In the world of forex trading, few FXCM Broker are as well-known as FXCM. Established in 1999, FXCM broker has become a cornerstone of the forex industry, offering traders globally a reliable, transparent, and user-friendly platform to engage with the markets. This chapter provides an overview of FXCM, exploring its rich history, its significant role in the forex trading industry, and why it stands out as a preferred choice for beginners.

FXCM: Pioneering Forex Trading

FXCM (Forex Capital Markets), founded at the cusp of the new millennium, marked a pivotal moment as the forex market was just beginning to recognize the potential of the internet. Consequently, this period marked a rapid evolution in trading practices, with FXCM leading the way. Over the years, FXCM has grown substantially, adapting to new technological advancements and regulatory changes, ensuring they remain at the forefront of the trading industry.

Key Milestones in FXCM’s History:

- In 1999, FXCM launched, ushering in a new era of online forex trading.

- 2001: Launch of its flagship platform, enhancing user experience with robust trading tools.

- 2010: Expansion into several international markets, broadening its global reach.

- 2015 and Beyond: Continual upgrades to its trading systems and platforms to incorporate the latest in trading technology and compliance standards.

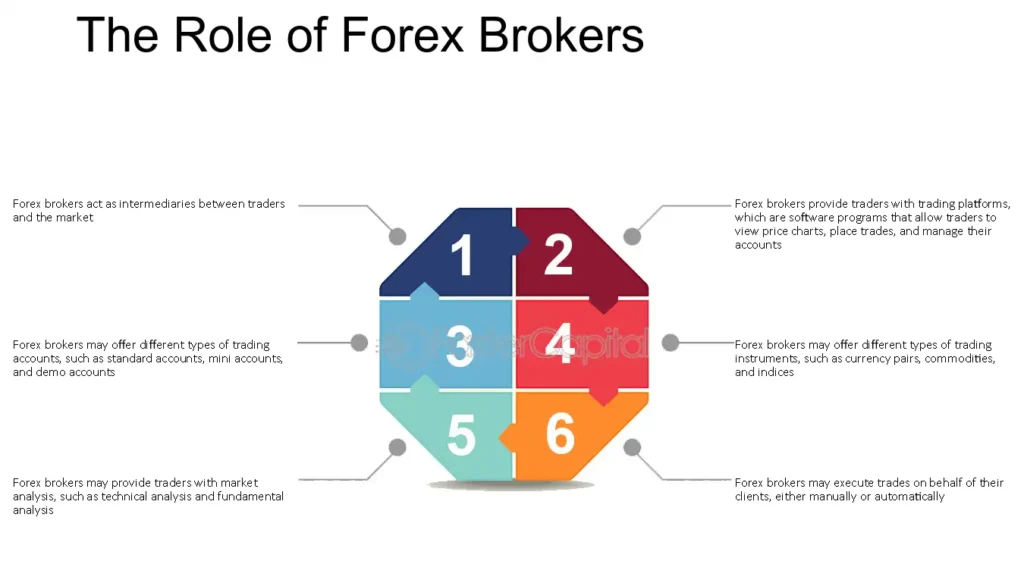

FXCM Broker Role in Forex Trading

As a major player in the forex market, FXCM’s role extends beyond just providing a trading platform. It is integral in shaping market practices, influencing regulatory standards, and pioneering innovations that define the industry.

- Furthermore, FXCM dedicates itself to educating traders by offering a wealth of learning materials. These resources include seminars, webinars, and written content that caters to both beginners and experienced traders. Additionally, these educational tools are designed to help traders at every skill level enhance their trading knowledge and proficiency.

- Innovative Trading Solutions: Constantly pushing the boundaries, FXCM has introduced numerous trading tools and analytics to help traders make informed decisions.

- Regulatory Compliance: Committed to transparency and fairness, FXCM adheres to the strictest regulatory standards, ensuring a trustworthy trading environment for all users.

“At FXCM, our mission is not just to provide a platform for trading but to empower traders to make informed, calculated, and successful trading decisions.” — FXCM Representative.

