AvaTrade, a leading online brokerage, excels in offering dynamic Forex and CFD trading experiences through its diverse Avatrade Account Types Avatrade Maximum Leverage options. This introduction delves into AvaTrade’s commitment to delivering a secure, user-friendly, and comprehensive platform. It caters to traders at all levels, emphasizing the importance of choosing the right AvaTrade Account Types & Max Leverage for optimal trading strategies. Understanding leverage—its advantages and risks—is crucial in the trading domain. AvaTrade stands as a prime example of leveraging expertise to empower traders, ensuring they have the tools and knowledge to navigate Forex and CFD markets effectively. With AvaTrade, selecting the ideal account type, understanding leverage, and trading Forex & CFDs become streamlined, offering a tailored trading journey.

AvaTrade: A Premier Forex and CFD Broker

Founded in 2006, AvaTrade has established itself as a leader in the online trading sector, offering access to a wide range of markets, including Forex, stocks, commodities, indices, and cryptocurrencies. Regulated in multiple jurisdictions, AvaTrade ensures a high level of security and transparency, providing traders with peace of mind. The broker offers various trading platforms, such as MetaTrader 4/5, AvaTradeGo, and a WebTrader, alongside innovative trading tools and resources designed to enhance the trading experience.

Understanding Leverage in Trading

Basic Concepts

Leverage is a powerful tool in trading that allows investors to gain a larger exposure to the market with a relatively small initial capital, referred to as margin. For example, with a leverage ratio of 100:1, you can control a $100,000 position with just $1,000.

Benefits

- Capital Efficiency: Leverage enables traders to make significant trades without tying up large amounts of capital, optimizing the efficiency of their trading strategy.

- Enhanced Profits: It amplifies potential profits, as traders can control a much larger position than their actual investment would allow.

Risks

- Amplified Losses: Just as leverage can magnify profits, it also amplifies potential losses, which can exceed the initial investment.

- Margin Calls: If the market moves against the leveraged position, traders may face a margin call, requiring additional funds to keep the position open.

The Importance of Choosing the Right Avatrade Account Types Avatrade Maximum Leverage

Selecting an appropriate account type is crucial when engaging in leverage trading. AvaTrade offers various account types, each tailored to different levels of trading experience and risk tolerance:

- Retail Accounts provide access to leverage trading with built-in protective measures like lower leverage limits and negative balance protection, catering to traders seeking a balance between opportunity and risk management.

- Professional Accounts offer higher leverage options for qualified traders who demonstrate sufficient trading experience and financial soundness, acknowledging their ability to assume and manage greater risks.

- Demo Accounts allow beginners to practice leverage trading in a risk-free environment, using virtual funds to understand the dynamics of leveraged positions without the financial risk.

Key Considerations

- Experience and Risk Tolerance: Your level of trading experience and risk tolerance are critical factors in choosing the right account. More experienced traders with a high-risk tolerance may opt for professional accounts, while beginners might start with a retail or demo account.

- Regulatory Protections: Retail accounts come with certain regulatory protections not available to professional accounts, such as lower leverage caps and negative balance protection, which are important safety nets for less experienced traders.

- Educational Resources: Leveraging AvaTrade’s comprehensive educational resources can help traders make informed decisions, understanding both the opportunities and risks of leverage trading.

Understanding Avatrade Account Types Avatrade Maximum Leverage

Avatrade Account Types Avatrade Maximum Leverage offers a diverse array of account types to accommodate the varied needs, preferences, and trading goals of its global clientele. From Retail and Professional accounts to specialized Islamic accounts and risk-free Demo accounts, each category is designed with specific features and eligibility criteria, particularly regarding leverage options. Let’s delve into the details of each account type, highlighting their unique characteristics and how they cater to different traders.

Retail Account

Description and Features

Retail accounts are designed for the general trading populace, providing access to a wide range of trading instruments and platforms. These accounts come with certain protective measures, like leverage caps and negative balance protection, making them suitable for beginners or those with a moderate risk appetite.

