Contract for Difference (CFD) trading is a popular form of derivative trading that allows investors to speculate on the rising or falling prices of fast-moving global financial markets or instruments, such as shares, indices, commodities, currencies, and treasuries. Unlike traditional trading, CFD trading doesn’t involve owning the underlying asset, offering a flexible and leveraged way to trade. This chapter introduces CFD trading for beginners, emphasizing the importance of selecting the best CFD brokers to navigate the complexities of the market effectively.

What Are CFDs and How Does CFD Trading Work?

CFDs are agreements to exchange the difference in the price of an asset from the point the contract is opened to when it is closed. Here’s how CFD trading works:

- Directional Trades: Traders can speculate on price movements in either direction. If you anticipate that the price of an asset will rise, you can open a ‘buy’ position (going long); if you expect it to fall, you opt for a ‘sell’ position (going short).

- Leverage: CFD trading is often leveraged, meaning you only need to deposit a small percentage of the total trade value to open a position. While leverage can magnify profits, it also significantly increases the risk of losses.

- Margins: Trading on margin involves two key concepts – the initial margin (the amount required to open a position) and the maintenance margin (the amount needed to keep a position open). Margin requirements vary across brokers and assets.

The Importance of Selecting the Best CFD Brokers Trading

Choosing the right CFD broker is crucial for several reasons:

Access to Markets

The best CFD brokers offer access to a wide range of global markets, enabling traders to diversify their portfolios across different asset classes.

Trading Platforms and Tools for Best CFD Brokers

A user-friendly trading platform equipped with advanced charting tools, technical indicators, and risk management features is essential for making informed trading decisions. Many top brokers also provide platforms that support automated trading strategies.

Educational Resources and Support

For beginners, comprehensive educational materials (tutorials, webinars, e-books) and responsive customer support can significantly enhance the learning curve and improve trading outcomes.

Regulation and Security

Trading with a regulated broker ensures that you are protected by financial laws and regulations. Regulated brokers adhere to strict standards regarding client fund protection, privacy, and fair trading practices.

Costs and Fees

Understanding the fee structure, including spreads, commissions, and overnight financing charges (swap rates), is vital. Competitive pricing and transparency are hallmarks of the best CFD brokers.

Key Features of the Best CFD Brokers for Beginners

For beginners stepping into the world of CFD trading, selecting a broker that provides a supportive and educative trading environment is crucial. The best CFD brokers for beginners distinguish themselves by offering features and services that cater specifically to the needs of novice traders, ensuring a smoother entry into the market. This chapter highlights the key features to look for in CFD brokers, helping beginners make informed choices.

Educational Resources

Comprehensive Learning Materials

The best CFD brokers offer an extensive range of educational resources tailored to beginners. This includes tutorials, articles, e-books, webinars, and video courses covering CFD trading basics, market analysis techniques, and risk management principles.

Demo Accounts

Demo accounts are invaluable for beginners, allowing them to practice trading strategies, get familiar with the trading platform, and understand market dynamics without risking real money. Look for brokers that offer unlimited access to demo accounts.

User-Friendly Trading Platform for Best CFD Brokers

Intuitive Interface

A beginner-friendly trading platform should have an intuitive interface, making it easy for novices to navigate, execute trades, and access market analysis tools without feeling overwhelmed.

Technical and Analytical Tools

While simplicity is key, the platform should also offer a range of technical and analytical tools. This includes charting software, technical indicators, and economic calendars, enabling beginners to make informed trading decisions.

Mobile Trading

In today’s fast-paced world, the ability to trade on the go is essential. The best CFD brokers provide mobile trading apps that offer full functionality, allowing beginners to monitor their positions and execute trades anytime, anywhere.

Customer Support

Responsive and Knowledgeable Support

Excellent customer support is critical, especially for beginners who may need guidance. The best CFD brokers offer responsive, multilingual customer service through live chat, email, and phone, ensuring that help is readily available.

Regulation and Security for Best CFD Brokers

Regulatory Compliance

Trading with a regulated broker ensures protection under financial laws and standards. Beginners should look for brokers regulated by reputable organizations like the FCA, ASIC, or CySEC, which enforce strict compliance and operational standards.

Secure Trading Environment

Data security and the protection of funds are paramount. The best CFD brokers employ advanced security measures, such as SSL encryption and two-factor authentication (2FA), and adhere to policies like segregated client funds.

Account Features

Low Minimum Deposits

Brokers that offer low minimum deposit requirements make it easier for beginners to start trading without committing a large amount of capital initially.

