EightCap is a well-regarded Forex broker that has carved out a niche for itself by offering robust trading platforms and favorable trading conditions designed to suit a wide range of traders, from beginners to advanced. In this chapter, we’ll explore the types of bonuses EightCap offers, highlighting the unique features of each to help you understand how you can benefit from these enticing eightcap bonus incentives.

Overview of EightCap as a Forex Broker

EightCap stands out in the Forex trading community for its commitment to providing traders with a seamless and supportive trading experience. Established and regulated under the strict oversight of the Australian Securities and Investments Commission (ASIC), EightCap prioritizes security, transparency, and trader education. Here are some key features that define EightCap:

- Robust Trading Platforms: EightCap offers MetaTrader 4 and MetaTrader 5, two of the most advanced and popular trading platforms in the industry. These platforms are renowned for their user-friendly interfaces, advanced charting tools, and automated trading capabilities.

- Wide Range of Instruments: Traders at EightCap have access to a broad array of trading instruments, including Forex pairs, CFDs on indices, commodities, and major cryptocurrencies.

- Excellent Customer Support: EightCap is known for its responsive and knowledgeable customer service team, available 24/5 to assist traders with any inquiries or issues.

Types of Bonuses Typically Offered by EightCap and Their Unique Features

EightCap offers a variety of EightCap Bonus schemes designed to attract new traders and enhance the trading experience for existing clients. These bonuses can significantly impact your trading capacity and strategy. Here are some common types of bonuses you might encounter:

1. Welcome Bonus:

- Description: This is a one-time offer for new clients, providing them with additional trading funds upon registering and funding their accounts.

- Unique Feature: The welcome bonus often matches a percentage of your initial deposit, thus increasing your total trading capital right from the start.

2. Deposit Bonus:

- Description: Similar to the welcome bonus, the deposit bonus is offered when clients make subsequent deposits into their trading accounts.

- Unique Feature: It can be offered multiple times and during specific promotions, providing traders with extra funds each time they boost their account balances.

3. No Deposit Bonus:

- Description: This bonus is particularly appealing to new traders as it requires no initial deposit to start trading.

- Unique Feature: It allows traders to begin trading immediately with bonus funds provided by EightCap, offering a risk-free introduction to Forex trading.

4. Loyalty Programs:

- Description: Aimed at retaining existing clients, these programs reward traders with points or credits that can be converted into trading credits or withdrawn as cash.

- Unique Feature: Loyalty bonuses often scale with the volume of trades a client executes, effectively rewarding the most active traders.

> **Pro Tip:** Before opting into any bonus offering, always read the terms and conditions carefully. Bonuses can come with specific trading volume requirements or other restrictions that must be understood fully.

Understanding the nuances of each bonus type offered by EightCap Bonus can help you leverage these opportunities to maximize your trading potential.

Understanding the Types of Bonuses at EightCap

EightCap provides a range of bonuses designed to enhance the trading experience and reward both new and loyal clients. In this chapter, we’ll delve deeper into the specifics of different bonuses such as deposit bonuses, no deposit bonuses, and loyalty programs offered by EightCap. Additionally, we will cover the eligibility criteria for each type of bonus, helping you understand how you can qualify and benefit from these offers.

Types of Bonuses at EightCap

1. Deposit Bonuses

- Description: Deposit bonuses are incentives offered to traders when they deposit funds into their trading accounts. These bonuses are usually a percentage of the deposit amount and are designed to increase the trading volume capacity of the traders.

- Unique Features: Deposit bonuses may vary in percentage and often have a maximum limit. For example, a 50% deposit bonus up to $500 means any deposit you make will be increased by 50% until the total bonus reaches $500.

- Eligibility Criteria: Generally, these bonuses are available to all clients upon making a qualifying deposit. There may be specific promotions targeting new or existing clients with different conditions.

2. No Deposit Bonuses

- Description: No deposit bonuses are particularly attractive to new traders as they provide bonus funds without the need for an initial deposit.

- Unique Features: This type of bonus is excellent for risk-free trading. It allows traders to experience real-market conditions without using their own capital. However, the bonus amount is typically less than what you might get from a deposit bonus.

- Eligibility Criteria: This bonus is usually offered to new clients and may require completion of the registration process and verification of your account to ensure compliance with security standards.