Eligibility Criteria

- Available to all individual traders who do not meet the criteria for a Professional account.

- No specific financial thresholds required.

Leverage Options

- Regulatory restrictions limit the maximum leverage for Retail accounts, often up to 30:1 for major currency pairs, to protect less experienced traders from the risks of high leverage.

Professional Account

Description and Features

Professional accounts offer higher leverage and fewer restrictions but require traders to forego some of the protective measures available to Retail accounts. They are suited for experienced traders with significant trading capital and a thorough understanding of leverage risks.

Eligibility Criteria

- Demonstrable experience in the financial trading sector.

- A sizable trading portfolio – typically, evidence of substantial transactions over the past year.

- Financial robustness, often defined by a portfolio exceeding a specific value (e.g., €500,000).

Leverage Options

- Offers significantly higher leverage than Retail accounts, which can exceed 400:1 for certain instruments, providing experienced traders with the opportunity to open larger positions.

Islamic Account

Description and Features

Islamic accounts, or swap-free accounts, are designed to comply with Sharia law by eliminating overnight swap rates. They offer a solution for traders who wish to participate in trading activities without accruing interest.

Eligibility Criteria

- Available to traders of the Islamic faith.

- Requires submission of a request to convert a standard account into an Islamic account, subject to AvaTrade’s approval.

Leverage Options

- Leverage options are similar to those available in Retail accounts but without the accrual of swap or interest, adhering to Islamic finance principles.

Demo Account

Description and Features

Demo accounts offer a simulated trading environment with virtual funds, allowing beginners to practice trading strategies, platform navigation, and understanding market movements without any financial risk.

Eligibility Criteria

- Available to all users without any prerequisites.

- Ideal for new traders or experienced traders looking to test new strategies.

Leverage Options

- Provides a simulated environment for practicing with leverage, mirroring the leverage options of Retail accounts but without real financial implications.

Choosing the Right Account Type

Selecting the appropriate AvaTrade account hinges on several factors, including your trading experience, risk tolerance, and compliance with religious principles. It’s crucial to assess how the leverage options associated with each account type align with your trading strategies and goals. Retail accounts offer a balanced approach with regulatory protections, Professional accounts cater to experienced traders seeking higher leverage, Islamic accounts provide swap-free trading in line with Sharia law, and Demo accounts serve as a practical learning platform. Understanding the distinctions between these accounts ensures that traders can make informed decisions, optimizing their trading experience while managing risk effectively.

Exploring Avatrade Account Types Avatrade Maximum Leverage

Leverage is a pivotal tool in trading, enabling traders to amplify their exposure to the financial markets with a relatively small amount of invested capital. Maximum leverage refers to the highest leverage ratio a broker like AvaTrade offers to its clients, allowing them to control large positions with a minimal initial deposit. Understanding how maximum leverage is applied at AvaTrade, its variation across different financial instruments, and the contrast in leverage options between Retail and Professional accounts can significantly influence trading strategies and risk management.

Application of Maximum Leverage at AvaTrade

At AvaTrade, leverage is applied based on the financial instrument being traded, the type of account held by the trader, and regulatory requirements in the trader’s jurisdiction. Maximum leverage allows traders to maximize their trading potential, but it also increases the risk of losses, making it essential to use leverage wisely and understand its implications fully.

Differences in Maximum Leverage Across Financial Instruments

Forex

Forex trading often comes with the highest leverage due to the forex market’s liquidity and lower volatility compared to other markets. AvaTrade might offer leverage up to 30:1 for Retail accounts and significantly higher for Professional accounts, depending on the currency pair.

Commodities

Commodities like gold, oil, and natural gas have different levels of volatility and therefore may have lower leverage ratios. For example, leverage for trading gold might be set at 20:1 for Retail accounts, reflecting the commodity’s relative stability compared to other commodities or assets.

Indices

Trading indices, which track the performance of a basket of stocks, offers moderate leverage. Leverage ratios for indices can vary, with major indices like the S&P 500 or Dow Jones Industrial Average potentially having leverage up to 20:1 for Retail accounts.