Competitive Spreads and Fees

Understanding the cost of trading is vital. Look for brokers that offer competitive spreads and transparent fee structures, including clear information on overnight financing charges and any commission fees.

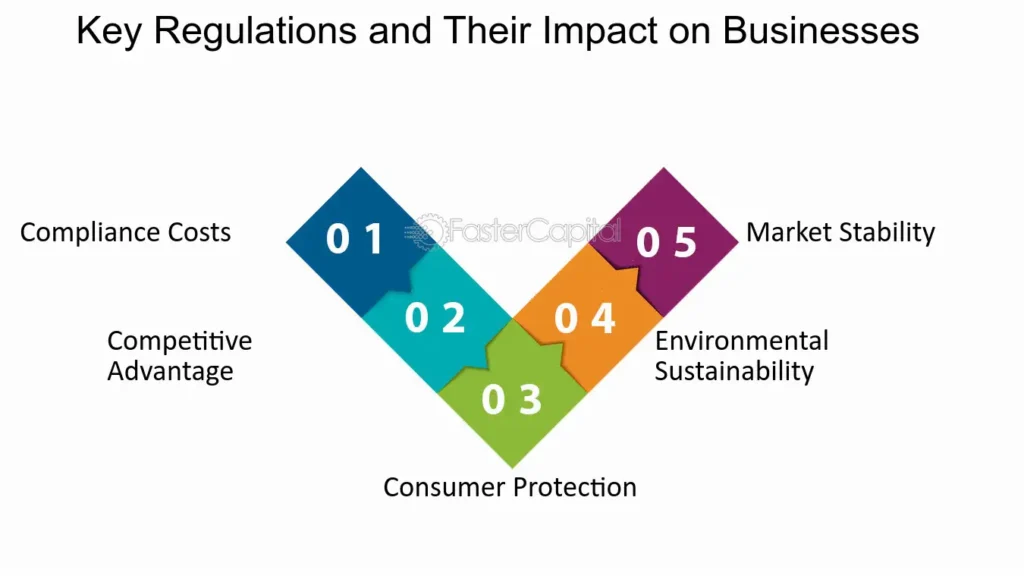

Regulatory Framework for Best CFD Brokers

Navigating the complex world of CFD trading requires not only a good understanding of market dynamics but also a keen awareness of the regulatory framework that governs CFD brokers. This framework plays a pivotal role in ensuring the reliability of brokers and the security of traders. Regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) are at the forefront of establishing and enforcing regulations that govern the operation of the best CFD brokers. This chapter delves into the significance of these regulatory bodies and their impact on the trading experience.

The Role of Regulatory Bodies

Ensuring Broker Reliability

Regulatory bodies enforce strict standards that CFD brokers must adhere to, ensuring they operate with transparency, fairness, and integrity. These standards cover a wide range of practices, from financial reporting and client fund segregation to risk management policies. By complying with these regulations, brokers demonstrate their commitment to upholding the highest levels of professionalism and reliability.

Protecting Trader Security

One of the primary roles of regulatory authorities is to protect the interests and security of traders. This includes implementing policies that ensure the safety of client funds, such as requiring brokers to keep client money in segregated bank accounts, separate from the broker’s operational funds. Such measures protect traders’ capital in the event of the broker’s insolvency.

Establishing a Secure Trading Environment

Regulatory bodies also mandate the use of secure trading platforms and data encryption technologies to safeguard traders’ personal and financial information. This creates a secure trading environment where traders can focus on their trading activities without concerns about data breaches or fraud.

Key Regulatory Authorities and Their Impact

Cyprus Securities and Exchange Commission (CySEC)

CySEC regulates many CFD brokers, especially those based in Europe. It ensures compliance with the European Union’s financial regulations, providing a framework for secure and transparent trading activities.

Financial Conduct Authority (FCA)

The FCA is known for its stringent regulatory standards, including robust consumer protection measures and the oversight of financial products and services in the UK. Brokers regulated by the FCA are considered among the most reliable in the industry.

Australian Securities and Investments Commission (ASIC)

ASIC regulates financial services and securities markets in Australia, focusing on investor protection, market integrity, and fairness. ASIC-regulated brokers are required to meet high operational standards, contributing to their reputation as trustworthy trading partners.

Choosing the Best CFD Brokers Account Type

For those new to CFD trading, selecting the appropriate account type is a critical decision that can significantly influence your trading experience and success. CFD brokers typically offer a variety of account types, each with its own set of features, benefits, and limitations, catering to the diverse needs of traders. This chapter provides an overview of the different CFD account types and offers guidance on choosing the best one for beginners, with a focus on the offerings of the best CFD brokers.

