Introduction to EightCap Funded Accounts

EightCap, a prominent player in the forex brokerage industry, offers a unique proposition for novice traders through its funded account options. This initial chapter delves into the foundational aspects of EightCap and the innovative concept of a funded account, providing beginners with a comprehensive starting point in their trading journey.

Overview of EightCap and the Concept of a Funded Account

EightCap stands out in the competitive forex market with its robust platform, user-friendly interface, and commitment to providing traders with a supportive environment. The concept of a funded account at EightCap is particularly appealing for beginners. Unlike standard accounts, a funded account allows traders to engage in trading activities without requiring them to invest their own capital initially. This model not only minimizes the financial risks associated with trading but also provides an opportunity to learn and grow in real-market conditions under less pressure.

Benefits of Trading with a Funded Account Versus a Standard Account

Trading with a funded account offers several advantages over using a standard trading account, especially for those new to forex trading:

- Lower Financial Risk: Funded accounts significantly reduce the barrier to entry. Beginners can trade with real money and experience the thrill and challenges of the forex market without the daunting risk of losing personal savings.

- Real-Time Learning: Funded accounts provide a practical learning environment. Beginners can apply trading strategies in real-time, which is far more effective than simulations or demo accounts that lack the psychological and emotional aspects of trading with real money.

- Enhanced Support and Resources: Typically, brokers like EightCap provide additional support to traders using funded accounts. This includes access to educational resources, mentoring, and sometimes more advanced trading tools, which are invaluable for a novice.

- Performance-Based Progression: Many funded account programs offer structured progression tiers. Traders can unlock higher levels of funding and more favorable trading conditions as they demonstrate skill and profitability. This not only motivates new traders but also aligns their interests with those of the broker.

- Potential for Higher Profits: While the initial investment is zero or minimal, the profit potential is substantial. Traders can earn a share of the profits from the trades they make, which can be a compelling incentive.

By choosing a broker like EightCap that offers funded accounts, beginners can navigate the forex market more safely and effectively, building confidence and experience without the usual financial strain.

Eligibility and Application Process for Funded Accounts

Aspiring to begin trading with a funded account at EightCap involves understanding the eligibility requirements and navigating the application process. This chapter provides a step-by-step guide to help beginners qualify for a funded account, outlining the necessary criteria and documentation needed.

Step-by-Step Guide on How to Qualify for a Funded Account

Qualifying for a funded account requires a series of steps that test a trader’s readiness and commitment. Here’s how you can start:

- Initial Research and Information Gathering: Begin by visiting the EightCap website to gather detailed information about the types of funded accounts offered, the benefits associated with each, and any associated costs or fees.

- Assessment of Trading Skills: Some brokers may require a demonstration of trading competency, which can include passing a trading assessment or submitting a trading history from other platforms.

- Understanding Terms and Conditions: Thoroughly review all terms and conditions related to funded accounts. This includes profit splits, trading restrictions, and risk management rules.

- Completion of Application Form: Fill out the application form provided by EightCap, ensuring all information is accurate and complete.

- Submission of Required Documents: Prepare and submit any required documents, which may include identification documents, proof of residence, and possibly previous trading statements.

- Waiting for Approval: Once the application and documents are submitted, the waiting period begins. EightCap will review the application to ensure that all criteria are met.

Required Criteria and Documentation for Application

To be eligible for a funded account, applicants must meet certain criteria, which typically include:

- Age Requirement: Applicants must be of legal age, usually 18 or older, depending on the jurisdiction.

- Trading Experience: Although designed for beginners, some level of understanding of the forex market and trading experience may be required.

- Proof of Identity and Residence: Valid government-issued identification and recent utility bills or bank statements are generally required to verify identity and residency.

- Clean Financial History: A clean financial background check might be necessary, ensuring no past bankruptcies or major credit issues that could impact trading responsibilities.

Applicants must also be prepared to discuss their trading strategy and goals, as this can be part of the evaluation process. Providing comprehensive and accurate documentation is crucial to successfully navigate the application process for a funded account.

