Leverage is a fundamental concept in forex trading that significantly enhances a trader’s ability to make substantial trades without committing large amounts of capital upfront. This introductory chapter provides an overview of what leverage is, its importance in the forex market, and specifically how it is applied at FXCM, one of the leading forex brokers.

Understanding Leverage

Leverage in forex trading allows traders to gain a much larger exposure to the market than the actual capital they deposit. Essentially, it acts as a loan provided by the broker to the trader, enabling them to trade larger amounts of currency units than they would be able to with their own capital alone.

How Leverage Works

When a trader decides to use leverage, they only need to provide a fraction of the total trade value as a margin. For example, if the leverage offered by a broker is 100:1, a trader can hold a position worth $100,000 with only $1,000 of their own money.

Benefits of Using Leverage

- Increase in Profit Potential: Leverage allows traders to amplify their potential profits from small price movements in the forex market.

- Capital Efficiency: Traders can use less capital to open larger positions, freeing up additional capital for other investments or trades.

- Access to Larger Markets: Especially for retail traders with limited capital, leverage makes it possible to participate meaningfully in the forex market.

Importance of Leverage in Forex Trading

Forex markets are characterized by relatively small price movements compared to other financial markets. Leverage makes forex trading more viable and potentially profitable by magnifying these movements, albeit along with increased risk.

Leverage at FXCM

FXCM offers leverage to its clients, which is subject to regulation and may vary depending on the trader’s location and account type. For example:

- Regulated Limits: In many jurisdictions, regulatory limits apply to the amount of leverage a broker can offer. For instance, in the European Union under ESMA regulations, the maximum leverage available to retail traders is typically capped at 30:1 for major currency pairs.

- Flexible Options: FXCM provides different leverage ratios, allowing traders to choose a level that suits their trading style and risk management strategy.

Risks Associated with Leverage

While leverage can increase potential returns, it also increases potential risks. Here’s why:

- Magnified Losses: Just as leverage can amplify profits, it can also amplify losses if the market moves against the trader’s position.

- Margin Calls: If the market moves unfavorably, traders may face a margin call, which requires them to add more funds to their account to keep their position open or risk having their position closed by the broker.

Best Practices for Using Leverage

- Risk Management: Use stop-loss orders to limit potential losses on leveraged positions.

- Conservative Leverage: Especially for beginners, starting with lower leverage can help manage risk while gaining experience.

- Regular Monitoring: Keep a close eye on open positions, as markets can move quickly and margin requirements can change.

FXCM Leverage Options

Leverage is a key tool in forex trading that enables traders to increase their market exposure beyond the initial investment. FXCM provides a range of leverage options, tailored to meet the needs and risk tolerances of various traders. This chapter offers detailed information on the leverage ratios available at FXCM, including maximum levels and variations by account type, which can influence your trading strategies and potential outcomes.

Overview of Leverage at FXCM

FXCM offers leverage that is competitive within the industry, adhering to regulatory standards which dictate maximum allowable leverage based on the trader’s location and account type.

Maximum Leverage Ratios

- Regulatory Influence: The maximum leverage available to traders at FXCM is influenced by regulatory guidelines in the trader’s registered country. For instance:

- European Union (including the UK): Due to ESMA (European Securities and Markets Authority) regulations, the maximum leverage for major forex pairs is capped at 30:1 for retail clients.

- Australia: Following ASIC (Australian Securities and Investments Commission) regulations, leverage can go up to 30:1 for major forex pairs.

- Other Regions: In jurisdictions with less stringent regulations, leverage options may be higher, reaching up to 400:1 or even 500:1 for major currency pairs.

Leverage by Account Type

- Standard Accounts: Generally offer leverage up to the regulatory maximum based on the trader’s region. For example, up to 30:1 in Europe and Australia, and potentially higher in other areas.

- Active Trader Accounts: While still subject to the same regulatory restrictions, Active Trader accounts might receive more favorable margin requirements due to the higher volumes traded and the experienced nature of the traders.

Variations by Instrument

- Forex Pairs: Major pairs typically receive the highest leverage, while exotic pairs may have lower leverage due to their higher volatility and risk.

