Chapter 1: Introduction to eToro Fee Structure

Overview of eToro as a Trading Platform

eToro Fees has emerged as a leader in the world of online trading, known for its user-friendly interface and innovative social trading features. As a platform, it caters to a wide array of trading preferences, including stocks, cryptocurrencies, ETFs, and forex trading, making it a versatile choice for beginners and experienced traders alike. What sets eToro apart is its commitment to making trading accessible to everyone, which is reflected in its structured yet straightforward fee system.

General Explanation of Fee Structures in Online Trading

Understanding fee structures is crucial for anyone entering the world of online trading. Typically, trading platforms charge in the following ways:

- Spread: The difference between the buy and sell price of an asset.

- Commission: A fixed rate per trade or a percentage of the trade’s volume.

- Overnight Funding: A fee for holding positions open over a set period (often overnight), applicable primarily in CFDs and forex trading.

eToro combines these elements into its fee structure, emphasizing transparency so that traders can make informed decisions without hidden costs impacting their trading outcomes.

> "While eToro offers commission-free trading for stocks, traders must be aware of other fees like spreads and overnight charges which can influence overall profitability."

Understanding eToro’s specific fee details can help traders manage their investments more effectively, ensuring that they are not caught off guard by unexpected charges. eToro’s fee structure is designed to be competitive while providing maximum value to its users through comprehensive trading tools and educational resources.

Chapter 2: Types of Fees on eToro Fees

Description of Various Fees Charged by eToro

eToro’s fee structure is multifaceted, designed to accommodate the diverse needs of its user base. Here’s a breakdown of the different types of fees that traders might encounter:

- Trading Fees: These are primarily built into the spread, which is the difference between the buy and sell prices of an asset. eToro does not charge a flat rate commission on trades, making it appealing for active traders.

- Non-Trading Fees: eToro charges fees for account inactivity and withdrawals. An inactivity fee is applied to accounts that have not been active for a certain period, encouraging traders to remain engaged or to withdraw funds if they are no longer trading.

- Overnight Fees: Also known as swap fees, these are charged when a position is held open overnight. The rate depends on the asset and the direction of the trade (buy or sell).

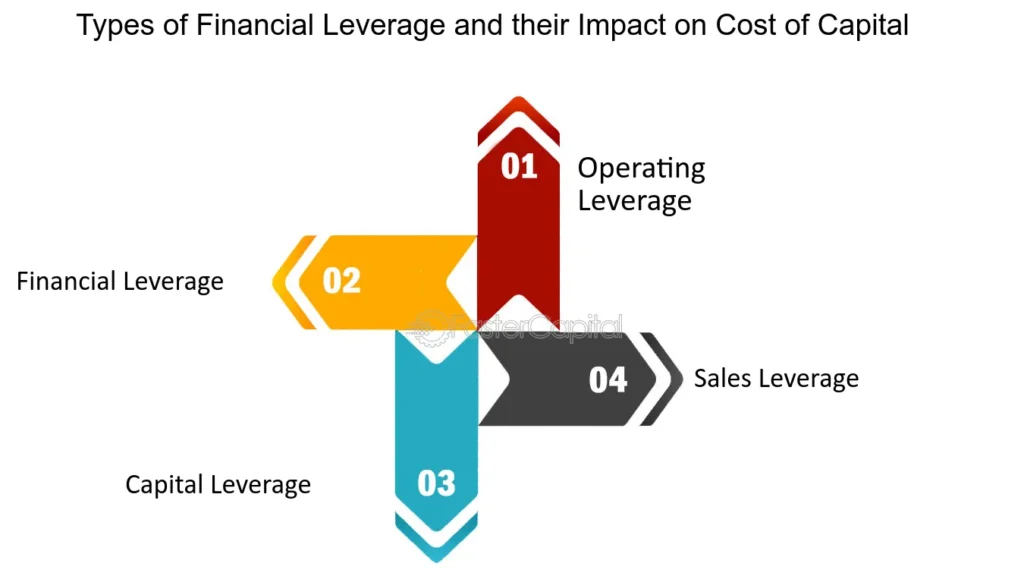

Differences Between Spreads, Commissions, and Management Fees

Understanding the differences between these fees is crucial for any trader:

- Spreads: This is the cost built into the buy and sell price of any asset. It varies from asset to asset and is generally how platforms like eToro earn the bulk of their trading revenue.

