Chapter 1: Introduction to Automated Trading on eToro

Overview of What Automated Trading Entails and Its Benefits

eToro automated trading, also known as algorithmic trading, uses computer programs to execute trades based on set criteria without human intervention. This approach to trading has gained significant popularity due to its precision, speed, and efficiency. Here are some key benefits:

- Speed and Efficiency: Computers can process orders much faster than humans, which is crucial in taking advantage of trading opportunities that might only exist for a few seconds.

- Emotion-Free Trading: Automated systems operate based on analytics and data, removing emotional decision-making that can often lead to suboptimal trading.

- Consistency: By trading a predefined strategy, automated systems can help maintain trading discipline and consistency.

Brief Introduction to eToro and Its Relevance in Automated Trading

eToro is known for its user-friendly interface and extensive trading instruments. It’s ideal for beginners, offering several key benefits for automated trading.

- CopyTrader System: eToro’s innovative CopyTrader technology allows users to replicate the actions of successful traders automatically, effectively integrating the concept of automated trading with the expertise of seasoned traders.

- CopyPortfolios: Another feature geared towards automation is eToro’s CopyPortfolios, where traders can invest in fully managed portfolios, clustering together assets or top traders under a unified strategy managed by eToro’s algorithms.

> "For those new to trading, eToro provides an accessible gateway into the potentially complex world of automated trading, simplifying sophisticated trading strategies into actionable and understandable investments."

eToro leverages automated tools to support new traders in the forex market. These tools help maximize trading effectiveness and can potentially increase returns.

Chapter 2: Understanding eToro’s Trading Platforms

Detailed Exploration of the eToro Platform Features That Support Automated Trading

eToro’s trading platform caters to both novice and experienced traders. It integrates features that support automated trading, enhancing user experience. Key features include:

- CopyTrader: Perhaps the most notable automated feature, CopyTrader allows users to mirror the trades of selected traders automatically. Users can view veteran traders’ performance, style, and risk scores to select who to copy based on their trading goals.

- CopyPortfolios: These are investment strategies grouped by either a theme or a top trader portfolio. Each CopyPortfolio’s performance is analyzed in depth and rebalanced automatically to maximize potential returns.

- Algorithmic Trading: While eToro does not offer direct access to trading bots, it supports algorithmic trading through its API, which skilled traders and third parties can use to program trading algorithms.

Comparison of the Web Platform Versus Mobile App Functionality

eToro offers both a web platform and a mobile app, each with unique strengths tailored to different trading styles and preferences:

- Web Platform:

- Comprehensive Analysis Tools: The web version provides more extensive analytical tools and charts, which are crucial for detailed trading strategy development and monitoring.

- Greater Accessibility to Information: It’s easier to access educational resources, historical data, and detailed asset information.

- Enhanced Usability for Complex Trades: The interface is better suited for engaging in more complex trading and investment activities that require multitasking.

- Mobile App:

- Convenience: Allows trading on the go with a simplified interface that is optimized for mobile devices.

- Essential Features: Although more compact, the mobile app includes critical features such as real-time alerts, one-tap operations, and basic charting functionalities.

- Notifications: Immediate push notifications about market events or changes in portfolio performance, which is crucial for managing ongoing trades.

Both platforms offer effective automated trading tools. The choice depends on personal preference and trading needs.

Chapter 3: Setting Up Automated Trading on eToro

Step-by-Step Guide on How to Set Up Automated Trading Systems on eToro

Setting up automated trading on eToro is a streamlined process, designed to be accessible even to those new to trading. Here’s how you can get started:

- Log In and Access Dashboard: Sign into your eToro account and navigate to your main dashboard.

- Explore CopyTrader: Click on the “Copy People” option. Here, you can browse through profiles of top traders. Use filters to find traders who match your investment goals and risk tolerance.

- Choose a Trader to Copy: Once you’ve selected a trader, click on their profile to view detailed performance statistics, including risk score, portfolio composition, and trading history.

