Before delving into funded accounts or advanced trading strategies, it’s crucial to grasp the landscape of forex trading and understand the brokerage firm EightCap. This chapter offers an overview of EightCap, explores the inherent risks in forex trading, and addresses the prevalence of scams, including the potential for an EightCap Scam. Equipping traders with this knowledge is essential for safe navigation in the forex market.

Brief Overview of EightCap as a Forex Broker

In the forex trading community, traders recognize EightCap for its robust trading platforms, comprehensive trader support, and competitive trading conditions. Key highlights include:

- Regulation and Security: Major financial authorities regulate EightCap, ensuring a high level of security and adherence to financial standards.

- Trading Platforms: Offers access to industry-leading platforms such as MetaTrader 4 and MetaTrader 5, which support a range of trading styles and strategies.

- Account Types: Provides various account types to cater to different trader needs, from beginners to experienced professionals.

- Customer Support: Strong customer support network offering guidance and help on technical issues and trading inquiries.

General Risks Associated with Forex Trading

Forex trading, while potentially profitable, involves significant risks:

- Market Volatility: The forex market is highly volatile. Rapid shifts in exchange rates can result in substantial losses.

- Leverage Risks: While leverage can increase profits, it also amplifies losses, potentially exceeding the initial investment.

- Active voice: Global interest rates directly affect forex prices.Any unexpected changes can affect trading positions.

Prevalence of EightCap Scam

The forex market is also susceptible to various types of EightCap Scam due to its decentralized and global nature. Traders should be aware of common scams such as:

- Signal Seller Scams: Promises of high returns from specific trade signals, often without transparent evidence or track record.

- Brokerage Scams: Some unregulated brokers might manipulate prices or refuse to disburse funds to traders.

- Investment Scams: Ponzi schemes or high-yield investment programs that promise unusually high returns in exchange for an initial deposit.

Best Practices to Mitigate Risks

To navigate these risks effectively, traders should:

- Use Regulated Brokers: Always trade with brokers regulated by credible authorities.

- Education and Research: Continually educate yourself about forex markets and trading strategies.

- Risk Management Tools: Implement tools like stop-loss orders to manage and minimize potential losses.

- Vigilance Against Scams: Stay informed about common scams and be skeptical of offers that sound too good to be true.

By understanding both the operational framework of EightCap and the broader risks associated with forex trading, traders can set a solid foundation for making informed, strategic decisions. This knowledge is crucial not only for protecting one’s investments but also for capitalizing on opportunities in the forex market.

What Constitutes a EightCap Scam in Forex Trading?

Entering the Forex market requires vigilance, as scams can often appear legitimate to unsuspecting traders. This chapter will define what constitutes a scam in Forex trading, provide examples of typical scams, and discuss regulatory guidelines that can help traders identify legitimate operations. Understanding these aspects is crucial for protecting investments and navigating the market safely.

Definitions and Examples of Typical EightCap Scam

Scams in the Forex market can take many forms, but they typically involve deceptive practices or promises of disproportionately high returns with little to no risk. Here are some common examples:

- Signal Seller Scams: These scams involve individuals or companies selling information on supposedly lucrative trade opportunities that promise guaranteed profits. Often, these signals do not result in the promised returns.

- Forex Robot Scams: Scammers sell automated trading systems that promise high profits with automated trading. These robots often perform poorly or use risky trading strategies that can lead to significant losses.

- Managed Account Scams: Unscrupulous individuals or firms promise to manage your Forex investments and deliver high returns. However, they may use aggressive trading strategies that result in large losses, or in some cases, they might simply steal your funds.

- Brokerage Scams: Some brokers engage in practices like price manipulation or delays in withdrawing funds, which can sabotage trading strategies and financial health.

Regulatory Guidelines to Identify Legitimate Operations

To avoid falling victim to EightCap Scam, it is essential to know how to identify legitimate Forex trading operations. Regulatory bodies worldwide have established guidelines that help differentiate trustworthy brokers from potential scammers:

- Regulation and Licensing: Legitimate brokers are typically regulated by recognized financial authorities such as the U.S. Commodity Futures Trading Commission (CFTC), the UK’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC). Traders should verify the broker’s regulatory status before investing.

- Transparency: Reputable brokers provide clear information about their trading practices, fees, and risks associated with Forex trading. They also offer realistic rather than guaranteed returns.