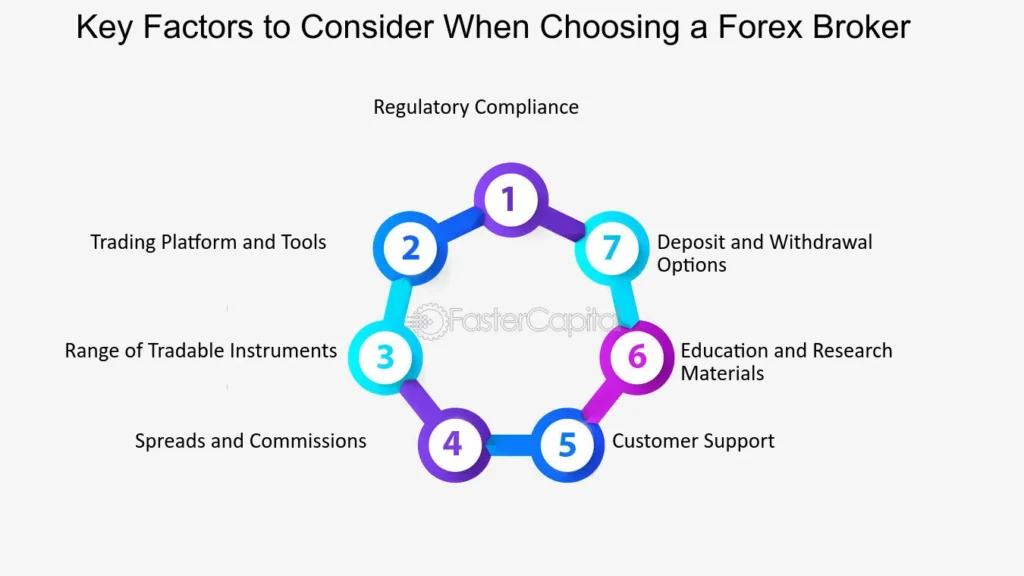

Why ChooseFXCM Broker?

Choosing the right FXCM Broker can be the difference between success and failure in forex trading. FXCM stands out for several reasons:

- User-Friendly Interface: Designed with the user in mind, FXCM’s platform is not only accessible but also easy to navigate, thereby making it suitable for both novices and professionals. Consequently, users find that engaging with the markets through FXCM becomes a smoother and more intuitive experience.

- Comprehensive Support: FXCM prides itself on its customer service, offering round-the-clock support and dedicated account managers.

- Security and Stability: With top-tier bank partnerships and robust financial backing, FXCM Broker provides a secure and stable environment for all trading activities.

For beginners, FXCM not only offers a gateway into the world of forex, but also ensures a supportive learning environment to foster their development. Furthermore, the broker provides extensive educational resources and tools that facilitate a smoother learning curve. As we delve deeper into what makes FXCM a top choice for newcomers, our next chapters will explore specific features and tools provided by FXCM that enhance beginner traders’ experiences.

Key Features of FXCM Broker

FXCM stands out in the forex trading community not only for its longevity and reliability but also for its comprehensive suite of trading tools, platforms, and educational resources. This chapter will delve into the details of what FXCM Broker offers to its users, highlighting how these features can significantly enhance the trading experience, particularly for beginners.

Robust Trading Platforms

FXCM Broker recognizes that the choice of platform can heavily influence a trader’s performance. Here’s a closer look at the platforms available:

Trading Station

- User-Friendly Interface: Known for its intuitive design, Trading Station is suitable for traders of all levels.

- Advanced Charting Tools: Offers a variety of pre-loaded indicators, allowing for detailed market analysis.

- Customizability: Users can tailor the platform to their preferences, enhancing their trading experience.

MetaTrader 4

- Wide Acceptance: MT4 is one of the most popular forex trading platforms globally, supported by a vast range of FXCM Broker.

- Automated Trading: Allows for the use of trading robots (Expert Advisors) to automate the trading process.

- Extensive Community and Support: Users benefit from a wide range of third-party tools and community support.

NinjaTrader

- Sophisticated Analysis Tools: Ideal for advanced traders looking for detailed charting and analysis options.