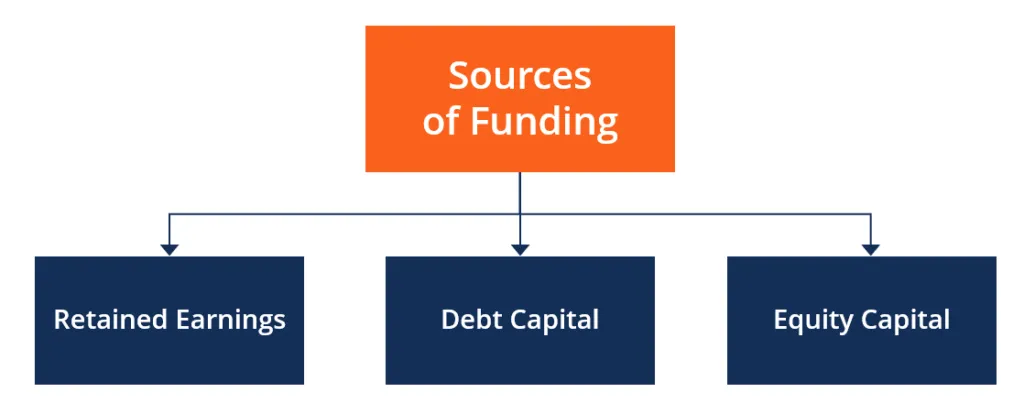

Understanding the Terms of Funded Accounts

Navigating the terms and conditions of funded accounts is crucial for traders, especially beginners, to ensure they fully understand what they are agreeing to before they start trading. This chapter breaks down the key contractual terms associated with funded accounts at EightCap, including profit sharing, drawdown limits, and trading periods, and compares these to standard trading accounts.

Detailed Explanation of the Contractual Terms

Funded accounts come with specific contractual terms that define the relationship between the trader and the broker. Here are the main components:

- Profit Sharing: Funded account agreements include details on how profits are split between the trader and the broker. Typically, the split can range from 50/50 to 80/20 in favor of the trader, depending on the level of the account and the broker’s policies.

- Drawdown Limits: This term defines the maximum allowable loss in a trading account before a trader must stop trading or funding is suspended. It is crucial for managing risk and protecting the capital of both the trader and the broker.

- Trading Periods: These are the times during which a trader can actively trade. Some funded accounts may have specific trading periods that align with market hours or particular events in the forex markets.

- Restrictions on Trading Strategies: Certain trading strategies may be prohibited under the terms of the agreement, such as scalping or the use of high-risk automated trading systems.

- Account Reset Options: In case of significant losses, some brokers offer the option to ‘reset’ the account, which often involves a fee. This allows traders to start over with a clean slate.

How These Terms Compare to Standard Trading Accounts

Comparing the terms of funded accounts with standard accounts reveals significant differences:

- Capital Requirement: Standard accounts require traders to use their own capital, which means they bear all financial risks directly. Funded accounts, on the other hand, provide traders access to capital without immediate personal financial exposure.

- Profit Potential and Risks: While standard accounts might offer unlimited profit potential (bounded by the amount of capital a trader can provide), funded accounts usually have a predefined profit sharing arrangement. This might limit absolute returns but also mitigates potential losses.

- Flexibility in Trading: Standard accounts typically offer more flexibility in terms of allowable trading strategies and times. Funded accounts may impose more restrictions to protect the invested capital.

- Educational and Support Services: Brokers often provide more extensive educational and support services to traders with funded accounts, helping them navigate the complexities of forex trading more effectively.

Understanding these terms is key to making informed decisions about whether to opt for a funded account or a standard trading account, especially considering personal trading style and risk tolerance.

Capital Allocation and Management Strategies

Effective management of allocated capital in a funded account is pivotal for long-term success in forex trading. This chapter explores essential strategies for capital preservation and growth, helping traders maximize the benefits of their funded accounts at EightCap.

How to Effectively Manage the Allocated Capital in a Funded Account

Managing capital effectively in a funded account involves several key practices:

- Risk Management: Implement strict risk management protocols. This includes setting stop-loss orders to limit potential losses and adjusting trade sizes according to the volatility of the market and the balance of the account.

- Diversification: Spread trading activity across different currency pairs or financial instruments to mitigate risk. Diversification helps in balancing the performance of the portfolio, reducing the impact of a poor performing asset.

- Leverage Management: Although leverage can amplify profits, it also increases the potential for significant losses. Manage leverage carefully by using it judiciously based on the market conditions and your trading experience.