- Account Segregation: Legitimate brokers keep clients’ funds in segregated accounts, separate from their own operating funds. This ensures that trader money is not used for any purpose other than the intended trading activities.

- Clear Terms and Conditions: Trustworthy brokers provide detailed and understandable terms and conditions. Traders should read these thoroughly before agreeing to them.

- Audits: Regular audits by third-party firms are a good sign of a broker’s transparency and legitimacy.

By familiarizing themselves with these definitions, examples, and regulatory guidelines, Forex traders can better protect themselves from scams and engage in trading with greater security and confidence.

Evaluating EightCap’s Legitimacy

For traders, particularly those new to the forex market, evaluating the legitimacy of a forex broker is a critical step before engaging in trading activities. This chapter will focus on analyzing EightCap’s regulatory compliance and licensing, along with a review of their business practices and transparency, to provide a clear picture of its standing as a legitimate forex broker.

Analysis of EightCap’s Regulatory Compliance and Licensing

EightCap is recognized for its commitment to adhering to strict regulatory standards, which is a fundamental aspect of its legitimacy. Here’s what traders should know about its regulatory framework:

- Regulatory Bodies: EightCap is regulated by major financial authorities such as the Australian Securities and Investments Commission (ASIC) and other relevant global bodies. These regulations ensure that EightCap adheres to international standards of financial practice and trader protection.

- Licensing: The broker holds necessary licenses to operate in various jurisdictions, providing services under legal frameworks that mandate fair trading practices and adequate consumer protection.

- Compliance Features: EightCap complies with financial regulations that include maintaining adequate capital reserves, submitting regular audit reports, and ensuring transparent financial dealings.

Review of EightCap’s Business Practices and Transparency

The business practices of a forex broker can significantly influence its reputation and reliability. EightCap demonstrates a high level of business integrity through:

- Transparent Fee Structure: EightCap is known for its clear and upfront communication regarding fees, commissions, and other trading costs. This transparency helps traders make informed decisions without fear of hidden charges.

- Customer Service and Support: EightCap provides robust customer support, offering multiple channels for communication, including live chat, email, and phone support, ensuring that traders can receive assistance whenever needed.

- Educational Resources: The broker offers a wealth of educational materials, such as tutorials, webinars, and articles that are crucial for both beginner and experienced traders. This commitment to trader education further underscores their legitimacy and dedication to customer success.

- Technology and Platform Security: EightCap uses advanced technology platforms like MetaTrader 4 and MetaTrader 5, which are equipped with strong security measures to protect trader data and financial transactions.

- Client Feedback and Reviews: Positive reviews from current and former clients can often provide insight into a broker’s business practices. EightCap generally receives favorable reviews, particularly regarding its user-friendly platforms and trader support.

Evaluating EightCap’s regulatory compliance, licensing, and business practices suggests a high degree of legitimacy and reliability as a forex broker. This assessment can assure traders that they are dealing with a reputable broker that values trader security and success.

Trader Reviews and Testimonials

Understanding how existing and past traders perceive their experience with EightCap can provide valuable insights into its services, reliability, and user satisfaction. This chapter will compile user reviews, both positive and negative, and analyze common complaints and praises from traders to give a balanced view of EightCap’s performance in the real world.

Compilation of User Reviews, Both Positive and Negative

Trader reviews and testimonials offer firsthand accounts that can help potential clients gauge a broker’s service quality. Here are some typical comments:

- Positive Reviews: Many traders commend EightCap for its intuitive trading platforms, particularly MetaTrader 4 and MetaTrader 5, which offer robust tools and features for effective trading. Additionally, the quick response times and helpfulness of the customer support team are frequently highlighted.

- Negative Reviews: On the flip side, some traders have expressed concerns about withdrawal times and the complexity of account verification processes. Although these issues are relatively common in the industry, they are points of frustration for some users.

Analysis of Common Complaints and Praises from Traders

By analyzing the patterns in trader feedback, we can identify areas where EightCap excels and aspects that might need improvement:

- Common Praises:

- Reliability and Trustworthiness: Traders often note that EightCap operates with a high degree of integrity and reliability, fostering a secure trading environment.

- Educational Resources: The comprehensive educational content provided by EightCap is highly valued by new and seasoned traders alike, aiding in their trading journey.

