FXCM, also known as Forex Capital Markets, is a well-established leader in the global foreign exchange (forex) marketplace. Renowned for providing retail traders and institutions with trading opportunities on forex, commodities, and indices, FXCM boasts a robust offering through its subsidiary, FXCM Markets. This introductory overview focuses on FXCM as a broker, particularly its services through FXCM Markets, emphasizing its global reach and target markets.

Overview of FXCM

Founded in 1999, FXCM has become one of the most recognizable names in the forex industry. The company provides access to a wide range of trading instruments and prides itself on innovative trading technology, transparency, and regulatory compliance.

Key Features:

- Global Presence: FXCM operates in major financial centers worldwide, offering services in various global markets which makes it accessible to a diverse client base.

- Regulatory Compliance: FXCM is known for its high standards of regulatory compliance, operating under the oversight of major financial authorities like the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

FXCM Markets Specific Offering

FXCM Markets is a part of the FXCM Group, focusing on expanding the company’s reach and offerings without the direct oversight of the more stringent regulators like the FCA or ASIC. This subsidiary is particularly aimed at expanding FXCM’s services to markets where local regulations may restrict certain trading features or products offered by other parts of the company.

Distinct Features of FXCM Markets:

- No Re-quotes: FXCM Markets offers no re-quotes on orders, which is a significant advantage in fast-moving markets, ensuring that traders can enter and exit trades at expected prices.

- Enhanced Leverage Options: Unlike its operations under stricter regulatory environments, FXCM Markets can offer higher leverage ratios, which can be attractive to traders looking for high-risk, high-reward trading opportunities.

- Diverse Account Types: Catering to a broad spectrum of traders, from beginners to experienced professionals, FXCM Markets provides various account types, each tailored to different trading strategies and capital sizes.

Target Markets:

- Global Traders: FXCM Markets targets international traders, particularly those from regions without stringent forex trading regulations. This includes parts of Asia, the Middle East, and Latin America, where traders can benefit from the flexible trading conditions offered.

- Experienced Traders and High-volume Traders: The offerings of FXCM Markets are particularly appealing to experienced traders who can handle the risks associated with high leverage and those who require a trading environment that supports high-volume trading strategies.

Products and Instruments Available with FXCM Markets

FXCM Markets offers a diverse portfolio of trading products and financial instruments, catering to the varied needs of global traders. This range includes forex pairs, Contracts for Difference (CFDs) on multiple asset classes, and commodities, providing ample opportunities for traders to diversify their investment strategies. Here’s a detailed look at the products and instruments available through FXCM Markets.

Forex Trading

Forex, or foreign exchange, trading involves currency pairs, and FXCM Markets offers a broad selection of major, minor, and exotic pairs.

Key Features:

- Major Pairs: These include the most traded pairs in the world, such as EUR/USD, GBP/USD, and USD/JPY. These pairs typically offer lower spreads and higher liquidity.

- Minor Pairs: Less frequently traded than majors but still relatively liquid, minor pairs include currencies like EUR/GBP, AUD/JPY, and NZD/USD.

- Exotic Pairs: Involving currencies from emerging economies, such as the Brazilian Real (BRL), the Russian Ruble (RUB), and the Turkish Lira (TRY). These pairs generally offer high volatility and potential for large price movements but come with higher spreads and lower liquidity.

CFDs on Indices, Stocks, and More

CFDs allow traders to speculate on the price movements of various assets without actually owning them. FXCM Markets provides access to a wide range of CFDs.

Key Features:

- Indices: Trade on global market indices such as the US SPX 500, GER 30 (DAX), and UK 100, which reflect the performance of the respective stock markets.

- Stock CFDs: Offers the ability to trade CFDs on some of the major companies’ stocks globally, allowing traders to take positions based on their forecasts of companies’ future performances.

- Cryptocurrency CFDs: Enables trading on the price movements of popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, reflecting the growing demand for digital currency investments.

Commodities Trading

Commodities trading with FXCM Markets includes precious metals, energy, and other commodities, providing a good hedge against inflation and a way to diversify trading strategies.

