Understanding the financial requirements, particularly the minimum deposit requirements, is crucial for any trader considering FXCM as their forex trading platform. This introductory chapter provides an overview of FXCM and discusses the significance of these minimum deposit requirements in the context of forex trading. We’ll explore why these financial thresholds are set and how they can impact a trader’s decision-making and strategy.

Overview of FXCM

FXCM (Forex Capital Markets) is a well-established forex broker that has been providing trading services since 1999. Known for its robust trading platforms, comprehensive educational resources, and a wide range of trading instruments, FXCM caters to traders of all levels, from novices to experienced professionals. It operates in various global markets, offering competitive spreads and access to a vast array of currency pairs, CFDs, and commodities.

Significance of Minimum Deposit Requirements

Function of Minimum Deposits

Minimum deposit requirements are a standard feature across forex brokers, including FXCM. These requirements serve several functions:

- Financial Viability: They ensure that clients have sufficient capital to undertake meaningful trading while managing risk effectively.

- Broker Services: Higher deposits may unlock additional services, such as lower spreads, access to better trading platforms, or personalized customer support.

- Market Accessibility: By setting a minimum threshold, brokers can filter clients based on their financial readiness to engage in trading, which helps maintain the quality and seriousness of the trading community.

FXCM’s Minimum Deposit Requirements

FXCM’s minimum deposit requirements vary depending on the account type, trading platform, and the geographical location of the trader. For example:

- Standard Accounts: Typically require a minimum deposit that is accessible to average retail traders, making it an attractive option for those new to forex trading.

- Active Trader Accounts: Targeted at more serious traders with higher trading volumes, these accounts may require a higher minimum deposit but offer additional benefits such as reduced commissions and dedicated support.

Impact on Trader Strategy

Understanding the implications of these requirements is crucial for formulating a successful trading strategy:

- Risk Management: The amount of capital a trader starts with will directly influence their ability to spread risk across different trades.

- Trading Style: Certain trading styles, like scalping or high-frequency trading, might require more capital due to the high volume of trades executed.

- Growth Strategy: Traders need to consider their long-term growth strategy, including how they plan to scale their trading activities and whether starting with a higher or lower balance fits into this strategy.

FXCM Minimum Deposit Requirements

FXCM offers a variety of account types to suit different trading styles and levels of investment. Each account type has specific minimum deposit requirements, which can influence a trader’s decision on which account best fits their needs. In this chapter, we will delve into the detailed information regarding the current minimum deposit amounts for various FXCM account types, helping traders understand what financial commitment is required to start trading with FXCM.

Standard Account

Minimum Deposit

The Standard Account is the most accessible account type offered by FXCM, designed for retail traders who are either new to forex trading or do not wish to commit a substantial amount of capital initially.

- Minimum Deposit Requirement: Typically, the minimum deposit for a Standard Account at FXCM starts at approximately $50 to $300, depending on the region and local regulations. This low barrier to entry makes it an attractive option for new traders.

Features

- Access to All Trading Platforms: Traders with Standard Accounts have access to all FXCM’s trading platforms, including MetaTrader 4, Trading Station, and the NinjaTrader.

- Leverage: Up to 30:1 leverage for major currency pairs, aligning with regulatory standards.

- Spreads: Competitive spreads with no commissions on forex trades.

Active Trader Account

Minimum Deposit

The Active Trader Account is tailored for high-volume traders who can benefit from tighter spreads and a dedicated support structure.

- Minimum Deposit Requirement: This account requires a significantly higher minimum deposit, usually around $25,000. This account is suitable for serious traders who have more capital and are looking for more aggressive trading conditions.

Features

- Reduced Trading Costs: Lower spreads and reduced commissions are key benefits, which can substantially lower the cost of trading for active traders.

- Dedicated Support: Personalized customer service, including access to a dedicated account manager.

- Additional Tools: Advanced reporting and customized trading solutions are available for Active Trader Account holders.

Professional Account

Minimum Deposit

Designed for professional traders with substantial trading volumes, the Professional Account offers the most advantageous conditions within FXCM’s portfolio.

