Is CMC Markets a scam? Despite being a globally recognized brokerage firm renowned for its comprehensive trading offerings, innovative trading technology, and stringent regulatory compliance, this question often arises. This introduction provides an overview of the company’s history, its offerings, and the regulatory framework governing its operations, aiming to address these concerns directly.

Overview of CMC Markets as a Brokerage Firm

CMC Markets is one of the leading global providers of online trading services, offering a broad range of financial products including forex, CFDs (Contracts for Difference), and spread betting. Established to provide retail and institutional clients with the opportunity to trade a wide range of financial instruments, CMC Markets combines advanced trading solutions and dedicated support to cater to both novice and experienced traders.

Key Offerings:

- Forex Trading: Access to major, minor, and exotic currency pairs with competitive spreads.

- CFDs and Spread Betting: Opportunities to trade thousands of global markets including indices, commodities, stocks, and treasuries.

- Shares Trading: Direct market access to global stocks, allowing for trading on major stock exchanges.

- Cryptocurrencies: Offering trading on popular digital currencies through CFDs.

- Advanced Trading Platforms: Including the proprietary Next Generation platform and the popular MetaTrader 4.

History of CMC Markets

Founded in 1989 by Peter Cruddas in London as a Foreign Exchange broker, CMC Markets originally started as a small operation but quickly grew in size and reputation. Over the years, it has significantly expanded its service offerings and now operates in numerous countries across the globe, catering to a vast client base.

Milestones:

- 1989: Establishment of the brokerage under the name Currency Management Corporation.

- 1996: Launch of the world’s first online retail FX trading platform, allowing clients to trade forex without the need for a physical broker.

- 2001: Introduction of CFD trading to its portfolio, broadening the range of available trading instruments.

- 2005: The company was rebranded as CMC Markets, and the Next Generation trading platform was launched.

- 2016: CMC Markets went public and was listed on the London Stock Exchange.

Regulatory Compliance

CMC Markets is heavily regulated by some of the world’s most respected regulatory bodies, ensuring high standards of corporate governance and consumer protection.

Key Regulatory Authorities:

- United Kingdom: Regulated by the Financial Conduct Authority (FCA), ensuring adherence to strict financial standards and ethical trading practices.

- Australia: Regulated by the Australian Securities and Investment Commission (ASIC), which oversees financial service businesses to protect consumers.

- Europe: Compliance with various EU regulatory bodies including BaFin in Germany and CySEC in Cyprus, adhering to stringent EU financial regulations.

- Canada: Regulated by the Investment Industry Regulatory Organization of Canada (IIROC), which sets and enforces standards for accounting, client assets, and conduct.

These regulatory frameworks ensure that CMC Markets operates with transparency and integrity, providing clients with a secure and reliable trading environment. The firm’s commitment to regulatory compliance not only reinforces its market position but also builds trust among its clientele by ensuring that their investments are handled responsibly and ethically.

Understanding CMC Markets Scam in Forex Trading

In the context of Forex trading, a scam refers to any deceptive or fraudulent activity carried out by a party claiming to offer services related to Forex trading, often aimed at extracting money from traders under false pretenses. Scams can take many forms, ranging from unlicensed brokers and misleading marketing to complex Ponzi schemes. Below, we explore the common types of scams in the Forex industry and how they operate.

Definition of a CMC Markets Scam in Online Trading

A scam in Forex trading involves unethical and illegal tactics to deceive investors, promising high returns with little to no risk, or providing misleading information about market conditions. Scams often lack transparency, operate without proper regulatory oversight, and fail to provide adequate security for client funds.

Common Types of CMC Markets Scam in the Forex Industry

1. Signal Seller Scams

- Description: Signal sellers offer daily trade recommendations based on professional forecasts, claiming they can secure substantial profits. For this ‘service,’ they charge substantial fees either upfront or in the form of a daily/weekly subscription.