- CFDs and Other Instruments: Leverage for trading instruments other than forex, such as commodities, indices, and cryptocurrencies, usually varies and is generally lower than for major forex pairs.

Important Considerations

Regulatory Changes

Regulatory standards are subject to change, and these changes can affect leverage ratios. Traders should stay informed about regulatory developments in their regions, as these could impact available leverage.

Risk Management

Higher leverage can amplify both profits and losses. Effective risk management is essential:

- Stop-Loss Orders: Utilize stop-loss orders to limit potential losses on leveraged positions.

- Balance Management: Monitor your account balance to ensure it meets the margin requirements, especially in volatile market conditions.

Margin Calls

Be aware of FXCM’s margin call policy. If the market moves against your position and your account equity falls below the required margin level, FXCM will notify you of a margin call to either close your positions or deposit additional funds.

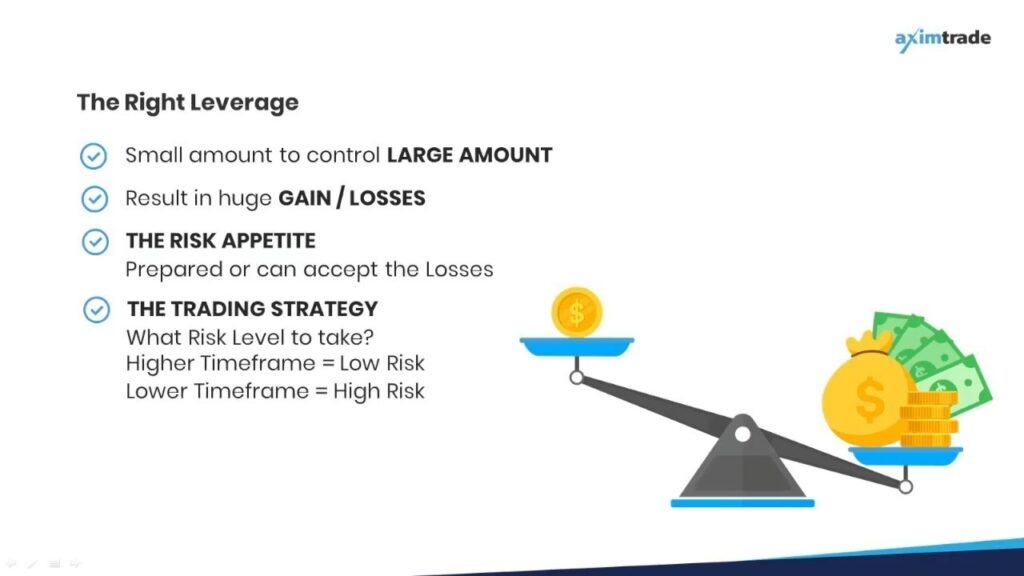

How to Choose the Right Leverage at FXCM

Selecting the appropriate leverage is a critical decision that can significantly impact your trading outcomes. The right leverage level at FXCM should align with your trading style, experience level, and risk tolerance. This guidance aims to help you understand how to choose the leverage that best suits your individual needs, enabling you to manage risks effectively while maximizing your trading potential.

Understand Your Trading Style

1. Assess Your Trading Style

- Day Trading: If you open and close positions within a single trading day, you might prefer a higher leverage to capitalize on small price movements.

- Swing Trading: For positions held over several days, moderate leverage might be more suitable as it balances the potential returns with the risks of overnight market fluctuations.

- Position Trading: Long-term traders might opt for lower leverage due to the extended exposure to market volatilities.

2. Frequency of Trades

- Frequent traders who execute many trades throughout the day may require different leverage compared to those who trade less frequently but take larger positions.

Evaluate Your Experience Level

1. Understand Leverage Implications

- Novice Traders: If you are new to forex trading, start with lower leverage. This minimizes risk as you learn to navigate market conditions and understand leverage dynamics.

- Experienced Traders: More experienced traders can use higher leverage effectively, as they are likely more skilled at managing risk and making informed trading decisions.

2. Practice with Different Levels

- Use a demo account to experiment with various leverage levels to see how they affect your trading strategy without any financial risk.

