Welcome to TradeChamp.net, your trusted resource for in-depth reviews and information on Forex brokers. In this article, we’ll start with an in-depth look at the CMC Markets Demo Account, a perfect tool for beginners to practice trading in a risk-free environment. As you embark on your trading journey, choosing the right broker is crucial, and CMC Markets offers a compelling mix of features, making it an ideal choice for novice traders.

Overview of CMC Markets as a Broker

CMC Markets stands out as a leading broker in the Forex world, renowned for its robust trading platform and comprehensive educational resources. Established in 1989, CMC Markets has grown to become a preferred choice for traders globally, thanks to its commitment to transparency, competitive spreads, and a user-friendly experience.

Key Features:

- Regulation and Security: Fully regulated by top-tier authorities, ensuring a high level of security and fairness.

- Platform and Tools: Features an advanced trading platform with customizable tools and real-time data, perfect for beginners to learn the ropes.

- Educational Resources: Offers a wealth of learning materials, including webinars, tutorials, and articles tailored to assist new traders.

Why CMC Markets is Suitable for Beginners:

- User-Centric Approach: Their platform is designed with new traders in mind, making navigation and trading operations straightforward.

- Support System: Exceptional customer support, providing beginners with the guidance needed to proceed confidently.

Importance and Benefits of Using a CMC Markets Demo Account

“A journey of a thousand miles begins with a single step.” – Lao Tzu

For beginners, stepping into Forex trading can be daunting, and that’s where demo accounts come into play. CMC Markets offers a CMC Markets Demo Account that mirrors the real trading environment but uses virtual money, allowing new traders to experiment and learn without financial risk.

Advantages of a Demo Account:

- Risk-Free Learning: Experiment with different trading strategies without the fear of losing real money.

- Understanding Market Dynamics: Provides a practical experience of how market fluctuations impact trades.

- Testing the Broker’s Platform: Allows you to assess the tools, features, and usability of the CMC Markets platform before committing real funds.

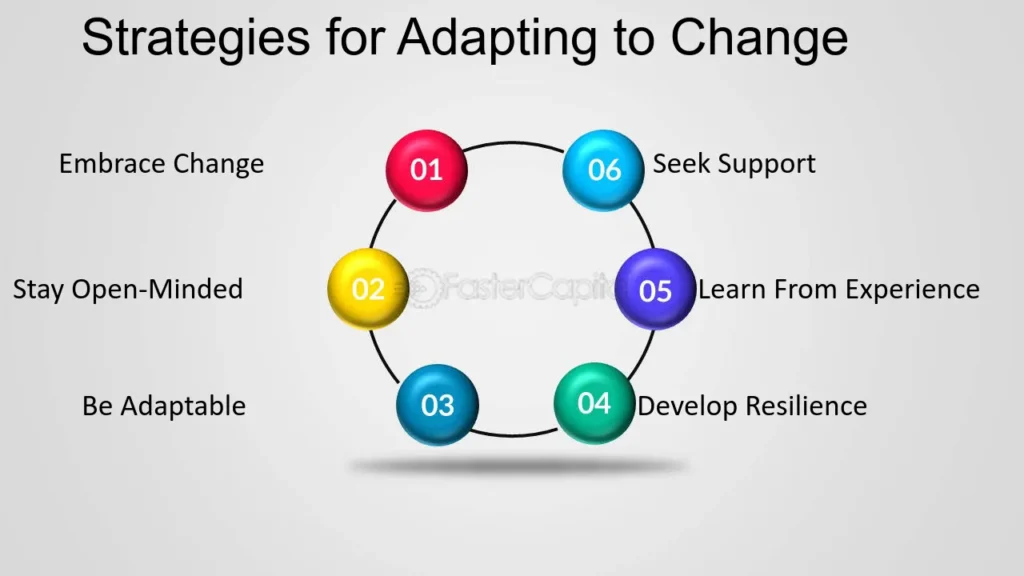

Using a demo account is like having a training wheels for Forex trading; it prepares you for the real market actions but with a safety net to fall back on.