- Red Flags: High fees with no verifiable track record of success; promises of exorbitant returns; lack of transparency in methodology.

2. Forex Robot Scams

- Description: Forex robots (or Expert Advisors) are software programs that claim to automate Forex trades. While legitimate versions exist, scams often promise high profits and deliver poor results.

- Red Flags: Guaranteed high profits with little to no risk; lack of real, verifiable trading data; no trial period or money-back guarantees.

3. Phony Trading Investment Scams (Ponzi Schemes)

- Description: Operators claim to increase your money by trading Forex, but no actual trading occurs. Instead, they pay returns to earlier investors using the capital of new investors, which is the typical structure of a Ponzi scheme.

- Red Flags: Promises of high returns with little or no risk; difficulty withdrawing funds; overly consistent returns regardless of market conditions.

4. Broker Scams

- Description: Unregulated or poorly regulated brokers manipulate trading platforms to create unfavorable conditions for traders, such as sudden price shifts, unusually high spreads, or unexplained slippage.

- Red Flags: Not regulated by any credible financial authority; negative reviews and user testimonials; lack of communication and customer support.

5. High Yield Investment Programs (HYIP)

- Description: HYIPs are investment scams that promise unsustainably high return on investment by paying previous investors with the money invested by new investors.

- Red Flags: Promises of very high returns in a very short period of time; flashy marketing materials with little substantive explanation.

How to Protect Yourself from CMC Markets Scam

Regulatory Verification

- Always check whether a broker or any service provider is regulated by a credible authority (like the FCA, CFTC, or ASIC). Regulatory websites provide lists of licensed operators.

Research and Reviews

- Conduct thorough research and read user reviews before engaging with any service provider. Be wary of providers that have mostly negative reviews or those that lack any online presence.

Skepticism of Over-Promises

- Be highly skeptical of any guarantee of high profits with low risk. The Forex market is inherently risky, and no returns can be guaranteed.

Secure Websites

- Ensure that any platform you use has adequate security measures in place, such as secure, encrypted websites (https).

Educational Awareness

- Educate yourself about Forex trading. The more knowledgeable you are, the less likely you are to fall for sophisticated scams.

Understanding these scams and knowing what to look out for can significantly reduce the risk of falling victim to fraudulent schemes in the Forex market. Always approach trading with caution and due diligence, especially when exploring new trading services or platforms.

Examining CMC Markets: Scam or Legitimate?

CMC Markets is a well-known provider of online trading services, including Forex, CFDs, and spread betting. To assess whether CMC Markets is a scam or a legitimate trading platform, it’s important to consider its regulatory status, industry reputation, and the oversight provided by financial authorities.

Regulatory Bodies and Licenses Overseeing CMC Markets

CMC Markets is regulated by several top-tier financial regulatory bodies around the world, which helps establish its legitimacy and commitment to adhering to strict financial and ethical standards. Here are key regulatory authorities overseeing CMC Markets:

1. Financial Conduct Authority (FCA) – United Kingdom

- License Details: CMC Markets is authorized and regulated by the FCA, one of the world’s leading financial regulatory bodies. The FCA’s regulations are stringent, focusing on the security of client funds, fair practice, and transparency.

- Implications: Being regulated by the FCA means that CMC Markets must comply with strict financial standards, including capital adequacy requirements. It also ensures that the firm follows the client money rules, which protect traders’ funds by holding them in segregated accounts separate from the company’s own funds.

2. Australian Securities and Investments Commission (ASIC) – Australia

- License Details: CMC Markets is also regulated by ASIC, which enforces financial service laws to protect Australian consumers, investors, and creditors.

- Implications: ASIC’s oversight assures that CMC Markets maintains high standards of corporate governance, financial reporting, and disclosure.

3. BaFin – Germany

- License Details: In Germany, CMC Markets operates under the regulatory authority of the Federal Financial Supervisory Authority (BaFin), which provides additional regulatory scrutiny.