- Minimum Deposit Requirement: The deposit requirements can vary, but they are generally higher than those for Active Trader Accounts, often exceeding $25,000.

Features

- Higher Leverage Options: Depending on the region and compliance with local regulations, professional accounts might offer higher leverage.

- Elite Pricing: Access to raw spreads and lower commission rates.

- Advanced Tools and Support: Includes access to premium tools, risk management services, and priority support channels.

Considerations for Traders

When choosing an FXCM account, traders should consider their trading strategy, volume, and how much capital they can reasonably commit to trading. The minimum deposit is just one factor in determining the right account type. Traders should also consider other features such as the cost of trading, the tools available, and the level of support offered by the broker.

Comparison of Account Types Based on Deposits at FXCM

When choosing a trading account, one of the primary considerations is the minimum deposit requirement. Different account types at FXCM cater to diverse trader needs and investment capabilities. This comparative analysis will help traders understand how minimum deposits vary across different FXCM account types and what benefits each account offers, facilitating an informed decision based on their trading strategy and capital availability.

Overview of FXCM Account Types

FXCM primarily offers several types of accounts, each tailored to different segments of the trading population, from beginners to seasoned professionals. Here’s a breakdown of these account types with a focus on minimum deposits and associated benefits:

1. Standard Account

Minimum Deposit

- Typical Minimum Deposit: $50 to $300, depending on the region.

Features

- Accessibility: Designed for retail traders, particularly beginners or those with limited capital.

- Trading Platforms: Access to all FXCM trading platforms including MetaTrader 4, the Trading Station, and NinjaTrader.

- Leverage and Spreads: Standard leverage up to 30:1 for major pairs with competitive spreads. No trading commissions on forex.

2. Active Trader Account

Minimum Deposit

- Typical Minimum Deposit: $25,000

Features

- Cost Efficiency: Lower transaction costs with reduced spreads and commissions, beneficial for high-volume traders.

- Support: Dedicated account manager and premium customer support.

- Tools: Access to elite data and advanced charting tools.

3. Professional Account

Minimum Deposit

- Typical Minimum Deposit: Often above $25,000; specific terms can vary based on individual circumstances and negotiations.

Features

- High Leverage: Higher leverage options available, subject to regulatory restrictions.

- Elite Pricing: Access to raw spreads and even lower commission rates than the Active Trader account.

- Enhanced Tools: Advanced trading tools, risk management options, and priority support services.

Comparative Analysis

Minimum Deposit and Trader Suitability

- Standard Account: The lowest minimum deposit requirement makes it ideal for new traders or those testing the FXCM platform. It’s also suited for traders with limited risk capital.

- Active Trader Account: Requires a significant increase in initial capital but offers considerable savings on trading costs, which can be beneficial for traders who trade frequently or with high volumes.

- Professional Account: Targets very experienced traders with substantial capital, offering the best prices and highest levels of support and tools. Suitable for professionals with specific trading needs that require customization.

Benefits and Strategic Fit

- Cost vs. Benefit: While higher deposit accounts offer reduced costs and more features, the benefits need to outweigh the increased financial commitment. Traders should assess whether the lower costs and additional features will provide enough value based on their trading frequency and volume.

- Leverage and Risk: Higher leverage in professional accounts can mean higher risk. Traders need to have solid risk management strategies in place to make the most of these accounts.

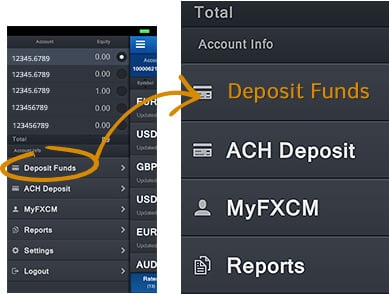

Methods of Depositing Funds with FXCM

For traders looking to fund their FXCM accounts, the broker provides a variety of convenient deposit methods. These options cater to diverse preferences and geographical locations, ensuring that traders can easily and securely transfer funds into their trading accounts. This chapter will provide an overview of all the available payment methods for depositing funds into an FXCM account, including details on bank transfers, credit cards, and e-wallets.

