Welcome to TradeChamp.net, your premier source for in-depth financial and trading information. Today, we delve into EightCap, a name that’s been gaining traction among beginners in the Forex trading world. If you’re looking to kickstart your trading journey, understanding Eightcap Demo Account is essential. EightCap stands out as a Forex broker with its user-friendly interface and comprehensive support structures designed specifically for those new to the trading arena. In this chapter, we will explore the foundational aspects of EightCap and what makes its trading platform a top choice for novice traders.

Overview of EightCap as a Forex Broker

Established with the aim of empowering traders, EightCap is recognized for its robust regulatory framework and commitment to providing a secure trading environment. This broker is regulated by top-tier financial authorities, ensuring that your trading journey is not only successful but also secure.

Key advantages of EightCap include:

- Regulation and Security: Fully regulated by the Australian Securities and Investments Commission (ASIC), EightCap provides a trading environment that adheres to high standards of financial compliance and operational integrity.

- Global Accessibility: Offering services across a wide geographical spread, EightCap allows traders from various parts of the world to access markets effortlessly.

Key Features and Benefits of Choosing EightCap for Trading

Choosing EightCap as your broker comes with numerous benefits that cater specifically to the needs of beginners:

- User-Friendly Platform: EightCap offers the MetaTrader 4 platform, renowned for its intuitive interface and powerful features. Beginners can navigate through complex trading environments with ease.

- Educational Resources: A wealth of learning materials, from webinars to comprehensive guides, are available to help novice traders understand market dynamics and develop effective trading strategies.

- Customer Support: New traders often require guidance, and EightCap’s responsive customer service ensures that help is always just a call or click away.

Why EightCap?

Imagine a trading platform that not only offers state-of-the-art tools but also surrounds you with a support system geared towards your trading success. That's what EightCap does for beginners.

EightCap’s commitment to enhancing user experience and providing educational support makes it an excellent choice for anyone starting their journey in Forex trading. As we proceed to the next section, think about what features matter most to you in a trading platform.

Getting Started with an EightCap Demo Account

Embarking on your trading journey with EightCap begins with a crucial step: setting up a demo account. This chapter provides a detailed, step-by-step guide to help beginners understand the process of creating a demo account, which is an excellent way to get acquainted with Forex trading without any risk. We will also explore the user interface and navigation of the platform to ensure you can leverage its features effectively.

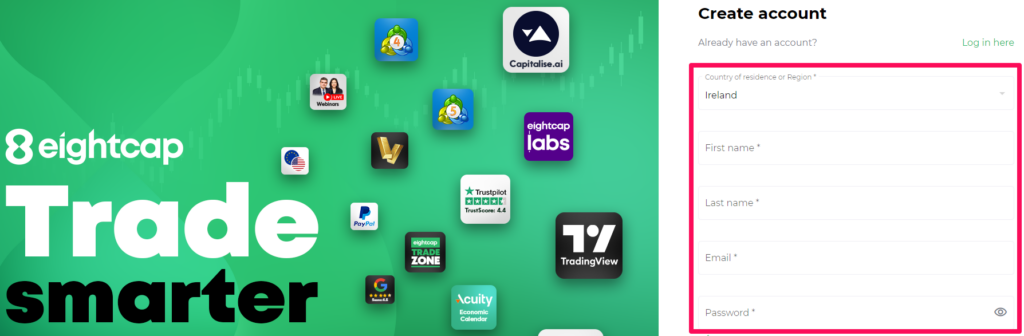

Step-by-Step Guide on Setting Up a EightCap Demo Account

Step 1: Visit the EightCap Website

Navigate to the official EightCap website. Look for the “Demo Account” section, typically accessible from the homepage or through the trading accounts menu.

Step 2: Fill Out the Registration Form

Provide the necessary details such as your name, email address, and phone number. You’ll also need to set a password for your account.

Step 3: Verification and Activation

After submitting your form, you may need to verify your email address. Follow the instructions sent to your email to activate your demo account.

Step 4: Download and Install Trading Software

Download the MetaTrader 4 platform from EightCap’s website if you haven’t already installed it. This platform is highly recommended for beginners due to its user-friendly interface.

Step 5: Log In to Your Demo Account

Using the login credentials provided after registration, log into the MetaTrader 4 platform to start exploring the features and tools available.