- Implications: BaFin’s regulation ensures that CMC Markets complies with German financial regulations, providing a layer of security for European clients.

4. Other Global Regulatory Bodies

- CMC Markets also complies with regulations in other jurisdictions where it operates, such as the Monetary Authority of Singapore (MAS) and the Investment Industry Regulatory Organization of Canada (IIROC). Each of these bodies enforces rules that protect investors and ensure fair trading practices.

Industry Reputation and Client Feedback

- Industry Awards: CMC Markets has received numerous awards that acknowledge its platform, customer service, and innovative technology, reinforcing its position as a reputable broker.

- Client Reviews: Feedback from clients generally highlights the platform’s reliability, range of tools, and customer support. Negative reviews, when present, are often related to individual trading experiences rather than systemic issues with the platform.

- Transparency: CMC Markets provides extensive disclosure on trading costs, risks, and procedures, which is a hallmark of reputable financial services firms.

Analysis Conclusion

Based on the regulatory oversight by several respected authorities and the generally positive feedback from the trading community, CMC Markets can be considered a legitimate and reliable broker rather than a CMC Markets Scam. The company’s commitment to adhering to regulatory requirements and providing transparent financial services helps establish trust with clients and ensures a secure trading environment.

Recommendations for Traders

- Verify Information: Always verify the regulatory status of CMC Markets or any broker through official regulatory websites.

- Understand the Risks: Engage with CMC Markets’ educational resources to fully understand the risks associated with trading.

- Use Demo Accounts: Test the platform using a demo account to familiarize yourself with its features without financial risk.

By taking these steps, traders can confidently engage with CMC Markets and benefit from its comprehensive range of trading services and tools.

How to Verify the Legitimacy of a Broker

Verifying the legitimacy of a broker is essential before engaging in any trading activities. This ensures you are dealing with a reputable company that complies with regulatory requirements, thereby safeguarding your investments. Below is a step-by-step guide on how to check broker credentials, emphasizing the importance of regulation and methods to verify it.

Step-by-Step Guide to Checking Broker Credentials

1: Check Regulatory Status

- Action: Determine which regulatory body the broker claims to be regulated by. Reputable brokers usually display this information prominently on their website, typically in the footer or an ‘About Us’ section.

- Resources: Visit the official website of the regulatory body. Most regulatory agencies maintain a database or a searchable list of licensed and regulated entities.

2: Verify Directly with the Regulator

- Action: Use the provided tools on the regulator’s website to verify the broker’s registration. This may include entering the broker’s name, license number, or other identifiers.

- Example: For a broker regulated by the Financial Conduct Authority (FCA) in the UK, you can use the FCA’s online register to confirm their authorization and to see if there are any regulatory actions against them.

3: Research Broker Reviews and Ratings

- Action: Look up reviews and ratings on reputable financial review websites and forums. Be mindful of the source to avoid biased or fake reviews.

- Considerations: Pay attention to repeated issues cited by multiple users, such as difficulties in withdrawing funds or poor customer service, which could indicate potential problems.

4: Test Contact and Support Channels

- Action: Contact the broker’s customer service via their listed email, phone, or live chat options. Ask detailed questions about their services and regulatory compliance.

- Indicator: Prompt, transparent, and knowledgeable responses can be a good indicator of a broker’s legitimacy and customer service quality.

5: Review the Terms and Conditions

- Action: Read through the broker’s terms and conditions carefully, paying special attention to policies on funds withdrawal, fee structures, and dispute resolution.

- Red Flags: Vague or overly complicated terms, hidden fees, or unfair withdrawal conditions may signal potential issues.

Importance of Regulation and How to Verify It

Why Regulation Matters

- Protection: Regulatory bodies enforce rules that protect investors from fraud, manipulation, and abusive practices.

- Transparency: Regulations require brokers to maintain a high level of transparency in their operations, which includes regular audits and public disclosures.

