MetaTrader 4 (MT4) is one of the most widely used trading platforms in the world, known for its robust functionality, user-friendly interface, and flexibility. Furthermore, when paired with a leading broker like CMC Markets, MT4 not only offers traders a powerful combination but also provides an enhanced experience for Forex and CFD trading. This chapter provides an overview of MT4 and discusses the benefits of using this platform with CMC Markets.

Overview of MT4 as a Leading Trading Platform

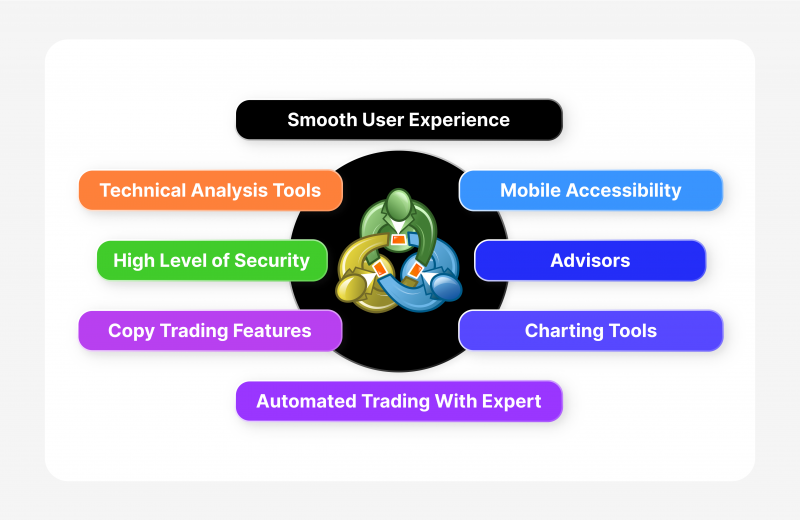

Key Features of MetaTrader 4:

- User Interface: Moreover, MT4 is praised for its clean and intuitive user interface. This design effectively caters to both beginners and experienced traders alike, making it a preferred choice for diverse trading needs.

- Charting Tools: Offers advanced charting capabilities, allowing users to view and analyze historical data with a variety of technical indicators and graphical objects.

- Expert Advisors (EAs): Supports automated trading through the use of EAs, which traders can use to automate their trading strategies based on technical analysis and trading signals.

- Customizability: Highly customizable, MT4 allows traders to modify the platform to fit their trading style and preferences, including the creation of custom indicators.

Popular Among Traders:

MT4 remains the platform of choice for many traders, primarily due to its stability, wide range of features, and extensive support community. Moreover, it’s particularly renowned for its algorithmic trading and customization features, making it highly favorable among experienced traders.

Benefits of Using MT4 with CMC Markets

Comprehensive Integration:

- Seamless Operation: CMC Markets ensures that MT4 integrates smoothly with its trading infrastructure, providing traders with stable and reliable trading execution.

- Advanced Trading Tools: In addition to MT4’s built-in tools, CMC Markets offers additional plugins and services to enhance the platform’s functionality.

Enhanced Trading Environment:

- Competitive Spreads and Pricing: CMC Markets offers competitive spreads and pricing, which can be crucial for strategies that require tight spreads, such as scalping.

- Access to CMC Markets Research and Data: Traders on MT4 with CMC Markets gain access to high-quality market research and trading insights, which can be directly utilized within the platform.

Support and Resources:

- Dedicated Support: CMC Markets provides robust support for MT4 users, including technical support and help with EA integration.

- Educational Resources: Offers comprehensive educational materials that help traders maximize their use of MT4, covering everything from basic functionalities to advanced trading strategies.

Security and Reliability:

- Regulated Environment: CMC Markets is a regulated broker, which adds a layer of security and peace of mind for traders using MT4.

- Reliable Order Execution: Ensures fast and reliable order execution, which is critical for minimizing slippage, especially in fast-moving markets.