- Trade Simulation: NinjaTrader provides an immersive simulation for strategy testing, which is invaluable for beginners.

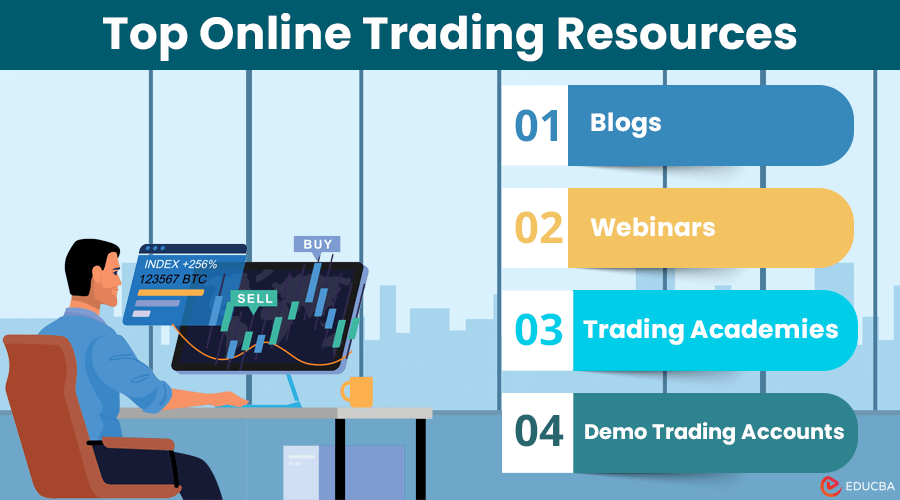

Comprehensive Educational Resources

Education is a cornerstone of FXCM’s offerings, with a focus on empowering traders through knowledge:

- Webinars and Seminars: Regularly scheduled live sessions cover various topics from introductory concepts to advanced trading strategies.

- Online Guides and Tutorials: A rich library of written content that helps traders understand the fundamentals of forex trading and beyond.

- Interactive Courses: Structured learning paths to guide beginners through the intricacies of forex markets.

Exceptional Trading Tools

FXCM equips its users with tools that can provide an edge in the fast-paced forex market:

- Economic Calendar: Keeps traders on top of market-moving events by providing timely economic news and indicators.

- Trading Analytics: Helps evaluate trading performance and improve strategies with detailed statistical feedback.

- Market Data Signals: Offers actionable trading insights based on FXCM’s proprietary algorithms.

“The tools and resources provided by FXCM Broker are designed not just to facilitate trading but to transform our users into knowledgeable traders capable of navigating the forex market with confidence.” — FXCM Educational Specialist.

Dedicated Customer Support

Understanding that the complexities of forex trading can be daunting, especially for novices, FXCM ensures that its customer support is both accessible and informative:

- 24/5 Customer Service: Traders can reach out via phone, email, or live chat any time during trading days.

- Account Management: Personalized support to help users manage their accounts effectively.

- Multilingual Assistance: To accommodate a global clientele, FXCM offers support in several languages.

FXCM’s comprehensive approach — from sophisticated trading platforms to extensive educational resources and robust support — makes it an ideal brokerage for beginners to start their forex trading journey.

Account Types Offered by FXCM Broker

Choosing the right account type is crucial for traders as it aligns with their investment goals, trading style, and level of experience. FXCM offers a variety of account types to cater to different needs, including standard accounts, mini accounts, and demo accounts. This chapter will provide a detailed overview of each account type available at FXCM Broker, helping traders make an informed decision that best suits their trading journey.

Standard Accounts

The standard account is the most popular choice among retail traders and offers a balance of features suitable for most trading strategies.

Features of Standard Accounts:

- Minimum Deposit: Standard accounts typically require a minimum deposit, which may vary based on the trader’s location and account specifics.

- Spreads and Commissions: These accounts benefit from competitive spreads and may have commissions depending on the instrument being traded.

- Leverage Options: Traders have access to leverage, which must be used judiciously to manage risk effectively.

- Market Access: Provides access to a wide range of currency pairs, as well as CFDs on indices, commodities, and cryptocurrencies.