3. Loyalty Programs

- Description: Loyalty programs are structured to reward regular and active traders. These programs accumulate points or credits based on trading volume and activity levels.

- Unique Features: Rewards from loyalty programs can often be converted into tradeable credit or cash. Some programs may offer additional perks like lower spreads, commissions, or access to exclusive events.

- Eligibility Criteria: Eligibility for loyalty programs is typically based on trading activity. The more you trade, the more points you earn, which can then be redeemed according to the program’s specific rules.

> **Important Note:** Bonuses and promotions are subject to terms and conditions. It is crucial to read these carefully, as there might be requirements related to trading volume, withdrawal limits, or expiration dates that affect how you can use the bonus.

How to Maximize the Benefits of EightCap Bonus

To make the most out of EightCap’s bonuses:

- Understand the Requirements: Make sure you are fully aware of what is required to claim and profit from the bonus.

- Use Bonuses Wisely: Consider using bonus funds to explore trading strategies that you might be too cautious to try with your own money.

- Monitor Expiry Dates: Some bonuses have expiration dates. Plan your trading activity to ensure you maximize the use of the bonus before it expires.

By understanding and utilizing these bonuses effectively, you can enhance your trading experience, expand your trading capacity, and potentially increase your profitability without significantly increasing your risk exposure.

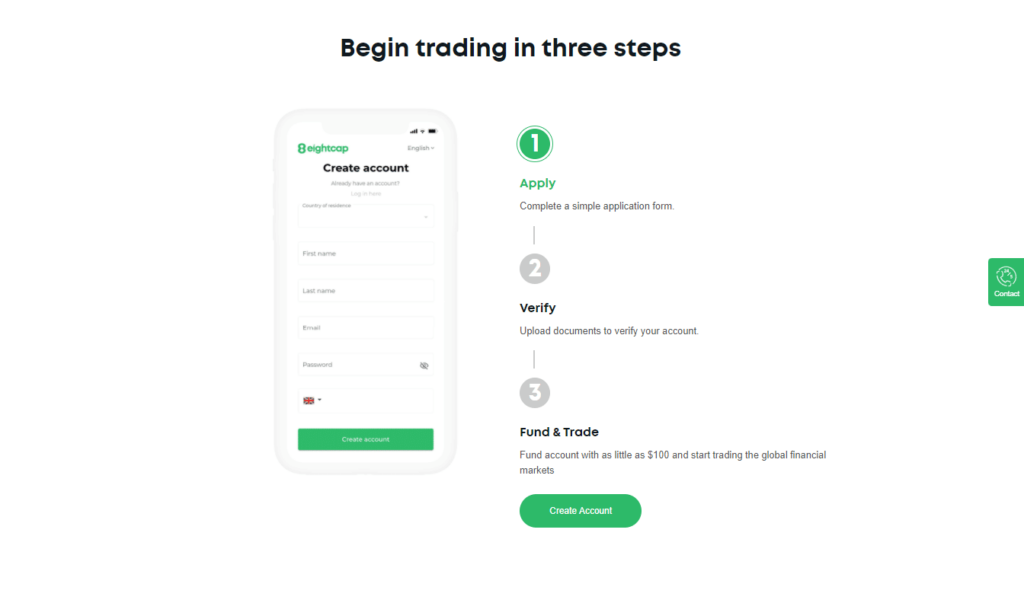

How to Qualify for EightCap Bonuses

Qualifying for bonuses at EightCap can provide a significant advantage in your trading activities. This chapter will guide you through the steps to open an account with EightCap and outline the necessary documentation and verification processes required to qualify for various bonuses. By following these steps, you can ensure you meet all requirements to take full advantage of EightCap’s bonus offerings.

Step-by-Step Guide on How to Open an Account

1: Visit the EightCap Website

- Go to the EightCap official website and find the ‘Sign Up’ or ‘Open Account’ button. This is typically prominently displayed on the home page.

2: Fill Out the Registration Form

- You will be prompted to enter personal information such as your name, email address, phone number, and residential address. This information must be accurate for verification purposes.

3: Choose the Type of Trading Account

- EightCap may offer different types of accounts (like Standard or Pro accounts). Choose the one that best suits your trading style and needs.