Overview of CFD Account Types

Standard Accounts

Standard accounts are the most common type offered by CFD brokers. They usually provide access to all trading instruments, platforms, and tools provided by the broker. This account type is suitable for traders with a moderate level of experience and capital, offering a balance between functionality and cost.

Demo Accounts

Demo accounts are designed for beginners and those looking to test trading strategies without risking real money. These accounts simulate real market conditions, using virtual funds, allowing traders to gain experience and confidence before moving to live trading.

Micro Accounts

Micro accounts allow trading in smaller contract sizes, often one-tenth the size of standard lots. This account type is ideal for beginners with limited capital, as it reduces financial exposure while offering real trading experience.

ECN Accounts

Electronic Communication Network (ECN) accounts provide direct access to other participants in currency markets. ECN accounts are known for their transparency and tighter spreads but may come with higher commissions and minimum trade sizes. They are more suited to experienced traders.

Islamic Accounts

Islamic accounts, also known as swap-free accounts, comply with Sharia law, meaning they do not incur or receive swap or interest rates on overnight positions, making them suitable for Muslim traders.

Choosing the Best Account Type for Beginners for Best CFD Brokers

When selecting a CFD account as a beginner, consider the following factors to ensure it meets your trading needs and goals:

Educational Resources and Support

The best CFD brokers offer comprehensive educational materials and dedicated support to help beginners navigate the complexities of CFD trading. Look for brokers that provide tutorials, webinars, and one-on-one coaching.

Minimum Deposit Requirements

Consider the minimum deposit required to open an account. Beginners may prefer brokers that offer low or no minimum deposit requirements for starting small and gradually increasing their investment as they gain confidence.

Trading Costs

Understand the cost structure associated with each account type, including spreads, commissions, and any other fees. Beginners may benefit from accounts with lower costs to minimize the impact on their trading capital.

Leverage and Margin Requirements

Leverage can magnify both profits and losses. Beginners should exercise caution with leverage and opt for accounts that offer adjustable leverage settings to manage risk effectively.

Demo Account Availability

Before committing to a live account, beginners should practice with a demo account to familiarize themselves with the trading platform and test their trading strategies in a risk-free environment.

Fees and Costs Associated with CFD Trading

Understanding the fees and costs associated with CFD trading is crucial for every trader, especially beginners, to manage and minimize expenses effectively. Trading costs can significantly impact your profitability, and being aware of them helps in making informed trading decisions. This chapter provides a detailed explanation of the various fees you might encounter, including spreads, commissions, and overnight fees, and offers tips on how to manage and minimize these trading costs while working with the best CFD brokers.

Understanding Trading Costs

Spreads

The spread is the difference between the buy (ask) and sell (bid) prices quoted for a CFD instrument. It represents the broker’s fee for executing the trade and is one of the most common costs traders face. Spreads can be fixed or variable:

- Fixed Spreads remain constant regardless of market conditions.

- Variable Spreads fluctuate based on the liquidity and volatility of the underlying asset.

Commissions

Some CFD brokers charge a commission on trades in addition to, or instead of, spreads. Commissions are usually a fixed fee per trade or a percentage of the trade’s volume. This fee structure is more common for shares CFDs, where the broker might charge a fixed rate per share or a percentage of the total trade value.

Overnight Fees (Swap Rates)

Holding a CFD position open overnight incurs a fee known as the overnight fee or swap rate. This fee compensates for the cost of the leverage that you use over the night. The rate can be either positive or negative, depending on the direction of your trade and the differential interest rate between the two currencies involved in a forex pair.

Tips for Managing and Minimizing Trading Costs

Choose the Right Broker

Selecting one of the best CFD brokers that offers competitive spreads and low commission rates is essential. Compare the fee structures of different brokers and consider how they align with your trading style and frequency.

Understand the Cost Structure

Before opening an account, fully understand all the potential costs you may incur, including spreads, commissions, and overnight fees. Transparency from your broker regarding their fee structure is crucial.

Consider Your Trading Strategy

Your trading strategy can significantly affect the costs you incur. For example, a strategy that involves holding positions open overnight will result in more swap fees. On the other hand, a high-frequency trading strategy might rack up considerable costs in spreads and commissions.

Monitor Overnight Positions

Be mindful of the impact of overnight fees on your trades, especially if you plan to hold positions for several days. Consider closing positions before the end of the trading day if the anticipated profits don’t justify the swap fees.

Utilize Limit and Stop Orders

Using limit and stop orders can help control your entry and exit points, potentially reducing the costs of spreads in fast-moving markets. Effective use of these orders can also help in risk management.