- Commissions: Unlike spreads, commissions are not typically charged by eToro on stock trades but may be applicable for other types of assets or in different trading platforms. When charged, they are usually a fixed fee per trade or based on the volume of the trade.

- Management Fees: These are relevant for managed portfolios or funds where the platform or fund manager takes a percentage of the assets under management or a percentage of the profits earned.

> "It's important for traders to consider how each type of fee can affect their trading strategy and overall investment returns. eToro’s emphasis on spread-only fees for stocks greatly simplifies trading cost calculations."

By providing a clear fee structure with competitive spreads and no stock trading commissions, eToro makes itself an attractive option for those new to forex and stock trading. The platform’s transparency in fee disclosure helps traders plan their trading activities without fear of unexpected costs.

Chapter 3: Understanding Spread eToro Fees

Detailed Explanation of How Spreads Work on eToro

Spread fees are a fundamental aspect of trading on platforms like eToro and understanding them is crucial for effective trading. A spread is essentially the difference between the bid (sell) price and the ask (buy) price of an asset. It represents the broker’s fee for executing the trade, embedded within the price of the asset rather than charged separately.

On eToro, spreads are dynamic and can change based on market conditions, liquidity, and volatility. This means that during periods of high market activity or for assets with lower liquidity, spreads might be wider.

Comparison of Spread Fees Across Different Asset Classes

Spread fees vary not just by platform but also across different asset classes on the same platform. Here’s how eToro’s spreads can differ among various markets:

- Stocks: Typically, eToro offers competitive spreads on stocks, which is advantageous for traders looking to engage in stock trading without additional commissions.

- Forex: Spreads in forex trading are generally low on eToro, but they can vary significantly depending on the currency pair and market conditions. Major pairs like EUR/USD might have lower spreads compared to exotic pairs.

- Cryptocurrencies: Due to their volatile nature, cryptocurrencies can have higher spreads compared to other asset classes. This reflects the increased risk associated with their price fluctuations.

- Commodities and Indices: Spreads for these assets are generally moderate but can vary depending on the specific commodity or index and market conditions at the time of trading.

> "Traders should monitor spread fees closely, as they directly affect trade profitability. Understanding how spreads vary between different assets can help in planning more cost-effective trading strategies."

eToro’s platform provides transparency in its spread fees, allowing traders to see real-time spread costs before executing trades. This level of clarity is crucial for traders who need to manage their trading costs effectively and make informed decisions based on the potential costs associated with different trading activities.

Chapter 4: Commission Fees Explained

Clarification on Assets That Carry Commission Fees

While eToro is renowned for its commission-free trades on stocks, it’s important for traders to understand that other asset classes might still incur commission fees. Here’s an overview of when eToro charges commission:

- CFDs (Contracts for Difference): Trading CFDs on eToro may involve commission fees, especially when dealing with non-stock assets. This includes commodities, indices, and currencies within the forex market.

- ETFs (Exchange Traded Funds): While trading individual stocks is commission-free, ETF trades on eToro might attract commissions depending on the specific fund and the trade volume.

These fees are typically calculated as a percentage of the trade volume and are transparently displayed within the trade execution interface on eToro’s platform.

Strategies to Minimize Commission Costs

Understanding commission structures is crucial, but equally important is knowing how to minimize these costs. Here are some effective strategies:

- Plan Your Trades: Consider the timing and frequency of your trades. Sometimes, making fewer, larger trades can be more cost-effective than making many smaller trades, depending on the commission structure.

- Utilize Alerts and Stop Orders: Use eToro’s tools like price alerts and stop orders to better manage your trading points, thereby optimizing the timing of entering and exiting trades to minimize costs.

- Choose Assets Wisely: Be mindful of the assets you choose to trade. Opt for assets with lower commission rates where possible, especially if you trade frequently.

> "Effective trading isn't just about maximizing returns; it's also about minimizing costs. Understanding and strategizing around commission fees is essential for maintaining profitability."

By employing these strategies, traders can significantly reduce the impact of commission fees on their overall trading performance. eToro provides several tools and features that can help in effectively managing these costs, ensuring that traders can maintain a healthy balance between costs and returns.