Overview of Deposit Methods

FXCM supports several deposit methods, each offering distinct advantages in terms of processing times, convenience, and accessibility.

1. Bank Wire Transfer

Features

- Security: Bank transfers are highly secure, making them a preferred method for transferring large amounts.

- Global Availability: Available worldwide, allowing traders from various countries to fund their accounts easily.

Considerations

- Processing Time: Can take several business days to process, which might be slower compared to other methods.

- Fees: Banks may charge a fee for wire transfers, which varies depending on the bank and the country.

2. Credit and Debit Cards

Features

- Speed: Credit and debit card deposits are usually processed quickly, often within minutes.

- Convenience: Almost universally accepted and easy to use. FXCM accepts major cards like Visa, MasterCard, and Discover.

Considerations

- Limits: There may be lower deposit limits compared to bank transfers, suitable for smaller deposits.

- Potential Fees: Some credit card companies might treat deposits as cash advances, which could incur additional fees.

3. E-Wallets

Features

- Variety: FXCM supports several popular e-wallets such as Skrill, Neteller, and PayPal, providing flexible options for electronic deposits.

- Efficiency: E-wallets typically process transactions quickly, often instantly or within a few hours.

Considerations

- Availability: The availability of specific e-wallet services may vary by country.

- Fees: E-wallets may charge fees for transactions, though these are usually lower than those associated with credit card cash advances.

4. Local Bank Transfer Services

Features

- Local Integration: Services like Sofort and BACS are available for traders in specific regions, offering localized payment solutions.

- Cost-Effective: Often incurs lower fees than international bank transfers.

Considerations

- Geographical Restrictions: Only available in certain countries, limiting access for some traders.

- Processing Times: May vary depending on the local service and bank.

Best Practices for Depositing Funds

Verification

Ensure that your FXCM account and all payment methods are fully verified to avoid delays or issues in processing deposits.

Check Fees and Limits

Review any applicable fees or deposit limits associated with each payment method. This information is typically available on FXCM’s website or directly through the payment provider.

Security

Always use secure internet connections when making online payments and keep all financial information confidential to prevent unauthorized access.

Consult Support

If unsure about the best method to use or if you encounter any issues during the deposit process, FXCM’s customer support can provide guidance and assistance.

Benefits of Meeting Minimum Deposit Requirements

Meeting the minimum deposit requirements when opening a trading account with FXCM not only facilitates the activation of your trading account but also unlocks a range of benefits that can significantly enhance your trading experience. This discussion will cover the various advantages associated with depositing at least the minimum required amount, from better trading conditions to access to more comprehensive features.

Enhanced Trading Conditions

Improved Leverage Options

- Increased Leverage: Depositing the minimum required amount or more can qualify traders for higher leverage options, which means more significant potential gains. However, traders must manage the increased risk responsibly.

Broader Access to Instruments

- Diverse Trading Instruments: A higher initial deposit may provide access to a wider range of trading instruments, including exotic forex pairs, CFDs, and global indices, which might otherwise be restricted to higher-tier accounts.

Access to Advanced Trading Platforms and Tools

Use of Premium Platforms

- Advanced Platforms: FXCM offers several trading platforms, such as the Trading Station and MetaTrader 4. Depositing the minimum required amount ensures full access to these platforms, which come equipped with advanced charting tools, automated trading features, and comprehensive market analysis capabilities.

Customizable Trading Tools

- Enhanced Tools: Higher deposits often grant access to more sophisticated trading tools and algorithms that can help in executing complex trading strategies more efficiently.

Educational and Analytical Resources

Comprehensive Educational Content

- Access to Webinars and Seminars: FXCM provides a plethora of educational resources including webinars, seminars, and online courses. Meeting the minimum deposit often grants traders enhanced access to these valuable learning tools, which can help them better understand market dynamics and refine their trading strategies.