- Regular Monitoring and Adjustment: Continuously monitor the performance of the trading account. Be prepared to adjust trading strategies in response to market changes or in light of the performance of the account.

Strategies for Capital Preservation and Growth

Capital preservation is as crucial as capital growth, particularly in the volatile forex market:

- Conservative Trading Strategies: Adopt conservative trading strategies that focus more on capital preservation than on aggressive growth. This might include less speculative trades and more focus on stable, liquid currency pairs.

- Use of Stop-Loss Orders: Consistently use stop-loss orders to protect capital. This ensures that even if trades do not go as planned, the losses are manageable and the capital base is protected.

- Balancing Risk and Reward: Aim for a balanced risk-reward ratio that aligns with your overall trading goals and risk tolerance. A commonly recommended starting ratio is 1:2, meaning aiming to make twice the amount risked on each trade.

- Incremental Growth Approach: Focus on achieving consistent, small gains rather than aiming for large profits in a single trade. This approach minimizes risks and contributes to steady account growth over time.

- Performance Review: Regularly review trading performance and adjust strategies as necessary. This includes analyzing both successful and unsuccessful trades to understand what works and what doesn’t in your trading approach.

By implementing these management and preservation strategies, traders can not only safeguard their capital but also increase the chances of its growth, making the most out of the funded account opportunity provided by EightCap.

Risk Management in Funded Trading

Effective risk management is the backbone of successful trading, especially when using funded accounts where both the trader and the brokerage have a vested interest in minimizing losses. This chapter focuses on the importance of risk management strategies specific to funded accounts, along with various tools and techniques that can help in minimizing losses and managing leverage efficiently.

Importance of Risk Management Strategies Specific to Funded Accounts

Risk management in funded accounts is crucial due to the shared risk between the trader and the broker. Effective strategies ensure:

- Protection of Capital: Proper risk management protects not only the trader’s potential earnings but also the broker’s capital.

- Sustainability of Trading Career: With effective risk management, traders can ensure longer trading careers by avoiding significant and rapid losses.

- Confidence in Trading: Knowing that risks are managed allows traders to focus on strategy and execution without undue stress about potential large losses.

Tools and Techniques to Minimize Losses and Manage Leverage

Several tools and techniques are essential for managing risks in funded accounts:

- Stop-Loss Orders: One of the most straightforward and essential tools for risk management. Setting stop-loss orders helps limit potential losses on each trade.

- Risk/Reward Ratio Calculation: Before entering a trade, calculate the potential risk versus the potential reward. Trades should ideally only be made if the expected reward justifies the risk.

- Position Sizing: Determine the size of each trade based on a percentage of the account’s total capital. Typically, it is advised not to risk more than 1-2% of the capital on a single trade.

- Leverage Control: While leverage can multiply profits, it also increases the potential for losses. Use leverage cautiously, understanding its impact on trade outcomes and the overall account.

- Use of Hedging Techniques: In certain situations, hedging can protect against losses. This involves opening multiple positions to offset potential losses in one position with gains in another.

- Regular Review of Trading Strategies: Continuously assess and adjust trading strategies based on their performance and changing market conditions. This may include lowering leverage during periods of high volatility or adjusting stop-loss levels according to the account’s performance.

- Stress Testing: Apply theoretical worst-case scenarios to your trading strategies to see how they would perform during extreme market conditions. This can help in understanding potential vulnerabilities in your trading plan.

By integrating these risk management tools and techniques into daily trading activities, traders can effectively minimize potential losses while optimizing their use of the capital provided by EightCap. This not only secures the capital but also builds a solid foundation for potentially profitable trading activities.

Trading Strategies Suitable for EightCap Funded Account

Choosing the right trading strategies is crucial for success, especially when trading with funded accounts. This chapter explores various trading strategies that are particularly effective for funded accounts, considering their specific constraints and opportunities. Additionally, it discusses how traders can adjust their trading styles to best utilize the unique features of funded accounts.

Discussion of Trading Strategies That Are Most Effective with EightCap Funded Account

Certain trading strategies align well with the structure and risk profile of funded accounts:

- Swing Trading: This strategy involves holding positions for several days to capitalize on expected upward or downward market shifts. This medium-term approach balances between the rapid trading of day traders and the long-term positions of buy-and-hold investors, suitable for funded accounts which often have drawdown limits that discourage high-frequency, high-risk trading.