Getting Started with Your CMC Markets Demo Account

As you embark on your Forex trading journey, one of the first practical steps you can take is to set up a demo account. This chapter provides a detailed guide on how to register for a CMC Markets Demo Account, specifically with CMC Markets, and explains the account verification requirements. This process is designed to be smooth and educational, giving you the foundational skills and confidence to trade effectively.

Step-by-Step Guide on How to Register for a Demo Account

1: Visit the Broker’s Website

Navigate to CMC Markets’ official website. On the homepage, you will find a section dedicated to demo accounts, often highlighted for easy access.

2: Registration Form

Click on the ‘Demo Account’ section, and you will be directed to a registration form. Here, you will need to provide basic information such as your name, email address, and phone number.

3: Choose Your Trading Platform

CMC Markets may offer different platforms for trading. Select the one that best suits your learning preferences. If unsure, the standard platform offered is usually a good start, as it typically includes all the essential features needed for beginners.

4: Submit Your Application

After filling out the form and selecting your platform, submit your application. You should receive an email confirmation with details on how to activate your demo account.

5: Log In and Explore

Once your account is activated, log in with the credentials provided. Take your time to explore the interface, check out the available tools, and familiarize yourself with the trading environment.

Understanding Account Verification Requirements in CMC Markets Demo Account

Why Verification Matters:

Account verification is crucial for maintaining security standards and regulatory compliance. It ensures that the trading environment remains safe and that all users are legitimately identified.

Common Verification Documents:

- Proof of Identity (POI): Typically requires a government-issued ID such as a passport or driver’s license.

- Proof of Residence (POR): This might include a recent utility bill or bank statement that confirms your address.

Verification Process:

- Submit Documents: Upload the required documents through the broker’s secure platform.

- Review: The broker will review the documents to ensure they meet the necessary criteria and standards.

- Approval: Once verified, you will receive notification, and any account restrictions will be lifted.

Verification is a one-time process that secures your account and enhances your trading experience. While it may seem like a formality, it is a fundamental aspect of modern trading practices.

Navigating the Trading Platform

For novice Forex traders, understanding the intricacies of a trading platform can be as crucial as grasping trading concepts themselves. This chapter will provide you with a comprehensive overview of the trading platform interface offered by CMC Markets and highlight the key features and tools available within the demo environment that can significantly enhance your trading proficiency.

Overview of the Trading Platform Interface

CMC Markets offers a sophisticated yet intuitive platform that caters to the needs of beginners and experienced traders alike. The interface is designed to provide a seamless trading experience with easy navigation and quick access to all essential functions.

Key Elements of the Interface:

- Dashboard: Your control center, displaying your account balance, equity, margin, and open positions.

- Market Watch: A real-time list of all available instruments, showing prices, spreads, and significant market movements.

- Charting Tools: Highly customizable charts that allow you to view historical data and apply various technical indicators.

Navigational Tips:

- Quick Access Toolbar: Customize this toolbar with links to your most-used features, like deposit funds, withdraw, or check your portfolio.

- Search Bar: Use this feature to quickly find specific markets or tools.

Key Features and Tools Available in the Demo Environment in CMC Markets Demo Account

The demo environment replicates the real trading conditions but without the financial risk, making it an ideal setting for beginners to experiment and learn. Here’s what you can expect:

Essential Tools:

- Charts: Access to multiple chart types, including line, bar, and candlestick, which helps in analyzing market trends.

- Technical Indicators: Tools like Moving Averages, RSI, and MACD, which are crucial for technical analysis.

- Trade Execution Buttons: Quick buy and sell options, allowing for swift trading actions.

Learning Features:

- Demo Trades: Execute trades with virtual money to understand the impact of market changes on your portfolio.

- Interactive Tutorials: Guided tours and pop-up tips that help you understand how to use various features of the platform.

- Webinars and Seminars: Regularly scheduled educational sessions that cover both basic and advanced trading techniques.

Safety Features:

- Risk Management Tools: Features like stop loss and take profit orders to help manage and mitigate risks effectively.

- Alerts and Notifications: Customizable alerts to keep you informed about market developments or when certain price levels are hit.