Setting Up MT4 with CMC Markets

Getting started with MetaTrader 4 (MT4) on CMC Markets involves a straightforward process of downloading, installing, and logging into the platform. This guide provides a step-by-step walkthrough to help you set up MT4 with CMC Markets efficiently, ensuring you are ready to trade as quickly and smoothly as possible.

Step-by-Step Guide on Downloading and Installing MT4 for CMC Markets

1: Visit the CMC Markets Website

- Navigate to CMC Markets’ official website. Look for the trading platforms section or use the search function to find the MT4 download page.

2: Download the MT4 Software

- Download the MT4 platform. CMC Markets will typically have a version of MT4 tailored for their brokerage services. Click on the download link provided on the MT4 page.

3: Install MT4

- Run the installation file. Once the download is complete, locate the file in your downloads folder and double-click to begin the installation process.

- Follow the installation prompts. The setup wizard will guide you through the installation process. Accept the license agreement, select your preferred installation folder, and proceed with the installation.

4: Restart Your Computer

- Restart your computer (optional but recommended). This ensures that all components of the software are installed correctly.

How to Log in to Your CMC Markets Account on MT4

1: Launch MetaTrader 4

- Open MT4. Once the installation is complete, launch the MT4 platform either from your desktop shortcut or from the start menu.

2: Locate the Server

- Find the CMC Markets server. On the MT4 platform, go to ‘File’ and then ‘Login to Trade Account’. You will be prompted to select a server. Choose the server listed for CMC Markets. If you are unsure of the server name, you can find this information on CMC Markets’ MT4 page or in your account setup email.

3: Enter Your Account Details

- Input your account credentials. You will need to enter your account number and password. These should have been provided to you by CMC Markets when you registered for an account.

- Ensure the ‘save password’ box is checked if you do not want to enter your password every time you access the platform.

4: Verify the Connection

- Check the connection status. Look at the bottom-right corner of the MT4 platform. You should see bars indicating your connection status. If you see green or blue bars, you are successfully connected to the server.

- Troubleshoot if necessary. If you experience issues logging in or do not see a proper connection, double-check your account details and server selection. If problems persist, contact CMC Markets’ support for assistance.

Navigating the MT4 Interface

MetaTrader 4 (MT4) is renowned for its comprehensive yet user-friendly interface, making it a favored platform among traders worldwide. Understanding how to navigate and customize the MT4 interface will enhance your trading experience by allowing you to adapt the platform to your personal trading style and preferences. This section provides a detailed tour of the MT4 interface and explains the key features and how you can customize your workspace.

Detailed Tour of the MT4 Interface

Main Components

- Market Watch: Located on the left-hand side of the screen, this window displays a list of the currency pairs and instruments available to trade, along with their bid and ask prices. Right-clicking on an instrument will provide options such as opening a new chart, viewing specifications, or placing a new order.

- Navigator: Below the Market Watch, the Navigator window provides quick access to your accounts, indicators, expert advisors, and scripts. This area is pivotal for swiftly managing multiple accounts or applying various technical tools to your charts.

- Chart Workspace: The central area of the MT4 interface is dedicated to charting. This is where you can open and arrange multiple charts to monitor different instruments or time frames.

- Terminal: The terminal appears at the bottom of the screen and includes multiple tabs like Trade (where you can see open positions and manage them), Exposure, Account History, News, Alerts, and Mailbox.

Key Features

- Charts: MT4 provides real-time charts, allowing you to apply a multitude of technical indicators and graphical objects. Charts can be displayed as a bar chart, candlestick chart, or line chart.

- Technical Indicators and Tools: MT4 is equipped with over 30 built-in indicators and 24 analytical objects, which include tools for lines, channels, geometric shapes, as well as Gann, Fibonacci, and Elliott tools.

- Expert Advisors (EAs): Automated trading robots that can trade for you based on pre-set strategies. You can also create or import your own EAs.

- Scripts: These are applications that can be used to perform specific functions on MT4, usually for handling repetitive tasks.

Customizing Your Workspace

Rearranging and Detaching Charts

- Rearrange Charts: You can easily rearrange chart windows by clicking and dragging their titles. This allows you to view multiple charts simultaneously in a way that best suits your trading style.