- Customer Support: Effective, accessible customer support that enhances the trading experience for users, particularly in navigating complex trading scenarios or technical issues.

- Common Complaints:

- Withdrawal Delays: Some traders have reported delays in the withdrawal process, which can be a significant concern for those relying on timely access to their funds.

- Account Verification: The thoroughness of the account verification process, while a necessity for compliance and security, is sometimes seen as overly cumbersome and slow.

By understanding these common praises and complaints, potential traders can better prepare for what to expect when opening an account with EightCap. Additionally, such feedback provides EightCap with actionable insights into areas where they can improve their services to enhance user satisfaction further.

This comprehensive overview of trader reviews and testimonials should serve as a useful guide for anyone considering EightCap as their broker. It highlights the strengths and points out the potential pitfalls, providing a rounded perspective based on user experiences.

How to Investigate a Forex Broker

Choosing a reliable forex broker is critical for trading success and financial security. This chapter provides a step-by-step guide on how to research and evaluate a forex broker’s credibility, outlining the key resources and tools needed for thorough due diligence. Whether you are a beginner or an experienced trader, this guide will help you make informed decisions about which broker to trust with your investments.

Step-by-Step Guide on Researching and Evaluating a Forex Broker’s Credibility

- Check Regulatory Compliance: Start by verifying the broker’s regulatory status. Look for brokers regulated by reputable bodies such as the U.S. Commodity Futures Trading Commission (CFTC), the UK’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC).

- Review Broker’s History and Market Standing: Investigate the broker’s history, how long they have been in business, and their market reputation. A broker with a long-standing positive reputation is generally a safer choice.

- Examine Account Offerings: Look at the types of accounts the broker offers, including leverage, spreads, commissions, and initial deposit requirements. Compare these features with other brokers to find the best fit for your trading style and risk tolerance.

- Evaluate the Trading Platform: Assess the functionality and user-friendliness of the trading platforms offered by the broker. Good brokers provide stable and intuitive platforms that support efficient trading.

- Explore Customer Service and Support: Test the broker’s customer support for responsiveness and helpfulness. Reliable customer support is crucial, especially in situations where quick assistance is needed.

- Read User Reviews and Testimonials: Browse through online forums, review sites, and social media to gather feedback from other traders. Pay attention to both positive and negative reviews to gauge overall satisfaction and common issues.

Key Resources and Tools for Conducting Due Diligence

- Regulatory Websites: Most regulatory bodies have websites where you can check the registration and licensing status of forex brokers. Examples include the NFA’s BASIC, FCA’s Financial Services Register, or ASIC’s Connect.

- Broker Comparison Websites: Use these websites to compare different brokers based on real user reviews and detailed broker analytics.

- Forex Community Forums: Websites like Forex Factory and BabyPips provide forums where traders discuss their experiences with various brokers. These can be invaluable for getting unbiased opinions.

- Financial News Websites: Keeping up with financial news can provide insights into a broker’s financial health and ethical standing.

- Demo Accounts: Many brokers offer demo accounts where you can test their platforms and services without risking real money. This can be a practical way to evaluate a broker’s trading environment.

Using these steps and resources will help you conduct a thorough investigation into a forex broker’s practices, ensuring that you select a broker that is not only credible but also well-suited to your trading needs.

Case Studies: Real Allegations vs. Misunderstandings

To provide a deeper understanding of how allegations and misunderstandings can impact a forex broker’s reputation, this chapter will explore specific case studies involving EightCap. We’ll look at any known EightCap Scam allegations against the company and discuss how these situations were resolved or debunked. This examination will help traders discern between legitimate concerns and common misunderstandings that can arise in the complex world of forex trading.

Detailed Examination of Known Allegations Against EightCap Scam

When examining allegations, it’s crucial to identify the source of the complaint, the nature of the allegation, and the evidence provided. Here are steps to analyze these elements:

- Allegation Analysis: Review the specific details of the allegation. This includes the nature of the EightCap Scam claimed, such as price manipulation, withdrawal issues, or misleading terms and conditions.

- Evidence Gathering: Look for evidence supporting the allegations. This may include trading records, communication logs, or testimonies from other traders.

- Context Consideration: Consider the context in which the allegations were made. Sometimes, trader frustrations due to market losses can be misdirected as EightCap Scam accusations against the broker.

