The advent of mobile trading apps has significantly transformed the investment landscape, democratizing access to the stock markets and empowering investors of all levels to manage their portfolios anytime and anywhere. These apps offer a range of advantages that cater to the modern trader’s lifestyle and needs, underlining the shift towards more dynamic and accessible trading practices. Here’s how mobile trading apps have become instrumental in reshaping stock trading and the specific benefits they offer.

Advantages of Using Mobile Apps for Stock Trading

Convenience and Accessibility

The most evident advantage of mobile trading apps is the convenience they offer. Investors can access their accounts, execute trades, and monitor the market from anywhere, as long as they have an internet connection. This level of accessibility has opened up stock trading to a broader audience, making it feasible for those who might not have the time to trade through traditional desktop platforms.

Real-Time Market Data and Notifications

Mobile apps provide real-time market data, news, and notifications about price movements or relevant economic events. This immediacy allows traders to make informed decisions quickly and take advantage of market opportunities as they arise.

User-Friendly Interfaces

Designed with the user in mind, the best stock trading apps feature intuitive interfaces that simplify the trading process. This user-friendliness is particularly appealing to beginners, reducing the learning curve associated with stock trading.

Integrated Tools and Resources

Many mobile trading apps come equipped with integrated trading tools and resources, including technical analysis indicators, charting capabilities, and educational content. These features enable traders to research stocks, develop strategies, and enhance their trading skills directly from the app.

Lower Costs

Mobile trading apps often boast competitive pricing structures, with lower commission rates and no minimum account balances. This cost efficiency makes stock trading more accessible to individuals with limited capital.

How Mobile Trading Has Transformed the Investment Landscape

Democratization of Trading

Mobile apps have democratized stock trading, breaking down barriers to entry and enabling a more diverse group of individuals to participate in the markets. This inclusivity fosters a broader base of retail investors and contributes to increased market liquidity.

Shift Towards Self-Directed Investing

The rise of mobile trading apps has encouraged a shift towards self-directed investing. With comprehensive tools and resources at their fingertips, more investors are taking control of their investment decisions, tailoring their strategies to fit their personal financial goals.

Increased Market Volatility

The ease of access to trading and the influx of retail investors using mobile apps can contribute to increased market volatility. Rapid, mass reactions to market news or trends, facilitated by instant notifications, can lead to more pronounced price fluctuations.

Focus on Innovation

The popularity of mobile trading apps has spurred continuous innovation among brokers and fintech companies. This competition drives the development of new features, better user experiences, and advanced technologies like artificial intelligence (AI) to assist with trading decisions.

Features to Look for in Stock Trading Apps

Selecting the right stock trading app can significantly influence your trading experience and success. The best stock trading apps combine functionality with ease of use, ensuring traders can efficiently manage their portfolios, access essential market data, and execute trades securely. Here are key features to look for in stock trading apps that can enhance user experience and trading efficiency.

Real-Time Quotes and Market Data

Access to real-time quotes and market data is crucial for making informed trading decisions. The ability to view live price movements, charts, and financial news ensures traders can react promptly to market opportunities or changes.

- Feature Importance: Keeps traders informed with up-to-the-minute information, enabling quick decision-making.

Easy-to-Use Interface

A user-friendly interface is essential, especially for beginners. Navigation should be intuitive, with key features easily accessible. This includes a straightforward process for executing trades, viewing account balances, and accessing portfolio performance.

- Feature Importance: Reduces the learning curve and enhances the overall trading experience, making it easier to manage investments.

Comprehensive Security Features

Given the financial and personal information handled by trading apps, robust security features are non-negotiable. Look for apps offering two-factor authentication (2FA), biometric login (fingerprint or facial recognition), and data encryption.

- Feature Importance: Protects your account from unauthorized access and ensures your personal and financial data are secure.

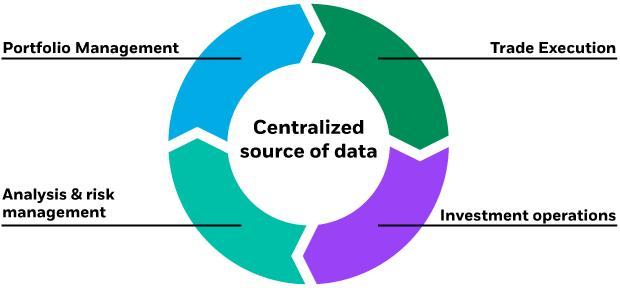

Portfolio Management Tools

Effective portfolio management is key to successful trading. Features that allow for the tracking of individual stock performance, overall portfolio health, and asset allocation help traders make educated adjustments to their investment strategy.