- Detaching Charts: Right-click on a chart tab and select “Detach Chart” to pop it out of the MT4 interface. This is particularly useful if you are using multiple monitors.

Applying and Customizing Indicators

- Applying Indicators: Right-click on a chart, select “Indicators,” and choose the one you wish to apply. You can adjust the parameters of each indicator to fit your analysis needs.

- Customizing the Appearance: You can change the color schemes and display settings of the charts by right-clicking on them and selecting “Properties” or by using the toolbar.

Using Templates and Profiles

- Templates: Save your chart setups as templates, which you can quickly apply to other charts. This saves time and ensures consistency in your analysis across different instruments.

- Profiles: MT4 allows you to save your entire workspace setup as a profile. This means you can have different profiles for different trading strategies or markets, and switch between them as needed.

Tools and Features of MT4

MetaTrader 4 (MT4) is equipped with a range of powerful tools and features designed to enhance trading efficiency and effectiveness. This chapter will explore MT4’s advanced charting tools, a variety of technical indicators, and how to utilize Expert Advisors (EAs) for automated trading. Understanding and leveraging these tools can significantly enhance your trading strategies.

Charting Tools and Technical Indicators

Charting Tools

- Chart Types: MT4 offers three primary chart types: line charts, bar charts, and candlestick charts. Each provides a different visual representation of market data and can be chosen based on your preference and analysis style.

- Customization Options: Users can customize chart colors and styles. For example, you can change the color of the candlesticks or the background of the chart to suit your visual preferences.

- Multiple Time Frames: MT4 allows you to view charts in various time frames, from one minute to one month. This feature is particularly useful for traders who practice multi-timeframe analysis to get a broader view of the market trends.

Technical Indicators

- Built-in Indicators: MT4 includes over 30 built-in indicators such as Moving Averages, MACD, RSI, and Fibonacci retracements. These indicators help traders identify trends, signals, and potential reversal points.

- Custom Indicators: Beyond the standard options, traders can also develop their own custom indicators using the MQL4 programming language. This flexibility allows traders to tailor their analytical tools to their specific trading strategies.

- How to Use Indicators: To apply an indicator, simply drag it from the ‘Navigator’ window onto a chart, or right-click on the chart, select ‘Indicators List’, and then choose the desired indicator. You can adjust the settings of each indicator to match your trading requirements.

Utilizing Expert Advisors (EAs) for Automated Trading

What are Expert Advisors?

Expert Advisors (EAs) are programs that automate trading processes on MT4. They can execute trades based on predefined criteria without manual intervention, allowing for 24/5 trading, minimizing the emotional impact on trading decisions, and providing the ability to test strategies using historical data.

Setting Up EAs

- Installation: To install an EA, you typically copy the EA files into the ‘Experts’ folder in your MT4 directory. Then restart MT4, and you will see the EA in the ‘Navigator’ pane under ‘Expert Advisors’.

- Activation: Drag the EA onto the appropriate chart, make sure that ‘Auto Trading’ is enabled in MT4 (button on the toolbar), and configure the EA settings according to your trading strategy.

- Testing: Before running an EA live, it is advisable to test it using the Strategy Tester feature in MT4. This tool allows you to run the EA against historical data to see how it would have performed in the past.

Best Practices for Using EAs

- Continuous Monitoring: Despite being automated, it’s important to monitor EAs periodically to ensure they are functioning as expected, especially under changing market conditions.

- Risk Management: Configure your EA to include risk management strategies, such as setting stop-loss orders or adjusting lot sizes based on your account balance.

- Updates and Maintenance: Regularly review and update the EA’s code or parameters to adapt to new market conditions or changes in your trading strategy.

Trading on MT4 with CMC Markets

Trading on MetaTrader 4 (MT4) with CMC Markets combines the robust functionality of a leading trading platform with the expertise of a well-established broker. This guide will provide you with step-by-step instructions on how to execute trades on MT4 and offer tips for effective order management, including setting stop loss and take profit levels.

