Embarking on the journey of forex trading can be both exciting and daunting for novices. Understanding the fundamentals of the forex market, how currency pairs work, and the mechanics behind trading are essential first steps. Equally crucial is recognizing the significant role that brokers play in this global marketplace. This chapter aims to demystify these concepts, with a particular focus on identifying the best forex brokers for beginners.

Introduction to the Forex Market

The forex market, or foreign exchange market, is where currencies are traded against each other, making it the largest and most liquid financial market in the world. Trading operates 24 hours a day, five days a week, involving participants from global central banks to individual investors, all looking to exchange currencies for a variety of reasons, from hedging and speculation to international trade and investment.

Currency Pairs and How Trading Works

Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or USD/JPY (US Dollar/Japanese Yen). The first currency in the pair is the base currency, and the second is the quote currency. Trading involves predicting whether the base currency will strengthen or weaken against the quote currency, with traders buying (going long) or selling (going short) pairs based on their forecasts.

The Critical Role Brokers Play in Forex Trading

Brokers act as intermediaries between individual traders and the vast forex market. They provide access to trading platforms where currencies can be bought and sold. The best forex brokers offer more than just a pathway to the market; they provide valuable resources, tools, and support to help beginners navigate forex trading successfully.

Choosing the Best Forex Brokers for Beginners

When looking for the best forex brokers, beginners should consider several key factors:

- Regulation: Ensure the broker is regulated by reputable financial authorities to guarantee transparency and protect your investments.

- User-Friendly Platform: A platform that is intuitive and easy to use, with educational resources and demo accounts, is crucial for beginners.

- Low Spreads and Fees: Competitive spreads and low trading costs can significantly impact profitability, especially for those just starting.

- Customer Support: Access to responsive and knowledgeable support can be invaluable for beginners facing technical issues or market-related queries.

- Educational Resources: Comprehensive learning materials, such as webinars, guides, and tutorials, can help demystify forex trading for novices.

Essential Features of Best Forex Brokers for Beginners

For novice traders stepping into the vast and dynamic forex market, selecting a broker that aligns with their needs is crucial. The best forex brokers for beginners not only provide a gateway to the market but also offer a supportive environment conducive to learning and growth. Understanding the essential features that make a broker suitable for beginners is key to making an informed choice. This chapter delves into these critical aspects, emphasizing the characteristics of the best forex brokers that cater to novice traders.

User-Friendly Trading Platform for Best Forex Brokers

A user-friendly trading platform is paramount for beginners. The platform should offer an intuitive interface, easy navigation, and clear instructions, enabling new traders to execute trades confidently without feeling overwhelmed by complex features.

- Visual Appeal and Simplicity: A clean, well-organized layout that presents information clearly.

- Educational Resources: Access to tutorials, guides, and glossaries directly within the platform.

- Demo Accounts: The availability of demo accounts for practicing trading strategies without financial risk.

Comprehensive Educational Materials

The best forex brokers for beginners invest in comprehensive educational resources to help new traders understand the forex market’s intricacies. These materials cover a wide range of topics, from the basics of forex trading to advanced strategies.

- Format Variety: Offering materials in various formats, such as videos, webinars, articles, and e-books, caters to different learning preferences.

- Progressive Learning Paths: Structured courses that guide beginners from basic concepts to more complex topics.

- Real-Time Examples: Incorporating current market data and examples into learning materials to demonstrate practical application.

Responsive Customer Support

Beginners are likely to have many questions and may encounter challenges as they familiarize themselves with trading. Responsive and knowledgeable customer support is essential.

- Multiple Channels: Offering support through live chat, email, and phone ensures that traders can receive help in the manner most convenient for them.

- 24/5 Availability: Forex markets operate 24 hours a day, five days a week, making access to support during these hours critical.

- Language Options: Support in multiple languages broadens accessibility for a global audience.

Competitive Spreads and Low Fees

Costs can quickly erode trading profits, especially for those who trade frequently. The best forex brokers for beginners offer competitive spreads and transparent fee structures.

- No Hidden Fees: Clarity about any charges, including withdrawal fees, inactivity fees, and account maintenance fees, is crucial.

- Low Entry Point: Minimum deposit requirements that are accessible for beginners, allowing them to start small.

Strong Regulatory Compliance

Trading with a regulated broker ensures that beginners are protected by financial laws and regulations. Regulatory oversight offers assurances regarding the broker’s integrity, security of funds, and ethical conduct.