- Feature Importance: Assists in maintaining a balanced and diversified portfolio aligned with the trader’s risk tolerance and investment goals.

Technical Analysis Tools

For those who use technical analysis to inform their trading decisions, having access to charting tools, technical indicators, and historical data is vital. These tools can help identify trends, patterns, and potential entry and exit points.

- Feature Importance: Enables more sophisticated analysis and strategy development, catering to intermediate and advanced traders.

Educational Resources

For beginners and experienced traders alike, ongoing education is vital. The best apps offer a range of educational materials, such as tutorials, webinars, and articles on trading strategies and market analysis.

- Feature Importance: Helps users improve their trading knowledge and skills, contributing to more informed trading decisions.

Fee Transparency

Understanding the cost of trades and any associated fees is essential for financial planning. Apps should clearly disclose commission rates, account fees, and any other costs.

- Feature Importance: Allows traders to accurately calculate potential profits and losses, ensuring no hidden fees erode investment returns.

Customer Support

Reliable customer support that’s easily accessible through the app can be invaluable, especially in situations requiring immediate assistance. Look for services offering multiple contact methods, including live chat, phone support, and email.

- Feature Importance: Ensures traders can receive timely help and answers to their queries, enhancing user satisfaction.

Mobile Optimization

Lastly, the app should be fully optimized for mobile use, providing a seamless experience across different devices and operating systems.

- Feature Importance: Guarantees that traders can effectively manage their portfolios and execute trades, regardless of the device used.

Comparing Commission-Free Trading Apps

The rise of commission-free trading apps has revolutionized the investment world, making stock trading more accessible to the general public. These apps eliminate the traditional per-trade commission fee, appealing to both novice and experienced investors. However, while trading without commission fees is a significant advantage, it’s essential to consider other aspects such as additional fees and the range of services offered. Here’s an overview of some of the best stock trading apps that offer commission-free trading, highlighting how they compare in terms of other fees and services.

Overview of Commission-Free Trading Apps

Robinhood

Features: Robinhood is often credited with popularizing commission-free trading. It offers an intuitive interface suitable for beginners and provides access to stocks, ETFs, options, and cryptocurrencies.

Other Fees: Robinhood makes money through Robinhood Gold (a premium service offering professional research and margin trading), lending securities, and interest on uninvested cash. There’s also a regulatory transaction fee for sales, but it’s minimal.

Webull

Features: Webull caters to both beginners and experienced traders with a comprehensive set of tools for analysis, including advanced charting, technical indicators, and economic calendars. It offers stocks, ETFs, options, and cryptocurrencies.

Other Fees: Webull generates revenue through margin trading interest, short-selling fees, and payment for order flow. Like Robinhood, it charges a minimal regulatory transaction fee on sales.

TD Ameritrade

Features: Known for its robust trading platforms and extensive educational resources, TD Ameritrade appeals to traders of all levels. It offers a wide range of investment products, including stocks, ETFs, options, and futures.

Other Fees: While offering commission-free trading on stocks and ETFs, TD Ameritrade may charge for options trading and has fees associated with broker-assisted trades, margin interest, and certain advanced trading platforms.

E*TRADE

Features: E*TRADE is recognized for its comprehensive research tools, professional-level trading platforms, and a vast selection of investment choices, including stocks, ETFs, options, and mutual funds.

Other Fees: Options contracts and mutual funds trades incur fees. E*TRADE also charges for broker-assisted trades and margin borrowing, among other services.

Comparing Other Fees and Services

When comparing these commission-free trading apps, consider the following:

- Platform and Tools: Assess whether the app provides the necessary tools and resources for your trading strategy. Advanced traders might prefer platforms like TD Ameritrade or Webull for their comprehensive analysis tools.

- Educational Resources: For beginners, apps like TD Ameritrade and E*TRADE offer extensive educational content that can be invaluable for learning about investing and trading.