Review Your Trading Performance

Regularly review your trading performance, including the costs associated with your trades. This analysis can help identify areas where you can reduce expenses or adjust your strategy to improve profitability.

Navigating CFD Trading Platforms and Tools

For individuals engaged in CFD trading, choosing the right trading platform is a crucial decision that can significantly impact their trading efficiency and overall experience. The best CFD brokers offer platforms equipped with a range of tools and indicators essential for making informed trading decisions. This chapter provides a comparison of popular trading platforms suitable for CFD trading and highlights the essential tools and indicators necessary for effective CFD trading.

Comparison of Popular Trading Platforms

MetaTrader 4 (MT4)

Widely recognized for its reliability and comprehensive analytical tools, MT4 remains a top choice for CFD traders. It offers advanced charting capabilities, numerous technical indicators, and supports automated trading through Expert Advisors (EAs).

- Pros: User-friendly interface, robust security features, and extensive community support.

- Cons: Primarily focused on forex trading, which might limit its functionality for trading other asset classes.

MetaTrader 5 (MT5)

As the successor to MT4, MT5 caters to traders looking for access to a wider range of financial markets, including stocks, commodities, and cryptocurrencies, in addition to forex. It features advanced charting tools, more technical indicators, and improved back-testing capabilities.

- Pros: Enhanced trading functions, built-in economic calendar, and supports more order types.

- Cons: Slightly more complex interface compared to MT4, which may require a steeper learning curve for beginners.

cTrader

cTrader is known for its intuitive interface and transparent pricing structure. It offers advanced charting tools, level II pricing, and detailed order execution statistics, making it suitable for both novice and experienced traders.

- Pros: Sleek and modern interface, direct market access, and advanced order protection options.

- Cons: Less widespread than MetaTrader platforms, potentially offering fewer community resources.

Essential Tools and Indicators for Effective CFD Trading

Technical Analysis Tools

- Charting Tools: Real-time charts are vital for monitoring market movements and identifying trends. Look for platforms that offer customizable charting options.

- Technical Indicators: Indicators such as Moving Averages, Bollinger Bands, MACD, and RSI help in analyzing market trends and making predictions based on historical price data.

Fundamental Analysis Tools

- Economic Calendars: Keep track of economic announcements and news events that can impact market prices.

- Market News and Analysis: Access to up-to-date market news and expert analyses can inform your trading decisions.

Risk Management Tools

- Stop Loss/Take Profit Orders: These tools allow you to set predefined levels for closing positions, helping manage risk and protect profits.

- Leverage and Margin Controls: Understanding and controlling leverage and margin requirements are crucial for managing the risk associated with CFD trading.

Tips for Managing and Minimizing Trading Costs

- Understand the Fee Structure: Be aware of the spreads, commissions, and overnight fees charged by your broker.

- Use Tight Spreads: Opt for brokers offering tight spreads to reduce transaction costs, especially if you trade frequently.

- Monitor Overnight Fees: Keep track of overnight (swap) fees if you hold positions open overnight, as these can accumulate over time.

- Plan Your Trades: Use analysis tools and indicators to plan your trades strategically, minimizing unnecessary transactions that can increase costs.

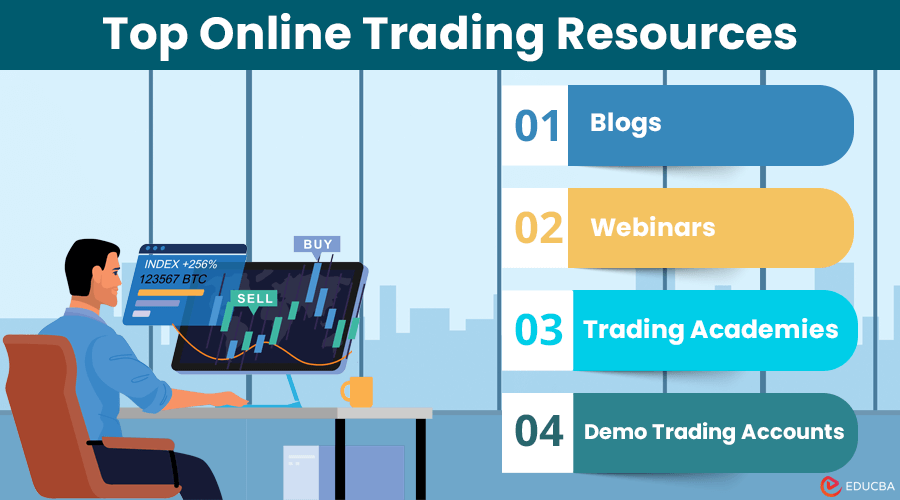

Educational Resources for CFD Trading Novices

Entering the world of CFD trading can be a daunting endeavor for novices. The complex nature of contracts for difference (CFDs) necessitates a solid foundation in both the theoretical and practical aspects of trading. Recognizing this, the best CFD brokers provide comprehensive educational materials tailored to assist beginners in navigating the markets confidently. This chapter emphasizes the importance of these resources and offers guidance on assessing the quality of a broker’s training materials, ensuring novices can partner with brokers that genuinely support their learning journey.