Mini Accounts

Mini accounts are designed for traders who prefer to start with a smaller investment and trade smaller lot sizes.

Features of Mini Accounts:

- Lower Minimum Deposit: Mini accounts often allow traders to start with a significantly lower initial deposit, making it more accessible to beginners.

- Reduced Lot Size: The lot size is smaller than in standard accounts, reducing the risk per trade, which is ideal for those new to forex trading or with limited capital.

- Leverage and Spreads: While leverage options are similar to standard accounts, spreads might be slightly wider due to the smaller trade size.

Demo Accounts

Demo accounts serve as an essential learning tool for beginners, allowing them to experience trading without risking real money.

Features of Demo Accounts:

- Risk-Free Trading: Traders can practice trading strategies and get accustomed to the platform without financial risk.

- Simulated Market Conditions: These accounts mimic real trading conditions, providing users with a realistic trading environment.

- Educational Value: Ideal for testing theories and learning how to use various trading tools and charts effectively.

“Using a demo account is like having training wheels on a bicycle—it helps you learn without the fear of falling.” — FXCM Trading Coach.

Choosing the Right Account

When deciding on an account type, consider the following:

- Trading Goals: Align your account choice with your trading objectives and risk tolerance.

- Investment Size: Determine how much capital you are willing to risk and choose an account type that matches your financial capacity.

- Experience Level: More experienced traders might opt for standard accounts, while beginners may start with mini or demo accounts to build confidence.

FXCM’s diverse account offerings ensure that traders of all levels find an option that suits their needs, whether they are just starting out or looking to expand their trading activities.

Fees and Commissions

Understanding the fee structure is critical for any trader as it directly impacts the profitability of trading activities. This chapter provides a comprehensive analysis of the fees, commissions, and potential hidden costs associated with trading on FXCM. By demystifying this aspect, traders can make more informed decisions and manage their trading budgets more effectively.

Spread and Commission Structure

FXCM employs a relatively straightforward fee structure, primarily revolving around spreads and commissions. Here’s what traders need to know:

Spreads

- Definition: Spreads are the difference between the bid and the ask price of a trading instrument. It’s essentially the cost you pay on entering a trade.

- Variable Spreads: FXCM offers variable spreads, which means they can change based on market conditions. Typically, major currency pairs have tighter spreads compared to exotic pairs.

- Impact on Trading: For scalpers and day traders, tight spreads are crucial as they enter and exit trades frequently.

Commissions

- Applicability: Commissions are charged on certain account types, particularly those offering raw spreads or when trading CFDs.

- Rate: The commission rate can vary based on the traded volume and the type of account. It’s generally set as a fixed rate per lot traded.

Additional Fees

Beyond spreads and commissions, there are other fees that traders should be aware of:

- Overnight Fees: Also known as swap fees, these are charged when a position is held open overnight. The rate depends on the instrument and the direction of the trade.

- Inactivity Fees: FXCM charges a fee for accounts that are inactive for an extended period, typically a year or more.

- Deposit/Withdrawal Fees: While FXCM itself does not charge for deposits or withdrawals, third-party fees from banks or payment processors may apply.

Transparency and Hidden Costs

FXCM prides itself on transparency, which means all potential costs are outlined upfront in their fee schedule. However, traders should be aware of a few areas where costs might not be as apparent:

- Slippage: This occurs when there is a difference between the expected price of a trade and the price at which the trade is executed, especially during high volatility periods. It’s not a direct fee but can affect trading costs.

- Market Data Fees: For traders requiring advanced market data, additional fees might be applicable for accessing premium services.

“Understanding the complete fee structure is crucial for effective trading budget management. Always factor in all possible costs to ensure your trading strategy remains profitable.” — Financial Analyst.

Evaluating Cost Efficiency

When evaluating FXCM’s cost-efficiency:

- Compare Spreads and Commissions: Assess how FXCM’s fees compare to other FXCM Broker, especially for the instruments you trade most frequently.

- Account Type Selection: Choose an account type that aligns with your trading volume and style to minimize costs.