Stocks and Equities

Stocks and equities typically have lower leverage due to their higher volatility. AvaTrade may offer leverage around 5:1 for Retail accounts when trading individual stocks.

Cryptocurrencies

Given their high volatility, cryptocurrencies usually have the lowest leverage ratios. Retail traders might access leverage of up to 2:1 for trading major cryptocurrencies like Bitcoin or Ethereum.

Comparison of Leverage Options Between Retail and Professional Accounts

Retail Accounts

- Regulatory restrictions cap maximum leverage for Retail accounts to protect less experienced traders from the risks associated with high leverage. For example, the European Securities and Markets Authority (ESMA) limits leverage to 30:1 for major currency pairs, 20:1 for major indices and gold, 10:1 for commodities other than gold, 5:1 for stocks, and 2:1 for cryptocurrencies.

Professional Accounts

- Professional accounts are eligible for higher leverage due to the assumption that professional traders have the experience, financial resources, and risk management skills to handle the increased risk. Leverage ratios can exceed 100:1 for certain instruments, offering substantial trading power but also increasing potential financial exposure.

How Leverage Affects Your Trading Strategy

Leverage is a powerful tool in trading that can significantly influence your trading outcomes. It allows traders to control a larger position with a smaller amount of invested capital, amplifying both profits and losses based on the change in the value of the underlying asset. Understanding the role of leverage and implementing strategies for its effective use are critical for navigating the markets successfully. Here’s an exploration of how leverage affects your trading strategy, including practical strategies for its use and illustrative case studies.

The Role of Leverage in Amplifying Profits and Losses

Amplifying Profits

Leverage can exponentially increase your potential returns. For example, using 10:1 leverage means that a 1% increase in the asset price can lead to a 10% gain on your initial investment, transforming modest market movements into significant profit opportunities.

Amplifying Losses

Conversely, leverage also amplifies losses. A 1% decrease in the asset price could result in a 10% loss on your position with 10:1 leverage. This amplification of losses can quickly deplete your trading capital, especially in volatile markets.

Strategies for Effectively Using Leverage

Risk Management

Implementing strict risk management strategies is paramount when using leverage. This includes setting stop-loss orders to limit potential losses, using take-profit orders to secure gains, and managing the size of leveraged positions to ensure they align with your overall risk tolerance.

Leverage Ratios

Choose leverage ratios that match your trading style and risk appetite. While higher leverage offers greater profit potential, it also comes with increased risk. Beginners may benefit from starting with lower leverage to minimize risk exposure as they learn.

Diversification

Diversifying your leveraged positions across different assets or markets can help spread risk. However, it’s crucial to monitor the cumulative risk from all leveraged positions to avoid overexposure.

Case Studies

Case Study 1: Successful Use of Leverage

A trader uses 20:1 leverage to buy EUR/USD, investing $1,000 to control a $20,000 position. The EUR/USD pair rises by 2%, leading to a $400 gain (2% of $20,000), significantly higher than the $20 gain (2% of $1,000) without leverage. This scenario showcases how leverage can amplify profits from relatively small market movements.

Case Study 2: The Risks of High Leverage

Another trader employs 100:1 leverage for a commodity trade, controlling a $100,000 position with $1,000. Unfortunately, the commodity’s price drops by 1%, resulting in a $1,000 loss, effectively wiping out the trader’s initial investment. This case highlights the heightened risk of loss associated with high leverage.