- Trend Following: Funded account traders can benefit from trend following, which involves identifying and following the direction of market trends. This strategy can be particularly effective in forex markets, where long-term trends can be more predictable.

- Price Action Trading: This strategy relies on historical price movements and chart patterns to make trading decisions, rather than complex indicators. Funded accounts benefit from this strategy as it allows for a straightforward approach to trading without the need for extensive technical analysis setups.

- Carry Trade: Suitable for traders in funded accounts who can handle medium to long-term positions, carry trade involves borrowing a currency with a low interest rate to fund the purchase of a currency with a higher interest rate. This strategy works well within the risk parameters of many funded accounts, provided the market volatility is favorable.

Adjusting Trading Styles to Fit the Constraints and Opportunities of a EightCap Funded Account

Adapting your trading style to fit a funded account involves understanding the specific rules and flexibility provided by the broker. Here’s how traders can adjust:

- Adhering to Drawdown Limits: Recognize the importance of strict risk management to stay within the drawdown limits set by the funded account terms. This may mean adopting more conservative trading strategies than one might use in a personal account.

- Leverage Management: Since funded accounts often provide access to higher leverage, understanding how to use leverage wisely—balancing the potential for higher returns against the risk of significant losses—is crucial.

- Compliance with Trading Hours and Conditions: Some funded accounts restrict trading during certain hours or in specific market conditions (like major news releases), which requires adapting the trading style to these time frames.

- Regular Strategy Review: Regularly review and adjust trading strategies based on performance metrics and feedback from the broker, ensuring alignment with both the trader’s goals and the broker’s requirements.

By employing these strategies and adjustments, traders can effectively navigate the intricacies of funded accounts, maximizing their potential for profit while managing the inherent risks.

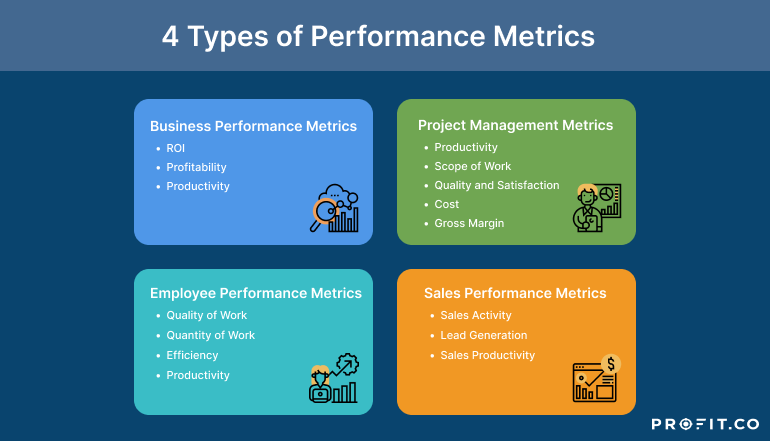

Performance Evaluation and Metrics

Effective performance evaluation is critical for traders utilizing funded accounts, as it not only affects their profitability but also their standing with the funding broker. This chapter will discuss the key performance indicators (KPIs) that traders should monitor in a EightCap Funded Account and explain how EightCap evaluates trader performance, along with the implications for continued funding.

Key Performance Indicators to Monitor in a Funded Account

Traders need to keep a close eye on several KPIs to gauge their performance accurately:

- Profit and Loss (P&L): The most direct indicator of trading success. Monitoring daily, weekly, and monthly P&L can help traders understand their effectiveness in the market.

- Drawdown: This measures the decline from a peak to a trough in the account balance, indicating the largest loss encountered during a specified period. Keeping drawdowns within acceptable limits is crucial for maintaining the health of the funded account.

- Risk-Reward Ratio: This KPI is vital for assessing the efficiency of trades. A healthy risk-reward ratio ensures that potential rewards justify the risks taken on each trade.

- Win Rate: The percentage of winning trades versus losing trades. A high win rate isn’t always necessary, especially if the risk-reward ratio is strong, but it can indicate consistent trading success.