Chapter 5: Non-Trading eToro Fees

In-depth Look at Non-Trading Fees

In addition to trading fees, eToro also charges several non-trading fees that are important for users to understand. These include:

- Withdrawal Fees: eToro charges a flat fee for withdrawals. This fee is standard regardless of the withdrawal amount, making it important for traders to plan their withdrawals to minimize costs.

- Inactivity Fees: To encourage regular trading activity, eToro imposes an inactivity fee on accounts that have not executed a trade for a certain period of time. This fee is deducted monthly from the available balance until trading resumes or the balance is depleted.

- Account Fees: There are no account opening fees on eToro, but other administrative fees may apply under certain conditions, such as currency conversion fees for non-USD deposits or withdrawals.

Tips on How to Avoid or Reduce Non-Trading Fees

While some fees might be unavoidable, there are several strategies to reduce or avoid non-trading fees on eToro:

- Plan Your Withdrawals: Since the withdrawal fee is fixed, consolidate your withdrawals to fewer, larger amounts to reduce the number of times you pay the fee.

- Stay Active: Avoid inactivity fees by logging in and making trades or, at a minimum, performing some form of account management activity regularly.

- Be Mindful of Currency Conversions: If possible, maintain your funds in USD to avoid conversion fees associated with deposits and withdrawals in other currencies.

> "Being strategic about how and when you perform certain account activities can significantly reduce the non-trading fees incurred on your eToro account."

By understanding and planning for these fees, traders can better manage their overall trading costs, allowing them to maximize their investments more effectively.

Chapter 6: Overnight and Weekend Fees

Explanation of Overnight and Weekend Fees for Different Instruments

Overnight and weekend fees, also known as swap fees, are charges that eToro applies when a leveraged position is held open after a certain time of day. These fees can vary by the type of asset and market conditions:

- Forex: Swap fees are common in forex trading due to the use of leverage. Fees differ for each currency pair, reflecting the underlying interest rates of the currencies.

- Stocks and Indices: For CFDs on stocks and indices, overnight fees reflect the cost of the capital leveraged to hold the position.

- Cryptocurrencies: Given the market’s 24/7 nature, crypto trades have a different fee structure, with a daily fee applied for holding leveraged positions overnight.

Examples of How These Fees Are Calculated and Billed

The calculation of overnight fees is based on several factors including the instrument’s leverage, the size of the position, and the number of days the position is held open. Here is how eToro typically calculates these fees:

- Fee Rate: Each instrument has a specific fee rate, which can be found on eToro’s fee page.

- Position Size: The larger the position, the higher the fee.

- Leverage: Higher leverage increases the potential fee as you are borrowing more from the broker.

For example, if you hold a leveraged position in EUR/USD:

- Fee Rate: $0.5 per $10,000 leveraged

- Position Size: $50,000 leveraged

- Calculation: $0.5 x (5) = $2.5 per night

Weekend fees are usually triple the daily rate because they cover the entire weekend period from Friday night to Monday morning.

> "Understanding how overnight and weekend fees are applied is crucial for traders using leverage, as these fees can significantly impact profitability, especially in trades held for longer durations."

Traders should regularly review the specific fee schedules for their traded instruments on eToro’s platform to manage these costs effectively.

Chapter 7: Leverage and Its Impact on Fees

How Using Leverage Affects Fees on eToro

Leverage is a powerful tool on trading platforms like eToro, allowing traders to control larger positions with a relatively small amount of capital. However, using leverage increases both the potential returns and the fees associated with a trade.

Impact on Fees:

- Increased Swap Fees: As previously discussed, holding a leveraged position overnight or over the weekend incurs swap fees. The higher the leverage, the larger the position, thus increasing the swap fee proportionally.

- Spread Costs: While the spread itself does not change with leverage, the effective cost relative to your own capital outlay is magnified. This means that while the nominal fee may remain the same, it represents a larger percentage of your invested capital.

Risks and Benefits of Trading with Leverage

Benefits:

- Amplified Returns: Leverage allows for significant profit potential from relatively small price movements in the underlying asset.

- Access to Larger Trades: Traders with limited capital can access more substantial trades and diversify their portfolios more effectively.

Risks:

- Amplified Losses: Just as profits can be amplified, losses are also magnified, which can exceed the initial investment quickly if the market moves against the trader.

- Increased Fee Burden: Higher leverage means higher swap fees if the position is held open for an extended period, impacting the net return on investment.

> "While leverage can certainly enhance your trading capabilities on eToro, it's important to carefully consider the increased fee burden and the risk of magnified losses."