Understanding the User Interface and Navigation

Once you’ve logged into your demo account, take some time to familiarize yourself with the layout:

- Dashboard: This is your command center. Here, you’ll find your balance, equity, margin, free margin, and profit/loss metrics.

- Market Watch Window: Displays a list of currency pairs available to trade along with real-time quotes.

- Chart Windows: Here, you can analyze the price movements of different currency pairs. Utilize tools like indicators and graphs to make informed decisions.

- Trade Execution Buttons: Learn how to use buttons like ‘New Order’ to open and close trades. This is crucial for managing your trades effectively.

**Quick Tip:** Use the demo account to experiment with different trading strategies and settings. It’s a safe way to learn the ropes without risking real money.

The demo account experience is designed to simulate real trading environments as closely as possible, providing you with valuable insights into how Forex trading works. As you become comfortable navigating the interface and making test trades, you’ll gain the confidence needed to transition to a real trading account.

Exploring the Features of the EightCap Demo Account

Now that you’re set up with your EightCap demo account, it’s time to dive deeper into the features and tools it offers. This chapter will provide a comprehensive breakdown of the resources available to you through the demo account and how they compare to a live trading account. Understanding these features will better equip you for a seamless transition to real trading.

Detailed Breakdown of Tools and Resources Available

The EightCap demo account is more than just a training ground; it’s a fully-equipped platform that mirrors the live trading environment, designed to give you a realistic trading experience. Here are some key tools and resources that you will find invaluable:

- Charts and Analysis Tools: Access professional-grade charts with a range of time frames, from one minute to one month. Utilize technical analysis tools like Fibonacci retracement, moving averages, and more to forecast market movements.

- Expert Advisors (EAs): Test automated trading strategies using EAs available in the MetaTrader 4 platform. This feature is particularly beneficial for understanding how trading algorithms can be used to automate your trading.

- Risk Management Tools: Learn to apply stop-loss and take-profit orders, crucial for managing the risks associated with trading.

> **Educational Insight:** Leverage the market analysis videos and trading tutorials provided within the demo environment to sharpen your trading skills.

Comparison with the Live Trading Account

While the demo account offers a robust platform to learn and practice, there are key differences when comparing it to a live trading account at EightCap:

- Market Conditions: While demo accounts simulate live trading, they may not always perfectly mirror real-time market liquidity or the psychological pressures of real trading.

- Execution Speed: Trades in a demo account are typically executed immediately without issues such as slippage or significant price changes, which can occur in live markets.

- Emotional Investment: Trading with virtual money lacks the emotional impact compared to real money, which can influence decision-making in live trading.

Understanding these differences is crucial as you prepare to transition from a demo to a live account. It’s important to remember that the skills and strategies developed in the demo should be adaptively applied in live trading scenarios to account for these variables.

**Think Ahead:** As you explore the demo account, consider how each feature could impact your real-world trading. This foresight can make a significant difference in your trading effectiveness.

Trading Instruments Available in the EightCap Demo Account

As you continue to explore the capabilities of your EightCap demo account, understanding the range of trading instruments available is essential. This chapter will cover the variety of Forex pairs, CFDs (Contracts for Difference), and other financial instruments that you can practice trading. Additionally, we’ll guide you through accessing and trading these instruments within the demo environment, providing you with the knowledge to utilize the full potential of your demo experience.

Overview of Forex Pairs, CFDs, and Other Instruments You Can Trade

EightCap offers a diverse array of trading instruments, each catering to different trading styles and strategies. Here’s a look at what’s available in your demo account:

- Forex Pairs: Trade major, minor, and exotic currency pairs. From the highly liquid pairs like EUR/USD and GBP/USD to more volatile options like USD/ZAR or EUR/TRY, you can experiment with a range of currencies.

- CFDs on Commodities: Whether you’re interested in precious metals like gold and silver, energy commodities like oil and natural gas, or soft commodities like coffee and sugar, CFDs allow you to speculate on price movements without owning the actual commodity.

- Indices and Stock CFDs: Gain exposure to global markets by trading CFDs on major indices like the S&P 500, NASDAQ, and others. Stock CFDs let you trade the market price of major companies without needing to own the stocks.

> **Pro Tip:** Use the economic calendar in your demo account to monitor market events that might affect these instruments, helping you make informed trading decisions.

How to Access and Trade These Instruments in the Demo Environment

Accessing and trading these instruments within your EightCap demo account involves a few straightforward steps:

1: Accessing the Instruments

- Log into your MetaTrader 4 platform.