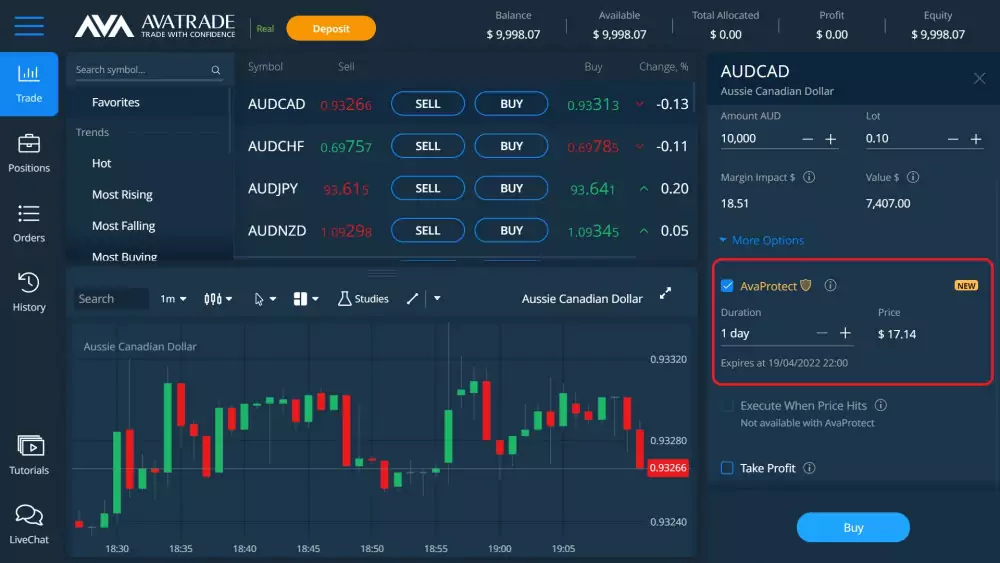

Avatrade Account Types Avatrade Maximum Leverage & Margin Requirements

Leverage and margin are pivotal concepts in the realm of trading, especially when dealing with products like Forex and CFDs. These mechanisms allow traders to amplify their potential gains from market movements but also come with increased risk. Understanding how margin operates in leverage trading, calculating margin requirements, and being aware of a broker’s policies on margin calls and close outs are essential for effective risk management. Let’s explore these concepts with a focus on AvaTrade’s approach.

Understanding Margin in Leverage Trading

The Role of Margin

Margin is essentially a security deposit required to open and maintain leveraged positions. It’s a fraction of the full value of your trade, set aside from your account balance to cover potential losses. Margin requirements are directly related to leverage; the higher the leverage, the lower the margin needed to open a trade, and vice versa.

Calculating Margin Requirements

The formula to calculate the margin requirement is quite straightforward:

[ \text{Margin Required} = \frac{\text{Total Value of the Trade}}{\text{Leverage Ratio}} ]

For example, if you want to open a position worth $100,000 and the leverage offered by AvaTrade is 30:1, the margin requirement would be:

[ \frac{\$100,000}{30} = \$3,333.33 ]

This means you need to have at least $3,333.33 in your trading account to open this trade.

AvaTrade’s Policies on Margin Calls and Close Outs

Margin Calls

A margin call is a warning that occurs when your account equity falls below the required margin level due to losing positions. AvaTrade notifies traders about approaching margin calls, urging them to either close out positions or add more funds to meet margin requirements and avoid liquidation.

Close Outs

If the account equity falls below a specific percentage of the required margin (often around 50% but can vary by broker), AvaTrade may start closing out positions, beginning with the one having the largest loss. This process, known as “stop out” or “close out,” is a protective measure to prevent your account balance from falling into a negative.

Understanding AvaTrade’s Margin Requirements

AvaTrade adjusts its margin requirements based on market volatility, trading size, and overall exposure of the trader. It’s crucial for traders to:

- Monitor Account Equity: Regularly check your account balance and margin level to ensure it meets the required margin for all open positions.

- Use Protective Stops: Implement stop-loss orders to manage potential losses and protect your margin.

- Stay Informed: AvaTrade updates its margin requirements and policies based on market conditions. Keeping abreast of these changes can help you adjust your trading strategy accordingly.

Risks and Rewards of Using High Leverage

High leverage in trading can be a double-edged sword, offering the potential for substantial gains while simultaneously exposing traders to significant risks. Understanding these dynamics is crucial for anyone considering high leverage trading. By analyzing the potential gains and pitfalls, applying risk management techniques, and learning from real-life examples, traders can navigate the complexities of leverage more effectively.