- Reputable Authorities: Look for brokers regulated by leading authorities like the FCA, CySEC, or ASIC.

- Segregation of Funds: Ensuring that clients’ funds are kept separate from the broker’s operational funds for added security.

Understanding Regulations in Best Forex Brokers Trading

Navigating the forex market can be complex, especially with the myriad of regulations governing it. For individuals venturing into forex trading, the role of regulatory bodies such as the Commodity Futures Trading Commission (CFTC), National Futures Association (NFA), and Financial Conduct Authority (FCA) is paramount. These institutions not only ensure trader security but also bolster broker credibility. This chapter explores the significance of these regulatory bodies in the forex market, highlighting their impact on ensuring that traders engage with the best forex brokers for a secure and transparent trading environment.

The Importance of Regulatory Bodies

Commodity Futures Trading Commission (CFTC)

The CFTC is a U.S. federal agency that regulates the United States’ commodity futures and options markets. Its primary mission is to protect market users and the public from fraud, manipulation, and abusive practices related to derivatives and other products under its jurisdiction.

National Futures Association (NFA)

The NFA operates as a self-regulatory organization for the U.S. derivatives industry, including on-exchange traded futures, retail off-exchange foreign currency (forex), and OTC derivatives (swaps). It aims to safeguard the integrity of the markets, protect investors, and ensure members meet their regulatory responsibilities.

Financial Conduct Authority (FCA)

Based in the UK, the FCA oversees the conduct of both retail and wholesale financial firms. It works to ensure that financial markets are honest, fair, and effective so that consumers get a fair deal. This includes regulation of forex brokers, ensuring they adhere to strict financial standards and operate with transparency.

How Regulation Affects Trader Security and Broker Credibility

Enhancing Trader Security

Regulatory bodies enforce rules that protect traders from fraud and unethical practices. They require brokers to maintain high standards of operation, including:

- Capital Adequacy: Ensuring brokers have enough capital to cover their market exposures.

- Segregation of Funds: Mandating that brokers keep client funds in separate accounts from their operational funds, protecting trader assets in case the broker faces financial difficulties.

- Transparent Trading Practices: Requiring clear disclosure of trading practices and costs associated with trading, promoting transparency.

Bolstering Broker Credibility

A broker regulated by reputable authorities like the CFTC, NFA, or FCA is often considered more credible and reliable. Regulation signifies that a broker is committed to upholding the highest standards of financial integrity and professional conduct.

- Compliance with Financial Standards: Regulated brokers must adhere to stringent financial standards and undergo regular audits, ensuring they operate in their clients’ best interests.

- Dispute Resolution: Regulatory bodies offer mechanisms for dispute resolution, providing traders with a means to resolve issues with brokers fairly and transparently.

- Enhanced Market Integrity: By enforcing rules and standards, regulatory bodies help maintain the integrity of the forex market, ensuring it operates efficiently and fairly.

Best Forex Brokers Account Types for Novices

For beginners embarking on the journey of forex trading, understanding the different account types offered by brokers is crucial. Each account type—micro, mini, and standard—serves different needs and trading strategies, making some more suitable for novices than others. This chapter explores these account options, highlighting their features and suitability for beginners. Furthermore, it provides guidance on selecting the best account type for both practice and live trading, ensuring novices can make informed decisions when choosing among the best forex brokers.

Micro Accounts

Overview

Micro accounts are designed for traders new to the forex market, allowing them to trade with significantly lower transaction volumes. One micro lot is typically 1,000 units of the base currency. This account type is ideal for beginners looking to test strategies without a substantial financial commitment.

Suitability for Beginners

- Low Risk: The small trade size reduces the financial risk, making it an excellent choice for learning the ropes of forex trading.

- Minimal Investment Required: Micro accounts often have very low minimum deposit requirements, making forex trading accessible to a broader audience.

Mini Accounts

Overview

Mini accounts offer a middle ground, with each mini lot representing 10,000 units of the base currency. These accounts are suitable for those who have gained some experience and confidence in trading but are not yet ready to commit to larger volumes.

Suitability for Beginners

- Moderate Risk: Mini accounts introduce a higher level of risk compared to micro accounts but remain manageable for novices.

- Greater Flexibility: Offers beginners the opportunity to experiment with slightly larger trades and potentially increase their returns while still keeping the risk in check.