- Security: Ensures that brokers keep client funds in segregated accounts, providing a level of financial security.

How to Verify Regulation

- Visit Regulatory Websites: As mentioned, regulatory bodies like the FCA (UK), SEC (USA), ASIC (Australia), and others provide online registers where the public can check the regulatory status of brokers.

- Check License Numbers: Always verify the broker’s license number by matching it with the information provided on the regulatory body’s official website.

- Beware of Clones: Be aware of ‘clone firms’ which use similar names, addresses, or other details to legitimate brokers. Always use contact information from the regulator’s website rather than any documents the broker provides.

Trader Reviews and Feedback for CMC Markets Scam

Compiling and analyzing trader reviews is an essential step in assessing a brokerage firm’s reputation and service quality. CMC Markets, being a well-known global brokerage, has numerous reviews across various platforms. Understanding how to sift through these reviews and distinguish genuine feedback from potentially misleading or fake ones is crucial. Here’s how you can approach this task.

Compilation and Analysis of Trader Reviews for CMC Markets Scam

1. Source Reviews from Multiple Platforms

- Action: Gather reviews from various trusted sources such as Forex trading forums, financial review websites, and social media platforms.

- Examples: Platforms like Trustpilot, Forex Peace Army, and Reddit provide a mix of user experiences and feedback.

2. Look for Consistency in Reviews

- Analysis: Identify common themes across reviews. Positive feedback might highlight aspects like platform reliability, customer service, and user-friendly features. Negative feedback may focus on issues like withdrawal difficulties, customer service responsiveness, or technical glitches.

- Action: Catalog these points to see if certain praises or complaints are consistently mentioned across different sources.

3. Consider the Context and Detail of Reviews

- Quality Check: Detailed reviews explaining specific experiences (both positive and negative) are often more reliable than vague or overly generalized statements.

- Relevance: Check the dates of the reviews to ensure they are relevant and consider whether the broker has made any significant changes since the reviews were posted.

4. Analyze Reviewer Profiles (If Possible)

- Credibility: On platforms like Trustpilot, look at the reviewer’s history. Frequent reviewers of varied services tend to be more reliable than accounts created just to post a single review.

How to Distinguish Genuine Reviews from Fake Ones

1. Assess the Emotional Tone

- Genuine Reviews often present a balanced view, mentioning both pros and cons of their experience.

- Fake Reviews might use overly enthusiastic or extremely negative language, often lacking specifics about the user’s personal experience.

2. Look for Specificity and Detail

- Genuine Reviews typically contain specific information about the user’s experience with the platform, detailing aspects like customer service interactions, specific features of the platform, and personal trading outcomes.

- Fake Reviews are often vague, lacking detail, and could apply to almost any service, not just trading with CMC Markets.

3. Check for Generic Names and Profiles

- Indicator: Profiles with generic names, no profile photos, or a lack of activity beyond the review in question might suggest that the review could be fabricated.

4. Quantity and Timing of Reviews

- Red Flag: A large number of reviews posted in a short time frame can sometimes indicate a coordinated effort to boost or damage the broker’s reputation artificially.

5. Cross-Reference with Official Responses

- Broker Engagement: Genuine issues or praises are often acknowledged by the broker’s official responses. Check if CMC Markets responds to reviews and how they handle criticism.

Safety Features and Protections Offered by CMC Markets Scam

CMC Markets, as a well-established and reputable online trading platform, provides a range of safety measures and trading protections designed to secure client funds and ensure a transparent trading environment. This overview details the specific features that CMC Markets offers for trader protection, comparing these provisions with industry standards.

Overview of Safety Measures and Trading Protections

1. Regulatory Compliance

- Details: CMC Markets is regulated by several top-tier regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and others.

- Importance: This compliance ensures that CMC Markets adheres to strict financial standards and operational requirements, providing a high level of trader protection and maintaining industry integrity.