How to Execute Trades on MT4

1: Open a Chart

- Select a Currency Pair or Instrument: From the ‘Market Watch’ window, double-click on the instrument you want to trade. This action will open a new chart window.

- Adjust the Chart: Customize the chart to your preference (e.g., chart type, time frame) for better analysis.

2: Enter a New Order

- Quick Trade: Right-click on the chart and select ‘New Order’. This brings up the ‘Order’ window. Alternatively, you can press F9 to open this window directly.

- Order Type: Choose from ‘Market Execution’ (trade at current market price) or ‘Pending Order’ (set a future price at which you want to enter the market).

3: Set Order Details

- Volume: Specify the size of your trade (in lots). Remember that 1 standard lot is typically 100,000 units of the base currency.

- Stop Loss and Take Profit: Enter values for stop loss and take profit to manage your risk and secure profits. These can be set by entering the price levels at which you want these orders to execute.

- Comment: Add any notes or comments to your trade for future reference.

4: Execute the Trade

- Review Your Trade Setup: Ensure all details are correct.

- Click ‘Buy’ or ‘Sell’: Depending on your analysis and the current market situation, click the appropriate button to execute the trade.

Tips for Order Management

Setting Stop Loss and Take Profit

- Use Technical Levels: Place stop loss and take profit orders at key technical levels (e.g., recent highs, lows, support, resistance levels).

- Risk-Reward Ratio: Maintain a healthy risk-reward ratio. Common ratios include 1:2 or 1:3, where the potential profit is two or three times the risk.

Managing Open Orders

- Modification: To modify an existing order, right-click on the trade in the ‘Trade’ tab of the Terminal, select ‘Modify or Delete Order’, and adjust your stop loss or take profit levels.

- Monitoring: Keep an eye on your open trades. MT4 provides real-time updates on profit/loss and allows you to close trades manually when necessary.

Using Advanced Order Types

- Trailing Stop: A trailing stop is a dynamic stop loss that automatically adjusts as the market moves in favor of your trade. This feature helps to lock in profits without manually adjusting stop loss levels.

- OCO Orders: ‘One Cancels the Other’ (OCO) is an order option that lets you set a pair of orders stipulating that if one order is executed fully or partially, the other is automatically canceled. MT4 can handle this through custom scripts or EAs.

Risk Management Tools on MT4

Effective risk management is crucial for successful trading, and MetaTrader 4 (MT4) offers a suite of tools to help traders manage and mitigate their risks. This section discusses the features available for risk management on MT4 and provides guidance on implementing effective risk management strategies using these tools.

Features Available for Risk Management on MT4

MT4 provides several key features that can be utilized to manage trading risks effectively:

Stop Loss and Take Profit Orders

- Stop Loss Orders: These are essential for limiting potential losses on a trade. A stop loss order automatically closes a trade at a specified price level that is less favorable than the current market price.

- Take Profit Orders: These orders are set to automatically close a trade at a specified price level that is more favorable than the current market price, thereby securing profits.

Trailing Stops

- Trailing Stop Loss: This is a dynamic stop loss that automatically adjusts itself as the market moves in your favor. It is designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in the trader’s favor, but closes the trade if the market price changes direction by a specified distance.

Margin Calls

- Margin Monitoring: MT4 continuously monitors the levels of margin on your account. If your account equity falls below a certain percentage of the required margin for your open positions, MT4 will issue a margin call warning you to either close some positions or deposit additional funds to cover the potential losses.

Implementing Effective Risk Management Strategies Using MT4 Tools

Establishing Stop Loss and Take Profit Levels

- Determine Appropriate Levels: Use technical analysis to determine strategic levels for stop loss and take profit. Consider support and resistance levels, moving averages, or Fibonacci retracement levels as guides.

- Setting the Orders: When you enter a new trade on MT4, you can set stop loss and take profit orders directly in the trade entry window. It’s essential to set these orders every time you initiate a trade to ensure you’re managing risk from the start.