The Importance of Comprehensive Educational Materials in Learning CFD Trading

Educational resources play a crucial role in demystifying the intricacies of CFD trading for beginners. These materials not only impart essential knowledge about how CFDs work but also cover market analysis, trading strategies, risk management, and the psychological aspects of trading. By offering a structured learning path, the best CFD brokers empower novices to build a strong trading foundation, enhancing their ability to make informed decisions and manage risks effectively.

Building Knowledge and Confidence

Quality educational content helps beginners understand the mechanics of CFD trading and the financial markets at large. This knowledge builds the confidence required to execute trades and navigate periods of volatility.

Accelerating the Learning Curve

With access to well-structured educational materials, novices can accelerate their learning curve, quickly moving from basic concepts to more advanced trading strategies. This progression is vital for adapting to the dynamic nature of the markets.

Promoting Independent Trading

The ultimate goal of broker-provided education is to equip traders with the skills and knowledge needed to trade independently. Comprehensive training resources enable novices to develop their trading style and strategies, fostering long-term success.

Assessing the Quality of a Broker’s Training Resources

Breadth and Depth of Content

The best CFD brokers offer a wide range of topics in their educational libraries, addressing the needs of both beginners and more experienced traders. Look for content that covers CFD trading fundamentals, advanced analysis techniques, trading psychology, and risk management.

Accessibility and Format

High-quality training materials should be accessible and available in various formats to accommodate different learning styles. This can include articles, ebooks, video tutorials, webinars, and interactive courses. Accessibility also means that resources are easy to navigate and available directly through the broker’s platform or website.

Practical Application

Theoretical knowledge is crucial, but practical application cements learning. Evaluate whether the broker offers demo accounts for practice trading, live trading sessions, case studies, and exercises that allow you to apply what you’ve learned in a simulated or real trading environment.

Expertise and Credibility of Instructors

Consider the expertise and credibility of the individuals providing the educational content. Ideally, training should be conducted by experienced traders, market analysts, or financial educators with a proven track record in CFD trading.

Community Support and Interaction

Learning within a community or having access to expert support can significantly enhance the educational experience. Check if the broker facilitates forums, discussion groups, or mentorship programs where novices can ask questions, share experiences, and gain insights from more experienced traders.

The Value of Demo Accounts in CFD Trading

Demo accounts play a crucial role in the world of CFD trading, particularly for beginners. These accounts, offered by the best CFD brokers, provide a risk-free environment where novices can gain practical experience, test strategies, and learn the intricacies of CFD markets without the pressure of risking real capital. This chapter explores the advantages of utilizing demo accounts for practice before transitioning to real trading and offers guidelines for leveraging these tools to develop effective trading strategies.

Advantages of Practicing with Demo Accounts

Risk-Free Learning Environment

Demo accounts offer a unique opportunity for beginners to familiarize themselves with the trading platform, understand market movements, and practice placing orders without the risk of losing money. This environment encourages experimentation and learning from mistakes, which is invaluable for building confidence.

Strategy Testing and Refinement

One of the key benefits of demo accounts is the ability to test various trading strategies in real-time market conditions. Traders can experiment with different approaches to find what works best for them, refine their strategies, and understand how different factors affect their trades.

Understanding Market Dynamics

Practicing with a demo account allows beginners to observe market dynamics, including volatility and trends, and learn how economic events and news releases impact market movements. This knowledge is crucial for making informed trading decisions.

Familiarization with Trading Platforms and Tools

Demo accounts give traders the chance to explore and master the features and tools of a trading platform provided by the best CFD brokers. This includes learning how to use charts, indicators, and other analytical tools that are essential for effective CFD trading.

Guidelines for Using Demo Trading to Develop Effective Strategies

Treat the Demo Account as a Real Account

To maximize the benefits of a demo account, treat the virtual capital as if it were real money. This approach helps in cultivating discipline and a realistic perspective on risk management, which are critical for successful trading.

