Welcome to an in-depth look at CMC Markets, one of the leading Forex brokers that has been catering to traders globally with its robust trading platforms and expansive educational resources. In this chapter, we will provide a detailed overview of CMC Markets as a broker and discuss why the minimum deposit is an essential consideration for anyone looking to start trading Forex.

Overview of CMC Markets as a Broker

CMC Markets has established itself as a stalwart in the financial services industry, renowned for its comprehensive offerings and commitment to providing an optimal trading environment for its clients.

Key Features of CMC Markets:

- Regulatory Compliance: CMC Markets is regulated by several top-tier financial authorities globally, ensuring a high standard of oversight and security.

- Trading Platforms: Offers a sophisticated trading platform, known as the ‘Next Generation’ platform, along with MetaTrader 4. These platforms are designed with both novice and experienced traders in mind, providing powerful tools and intuitive interfaces.

- Asset Variety: Traders have access to a wide range of instruments including Forex pairs, commodities, stocks, indices, and cryptocurrencies.

Reputation and Customer Support:

- Global Presence: With offices in major financial hubs around the world, CMC Markets serves a global clientele with local expertise.

- Customer Support: Offers extensive customer support options including live chat, email, and phone services, ensuring traders can get assistance whenever needed.

Importance of the Minimum Deposit in CMC Markets Minimum Deposit

When choosing a Forex broker, one of the critical considerations is the minimum deposit requirement. This figure can be a decisive factor for many traders, particularly those just starting out.

Why It Matters:

- Accessibility for Beginners: A lower minimum deposit makes Forex trading more accessible to beginners who might not be willing to risk a large amount of money right off the bat.

- Risk Management: It allows new traders to manage their risks better by not overcommitting funds. Trading with smaller amounts helps build experience without enduring potentially crippling financial losses.

- Broader Client Base: Brokers with lower minimum deposits can attract a broader range of clients, including those who prefer to start trading with lower capital outlay.

Strategy Considerations:

- Testing the Waters: With a lower minimum deposit, traders can test the broker’s services without significant investment. This can be particularly useful for evaluating the trading platform, customer service, and transaction execution quality.

- Gradual Investment: Traders can choose to increase their investment as they grow more comfortable and confident in their trading strategies and the broker’s reliability.

Understanding CMC Markets Minimum Deposit Requirement

The minimum deposit requirement is a crucial factor for many traders when selecting a Forex broker. It not only affects the accessibility of trading but also influences risk management and investment strategies. This chapter will explore the minimum deposit amounts for CMC Markets, examining how these requirements can vary by country and account type, providing traders with a clearer understanding of what to expect when opening an account.

Detailed Explanation of the Minimum Deposit Amount for CMC Markets

CMC Markets offers competitive entry points for traders, tailored to accommodate various levels of investment and risk tolerance.

Minimum Deposit Overview:

- Standard Minimum Deposit: CMC Markets typically sets a reasonable minimum deposit for opening a trading account, which can be appealing to beginners. For most countries, this amount is relatively low, making it accessible for new traders to enter the market.

Factors Influencing Minimum Deposit:

- Currency and Payment Methods: The minimum deposit can vary depending on the currency used and the payment methods available. For example, deposits made via bank transfer might have different requirements compared to those made through online payment systems or credit cards.

- Promotions and Changes: Occasionally, CMC Markets might lower the minimum deposit as part of promotional offers or adjust it based on economic and market conditions.

How the CMC Markets Minimum Deposit Varies by Country and Account Type

The minimum deposit requirements at CMC Markets can vary significantly based on the trader’s location and the type of account they choose to open. This variability allows the broker to cater to the financial norms and capabilities of traders from different regions.

Variation by Country:

- Regulatory Environment: In countries with stricter financial regulations, the minimum deposit might be higher due to compliance costs.

- Economic Factors: Economic conditions such as currency strength and purchasing power parity in a trader’s home country can influence the minimum required deposit.

Variation by Account Type:

- Standard vs. Premium Accounts: While a standard account might have a lower minimum deposit, premium accounts, which offer additional features like lower spreads and personal account managers, may require a higher deposit.

- Professional Accounts: For professional traders, the minimum deposit is usually higher, reflecting the advanced features and higher leverage options available to these users.

Strategic Considerations:

- Starting Small: Traders new to CMC Markets or Forex trading, in general, might consider starting with the minimum deposit to test the platform’s features and their own trading strategies without a significant initial outlay.

- Gradual Increases: As traders gain more confidence and experience, they may choose to increase their deposits to take advantage of higher trading volumes and potential profits.