- Investment Products: While all these apps offer stocks and ETFs, the availability of other products like options, mutual funds, and cryptocurrencies varies. Choose an app that aligns with your investment interests.

- User Experience: Consider the app’s ease of use, interface design, and mobile optimization. User experience can significantly affect your trading efficiency and satisfaction.

Understanding App Security and Data Protection

In the digital age, where stock trading can be conducted at the touch of a button, the security of trading apps and the protection of user data have become paramount. The best stock trading apps not only offer a wide range of features and commission-free trading but also prioritize robust security measures and data privacy to safeguard users’ financial and personal information. Understanding these security protocols and the importance of data protection is crucial for traders looking to navigate the mobile trading landscape confidently.

Security Measures to Look for in a Stock Trading App

Encryption

Encryption is the first line of defense in protecting your data on a trading app. Look for apps that employ strong encryption protocols (such as AES-256) for both data in transit (as it moves between your device and the server) and at rest (stored data on servers). This ensures that your sensitive information, such as account details and transaction history, is unreadable to unauthorized parties.

Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring two forms of identification before granting access to your account. Typically, this involves something you know (like a password) and something you have (such as a code sent to your mobile device). 2FA significantly reduces the risk of unauthorized account access, even if your password is compromised.

Biometric Authentication

Many apps now offer biometric authentication features, including fingerprint scanning, facial recognition, or voice identification, as a secure and convenient way to access your trading account. These biometric identifiers are nearly impossible for fraudsters to replicate, providing a high security level.

Regular Security Audits and Updates

Top trading apps undergo regular security audits to identify and rectify potential vulnerabilities. Ensure the app you choose is committed to continuously updating its security features and protocols to protect against emerging threats.

Privacy Policy and Data Handling Practices

Understanding an app’s privacy policy is essential. It should clearly outline what personal data is collected, how it is used, and who it may be shared with. The best stock trading apps are transparent about their data handling practices, ensuring they comply with regulations like GDPR in Europe or other local data protection laws.

Importance of Data Privacy and Protection in Mobile Trading

Trust and Reputation

A trading app’s commitment to security and data protection significantly impacts its reputation among users. Apps that prioritize user privacy build trust, encouraging more traders to use their platform confidently.

Compliance with Regulations

Financial services, including mobile trading platforms, are subject to strict regulatory requirements regarding data protection and user privacy. Compliance not only avoids legal repercussions but also assures users that the platform adheres to high security and privacy standards.

Protection Against Identity Theft and Fraud

Robust security measures protect users from identity theft, phishing attacks, and other forms of financial fraud. In the context of stock trading, where significant amounts of money can be involved, safeguarding against unauthorized transactions and access is critical.

Personal Data Integrity

Ensuring that personal and financial data remains accurate and unaltered is vital for maintaining the integrity of trading activities. Security measures prevent unauthorized changes to your account details or trading positions.

Top Apps for Beginner Stock Investors

For beginner stock investors, starting the journey into the world of trading can be overwhelming. The key to a smooth introduction lies in choosing a stock trading app that combines user-friendly interfaces with robust educational resources and dedicated customer support. These apps not only facilitate the trading process but also empower beginners with the knowledge and confidence needed to make informed decisions. Here’s a look at some of the best stock trading apps tailored for beginners, highlighting their standout features.

1. Robinhood

User-Friendly Interface: Robinhood is renowned for its simple, intuitive design, making it ideal for those new to stock trading. The app demystifies the trading process with straightforward navigation and clear, concise information.

Educational Resources: Robinhood provides a “Learn” section filled with easy-to-understand articles on investing basics, market trends, and financial concepts, suitable for beginners looking to expand their knowledge.

Customer Support: While primarily online-based, Robinhood offers an extensive FAQ section and the ability to contact support through the app for any inquiries, providing sufficient assistance for new investors.

2. E*TRADE

Comprehensive Educational Content: E*TRADE stands out for its vast array of educational materials, including articles, videos, webinars, and live events that cover various aspects of investing and trading strategies.

User-Friendly Interface: The app offers a customizable dashboard, allowing beginners to access the tools and features they need without clutter. Mobile optimization ensures a seamless trading experience across devices.

Customer Support: E*TRADE offers 24/7 customer support through phone, chat, and email, ensuring beginners can get help whenever needed. Their customer service is noted for being knowledgeable and responsive.