4: Agree to Terms and Conditions

- Read through the terms and conditions carefully. You will need to agree to these terms to proceed with account creation.

5: Submit the Application

- Once you have completed the form and agreed to the terms, submit your application. You will receive an email to confirm the submission of your application.

Necessary Documentation and Verification Processes

6: Verify Your Identity and Residence

- Identity Verification: You will need to provide a government-issued ID such as a passport or driver’s license. This document must be valid and clearly show your full name and date of birth.

- Residence Verification: A recent utility bill or bank statement (usually within the last three months) that shows your name and address will be required to verify your residence.

7: Await Account Approval

- After submitting your documents, EightCap will review your application and documents to verify your identity and residence. This process usually takes a few days.

8: Fund Your Account

- Once your account is approved, you will need to deposit funds to activate it fully and qualify for certain bonuses, such as deposit bonuses.

9: Claim Your Bonus

- Depending on the specific bonus terms, you may need to opt-in through a promotional page or enter a bonus code during the deposit process. Be sure to follow the specific instructions provided by EightCap to ensure you properly claim any bonuses.

> **Pro Tip:** Keep digital copies of your identification documents handy for quick uploads and ensure all copies are clear and legible to avoid delays in the verification process.

Final Considerations

- Compliance: Always ensure that all information provided is accurate and truthful. Any discrepancies can lead to delays or denial of account activation and bonus qualification.

- Security: EightCap takes the security of your data seriously. All communications and document submissions through their platform are encrypted for your protection.

By following these steps, you can smoothly open an account with EightCap, complete all necessary verifications, and qualify for their attractive bonuses, setting you up for a more enriched trading experience.

Terms and Conditions: What You Need to Know

When it comes to trading bonuses, understanding the terms and conditions is crucial to maximize benefits without inadvertently violating any rules. This chapter will provide a detailed breakdown of the terms associated with each type of bonus offered by EightCap and guide you through the fine print so you can effectively utilize these incentives in your trading strategy.

Overview of Terms Associated with Each Bonus

1. Welcome Bonus

- Typical Terms: This bonus is generally a one-time offer for new customers who open an account and make their first deposit. The bonus might be a fixed amount or a percentage of the deposit.

- Key Conditions:

- Minimum deposit requirements.

- The bonus must be claimed within a specific timeframe after account registration.

- Trade volume requirements: You might need to achieve a certain volume of trades before you can withdraw the bonus amount.

2. Deposit Bonus

- Typical Terms: Offered on subsequent deposits beyond the initial funding. Like the welcome bonus, this can also be a percentage of the deposit.

- Key Conditions:

- The bonus is applicable only up to a certain deposit amount.

- It may not be available on all account types.

- Withdrawal restrictions often apply, typically tied to trading volumes.

3. No Deposit Bonus

- Typical Terms: A small bonus amount is credited to your account simply for signing up and completing the verification process, with no need to deposit your own funds.

- Key Conditions:

- The bonus amount is usually fixed.

- High trading volume requirements to withdraw the bonus and any profits.

- The bonus might be valid only for a limited time before expiration.

4. Loyalty Programs

- Typical Terms: Rewards are accumulated based on trading activity and can sometimes extend to include competitions and giveaways.

- Key Conditions:

- Points or rewards are often tier-based, with higher levels offering greater benefits.

- Certain trades or instruments might accrue points at different rates.

- There may be limitations on how points can be redeemed (e.g., trading credits, cash, or gifts).

Understanding the Fine Print to Maximize Benefits

Read Carefully: Always read the full terms and conditions for each bonus. Pay special attention to the requirements for claiming the bonus, restrictions on withdrawal, and expiration dates.

Compliance: Ensure that all your trading activity complies with the terms set out in the bonus conditions. Non-compliance can result in the forfeiture of the bonus and any associated earnings.

Strategy Alignment: Align your trading strategy with the terms of the bonus. For example, if a bonus requires a high trade volume, plan your trades in a way that can realistically meet this requirement without excessive risk.

> **Cautionary Note:** Be wary of overextending your trading to meet bonus requirements. While it can be tempting to increase trade volumes to unlock a bonus, this should not lead to taking on more risk than you can comfortably manage.