Market Insights and Analysis

- Exclusive Market Reports: Traders who meet minimum deposit requirements may receive exclusive insights and detailed market analyses, which can significantly improve decision-making processes by providing timely and critical information.

Customer Support and Personalized Service

Dedicated Account Management

- Personal Account Manager: For traders who deposit at or above the minimum requirements, FXCM often offers the services of a dedicated account manager. This personalized service can provide tailored advice, faster response times, and individualized support.

Priority Customer Support

- Enhanced Support: Depositing the required amount ensures that traders have access to priority customer support, reducing waiting times and providing more immediate assistance for trading-related inquiries or technical issues.

Financial Stability and Risk Management

Better Risk Management

- Balanced Risk: By depositing at least the minimum required amount, traders can manage their risks more effectively. It allows for diversifying trades and applying risk management techniques more efficiently, which can buffer against potential losses.

Psychological Comfort

- Increased Confidence: Having a cushion of the minimum required balance can provide psychological comfort to traders, allowing them to trade with more confidence and less anxiety about margin calls.

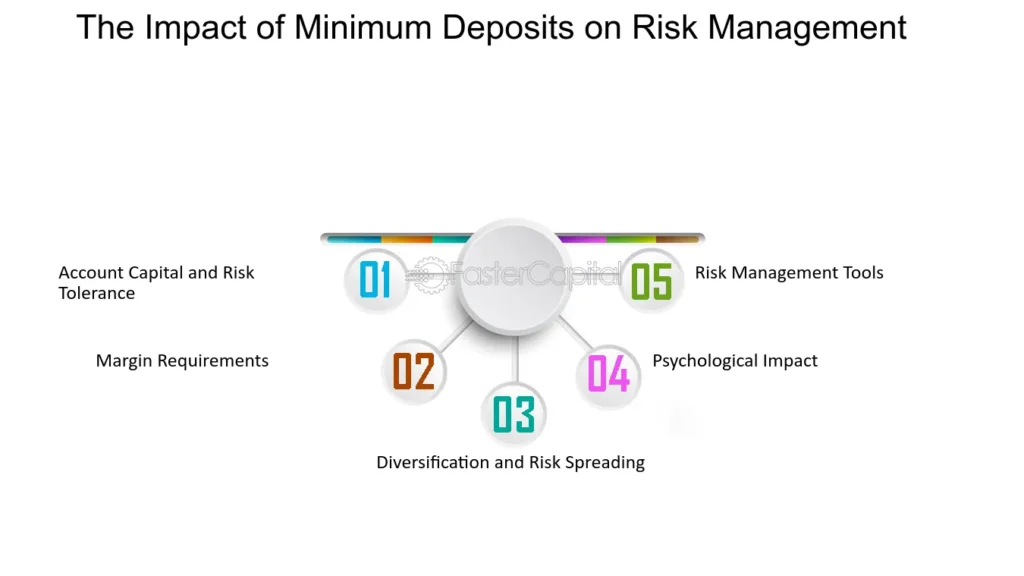

Impact of Deposit Amount on Trading Strategies

The size of your deposit plays a crucial role in shaping your trading strategy and risk management approach. A larger deposit can offer greater flexibility and more opportunities, but it also requires careful management to mitigate potential risks. This chapter explores how the size of your deposit can affect your trading style and risk management strategies, providing insights into how traders can adjust their approaches based on their capital investment.

Trading Style Adaptation

Scalability of Trades

- Larger Deposits: Traders with larger deposits have the capability to engage in more significant positions or multiple trades simultaneously without disproportionately affecting their risk capital. This can lead to a more aggressive trading style, focusing on maximizing returns from market movements.

- Smaller Deposits: Conversely, traders with smaller deposits might adopt a more conservative trading style, focusing on fewer, smaller trades to manage risk effectively.

Leverage and Margin

- Influence of Deposit Size on Leverage: A substantial deposit reduces the relative amount of leverage needed to open a significant position. While leverage can amplify returns, excessive leverage can also magnify losses, making it crucial for traders with smaller deposits to use leverage cautiously.