3. TD Ameritrade

Robust Educational Resources: TD Ameritrade is a leader in investor education, offering an immersive curriculum that includes articles, videos, webinars, and even a virtual trading simulator to practice strategies without risk.

User-Friendly yet Comprehensive Platform: The app balances a sophisticated set of tools with an accessible design, making it suitable for beginners who wish to grow their trading skills over time.

Exceptional Customer Support: With 24/7 availability via phone, chat, and even in-person consultations at local branches, TD Ameritrade provides unparalleled support to its users.

4. Fidelity

Extensive Educational Content: Fidelity offers in-depth resources for learning, including articles, videos, and webinars that cover investing basics to advanced strategies, all tailored to help beginners navigate the stock market.

Intuitive App Design: The app prioritizes ease of use without sacrificing functionality, offering beginners a stress-free way to manage their investments and access educational materials.

Dedicated Customer Support: Fidelity provides comprehensive customer service, including a direct line to financial advisors for more personalized guidance.

5. Acorns

Simplified Investing Approach: Acorns is perfect for beginners looking to start small, offering automated investing by rounding up spare change from everyday purchases into diversified portfolios.

Educational Focus: The app includes a built-in education platform that covers financial basics, investing strategies, and personal finance tips, all presented in an easy-to-understand format.

Support and Guidance: While Acorns operates more on an automated investing model, it provides ample educational support and straightforward guidance for beginners taking their first steps into investing.

Analyzing Fees and Costs Associated with Trading Apps

While commission-free trading has become a significant selling point for many stock trading apps, it’s crucial to understand the broader spectrum of fees and costs that can affect your investment returns. Beyond commissions, several other charges should be considered when choosing the best stock trading apps. This analysis provides a breakdown of potential fees, helping investors make informed decisions based on the total cost of using a trading app.

Account Minimums

Some trading apps require a minimum amount to open or maintain an account. While many apps have lowered or eliminated these minimums to attract more users, it’s still essential to check for any required initial deposits, as they can vary widely among platforms.

- Impact: Account minimums can limit accessibility for investors with limited capital, affecting the choice of trading app.

Inactivity Fees

Inactivity fees are charged by some brokers if your account does not meet a certain number of trades within a specified period. These fees can slowly erode an investment portfolio if you’re a passive investor or take a break from trading.

- Impact: Investors planning to trade infrequently should look for apps that do not penalize inactivity to avoid unnecessary costs.

Transfer Fees

Transfer fees may apply when you move assets in or out of your trading account, especially in the case of transferring a stock portfolio to another broker. These fees can vary significantly and should be considered if you anticipate transferring your investments.

- Impact: High transfer fees can discourage or financially penalize investors wishing to switch platforms or consolidate their investments.

Withdrawal and Deposit Fees

Some apps charge fees for depositing or withdrawing funds from your trading account, particularly when using certain payment methods like wire transfers or international bank transfers.

- Impact: These fees can add up, especially for investors who make frequent deposits or withdrawals. Look for platforms with low or no fees for these transactions to minimize costs.

Miscellaneous Fees

Paper Statement Fees

While most trading apps encourage electronic statements, some charge a fee for mailing physical copies. Opting for electronic statements can avoid these charges.

Custodial Fees

For specific types of accounts, such as IRAs, some apps may charge custodial fees. These annual fees cover the administrative costs of maintaining the account.

Regulatory Fees

Trading activities may incur small regulatory fees, mandated by financial authorities. These are usually a fixed percentage of the sale value and are relatively minimal but should be acknowledged.

Navigating Advanced Features and Tools

Advanced trading tools and analysis features have become key differentiators among the best stock trading apps, catering to the needs of more experienced traders and those looking to develop sophisticated trading strategies. These features not only enhance the trading experience but also provide critical insights and analytics, enabling traders to make informed decisions. Understanding these tools and their importance can significantly impact your trading effectiveness.