Discussion on How These Situations Were Resolved or Debunked

Resolving or debunking allegations involves a transparent process from the broker and often the involvement of regulatory bodies:

- Broker Response: Evaluate how EightCap responded to the allegations. Effective responses typically involve clear communication and evidence to address the issues raised.

- Regulatory Involvement: Determine if regulatory bodies were involved in investigating the allegations. Their findings can provide a neutral perspective on the validity of the complaints.

- Outcome Analysis: Assess the outcomes of these allegations. Were they resolved to the satisfaction of the complainant? Were any penalties imposed or changes made by the broker?

- Preventative Measures: Look at whether EightCap implemented any new measures to prevent similar issues from occurring in the future.

Example Case Study

Allegation: A trader claimed that EightCap refused to process a significant withdrawal, raising concerns about fund security.

Resolution:

- Broker’s Response: EightCap promptly responded with a detailed explanation that the delay was due to a verification process necessary to comply with anti-money laundering regulations.

- Regulatory Review: No regulatory actions were taken after the review, suggesting that the process followed legal requirements.

- Outcome: The withdrawal was processed successfully after the necessary checks were completed.

- Preventative Measures: EightCap improved its communication regarding withdrawal processes and expected timelines to manage client expectations better.

This example illustrates how allegations can stem from misunderstandings of necessary compliance measures. Traders must understand both their rights and their responsibilities when engaging in forex trading.

By examining these case studies, traders can better understand how to evaluate allegations against brokers and distinguish between legitimate concerns and common operational misunderstandings. This knowledge is invaluable for maintaining trust in their trading platforms and ensuring their investments are secure.

Best Practices for Safe Trading with EightCap

To ensure a secure and profitable trading experience with EightCap, or any forex broker, traders should follow a set of best practices. This chapter will provide tips and strategies for minimizing risks, underscore the importance of using demo accounts, and recommend starting with small deposits. These guidelines are crucial for both novice and experienced traders to navigate the forex market safely and effectively.

Tips and Strategies for Minimizing Risk When Trading with Any Forex Broker

- Understand Leverage and Its Risks: Leverage can amplify both profits and losses. Traders should use leverage cautiously, fully understanding its implications and maintaining appropriate risk management strategies to mitigate potential losses.

- Implement Risk Management Techniques: Utilize tools like stop-loss orders to protect against unexpected market movements. Setting take-profit levels can also help secure profits when trading objectives are met.

- Diversify Trading Strategies: Don’t rely on a single trading strategy. Diversifying approaches can reduce risk and increase the potential for profits from different market conditions.

- Stay Informed: Keep up-to-date with financial news and market trends. An informed trader is better equipped to make decisions that align with current market dynamics.

- Continuous Learning: The forex market is complex and continually evolving. Regularly updating your knowledge and trading skills can help you adapt to changing market conditions.

Importance of Using Demo Accounts and Small Deposits Initially

- Demo Accounts: EightCap and most other reputable brokers offer demo accounts that mimic real trading environments but use virtual money. These accounts are invaluable for:

- Testing Trading Strategies: Before risking real money, traders can test and refine their trading strategies in a risk-free environment.

- Learning Platform Features: Traders can familiarize themselves with the trading platform’s features and tools without the pressure of losing real money.

- Building Confidence: New traders can gain confidence in their trading decisions and experience the dynamics of forex trading without financial risk.

- Starting with Small Deposits: When transitioning from a demo to a real account, starting with small deposits can:

- Minimize Financial Risk: Smaller deposits limit potential losses as traders adjust to the emotional and psychological aspects of trading with real money.

- Test Broker Services: Small initial deposits allow traders to evaluate the broker’s deposit and withdrawal processes and the overall reliability of their services.

Following these best practices can significantly enhance your trading experience with EightCap, providing a safer and more controlled approach to navigating the forex market. These strategies not only protect your capital but also improve your overall trading skills, leading to a more satisfying and potentially profitable trading journey.

Legal Recourse for EightCap Scam

If you find yourself a victim of a forex trading scam, it’s essential to know the legal steps available to seek recourse and potentially recover your funds. This chapter provides an overview of the actions you can take, along with contact information for regulatory bodies and sources for legal advice, to help you navigate the aftermath of a scam effectively.