Set Clear Objectives

Define what you aim to achieve with your demo trading experience, whether it’s testing a specific strategy, getting accustomed to the trading platform, or understanding how to analyze the market. Clear objectives guide your learning process and help in evaluating your progress.

Keep a Trading Journal

Documenting your demo trades, including the rationale behind each trade, the outcomes, and any lessons learned, can provide deep insights into your trading habits and strategy effectiveness. A trading journal is a valuable tool for continuous improvement.

Limit the Time Spent on Demo Trading

While demo accounts are beneficial, spending too much time in demo mode can lead to a disconnect from the realities of real trading, particularly the emotional aspects of managing real money. Set a timeline for transitioning to a live account based on your confidence and competence levels.

Use Realistic Trade Sizes

Practice with trade sizes that you would realistically use in live trading. This helps in understanding the impact of trade size on profit and loss, margin requirements, and risk management.

Executing Your First CFD Trade

Taking the step to execute your first CFD trade is a significant milestone in your trading journey. This comprehensive guide is designed to walk you through the process, including essential risk management tips. Additionally, we’ll highlight common pitfalls beginners encounter and offer advice on how to avoid them, ensuring a smoother experience with the best CFD brokers.

Step-by-Step Guide to Your First Trade

Step 1: Choose a Reputable Broker

Begin by selecting one of the best CFD brokers, ensuring they are regulated, offer a user-friendly trading platform, and provide adequate educational resources.

Step 2: Educate Yourself

Utilize the educational materials provided by your broker to understand the basics of CFD trading, including how leverage works and the factors influencing CFD prices.

Step 3: Practice with a Demo Account

Before committing real capital, use a demo account to familiarize yourself with the trading platform and practice executing trades. This risk-free environment is invaluable for testing strategies and building confidence.

Step 4: Develop a Trading Plan

A solid trading plan should outline your trading goals, risk tolerance, criteria for entering and exiting trades, and how you’ll manage risk. Stick to your plan to maintain discipline.

Step 5: Start Small

When you’re ready to transition to a live account, start with a small investment. This approach allows you to get a feel for the market’s dynamics without exposing significant capital to risk.

Step 6: Analyze the Market

Use the tools and indicators provided by your broker to analyze potential trades. Consider both technical analysis, such as price charts and indicators, and fundamental analysis, including economic news and events.

Step 7: Place Your First Trade

Decide on the asset you wish to trade, determine whether you expect its price to rise (go long) or fall (go short), and place your trade. Remember to set stop-loss and take-profit orders to manage risk effectively.

Step 8: Monitor and Review

After placing your trade, monitor the market and adjust your positions as necessary. Review completed trades to learn from your successes and mistakes.

Risk Management Tips

- Use Stop-Loss Orders: Automatically close out a position at a predetermined price to limit potential losses.

- Manage Leverage Wisely: While leverage can magnify gains, it can also amplify losses. Use leverage cautiously, especially as a beginner.

- Diversify: Spread your risk by trading different assets rather than concentrating on a single market.

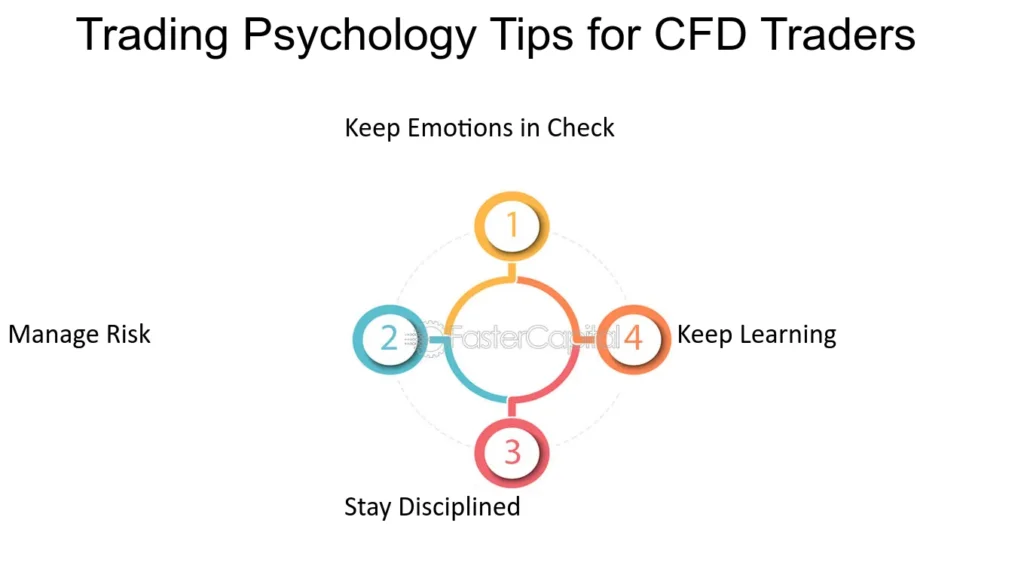

Common Pitfalls and How to Avoid Them

Overtrading

Avoid the temptation to trade too frequently or with too much volume. Overtrading can lead to significant losses and higher transaction costs.