Using Trailing Stops

- Enabling Trailing Stops: To set a trailing stop, right-click on an open position in the ‘Trade’ tab of the Terminal, select ‘Trailing Stop’ and choose the desired distance in points (a point is the smallest possible price change on the left side of the decimal point).

- Conditions for Activation: Remember, trailing stops are only activated when the trade becomes profitable by the specified number of points. They are also only maintained locally on your computer and not on the server, meaning they require your trading platform to be open to function.

Monitoring Margin and Leverage

- Understand Leverage Implications: High leverage can amplify both profits and losses. It’s crucial to use leverage wisely and understand the implications it has on your account equity and margin levels.

- Regularly Check Margin Levels: Keep a regular check on your margin level (seen in the ‘Trade’ tab of the Terminal), and ensure it does not fall too close to the margin call level by either using lower leverage or by managing the size and number of open positions.

Additional Tips

- Regularly Review Strategies: Regularly review and adjust your risk management strategies based on market conditions and your trading performance.

- Educational Resources: Utilize educational resources available on MT4 and from CMC Markets to better understand and implement risk management tools.

Advanced Trading Strategies Using MT4

MetaTrader 4 (MT4) is not only a platform for executing trades but also a powerful tool for developing and implementing advanced trading strategies. This section explores how to leverage MT4’s capabilities, including the use of custom indicators and scripts, to enhance your trading tactics and gain a competitive edge in the markets.

Advanced Trading Strategies Specific to MT4

Scalping

- Description: Scalping involves making numerous trades in a single day to capture small price changes. MT4’s ability to handle rapid trade execution is crucial for this strategy.

- MT4 Tools: Utilize MT4’s one-click trading and custom scripts to automate entry and exit points, ensuring quick response times necessary for effective scalping.

Hedging

- Description: Hedging is a strategy used to offset potential losses in one position by initiating another position in an opposing market or instrument.

- MT4 Tools: Employ MT4’s ability to open multiple positions simultaneously, including directly opposing positions if your broker allows hedging. Use EAs to manage the entry and exit of these positions based on predefined market conditions.

Algorithmic Trading

- Description: This strategy involves using algorithms to automate trading decisions based on specified criteria.

- MT4 Tools: Develop or purchase Expert Advisors (EAs) that can automatically analyze market conditions and execute trades based on your algorithmic strategies.

News Trading

- Description: This strategy capitalizes on the market volatility seen after major news announcements.

- MT4 Tools: Use MT4’s built-in economic calendar to stay ahead of important economic events, and set up custom alerts or scripts to trade based on these news triggers.

Using Custom Indicators and Scripts to Enhance Trading Tactics

Custom Indicators

- Creation and Application: Traders can create custom indicators in MT4 using the MQL4 programming language. These indicators can be tailored to identify unique market opportunities that standard indicators do not capture. For example, a custom indicator could be designed to combine multiple standard indicators into a single trading signal.

- How to Use: To add a custom indicator, place its file in the ‘Indicators’ folder within the MT4 directory, then restart MT4, and you’ll find the indicator listed in the ‘Navigator’ window under ‘Custom Indicators’. Drag the indicator onto the chart and configure its parameters to suit your strategy.

Scripts

- Functionality: Scripts are used for executing repetitive tasks on MT4. For example, a script can be written to close all open positions at a specific time or delete all pending orders simultaneously.

- Implementation: Scripts can be written in MQL4 and added to the ‘Scripts’ folder within the MT4 directory. They can be executed by dragging the script from the ‘Navigator’ window to a chart or by double-clicking on them in the ‘Navigator’.

Tips for Effective Use of Advanced Strategies

- Backtesting: Before applying a new strategy or custom tool on live markets, use MT4’s Strategy Tester to backtest it against historical data to evaluate its effectiveness.

- Continuous Monitoring: Even automated strategies require monitoring to ensure they are performing as expected, particularly around economic news or at times of unusual market volatility.

- Risk Management: Regardless of the strategy, incorporate strict risk management rules, including the use of stop-loss orders, to protect your capital.