- Margin Requirements: Higher deposits can also affect margin requirements. With more capital, traders might face lower relative margin calls, providing more breathing room during market fluctuations.

Risk Management Strategies

Diversification

- Opportunities for Diversification: Larger deposits allow for greater diversification across different asset classes, reducing the risk inherent in concentrating funds in a single market or instrument. This is critical in spreading risk and potentially stabilizing returns over time.

- Limitations with Smaller Deposits: With smaller deposits, traders may need to be more selective in their trades, which might limit their ability to diversify effectively.

Stop-Loss and Take-Profit Orders

- Flexibility in Setting Orders: Traders with larger deposits have more flexibility in setting stop-loss and take-profit orders. They can afford to set wider stop-losses without the fear of losing a significant portion of their capital, which can be particularly advantageous in volatile markets.

- Precision Required for Smaller Deposits: For smaller deposits, precision in setting these orders becomes crucial to protect limited capital. The risk of each trade must be meticulously calculated to prevent substantial erosion of capital.

Psychological Aspects

Risk Tolerance and Psychological Pressure

- Impact of Larger Deposits: While a larger deposit might suggest a higher risk tolerance, it also increases the psychological pressure to manage that capital wisely. The potential for larger losses can impact decision-making, leading to either overly cautious or overly aggressive trading.

- Smaller Deposits and Risk Aversion: Smaller deposits may limit exposure to massive losses, potentially reducing psychological stress but also limiting market opportunities.

Strategic Considerations

Long-Term Planning

- Sustainability with Larger Deposits: Traders with larger deposits need to plan for long-term sustainability, balancing the pursuit of profits with the need for capital preservation.

- Growth Strategies for Smaller Deposits: Traders starting with smaller deposits should focus on growth strategies that gradually build their capital through consistent, small gains, rather than taking disproportionate risks.

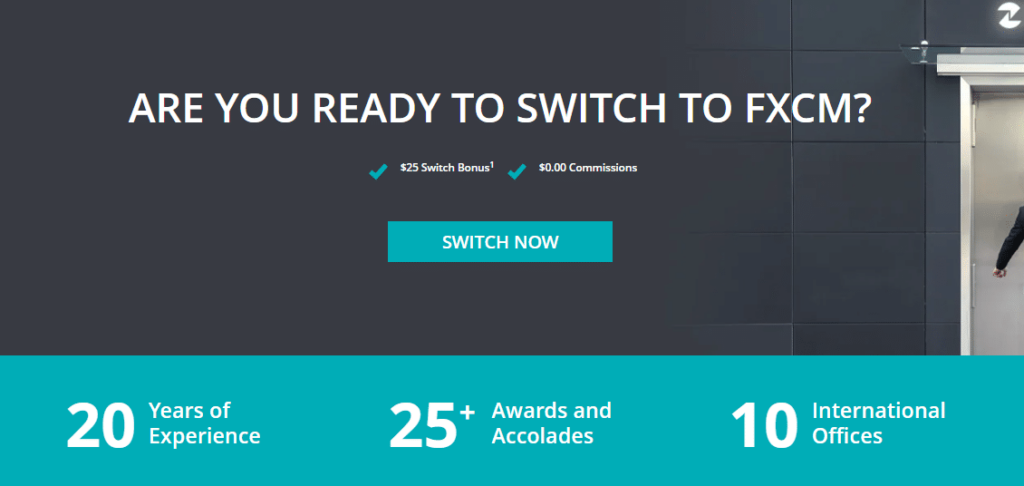

FXCM Bonuses Related to Initial Deposits

FXCM, like many forex brokers, often incentivizes new and existing clients with various bonuses and promotions that are tied to the initial deposit amount. These incentives are designed to encourage traders to fund their accounts and to start trading on a strong footing. Here’s an overview of the types of bonuses or promotions FXCM might offer for meeting or exceeding the minimum deposit requirements.

Types of Deposit-Related Bonuses at FXCM

Welcome Bonus

- Description: FXCM may offer a welcome bonus to new clients who open an account and deposit funds that meet or exceed a specified minimum. This bonus is typically a one-time offer and is designed to boost the trader’s initial capital.