2. Client Fund Segregation

- Details: Client funds are held in segregated bank accounts separate from the company’s funds. This means that client money is kept distinct from the firm’s operational funds and cannot be used by the company for its business activities.

- Comparison: Segregation of client funds is a standard regulatory requirement for regulated brokers and is crucial for protecting client assets, especially in the event of the broker’s insolvency.

3. Risk Management Tools

- Details: CMC Markets offers various risk management tools such as stop-loss orders, guaranteed stop-loss orders, and take-profit orders. These tools help traders manage and limit their risk effectively.

- Comparison: While most brokers offer basic risk management tools like stop-loss orders, not all provide guaranteed stop-loss orders, which lock in the stop-loss price without slippage, ensuring that the order is executed at the exact trigger price.

4. Platform Security

- Details: The trading platforms provided by CMC Markets employ high-level encryption technologies to secure user data and financial transactions. This prevents unauthorized access and ensures the confidentiality and integrity of client information.

- Comparison: High-level encryption is a common feature among reputable brokers, aligning with industry standards for cybersecurity.

5. Financial Services Compensation Scheme (FSCS)

- Details (for UK clients): CMC Markets UK clients are covered by the FSCS, which provides compensation up to £85,000 per person in the unlikely event that CMC Markets faces insolvency.

- Comparison: This type of investor protection scheme is standard in the UK and similar to other protection schemes in the EU and other jurisdictions, though the specific compensation limits can vary.

6. Negative Balance Protection

- Details: CMC Markets offers negative balance protection, ensuring that clients cannot lose more money than they have deposited in their accounts.

- Comparison: Negative balance protection has become more common following regulatory changes, especially in Europe post-ESMA (European Securities and Markets Authority) regulations. It is now a standard feature for most regulated brokers in certain regions.

7. Transparent Pricing and Fees

- Details: CMC Markets provides clear information on pricing, with competitive spreads and no hidden fees. The cost structure for trading different instruments is available on their website.

- Comparison: Transparency in pricing and fees is vital for trust and is generally well-regulated within the industry. CMC Markets adheres to this principle, which is consistent with industry best practices.

Handling Disputes with a Broker: A Comprehensive Guide

Disputes between traders and brokers can arise due to misunderstandings, service dissatisfaction, or more serious issues such as mismanagement or misconduct. Knowing how to effectively handle these disputes and where to file complaints can protect your investments and ensure fair resolution. Here’s a detailed guide on managing disputes with a broker and the resources available for filing complaints.