- Leverage Utilization: How much leverage is used in trading activities. Effective leverage management can amplify gains without excessively increasing risk.

How EightCap Evaluates Trader Performance and the Implications for Continued Funding

EightCap evaluates trader performance based on several criteria:

- Consistency of Profits: Regular profit generation is a primary performance metric. Traders who consistently generate profits are more likely to retain their funded accounts.

- Adherence to Risk Management Guidelines: Traders must follow the risk management rules set by EightCap. Violations of these guidelines, such as exceeding drawdown limits, can lead to a review or revocation of the funded account.

- Strategic Discipline: Traders are expected to stick to their trading strategies. Frequent, radical changes in strategy can be viewed as a lack of discipline, affecting their evaluation.

- Growth and Scalability: EightCap assesses whether a trader’s approach has the potential for scalability. This includes the ability to manage increased capital effectively and maintain or improve profitability.

The implications of these evaluations are significant:

- Continuation of Funding: Positive evaluations lead to continued or increased funding.

- Educational Interventions: If a trader’s performance is lacking, EightCap may offer further training or reduce the level of funding as a form of risk control.

- Termination of Funding: Continued poor performance or violation of terms may result in the termination of the funding arrangement.

Monitoring these KPIs and understanding how performance is evaluated are essential for traders in maintaining their funded accounts and enhancing their trading careers.

Scaling Up: Advancing to Higher Levels of Funding

For many traders, starting with a funded account is just the beginning. The ultimate goal is to scale up, advancing to higher levels of funding and greater financial opportunities. This chapter examines the criteria necessary for scaling up within a funded account framework like EightCap’s, along with inspiring success stories and case studies of traders who have successfully advanced their funding levels.

Criteria for Scaling Up and Increasing the Level of Funding

Scaling up in a funded account environment typically depends on meeting specific performance-based criteria:

- Consistent Profitability: Demonstrating consistent profitability over a significant period is the primary criterion for scaling up. This shows the broker that the trader can handle larger amounts responsibly.

- Low Drawdowns: Maintaining low drawdowns is essential. It indicates that the trader is not only profitable but also risks averse, which is crucial when handling more significant amounts of capital.

- Adherence to Trading Plans: Traders who follow their trading plans meticulously are often considered for higher funding levels. This adherence shows discipline and a strategic approach to trading.

- Positive Risk-Reward Ratios: Traders must continue to demonstrate favorable risk-reward ratios, ensuring that they are not achieving profits by taking disproportionate risks.

- Broker’s Discretion: Ultimately, the decision to increase funding also involves the broker’s discretion, which can be influenced by market conditions, the trader’s overall approach, and the strategic needs of the brokerage.

Success Stories and Case Studies of Traders Who Advanced Their Funding Levels

Several traders have successfully scaled their funded accounts by meeting or exceeding the above criteria. Here are a couple of examples:

- 1: John Doe started with a $50,000 funded account and, over the course of 12 months, demonstrated a consistent profit with a drawdown of less than 10%. By sticking to his low-volatility trading strategy, he was able to double his funding to $100,000, thanks to his disciplined approach and consistent performance.

- 2: Jane Smith utilized a combination of swing trading and trend following to consistently outperform her benchmarks. After six months of profitable trading with minimal drawdowns and high compliance with risk management rules, her initial funding of $30,000 was increased to $60,000. Jane’s story is particularly notable for her strategic adjustments during periods of market volatility.

These success stories highlight the potential career trajectory within funded trading accounts. They serve as inspiration for new traders who aspire to similar achievements by demonstrating the same level of dedication, strategic acumen, and adherence to risk management principles.

Scaling up in funded trading not only increases the potential for higher earnings but also enhances a trader’s credibility and market standing. It’s a testament to their skill, discipline, and understanding of the forex market.

Common Pitfalls and How to Avoid Them

Trading with funded accounts offers unique opportunities, but it also comes with its own set of challenges and potential pitfalls. This chapter will discuss the common mistakes traders make when managing funded accounts and outline best practices for effectively navigating these challenges to ensure sustained success.

Challenges and Common Mistakes Traders Make with EightCap Funded Account

- Overtrading: One of the most frequent pitfalls is overtrading, where traders, driven by the urge to quickly increase profits, execute an excessive number of trades. This often leads to diminished returns and increased transaction costs.