- Utilize Demo Accounts: Experiment with different strategies in the demo account to see how spreads and commissions would impact your trades without any financial risk.

By comprehensively understanding FXCM’s fees and commissions, traders can better strategize their trades and optimize their potential returns, keeping cost efficiency in focus.

Regulations and Security

For traders, the security of their investments and the integrity of their FXCM Broker are paramount. This chapter focuses on the regulatory bodies that oversee FXCM’s operations and the security measures FXCM has in place to protect traders. Understanding these aspects reassures traders of the legitimacy and safety of their trading environment.

Regulatory Oversight

FXCM is subject to strict regulatory standards, which help ensure transparency, fairness, and ethical business practices in the forex market. Here’s how FXCM maintains its regulatory compliance:

Major Regulatory Bodies

- United States: In the U.S., FXCM was historically regulated by the Commodity Futures Trading Commission (CFTC) and was a member of the National Futures Association (NFA). However, following reorganization, its U.S. operations have been scaled back.

- United Kingdom: In the UK, FXCM is regulated by the Financial Conduct Authority (FCA), known for its stringent guidelines and standards for financial operations.

- Australia: FXCM Australia is regulated by the Australian Securities and Investment Commission (ASIC), which ensures that financial services comply with the legal requirements to protect Australian investors.

Compliance with International Standards

FXCM adheres to international regulatory standards, including:

- KYC (Know Your Customer): This involves verifying the identity of clients and assessing their suitability, along with the potential risks of illegal intentions towards the business relationship.

- AML (Anti-Money Laundering): FXCM implements rigorous measures to prevent, detect, and report potential money laundering activities.

Security Measures

To protect clients’ funds and personal information, FXCM employs several robust security measures:

Data Encryption

- Secure Socket Layer (SSL): All transaction data entered through FXCM’s platforms is encrypted using SSL technology to prevent unauthorized access.

Segregation of Funds

- Client Accounts: Traders’ funds are held in segregated accounts, separate from the company’s own funds, ensuring that traders’ investments are not used for any other purpose.

Risk Management Protocols

- Margin Policies: FXCM provides transparent margin policies to help traders understand the risks involved and manage their trades effectively.

- Negative Balance Protection: FXCM offers negative balance protection, which prevents clients from losing more money than they have deposited.

“Regulatory compliance and stringent security measures are the backbones of a trustworthy FXCM Broker. At FXCM, we prioritize your trading safety above everything else.” — FXCM Security Officer.

Continual Monitoring and Upgrades

FXCM is committed to continually updating its security protocols and compliance measures to meet the evolving standards of the forex market and technological advancements. Regular audits and reviews by regulatory bodies ensure that FXCM maintains the highest standards of operation.

Transparency in Operations

FXCM promotes transparency by providing clients with easy access to its regulatory and financial compliance records, making it easier for traders to verify the credibility and reliability of their FXCM Broker.

By ensuring adherence to regulatory standards and implementing robust security measures, FXCM creates a secure and reliable trading environment for its clients. This commitment to regulation and security not only protects traders but also enhances the overall integrity of the forex market.

Trading Platforms and Technology

In the competitive world of forex trading, the technological infrastructure and platforms a FXCM Broker offers can significantly impact the efficiency and success of traders. This chapter reviews the trading platforms available through FXCM, such as Trading Station, MetaTrader 4, and others, highlighting their technological advancements and how they cater to the diverse needs of traders.

FXCM’s Trading Platforms

FXCM offers several trading platforms, each designed to meet different trading preferences and strategies. Here’s a closer look at each:

Trading Station

Trading Station is FXCM’s proprietary platform, known for its robustness and user-friendly interface.

- Customization: Users can customize layouts and features to fit their trading style and preferences.

- Advanced Charting Tools: Provides a wealth of charting capabilities and technical indicators for comprehensive market analysis.

- Mobile Accessibility: Offers a mobile version that allows traders to manage their accounts and trade from anywhere.

MetaTrader 4 (MT4)

MetaTrader 4 remains one of the most popular trading platforms globally due to its flexibility and powerful features.

- Automation: Supports automated trading through Expert Advisors (EAs), allowing traders to automate their strategies.