Consider Your Risk Tolerance

1. Quantify Your Risk Appetite

- Risk Assessment: Determine how much risk you are willing to take on each trade. Typically, traders should not risk more than 1% to 2% of their account balance on a single trade.

- Risk vs. Reward: Analyze potential loss and gain scenarios with different leverage settings to find a balance that you are comfortable with.

2. Use Risk Management Tools

- Implement stop-loss orders to protect against market volatility. This is crucial when using higher leverage, as it helps to cap potential losses.

Check Regulatory Restrictions

- Be Aware of Limits: Understand the leverage limits imposed by regulatory bodies in your jurisdiction. These limits are designed to protect traders from excessive risk and can influence the maximum leverage you can use.

Leverage Recommendations at FXCM

- Begin with Caution: Start with a lower leverage ratio until you develop a consistent track record of profitability.

- Adjust Gradually: As you gain experience and confidence, you can consider gradually increasing your leverage while continuously monitoring your trading performance and risk exposure.

- Stay Informed: Keep up to date with any changes in leverage regulations or offerings by FXCM that might affect your trading.

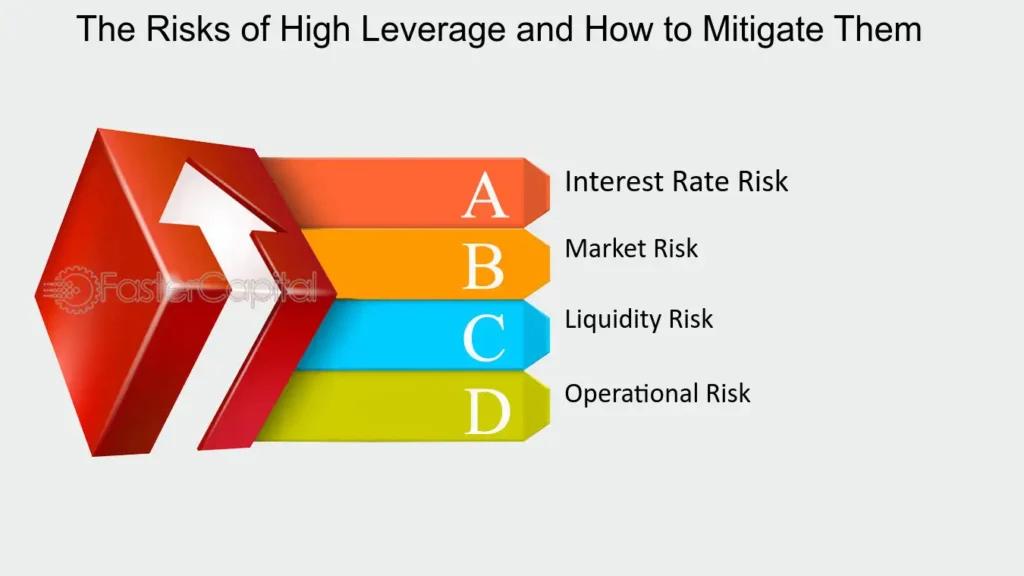

Risks Associated with High Leverage

High leverage in forex trading can significantly amplify profits but also increases the potential for substantial losses. Understanding the risks associated with using high leverage is essential for effective risk management. This chapter provides an in-depth look at the potential risks of using high leverage in forex trading and offers strategies on how to manage these risks effectively.

Overview of High Leverage Risks

High leverage allows traders to control large positions with a relatively small amount of capital. While this can yield large profits from small price movements, the converse is also true—small adverse price movements can result in significant or even total losses of the trading capital.

1. Magnified Losses

- Proportional Increase in Losses: Just as leverage can increase the potential return on investment, it proportionally increases the potential for losses. A minor adverse movement in currency prices can lead to a rapid depletion of a trader’s capital if the position is highly leveraged.

2. Margin Calls

- Account Liquidation: If the market moves against a leveraged position and the account balance falls below the minimum margin requirements, brokers may issue a margin call. This requires the trader to add additional funds to maintain their positions. If the trader cannot meet the margin call, the broker may close the position, and the trader could lose the capital invested in that position.

3. Market Volatility

- Increased Sensitivity: High leverage makes a trading account more sensitive to market volatility. News events, economic announcements, and market sentiments that cause price fluctuations can lead to quick and large losses.