Practical Application

Use bonuses to supplement your trading strategy, not define it. Bonuses can provide additional leverage or act as a buffer against losses, but they should not drastically change the way you trade. Maintaining a disciplined approach to trading, regardless of bonuses, is essential for long-term success.

Understanding and adhering to the terms and conditions of trading bonuses is key to making the most of these offers without facing unexpected setbacks. If you have any doubts or questions about specific terms, don’t hesitate to contact EightCap’s customer support for clarification.

Strategies to Maximize Benefits from EightCap Bonus

Bonuses can significantly enhance your trading capabilities by providing additional leverage or serving as a buffer against early losses. However, to truly benefit from these bonuses, traders must strategically incorporate them into their trading plans. This chapter will explore how to effectively use bonuses in trading strategies, including practical examples of successful approaches.

How to Effectively Use EightCap Bonus in Trading Strategies

1. Increase Trading Volume Carefully:

- Approach: Use the bonus to increase your trading volume. This is particularly useful when trying to meet volume requirements associated with bonus withdrawals.

- Cautious Expansion: While it’s tempting to increase trade sizes significantly, it’s vital to do so within a risk management framework to avoid disproportionate losses.

2. Experiment with New Strategies:

- Approach: Bonuses allow you to test out strategies that you might not typically consider if using just your own funds.

- Risk Mitigation: Use the bonus as a risk-free trial fund to explore high-potential strategies. If the strategy doesn’t work, your primary capital is not affected.

3. Extend Holding Periods:

- Approach: With additional buffer funds from a bonus, you can afford to hold positions longer than you might with just your own capital.

- Potential Benefit: This can be particularly effective in markets that have high short-term volatility but clear longer-term trends.

Examples of Successful Strategies That Incorporate Bonus Amounts

1: Using a Bonus with a Trend Following Strategy

- Scenario: You receive a 50% deposit bonus on your initial investment.

- Strategy: Allocate the bonus to extend the size and duration of trades within a trend following strategy. This can involve more substantial positions on major forex pairs known for their trending behavior, such as EUR/USD or GBP/JPY.

- Outcome: The additional funds allow you to maintain positions even in the face of short-term reversals, potentially leading to greater profits as trends continue.

2: Hedging with Bonus Funds

- Scenario: A no-deposit bonus is applied to your account.

- Strategy: Use the bonus to set up hedge positions. For instance, if you have a long position in USD/CAD, you could use the bonus to take a short position in oil as a hedge (since CAD is often positively correlated with oil prices).

- Outcome: This strategy can protect your existing investments from adverse movements and is essentially cost-free, as it utilizes the bonus funds.

3: Scalping Strategy Enhancement

- Scenario: A deposit bonus increases your account balance by a fixed percentage.

- Strategy: Employ a scalping strategy, which involves making a large number of trades to profit from small price changes, now with larger volumes thanks to the bonus.

- Outcome: The bonus not only increases the profit per trade but also helps absorb the costs of trading commissions and spreads.

> **Pro Tip:** Always ensure that the increased volume and altered trade sizes still align with your overall risk management strategy. The goal is to maximize profits without exposing yourself to unsustainable losses.

Risks and Considerations When Using EightCap Bonus

While trading bonuses can provide significant advantages, they also come with specific risks and considerations that traders must be aware of to avoid potential pitfalls. This chapter will discuss the common risks associated with bonus trading and provide guidance on how to navigate these challenges effectively, ensuring compliance with trading requirements and maintaining a healthy trading strategy.

Common Pitfalls and Risks Associated with EightCap Bonus Trading

1. Over-Leveraging:

- Risk: Bonuses can tempt traders to open larger positions than they normally would, as the bonus funds increase their total trading capital. This can lead to over-leveraging, where traders are exposed to much higher risks than their capital can support.

- Mitigation: Always consider the size of your positions relative to your actual capital, not just the inflated balance due to the bonus. Stick to your risk management rules.

2. Misunderstanding Bonus Terms:

- Risk: Bonuses come with specific terms and conditions, such as withdrawal restrictions and trading volume requirements. Misunderstanding these terms can lead to frustration and financial losses.

- Mitigation: Carefully read and understand all terms and conditions associated with any bonus. If anything is unclear, contact the broker’s customer support for clarification before you start trading with bonus funds.