Navigating a trading platform with confidence is key to a successful trading career. The more familiar you are with the tools and features available, the better equipped you’ll be to make informed trading decisions. CMC Markets’ demo platform is particularly well-suited for beginners due to its comprehensive range of features and user-friendly interface.

Trading Instruments Available in CMC Markets Demo Account

As you gain confidence navigating the trading platform, it’s crucial to familiarize yourself with the variety of trading instruments available. This chapter will introduce you to the range of assets you can trade using the CMC Markets Demo Account, including Forex pairs, stocks, indices, and other financial instruments. Understanding each type will help you make informed decisions about where to focus your trading efforts.

List of Forex Pairs, Stocks, Indices, and Other Assets

CMC Markets offers a diverse array of trading options that cater to different interests and investment strategies. Here’s a breakdown of the main categories:

Forex Pairs:

- Major Pairs: These include the most traded pairs worldwide, such as EUR/USD, GBP/USD, and USD/JPY. They are known for their liquidity and tight spreads.

- Minor Pairs: Less commonly traded pairs that do not include the US dollar, such as EUR/GBP and AUD/NZD.

- Exotic Pairs: Pairs that include a major currency and a currency from a smaller or emerging economy, like USD/SGD or EUR/TRY.

Stocks:

- Global Giants: Companies like Apple, Amazon, and Microsoft, which have significant weight in global markets.

- Emerging Market Stocks: Shares of companies based in emerging markets which offer high growth potential but also come with higher risk.

- Sector-based Stocks: Diverse sectors such as technology, healthcare, and energy, allowing traders to diversify their portfolio based on sector performance.

Indices:

- Major Global Indices: Such as the S&P 500, NASDAQ, and the Nikkei 225, which reflect the performance of a specific basket of stocks.

- Regional Indices: Focus on a particular region or country, like the DAX (Germany) or the FTSE 100 (UK).

Other Assets:

- Commodities: Such as gold, silver, and oil. These are often used as a hedge against inflation or currency devaluation.

- Cryptocurrencies: Including Bitcoin, Ethereum, and other popular digital currencies, known for their volatility and market growth potential.

- Bonds: Government or corporate bonds, which are considered safer investments compared to stocks.

Brief Introduction to Each Type of Trading Instrument in CMC Markets Demo Account

Forex trading involves buying one currency while selling another, betting on the changes in their relative values. Forex markets are highly liquid, making them attractive for short-term trading strategies.

Stocks:

Investing in stocks means buying shares of a company. Stock traders benefit from both dividends and capital gains. They can choose from a variety of sectors and markets to find the stocks that best match their investment criteria and risk tolerance.

Indices:

Indices provide a snapshot of the market by tracking the performance of a group of stocks. They are used by traders to gauge the health of an economy or a sector and can be traded via derivatives like CFDs.

Commodities and Cryptocurrencies:

Commodities trading involves physical goods like metals and energy resources, which are influenced by market demand, geopolitical stability, and economic indicators. Cryptocurrencies, meanwhile, offer a modern alternative with rapid price movements and high potential returns.

Bonds:

Bonds are generally considered safer investments than stocks or commodities. They provide a fixed income over time and are less sensitive to market fluctuations, suitable for risk-averse investors.

Using Trading Tools and Resources

As a beginner in the world of Forex trading, mastering the use of trading tools and resources is essential for making informed decisions and developing effective strategies. This chapter will guide you through the practical application of charts, indicators, and other analytical tools available on CMC Markets Demo Account. Additionally, we’ll cover how to make the most of news feeds and market analysis features to stay ahead in the trading game.

How to Use Charts, Indicators, and Other Analytical Tools

Charts, indicators, and various analytical tools are the backbone of technical analysis in Forex trading. Here’s how you can effectively use these tools on the CMC Markets platform:

Utilizing Charts:

- Accessing Charts: Navigate to the trading instrument of your choice and select ‘Chart’ to open a detailed graphical representation.

- Customization: Adjust time frames, chart types (e.g., candlestick, line, bar), and colors to match your preferences and enhance readability.