4. Overtrading

- Psychological Pressure: High leverage might encourage traders to open more positions or larger positions than advisable, as the potential for higher returns can overshadow the associated risks. This overtrading can increase exposure unnecessarily.

Managing Risks of High Leverage

1. Implement Strict Risk Management Rules

- Use Stop-Loss Orders: Setting stop-loss orders for each trade can cap potential losses if the market moves unfavorably.

- Risk-Reward Ratios: Maintain a disciplined approach to risk-reward ratios. Avoid entering trades where the potential upside does not justify the risk.

2. Lower Leverage Usage

- Scale Down Leverage: Use lower levels of leverage, especially in highly volatile market conditions or when trading less liquid currency pairs.

- Adjust According to Experience: New traders should start with lower leverage to learn how to manage risk effectively before gradually increasing leverage as they gain more experience and confidence.

3. Continuous Education and Market Research

- Stay Informed: Keep abreast of market conditions, news, and economic events that can affect currency markets. Understanding market dynamics can help in making informed trading decisions.

- Learn from Mistakes: Analyze your trading decisions, especially the losing ones, to understand what went wrong and how similar mistakes can be avoided in the future.

4. Maintain Adequate Capital

- Capital Buffer: Keep a buffer of capital in your trading account over and above the minimum margin requirements to guard against unexpected market movements and margin calls.

5. Regularly Review Trading Strategy

- Periodic Assessments: Regularly review and adjust your trading strategy based on performance and changing market conditions. Ensure your use of leverage is always aligned with your overall trading goals and risk tolerance.

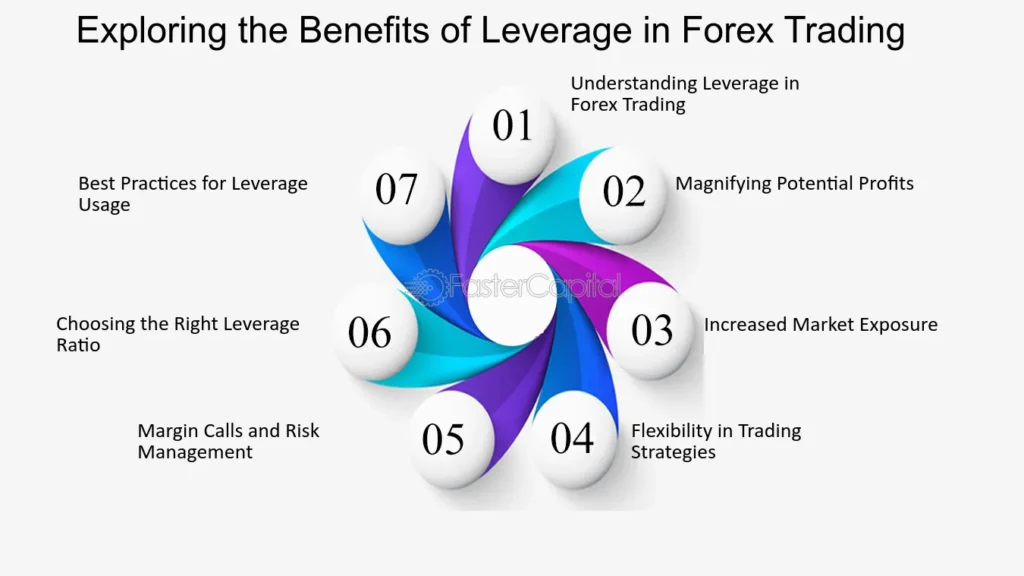

Benefits of Using Leverage with FXCM

Leverage is a powerful tool in forex trading, allowing traders to increase their exposure to the market without committing large amounts of capital upfront. FXCM, as a reputable forex broker, provides leverage options that can significantly enhance the trading experience. This discussion highlights the advantages of using leverage with FXCM, focusing on how it can amplify profitability, increase market access, and offer flexibility in trading strategies.

Enhanced Profitability on Successful Trades

Amplifying Returns

- Higher Potential Returns: Leverage allows traders to open larger positions than their actual deposited capital would otherwise permit. This means that even small movements in currency prices can result in significant profits relative to the trader’s initial investment.

