on regulatory changes, technological advancements, and market trends. They are essential resources for traders looking to stay informed.

Social Media and Forums

Social media platforms like Twitter and Reddit, along with forums such as Bitcointalk, can be valuable sources of real-time information and community sentiment. Influential figures in the crypto space often use these platforms to share insights, making them important for staying ahead of market movements.

Market Analysis Platforms

Platforms that offer market analysis and commentary, such as TradingView or CryptoCompare, provide not only data and charts but also expert opinions and analysis on market trends. These can be particularly useful for interpreting how news events might impact the market.

Economic Calendars

Economic calendars listing upcoming events known to affect financial markets, including cryptocurrencies, can help traders anticipate market movements. These events might include central bank announcements, inflation reports, or technology conferences relevant to the crypto space.

Security Measures and Best Practices in Crypto Trading

The digital nature of cryptocurrencies makes them susceptible to various online threats, including hacking, phishing, and other forms of cyberattacks. Safeguarding your investments requires a proactive approach to security, employing robust measures, and adhering to best practices. Here’s how traders can protect their assets in the volatile world of crypto trading.

Using Hardware Wallets

A hardware wallet is a physical device that stores the user’s private keys in a secure hardware device, offering an extra layer of security compared to software wallets.

- Benefits: Hardware wallets are immune to computer viruses that steal from software wallets and provide secure offline storage for your cryptocurrencies.

- Best Practice: Use hardware wallets to store the bulk of your assets, especially if you’re holding long-term. Keep only the necessary amount for trading or transactions in online wallets.

Enabling Two-Factor Authentication (2FA)

Two-factor authentication adds an additional layer of security by requiring not only a password and username but also something that only the user has on them, i.e., a piece of information only they should know or have immediately to hand – such as a physical token.

- Benefits: 2FA significantly reduces the risk of unauthorized access to your trading accounts and wallets, even if someone manages to discover your password.

- Best Practice: Enable 2FA on all your crypto accounts, including exchanges and wallets. Opt for an authenticator app over SMS-based verification when possible, as it’s more secure.

Avoiding Phishing Scams

Phishing scams involve tricking individuals into giving out confidential information, such as login credentials and private keys, by pretending to be a trustworthy entity in an electronic communication.

- Best Practice: Never click on unverified links in emails or messages. Always double-check the URL of the website you’re visiting to ensure it’s the official site and not a clever imitation designed to steal your information.

- Awareness: Be wary of unsolicited communications and too-good-to-be-true offers. Legitimate organizations will never ask for your private keys or sensitive login details via email or social media.

Regular Software Updates

Keeping your software updated is crucial for security. This includes your operating system, trading applications, and any other software you use for crypto trading.

- Benefits: Updates often contain patches for security vulnerabilities that could be exploited by attackers.

- Best Practice: Enable automatic updates where available to ensure you’re always running the latest versions of software.

Using Secure and Private Networks

The network you use for trading can also pose a risk, especially if it’s insecure or public.

- Best Practice: Avoid using public Wi-Fi for trading. If you must trade on a public network, use a VPN (Virtual Private Network) to encrypt your internet traffic and protect your data from snooping.

Educating Yourself on Crypto Security

Staying informed about the latest security threats and protective measures in the crypto space can greatly enhance your ability to safeguard your investments.

- Continuous Learning: Follow reputable crypto security experts and resources. Participate in community forums where security tips and alerts about new threats are often shared.

Getting Started with Your First Crypto Trade

Embarking on your first crypto trade is a significant step into the world of digital currency trading. Crypto trading offers vast opportunities but comes with its unique set of risks. Understanding the steps involved in making your first trade and being aware of common mistakes can help you navigate this journey more smoothly. Here’s a guide to making your first crypto trade and tips on avoiding beginner pitfalls.

Steps for Making Your First Crypto Trade

Choose a Reputable Crypto Exchange

Your choice of exchange significantly impacts your trading experience. Look for exchanges with a strong reputation for security, user-friendly interfaces, a wide selection of cryptocurrencies, and responsive customer support.

Set Up and Secure Your Account

Once you’ve chosen an exchange, you’ll need to create an account. This process typically involves providing some personal information and possibly verifying your identity to comply with regulatory requirements.

- Security Measures: Enable security features like two-factor authentication (2FA) to add an extra layer of protection to your account. Consider using a unique, strong password for your trading account.

Fund Your Account

Before you can start trading, you need to deposit funds into your account. Most exchanges allow you to fund your account with fiat currencies (like USD, EUR, etc.) via bank transfer, credit card, or other payment methods. Alternatively, you can deposit cryptocurrencies.

Research and Choose Your Cryptocurrency

Conduct thorough research to decide which cryptocurrency you want to trade. Consider factors like market capitalization, liquidity, recent price movements, and fundamental analysis.

Make Your First Trade

- Market Orders: To buy a cryptocurrency immediately at the current market price, place a market order. This order type is best when you want to execute a trade quickly.

- Limit Orders: If you want to buy or sell at a specific price, use a limit order. This gives you control over the price but may delay the execution until your target price is reached.

Monitor Your Trade

After placing your trade, monitor its progress. Use the exchange’s tools to track your position, and consider setting up alerts for significant price movements.

Common Mistakes Beginners Should Avoid

Overtrading

One common mistake is making too many trades too quickly without adequate research or a clear strategy. Take the time to analyze the market and make informed decisions.

Neglecting Risk Management

Failing to implement risk management strategies, such as setting stop-loss orders, can lead to significant losses. Determine how much of your portfolio you are willing to risk on a single trade.

Chasing Losses

After experiencing a loss, beginners might be tempted to immediately enter another trade to try to make up for it, often leading to further losses. Take a step back and reassess your strategy instead of acting impulsively.

Falling for Hype

The crypto market can be susceptible to hype and speculation. Avoid making trades based on hype or the fear of missing out (FOMO). Base your trading decisions on thorough analysis and sound reasoning.

Ignoring Security Practices

Not taking security seriously can lead to the loss of funds through hacks or scams. Use hardware wallets for storing significant amounts of cryptocurrencies and be cautious of phishing scams.

FAQs:

- What Is Crypto Trading?

- Crypto trading involves speculating on cryptocurrency price movements via a trading account or buying and selling the underlying coins via an exchange.

- How Do I Choose a Crypto Exchange?

- Consider factors like security features, fee structure, the variety of available cryptocurrencies, and the ease of use of the platform.

- Can I Trade Crypto with Technical Analysis?

- Yes, technical analysis is a critical tool for crypto traders to predict future price movements based on historical data and trends.

- What Are the Risks of Crypto Trading?

- Risks include high volatility, potential for significant losses, regulatory changes, and security risks associated with exchange platforms.

- How Important Is Risk Management in Crypto Trading?

- Given the volatility in the crypto market, effective risk management is crucial to protect your capital and maximize profits.

- What Trading Strategies Are Common in Crypto?

- Popular strategies include day trading, swing trading, and holding (long-term investment), each with different risk profiles and time commitments.

- How Can I Manage My Emotions While Trading?

- Develop a trading plan, set clear goals, use stop-loss orders to limit potential losses, and don’t let fear or greed drive your trading decisions.

- Where Can I Learn More About Crypto Trading?

- Many online platforms offer courses, webinars, and articles on crypto trading. Engaging with community forums and experienced traders can also provide valuable insights.

- What Security Measures Should I Take?

- Use strong, unique passwords, enable two-factor authentication, store large amounts in hardware wallets, and be wary of phishing attempts.

- How Do I Make My First Crypto Trade?

- Start by choosing a reputable exchange, setting up and funding your account, then making trades based on your research and risk tolerance.