- Community and Support: Benefits from a large global community that shares tools, scripts, and strategies.

- Compatibility: Available on a wide range of devices, including PC, Mac, iOS, and Android.

NinjaTrader

NinjaTrader is favored by advanced traders for its extensive features in charting and trade management.

- Sophisticated Analysis: Offers advanced charting tools, including custom indicators and the ability to back-test strategies.

- Trade Simulation: Includes a simulation feature that helps traders practice their trades in a real-market environment without financial risk.

- Market Data: Provides detailed market data feeds that are essential for high-frequency trading strategies.

Technological Infrastructure

FXCM’s technological infrastructure is designed to ensure reliability, speed, and security in all trading activities:

- Server Reliability: Uses high-performance servers to minimize downtime and ensure trades are executed promptly.

- Data Security: Implements the latest security protocols to protect traders’ data and financial information.

- Innovative Tools: Continuously introduces new tools and enhancements to help traders gain an edge in the market.

“At FXCM, we understand that our technological capabilities directly impact our clients’ trading success. We are committed to continuously refining our platforms to ensure they remain at the cutting edge of trading technology.” — FXCM Technology Specialist.

Evaluating the Right Platform for You

When choosing a trading platform, consider the following:

- User Experience: Ensure the platform is intuitive and aligns with your trading style.

- Tools and Features: Look for platforms that offer the tools and features necessary to implement your trading strategy effectively.

- Support and Resources: Choose platforms that come with good educational and technical support.

FXCM’s range of platforms provides powerful trading solutions that can meet the needs of both novice and experienced traders. By leveraging these technologies, FXCM clients can enhance their trading performance, benefiting from advanced features and comprehensive support.

Educational and Training Resources

FXCM recognizes the importance of education in trading success and offers a comprehensive suite of educational materials and training programs designed to cater to traders of all experience levels. This chapter discusses the range of resources available through FXCM, highlighting how these can help traders enhance their knowledge and skills.

Overview of FXCM’s Educational Offerings

FXCM’s commitment to trader education is evident in its diverse range of learning resources, which are structured to support both beginners and seasoned traders.

Online Courses and Webinars

- Structured Learning: FXCM provides a series of online courses that cover everything from the basics of forex trading to advanced strategies.

- Live Webinars: Regular webinars allow traders to learn directly from experts and participate in real-time discussions on market trends and trading techniques.

Trading Guides and Tutorials

- Comprehensive Guides: Detailed trading guides offer insights into market concepts, technical analysis, and fundamental strategies.

- Step-by-Step Tutorials: These tutorials help new traders understand how to use FXCM’s platforms effectively, including how to execute trades, analyze charts, and utilize trading tools.

Video Library

- Visual Learning: FXCM’s extensive video library includes tutorials and detailed analyses, providing visual learners with a clear understanding of complex trading concepts and strategies.

- Diverse Topics: Videos cover a range of topics, from basic trading principles to in-depth explorations of trading software and tools.

Specialized Training Programs

For traders seeking more personalized training, FXCM offers specialized programs:

One-on-One Coaching

- Personalized Attention: Traders can benefit from individual coaching sessions with experienced traders, offering tailored advice and feedback on their trading strategies.

- Customized Learning: Each session is customized to the trader’s specific needs, whether they are learning the basics or refining advanced strategies.

Demo Account Training

- Practical Experience: FXCM’s demo accounts serve as practical training grounds, allowing traders to apply what they have learned in a risk-free environment.

- Real-time Practice: Traders can practice their strategies in real-time market conditions, helping to build confidence and competence without the financial risk.

“Education is the foundation upon which successful trading careers are built. At FXCM, we are dedicated to providing traders with the tools and knowledge they need to succeed in the competitive world of forex trading.” — FXCM Educational Coordinator.

Accessing FXCM’s Educational Resources

To access these educational resources, traders can simply register on the FXCM website. Most resources are available for free, although some specialized training programs might require a fee. FXCM also offers periodic promotions and free access to premium resources, making it easier for traders to enhance their learning.