- Example: If FXCM offers a leverage of 30:1, a trader with a $1,000 deposit can control a $30,000 position. A 1% move in the right direction can result in a $300 gain, substantially higher than what could be achieved without leverage.

Increased Market Access

Trading Larger Positions

- Broad Market Exposure: Leverage enables traders to participate in markets and trade sizes that would be out of reach with their capital alone. This is particularly advantageous for small-scale retail traders who wish to trade global forex markets.

- Diversification: By controlling larger positions, traders can diversify their portfolios across various currencies and instruments, spreading risk and increasing potential points of profit.

Flexibility in Trading Strategies

Implementing Sophisticated Strategies

- Day Trading and Scalping: These strategies often require quick, short-term trades to capitalize on small market movements. Leverage makes these strategies feasible by maximizing the potential returns from small price changes.

- Swing Trading and Position Trading: Leverage can also be beneficial for holding positions open over longer periods. Traders can use less of their capital to maintain open positions, freeing up funds for other investments.

Efficient Capital Use

Optimal Use of Capital

- Capital Efficiency: Leverage allows traders to use their capital more efficiently. By depositing only a fraction of the total position value, traders can keep additional funds in reserve for other trading opportunities or unexpected events.

- Risk Management: While leverage increases potential returns, it also raises risks. FXCM provides tools and resources, such as stop-loss orders and risk management education, to help traders use leverage wisely and protect themselves against large losses.

Enhanced Trading Experience with FXCM

Support and Resources

- Educational Resources: FXCM offers extensive educational materials and trading tools that help traders understand how to use leverage effectively and safely.

- Customer Support: Traders can benefit from FXCM’s robust customer support, which can guide them on the best practices for using leverage based on their individual trading styles and risk tolerance.

Leverage Regulations at FXCM

Leverage is a critical feature in forex trading, allowing traders to increase their market exposure beyond their actual invested capital. However, the leverage offered by brokers like FXCM is not solely determined by the broker’s policies but is also significantly influenced by regulatory guidelines specific to each jurisdiction where they operate. This overview provides insight into the regulatory constraints that shape the leverage FXCM can offer to traders across different regions.

Overview of Regulatory Influence on Leverage

Regulatory bodies worldwide impose limits on leverage to protect traders from the high risks associated with trading on margin. These regulations ensure that the leverage offered by brokers aligns with prudent financial practices to minimize excessive trading risk.

Major Regulatory Bodies and Their Impact

1. United States

- Regulated by: Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA).

- Leverage Limits: Maximum leverage for forex transactions is capped at 50:1 for major currency pairs and 20:1 for minors and exotics.

2. European Union

- Regulated by: European Securities and Markets Authority (ESMA).

- Leverage Limits: Maximum leverage for major currency pairs is limited to 30:1. Lower limits apply to minor pairs, gold, and major indices (20:1), and even lower for commodities other than gold and exotic pairs (10:1).

3. United Kingdom

- Regulated by: Financial Conduct Authority (FCA), following similar rules as ESMA.

- Leverage Limits: Similar to the EU, with a maximum of 30:1 for major currency pairs.

4. Australia

- Regulated by: Australian Securities and Investments Commission (ASIC).

- Leverage Limits: Recent regulations have aligned with other major jurisdictions, capping leverage at 30:1 for major forex pairs.

5. Other Regions

- Regulation: Varies by country, with some areas having less stringent regulations allowing for higher leverage, potentially up to 400:1 or 500:1.

- Example: Some offshore jurisdictions may offer higher leverage due to less regulatory oversight, but these may carry higher risks.

How FXCM Adapts to Regulatory Requirements

FXCM complies strictly with the regulations in each jurisdiction to ensure they provide services responsibly and protect their clients’ interests.

Adjustments Based on Jurisdiction

- FXCM adjusts the leverage offered based on the local regulations of the trader’s residency. This means a trader in the UK will have different leverage options compared to a trader in Australia, reflecting the respective regulatory frameworks.

Risk Management and Compliance

- Educational Initiatives: FXCM invests in trader education, emphasizing the risks and management of leverage.

- Tools and Support: They provide tools for risk management, such as stop-loss orders, and access to customer support to assist traders in making informed decisions about using leverage.