Key Features:

- Precious Metals: Trade gold, silver, and other precious metals, which are traditional safe havens during times of economic uncertainty.

- Energy Commodities: Includes oil and natural gas, which are essential for global economic activity and can be highly volatile, influenced by geopolitical events and changes in supply and demand.

- Other Commodities: Opportunities to trade in commodities like copper, which can be influenced by industrial demand and economic indicators.

Benefits of Trading with FXCM Markets

- Diverse Trading Options: The wide range of instruments allows traders to diversify their portfolios and hedge against risks.

- Leverage Options: Enhanced leverage opportunities can increase potential returns on these various instruments.

- Advanced Trading Tools: Access to advanced charting tools, risk management features, and automated trading options to better analyze and trade these markets.

Account Types at FXCM Markets

FXCM Markets offers a variety of account types to cater to the diverse needs and preferences of traders from around the world. Each account type is designed with specific features to accommodate different levels of trading experience, investment sizes, and trading strategies. Here’s a detailed overview of the account options provided by FXCM Markets, helping traders choose the one that best suits their trading goals.

Standard Account

Features:

- Minimum Deposit: Generally accessible, the standard account may require a relatively low minimum deposit, making it suitable for retail traders who are new to forex or those with limited capital.

- Spreads and Commissions: Offers competitive spreads and may include no commission on trades, depending on the instruments.

- Leverage: Up to regulatory limits, typically offering flexibility to increase market exposure.

- Platform Access: Full access to FXCM’s trading platforms, including Trading Station, MetaTrader 4, and the mobile trading platform.

- Tools and Resources: Traders have access to all of FXCM’s educational materials, market research, and trading tools.

Best For:

Novice traders or those with smaller capital who wish to access the forex and CFD markets with a reliable and straightforward trading environment.

Active Trader Account

Features:

- Minimum Deposit: Requires a higher minimum deposit, catering to more experienced traders or those with more significant capital.

- Reduced Spreads and Commissions: Active Trader accounts often benefit from reduced spreads and lower commission rates, optimizing trading costs for high-volume traders.

- Priority Support: Enhanced customer service, including dedicated account managers and premium support services.

- Performance Analytics: Access to advanced trading analytics tools to help refine strategies and maximize trading performance.

- Leverage: Similar to the Standard Account but tailored to support more substantial trading volumes efficiently.

Best For:

Experienced traders who trade in higher volumes and can take advantage of tighter spreads and a more robust trading environment.

Professional Account

Features:

- Minimum Deposit: This account type has the highest minimum deposit requirement and is geared towards professional and institutional traders.

- Elite Pricing: Offers the lowest spreads and commission rates available at FXCM Markets, significantly reducing transaction costs for large volume trading.

- Exclusive Tools: Includes access to specialized trading tools, risk management solutions, and bespoke trading services.

- Personalized Support: Tailored customer support that includes one-on-one consultations, strategy discussions, and direct access to market analysts.

- High Leverage Options: Depending on the regulatory environment, professional accounts might offer higher leverage options under certain conditions.

Best For:

Professional traders and institutions looking for a premium trading experience with all the best features FXCM Markets can offer, including cost efficiency on large volumes and personalized services.

Demo Account

Features:

- Risk-Free Trading: A simulation of the real trading environment with virtual money, perfect for beginners to practice or experienced traders to test new strategies.

- Access to All Platforms and Tools: Includes full access to all of FXCM’s trading platforms and educational resources without any financial risk.

- No Time Limit: Unlike many brokers, FXCM Markets might offer an unlimited time to use the demo account, providing ongoing practice opportunities.

Best For:

Traders of all levels who want to practice trading strategies and get familiar with FXCM Markets’ trading platforms without risking real money.

Trading Platforms Used by FXCM Markets

FXCM Markets offers a selection of robust trading platforms, each designed to cater to different trading styles and preferences. These platforms include industry favorites like MetaTrader 4, FXCM’s proprietary platform Trading Station, and the versatile NinjaTrader. Here’s a detailed review of each platform available through FXCM Markets, helping traders decide which might best suit their trading needs.