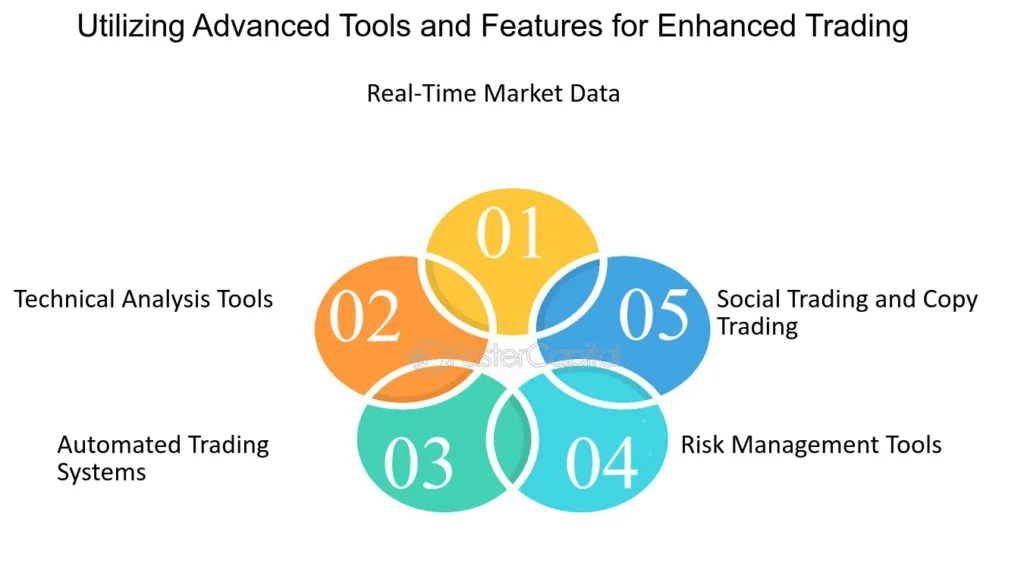

Key Advanced Trading Tools and Features

Technical Analysis Tools

Description: Includes charting tools, technical indicators like moving averages, MACD, RSI, and Fibonacci retracements, and the ability to perform backtesting on trading strategies.

Importance: These tools are essential for identifying trends, potential entry and exit points, and testing the viability of strategies before applying them in real markets.

Fundamental Analysis Resources

Description: Access to comprehensive financial data, earnings reports, SEC filings, and market news. Some apps also integrate analyst ratings and forecasts.

Importance: Fundamental analysis helps traders assess the intrinsic value of stocks, making it easier to identify under or overvalued assets in the market.

Automated Trading & Alerts

Description: Allows traders to set up automated trading strategies based on specific criteria and receive real-time alerts on market movements, news, or when certain conditions are met.

Importance: Automating aspects of trading can save time and ensure you don’t miss trading opportunities. Alerts keep you informed of market developments relevant to your interests or portfolio.

Risk Management Tools

Description: Features such as stop-loss and take-profit orders, risk/reward calculators, and portfolio diversification analyzers.

Importance: Effective risk management is crucial for long-term trading success, and these tools help in mitigating potential losses while maximizing returns.

Social Trading and Community Features

Description: Some apps offer social trading features, allowing users to follow and copy the trades of experienced investors, or engage with a community for ideas and discussions.

Importance: For traders looking to learn from others or validate their strategies, social trading and community features provide valuable insights and networking opportunities.

Customization and Personalization

Description: The ability to customize dashboards, create watchlists, and personalize notification settings according to individual trading needs and preferences.

Importance: Customization enhances the user experience, making it easier to monitor the markets and assets you’re most interested in, and align the app’s functionality with your trading strategy.

Choosing Apps with Advanced Features

When selecting a stock trading app, consider your trading style, strategy, and experience level. While beginners might prioritize educational resources and ease of use, more experienced traders will likely seek apps with comprehensive analytical tools, customization options, and advanced order types. It’s also vital to consider the app’s performance, reliability, and the quality of customer support offered.

The Role of Paper Trading and Demo Accounts

Paper trading and demo accounts play a pivotal role in the world of stock trading, especially for beginners and even for experienced traders looking to test new strategies. Offered by many of the best stock trading apps, these features allow users to simulate real trading with virtual money, thus practicing strategies and making trades without any financial risk. Understanding the benefits of these tools can significantly enhance a trader’s ability to navigate the markets effectively.

Key Benefits of Paper Trading and Demo Accounts

Risk-Free Learning Environment

The most apparent advantage is the risk-free environment these accounts provide. Beginners can get acquainted with the stock market’s mechanics, including order types, market indicators, and trading platforms, without the fear of losing real money.