Standard Accounts

Overview

Standard accounts are typically aimed at more experienced traders, with each lot representing 100,000 units of the base currency. This account type requires a higher level of investment and brings a greater risk due to the larger trade size.

Suitability for Beginners

- Higher Risk: The substantial trade volume means higher potential profits but also increases the risk, which might not be suitable for all beginners.

- Significant Investment: Generally requires a higher minimum deposit, making it less accessible to those just starting.

Deciding on the Best Account Type for Practice and Live Trading

Choosing the right account type involves assessing your risk tolerance, investment capacity, and familiarity with the forex market.

- For Practice Trading: Novices are advised to start with demo accounts offered by the best forex brokers. These accounts simulate real trading environments without any financial risk, allowing beginners to gain experience and test strategies.

- For Live Trading: Micro or mini accounts are the most suitable for beginners making the transition to live trading. These account types allow novices to experience the market dynamics and practice risk management with lower financial exposure.

Key Considerations

- Educational Resources: Look for brokers that offer comprehensive educational materials alongside these accounts, enhancing your learning experience.

- Risk Management Tools: Ensure the broker provides tools like stop-loss orders to help manage risk effectively.

- Regulation and Security: Choose regulated brokers that offer a secure trading environment, protecting your investment.

Comparing Forex Broker Fees and Spreads

In the world of forex trading, understanding the fee structure of brokers is crucial for every trader, especially beginners aiming to maximize their trading efficiency while minimizing costs. This chapter explains the various trading costs, including spreads, commissions, and other fees associated with trading with the best forex brokers. Additionally, it outlines strategies for minimizing these fees, ensuring traders can make the most out of their forex trading experience.

Explanation of Spreads, Commissions, and Other Trading Costs

Spreads

The spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair. It represents the broker’s fee for executing the trade and is how most forex brokers earn their revenue. Spreads can be either fixed or variable, with variable spreads fluctuating based on market conditions.

Commissions

Some forex brokers also charge a commission on trades in addition to, or instead of, spreads. Commissions are typically charged on a per-trade basis and are common in accounts offering lower spreads. The exact structure can vary, with some brokers charging a flat fee per lot traded, while others may charge a percentage of the trade’s value.

Other Trading Costs

- Overnight or Swap Fees: Charged when a position is held open overnight, based on the differential interest rates of the traded currencies.

- Account Inactivity Fees: Some brokers may charge a fee if your account remains inactive for a certain period.

- Deposit and Withdrawal Fees: Fees associated with funding your account or withdrawing profits can also impact overall trading costs.

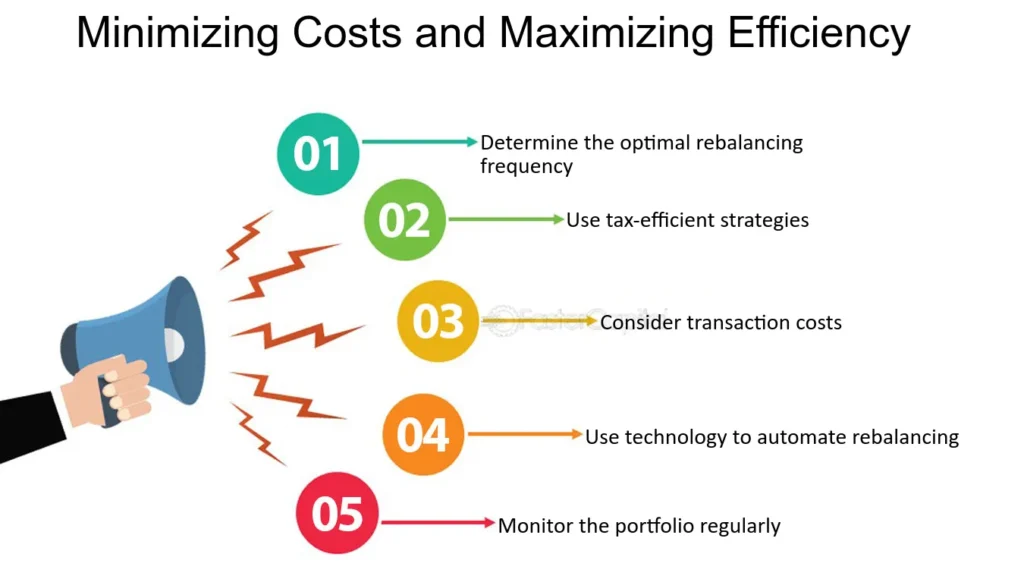

Strategies for Minimizing Fees and Maximizing Trading Efficiency

Choose the Right Account Type

Understanding the fee structure associated with different account types can help you choose one that aligns with your trading style and volume. For example, if you trade frequently and in high volumes, an account with lower spreads but higher commissions might be more cost-effective.