- Navigate to the ‘Market Watch’ window where you can see a list of all available instruments.

- Right-click in this window and select ‘Show All’ to display the full range of instruments.

2: Opening a Trade

- Double-click on the instrument you wish to trade.

- This action will open a new order window where you can set your trade size (lot size), stop loss, and take profit levels.

- Click on ‘New Order’ to execute your trade.

3: Monitoring Your Trades

- Your open trades can be viewed in the ‘Trade’ tab at the bottom of the platform.

- Monitor the performance and adjust your strategy as needed.

**Key Consideration:** Experiment with different instruments to understand how each behaves under various market conditions. This practice will be invaluable when you transition to a live trading environment.

By familiarizing yourself with the diverse instruments available and practicing their trade execution in the demo environment, you are laying a solid foundation for your trading career.

Effective Trading Strategies Using the EightCap Demo Account

After familiarizing yourself with the various trading instruments available in your EightCap demo account, it’s time to develop and refine effective trading strategies. This chapter focuses on crafting strategies suitable for beginners, as well as testing and improving advanced trading techniques. Whether you’re just starting out or looking to enhance your trading approach, the demo account is an invaluable tool for experimentation and learning.

Developing Trading Strategies Suitable for Beginners

For those new to trading, starting with simple, low-risk strategies is essential. Here are a few foundational strategies that beginners can easily adopt:

- Trend Following: This strategy involves identifying and following the market’s direction. Beginners can use simple tools like moving averages to determine whether to buy (if the price is above the moving average) or sell (if the price is below).

- Range Trading: This involves trading within the high and low price range that an instrument experiences over a given period. Support and resistance levels are used to make buy and sell decisions.

- Position Trading: Although it requires patience, position trading is suitable for beginners because it focuses on long-term changes in the markets, reducing the need to make quick, high-pressure decisions.

> **Beginner Tip:** Start with small trades to manage risk effectively while you’re learning. Even in a demo account, this practice can help simulate realistic trading stakes.

Testing and Refining Advanced Trading Strategies

For more experienced traders, the demo account provides a perfect platform to test out more complex strategies without financial risk. Advanced strategies to explore might include:

- Scalping: This strategy aims to make many small profits on minimal price changes throughout the day. It requires quick decision-making and excellent timing.

- Day Trading: This involves buying and selling on the same day, taking advantage of small price movements. It can be more demanding but offers greater control over open positions since no trades are left open overnight.

- Swing Trading: This strategy is all about capturing short- to medium-term gains over a few days to several weeks. Traders using this strategy will need to analyze patterns and market momentum thoroughly.

- Automated Trading Systems: Experienced traders can also test automated trading strategies using algorithms designed to execute trades based on a set of indicators and rules.

**Strategy Enhancement:** Use the analytical tools available in the demo account to assess the effectiveness of your strategies. Adjust your approaches based on the analytics to optimize performance.

Utilizing a demo account to experiment with both basic and advanced trading strategies not only builds your confidence but also enhances your understanding of market dynamics without the risk of losing real money.

Using Technical Analysis Tools in the EightCap Demo Account

Technical analysis is a crucial skill for traders, allowing them to predict future market movements based on historical price data and trends. In this chapter, we will explore the range of technical indicators available on the EightCap demo account and provide practical examples of how to apply these tools in demo trades. This guidance will help you gain proficiency in using technical analysis to make informed trading decisions.

Introduction to Technical Indicators Available on EightCap

EightCap’s MetaTrader 4 platform is equipped with a variety of technical indicators that are essential for conducting thorough market analysis. Here are some of the key indicators available:

- Moving Averages (MA): Useful for identifying trends over a specified period by smoothing out price data.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements, ideal for identifying overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): This tool helps detect changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

- Bollinger Bands: These bands widen or contract based on market volatility and are particularly effective in identifying market conditions.

Practical Examples of Applying These Tools in Demo Trades

To demonstrate how these technical indicators can be applied, let’s consider a couple of practical examples:

Example 1: Trading with Moving Averages

- Objective: Identify a potential buying opportunity in a trending market.

- Action: Set up two moving averages on your chart, one short-term (e.g., 10 days) and one long-term (e.g., 50 days). A buy signal is typically considered when the short-term moving average crosses above the long-term moving average.