By taking advantage of FXCM’s comprehensive educational and training resources, traders can significantly improve their understanding of forex markets and refine their trading skills, paving the way for a successful trading career.

Customer Support and Services

Effective customer support can greatly enhance the trading experience, providing traders with the confidence and backing they need to navigate the complex world of forex trading. This chapter offers insight into the quality of customer service provided by FXCM, including aspects of availability, responsiveness, and the range of languages supported.

Overview of FXCM’s Customer Support

FXCM is committed to providing comprehensive support to its clients, ensuring that assistance is readily available for any trading issue or query they might encounter.

Availability

- 24/5 Support: FXCM offers customer support 24 hours a day, five days a week, aligning with global forex market hours.

- Multiple Channels: Traders can reach out to FXCM via various channels, including phone, email, and live chat, allowing them to choose the method that best suits their needs.

Responsiveness

- Quick Response Times: FXCM prides itself on its swift response times. Live chat and phone inquiries are typically answered within minutes, while emails are responded to within a few hours.

- Efficiency in Problem-Solving: The customer service team is trained to handle inquiries efficiently, ensuring that most issues are resolved in a single interaction.

Languages Supported

- Multilingual Support: Recognizing the global nature of forex trading, FXCM provides customer support in several major languages, including English, Spanish, French, German, and Arabic. This broad language support ensures that traders from various regions can receive assistance in their preferred language.

Training and Expertise of Customer Support Staff

FXCM ensures that its customer support team is well-trained and knowledgeable about forex trading and its platforms.

- Regular Training: Support staff undergo regular training to stay updated on the latest market developments and technological changes.

- Expertise in Trading: Many support team members are experienced traders themselves, providing them with the insight needed to offer practical and informed assistance.

Additional Support Services

Beyond basic queries, FXCM offers several additional support services to enhance the trading experience:

Account Management

- Personal Account Managers: For certain account types, FXCM provides personal account managers who help traders manage their accounts more effectively, offering customized advice based on their trading activity and needs.

Technical Support

- Platform Assistance: FXCM offers technical support for issues related to trading platforms and tools, ensuring that traders can maintain seamless trading operations.

Educational Support

- Guidance on Educational Resources: Customer support can help traders navigate FXCM’s extensive educational materials, helping them to find resources that best match their learning stage and trading goals.

“At FXCM, we understand that solid customer support is crucial to a trader’s success. We’re committed to providing unparalleled support to ensure our traders can focus on what matters most: trading.” — FXCM Customer Service Manager.

By maintaining high standards in customer support, FXCM ensures that traders have a reliable resource to turn to whenever they need help. This commitment to quality support helps build trust and fosters a positive trading environment.

User Reviews and Feedback

Understanding the experiences of actual users provides invaluable insights into the practical aspects of trading with FXCM. This chapter compiles user reviews and testimonials, shedding light on the real-life benefits and challenges faced by traders on the FXCM platform. Such feedback can help prospective traders gauge the FXCM Broker performance and determine if it aligns with their trading needs.

Compilation of User Experiences

To provide a balanced view, we have gathered feedback from a variety of sources, including direct testimonials, online trading forums, and review sites.

Positive Feedback

- User-Friendly Platform: Many users praise FXCM’s platforms, particularly Trading Station and MetaTrader 4, for their ease of use and robust functionality. Traders appreciate the intuitive design which facilitates a smoother trading experience.

- Quality of Educational Resources: New traders frequently commend the comprehensive educational content offered by FXCM. They find the webinars, video tutorials, and written guides particularly helpful in accelerating their learning curve.

- Responsive Customer Support: A recurring theme in user reviews is the responsiveness and helpfulness of FXCM’s customer support team. Traders appreciate the quick response times and the expertise of the support staff, especially during critical trading times.

“I was new to forex trading and quite apprehensive, but FXCM’s educational resources were a game-changer for me. The webinars and e-books made the learning process much more manageable.” — Jessica, Retail Trader.

Critical Feedback

- Spreads and Fees: Some users express concerns about the spreads and fees, especially when trading less popular currency pairs or during volatile market conditions. They suggest that while competitive, the costs can accumulate, affecting profitability.