3. Distraction from Trading Strategy:

- Risk: The requirements to qualify for a bonus, such as reaching a certain trading volume, can lead traders to make unwise trades just to meet these criteria.

- Mitigation: Ensure that your trading decisions are always aligned with your trading strategy, not just aimed at maximizing or retaining bonuses.

How to Avoid Common Mistakes and Ensure Compliance with Trading Requirements

1. Adherence to Trading Strategy:

- Approach: Do not alter your trading strategy solely to accommodate bonus terms unless it aligns with your overall trading goals and risk management plan.

- Example: If your strategy is based on trading daily charts, don’t switch to scalping just to increase your trade volume for a bonus.

2. Compliance with Bonus Rules:

- Approach: Ensure that every trade that uses bonus funds complies with the specific rules set out in the bonus terms. This includes trading volume requirements and the types of allowed trades.

- Example: Some bonuses may exclude certain pairs or markets; make sure your trades are not only profitable but also eligible under the bonus terms.

3. Regular Review of Bonus Status:

- Approach: Keep track of your progress towards meeting bonus conditions, such as minimum trade volumes and time frames.

- Example: Set reminders to review your bonus status weekly to ensure that you are on track to meet the requirements without needing to rush as the deadline approaches.

> **Critical Reminder:** Always have an exit strategy for each trade, regardless of bonus impacts. Your primary goal should be preserving capital and adhering to your trading plan.

Comparing EightCap Bonus to Other Forex Brokers

When choosing a Forex broker, it’s important to consider how their bonus offerings stack up against the competition. This chapter will provide a comparative analysis of EightCap’s bonus offerings versus those of other notable Forex brokers. We’ll explore the unique features that make EightCap bonuses attractive, as well as areas where they may be lacking, helping you make an informed decision about which broker best suits your trading needs.

Comparative Analysis of EightCap Bonus Offerings Versus Competitors

EightCap Bonuses:

- Welcome and Deposit Bonuses: Typically offers a match on your first deposit, which can be a significant percentage, enhancing your initial trading capital.

- No Deposit Bonuses: Often provides a smaller no deposit bonus to new traders, which is great for testing trading strategies without any financial commitment.

- Loyalty Programs: Features points-based systems that reward traders for their trading volume, which can be redeemed for cash or trading credits.

Comparison with Other Major Forex Brokers:

- A Broker:

- Bonuses: Often includes similar deposit bonuses but might offer higher no deposit bonuses.

- Unique Offering: May provide seasonal promotions and contests with substantial prizes.

- Drawback: Higher trading volume requirements for bonus withdrawals, which can be a significant barrier for smaller traders.

- B Broker:

- Bonuses: Frequently lacks a no deposit bonus but offers higher percentage deposit bonuses.

- Unique Offering: Specializes in cashback bonuses or rebates based on trading volume, beneficial for high-volume traders.

- Drawback: Fewer educational resources and tools available for new traders to learn from while using their bonuses.

- C Broker:

- Bonuses: Often includes both deposit and no deposit bonuses but with stricter conditions.

- Unique Offering: Provides access to exclusive events and webinars for clients who meet certain bonus thresholds.

- Drawback: Bonuses and rewards are often tied to extremely high trading volumes or high minimum deposit requirements.

What Makes EightCap Bonuses Attractive or Lacking?

Attractive Features:

- Accessibility: EightCap’s bonuses are generally more accessible to a wider range of traders, including those with smaller bankrolls.

- Simplicity: The terms and conditions associated with EightCap bonuses tend to be clearer and more straightforward than some competitors.

- Support: Excellent customer service that helps traders understand and make the most of their bonuses.

Lacking Areas:

- Variety: Compared to some competitors, EightCap may offer fewer types of bonuses, particularly in areas like high-value contests or technology-specific bonuses (e.g., free VPS hosting).

- Size: The actual monetary value of EightCap’s bonuses may be lower than some top-tier competitors, who can afford to offer more aggressive promotions.

> **Pro Tip:** When evaluating Forex broker bonuses, consider not just the size of the bonus but also the feasibility of the associated terms. A large bonus under restrictive conditions may be less valuable than a smaller bonus with more achievable terms.