Strategy Testing and Refinement

For both new and seasoned traders, demo accounts offer a valuable space to test and refine trading strategies. Traders can experiment with different approaches to see what works best for them, analyzing the outcomes and making adjustments before putting real capital on the line.

Familiarization with Trading Platforms

Paper trading allows users to become comfortable with a trading app’s interface and features. This familiarity can make the transition to real trading smoother and more intuitive, reducing the likelihood of costly errors due to unfamiliarity with the platform.

Emotional Discipline and Psychological Preparation

Trading with real money can evoke strong emotions, potentially leading to impulsive decisions. Practicing in a simulated environment helps traders learn to manage emotions like fear and greed, developing the psychological resilience needed for successful trading.

Market Understanding

By engaging with the market in real-time, traders using demo accounts can better understand market dynamics, how different factors influence stock prices, and how to react to market volatility, all without any financial consequences.

Education Integration

Many of the best stock trading apps integrate educational content with demo trading, allowing traders to apply what they learn directly in a trading context. This hands-on approach can be more effective for retaining information and understanding complex concepts.

Choosing the Right App for Paper Trading

When selecting a stock trading app with paper trading or demo account features, consider the following:

- Realism: The best demo accounts simulate real market conditions as closely as possible, including spreads, market liquidity, and order execution speed.

- Accessibility: Look for apps that offer easy access to demo accounts, ideally without needing to fund a live account first.

- Features and Tools: Ensure the demo account provides access to the same tools, charts, and analysis features as the live trading platform, for a truly educational experience.

- Time Limitations: Some apps limit the time you can use a demo account. Opt for platforms that offer unlimited or extended access to practice thoroughly.

Making Your First Trade: A Step-by-Step Guide

Embarking on your first stock trade can be both exhilarating and daunting. With the right preparation and understanding of the process, you can make this initial step with confidence. Mobile apps have made trading more accessible, allowing you to monitor and manage your portfolio anywhere. Here’s a guide to executing your first stock trade using a mobile app, coupled with tips for effective portfolio management on the go, focusing on the best stock trading apps for beginners.

Step 1: Choose a Reputable Trading App

Research and select one of the best stock trading apps that suits your investment goals and needs. Consider factors like user-friendliness, fees, available educational resources, and customer support. Ensure the app is from a reputable broker, ideally regulated by a major financial authority.

Step 2: Set Up and Fund Your Account

Follow the app’s process to set up a new account. This will typically involve providing some personal information and possibly verifying your identity. Once your account is set up, deposit funds you’re comfortable with investing. Be aware of any minimum deposit requirements.

Step 3: Educate Yourself

Before making your first trade, take advantage of the educational resources provided by the app. Learn the basics of stock trading, how to analyze stocks, and understand key trading concepts like market orders, limit orders, stop-loss orders, etc.

Step 4: Start with a Plan

Define your trading strategy and objectives. Are you looking for short-term gains, or are you investing for the long haul? Decide in advance how much of your capital you’re willing to risk on individual trades.

Step 5: Research and Choose Your Stock

Use the app’s tools and resources to research potential stocks. Look for stocks that align with your investment strategy, financial goals, and risk tolerance. Pay attention to financial news, stock performance charts, and analyst recommendations provided within the app.

Step 6: Make Your First Trade

Once you’ve selected a stock:

- Enter the stock symbol in the app’s search feature.

- Choose the type of order you want to place (e.g., market, limit).

- Specify the quantity of stocks you wish to buy.

- Review and confirm your order details before executing the trade.

Step 7: Monitor Your Portfolio

After executing your trade, use the app to regularly check the performance of your stock. Most apps provide real-time data, alerts, and notifications to keep you updated on your investments.

Tips for Managing Your Portfolio on the Go

- Set Up Alerts: Configure price alerts for your stocks to stay informed of significant movements without having to constantly check the app.

- Review Regularly: Make it a habit to review your portfolio’s performance regularly, adapting your strategy as needed based on market changes.

- Diversify: Consider diversifying your portfolio across different stocks and sectors to mitigate risk.

- Stay Informed: Use your app to stay up-to-date with the latest financial news and market trends that could impact your investments.