- Benefit: Increases the trader’s leverage by providing additional funds for trading, enhancing their ability to take significant positions right from the start.

Deposit Match Bonus

- Description: A deposit match bonus involves FXCM offering to match a percentage of the trader’s deposit up to a certain limit. For example, a 50% match on a deposit of $2,000 would give the trader an additional $1,000 in bonus funds.

- Benefit: Directly increases trading capital, providing more flexibility in trading strategies and the potential to increase exposure to various markets.

First-Time Deposit Bonus

- Description: Specifically targeting new customers, this bonus rewards traders who make their first deposit. The specifics can vary, often depending on the campaign running at the time.

- Benefit: Encourages new traders to start trading with a larger balance, potentially leading to more substantial profits.

Tiered Deposit Bonus

- Description: Some promotions may offer tiered bonuses that increase with the deposit amount. For instance, depositing $1,000 might yield a 10% bonus, whereas depositing $5,000 might yield a 20% bonus.

- Benefit: Motivates traders to deposit larger amounts by offering increasingly valuable rewards, aligning the trader’s commitment with greater financial incentives.

Conditions and Considerations

- Minimum Deposit Requirement: Each bonus type will have a minimum deposit requirement that must be met to qualify. These thresholds are typically clearly outlined in the promotion details.

- Withdrawal Conditions: Bonuses usually come with specific conditions that must be met before bonus funds can be withdrawn. This often includes trading a certain volume within a given timeframe.

- Expiration of Offer: Most deposit-related bonuses have an expiration date, meaning the bonus must be claimed within a specific period after the account is opened or the deposit is made.

- Regional Restrictions: Depending on the trader’s location, some bonuses may not be available due to regional regulatory requirements.

Strategic Use of Deposit Bonuses

To maximize the benefits of FXCM’s deposit-related bonuses, traders should:

- Plan Their Deposit: Align the deposit with the bonus structure to maximize the potential bonus amount.

- Understand the Terms: Fully understand all the conditions associated with the bonus, including trading volume requirements and the bonus expiry period.

- Incorporate Into Trading Strategy: Use the additional funds strategically to explore new trading strategies or to bolster existing ones without unnecessarily increasing risk exposure.

FAQs About Depositing with FXCM

Depositing funds into a trading account can raise several questions for both new and experienced traders. To help clarify common concerns, here’s a compilation of frequently asked questions about depositing funds with FXCM, covering minimum requirements, deposit methods, processing times, and other related topics.

1. What is the minimum deposit required to open an account with FXCM?

Answer: The minimum deposit required to open an account with FXCM typically ranges from $50 to $300, depending on the account type and the trader’s location. It’s advisable to check the specific requirements for your region on the FXCM website or contact their support for the most accurate information.

2. What methods can I use to deposit funds into my FXCM account?

Answer: FXCM offers several deposit methods including bank wire transfers, credit and debit cards (Visa, MasterCard, Discover), and e-wallets such as Skrill, Neteller, and PayPal. The availability of these methods may vary by country.

3. Are there any fees associated with depositing funds?

Answer: FXCM does not typically charge any fees for depositing funds. However, it’s important to note that your bank or payment provider might impose a fee for facilitating a transfer or currency conversion. Always check with your payment provider before making a deposit.

4. How long does it take for deposited funds to appear in my trading account?

Answer: The processing time for deposits depends on the method used:

- Credit/Debit Cards and E-Wallets: Usually instant or within a few hours.

- Bank Wire Transfers: Can take several business days, depending on your bank and country.

5. Can I deposit funds in a currency other than USD?

Answer: Yes, FXCM allows deposits in several major currencies including EUR, GBP, AUD, and JPY. The availability of specific currencies can depend on your account setup and region. Currency conversion fees may apply if your deposit currency differs from your account currency.

6. What should I do if my deposit has not been credited to my account?

Answer: If your deposit does not show up in your account within the expected time frame, contact FXCM customer support. Be ready to provide details such as the deposit amount, transaction date, and proof of payment or transaction reference number.