- Applying Technical Indicators: Add indicators such as Moving Averages, Bollinger Bands, or the Relative Strength Index (RSI) to help identify trends and potential reversal points.

Step-by-Step Guide to Using Indicators:

- Select an Indicator: Choose from the list of available indicators in the platform’s menu.

- Configure Settings: Customize the parameters of the indicator to fit your trading strategy.

- Analyze Outputs: Interpret the signals provided by the indicators to make educated trading decisions.

Utilizing News Feeds and Market Analysis Features

Staying updated with the latest financial news and market trends is crucial for successful trading. Here’s how to leverage news feeds and analysis features on your platform:

Accessing News Feeds:

- Navigate to the News Section: Typically found on the dashboard or main menu, this section aggregates real-time news relevant to Forex markets.

- Customize Alerts: Set up alerts for news events related to your traded assets or economic indicators, ensuring you never miss critical information.

Leveraging Market Analysis:

- Daily Reports: Use daily market analysis reports provided by experienced analysts to gain insights into market movements and potential opportunities.

- Economic Calendar: Keep an eye on upcoming economic events, like policy announcements or interest rate changes, which can significantly affect market conditions.

Tips for Effective Use:

- Regularly Consult News: Make it a habit to check news updates frequently throughout the trading day to react swiftly to market-moving events.

- Combine Tools: Use both technical tools and fundamental news analysis to develop a balanced trading strategy.

Practical Trading Strategies

For novice traders, developing sound trading strategies and understanding risk management are pivotal steps towards achieving long-term success in Forex trading. This chapter delves into how beginners can use the CMC Markets demo account to craft effective trading strategies and implement robust risk management techniques. We will also provide tips on leveraging the demo account features to simulate real trading conditions as closely as possible.

Developing Trading Strategies Using the Demo Account

Using a demo account is an excellent way to experiment with different trading strategies without the risk of losing real money. Here’s how you can develop and refine your trading strategies effectively:

1: Define Your Trading Goals

Start by clarifying your financial goals, risk tolerance, and time commitment. This will help you determine the trading style that best suits your needs, whether it be day trading, swing trading, or long-term investing.

2: Learn and Apply Basic Trading Concepts

Familiarize yourself with basic trading concepts such as support and resistance levels, trend lines, and price patterns. Apply these concepts to the charts in the demo account to begin recognizing potential trading opportunities.

3: Experiment with Different Strategies

Use the demo account to try out various strategies:

- Trend Following: Buy when the market is trending upward, and sell when it’s trending downward.

- Range Trading: Trade within the bounds of price fluctuations when markets are relatively stable.

- Scalping: Take advantage of small price gaps created by order flows or spreads.

4: Review and Adjust

Regularly review the outcomes of your trades. Analyze successful trades to understand what worked, and study your losses to identify what didn’t. Adjust your strategies based on these insights.

Tips for Risk Management and Leveraging the Demo to Simulate Real Trading Conditions

Risk Management Techniques:

- Set Stop-Loss Orders: Use stop-loss orders to limit potential losses. Set these at a percentage of your account balance to ensure you are not risking more than you can afford to lose on a single trade.

- Manage Leverage Wisely: While leverage can increase potential profits, it also increases risk. Start with lower leverage in the demo account to understand its impact on trades.

- Diversify Your Trades: Don’t put all your capital into a single market or asset. Diversification can help spread risk across various instruments.

Simulating Real Trading Conditions:

- Trade with Realistic Amounts: Operate the demo account as if it were real money. Avoid opening unrealistically large positions that you would not be comfortable with in actual trading.

- Follow the Market: Make decisions based on real market conditions. Keep abreast of market news and events, and apply this information to your trading decisions in the demo environment.

- Use Realistic Trade Settings: Apply the same trade settings (like stop-loss, take profit, and order sizes) that you would use in a live trading scenario.

Advanced Features and Customization

For those who have a firm grasp of the basics and are looking to further enhance their trading experience, this chapter explores the advanced features and customization options available on CMC Markets’ trading platform. We will focus on how to personalize your trading dashboard, set up alerts, and explore automated trading options. These tools can significantly improve your efficiency and responsiveness in the trading market.