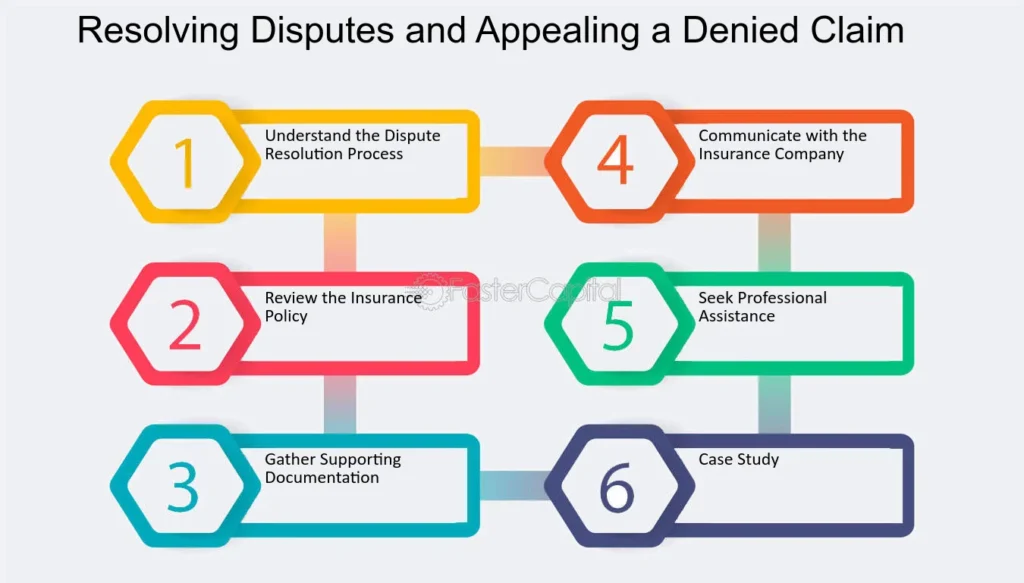

Step-by-Step Process for Handling Disputes

1: Internal Resolution Attempts

- Contact Customer Support: Initially, address your concern directly with the broker’s customer service. This is often the quickest way to resolve misunderstandings or minor issues.

- Formal Complaint: If the issue is not resolved through customer support, escalate the matter by filing a formal complaint. Most brokers, including CMC Markets, have a formal complaint procedure outlined on their website.

2: Documentation

- Gather Evidence: Compile all relevant communications, agreements, transaction records, and any other documentation that supports your case.

- Detailed Account: Write a clear and concise account of the issue, stating what you believe went wrong and what resolution you expect.

3: External Dispute Resolution

- Regulatory Body: If the broker does not resolve your complaint to your satisfaction, you can take your complaint to the financial regulatory authority that oversees the broker.

- Financial Ombudsman Service: In many countries, there is a financial ombudsman service that can be approached as a neutral third party to resolve disputes between clients and financial services providers.

Resources for Filing Complaints

1. Regulatory Authorities

- Example in the UK: For brokers regulated by the Financial Conduct Authority (FCA), complaints can be escalated to the FCA. However, the FCA does not handle individual complaints but ensures that regulated entities follow proper complaint handling procedures.

- In the US: For brokers regulated by the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC), you can file a complaint through their respective websites.

2. Financial Ombudsman Service

- UK: If you are trading with a UK-regulated broker, you can contact the Financial Ombudsman Service (FOS) after you have reached the end of the broker’s complaints process.

- Australia: Similar services exist, like the Australian Financial Complaints Authority (AFCA), where disputes can be filed if the broker fails to resolve the issue satisfactorily.

3. Consumer Protection Agencies

- General Resource: In many countries, consumer protection agencies or organizations can offer advice and support in disputes with financial services providers.

4. Legal Advice

- Consult a Lawyer: If significant amounts are at stake or the broker’s actions may have been illegal, it might be wise to seek legal advice.

Best Practices

- Understand Your Rights: Be aware of your rights as a trader. Read all agreements carefully before you start trading with a broker.

- Stay Professional and Patient: Keep communications professional and factual. Dispute resolution can be a lengthy process, requiring patience.

- Preventive Measures: Choose a broker with a good reputation and robust regulation. Regularly review your trading records and statements.

Handling disputes with a broker effectively hinges on understanding the proper channels for resolution, being prepared with thorough documentation, and knowing when to seek further assistance from regulatory and legal bodies. By following these guidelines, you can ensure that your dealings with financial disputes are handled as smoothly and fairly as possible.

Avoiding CMC Markets Scam: Best Practices in Forex Trading

Navigating the Forex trading landscape requires vigilance, especially given the prevalence of scams that can entangle even the most seasoned traders. Understanding how to protect yourself and your investments is crucial. Here are essential tips on avoiding scams and the importance of continuous education to remain vigilant against fraudulent activities.

Best Practices for Avoiding CMC Markets Scam

1. Verify Broker Credentials

- Regulatory Compliance: Always check if a broker is regulated by credible authorities (e.g., FCA, CFTC, ASIC). Regulatory bodies enforce standards that protect traders.

- Registration: Verify the broker’s registration through the official websites of these regulatory bodies, which often list licensed brokers and any disciplinary actions against them.

2. Scrutinize Marketing Promises

- Realistic Offers: Be wary of brokers or services offering guaranteed high returns with little or no risk. Such promises are unrealistic and a common hallmark of CMC Markets Scam.