Integrating Third-Party Tools and Resources into MT4

MetaTrader 4 (MT4) is a versatile platform that supports the integration of various third-party tools and resources. This capability can significantly enhance your trading experience by allowing you to leverage external signals, tools, and trading systems. Here’s how you can integrate these resources into MT4 and optimize your trading strategies.

Integrating Additional Tools and Resources into MT4

1. Identifying Suitable Tools

- Research: Start by identifying third-party tools that can enhance your trading strategy. These might include advanced charting tools, news feed aggregators, or automatic trading systems.

- Compatibility: Ensure the tools are compatible with MT4. Most tool providers specify compatibility and installation instructions on their websites.

2. Downloading and Installing Plugins

- Download: Once you’ve identified a compatible tool, download the necessary files. These might include .exe files for applications or .mq4/.ex4 files for indicators and scripts.

- Installation: Install the software according to the provider’s instructions. For MT4-specific tools, you typically need to place the files in the appropriate MT4 subfolder (e.g., ‘Indicators’, ‘Experts’, or ‘Scripts’) within the MT4 directory.

3. Configuring and Using the Tools

- Configuration: After installation, configure the tools as necessary. This might involve setting parameters within the MT4 options or adjusting settings directly in the third-party application.

- Usage: Activate the tools from within MT4 (for example, by dragging an indicator onto a chart or enabling an EA) or use them alongside MT4 if they run as standalone applications.

Leveraging External Signals and Trading Systems

1. Using External Signals

- Subscription to Signal Services: Subscribe to external signal providers if you don’t want to develop trading signals yourself. MT4 has a built-in ‘Signals’ tab where you can subscribe to signal providers directly.

- Manual or Automated Trading: Decide whether to use these signals for manual trading or to automate the trading process using EAs that can interpret and trade these signals.

2. Incorporating Trading Systems

- Automated Trading Systems (ATS): You can integrate ATS that operate within the MT4 environment. This might include systems developed using MQL4 or those that use external interfaces.

- Testing and Optimization: Use MT4’s Strategy Tester to test any automated systems before going live. This is crucial to ensure that the system performs well under different market conditions.

3. Safety and Security Considerations

- Trustworthiness: Only use tools and signals from reputable providers to avoid scams and subpar performance.

- Security Measures: Ensure that any third-party software does not compromise your trading platform’s security. Keep your antivirus software updated and scan any downloaded files.

4. Continuous Monitoring and Updates

- Performance Monitoring: Regularly monitor the performance and impact of integrated tools and signals on your trading outcomes.

- Updates: Keep the tools updated to ensure compatibility with any new MT4 updates and to incorporate improvements and bug fixes.

Troubleshooting Common MT4 Issues on CMC Markets

MetaTrader 4 (MT4) is a robust platform, but like any software, users might encounter issues. This guide addresses common problems faced by MT4 users on CMC Markets and provides practical solutions and tips to ensure optimal trading performance.

Common Issues and Solutions

1. Connection Problems

- Symptoms: ‘No connection’, ‘Invalid account’, or constant requotes.

- Solutions:

- Check Your Internet: Ensure your internet connection is stable and fast. Try resetting your modem/router.

- Review Server Name: Make sure you are connecting to the correct server as provided by CMC Markets. This can usually be selected manually from the login screen.

- Firewall/Antivirus Settings: Verify that your firewall or antivirus is not blocking MT4. You might need to whitelist MT4 in your firewall settings.

2. Platform Freezes or Crashes

- Symptoms: MT4 not responding or shutting down unexpectedly.

- Solutions:

- Reduce Workload: Limit the number of open charts, indicators, and EAs. Overloading MT4 can lead to crashes.

- Update Software: Ensure MT4 and your operating system are up to date.

- Reinstall MT4: Sometimes, a fresh install can resolve persistent issues.

3. Problems with Displaying Charts

- Symptoms: Charts do not update, or specific time frames do not load.

- Solutions:

- Clear Cache and Reset Data: Right-click on the chart and select ‘Refresh’ or ‘Reload’. You can also clear the history by going to ‘Tools’ -> ‘Options’ -> ‘Charts’ and clicking on ‘Clear History’.