7. Is there a limit to how much I can deposit into my FXCM account?

Answer: There is no set maximum deposit limit at FXCM, but for large transactions, especially via credit card, it might be necessary to verify the transaction with both FXCM and your card provider to ensure security compliance.

8. Can I use someone else’s payment method to deposit funds into my account?

Answer: No, FXCM requires that all deposits come from accounts or payment methods under the same name as the FXCM account holder to comply with anti-money laundering regulations.

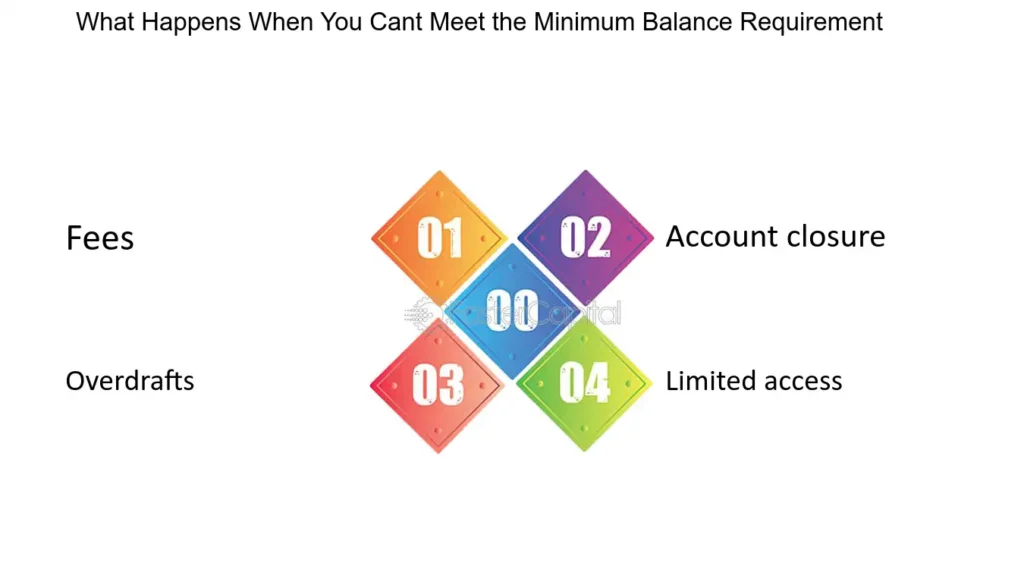

9. What happens if I deposit more than the minimum required amount?

Answer: Depositing more than the minimum can provide additional trading flexibility, potentially better risk management through diversified trades, and may qualify you for additional services or promotions depending on the amount deposited.

10. How can I withdraw funds, and are there any restrictions?

Answer: Withdrawals must be made using the same method as the deposit when possible, and back to the same account. The time it takes to process withdrawals can vary. There may be restrictions if you have open positions or if the funds are tied to a bonus with outstanding qualification criteria.

By understanding these FAQs about depositing with FXCM, traders can more effectively manage their funding and trading activities, ensuring a smoother trading experience. If you have more specific questions or need further clarification on any aspect of your account, FXCM’s customer support is readily available to assist.

Real Trader Experiences with FXCM Deposits

Understanding how actual traders experience the deposit process with FXCM can provide valuable insights for potential and existing clients. Below is a collection of testimonials and feedback from various FXCM users regarding their experiences with making deposits. These accounts cover various aspects, from the ease of transaction to customer service interactions, highlighting both the strengths and areas for improvement.

Testimonial 1: Ease of Depositing

Name: Jennifer

Location: United Kingdom

Experience:

“I found the deposit process at FXCM to be straightforward and user-friendly. I used my credit card to fund my account, and the funds were available almost immediately. The fact that there were no processing fees was a big plus for me. I was trading within an hour of my first visit to the website, which was great.”