- Application: Monitor the EUR/USD pair in your demo account, applying the moving averages. When the 10-day MA crosses above the 50-day MA, consider executing a demo buy trade.

Example 2: Using RSI to Identify Sell Opportunities

- Objective: Spot overbought conditions that may signal a selling opportunity.

- Action: Apply the RSI indicator to your chart and set the period to 14. Watch for the RSI reading to go above 70, which is generally considered overbought.

- Application: Choose a volatile instrument, like GBP/JPY. If the RSI exceeds 70, this might be a good time to execute a demo sell trade, anticipating a possible price reversal.

> **Tip:** Always confirm your signals with other indicators or tools. For instance, if using RSI for a sell signal, check if the price is near a resistance level for additional confirmation.

These practical examples should give you a starting point for experimenting with different technical analysis tools in your EightCap demo account. Remember, the goal of using a demo account is not just to make profitable trades, but to understand the tools and strategies that will serve you well in live trading scenarios.

Risk Management with a EightCap Demo Account

Effective risk management is essential for successful trading, helping to minimize losses and protect profits. This chapter will address the importance of risk management in trading and demonstrate how you can practice these critical techniques using your EightCap demo account. By mastering risk management in a simulated environment, you prepare yourself to handle real-market conditions more effectively.

Importance of Risk Management in Trading

Risk management in trading involves understanding and applying strategies to manage and reduce financial risks. It is a fundamental aspect of trading that can determine long-term success or failure. Here’s why it’s so crucial:

- Preserves Capital: Helps prevent significant losses that can deplete trading capital quickly.

- Enhances Profitability: By managing losses, traders can maintain a more consistent profitability over time.

- Reduces Emotional Trading: Effective risk management strategies can help traders make more rational, less emotionally-driven decisions.

How to Practice Risk Management Techniques Using the EightCap Demo Account

Practicing risk management techniques in a demo account allows you to experience the efficacy of these methods without financial risk. Here are some key techniques and how you can implement them in your demo trading:

1. Setting Stop-Loss Orders

- Definition: A stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price. It is designed to limit an investor’s loss on a security position.

- Application: For instance, if you enter a long position on EUR/USD at 1.1200, you might set a stop-loss order at 1.1150. This means if the price drops to 1.1150, the position will automatically close to prevent further loss.

2. Using Position Sizing

- Definition: Position sizing involves determining how much of your total capital you will risk on a single trade.

- Application: Suppose you have a $10,000 account in your demo. You might decide never to risk more than 1% ($100) on a single trade. Depending on your stop-loss, adjust the size of the position to ensure you do not lose more than $100.

3. Implementing Risk-Reward Ratios

- Definition: The risk-reward ratio measures the potential profit for every dollar risked.

- Application: A common ratio is 1:3, meaning for every $1 risked, you aim to make $3. If your stop-loss is set to risk $50 on a trade, your target (take-profit) should be set to gain $150.

> **Practice Tip:** Experiment with these settings in your demo account. Adjust the parameters based on different trading scenarios and market conditions to see how they impact the outcomes of your trades.

4. Regular Review and Adjustment

- Definition: Continuously analyzing the outcomes of your trades and adjusting your strategies as needed.

- Application: Use the analytics tools available in the MetaTrader 4 platform to review the performance of your trades. Look for patterns in what works and adjust your approach to improve your risk management strategy.

Understanding and implementing these risk management strategies in your demo account will build your confidence and competence, preparing you for real-world trading.

Learning from the Demo Experience: What to Monitor and Analyze

Utilizing a demo account is not just about practicing trades; it’s also about learning from each transaction to refine your trading strategies. This chapter focuses on the key metrics and performance indicators you should monitor and how to analyze your demo trading data to improve your future trading decisions. By understanding what to track and how to interpret this information, you can turn your demo experience into a powerful learning tool.

Key Metrics and Performance Indicators to Track

When trading in a demo account, it’s crucial to monitor several metrics that indicate the health and effectiveness of your trading strategies. Here are some of the most important metrics to keep an eye on:

- Profit and Loss (P&L): This is the basic measure of your trading success. Tracking daily, weekly, and monthly P&L will help you understand the effectiveness of your trading decisions.

- Win Rate: This is the percentage of trades that are profitable. A high win rate indicates effective strategy, but must be viewed in context with the risk-reward ratio.