Customizing the Trading Dashboard

Personalizing your trading dashboard is essential for streamlining your trading process and ensuring that the information most important to you is readily available. Here’s how you can customize your dashboard effectively:

1: Choose Your Layout

- Select Layout Options: Most platforms offer a range of pre-set layouts or allow you to create custom configurations that best fit your trading style.

- Organize Panels: Arrange panels like charts, order execution, open positions, and news feeds according to your preferences.

2: Add and Remove Widgets

- Custom Widgets: Add widgets that provide quick access to necessary tools such as economic calendars, real-time quotes, or risk management features.

- Remove Unnecessary Elements: Declutter your dashboard by removing any elements that you do not use frequently, which can help reduce distractions and focus on your trading.

Setting Up Alerts and Automated Trading Options

Staying informed and automating certain processes can enhance your trading efficiency. Here’s how to set up alerts and explore automated trading:

Alerts

- Price Alerts: Set alerts for when a particular currency pair reaches a specific price. This feature helps you capitalize on trading opportunities without needing to constantly monitor the market.

- Event Alerts: Configure alerts for economic announcements or significant market-moving events, ensuring that you’re always aware of factors that could impact your trading decisions.

Automated Trading

- Using Expert Advisors (EAs): If the platform supports it, utilize Expert Advisors (EAs) for automated trading based on predefined criteria.

- Backtesting: Before running an EA live, perform backtesting to see how your automation strategy would have performed in past market conditions.

Tips for Effective Customization and Automation:

- Continuously Update Your Preferences: As your trading strategy evolves, make sure to update your dashboard layout and settings to match your current needs.

- Leverage Technology Prudently: While automation can be highly effective, always keep a check on automated systems and ensure they align with your overall trading goals.

Transitioning from a Demo to a Real Account

Moving from a demo to a real trading account is a significant milestone for any Forex trader. This chapter will guide you through the critical considerations and steps involved in making this transition smoothly and effectively. We’ll discuss how to decide when you’re ready to move to a live account and what aspects of your trading experience will change or remain the same.

How to Decide When You’re Ready to Move to a Live Trading Account

Assess Your Performance in the Demo Account

- Consistency in Profits: Have you been consistently making profits over a significant period? Consistency is more indicative of readiness than occasional large gains.

- Adherence to Strategy: Evaluate whether you have been able to stick to your trading strategy under different market conditions. This discipline is crucial for real-world trading.

Evaluate Your Emotional Readiness

- Handling Losses: Consider how you react to losses in the demo environment. Emotional resilience and the ability to handle the stress of real losses are key to transitioning successfully.

- Confidence in Decision-Making: Being confident in your trading decisions without the safety net of a demo account is essential.

What Changes and What Stays the Same in the Transition

1 What Changes:

- Risk and Money Management: Real trading involves actual capital; therefore, effective risk and money management become crucial.

- Emotional Impact: The psychological aspect of trading with real money can significantly affect your decision-making and stress levels.

- Market Conditions: Sometimes, execution in live markets can differ from a demo due to factors like liquidity and slippage.

2 What Stays the Same:

- Trading Platform: The interface and tools you’ve become accustomed to in the demo account will generally be the same in the live account.

- Strategies and Techniques: The strategies and analysis techniques you developed in the demo should still apply. However, be prepared to adapt them as you gain more experience with live market conditions.

Steps to Transition:

- Start Small: Begin with trading smaller amounts than you might be tempted to, to mitigate risk as you adjust to the emotional aspects of live trading.

- Continue Learning: Keep using your demo account to test new strategies before applying them with real money.

- Set Realistic Goals: Establish clear, achievable goals for your live trading to guide your activities and help manage expectations.

Common Pitfalls to Avoid with Demo Trading

Demo trading is an invaluable tool for beginners to learn the ropes of Forex trading without the financial risks. However, there are several common pitfalls that can impede the learning process and affect the transition to real trading. This chapter addresses these pitfalls, focusing on the psychological differences between demo and real trading, and outlines common mistakes beginners make in demo environments, along with strategies to avoid them.