MetaTrader 4 (MT4)

Features:

- User-Friendly Interface: MT4 is renowned for its intuitive interface, making it accessible for beginners while still powerful enough for advanced traders.

- Advanced Charting Tools: Offers comprehensive charting capabilities, technical indicators, and graphical objects.

- Expert Advisors (EAs): Allows for the use of automated trading strategies through EAs, enabling traders to automate their trading based on predefined criteria.

- Customization: Traders can customize the platform and EAs using the MQL4 programming language, tailored to their trading requirements.

Best For:

Traders looking for a reliable and widely-used platform that supports automated trading and extensive customization options.

Trading Station

Features:

- Proprietary Platform: Developed by FXCM, Trading Station is known for its innovative tools and superior charting capabilities.

- Multiple Order Types: Supports a wide range of order types, including OCO (one cancels the other), trailing stops, and more, offering enhanced control over trade execution.

- Market Data: Provides integrated market news and extensive historical data, which can be crucial for conducting thorough market analysis.

- User Experience: Features a more modern user interface compared to MT4 and is designed to be highly intuitive and responsive.

Best For:

Traders who prefer a platform with advanced analytical tools and a more streamlined, integrated trading experience.

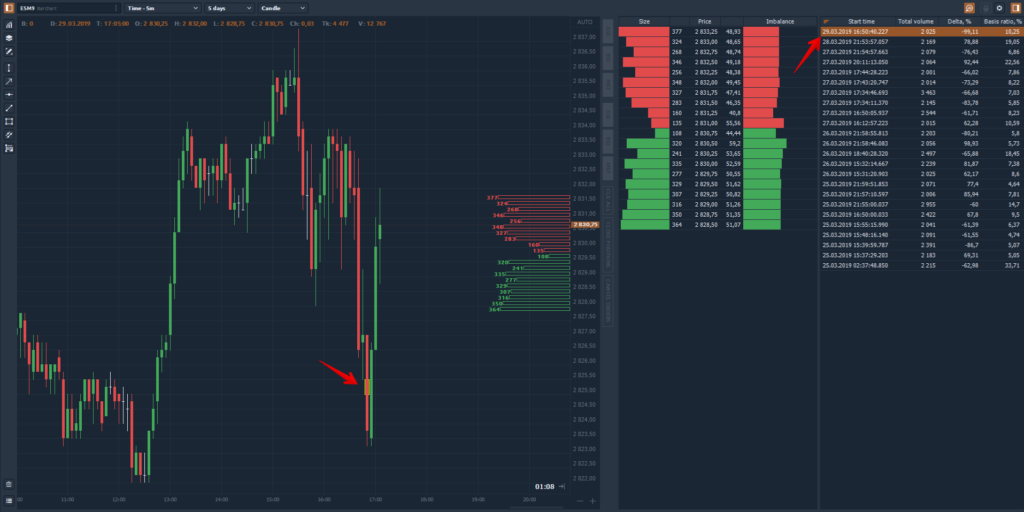

NinjaTrader

Features:

- Sophisticated Analysis Tools: Offers advanced charting, automated strategy development, and backtesting capabilities.

- Market Simulation: NinjaTrader includes a market replay feature that allows traders to practice trading on historical data, honing skills without financial risk.

- Customization and Flexibility: Highly customizable in terms of indicators, interfaces, and strategies. Supports C# for developing custom indicators and automated strategies.

- Order Execution: Provides advanced trade management features, including automated stop loss and profit targets, which are essential for precise and strategic trade execution.

Best For:

Advanced traders who need powerful charting tools and the ability to backtest and automate strategies extensively.

Mobile Trading

Features:

- Accessibility: FXCM Markets also offers mobile trading options through apps available for both Android and iOS devices. These mobile platforms integrate seamlessly with all FXCM’s desktop platforms.