- Know When to Exit: Have clear criteria for when to sell a stock, whether it’s reaching a specific profit target or cutting losses.

How to Choose the Best Stock Trading App for You

Choosing the best stock trading app requires a thoughtful assessment of your trading style, investment goals, and level of experience. The ideal app should not only meet your current needs but also support your growth as an investor. Here’s a comprehensive guide to help you evaluate and select a stock trading app that aligns perfectly with your trading aspirations.

Factors to Consider

Your Trading Style

- Active vs. Passive: Determine whether you intend to trade actively (daily or weekly) or adopt a more passive, long-term investment approach. Active traders might prefer apps with advanced charting tools and low latency, while passive traders might value educational resources and portfolio management features.

Investment Goals

- Growth vs. Income: Are you looking to grow your capital over time, or are you interested in generating income through dividends? Your goal can influence the types of stocks you focus on and, consequently, the app features you might need, such as dividend reinvestment plans (DRIPs).

Level of Experience

- Beginner vs. Experienced: If you’re new to trading, look for apps with comprehensive educational content, user-friendly interfaces, and responsive customer support. Experienced traders might prioritize apps offering detailed analytical tools, customization, and the ability to execute complex trade orders.

Checklist for Evaluating Stock Trading Apps

1. Regulatory Compliance and Security

- Ensure the app is offered by a broker regulated by reputable authorities.

- Check for security features like data encryption, two-factor authentication (2FA), and biometric login options.

2. Fees and Costs

- Understand the fee structure, including any commission on trades, account maintenance fees, and charges for withdrawals or inactivity.

- Consider the overall cost impact on your investment returns.

3. Usability and Interface

- The app should be intuitive and easy to navigate, regardless of your experience level.

- Look for customizable interfaces that can adapt to your preferences and trading needs.

4. Features and Tools

- Assess the availability of tools necessary for your trading style, such as real-time charts, technical indicators, and news feeds.

- Check if the app offers paper trading or demo accounts for practice.

5. Range of Investments

- Ensure the app provides access to the types of stocks or other assets you’re interested in trading, including international markets if desired.

- Some apps also offer access to ETFs, options, mutual funds, and cryptocurrencies.

6. Educational Resources

- For beginners, valuable educational materials can significantly enhance the learning experience. Look for apps offering tutorials, webinars, and articles on investing and trading strategies.

7. Customer Support

- Evaluate the quality of customer support, including availability (24/7 vs. business hours) and channels of communication (phone, chat, email).

- Responsive and knowledgeable support is crucial, especially for new traders.

8. Reviews and Reputation

- Read user reviews and ratings on reputable platforms to gauge the app’s performance and reliability.

- Consider feedback on app stability, execution speed, and customer service quality.

FAQs:

- What Makes a Stock Trading App User-Friendly?

- An intuitive interface, easy navigation, quick access to market data, and straightforward trading processes make an app user-friendly.

- Can I Trade Stocks for Free Using These Apps?

- Many apps offer commission-free trading, but it’s important to understand other potential costs and fees.

- How Secure Are Mobile Trading Apps?

- Look for apps with strong security measures like encryption, biometric logins, and two-factor authentication.

- What Educational Resources Should I Expect from a Trading App?

- Quality apps provide tutorials, webinars, articles, and real-time market news to educate users on trading and investment strategies.

- Are Demo Accounts Available on All Trading Apps?

- Not all, but many top-rated apps offer demo accounts or paper trading features to practice trading strategies risk-free.

- How Do I Open an Account with a Stock Trading App?

- Download the app, complete the registration process, verify your identity, and deposit funds to start trading.

- What Advanced Features Might Benefit Experienced Traders?

- Advanced charting tools, analytical capabilities, and automated trading options can benefit traders with more experience.

- Can I Manage My Entire Portfolio from a Mobile App?

- Yes, many trading apps allow you to manage your portfolio, set alerts, and execute trades directly from your mobile device.

- How Do I Know If a Trading App Is Right for My Trading Style?

- Consider your trading frequency, the complexity of trades you plan to execute, and the depth of market analysis you require.

- Is It Possible to Switch Between Different Trading Apps?

- Yes, you can switch apps or use multiple apps, but be mindful of the potential for increased complexity and costs.