Psychological Differences Between Demo and Real Trading

Trading with virtual money can significantly differ from trading with real funds, primarily due to the psychological impact and emotional responses involved.

Key Psychological Differences:

- Risk Perception: In demo trading, the lack of real financial loss can lead to underestimating the risks associated with trading decisions, which might result in more aggressive trading.

- Emotional Investment: The emotional response to profit and loss is more intense with real money, which can affect decision-making processes.

Understanding these differences is crucial in preparing for a smooth transition to real trading, where emotional control and risk management are key.

Common Mistakes Beginners Make in Demo Trading and How to Avoid Them

Overtrading

- What It Is: Making an excessive number of trades just because there are no real financial consequences.

- How to Avoid: Treat the demo account as if it were a real account with genuine capital. Establish and adhere to a trading plan that includes defined trading times and conditions.

Ignoring Risk Management

- What It Is: Not applying stop-loss orders or managing position sizes because the money is not real.

- How to Avoid: Practice risk management techniques rigorously. Use stop-loss and take-profit orders, and calculate the appropriate position size as if the money were real.

Not Reflecting on Trades

- What It Is: Skipping the review of trades since there is no real loss or gain.

- How to Avoid: Keep a trading journal, even in demo trading. Analyze both successful and unsuccessful trades to understand what worked and what didn’t.

Unrealistic Trading

- What It Is: Trading with amounts vastly unproportional to what would be realistic based on one’s actual financial situation.

- How to Avoid: Trade with a virtual capital amount that closely mirrors what you would realistically invest in a live account.

Lack of a Consistent Strategy

- What It Is: Frequently changing trading strategies or testing out many different approaches without giving them a proper chance to work.

- How to Avoid: Develop and stick to one or two strategies. Give them enough time to yield meaningful results before making adjustments.

Further Learning and Resources

Continuing your education in Forex trading is essential for maintaining and improving your trading skills. This chapter will guide you through additional resources for education and training, focusing on what CMC Markets offers and other recommended sources that can help you deepen your understanding and refine your trading strategies.

Continuing Your Trading Education with CMC Markets

CMC Markets is committed to providing traders with comprehensive learning resources that cater to both beginners and experienced traders.

Key Educational Offerings:

- Webinars and Workshops: Regularly scheduled online sessions covering a range of topics from basic trading concepts to advanced strategy discussions.

- E-Learning Courses: Structured courses designed to progressively enhance your trading knowledge and skills.

- Trading Guides and Articles: Extensive library of guides and articles that delve into various aspects of trading, market analysis, and strategies.

Utilizing these resources can help you stay updated with the latest market trends and trading techniques.

Other Recommended Sources for Trading Education

Books

Consider these classics and new entries in the field of Forex trading:

- Currency Trading for Dummies by Brian Dolan – A great starter book that covers the basics of Forex trading.

- The Art of Currency Trading by Brent Donnelly – Offers insights into developing profitable trading strategies.

Online Platforms

- Investopedia: Known for its comprehensive content on all kinds of financial topics, including Forex trading.

- Babypips: Excellent for beginners, offering easy-to-understand lessons on all aspects of Forex trading.

Trading Forums and Community Groups

- Forex Factory: Provides forums where you can discuss trading strategies and get advice from other traders.

- Reddit: Subreddits like r/Forex and r/Daytrading offer community support and a place to share experiences and strategies.

YouTube Channels

- TraderNick: Offers practical advice and analysis that can benefit traders at all levels.

- Rayner Teo: Known for clear explanations of trading strategies and market analysis.

Tips for Effective Learning

- Set Learning Goals: Define what you want to achieve with your trading education. Focus on one area at a time to avoid information overload.

- Apply Your Knowledge: Regularly apply what you learn in a practical context, such as through a demo account, to reinforce new concepts and strategies.

- Keep Updated: The Forex market is dynamic. Stay informed about global economic events and market changes through reliable news sources.