- Set Up Copying: Click on “Copy”.

- When you copy a trader on eToro, specify the investment amount. eToro then replicates the trader’s ongoing trades proportionally.

- Adjust Settings: Set a Stop Loss to limit potential losses if the trader’s strategy underperforms.

Required Tools and Settings for Initiating Automated Trades

To ensure a successful automated trading setup on eToro, familiarize yourself with the following tools and settings:

- Risk Score: Each trader has a risk score from 1 to 10, calculated based on the volatility of their trading strategies. Choose traders whose risk level aligns with your risk tolerance.

- Copy Stop Loss: This tool is crucial for managing potential losses. Setting a Copy Stop Loss caps potential losses at an amount you’re comfortable with, preventing excessive financial risk.

- Diversification: Don’t put all your funds into a single trader. Spread your investment across multiple traders to mitigate risks and stabilize potential returns.

> "Automated trading on eToro doesn’t just simplify the trading process; it empowers you to leverage the expertise of seasoned traders with the peace of mind that comes from built-in risk management tools."

Follow these steps to establish an effective automated trading system on eToro. This approach leverages the platform’s capabilities, potentially enhancing outcomes without micromanaging each trade.

Chapter 4: CopyTrader System

Comprehensive Guide on Using eToro’s CopyTrader Feature

eToro’s CopyTrader is a revolutionary tool that lets users replicate successful traders’ moves automatically. It’s ideal for beginners eager to learn from the experienced. Here’s a step-by-step guide to effectively using the CopyTrader system:

- Access CopyTrader: Navigate to the CopyTrader section from your dashboard. This area showcases a variety of traders, highlighting their performance metrics.

- Evaluate Traders: Use eToro’s comprehensive filters to narrow down traders by performance, risk level, and the number of copiers. Review their profiles for more in-depth information.

- Choose a Trader: Select a trader whose strategy and performance align with your trading goals. It’s important to consider their trading history for consistency, not just recent successes.

- Select a trader and choose your investment amount for copying. eToro automates the rest, mirroring each trade in proportion to your investment.

How to Select Traders to Copy Based on Performance, Risk, and Trading Style

Selecting the right traders is crucial for maximizing the benefits of the CopyTrader system. Here are key factors to consider:

- Performance Analysis: Look at the historical performance over various periods. Consistent returns over a long period can be a good indicator of stability and skill.

- Risk Assessment: Each trader is assigned a risk score based on the volatility of their trades. Depending on your risk tolerance, choose a trader with a corresponding risk level.

- Understand their trading style. Determine if they prefer long-term or short-term trading. Identify the markets they focus on and their typical trading frequency. Alignment with your own trading preferences is key.

> "Copying a trader is not just about replicating success; it’s about understanding and aligning with their approach to the markets. The right match can significantly enhance your trading outcomes."

Best Practices for Using CopyTrader

To get the most out of the CopyTrader feature, adhere to these best practices:

- Diversification: Don’t rely solely on one trader. Diversify your copy investments across different traders to mitigate risks.

- Monitoring: Regularly check the performance of your copied trades. Be prepared to adjust your settings or change the traders you copy based on their ongoing performance.

- Engagement: Engage with the community. Many traders share insights about their strategies and market outlooks, which can be invaluable for understanding your investments.

Follow these guidelines to maximize your trading with eToro’s CopyTrader. Learn from seasoned traders and boost your returns effectively.

Chapter 5: CopyPortfolios

Explanation of eToro’s CopyPortfolios and How They Differ from CopyTrader

eToro’s CopyPortfolios bundles financial assets into thematic strategies or mimics successful traders’ portfolios. This feature suits investors seeking a pre-built strategy that diversifies risk across multiple assets, managed by eToro’s investment committee.