- Platform Glitches: A few traders have reported occasional glitches with trading platforms, particularly during market updates or platform maintenance. While these issues are generally resolved quickly, they can be a point of frustration.

Neutral Observations

- Software Learning Curve: A number of users mention that while FXCM’s platforms are powerful, there is a learning curve involved. Beginners might require some time to fully utilize all the features available.

Analysis of Feedback Trends

Analyzing these reviews indicates several trends:

- Satisfaction with Educational Support: There is widespread appreciation for FXCM’s commitment to trader education, which appears to be a significant factor in the platform’s favor.

- Call for More Competitive Pricing: Feedback on costs suggests a desire for more competitive pricing structures, particularly for high-volume traders.

- Reliability and Trust: Overall, traders express a high level of trust in FXCM, citing its regulatory compliance and established market presence as key factors.

Leveraging User Feedback

FXCM uses this feedback to continuously improve its services. This includes enhancing platform stability, adjusting pricing models where feasible, and expanding educational initiatives to further empower traders.

“Real user feedback is vital for us. It helps us refine our services and ensure we are meeting the needs of our traders.” — FXCM Management.

By considering these diverse user reviews and testimonials, prospective traders can make more informed decisions about engaging with FXCM for their trading needs.

Conclusion: Should You Trade with FXCM?

As we conclude our comprehensive review of FXCM, it’s essential to weigh the advantages and disadvantages of choosing FXCM as your forex FXCM Broker. This final chapter synthesizes the insights gathered from various aspects of FXCM’s service offerings, including its trading platforms, educational resources, customer support, and user feedback, to provide a balanced view that can help potential traders make an informed decision.

Advantages of Trading with FXCM

Robust Trading Platforms

FXCM offers a variety of trading platforms, including the user-friendly Trading Station, the widely popular MetaTrader 4, and NinjaTrader, known for its advanced charting capabilities. These platforms cater to the needs of both novice and experienced traders, providing a range of tools and features that enhance trading efficiency.

Comprehensive Educational Resources

One of FXCM’s standout features is its commitment to trader education. With an extensive array of webinars, online courses, and tutorials, FXCM ensures that traders are well-equipped with the knowledge necessary to navigate the forex markets effectively.

Reliable Customer Support

FXCM’s responsive and knowledgeable customer support team is available 24/5, offering assistance through various channels. This support is crucial for resolving issues promptly and helps traders maintain continuity in their trading activities.

Regulatory Compliance

As a FXCM Broker that adheres to strict regulatory standards, FXCM offers traders the assurance of transparency and security. The regulatory oversight by authorities like the UK’s Financial Conduct Authority (FCA) and Australia’s ASIC provides a safe trading environment.

Disadvantages of Trading with FXCM

Cost Concerns

Some traders have expressed concerns regarding FXCM’s spreads and fees, especially under less popular trading conditions or during high volatility. These costs can impact profitability, particularly for those who trade in large volumes or deal with exotic currencies.

Occasional Platform Glitches

Although generally reliable, FXCM’s platforms have been reported to experience occasional glitches. These are typically quickly resolved, but they can pose temporary inconveniences for traders.

Final Assessment

FXCM stands out as a reputable FXCM Broker with a strong focus on technological innovation, trader education, and customer service. Its platforms are robust and offer a range of tools that are beneficial for comprehensive market analysis and trading. The educational support provided by FXCM is particularly valuable for new traders, equipping them with the skills needed to succeed.

However, potential traders should consider their specific trading style, volume, and sensitivity to costs when deciding if FXCM is the right FXCM Broker for their needs. For those who prioritize educational resources, customer support, and a variety of trading platforms, FXCM is a compelling choice.

“While no FXCM Broker is perfect, FXCM’s strengths in educational resources, platform diversity, and regulatory compliance make it a strong candidate for anyone serious about forex trading.” — Financial Analyst.

For traders seeking a reliable and supportive trading environment, FXCM offers a solid foundation to embark on or continue their forex trading journey. By weighing these factors carefully, traders can decide if FXCM aligns with their trading goals and strategies.