Case Studies: Success Stories Using EightCap Bonuses

Exploring real-life examples of traders who have successfully utilized bonuses from EightCap can provide valuable insights and strategies for others looking to optimize their trading results using similar incentives. This chapter will delve into a few success stories, outlining the lessons learned and tips from these experienced traders.

1: The Conservative Beginner

Background:

- A novice trader, initially cautious about investing personal funds, decided to start with EightCap’s no deposit bonus.

Strategy Used:

- The trader used the no deposit bonus to experiment with different trading strategies without risking personal funds.

- Focused primarily on low-volatility currency pairs to maintain conservative trading practices.

Outcome:

- Gained confidence after a series of small but consistent gains.

- Transitioned to using a combination of their capital and a welcome deposit bonus to gradually increase trading volume.

Lessons and Tips:

- Start Small: Begin with small trades to understand market dynamics.

- Use Bonuses for Learning: Utilize no deposit bonuses as a risk-free educational tool.

2: The Aggressive Scalper

Background:

- An experienced trader with a preference for high-frequency trading, or scalping, took advantage of the deposit bonus to increase leverage.

Strategy Used:

- Applied the deposit bonus to an aggressive scalping strategy across multiple forex pairs.

- Used technical indicators extensively to time the market for frequent, small profits.

Outcome:

- Maximizing the volume of trades helped fulfill the bonus withdrawal conditions quickly.

- Achieved substantial profits from high leverage enabled by the bonus.

Lessons and Tips:

- High Volume Trading: Utilize deposit bonuses to support high-frequency trading strategies.

- Risk Management: Even when trading aggressively, maintain strict stop-loss orders to protect against market volatility.

3: The Strategic Position Trader

Background:

- A mid-level trader focusing on long-term positions used a loyalty program bonus to cushion risks in more volatile markets.

Strategy Used:

- Targeted commodities and indices, taking longer-term positions based on fundamental market changes.

- Used the loyalty bonus as additional margin to manage larger positions without extra personal capital.

Outcome:

- The trader was able to hold positions longer, benefiting from significant market movements.

- The additional buffer from the loyalty bonus reduced the need for immediate trades to cover fluctuations.

Lessons and Tips:

- Use Bonuses as Margin: Leverage bonuses to hold larger or longer positions.

- Diversify: Expand into different markets with the aid of bonus funds to explore new opportunities.

> **General Advice:** Always tailor bonus usage to your trading style and goals. What works for one trader might not work for another, so it's important to align strategies with personal risk tolerance and market outlook.

Future of EightCap Bonus in Forex Trading

Bonuses have been a significant part of the Forex trading landscape, attracting new traders and encouraging trading activity. However, the future of these incentives is influenced by evolving market dynamics, regulatory changes, and trader preferences. This chapter will explore trends and predictions for bonuses in the Forex industry and examine how potential regulatory changes might affect these bonus offerings.

Trends and Predictions for Bonuses in the Forex Industry

1. Increased Regulatory Scrutiny:

- Trend: There has been a global trend toward stricter financial regulations, especially concerning bonuses and incentives that may mislead or cause undue risk to retail traders.

- Prediction: We can expect more transparency requirements and stricter criteria on how bonuses are advertised and awarded. Brokers might shift towards offering bonuses that comply with educational and trading tools enhancements rather than straightforward cash incentives.

2. Greater Focus on Loyalty and Education:

- Trend: With the effectiveness of traditional bonuses being questioned, many brokers are shifting focus towards loyalty programs that reward long-term relationships and educational programs that enhance trader skills.

- Prediction: Future bonuses may more frequently involve comprehensive educational programs, enhanced trading tools, or improved trading conditions (like lower spreads and commissions).

3. Integration with Technology:

- Trend: The integration of technology in trading platforms is on the rise. Innovative tools such as advanced analytics and automated trading systems are becoming standard offerings.

- Prediction: Bonuses might include free access to premium technological tools, customized trading dashboards, or advanced analytical software. This trend aligns with the growing demand for technology-driven trading enhancements.

How Regulatory Changes Might Affect EightCap Bonus Offerings

1. Restriction on Cash Bonuses:

- Impact: In some jurisdictions, regulators have already moved to restrict or ban outright the offering of monetary bonuses tied to trading volumes or account openings, as these can encourage excessive risk-taking.