Compare Broker Fees

Before settling on a broker, compare the fees, spreads, and commission structures of various best forex brokers. Look for transparency in their fee structure to avoid hidden costs.

Consider Trading Times

Spreads can widen during times of high volatility or outside of major trading hours. Planning your trades during peak trading hours can lead to more predictable costs.

Utilize Limit and Stop Orders

Using limit and stop orders can help manage trading costs by setting specific prices at which you’re willing to enter or exit the market, potentially avoiding the need for paying wider spreads in fast-moving markets.

Monitor Swap Fees

If you hold positions overnight, be aware of the swap fees that can accumulate, especially in trades where the interest rate differential is against you. Consider closing positions before the end of the trading day if the swap costs outweigh the potential profits.

Review and Adjust Strategies Regularly

Regularly review your trading strategy and performance to identify areas where costs can be reduced. This might include adjusting trade sizes, changing the frequency of trades, or re-evaluating the currency pairs you trade most often.

Selecting Forex Trading Platforms and Tools

For beginners venturing into the forex market, choosing the right trading platform is as crucial as selecting the best forex brokers. The platform acts as a bridge to the market, offering the tools and resources necessary for effective trading. Among the plethora of platforms available, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) stand out due to their comprehensive features and widespread acceptance. This chapter explores these platforms and underscores the importance of user-friendly tools and resources for novices, guiding them towards making informed decisions in their trading journey.

Overview of Popular Platforms

MetaTrader 4 (MT4)

MT4 has established itself as the industry standard for forex trading. Renowned for its reliability, this platform offers a wealth of features tailored to traders of all levels, making it a top choice among the best forex brokers.

Key Features:

- User-Friendly Interface: Its intuitive design ensures beginners can navigate the platform with ease.

- Advanced Charting Tools: Provides a variety of charting tools and over 30 technical indicators, enabling thorough market analysis.

- Expert Advisors (EAs): Allows for the automation of trades through custom algorithms, appealing to those interested in algorithmic trading.

- Customizability: Users can tailor the platform to their trading needs and preferences.

MetaTrader 5 (MT5)

As the successor to MT4, MT5 caters to a broader market by supporting additional asset classes. It builds on the strengths of MT4, offering enhanced features while maintaining a familiar user experience.

Key Features:

- Extended Range of Timeframes: Offers more timeframes, allowing for more precise market analysis.

- Advanced Financial Trading Functions: Includes additional tools for technical and fundamental analysis.

- Enhanced Expert Advisors (EAs): More sophisticated algorithmic trading features.

- Improved Strategy Tester: For testing and optimizing trading strategies more efficiently.

Importance of User-Friendly Tools and Resources for Beginners

Simplified Market Analysis

For beginners, complex market analysis can be daunting. Platforms like MT4 and MT5 provide user-friendly analytical tools, making it easier to understand market trends and make informed trading decisions.

Access to Educational Resources

The best forex brokers offer platforms that include tutorials, guides, and webinars integrated within the platform interface, facilitating a seamless learning experience for novices.

Practice with Demo Accounts

Demo accounts are a critical feature of trading platforms, allowing beginners to practice trading strategies in a risk-free environment. They mimic live market conditions, offering valuable practical experience.

Community Support

Both MT4 and MT5 boast vast communities of traders. Beginners can access forums and exchange ideas, strategies, and experiences with more experienced traders, enhancing their learning curve.

Educational and Training Resources for Forex Trading

In the journey of becoming a proficient forex trader, education and training hold paramount importance. Broker-provided education plays a crucial role in a trader’s development, offering the foundational knowledge and advanced strategies necessary for successful trading. The best forex brokers understand this and offer a suite of educational materials tailored to meet the needs of traders at all levels. This chapter explores the significance of these resources and provides insights into evaluating the comprehensiveness and quality of the educational material provided by brokers.

The Role of Broker-Provided Education in a Trader’s Development

Foundation for Informed Trading

Broker-provided education equips traders with a solid understanding of forex market fundamentals, trading techniques, risk management, and the psychological aspects of trading. This foundational knowledge is critical for making informed decisions and developing effective trading strategies.