- Risk-Reward Ratio: As discussed previously, this ratio helps you understand the potential reward for every dollar risked. Maintaining a favorable risk-reward ratio is key to long-term trading success.

- Maximum Drawdown: This metric shows the largest single drop from peak to bottom in your portfolio’s value, helping you understand the biggest risk you are taking.

Using the Demo Trading Data to Improve Trading Decisions

Analyzing the data from your demo account trades can provide valuable insights into how to adjust your strategies for better outcomes. Here’s how you can use this data effectively:

1. Analyze Trade Outcomes

- Method: Review each trade’s outcome and categorize them by strategy used, market conditions, and time of day. Look for patterns in what works and what doesn’t.

- Application: If you notice that a particular strategy consistently results in losses, it may be time to refine or abandon it. Conversely, strategies that lead to profits should be studied and possibly scaled.

2. Keep a Trading Journal

- Method: Maintain a detailed journal of all your trades, including the reasoning behind each decision, the outcomes, and any external factors affecting your trades.

- Application: This journal will be a critical resource for understanding your trading habits and triggers. Regular review will help you make more disciplined and informed decisions.

3. Use Analytics Tools

- Method: Utilize the analytical tools available in the MetaTrader 4 platform to conduct more complex analyses of your trading performance.

- Application: Tools like the ‘Strategy Tester’ allow you to backtest strategies using historical data. This can help you refine your approach before applying it in real trading scenarios.

> **Key Insight:** Regularly scheduled review sessions to go over your trading data can help turn sporadic successes into repeatable strategies.

By diligently monitoring and analyzing your demo account trading data, you can identify what strategies work best for you, refine your trading techniques, and increase your readiness for live trading.

Transitioning from a Demo to a Live Account

After spending time in a demo environment, moving to a real trading account is a significant step for any trader. This chapter will guide you through understanding when it’s appropriate to make the move from demo trading to real trading, and outline the adjustments you can expect along with strategies to manage them effectively. This transition is crucial as it introduces elements of real trading that aren’t fully simulated in a demo account, such as emotional factors and financial risks.

When and How to Make the Move from Demo Trading to Real Trading

When to Transition:

- Consistent Profitability: Have you been consistently making profits over a significant period in your demo account? Consistency in successful trading, more than just occasional profits, is key.

- Mastery of Trading Platform and Tools: Ensure you are completely comfortable with the trading platform and its tools. You should be able to execute trades and use advanced features without hesitation.

- Understanding of Risk Management: You should have robust risk management strategies that have proven effective in your demo trading.

How to Transition:

- Start Small: When you move to a live account, begin with small trades. This will help you acclimate to the psychological differences without risking significant capital.

- Maintain Your Strategy: Use the same strategies that were successful in the demo account, as drastic changes can lead to unexpected results.

- Choose the Right Broker: Ensure that your broker is reliable and offers the services you need. It’s crucial to continue with a broker like EightCap, which you are familiar with from your demo experience.

Adjustments to Expect and How to Manage Them

1. Dealing with Emotional Factors:

- Expectation vs. Reality: Real losses can trigger stress and fear, which were not present during demo trading. It’s vital to stay disciplined and not let emotions drive your trading decisions.

- Managing Emotions: Set clear rules for trading and stick to them, regardless of how you feel. Techniques such as meditation or taking breaks can also help manage emotional responses.

2. Financial Risks:

- Increased Stakes: Real trading involves actual money, so the stakes are naturally higher. This can alter how you perceive and handle trades.

- Managing Financial Risks: Continue to use strict risk management practices such as stop-loss orders, and only risk a small percentage of your total capital on any single trade.

3. Market Conditions:

- Unpredictability: Real markets may behave slightly differently than simulated ones, especially due to factors like liquidity and market impact.

- Adapting to Market Conditions: Stay informed about market conditions and be prepared to adapt your strategies accordingly. Continuous learning and staying updated with financial news are crucial.

> **Transition Tip:** Keep a detailed trading journal as you transition to a live account. This can help you analyze your trades, manage your emotions, and adjust your strategies based on real-world results.

Transitioning from a demo to a live trading account is a pivotal phase in your trading career. By taking calculated steps and maintaining discipline, you can ensure that this transition enhances your trading skills and contributes to your long-term success.