- Functionality: While more limited than desktop versions, mobile apps still offer robust functionality, including interactive real-time charting, live streaming prices, and the ability to manage and execute trades.

Best For:

Traders who need to manage their accounts and trade while on the go, ensuring they never miss a market opportunity.

Leverage and Margin Requirements at FXCM Markets

Understanding the leverage options and margin requirements is crucial for effectively managing trading strategies at FXCM Markets. Leverage allows traders to control larger positions than their actual deposited funds would permit, while margin requirements ensure that traders have enough funds in their account to cover potential losses. This discussion explores the specifics of leverage and margin at FXCM Markets and how they influence trading decisions and risk management.

Leverage Options at FXCM Markets

FXCM Markets offers a range of leverage options, which can significantly impact trading outcomes. The specific leverage available depends on the instrument being traded, the trader’s account type, and the regulatory environment of the trader’s residency.

Key Features:

- Forex Trading: Leverage for major currency pairs can be as high as 30:1 in jurisdictions following ESMA guidelines, while other regions may offer leverage up to 400:1 or even 500:1 for major pairs.

- CFDs and Commodities: Leverage for CFDs, including indices, metals, and energy commodities, typically has lower maximums than forex due to their differing market volatilities and risks.

Margin Requirements

Margin is the amount of equity required to maintain open positions. FXCM Markets sets margin requirements based on the leverage used, the size of the position, and market conditions.

Calculating Margin

- Margin Requirement Formula: The margin required can generally be calculated as the inverse of the leverage ratio. For example, a leverage ratio of 100:1 requires a margin of 1% of the total position value.

- Dynamic Margins: Depending on market volatility or economic events, FXCM Markets might adjust margin requirements to mitigate risk during periods of high volatility.

How Leverage and Margin Impact Trading Strategies

1. Enhanced Trading Capacity

- Increased Exposure: Higher leverage allows traders to open larger positions with a smaller amount of capital, amplifying potential profits but also increasing potential losses.

2. Risk Amplification

- Higher Risk of Loss: While leverage can increase the returns on investment, it also raises the stakes of each trade, magnifying losses just as much as profits.

3. Margin Calls and Close-Outs

- Account Monitoring: Traders must continuously monitor their margin levels. If the market moves against a highly leveraged position and the account equity falls below the margin requirement, FXCM Markets may issue a margin call requiring additional funds or close out positions to protect both the trader and the brokerage.

4. Strategic Use

- Short-Term Trading: High leverage is often more suitable for short-term trading strategies, such as day trading or scalping, where traders benefit from small price movements and can closely manage trades.

- Long-Term Trading: For strategies like swing trading or position trading, using lower leverage can reduce risk, as these positions are typically held longer and may experience wider market fluctuations.

Managing Risks Associated with Leverage

1. Conservative Leverage Use

- Starting Small: Especially for new traders, starting with lower leverage and gradually increasing as experience and confidence grow is advisable.

2. Robust Stop-Loss Orders

- Limiting Losses: Setting stop-loss orders to close out trades at a predetermined price can help manage the risks associated with unexpected market movements.

3. Continuous Education

- Learning and Adaptation: Ongoing education on market conditions and leverage management is crucial for effectively utilizing leverage in line with evolving market dynamics.

Regulatory Environment and Licensing at FXCM Markets

FXCM Markets, as part of the broader FXCM Group, operates within a complex regulatory environment designed to protect traders and ensure fair trading practices. Understanding the regulatory frameworks governing FXCM Markets and the security measures in place is crucial for traders when evaluating the trustworthiness and reliability of their broker. Here’s an overview of the regulatory landscape and the protective measures FXCM Markets adheres to.

Regulatory Oversight

FXCM Markets operates under the jurisdiction of the FXCM Group, which is known for its commitment to high regulatory standards. However, it’s important to note that FXCM Markets itself is not directly regulated by some of the more stringent regulatory bodies that oversee other parts of the FXCM Group, such as:

Key Regulatory Bodies for FXCM Group

- United States: Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA).