Managing Leverage Effectively

To manage the risks and costs associated with leverage, traders should:

- Use Stop-Loss Orders: Protect your investments by setting stop-loss orders, limiting potential losses.

- Monitor Trades Closely: Leverage requires close monitoring of open positions to manage risks proactively.

- Educate Yourself: Understand the specifics of leverage for different instruments and market conditions to use this tool effectively.

Leverage can be a double-edged sword, enhancing your trading capabilities while introducing higher fees and risks. By understanding and managing these aspects, traders can utilize leverage to their advantage on platforms like eToro.

Chapter 8: eToro Club Membership and Its Benefits

Overview of the eToro Club Tiers and Benefits

eToro Club is a membership program designed to reward active and high-net-worth individuals with a range of benefits that enhance their trading experience. The club is structured into several tiers based on the equity level in a member’s account, each offering progressively greater benefits:

- Silver: The entry level, which provides access to a dedicated account manager and a subscription to a financial magazine.

- Gold: Includes all Silver benefits plus access to live webinars and market analysis updates.

- Platinum: Adds to the Gold benefits with no withdrawal fees and access to Trading Central, a tool for advanced financial insights.

- Platinum+: Provides additional perks such as tickets to top-tier sporting events and a personal finance advisor.

- Diamond: The highest tier, offering exclusive invitations to industry events and luxury retreats.

Each tier is designed to cater to the varying needs of traders, from beginners to the most advanced, providing tools and services that can help maximize their trading potential.

How Membership Can Affect Fee Structure and Trading Conditions

Being a member of the eToro Club can significantly alter the fee structure and trading conditions in favor of the trader:

- Reduced Fees: Higher tiers within the club often enjoy reduced fees, such as lower spreads and no charges on withdrawals, which can considerably decrease the cost of trading.

- Improved Trading Conditions: Members might receive access to leverage at more favorable rates and the ability to participate in exclusive trading events that are not available to regular users.

> "Membership in the eToro Club not only offers prestige but also tangible benefits that can lead to more profitable trading conditions."

Maximizing the Benefits of eToro Club Membership

To fully benefit from the eToro Club, members should:

- Engage with Personal Account Managers: Use the expertise of dedicated managers to gain insights and strategic advice tailored to your trading style.

- Utilize Exclusive Resources: Make the most of tools like Trading Central and exclusive webinars to enhance your trading knowledge and skills.

- Attend VIP Events: Take advantage of networking opportunities at events to expand your industry connections and gain insights from other successful traders.

The eToro Club is designed to enrich the trading experience by providing resources and benefits that can lead to improved trading outcomes and enhanced engagement with the financial markets.

Chapter 9: Comparative Analysis with Other Brokers

Comparison of eToro’s Fees with Other Popular Forex and CFD Brokers

When choosing a forex or CFD broker, it’s crucial to understand how the fees compare across different platforms. Here’s a detailed comparison of eToro’s fees against other popular brokers in the market:

- Spreads:

- eToro: Varies by asset; competitive spreads on major forex pairs like EUR/USD.

- Broker X: Generally lower spreads but charges a commission on trades.

- Broker Y: Similar spread levels to eToro but higher on exotic pairs and less popular stocks.

- Commissions:

- eToro: No commissions on stock trading; charges are embedded in spreads for other assets.

- Broker X: Charges a fixed commission per lot on forex and a percentage on stock CFDs.

- Broker Y: No commission on forex trades but applies a variable commission based on trade volume for stocks.

- Non-Trading Fees:

- eToro: Charges withdrawal and inactivity fees.

- Broker X: No inactivity fees but charges for account maintenance.

- Broker Y: Higher withdrawal fees and an inactivity fee after one month of no trading activity.

Charting or Tabulation of Fee Differences for Easier Understanding

Here’s a simple tabulation to visually compare these fees:

| Fee Type | eToro | Broker X | Broker Y |

|---|---|---|---|

| Spreads | Competitive | Lower | Similar |

| Commissions | No Stocks | Per Lot/Fixed | Variable |

| Non-Trading | Yes | Account Maintenance | High Withdrawal & Inactivity |

> "While eToro offers a user-friendly platform with competitive fee structures, especially for stocks and major forex pairs, it is crucial to consider the overall cost structure, including non-trading fees, when comparing brokers."