Differences from CopyTrader:

- Automation Level: While CopyTrader requires investors to select individual traders to copy, CopyPortfolios offer a fully managed portfolio based on a targeted strategy or the collective approach of top-performing traders.

- Diversification: CopyPortfolios inherently provide more diversification, as each portfolio can contain multiple assets or several traders’ strategies, rather than being tied to the trades of a single person.

- Investment Approach: CopyPortfolios are structured with a long-term investment strategy in mind, whereas CopyTrader can be used for shorter-term trading based on individual trader performance.

Guide on Investing in CopyPortfolios, Including Thematic and Top Trader Portfolios

Investing in CopyPortfolios is straightforward. Here’s how you can get started:

- Access CopyPortfolios: From your eToro dashboard, navigate to the CopyPortfolios section to see the available portfolios.

- Choose a Portfolio Type:

- Thematic Portfolios: These portfolios are based on a particular theme or industry trend, such as renewable energy, tech innovations, or cryptocurrencies.

- Top Trader Portfolios: These are based on the performance of selected top traders on eToro and are dynamically managed to maximize returns.

- Evaluate and Select:

- Review the Portfolio Details: Each portfolio has detailed information including past performance, the management strategy, risk level, and the composition of assets or traders.

- Check the Minimum Investment: Be aware of the minimum investment required, which can vary between portfolios.

- Invest: Once you’ve chosen a portfolio that aligns with your investment goals and risk tolerance, decide on the amount you want to invest and proceed to allocate funds to the portfolio.

> "CopyPortfolios represent a next-level investment opportunity for those looking to diversify their investments across multiple assets or top-performing strategies, all managed under the expert guidance of eToro’s investment professionals."

Monitoring and Adjusting Your Investment in CopyPortfolios

While CopyPortfolios are designed as a set-and-forget investment, it’s wise to monitor their performance regularly. eToro provides tools and updates on the portfolio’s progress, helping you to understand how your investment is performing against market conditions. If your investment goals or the market dramatically changes, consider reallocating your funds to different portfolios to better suit your new objectives.

By utilizing eToro’s CopyPortfolios, investors can take advantage of diversified strategies that are both innovative and aligned with global investment trends, enhancing their potential for long-term growth.

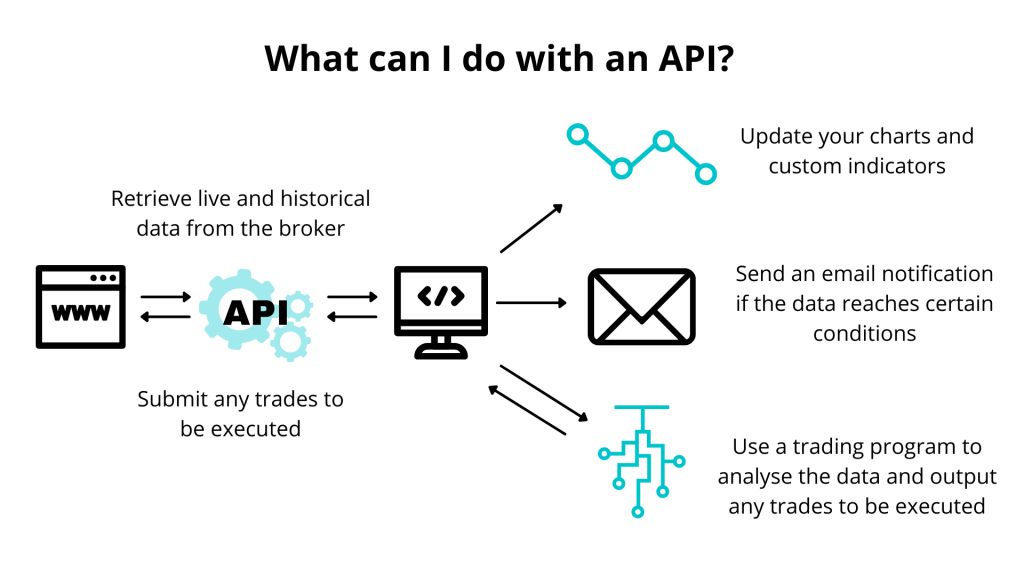

Chapter 6: Using APIs for Custom Automation

How to Use eToro’s APIs for Custom Trading Strategies

For those looking to take their trading to a more customized level, eToro’s APIs provide a robust toolset for building and implementing personal trading algorithms. These APIs allow advanced traders to automate their strategies precisely according to their specifications.