- United Kingdom: Financial Conduct Authority (FCA).

- European Union: European Securities and Markets Authority (ESMA).

- Australia: Australian Securities and Investments Commission (ASIC).

FXCM Markets is registered in Bermuda, where the regulatory environment offers more flexibility in terms of financial products and leverage offered. This registration allows FXCM Markets to provide certain trading benefits that might be restricted in jurisdictions with tighter regulations.

Security Measures and Trader Protection

While FXCM Markets may offer more flexible trading conditions, it does not compromise on security and trader protection. Here are the key security measures in place:

Segregated Accounts

- Client Funds: FXCM Markets maintains client funds in segregated accounts, separate from the company’s own operational funds. This is a crucial practice that protects traders’ capital from being used for any company-related expenses.

Risk Management Protocols

- Margin Policies: FXCM Markets implements strict margin policies to prevent clients from losing more money than they have deposited, protecting against negative balance scenarios.

- Real-Time Monitoring: The firm uses advanced technology to monitor positions and margin in real-time, ensuring traders can react swiftly to market movements or margin calls.

Data Encryption and Privacy

- Secure Transactions: All transactional and personal data are encrypted using advanced security protocols to prevent unauthorized access and ensure data integrity.

- Privacy Compliance: FXCM Markets adheres to strict data protection regulations, ensuring that client information is confidential and used only for trading purposes.

Compliance and Transparency

Regular Audits

- External Audits: FXCM Markets undergoes regular audits by independent third parties to ensure compliance with financial standards and operational integrity.

- Transparency Reports: Transparency in pricing, execution, and financial reporting is a cornerstone of FXCM Markets’ operational philosophy, fostering trust with its clients.

Customer Support and Education

- Educational Resources: FXCM Markets offers comprehensive educational materials to help traders understand market dynamics, leverage, and risk management.

- Support Services: Traders have access to robust customer support services, including account assistance, technical support, and trading guidance, further enhancing the trading experience and safety.

Educational Resources and Support at FXCM Markets

FXCM Markets is committed to providing its traders with comprehensive educational resources and robust customer support services. These tools are designed to help traders at all levels enhance their trading skills and effectively navigate the forex and CFD markets. Here’s an overview of the educational tools and support services available to traders using FXCM Markets.

Educational Resources

FXCM Markets offers a wide array of educational resources aimed at improving traders’ knowledge and trading skills. These resources cater to both novice and experienced traders, providing valuable information to help them make informed trading decisions.

Online Trading Courses

- Beginner to Advanced Levels: Courses cover topics ranging from basic forex education to advanced trading strategies and risk management.

- Interactive Learning: Modules include videos, webinars, and quizzes to enhance learning and retention.

Webinars and Seminars

- Live Sessions: Conducted by experienced market analysts and trading experts, these sessions cover market updates, trading strategies, and Q&A segments.

- Archived Webinars: Available for on-demand access, allowing traders to learn at their own pace and revisit complex topics.

Trading Guides and Market Analysis

- Comprehensive Guides: Cover a variety of topics including technical and fundamental analysis, trading psychology, and effective use of trading tools.

- Daily Market Analysis: Provides insights into market trends, upcoming economic events, and potential trading opportunities.

Customer Support Services

Understanding the importance of timely and effective support, FXCM Markets offers multiple channels of customer service to address the needs of its diverse client base.

24/5 Customer Support

- Availability: Support is available 24 hours a day, five days a week, ensuring that traders can receive assistance during trading hours across global markets.

- Multilingual Support: Catering to an international audience, FXCM Markets provides support in various languages, making it accessible to a wider range of traders.

Account Assistance

- Account Management: Traders can receive help with account settings, funding options, and navigational assistance within the trading platforms.

- Technical Support: Provides troubleshooting and technical help for issues related to trading platforms and tools.

Dedicated Account Managers

- Personalized Service: Available for traders with larger account balances or those in premium account categories, offering tailored trading advice and personalized service.