Continuous Learning

The forex market is dynamic, with constant changes in market conditions, regulations, and trading technologies. Ongoing education offered by brokers ensures that traders stay updated with the latest trends and tools, facilitating continuous improvement and adaptation.

Customized Learning Paths

The best forex brokers offer educational resources that cater to different levels of experience, from beginners to advanced traders. This personalized approach allows traders to progress at their own pace, focusing on areas that match their specific learning needs and trading goals.

Evaluating the Comprehensiveness and Quality of Educational Material

Breadth and Depth of Topics

A comprehensive education suite should cover a broad range of topics, from basic concepts of forex trading to advanced analysis and strategy development. It should also delve deep into each subject, providing detailed explanations and examples.

Practical Application

High-quality educational materials go beyond theoretical knowledge, offering practical applications and real-world examples. This includes live trading sessions, case studies, and simulated trading environments where traders can apply what they’ve learned.

Accessibility and Format

The best forex brokers offer educational materials in various formats, such as webinars, e-books, video tutorials, and interactive courses, ensuring accessibility for all types of learners. Additionally, these resources should be easily accessible, preferably directly through the trading platform or broker’s website.

Expertise of Instructors

The credibility and expertise of the individuals providing the education are crucial. Look for materials created by experienced traders, market analysts, or financial educators with a proven track record in forex trading.

Community and Support

Learning is often enhanced in a community setting where traders can share experiences and insights. Evaluate whether the broker offers forums, discussion groups, or mentorship programs as part of their educational offerings.

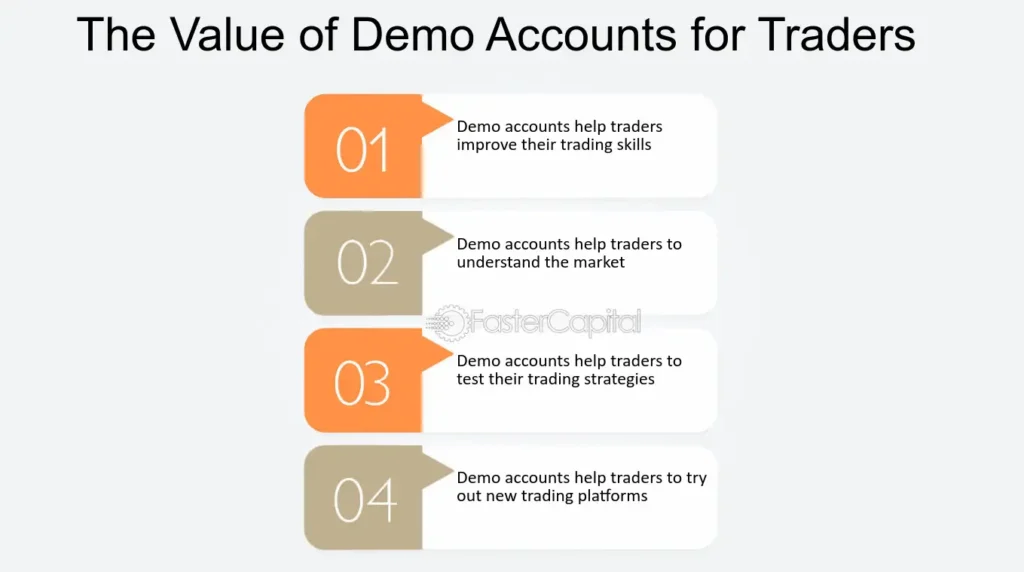

The Value of Demo Accounts in Forex Trading

Demo accounts in forex trading serve as an essential tool for beginners and experienced traders alike, offering a risk-free environment to refine trading strategies, understand market dynamics, and gain confidence before transitioning to real trading accounts. Provided by the best forex brokers, these accounts simulate real market conditions, using virtual money, thus providing invaluable experience without financial risk. This chapter discusses the benefits of using demo accounts and offers practical tips for making the successful transition from demo to real trading.

Benefits of Using Demo Accounts

Risk-Free Practice

Demo accounts allow traders to experiment with different strategies and learn how the forex market operates without the risk of losing real money. This risk-free environment is particularly beneficial for beginners who are not yet comfortable navigating the market.

Strategy Testing and Refinement

Even for more experienced traders, demo accounts offer the opportunity to test new strategies and refine existing ones against real market data. This can include exploring different currency pairs, experimenting with leverage, or practicing risk management techniques.