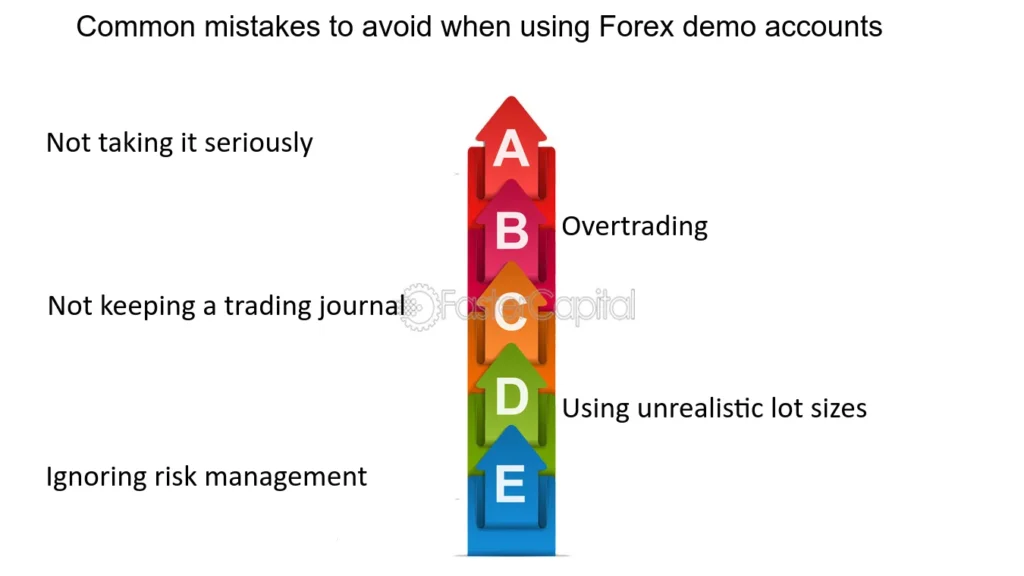

Common Mistakes to Avoid with Demo Accounts

Using a demo account is an excellent way to learn the ropes of Forex trading without risking actual money. However, beginners often fall into certain traps that can skew their learning experience or give them a false sense of security. This chapter will outline the common pitfalls and errors that beginners make with demo accounts and provide tips on using these tools more effectively to gain meaningful, real-world trading experience.

Pitfalls and Common Errors Beginners Make with EightCap Demo Account

1. Overtrading:

- Issue: Beginners might execute an excessive number of trades because there are no real financial consequences. This can lead to bad habits that are not sustainable in live trading.

- Avoidance Tip: Treat your demo account as if it were real money. Limit your trading to what you would realistically manage with your actual capital.

2. Ignoring Risk Management:

- Issue: It’s easy to neglect risk management strategies when the risk feels abstract. Without the fear of real loss, traders might take unreasonably large positions or fail to set stop-loss orders.

- Avoidance Tip: Apply the same risk management rules in your demo account that you intend to use in live trading. This practice builds good habits and helps transition to a live account smoothly.

3. Not Reflecting on Trades:

- Issue: Without the pain of loss, there’s less incentive to analyze and learn from unsuccessful trades.

- Avoidance Tip: Keep a trading journal even in demo trading. Review each trade to understand what went right or wrong, and what could be improved.

Tips on Using the EightCap Demo Account More Effectively to Gain Real Experience

1. Set Realistic Goals:

- Strategy: Before you start trading, define what you want to achieve with your demo account. Whether it’s testing a particular strategy, getting used to the trading platform, or practicing trade entries and exits, having clear goals will guide your actions.

- Application: Establish a weekly review process to assess whether you are meeting these goals and adjust your strategies accordingly.

2. Use a Simulated Capital Amount That Reflects Your Future Investment:

- Strategy: Trade with an amount in your demo account that closely matches the capital you plan to invest in your real account. This makes your demo trading experience as realistic as possible.

- Application: If you plan to start live trading with $10,000, set your demo account balance to the same amount.

3. Time Your Demo Trading:

- Strategy: Limit the time you spend in the demo environment. Extended periods might lead to complacency and a detachment from real trading dynamics.

- Application: A typical recommendation is to use a demo account for a few months before transitioning to live trading, depending on how quickly you learn and adapt.

> **Pro Tip:** Incorporate lessons from real-world market analysis into your demo trading. This can help you understand how external factors influence market movements and improve your decision-making skills.

By avoiding common mistakes and using your demo account effectively, you can build a strong foundation that will serve you well in the competitive world of Forex trading.