- Ignoring Risk Management: Neglecting established risk management protocols is a critical mistake that can lead to substantial losses, particularly when trading with leverage.

- Emotional Trading: Funded account traders sometimes let emotions drive their trading decisions. Fear of missing out (FOMO) or the desire to quickly recover losses (revenge trading) can lead to disastrous results.

- Failure to Adapt to Market Changes: Market conditions can change rapidly, and a failure to adapt strategies accordingly can lead to ineffective trading and losses.

- Lack of Consistent Strategy: Some traders frequently change strategies, seeking ‘the next big thing’, rather than developing a consistent approach that performs well over time.

Best Practices to Navigate Pitfalls Effectively

To avoid these pitfalls and maintain a successful trading operation, consider the following best practices:

- Strict Adherence to a Trading Plan: Develop a comprehensive trading plan that includes specific risk management rules and stick to it religiously. This plan should detail when to enter and exit trades, how much capital to risk per trade, and under what conditions to revise the strategy.

- Set Realistic Goals: Establish realistic trading goals that align with your trading strategy and experience level. This helps in maintaining focus and discourages risky behaviors aimed at unrealistically high profits.

- Emotional Discipline: Train yourself to detach emotions from trading decisions. Tools like setting automated trades and adhering to stop-loss orders can help maintain discipline.

- Continuous Learning and Adaptation: The forex market is dynamic, so continuously educate yourself about market trends and new trading strategies. Adapt your approach as necessary to stay relevant and effective.

- Routine Performance Reviews: Regularly review your trading performance against the trading plan and goals. Identify what is working and what isn’t, and make adjustments as needed.

By understanding and preparing for these common pitfalls, traders can more effectively manage funded accounts, leading to better performance and sustainability in their trading careers.

Q&A on EightCap Funded Account

To further clarify the workings and benefits of funded accounts at EightCap, this chapter presents a comprehensive Q&A section. It includes answers to frequently asked questions sourced from experienced traders and financial experts. This section will also provide tips and advice that can guide new traders towards successful trading experiences with funded accounts.

Frequently Asked Questions About Funded Accounts

- What are the primary benefits of trading with a EightCap Funded Account?

- Answer: The primary benefits include reduced personal financial risk, access to larger capital bases, and the ability to learn and earn through real-market conditions without the need to deploy substantial personal funds.

- How does the profit split work in an EightCap Funded Account?

- Answer: Profit splits vary depending on the specific account program, but generally, traders receive a significant percentage of the profits made from trades. This could range from 50% to 80% of the profits, encouraging traders to perform well while managing risks effectively.

- What happens if I reach the drawdown limit in my funded account?

- Answer: Reaching a drawdown limit typically results in a review of your account status. Depending on the circumstances, this could mean temporary suspension of trading privileges, reduction in allocated capital, or a reset of the account under certain conditions.

- Are there any specific trading strategies that are prohibited in EightCap funded accounts?

- Answer: Yes, certain high-risk strategies such as scalping or aggressive leverage might be restricted or prohibited. It’s important to fully understand the trading conditions and restrictions before beginning to trade.

- Can I apply for a EightCap Funded Account if I’m completely new to trading?

- Answer: While beginners are welcome, some basic knowledge and trading experience can significantly enhance your chances of being approved and succeeding. EightCap may require a demonstration of trading knowledge or a small experience portfolio during the application process.

Tips and Advice from Experienced Traders and Financial Experts

- Start Conservatively: Begin your trading with conservative strategies and low leverage to get accustomed to the dynamics of trading with a funded account.

- Utilize Educational Resources: Make full use of EightCap’s training materials, webinars, and any other educational resources to continually improve your trading skills.

- Keep a Trading Journal: Maintain a detailed journal of all your trading activities. This helps in identifying successful patterns and strategies, and also highlights recurrent mistakes to be avoided.

- Network with Other Traders: Engage with the community of funded traders. Learning from peers can provide insights and strategies that are not readily available through formal channels.

- Regular Strategy Reviews: Consistently review and refine your trading strategy based on performance data and changing market conditions.

This Q&A along with expert advice should serve as a robust guide for new traders considering or starting with a EightCap Funded Account, ensuring they are well-prepared to navigate the complexities of forex trading.