Familiarization with Trading Platforms

Demo accounts provide a platform for traders to become familiar with the tools and features of trading platforms offered by the best forex brokers. This familiarity can significantly reduce the learning curve when starting real trading.

Psychological Preparation

Trading with a demo account helps in understanding and managing the psychological aspects of trading, such as dealing with losses and the emotional discipline required for successful trading, without the stress of real financial stakes.

Tips for Transitioning from Demo to Real Trading Accounts

Set Realistic Goals

When practicing with a demo account, it’s crucial to set realistic goals and trade as if you were using real money. This includes following your trading plan, using appropriate lot sizes, and implementing risk management strategies.

Start Small

When you decide to transition to a real account, consider starting small. Use the minimum deposit option provided by your broker and trade smaller lot sizes. This will help you adjust to the emotional aspect of trading with real money while minimizing potential losses.

Use Risk Management

Apply the same risk management techniques you practiced in your demo account to your real trading. This includes setting stop-loss orders, managing leverage wisely, and not risking more than a small percentage of your account on a single trade.

Keep a Trading Journal

Maintain a trading journal when you transition to a real account, documenting your trades, strategies used, outcomes, and emotional reactions. This can be a valuable tool for self-assessment and for refining your trading strategy over time.

Be Patient and Continuously Learn

The transition from demo to real trading can be challenging. Be patient with yourself and recognize that making mistakes is part of the learning process. Continuously seek educational resources provided by the best forex brokers to enhance your knowledge and stay updated on market trends.

Making Your First Forex Trade for Best Forex Brokers

Entering the forex market and making your first trade is a significant milestone for any beginner trader. This step-by-step guide aims to navigate you through planning and executing your first forex trade with confidence. Additionally, it highlights common beginner errors and offers advice on how to avoid them, ensuring a smoother initiation into trading with the best forex brokers.

Step-by-Step Walkthrough

Step 1: Educate Yourself

Before making your first trade, invest time in understanding the forex market’s basics, including currency pairs, how trades are executed, and the factors that influence currency movements. Utilize the educational resources provided by the best forex brokers.

Step 2: Choose a Reputable Broker

Selecting one of the best forex brokers is crucial. Ensure they are regulated, offer a user-friendly trading platform, and provide access to quality educational and analytical resources.

Step 3: Open a Trading Account

After choosing a broker, you’ll need to open a trading account. Consider starting with a demo account to practice trading strategies without financial risk.

Step 4: Develop a Trading Plan

A trading plan should outline your trading goals, risk tolerance, strategy, and criteria for entering and exiting trades. Stick to your plan to maintain discipline.

Step 5: Analyze the Market

Use technical and fundamental analysis to identify potential trading opportunities. Technical analysis involves studying price charts and patterns, while fundamental analysis looks at economic indicators and news events.

Step 6: Choose a Currency Pair

Select a currency pair to trade. Beginners might consider starting with major pairs like EUR/USD or USD/JPY due to their liquidity and lower volatility.

Step 7: Decide on Your Position

Determine whether you want to buy (go long) or sell (go short) based on your market analysis. Consider the size of your trade, ensuring it aligns with your risk management strategy.

Step 8: Set Stop Loss and Take Profit Levels

To manage risk effectively, set stop loss and take profit levels. A stop loss limits potential losses, while a take profit level secures profits at a predetermined price.

Step 9: Execute Your Trade

Place your trade through your broker’s trading platform. Monitor the market and adjust your stop loss and take profit levels as needed.

Step 10: Review and Learn

After closing your trade, review the outcome and process. Analyze what worked, what didn’t, and how you can improve future trades.

Common Beginner Errors and How to Avoid Them for Best Forex Brokers

Overleveraging

Using excessive leverage can amplify losses. Manage leverage wisely, starting with lower levels until you gain more experience.

Neglecting Risk Management

Failing to implement risk management strategies, such as setting stop loss orders, can result in significant losses. Always use risk management tools provided by your broker.

Emotional Trading

Making trades based on emotions rather than analysis and planning is a common mistake. Stick to your trading plan and make decisions based on data and strategy.

Overtrading

Entering too many trades or trading with too much volume can deplete your account. Focus on quality trades rather than quantity.

Ignoring the News

Economic news and events can significantly impact currency markets. Stay informed about major economic indicators and news releases to make well-informed trades.