Emotional Trading

Emotions like fear and greed can lead to impulsive decisions. Stick to your trading plan and make decisions based on analysis, not emotion.

Neglecting Risk Management

Failing to implement effective risk management strategies is a common mistake. Always be aware of how much you’re risking on a trade and use tools like stop-loss orders to protect your investment.

Lack of Education

Underestimating the importance of ongoing education can hinder your success. Take advantage of the resources provided by the best CFD brokers to continually improve your knowledge and skills.

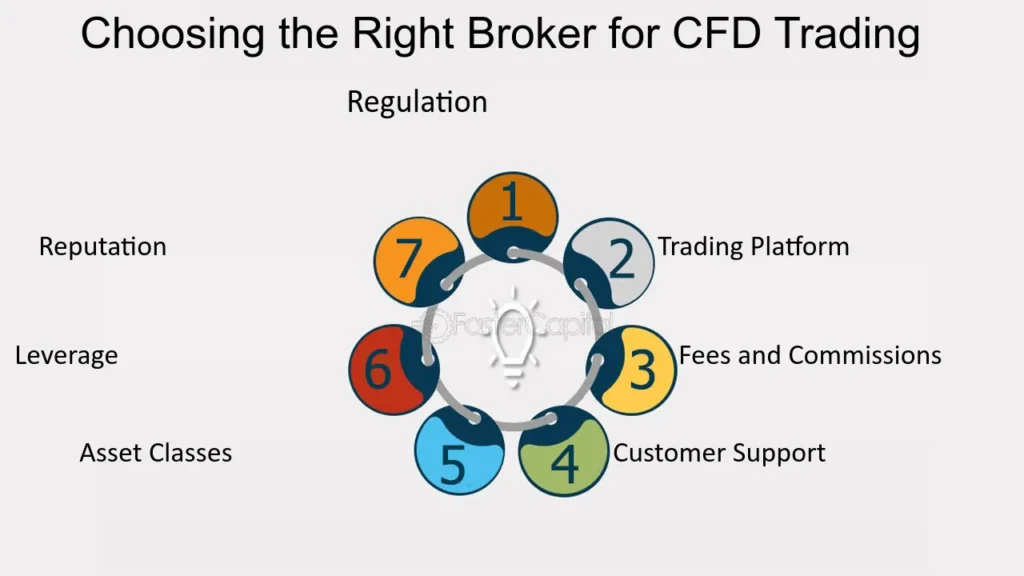

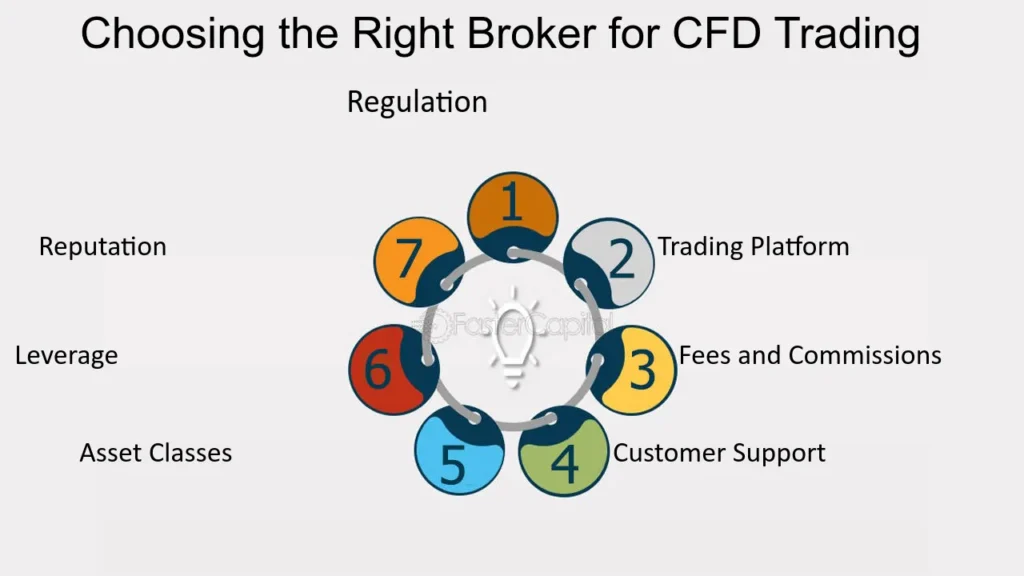

How to Choose Your First CFD Broker

Selecting the right CFD broker is a pivotal step in your trading journey, especially for beginners entering the market. A good broker can provide the tools, resources, and support necessary for a positive trading experience. This guide offers a checklist for evaluating and selecting a CFD broker and includes recommendations for beginner-friendly CFD brokers, based on in-depth reviews, all aimed at helping you find the best CFD brokers to meet your needs.

Checklist for Evaluating a CFD Broker

Regulatory Compliance

Ensure the broker is regulated by reputable authorities like the FCA, CySEC, or ASIC. Regulation is a hallmark of reliability and trader security, ensuring brokers adhere to strict financial standards and practices.

User-Friendly Trading Platform

The trading platform is your gateway to the markets. Look for platforms that are intuitive, stable, and equipped with essential tools for analysis and trade execution. Platforms like MetaTrader 4/5 are popular and widely respected.

Educational Resources and Support

For beginners, comprehensive educational materials are vital. The best CFD brokers offer a range of resources, including tutorials, webinars, and articles, to help you understand CFD trading. Equally important is responsive customer support, available through multiple channels.

Account Types and Minimum Deposits

Beginners should look for brokers offering accounts that don’t require large initial deposits and allow trading in small sizes. This makes it easier to start trading with lower risk.

Fees and Spreads

Compare the broker’s fee structure, focusing on spreads, commissions, and any other charges such as overnight fees. Lower costs can significantly impact your trading profitability, especially when starting.

Demo Account Availability

A demo account allows you to practice trading strategies and get familiar with the platform without risking real money. Ensure the broker offers a demo account with realistic market conditions.

Additional Features

Consider other features like social trading platforms, which allow you to copy trades of experienced traders, and risk management tools, which are crucial for controlling losses.

Recommendations for Beginner-Friendly CFD Brokers