Getting Started with eToro APIs:

- Access the API: First, you need to apply for access to eToro’s API. This is typically reserved for traders who meet certain criteria in terms of account size and trading activity.

- Understand the Documentation: Familiarize yourself with the API documentation provided by eToro. It includes all necessary endpoints, data formats, and protocols needed to interact with the trading platform.

- Set Up Your Development Environment: Prepare your coding environment. Most traders use programming languages like Python due to its extensive support for financial and data analysis libraries.

Examples of Trading Algorithms Users Can Implement

Here are a few examples of trading algorithms that users can implement using eToro’s APIs:

- Trend-Based Algorithm: This algorithm analyzes historical price data to identify trends in the market for specific securities. When a trend is detected, the algorithm can execute trades to capitalize on this direction.

- Arbitrage Strategy: For those with access to multiple markets or assets that have price discrepancies, an arbitrage algorithm seeks to exploit these inefficiencies by purchasing in one market and simultaneously selling in another at a higher price.

- Mean Reversion Strategy: This strategy is based on the assumption that prices and returns eventually move back towards the mean or average. This strategy can be programmed to buy assets when they are below their historical average and sell them when they exceed the average.

> "Utilizing eToro’s APIs can significantly enhance trading effectiveness by allowing for the automation of complex, customized trading strategies that are responsive to real-time market data."

Best Practices When Using eToro’s APIs

- Backtesting: Before going live with any automated strategy, it is crucial to backtest it with historical data. This will help you understand how your algorithm would have performed in the past and refine it before risking actual capital.

- Security: Ensure that your API keys and your trading environment are secure. This involves using secure methods for storing keys and using encrypted communications for sending trade orders.

- Monitoring: Continuously monitor the performance of your automated systems. Automated does not mean unattended; you should be ready to intervene if market conditions change or in the event of software malfunctions.

By harnessing the power of eToro’s APIs, traders can create personalized automation strategies that align closely with their trading philosophy and risk tolerance, leveraging technology to maximize their trading potential.

Chapter 7: Risk Management in Automated Trading

Best Practices for Managing Risk When Using Automated Trading Systems

Automated trading systems, while beneficial in many aspects, also introduce unique risk factors that traders must manage proactively. Here’s how you can effectively mitigate these risks to safeguard your investments:

- Understand the Algorithms: Before using any automated system, it is vital to understand how the algorithm functions under different market conditions. Knowing the strategy’s strengths and limitations can help anticipate how it will perform and what risks may be involved.

- Use a Demo Account: eToro and other platforms offer demo accounts where you can test your automated strategies without financial risk. This is crucial for validating the effectiveness of your approach in a risk-free environment.

- Set Stop Loss and Take Profit Limits: Define clear stop-loss points to automatically close out positions at a specified price to prevent substantial losses. Similarly, take-profit limits can ensure that profits are secured when price targets are reached.

Tools and Strategies to Safeguard Investments

Several tools and strategies are particularly effective in managing risks associated with automated trading:

- Backtesting Tools: Use backtesting to simulate how your strategy would have behaved in past market conditions. This can help you fine-tune it before applying it in the real market.

- Diversification: Avoid concentrating all your capital in a single trading strategy or market. Diversification across different assets and strategies can reduce risk and smooth out potential returns.

- Regular Monitoring and Updates: Keep a close eye on your trading algorithms and market conditions. Update and adjust your strategies as necessary to respond to changing market dynamics or unforeseen events.