Potential Gains and Pitfalls of High Leverage Trading

Gains

- Amplified Returns: High leverage allows traders to control a large position with a relatively small amount of capital, magnifying potential returns on investment. For instance, with 100:1 leverage, a 1% increase in the market can result in a 100% gain on the trader’s initial margin.

- Capital Efficiency: It enables traders to open larger positions without tying up significant capital, allowing for diversification and the ability to take advantage of more trading opportunities.

Pitfalls

- Amplified Losses: Just as profits can be amplified, so too can losses. A small market movement against the trader’s position can result in substantial losses, possibly exceeding the initial investment.

- Margin Calls and Liquidation: If the market moves unfavorably and the account balance falls below the margin requirement, traders may face margin calls, requiring additional funds, or risk having their positions automatically closed (liquidated).

- Overtrading: The access to high leverage might encourage traders to take on too many positions or trade with larger sizes than their capital and risk management strategies would normally allow, increasing the risk of significant losses.

Risk Management Techniques

Setting Stop-Loss Orders

Implementing stop-loss orders is a fundamental risk management tool that limits potential losses by automatically closing a position at a predetermined price level.

Risk-Reward Ratios

Adopting a disciplined approach to risk-reward ratios ensures that potential rewards justify the risks taken. A common strategy is never to risk more than a certain percentage of the account balance on a single trade.

Leverage Caps

Self-imposing leverage caps can prevent the temptation of overleveraging. Trading with leverage levels within a manageable range can mitigate risk exposure.

Diversification

Spreading capital across different instruments or markets can reduce risk, as not all positions are likely to move against the trader simultaneously.

Real-Life Examples of Leverage Management

Example 1: Successful Use of High Leverage

In a bullish Forex market, a trader using 100:1 leverage on EUR/USD benefits from a 2% market rise. With an initial investment of $1,000 controlling a $100,000 position, the 2% increase translates to a $2,000 profit, doubling the initial investment. This scenario underscores the potential for high returns but also requires precise market timing and understanding.

Example 2: High Leverage Pitfall

Conversely, another trader with the same leverage and position size faces a 2% market decline. This results in a $2,000 loss, wiping out the initial margin and potentially incurring a margin call. This example illustrates the high risks associated with leverage.

Choosing the Right Avatrade Account Types Avatrade Maximum Leverage

Leverage is a critical aspect of trading that can significantly affect your trading strategy and outcomes. AvaTrade offers various account types with different leverage options, catering to the diverse needs and risk tolerances of traders. When selecting an AvaTrade account based on leverage preferences, several factors need to be considered, including how to switch or upgrade account types for higher leverage. Here’s a guide to help you make an informed decision, with tailored recommendations for beginners versus experienced traders.

Factors to Consider

Trading Experience and Risk Tolerance

Your level of trading experience and risk tolerance are paramount in choosing an account. High leverage can amplify both profits and losses, making it important to assess your comfort with potential outcomes.

Financial Goals

Consider your financial goals. Are you seeking aggressive growth, or is preserving capital with steady, modest gains more your style? Your goals will influence the level of leverage that is appropriate for you.

Market Knowledge

Different markets have different volatility levels, influencing how leverage affects your trades. Knowledge of these markets can guide your leverage decisions.

Regulatory Requirements

Regulations may cap leverage levels for retail traders in certain jurisdictions. Understanding these regulations can help you select an account type that aligns with your desired leverage but remains compliant.

Switching or Upgrading Account Types

From Retail to Professional

If seeking higher leverage, retail traders with sufficient trading experience and financial robustness can apply to upgrade to a professional account. This process involves providing proof of trading experience, financial expertise, and the size of your financial portfolio.

Account Verification

Switching account types may require additional verification or documentation to meet regulatory and broker-specific criteria. AvaTrade’s customer support can guide you through this process.

Recommendations for Leverage Use

Beginners

- Start with Lower Leverage: Beginners should opt for retail accounts with lower leverage limits to minimize risk while gaining market experience.