Testimonial 2: Multiple Deposit Methods

Name: Carlos

Location: Brazil

Experience:

“I appreciate the variety of deposit methods available at FXCM. I initially started with a bank transfer, but I’ve since switched to using an e-wallet (Skrill) because it’s faster. Each time I’ve made a deposit, it has been seamless, with no issues or delays.”

Testimonial 3: Customer Support During Deposit

Name: Aisha

Location: UAE

Experience:

“When I made my first deposit, I encountered some issues because my bank flagged the transaction. I contacted FXCM’s customer support, and they were incredibly helpful. They guided me through the process, and once the issue was resolved, my deposit went through without any further problems. Their support made a huge difference.”

Testimonial 4: Dealing with Currency Conversion

Name: Mark

Location: Australia

Experience:

“As an Australian trader, I needed to deposit AUD into my trading account, which involves currency conversion. FXCM’s platform made this process very transparent, showing me exactly how much I would get in my trading account after the conversion. The rates were competitive, and there were no hidden charges, which I’ve appreciated.”

Testimonial 5: Feedback on Processing Times

Name: Emily

Location: Canada

Experience:

“The only gripe I have is with the processing time for a bank wire transfer. It took almost five days for my deposit to reflect in my account, which was frustrating. However, I understand this is partly due to the banks’ processing times. For faster access, I might try using a credit card next time.”

Testimonial 6: High Deposit Limits

Name: David

Location: Germany

Experience:

“I’m a professional trader, and I often make large deposits. FXCM has accommodated my needs well, allowing me to transfer substantial amounts without issues. Their platform and team have been very supportive and ensure that all my transactions are handled securely.”

Conclusion: Is FXCM the Right Choice for Your Deposit Size?

When selecting a forex broker, one critical factor to consider is the broker’s minimum deposit requirement, as it dictates the initial amount you need to start trading. FXCM, known for its range of trading services and robust platform options, offers relatively flexible deposit requirements that cater to a broad spectrum of traders. Here’s a final analysis of how FXCM’s minimum deposit requirements compare to other brokers and what traders should consider when choosing a broker based on deposit limits.

Comparison with Other Brokers

Competitive Deposit Requirements

FXCM’s minimum deposit requirements are competitive within the industry. Starting from about $50 to $300 for a standard account, these amounts are accessible for novice traders while still offering enough flexibility for more experienced traders to operate effectively. This is comparable to other major brokers like OANDA and Forex.com, which also offer similar entry points, making FXCM a viable option for traders of all levels.

Higher-Tier Accounts

For more seasoned traders or those looking to trade with higher volumes, FXCM also provides Active Trader and Professional accounts, which require significantly higher deposits. This structure is similar to brokers like Saxo Bank or Interactive Brokers, which cater to high-volume traders with advanced features but at a higher financial entry point. The key here is that FXCM offers a graduation of account types, which can suit your growing needs as a trader.

Considerations for Choosing Based on Deposit Limits

Assess Your Financial Capability

Evaluate your financial situation to determine how much capital you can comfortably invest without jeopardizing your financial health. FXCM’s lower minimum for standard accounts is appealing if you’re starting out or if you prefer to minimize your initial investment.

Consider Growth and Scalability

Think about your long-term trading goals. If you start with a standard account, does the broker provide an easy path to upgrade to higher-tier accounts as your trading strategy evolves and your capital increases? FXCM offers this scalability, which can be a significant advantage.

Compare Account Features and Broker Services

Beyond just the initial deposit, consider what features, tools, and services you get with your account. For example, higher deposit accounts at FXCM offer reduced spreads and commissions, dedicated support, and more robust trading tools. Weigh these benefits against the deposit requirements to see if they align with your trading strategies.

Review Deposit-Related Bonuses and Promotions

Consider any deposit-related bonuses or promotions which can add value to your initial investment. FXCM occasionally offers promotions like deposit bonuses or rebates that can enhance your trading capacity. Check the current offers and understand their terms fully.

Regulatory and Security Aspects

Ensure that the broker’s regulatory standing and the security measures they have in place are up to your standards. FXCM’s adherence to strict regulatory guidelines offers peace of mind but always perform your due diligence.