> "While automation in trading can significantly enhance efficiency and effectiveness, it is not set-and-forget. Active risk management remains crucial to protecting your investment."

Leveraging eToro’s Risk Management Features

eToro provides several built-in tools that can help in risk management:

- Risk Scores: Each trader you might copy or portfolio you invest in has a risk score that eToro calculates based on historical volatility and real-time behavior. Use these scores to assess potential risk levels before committing capital.

- Real-Time Alerts: Set up alerts to be notified of significant price movements or changes in market conditions that might affect your trading strategies.

Effective risk management in automated trading involves a combination of using the right tools, staying informed about market conditions, and regularly reviewing and adjusting your strategies. By following these practices, you can enhance your chances of successful trading outcomes while minimizing potential losses.

Chapter 8: Monitoring and Adjusting Automated Trades

How to Monitor Automated Trades Effectively

Effective monitoring is essential for maintaining control over automated trading systems and ensuring they perform as expected. Here are key strategies to monitor your automated trades on platforms like eToro:

- Set Up Trade Alerts: Most trading platforms, including eToro, allow you to set custom alerts for specific market conditions, price levels, or changes in your account balance. Utilizing these alerts can help you stay informed without needing to constantly watch the markets.

- Review Regular Reports: Automated systems often provide detailed reports and analytics on trading performance. Regularly review these reports to understand the behavior of your strategies under different market conditions.

- Real-Time Monitoring Tools: Use real-time dashboards and monitoring tools available on eToro to track the performance of your trades as they happen. This can help you catch and respond to issues before they result in significant losses.

When and How to Adjust Automated Strategies for Optimal Performance

Even the best-designed automated trading strategies may require adjustments based on changing market conditions or shifts in investment goals. Here’s how to effectively adjust your automated trading strategies:

- Market Condition Changes: If there’s a major market event or a shift in market volatility, review your strategies to ensure they are still appropriate. For example, a strategy that performs well in a bull market may need adjustment in a bear market.

- Poor Performance: If a strategy consistently underperforms, it may need tweaking. Analyze the strategy to identify what is causing the issues—be it the timing of trades, the assets chosen, or risk parameters.

- Adapting to New Data: As your automated system gathers more data, use this information to refine your algorithms. Machine learning models, in particular, can evolve as they are exposed to new data over time.

> "Timely adjustments based on thorough analysis can significantly enhance the effectiveness of automated trading strategies, turning potential setbacks into opportunities for growth."

Best Practices for Adjusting Automated Trading Strategies

- Backtest Adjustments: Before applying any changes to your live trading strategy, backtest the adjustments using historical data to predict their impact.

- Incremental Changes: Make small, incremental adjustments to minimize risk. This allows you to evaluate the effects of each change without overhauling your strategy entirely.

- Continuous Learning: Stay educated on the latest trading technologies and methodologies. Regularly attending webinars, reading up on new algorithms, and testing emerging tools can provide fresh insights that might be integrated into your strategy.

By actively monitoring and judiciously adjusting your automated trades, you can maintain a dynamic trading strategy that adapts to changes and continues to meet your investment objectives effectively.

Chapter 9: Legal and Regulatory Considerations

Understanding the Legal Implications and Regulatory Constraints of Automated Trading on eToro

Automated trading, while offering significant advantages, also comes with a set of legal and regulatory considerations that must be understood and adhered to ensure compliance and protect your investments. Here’s what you need to know about the legal landscape surrounding automated trading on platforms like eToro:

- Regulatory Compliance:

- Platform Regulation: eToro operates under the regulations of several jurisdictions, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, and other regulatory bodies depending on the region. These regulations ensure that eToro maintains fair trading practices and adequate consumer protection.

- Algorithm Compliance: Any trading algorithm must comply with market abuse regulations. This includes ensuring that automated trading does not manipulate market prices or engage in insider trading.