- Educational Resources: Utilize AvaTrade’s educational tools and a demo account to understand leverage dynamics without financial risk.

Experienced Traders

- Consider Professional Accounts: If you have the necessary experience and financial means, a professional account can offer higher leverage, suiting aggressive trading strategies.

- Risk Management: Employ robust risk management strategies, regardless of experience. This includes using stop-loss orders, monitoring trades closely, and never risking more than you can afford to lose.

Leverage Regulations and Compliance

Leverage in trading, particularly in the Forex and CFD markets, is subject to stringent regulatory frameworks across different jurisdictions. These regulations are designed to protect traders from the significant risks associated with high leverage, including the potential for rapid losses. AvaTrade, as a globally recognized broker, adheres to these regulatory standards to ensure a secure and compliant trading environment for its clients. Understanding how these regulations influence leverage usage, AvaTrade’s compliance measures, and the impact on trading strategies is essential for traders navigating the global markets.

Regulatory Frameworks Governing Leverage Usage

European Union (ESMA)

The European Securities and Markets Authority (ESMA) has set leverage limits for retail traders to a maximum of 30:1 for major currency pairs, decreasing to 20:1 for non-major currency pairs, gold, and major indices; 10:1 for commodities other than gold and non-major equity indices; 5:1 for individual equities and other reference values; and 2:1 for cryptocurrencies.

Australia (ASIC)

The Australian Securities and Investments Commission (ASIC) implemented similar restrictions to ESMA’s, capping leverage for major currency pairs at 30:1 for retail clients, with tiered limits for other instruments.

Other Jurisdictions

Regulatory bodies in other regions, such as the Commodity Futures Trading Commission (CFTC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom, also impose their own leverage limits and regulatory measures, often aligning with the goal of protecting retail traders.

AvaTrade’s Compliance Measures

AvaTrade complies with regional regulatory standards by adjusting the available leverage for traders based on their account type (retail or professional) and the jurisdiction in which they are trading. The broker implements the following measures to ensure compliance and protect traders:

- Leverage Limits: Applying leverage caps in accordance with regional regulations for retail traders.

- Risk Disclosure: Providing clear, transparent information about the risks associated with leverage trading.

- Negative Balance Protection: Ensuring retail traders cannot lose more than their deposited funds.

- Client Categorization: Differentiating between retail and professional clients, offering higher leverage to professional clients who meet specific criteria and acknowledge the increased risks.

Impact of Regulatory Changes on Leverage Limits and Trading Strategies

Regulatory changes can significantly impact leverage limits, affecting traders’ ability to open large positions with a relatively small investment. For traders, this means:

- Adjusting Trading Strategies: Traders may need to revise their trading strategies to account for lower leverage limits, focusing more on risk management and capital efficiency.

- Capital Requirements: Lower leverage means higher margin requirements for opening positions, potentially requiring traders to allocate more capital to their trading accounts.

- Opportunity and Risk Balance: While lower leverage limits reduce the risk of substantial losses, they also limit the potential for high returns, prompting traders to seek a balance between opportunity and risk in their trading activities.

Tools and Resources for Avatrade Account Types Avatrade Maximum Leverage

AvaTrade offers an array of tools and educational resources designed to enhance the leverage trading experience. These resources aim to equip traders with the knowledge and skills necessary to utilize leverage effectively while managing the associated risks. From demo accounts that offer a risk-free environment for practice to advanced tools and indicators for managing leverage and exposure, AvaTrade supports its traders at every step of their journey. Let’s explore these offerings in more detail.

Educational Resources

AvaTrade Academy

A comprehensive learning hub that provides traders with a wealth of information on leverage trading, including video tutorials, articles, e-books, and webinars. Topics range from the basics of leverage and margin to advanced strategies and risk management techniques.

Webinars and Seminars

Live sessions conducted by experienced traders and market analysts, offering insights into leverage trading across different markets. These sessions often include Q&A segments, allowing traders to seek advice on leverage-related queries.