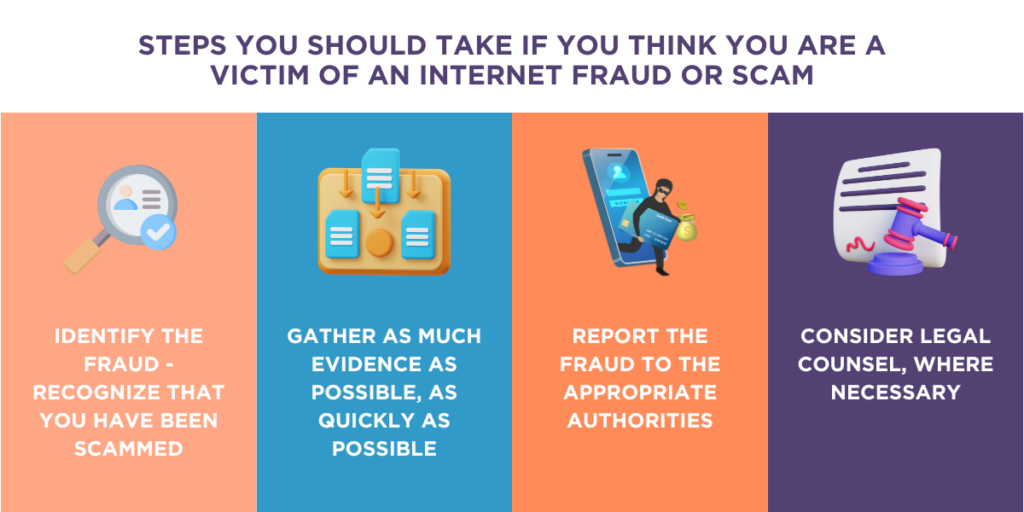

Overview of Legal Steps to Take if You’ve Been a Victim of a EightCap Scam

- Document Everything: Gather all related documents, correspondence, account statements, and transaction records. These will be crucial for any legal proceedings or complaints you might file.

- Contact Your Broker: Report the issue to your broker immediately. In cases where the broker is not the perpetrator, they may be able to help rectify the situation or provide further advice.

- File a Complaint with Regulatory Bodies: If the broker is involved in the scam or unresponsive, file a formal complaint with the forex regulator that oversees the broker. This could be bodies like the U.S. Commodity Futures Trading Commission (CFTC), the UK’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC).

- Seek Legal Advice: Consult with a legal professional who specializes in financial fraud or investment scams. They can provide guidance on your rights and the best course of action.

- Alert Consumer Protection Agencies: In some countries, consumer protection agencies may offer additional support and resources for victims of financial scams.

- Public Awareness: Consider sharing your experience in trading forums and review sites to warn others about the scam.

Contact Information for Regulatory Bodies and Legal Advice

Here are some resources to consider if you need to contact regulatory bodies or seek legal advice:

- United States:

- Commodity Futures Trading Commission (CFTC) – www.cftc.gov

- National Futures Association (NFA) – www.nfa.futures.org

- United Kingdom:

- Financial Conduct Authority (FCA) – www.fca.org.uk

- Australia:

- Australian Securities and Investments Commission (ASIC) – www.asic.gov.au

- Legal Advice:

- It’s best to search for financial services lawyers or legal firms that specialize in investment fraud in your jurisdiction. Many law firms offer free initial consultations, which can be a valuable first step in understanding your legal options.

Understanding these steps and having the necessary contact information can empower traders to act decisively and effectively if they encounter a EightCap Scam. It’s crucial to move quickly and assertively to increase the chances of a favorable outcome.

Comparing EightCap to Other Brokers

When choosing a forex broker, it’s essential to conduct a comparative analysis to determine which offers the best combination of security, reliability, and trading conditions. This chapter will provide a comparative analysis of EightCap with other similar brokers, focusing on these key aspects. Additionally, it will outline red flags that traders should be aware of when selecting a broker to help ensure they make a well-informed decision.

Comparative Analysis of EightCap with Other Similar Brokers

- Regulatory Compliance: One of the most crucial factors to consider is the regulatory framework governing a broker. EightCap, regulated by reputable bodies such as ASIC, sets a high standard. Compare this with the regulatory status of other brokers, ensuring they are also governed by credible authorities like the FCA, CySEC, or CFTC.