Trading Tools

- Free Trading Tools: FXCM Markets offers various trading tools, such as trading calculators, economic calendars, and advanced charting software.

- APIs and Trading Automation: Supports automated trading solutions and access to APIs, allowing traders to develop custom trading applications and algorithms.

Fees, Spreads, and Other Trading Costs at FXCM Markets

Understanding the cost structure of a trading platform is crucial for traders in managing their expenses and maximizing profitability. FXCM Markets offers competitive pricing structures, including spreads, commission rates, and other trading costs, which are designed to accommodate the needs of diverse traders. This analysis will detail the cost structure at FXCM Markets, highlighting key areas such as spreads, commissions, and any potential hidden fees.

Spreads

Definition and Role

- Spreads represent the difference between the bid (sell) price and the ask (buy) price of a trading instrument. It is essentially the cost paid by the trader on every trade.

Typical Spreads at FXCM Markets

- Forex: Spreads vary depending on the currency pair. Major pairs like EUR/USD might offer very tight spreads, often starting from as low as 1.0 pip during normal market conditions.

- CFDs: For CFDs on indices, commodities, and other instruments, spreads can be higher and vary significantly depending on the market volatility and the specific asset.

Commissions

Trading Commissions

- Forex Trading: FXCM Markets typically charges a commission on forex trades only for accounts with raw spreads or those designed for high-volume traders (like Active Trader accounts). Commissions are calculated based on the traded volume.

- CFD Trading: Commission rates for trading CFDs might differ, often depending on the type of asset and the account type. Some CFD trades may be commission-free, with costs built into the spread.

Other Trading Costs

Overnight Fees

- Rollover or Swap Fees: Traders holding positions overnight must pay or receive interest differential between the two currencies in a pair, known as swap or rollover fees. These fees vary by currency pair and market conditions.

Inactivity Fees

- Account Inactivity: FXCM Markets may charge a monthly inactivity fee if an account has not been used for trading or has no open positions for an extended period, typically a year or more.

Hidden Fees

Transparency

- No Hidden Fees: FXCM Markets prides itself on transparency, ensuring that all potential fees are communicated clearly to traders. There should be no hidden costs, but it is always advisable for traders to review the terms and conditions thoroughly.

Cost Management Strategies

Trading During High Liquidity

- Lower Spreads: Trading during periods of high liquidity, such as the overlap of the New York and London trading sessions, might offer lower spreads.

Monitoring Fees

- Regular Reviews: Keep a close eye on swap fees, especially if you tend to hold positions open for extended periods. This can significantly affect profitability on long-term trades.

Account Type Selection

- Choosing the Right Account: Select an account type that aligns with your trading frequency and volume. For example, high-volume traders might benefit from accounts with lower spread and commission costs but might require a higher minimum deposit.

Strategic Trading Tips for FXCM Markets

Trading successfully with FXCM Markets requires a strategic approach that leverages the strengths of the platforms and services offered. Here are some effective trading strategies and tips tailored specifically for the trading environment at FXCM Markets. These strategies are designed to help you utilize FXCM’s tools and insights to enhance your trading performance.

1. Leverage the Advanced Trading Platforms

MetaTrader 4

- Automate Trading: Utilize the Expert Advisors (EAs) on MT4 to automate your trading strategies. EAs can help you execute trades faster than manual trading and can be tailored to react to market changes instantaneously.

- Custom Indicators: Use custom indicators in MT4 to better analyze market trends and potential reversals which are crucial for timing your trades effectively.

Trading Station

- Utilize Advanced Charting Tools: Trading Station offers powerful charting tools that can enhance your market analysis. Make use of the comprehensive technical indicators and graphical objects to identify patterns and support/resistance levels.

- Real-Time Data and News: Stay updated with real-time market data and news available through Trading Station, allowing you to make informed decisions based on the latest market developments.

NinjaTrader

- Backtesting Capabilities: Take advantage of NinjaTrader’s advanced backtesting tools to test your trading strategies using historical data before applying them in the live market.