- Data Protection and Privacy:

- Personal Data: Automated trading systems often require access to personal data for execution. eToro is bound by General Data Protection Regulation (GDPR) in the EU and similar regulations in other jurisdictions to protect personal data.

- Security Measures: Ensuring the security of the trading platform and the privacy of user data is paramount. eToro uses advanced security technologies to protect users against data breaches and unauthorized access.

- Transparency Requirements:

- Algorithmic Disclosures: Some jurisdictions require disclosures regarding the use of algorithms, especially if they significantly impact market conditions. Traders using custom algorithms should ensure they are transparent about their strategies as required by law.

- Performance Reporting: Regular reporting of trading performance and any automated decisions is essential to comply with certain regulatory standards.

> "Navigating the regulatory landscape is crucial for maintaining the legality and integrity of your automated trading activities. Compliance not only safeguards your trading but also builds trust in the trading environment."

Best Practices for Ensuring Compliance in Automated Trading

- Stay Informed: Regulations can change, and staying informed about current and upcoming regulations is critical.

- Use Regulated Platforms: Engaging in automated trading on regulated platforms like eToro ensures that your trading activities are monitored under financial regulatory standards.

- Consult with Experts: Legal and financial advice from experts can help in understanding complex regulatory requirements and implementing compliant trading strategies.

By understanding and adhering to these legal and regulatory considerations, traders can ensure that their use of automated trading systems on platforms like eToro is not only effective but also compliant with relevant laws and regulations, protecting themselves and their investments.

Chapter 10: Future Trends in Automated Trading on eToro

Predictions and Upcoming Features for Automated Trading on eToro

The landscape of automated trading is continuously evolving, with platforms like eToro at the forefront of introducing innovative features and enhancements. Here are some predictions and upcoming features that could shape the future of automated trading on eToro:

- Enhanced CopyTrading Features: eToro may expand its CopyTrading capabilities, integrating more advanced filtering and selection tools to help users more effectively match with traders that suit their risk and return profiles.

- Greater Integration of AI and Analytics: Future versions of eToro are likely to incorporate more advanced AI-driven analytics tools that provide deeper insights into market trends and trader behavior, allowing users to make more informed trading decisions.

- Customizable Algorithms: There might be a move towards offering more customizable algorithmic options, where users can create and adjust their trading algorithms directly on the platform, using a user-friendly interface without needing extensive programming knowledge.

How Advances in AI and Machine Learning Might Impact Automated Trading

Advances in AI and machine learning are set to dramatically impact automated trading by enhancing the sophistication and effectiveness of trading algorithms:

- Predictive Analytics: AI can analyze vast amounts of market data to predict market trends with high accuracy. These predictions can be used to automate buy and sell decisions in real-time.

- Natural Language Processing (NLP): AI can interpret news, reports, and social media feeds to gauge market sentiment. This can lead to algorithms that can react to market-moving news faster than human traders.

- Risk Management: Machine learning models can continuously learn from trades and adjust their strategies to minimize risks based on changing market conditions.

> "As eToro integrates these advanced technologies, automated trading is expected to become not only more efficient but also more accessible to the average user, democratizing high-level trading strategies."

Preparing for the Future of Automated Trading on eToro

To stay ahead in the rapidly evolving field of automated trading, traders should:

- Continuously Learn: Stay updated with the latest developments in AI and machine learning as they relate to finance and trading.

- Engage with New Features: Actively test and engage with new features as they are rolled out on eToro. Early adoption can provide a competitive advantage.

- Network with Other Traders: Use eToro’s social features to connect with other traders and share insights about using AI and automated systems effectively.

The future of automated trading on eToro promises not only enhanced capabilities but also greater accessibility, making sophisticated trading strategies available to a broader audience. By embracing these technologies, traders on eToro can look forward to more empowered and potentially more profitable trading experiences.