How to Choose the Best Forex Broker as a Beginner

Choosing the right forex broker is a critical decision that can significantly impact your trading journey. As a beginner, it’s essential to select a broker that not only provides a secure and transparent trading environment but also supports your learning and development as a trader. This guide outlines the criteria for evaluating and selecting the best forex brokers for beginners and recommends top brokers based on thorough reviews.

Criteria for Evaluating and Selecting a Broker

Regulatory Compliance

The foremost criterion is to ensure the broker is regulated by reputable financial authorities (e.g., CFTC, NFA, FCA). Regulation provides a layer of protection, ensuring the broker adheres to strict financial standards and ethical trading practices.

User-Friendly Trading Platform

A beginner-friendly trading platform should be intuitive, easy to navigate, and equipped with essential tools and resources for market analysis, order execution, and risk management. Demo accounts are a plus, offering a risk-free way to practice trading.

Educational Resources

Top brokers for beginners offer comprehensive educational materials, including tutorials, webinars, articles, and e-books, to help novices understand forex trading basics and develop effective trading strategies.

Customer Support

Accessible and responsive customer support is crucial for addressing any questions or issues you may encounter. Look for brokers that offer support through multiple channels (e.g., live chat, phone, email) and in various languages.

Account Types and Minimum Deposits for Best Forex Brokers

Brokers offering accounts with low minimum deposits and the option to trade micro-lots are ideal for beginners, allowing you to start trading with a smaller capital and manage risk effectively.

Fees and Spreads

Compare the brokers’ fee structures, focusing on spreads, commissions, and any additional costs (e.g., withdrawal fees, inactivity fees). Opt for brokers with competitive spreads and transparent fee policies.

Execution Speed and Reliability

Fast and reliable trade execution is essential to ensure your trades are filled at the best possible prices, especially in fast-moving markets. Test the broker’s platform to assess execution speed and reliability.

Top Recommended Forex Brokers for Beginners

1. eToro

eToro stands out for its user-friendly platform and social trading features, allowing beginners to copy trades of more experienced traders. It’s regulated by multiple financial authorities and offers a wealth of educational resources.

2. IG Markets

IG Markets offers a comprehensive trading package, including a robust trading platform, extensive market analysis tools, and a wide range of educational materials. It’s regulated by several top-tier authorities, making it a reliable choice for beginners.

3. XM

XM is known for its beginner-friendly approach, offering a low minimum deposit, micro-lot trading, and a rich selection of educational resources. Its customer service is excellent, and it operates under the regulation of reputable financial bodies.

4. Forex.com

Forex.com provides a powerful trading platform, competitive spreads, and a vast array of educational content tailored to new traders. It’s highly regulated and offers reliable trade execution.

5. Plus500

Plus500 offers a simple, intuitive platform ideal for beginners, with a risk management tool to set stop-losses easily. It’s regulated by top-tier financial authorities and provides a demo account for practice trading.

FAQs:

- What Is Forex Trading?

- Forex trading involves exchanging one currency for another, aiming to profit from changing exchange rates.

- Why Are Specific Brokers Better for Beginners?

- Beginners benefit from brokers offering comprehensive educational materials, supportive trading environments, and user-friendly platforms.

- How Do Forex Broker Fees Work?

- Brokers may charge through spreads, commissions, or both, affecting the overall cost of trading.

- What Regulatory Bodies Oversee Forex Brokers?

- Organizations like the CFTC, NFA, and FCA ensure brokers adhere to strict standards for trader safety and fair trading practices.

- Can I Start Forex Trading with a Small Deposit?

- Yes, many brokers cater to beginners with low initial deposit requirements and accounts designed for small trades.

- How Do I Open a Forex Trading Account?

- Choose a regulated broker, complete their application, verify your identity, and deposit funds to start trading.

- What Is the Importance of a Demo Account?

- Demo accounts allow beginners to practice trading in a risk-free environment, honing strategies without financial loss.

- What Features Should I Look for in a Forex Trading Platform?

- Platforms should offer real-time data, analytical tools, educational resources, and be easy to navigate for beginners.

- How to Verify a Forex Broker’s Reliability?

- Check their regulatory status, read trader reviews, and assess their trading conditions and customer support.

- When Should I Switch from a Demo to a Real Account?

- Transition when you feel confident in your trading strategy, understand the risks, and are ready to manage real funds.