- Check for Updates: Ensure that your MT4 platform is running the latest version.

4. Order Execution Issues

- Symptoms: Delays in order execution or errors in placing orders.

- Solutions:

- Check Market Hours: Ensure that you are trading within the market hours for the specific instrument.

- Review Margin Requirements: Ensure you have sufficient margin in your account to execute new trades.

- Consult Logs: Check the ‘Experts’ and ‘Journal’ tabs in the Terminal window for error messages that can provide more insight.

Tips for Maintaining Optimal Trading Performance

Monitor Resource Usage

- Regularly check your computer’s performance, especially CPU and memory usage. MT4 can become resource-intensive with multiple charts, indicators, and EAs running simultaneously.

Utilize VPS for Trading

- A Virtual Private Server (VPS) can help maintain a stable environment for trading, especially if using EAs. A VPS provides a dedicated portion of the server’s resources and is not affected by issues on your local computer.

Regular Backups

- Regularly back up your MT4 settings, charts, and profiles. This practice helps you quickly restore your setup if MT4 needs to be reinstalled or if you are setting up MT4 on a new device.

Keep Learning

- Stay updated with new features and tools available on MT4 through forums, tutorials, and CMC Markets’ support resources. Being well-informed helps you utilize the platform to its full potential and troubleshoot issues more effectively.

Evolving Your Trading: Moving Beyond MT4

As traders progress and their trading strategies evolve, they may find that their needs surpass the capabilities of MetaTrader 4 (MT4). CMC Markets offers other trading platforms that might better align with advanced trading requirements. This guide will help you understand when to consider using other platforms offered by CMC Markets and provide a roadmap for transitioning from MT4 to these more advanced platforms.

When to Consider Using Other Platforms

1. Increased Functional Requirements

- Complex Trading Needs: If you require more sophisticated analytical tools, algorithmic trading options, or integrated financial news and data feeds that go beyond what MT4 can offer.

- Asset Diversity: If you are looking to trade a broader range of assets that might not be supported on MT4.

2. Scalability and Performance Issues

- High Volume Trading: Traders who execute a large volume of trades or need faster and more reliable order execution may benefit from platforms with superior processing capabilities.

- Professional Trading Features: As traders become more experienced, they might require features such as advanced risk management tools, enhanced charting capabilities, and the ability to trade directly from charts.

3. Regulatory and Compliance Needs

- Professional Trading Accounts: Some platforms offer features compliant with regulatory requirements for professional traders, providing additional resources like enhanced leverage, access to institutional-grade spreads, and deeper liquidity.

Transitioning to Other Advanced Platforms or Tools

1. Evaluate Your Needs

- Identify Requirements: Clearly define what you need in a trading platform that MT4 does not provide. This could be technical indicators, execution speed, user interface, or types of orders.

- Research Alternatives: Explore other platforms offered by CMC Markets. Look into their features, supported instruments, and any specific terms associated with their use.

2. Test the New Platform

- Demo Account: Most advanced platforms provide demo versions. Use these to familiarize yourself with the interface and features without financial risk.

- Parallel Trading: Initially, run your new platform in parallel with MT4. This approach allows you to compare performance and usability directly.

3. Educate Yourself

- Training Resources: Utilize all educational resources provided by CMC Markets. This may include webinars, tutorials, and user guides specific to the new platform.

- Community Insights: Engage with other traders using the same platform. Forums and trading communities can offer practical insights and troubleshooting tips.

4. Seamlessly Integrate Your Portfolio

- Data Migration: Check if it’s possible to transfer your historical data, trading journal, and settings from MT4 to the new platform. CMC Markets support can provide guidance on this.

- Risk Management Reevaluation: Reassess your risk management strategies to suit the functionalities and operational nuances of the new platform.

5. Optimize and Customize

- Custom Settings: Adjust the new platform’s settings to match your trading preferences. Customize indicators, charts, and interfaces to optimize the trading experience.

- Continual Adjustment: As you gain more experience with the new platform, continue to refine your strategies and settings.