Evaluating Overall Value

Factors like user interface, customer support, educational resources, and the trading community can significantly impact your trading experience. For example, eToro excels with its social trading features, a valuable asset for beginners. Comparing these aspects helps traders decide based on cost, service quality, and additional features that enhance trading effectiveness.

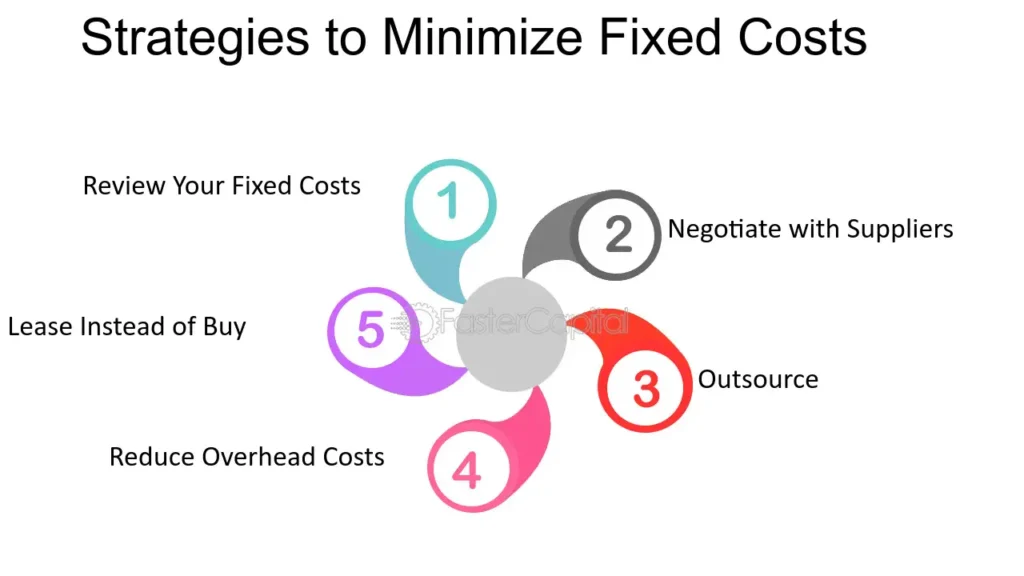

Chapter 10: Strategies to Minimize Fees

Best Practices for Managing and Minimizing Fees on eToro

Managing and minimizing trading fees on eToro is crucial for maintaining profitability. Here are several strategies that traders can employ:

- Understand the Fee Structure: Be fully aware of the types of fees charged by eToro, including spread costs, overnight fees, and non-trading fees. Understanding these can help you plan your trading activities to avoid unnecessary costs.

- Plan Your Trading Times: Timing can influence fees, especially when it comes to spreads and overnight charges. For example, trading during major market hours can result in lower spreads due to higher liquidity. Avoid holding positions open overnight when possible to escape swap fees unless you’re in a trade where the potential profit outweighs the cost.

- Consolidate Withdrawals: Since eToro charges a flat fee per withdrawal, it’s cost-effective to minimize the number of withdrawals by consolidating them into fewer, larger amounts.

How to Plan Trading Activities to Optimize Costs

Effective planning of trading activities can significantly reduce costs associated with trading on eToro. Here are some tips:

- Use Alerts and Orders: Utilize eToro’s tools like price alerts and set orders at your target prices to execute trades at the most cost-effective times.

- Leverage the Practice Account: Use eToro’s demo account to test strategies without any financial risk. This can help you refine your strategies before applying them in the real market where fees apply.

- Engage in Social Trading Wisely: Choose successful traders whose strategies minimize fees. Look for traders who manage their trades to minimize overnight fees and other costs.

> "Adopting these strategies can help eToro users manage and even reduce their trading costs, maximizing the profitability of their trading endeavors."

Monitoring and Adjusting Strategies

Continuously monitor the effectiveness of your fee-minimization strategies and be ready to adjust based on performance and market conditions. Markets evolve, and so should your strategies. Regular reviews and adjustments can ensure that your approach remains optimal in minimizing fees.

- Review Regularly: Set a regular schedule to review your trading costs and fee impacts.

- Stay Informed: Keep up-to-date with any changes in eToro’s fee structure or new features that can help reduce costs.

Implementing these strategies on eToro can reduce fee impact and enhance trading performance.