- Pressure Tactics: Avoid brokers who pressure you into making large deposits or quick decisions, often a sign of a scam.

3. Safeguard Personal Information

- Secure Transactions: Only use secure and reputable payment methods for deposits and withdrawals. Avoid sharing your banking details on unencrypted or suspicious websites.

- Personal Data Protection: Be cautious about the amount of personal information you share online. Use strong, unique passwords for your trading accounts.

4. Use Demo Accounts

- Practice First: Before investing real money, use a broker’s demo account to familiarize yourself with their platform and ensure it operates transparently and reliably.

5. Read Reviews and Testimonials

- Reputation Check: Look up reviews and feedback from other traders. Be mindful of the source of reviews to differentiate between genuine user experiences and promotional or fake reviews.

6. Beware of Unsolicited Offers

- Unexpected Contacts: Be cautious if you receive unsolicited phone calls, emails, or messages about investment opportunities. Legitimate brokers typically do not make such cold contacts.

Importance of Continuous Education on CMC Markets Scam

1. Stay Informed About New CMC Markets Scam

- Emerging Threats: Scam tactics evolve rapidly. Keeping up-to-date with the latest scam trends can help you avoid falling victim to new schemes.

2. Understand the Mechanics of Forex Trading

- Informed Decisions: Knowledge of how Forex trading works, including aspects like leverage, spreads, and market factors, equips you to recognize unrealistic offers or trading conditions.

3. Participate in Community Forums and Webinars

- Shared Experiences: Engaging with community forums and attending webinars can provide insights into common pitfalls and preventive strategies as shared by fellow traders.

4. Educational Resources

- Broker and Independent Sources: Utilize educational resources offered by your broker and independent educational platforms to continuously sharpen your trading knowledge and skills.

5. Regulatory Updates

- Legal Changes: Keep abreast of regulatory changes and updates in the jurisdictions where you trade, as these can affect trading conditions and standards.

Resources and Tools for Safe Trading

Safe trading practices are essential for anyone engaged in financial markets, especially in the dynamic realm of online trading platforms like CMC Markets. Utilizing a variety of tools and resources can greatly enhance a trader’s ability to operate securely and effectively. Here’s a list of valuable tools and resources, along with tips on how to use them effectively.

Essential Tools and Resources for Safe Trading

1. Risk Management Tools

- Stop-Loss Orders: Automatically closes a trade at a predetermined price to limit potential losses.

- Take-Profit Orders: Secures profits by closing a trade when it reaches a certain profit level.

- Negative Balance Protection: Ensures traders do not lose more money than they have deposited.

2. Educational Resources

- Webinars and Online Courses: Platforms like CMC Markets often provide webinars and training courses that cover various aspects of trading, from the basics to advanced strategies.

- E-Books and Articles: Comprehensive guides and articles can offer insights into market trends, trading techniques, and risk management.

3. Technical Analysis Tools

- Charting Software: Tools that provide real-time charts with customizable indicators and analytical capabilities to predict potential market movements.

- Pattern Recognition Software: Helps in identifying common trading patterns and potential market trends.

4. Economic Calendars

- Tracks economic events and indicators that influence the markets. This tool is crucial for timing trades, especially around events that cause high volatility.

5. Demo Accounts

- Simulate real trading conditions without financial risk. This is an excellent way for traders to practice strategies and get familiar with the platform’s tools without the pressure of losing money.

6. Regulatory Resources

- Financial Regulatory Authorities’ Websites: Websites like the FCA, ASIC, or SEC provide resources and alerts on market conditions, broker regulations, and potential scams.

7. Community Forums and Peer Groups

- Online Trading Forums: Places like Reddit, Forex Factory, or specific broker community forums allow traders to share strategies, tips, and experiences.

- Professional Networks: Engaging with networks on platforms like LinkedIn can provide insights and professional guidance.