Market Analysis

AvaTrade provides detailed market analysis and updates, helping traders make informed decisions. Understanding market conditions is crucial for leverage trading, as it impacts volatility and potential exposure.

Practical Tools for Leverage Trading

Demo Accounts

Demo accounts stand out as one of the most valuable resources for both beginners and experienced traders. They simulate real trading conditions, allowing traders to:

- Practice placing leveraged trades without the risk of losing real money.

- Test different strategies to see how changes in leverage affect trade outcomes.

- Get comfortable with AvaTrade’s trading platforms and tools.

Risk Management Tools

AvaTrade offers several tools and features to help manage the risks associated with leverage trading:

- Stop Loss/Take Profit Orders: Essential for setting predefined exit points for trades to cap potential losses or lock in profits.

- Negative Balance Protection: Ensures traders cannot lose more than their account balance, providing a safety net for leveraged positions.

- Margin Calculator: An invaluable tool for calculating the margin required for trades, helping traders understand their potential leverage and exposure before entering a position.

Advanced Trading Platforms and Indicators

- MetaTrader 4 and MetaTrader 5: Both platforms offer advanced charting tools, indicators, and automated trading options (Expert Advisors), allowing for sophisticated analysis and strategy implementation.

- Custom Indicators: Traders can utilize a range of indicators, such as RSI, MACD, and Bollinger Bands, to analyze market trends and volatility, which are crucial for making informed leverage decisions.

Conclusion: Avatrade Account Types Avatrade Maximum Leverage

Leveraging the comprehensive suite of tools, resources, and account options provided by AvaTrade equips traders with the capabilities to navigate the complexities of the financial markets effectively. The thoughtful selection of an account type that aligns with your trading style, experience level, and risk tolerance is crucial in setting the foundation for a successful trading journey. As we conclude, let’s recap the key considerations for utilizing AvaTrade’s offerings to their fullest potential and share some final advice for cultivating a disciplined trading approach that embraces prudent leverage practices.

Key Considerations for Leveraging AvaTrade’s Offerings

- Account Selection: Choose an account type—be it Retail, Professional, Islamic, or Demo—that best matches your trading aspirations and experience. Each account type offers unique benefits and leverage options tailored to different trader needs.

- Leverage and Margin: Understand the leverage and margin requirements associated with your chosen account. Leverage can significantly amplify both gains and losses, making an awareness of margin requirements and effective risk management essential.

- Educational Resources: Take advantage of AvaTrade’s educational content to deepen your understanding of leverage, trading strategies, and risk management. Continuous learning is key to evolving as a trader.

- Risk Management Tools: Utilize AvaTrade’s risk management tools, including stop-loss orders and margin calculators, to safeguard your investments. Developing a trading plan that includes strict risk parameters is crucial for long-term success.

- Demo Practice: Before diving into live trading, practice with a demo account to hone your skills and test strategies without financial risk. This is invaluable for familiarizing yourself with leverage effects in a controlled environment.

Developing a Disciplined Trading Approach

- Incorporate Sound Leverage Practices: Leverage should be used judiciously, with a clear understanding of how it affects your trading outcomes. Start with lower leverage to mitigate risk as you learn to navigate its impact.

- Stay Informed: Keep abreast of market conditions, economic news, and leverage regulations. The global financial landscape is dynamic, with factors that can influence market volatility and, consequently, leverage effectiveness.

- Continuous Strategy Evaluation: Regularly review and adjust your trading strategy based on market performance and personal trading results. Flexibility and adaptability are assets in the fast-paced world of trading.

Encouragement for Traders

AvaTrade provides a robust platform for traders to maximize their trading potential, offering a blend of innovative tools, comprehensive resources, and diverse account options. By adopting a disciplined trading approach that incorporates sound leverage practices, you position yourself to navigate both the opportunities and challenges presented by the markets.

Stay informed about market conditions and regulatory changes, and never stop learning. The path to trading success is a journey of continuous education and adaptation. With AvaTrade as your partner, you have access to the resources and support needed to explore the markets confidently, harnessing the power of leverage to unlock your trading potential.