Transparency

- FXCM ensures transparency in its communication about leverage and any changes resulting from regulatory adjustments. This is crucial for maintaining trust and compliance.

Comparative Analysis: FXCM Leverage vs. Other Brokers

Leverage is a crucial feature in forex trading, offering the potential to amplify profits but also increasing the risk of substantial losses. Different brokers offer varying leverage levels based on regulatory compliance and their own risk management policies. This comparative analysis will explore how FXCM’s leverage options stack up against those offered by other major forex brokers, providing traders with insights to make informed decisions based on leverage availability.

FXCM Leverage Overview

FXCM provides leverage according to regulatory standards specific to each jurisdiction. For example:

- European Union and UK: Up to 30:1 for major currency pairs, following ESMA and FCA regulations.

- Australia: Also up to 30:1 following recent ASIC guidelines.

- Other Regions: Can vary, with some jurisdictions allowing higher leverage, potentially up to 400:1.

Comparison with Other Major Forex Brokers

1. IG Markets

- Leverage Offered: Similar to FXCM, IG Markets adheres to regulatory maximums, offering up to 30:1 for major currency pairs in regulated markets like the EU and Australia. In other less regulated regions, higher leverage may be available.

- Regulatory Compliance: IG is known for its strict compliance with regulatory authorities across different regions, ensuring a high level of trader protection.

2. Saxo Bank

- Leverage Offered: Saxo Bank typically offers lower leverage than FXCM, with maximum leverage for forex trades capped around 30:1 in line with European regulations. Saxo might offer lower leverage due to its focus on a wider range of investment products.

- Regulatory Compliance: Saxo is highly regulated, which influences its more conservative leverage offerings.

3. OANDA

- Leverage Offered: Similar to FXCM, OANDA offers up to 50:1 leverage in the United States and up to 30:1 in other regulated jurisdictions like Europe and Australia.

- Regulatory Compliance: OANDA complies with local regulatory limits and tends to offer competitive leverage ratios within those limits.

4. eToro

- Leverage Offered: eToro offers leverage up to 30:1 for major currency pairs, which is standard for brokers regulated in Europe and other similar jurisdictions. eToro also focuses on social trading aspects, which may influence its leverage policies.

- Regulatory Compliance: eToro follows regulatory guidelines strictly, which dictates its leverage offerings.

5. Pepperstone

- Leverage Offered: Offers high leverage options, up to 500:1 for professional clients, which is significantly higher than what FXCM offers in most jurisdictions.

- Regulatory Compliance: While Pepperstone provides higher leverage, it remains compliant with regulatory standards, offering these high ratios in regions with less stringent regulations.

Factors Influencing Broker Leverage Comparison

- Regulatory Environment: The primary factor affecting leverage ratios is the regulatory environment in which the broker operates. All brokers operating in heavily regulated environments (EU, UK, US, Australia) tend to offer similar maximum leverage ratios.

- Broker Risk Management Policies: Individual broker policies also play a role, especially where the regulatory framework allows for discretion. Risk-averse brokers might offer lower leverage irrespective of regulatory allowances.

- Market and Product Focus: Brokers focusing on professional or institutional markets might offer different leverage ratios compared to those targeting retail traders.