- Market Simulation: Use the market replay feature to practice trading in a simulated environment, which can help refine your strategies without financial risk.

2. Employ Sound Risk Management

- Set Stop-Loss and Take-Profit Orders: Always use stop-loss orders to minimize potential losses. Setting take-profit orders can also help lock in profits when your target levels are reached, crucial for maintaining a favorable risk-reward ratio.

- Manage Leverage Wisely: While FXCM Markets offers high leverage, using it cautiously is key. High leverage can magnify both gains and losses, so adjust leverage according to your risk tolerance and market volatility.

3. Capitalize on Educational Resources

- Webinars and Seminars: Participate in the webinars and seminars offered by FXCM Markets. These sessions provide valuable insights into forex trading strategies and market trends from experienced professionals.

- Continuous Learning: Use the educational materials provided to keep your trading knowledge current. Understanding new trading tools and economic indicators can significantly improve your trading decisions.

4. Monitor and Adapt to Market Conditions

- Stay Informed: Keep abreast of global economic events and market news that can affect currency markets. FXCM Markets provides timely updates and analyses that can be crucial for forex trading.

- Flexibility in Strategies: Be flexible in your trading strategies. The forex market is dynamic, and adaptive strategies are often more successful. For instance, consider scaling in and out of positions or using different entry and exit strategies depending on market conditions.

5. Diversify Your Trading

- Trade Multiple Instruments: FXCM Markets offers a variety of trading instruments. Diversifying your trades across different instruments can reduce risk and increase potential returns. For example, if forex trading is experiencing low volatility, consider commodities or indices which might offer better opportunities.

Conclusion: Evaluating FXCM Markets for Your Trading Needs

FXCM Markets offers a comprehensive suite of trading services and platforms tailored to meet the needs of diverse traders worldwide. As you consider whether FXCM Markets is the right broker for your trading activities, it’s crucial to weigh its strengths and potential areas for improvement. This final assessment provides an overview to help you make an informed decision.

Strengths of FXCM Markets

Wide Range of Trading Instruments

FXCM Markets provides access to a broad spectrum of trading instruments, including forex, CFDs on indices, commodities, and cryptocurrencies. This variety allows traders to diversify their portfolios effectively, mitigating risk while capitalizing on different market opportunities.

Advanced Trading Platforms

FXCM Markets offers multiple advanced platforms such as MetaTrader 4, Trading Station, and NinjaTrader. These platforms cater to all types of traders, from beginners to advanced, and include features like automated trading, advanced charting tools, and comprehensive market data.

High Leverage Options

While leveraging varies by region due to regulatory constraints, FXCM Markets generally offers higher leverage ratios, especially in regions with less stringent regulations. This can significantly enhance profit potential on successful trades.

Robust Educational and Analytical Resources

The broker excels in providing educational resources, including webinars, seminars, and extensive trading guides. These resources are invaluable for both new and experienced traders looking to enhance their trading skills and market knowledge.

Transparent and Competitive Pricing

FXCM Markets is known for its transparent pricing model. It offers tight spreads and low trading costs, which are crucial for long-term trading profitability. The absence of hidden fees fosters trust and reliability.

Areas for Improvement

Regulatory Clarity

While FXCM Markets operates under the umbrella of the FXCM Group, it is primarily regulated in Bermuda, which might offer more flexible trading conditions but could be seen as less stringent compared to regulators like the FCA or ASIC. Traders looking for the highest regulatory safeguards might view this as a potential drawback.

Customer Support

While generally robust, the responsiveness and availability of customer support can vary, especially during high-volume periods. Strengthening this area could enhance the overall trader experience, particularly for new traders needing frequent guidance.

Market Coverage

Although FXCM Markets offers a broad range of instruments, its offerings in certain niche markets like specific emerging market currencies or exotic commodities might be less comprehensive than some competitors. Expanding these offerings could attract a broader audience.

Platform Customization

While FXCM’s platforms are highly functional, opportunities for deeper customization to meet specific trader demands can enhance user experience, especially for advanced traders who rely on highly tailored tools.