8. Security Software

- VPN Services: Ensures secure and private connections to trading platforms, protecting data from unauthorized access.

- Antivirus and Anti-Malware Software: Protects personal computers and mobile devices from malicious software that could compromise trading activities.

How to Use These Tools Effectively

Implementing Risk Management

- Utilize stop-loss and take-profit orders on every trade to automatically manage potential losses and desired profits.

- Regularly review and adjust the parameters of these tools to adapt to changing market conditions.

Continual Learning and Application

- Regularly participate in webinars and courses to stay updated with the latest trading strategies and market conditions.

- Apply new knowledge and strategies in a demo account to test their effectiveness before using them in live trades.

Technical Analysis

- Use charting tools to analyze historical data and current market trends to make informed trading decisions.

- Incorporate pattern recognition tools to identify potential trading opportunities based on established market patterns.

Economic Awareness

- Regularly consult the economic calendar to plan trading activities around major economic announcements and avoid trading during high volatility if it does not suit your trading strategy.

Community Engagement

- Participate in forums and networks to gain insights from other traders’ experiences and share your own to contribute to the community.

Enhancing Security

- Always use a reliable VPN service when trading on public or unsecured Wi-Fi networks.

- Keep your antivirus software up to date to prevent any security breaches that could impact your trading platform.

By effectively utilizing these tools and resources, traders on platforms like CMC Markets can enhance their trading proficiency, manage risks better, and safeguard their trading activities against common threats.

Conclusion and Moving Forward Safely in Forex Trading

Forex trading offers numerous opportunities but also comes with its share of risks. Vigilance and continuous learning are crucial to navigating this dynamic and sometimes volatile market. By understanding the tools, strategies, and best practices available, traders can enhance their trading efficiency, mitigate risks, and increase their chances of success. Here’s a recap of the importance of vigilance in Forex trading and some encouragement for traders to continue practicing safe trading techniques.

The Importance of Vigilance in Forex Trading

Vigilance is the cornerstone of successful Forex trading. It encompasses:

- Risk Awareness: Understanding the inherent risks of Forex trading, including market volatility and the potential for loss.

- Scam Prevention: Recognizing the signs of fraudulent activities and knowing how to verify broker credentials to avoid scams.

- Regulatory Compliance: Being aware of and compliant with the regulations and guidelines set by authoritative bodies that govern trading activities.

Being vigilant means staying informed about market trends, regulatory changes, and emerging technologies that can impact trading strategies. It also involves keeping abreast of global economic events that could influence market conditions.

Encouragement for Safe Trading Practices

As you move forward, it’s important to build on a foundation of safe trading practices:

- Utilize Educational Resources: Continually educate yourself through webinars, online courses, and current market analyses. Knowledge is a powerful tool that can help you make informed decisions and remain competitive in the Forex market.

- Apply Robust Risk Management: Always use risk management tools like stop-loss orders to protect your investments. Understand leverage and its implications to avoid excessive exposure.

- Stay Connected: Engage with community forums and networks to share experiences and learn from the successes and mistakes of others. This community engagement can provide support and valuable insights.

- Practice Regularly: Use demo accounts to hone your strategies without financial risk. Testing your approaches in a simulated environment first can significantly improve your trading confidence and skill.

- Maintain Security Measures: Keep your trading platforms and personal data secure. Use reliable antivirus software, secure internet connections, and follow best practices for data protection.

Moving Forward

The path to successful Forex trading is continuous and requires a commitment to learning and adaptation. Markets evolve, and so should your strategies. By staying vigilant, continually educating yourself, and employing safe trading practices, you set a strong foundation for potentially profitable trading. Remember, in Forex trading, the best traders are those who are prepared, informed, and always alert to the changing dynamics of the market.

Embrace the journey of Forex trading with dedication and prudence, and you will be better equipped to navigate its challenges and capitalize on its opportunities. Safe trading!