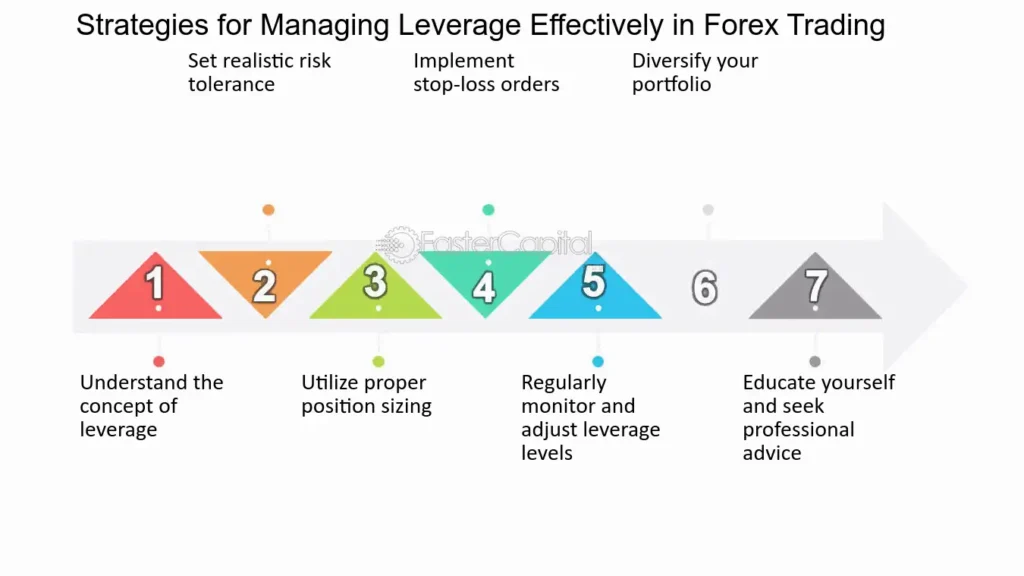

Strategies for Trading with Leverage at FXCM

Leverage is a double-edged sword in forex trading, amplifying both potential gains and losses. When trading with leverage at FXCM, it’s crucial to use strategic approaches that maximize profits while minimizing risks. Here are some essential tips and strategies for effectively leveraging your trading at FXCM, including key risk management techniques.

1. Understand Leverage and Its Impact

Before employing leverage, fully understand how it works and its potential impact on your trading account. Leverage increases your buying power, allowing you to open larger positions than your actual deposited funds would permit. However, remember that while potential profits are magnified, potential losses are equally magnified.

2. Start with Lower Leverage

For those new to trading or new to using leverage, start with a lower leverage ratio. This can help you get accustomed to the increased risk without exposing you to large losses. Gradually increase leverage as you gain more experience and confidence in your trading strategies.

3. Implement Strong Risk Management

Risk management is crucial when trading with leverage. Implement these key strategies:

a. Use Stop-Loss Orders

Always use stop-loss orders to limit potential losses. This is essential in preventing a single trade from significantly damaging your account.

b. Maintain Adequate Margin

Keep track of your account’s margin requirements and ensure you have sufficient funds to maintain open positions. This can prevent margin calls and forced liquidation of positions at unfavorable prices.

c. Monitor Positions Regularly

Keep a close eye on your open positions, especially when using high leverage. Market conditions can change rapidly, and active management is necessary to react promptly.

4. Leverage According to Market Conditions

Adjust your leverage based on current market volatility and liquidity. In highly volatile markets, consider reducing leverage to reduce risk, as price swings are more pronounced and can quickly trigger stop-loss orders.

5. Diversify Your Trades

Diversification can help spread risk, particularly when using leverage. Instead of concentrating on a single currency pair or market, diversify your investments across different instruments. This helps mitigate the risk if one trade or market performs poorly.

6. Develop a Trading Plan

A well-defined trading plan is essential, especially when using leverage. Your plan should include:

- Entry and exit strategies.

- How much of your total capital you are willing to risk on each trade.

- How leverage will be used in different scenarios.

7. Educate Yourself Continuously

Stay informed about market trends, economic factors, and news that can affect currency prices. Use FXCM’s educational resources to deepen your understanding of forex trading and leverage.

8. Use Demo Accounts to Practice

FXCM offers demo accounts where you can practice trading with virtual money. Use this to experiment with different levels of leverage and refine your trading strategies without any financial risk.

Real Trader Experiences with FXCM Leverage

Leverage is a critical tool in forex trading, allowing traders to magnify potential returns while also increasing risks. Here, we compile testimonials and case studies from FXCM users who have utilized leverage in their trading strategies. These real-life examples highlight both the benefits and challenges associated with leveraging investments, providing practical insights into how leverage is employed in different trading scenarios.

Testimonial 1: The Cautious Beginner

Name: Sarah

Location: United Kingdom

Experience:

“As a beginner, the idea of using leverage was quite daunting. I started with the minimum leverage option provided by FXCM, which was 30:1 for major forex pairs. This allowed me to slowly get used to the idea of trading larger amounts than my deposit. With careful use of stop-loss orders and constant monitoring of my trades, I’ve been able to gradually improve without overwhelming losses. The educational resources provided by FXCM were instrumental in helping me understand risk management better.”