eToro

eToro is renowned for its user-friendly platform and strong emphasis on community trading. It’s regulated by multiple financial authorities and offers an innovative copy trading feature, ideal for beginners looking to learn from experienced traders.

Plus500

Plus500 offers a straightforward, intuitive trading platform with a wide range of CFD products. It’s well-regulated and provides a free demo account, making it a good choice for novices.

IG Markets

IG Markets stands out for its comprehensive educational resources and support. With regulation from top-tier authorities and a customizable trading platform, it caters well to beginner traders.

XM

XM is known for its low minimum deposit requirements and a broad selection of educational materials. It offers MT4 and MT5 platforms and is regulated by several financial authorities.

CMC Markets

CMC Markets offers an advanced trading platform with superior charting tools and over 10,000 CFD instruments. Its detailed educational content and competitive spreads make it suitable for beginners.

FAQs:

- What Is CFD Trading?

- CFD trading allows investors to speculate on the price movement of financial assets (like stocks, commodities, and currencies) without owning the underlying asset.

- Why Is Choosing the Right CFD Broker Important for Beginners?

- The right broker provides educational resources, user-friendly trading tools, and customer support crucial for navigating CFD trading.

- What Fees Are Involved in CFD Trading?

- Traders may encounter spreads, commission fees, and overnight (swap) fees, which vary by broker.

- What Should I Know About CFD Trading Regulations?

- Regulation ensures brokers adhere to fair practices. Look for brokers regulated by reputable bodies like the FCA or ASIC.

- Can Beginners Trade CFDs with a Small Initial Investment?

- Yes, many CFD brokers offer accounts with low minimum deposits, though it’s vital to understand the risks involved in leveraged trading.

- How Do I Open a CFD Trading Account?

- Select a regulated CFD broker, fill out the application form, provide required documentation, and deposit funds to start trading.

- Why Are Demo Accounts Important in CFD Trading?

- Demo accounts offer a risk-free way to learn the platform’s features and test trading strategies without using real money.

- What Features Are Important in CFD Trading Platforms?

- Look for platforms with real-time data, analytical tools, educational materials, and customer support geared towards beginners.

- How Can I Assess a CFD Broker’s Trustworthiness?

- Verify their regulatory status, review customer feedback, and evaluate their trading conditions and support services.

- When Should I Move from Demo Trading to Real CFD Trading?

- Transition to real trading once you’re comfortable with your trading strategy, the platform, and understanding the risks associated with CFD trading.