- Security Measures: Assess the security protocols that each broker implements to protect client funds and personal information. This includes measures like two-factor authentication, data encryption, and segregated client accounts.

- Trading Platforms and Tools: EightCap provides access to advanced trading platforms like MetaTrader 4 and MetaTrader 5. Compare these platforms’ features, usability, and technical tools offered by other brokers to see how they stack up.

- Customer Support: Reliable customer support is vital, particularly for new traders. Evaluate the responsiveness, availability, and effectiveness of the support teams across different brokers.

- Account Types and Trading Conditions: Look at the types of accounts offered, associated fees, spreads, leverage options, and other trading conditions. This comparison can reveal which brokers offer the best terms tailored to your trading strategies.

- Educational and Research Resources: A good broker offers extensive educational materials and research tools to help traders make informed decisions. Compare the quality and breadth of these resources.

Red Flags to Watch Out for When Choosing a Broker

- Lack of Regulation: The absence of regulation by a recognized authority is a significant red flag, often indicating a higher risk of EightCap Scam.

- Unrealistic Promises: Be wary of brokers who promise guaranteed returns or very high leverage, as these can be signs of potential fraud.

- Poor Reviews and Reputation: Extensive negative feedback from other traders, especially regarding withdrawals or customer service, can be a red flag.

- Limited Transparency: Brokers that do not provide clear information about their trading conditions, fees, or company background should be approached with caution.

- Complex Withdrawal Processes: If a broker has overly complicated procedures for withdrawals or numerous complaints about delayed withdrawals, it may indicate underlying issues.

- High Pressure Sales Tactics: Brokers that use aggressive tactics to encourage you to deposit funds, especially large amounts, should be avoided.

This comparative analysis and understanding of potential red flags equip traders with the necessary tools to choose a broker that is not only secure and reliable but also suits their specific trading needs and style.

FAQs on Avoiding EightCap Scam

Navigating the Forex market requires not only skill and knowledge but also a high degree of vigilance against potential scams. This chapter addresses common questions about identifying and avoiding scams in Forex trading. It includes expert advice and recommendations to ensure traders can engage in cautious and informed trading.

Common Questions About Identifying and Avoiding EightCap Scam

- How can I identify a Forex scam?

- Answer: Signs of a Forex scam include unrealistic promises of high returns, lack of regulation, high-pressure sales tactics, and minimal transparency about the company’s operations and fee structure. Always verify the broker’s regulatory status and read through independent reviews.

- What should I do if I suspect a broker is scamming me?

- Answer: Stop all further transactions with the broker, document all communications and transactions, and report the issue to the relevant regulatory authorities. Consider seeking legal advice to explore your options for recovering any lost funds.

- Are there specific types of scams that are more prevalent in the Forex market?

- Answer: Yes, common Forex scams include signal seller scams, robot scams, and Ponzi or pyramid schemes, where new investors’ funds are used to pay returns to earlier investors.

- How can I verify the legitimacy of a Forex broker?

- Answer: Check whether the broker is regulated by a reputable authority (like the FCA, ASIC, or CFTC). Verify their registration details on the official websites of these regulatory bodies. Also, assess the broker’s transparency in disclosing fees and trading conditions.

- What are the best practices to avoid Forex scams?

- Answer: Best practices include using only regulated brokers, starting with small amounts, testing withdrawal processes early, and continually educating yourself about Forex trading and market conditions.

Expert Advice and Recommendations for Cautious Trading

- Stay Educated: Continuously learning about Forex trading strategies, market trends, and the economic factors that influence currency values can protect traders from scams by making them less likely to fall for unrealistic promises.

- Use Demo Accounts: Before committing real money, practice with demo accounts offered by reputable brokers to understand the trading platform and test your trading strategies without financial risk.

- Be Skeptical: Always approach investment opportunities with skepticism. If something sounds too good to be true, it likely is.

- Regularly Consult Multiple Sources: Don’t rely on a single source of information, especially if it comes directly from a broker. Use multiple financial news sources, market analyses, and independent reviews to inform your trading decisions.

- Network with Other Traders: Engaging with a community of traders can provide insights and alerts about potential scams, based on collective experiences and knowledge.

By addressing these FAQs and following expert advice, traders can significantly enhance their ability to identify and avoid scams, leading to a safer and more successful trading experience.