Testimonial 2: The Day Trader

Name: Mike

Location: Australia

Experience:

“Day trading with leverage at FXCM has been a game-changer for me. I typically use a higher leverage ratio because I like to capitalize on small price movements throughout the day. While this strategy is riskier, FXCM’s platforms provide robust tools that help me manage risks effectively. Real-time data and quick execution speeds are crucial for my trading style, and I’ve been satisfied with the support and technology at FXCM.”

Testimonial 3: The Professional Trader

Name: Anika

Location: Canada

Experience:

“I trade professionally, and leveraging my positions significantly enhances my trading capacity. At FXCM, I’ve used leverage up to 50:1 for major pairs, which is perfect for my aggressive trading strategies. However, it’s not without its challenges—maintaining the right balance and not overextending has been key. FXCM’s advanced charting tools and analytics help me make informed decisions and stay on top of market trends.”

Testimonial 4: The Risk-Averse Investor

Name: David

Location: USA

Experience:

“Initially, I was hesitant to use much leverage because of the risk of substantial losses. However, after attending several webinars and learning more about risk management techniques through FXCM, I felt more comfortable utilizing a moderate amount of leverage. I’ve found that even a small amount of leverage can increase my potential returns without exposing me to unacceptable risks. The transparency and educational content FXCM offers have been crucial in building my confidence.”

Case Study: Recovery from a Margin Call

Scenario:

A trader experienced a margin call after a sudden market downturn impacted their heavily leveraged position.

Outcome:

“The experience taught me the importance of not only setting stop-losses but also keeping an eye on economic events that can trigger high volatility. FXCM’s alerts and tools helped me respond quickly and mitigate further losses. This was a tough but valuable lesson in leverage management.”

Conclusion: Leveraging Your Success at FXCM

Leverage is a powerful tool in forex trading that, when used wisely, can significantly enhance trading outcomes. FXCM offers a range of leverage options tailored to meet the needs of diverse traders, from novices to experienced professionals. This conclusion summarizes the key points about FXCM’s leverage options and provides guidance on how traders can effectively use them to achieve greater trading success.

Key Points about FXCM’s Leverage Options

Regulatory Compliance

FXCM complies with international regulatory standards, which ensures that the leverage offered is within safe and permissible limits. For instance, traders in the European Union and the UK can access leverage up to 30:1 for major forex pairs due to ESMA and FCA guidelines, while other regions might offer higher leverage.

Tailored Leverage Levels

FXCM provides different leverage levels based on the trader’s account type and region. This flexibility allows traders to choose leverage that aligns with their trading style and risk tolerance. Higher leverage is available for professional and high-volume traders, which can be an advantage for those with more experience and a higher appetite for risk.

Integration with Risk Management Tools

FXCM equips its trading platforms with robust risk management tools, such as stop-loss orders and real-time alerts. These tools are essential for managing the risks associated with high leverage, allowing traders to protect their investments from excessive losses.

Leveraging Success at FXCM

Start with Education

Before using leverage, educate yourself thoroughly. FXCM offers extensive educational resources that cover the fundamentals of leverage and risk management. Utilizing these resources can prepare traders to make informed decisions about leveraging their trades.

Practice with Demo Accounts

FXCM provides demo accounts where traders can practice using leverage without financial risk. This is an invaluable tool for beginners to gain confidence and for experienced traders to test new strategies.

Implement Conservative Leverage Initially

If you are new to trading or to using leverage, start conservatively. Use lower leverage while you learn how market movements affect your positions and until you have proven strategies that work consistently.

Use Stop-Loss Orders

Always set stop-loss orders to limit potential losses. This is crucial when trading with leverage, as markets can move quickly and magnify losses just as they can magnify gains.

Monitor and Adjust

Regularly review your trading strategy and leverage use. Markets change, and what works today might not work tomorrow. Be prepared to adjust your leverage and strategies to align with current market conditions and your evolving trading skills.

Balance Leverage with Risk Tolerance

Always align your use of leverage with your personal risk tolerance. More leverage increases both potential gains and potential losses, so it should match your financial situation and your ability to endure periods of volatility.