- Outcome: Brokers may replace cash bonuses with other forms of incentives that do not directly increase trading risk, such as free training sessions, one-on-one coaching, or risk-free trades.

2. Enhanced Disclosure Requirements:

- Impact: Regulations may require brokers to provide more detailed disclosures about the terms and conditions of bonuses, ensuring traders are fully aware of the implications of accepting bonuses.

- Outcome: This could lead to a more informed trading community where bonuses are viewed as part of a broader trading strategy rather than free money.

3. Global Convergence of Bonus Regulations:

- Impact: As the Forex market is inherently international, differing regulations across countries can create confusion and compliance challenges for global brokers.

- Outcome: There might be a move towards more standardized global practices regarding bonuses, influenced by the strictest regulatory regimes.

> **Strategic Insight:** Traders should stay informed about regulatory trends and consider the long-term implications of accepting any bonus. Understanding the full terms and the strategic use of bonuses can turn them into a valuable tool rather than a potential pitfall.

FAQs About EightCap Bonuses

Bonuses can be a compelling feature for both new and experienced Forex traders but often come with questions and concerns regarding their usage, terms, and overall benefits. This section provides answers to frequently asked questions about EightCap bonuses, offering expert advice to help traders make informed decisions.

Common Questions About EightCap Bonuses

1. What types of bonuses does EightCap offer?

- Answer: EightCap primarily offers three types of bonuses: Welcome Bonuses, Deposit Bonuses, and No Deposit Bonuses. They may also have periodic promotions and loyalty programs designed to reward regular traders with additional benefits.

2. How can I qualify for a Welcome EightCap Bonus?

- Answer: To qualify for a Welcome Bonus, you generally need to register a new trading account with EightCap, verify your identity, and make your first deposit according to the minimum requirements stipulated in the bonus terms.

3. Are there any restrictions on withdrawing bonuses from EightCap?

- Answer: Yes, bonuses often come with specific trading volume requirements that must be met before you can withdraw the bonus funds. This might include trading a certain number of lots within a specified time period.

4. Can I use the bonus for all types of trades?

- Answer: Typically, bonuses can be used for most types of trades, but there are exceptions. Some bonuses may have restrictions regarding the trading instruments or platforms. Always read the specific terms and conditions associated with each bonus.

5. What should I be cautious of when using a Forex bonus?

- Answer: Be wary of the requirements and restrictions attached to the bonus. For instance, high trading volume requirements could encourage excessive trading or taking unnecessary risks. Always ensure that using the bonus aligns with your trading strategy and risk management practices.

6. How do EightCap’s bonuses compare to other Forex brokers?

- Answer: EightCap’s bonuses are competitive within the industry, offering a balance between attractiveness and achievable conditions. However, some brokers may offer larger bonuses or bonuses with different conditions, so it’s important to compare these based on your individual trading needs and preferences.

7. What happens to my bonus if I don’t meet the trading requirements?

- Answer: If you fail to meet the trading requirements within the specified timeframe, you typically forfeit the bonus funds, and any profits made using the bonus may also be withdrawn from your account. It’s crucial to track your progress towards meeting these requirements.

8. Can bonuses be used in conjunction with other promotions?

- Answer: This depends on the specific policies of EightCap at the time. Some bonuses may not be combinable with other offers or promotions. Always check the terms of each promotion to understand whether they can be used together.

Expert Advice for Using EightCap Bonus

- Understand the Terms: Fully reading and understanding the terms and conditions is crucial. This can prevent any surprises regarding bonus eligibility, usage, or withdrawal.

- Align Bonuses with Your Strategy: Use bonuses to support or enhance your existing trading strategy rather than allowing the bonus to dictate your trading behavior.

- Manage Risk Wisely: Even with bonus funds, maintain rigorous risk management practices. Don’t view bonus funds as an excuse to take on excessive risk.

> **Pro Tip:** Consider the bonus as part of your overall trading capital and incorporate it into your financial planning just as you would with your deposited funds. This approach helps maintain a balanced perspective on trading with bonus funds.

By addressing these FAQs and following the expert advice provided, traders can effectively utilize EightCap bonuses to enhance their trading experience and potential profits while staying informed and cautious about the associated terms and conditions.