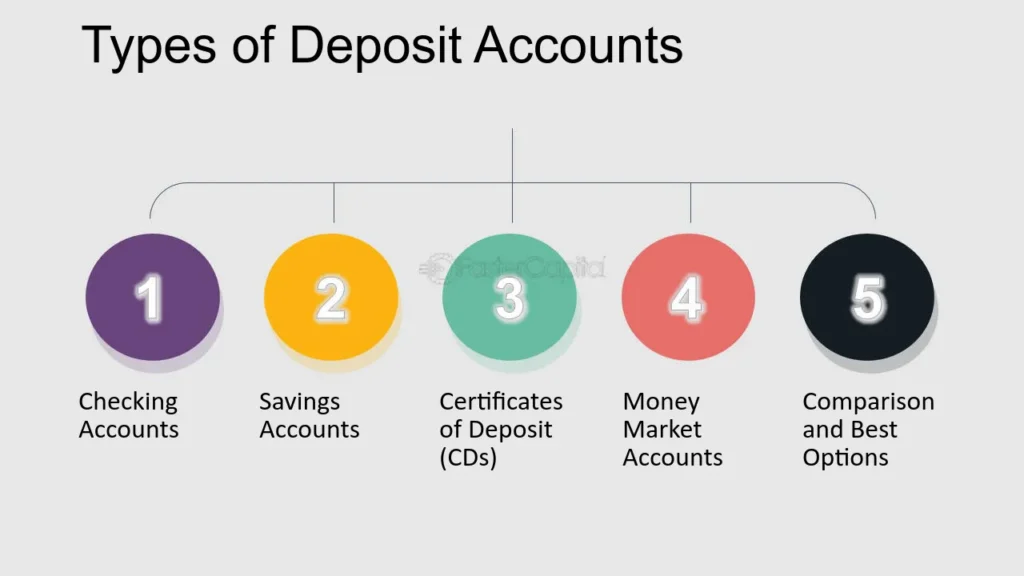

Account Types and Deposit Conditions

Choosing the right trading account is a crucial decision for any trader. It influences not only the initial investment but also the features, tools, and conditions available for trading. This chapter will provide a detailed breakdown of the different trading account types offered by CMC Markets and discuss the minimum deposit requirements associated with each account type.

Breakdown of Different Trading Account Types Offered by CMC Markets

CMC Markets caters to a diverse range of traders by offering various account types, each designed to meet specific trading needs and preferences.

Standard Account

- Features: This account type is ideal for beginner to intermediate traders. It offers access to all trading platforms, comprehensive educational resources, and standard customer support.

- Trading Instruments: Includes Forex, indices, commodities, and some CFDs.

- Spreads and Fees: Competitive spreads with no commissions on trades.

Premium Account

- Features: Aimed at more experienced traders, the Premium account provides enhanced features such as a dedicated account manager, priority customer support, and access to exclusive webinars and events.

- Trading Instruments: Offers the same range as the Standard account but often with better pricing and execution speeds.

- Spreads and Fees: Lower spreads than the Standard account and potential discounts on trading costs depending on the trading volume.

Professional Account

- Features: For traders who qualify as professional clients, this account offers higher leverage options and margin rates. Applicants must meet specific criteria to qualify.

- Trading Instruments: Access to all instruments available to retail clients, plus additional exposure limits.

- Spreads and Fees: Similar to the Premium account but tailored to accommodate high-volume trading.

CMC Markets Minimum Deposit Requirements for Each Account Type

The minimum deposit required to open an account with CMC Markets varies depending on the account type selected.

Standard Account

- Minimum Deposit: Generally, the minimum deposit is relatively low, making it accessible for most individual traders. The exact figure can vary, but it is designed to be an entry-level option.

Premium Account

- Minimum Deposit: This account requires a higher minimum deposit due to the additional services and lower cost structure provided. The exact amount depends on the jurisdiction and specific terms offered at the time of application.

Professional Account

- Minimum Deposit: As this account caters to high-volume, experienced traders, the minimum deposit is significantly higher. This reflects the advanced risk management options and higher potential returns available to professional traders.

Strategic Considerations

- Choosing the Right Account: Traders should consider their experience level, trading volume, and investment capital when selecting an account type.

- Potential Upgrades: Starting with a Standard account might be wise for new traders, with the option to upgrade as their skills and trading volumes grow.

Methods of Deposit

When you’re ready to fund your trading account at CMC Markets, it’s important to choose a deposit method that suits your needs. Each method comes with its own set of advantages and disadvantages, impacting everything from transfer speeds to convenience. This chapter will outline the available payment methods for making deposits at CMC Markets and discuss the pros and cons of each to help you make an informed decision.

Available Payment Methods for Making Deposits

CMC Markets offers several convenient methods for depositing funds into your trading account, ensuring traders can easily and efficiently manage their finances.

Bank Transfer

- Description: Direct transfer of funds from your bank account to your trading account.

- Availability: Widely available across most countries.

Credit Cards

- Description: Using Visa, Mastercard, or other major credit cards to fund your account.

- Availability: Accepted globally.

E-Wallets

- Description: Digital wallets such as PayPal, Skrill, or Neteller that allow you to deposit funds electronically.

- Availability: May vary by country.

Other Methods

- Description: Some regions may have additional options like local bank transfers, online payment services, or even mobile payment methods.

- Availability: Depends on the specific country and regional banking regulations.

Pros and Cons of Each Deposit Method

Each deposit method has its strengths and weaknesses, which can affect your trading strategy and financial management.

Bank Transfer

- Pros:

- Security: Generally considered one of the safest methods as it is handled directly by banks.

- Higher Limits: Often allows for larger deposits, which is beneficial for serious traders.

- Cons:

- Slower Transactions: It can take several business days to process.

- Potential Fees: Banks may charge fees for wire transfers, especially for international transactions.

Credit Cards

- Pros:

- Speed: Funds are usually available almost immediately.

- Convenience: Nearly everyone has a credit card, and it’s easy to use.

- Reward Points: Some credit cards offer rewards on transactions.

- Cons:

- Potential for Debt: It’s easy to overextend financially by using credit.

- Withdrawal Issues: Some regions may have restrictions on withdrawing profits to a credit card.

- Fees: There can be fees associated with credit card deposits.

E-Wallets

- Pros:

- Fast Processing: Quick deposit times similar to credit cards.

- Lower Fees: Often lower fees than bank transfers or credit cards.

- Convenience: Easy to set up and use with just an email address and password.

- Cons:

- Availability: Not all e-wallets are available in every country.

- Withdrawal Limits: Some e-wallets have lower withdrawal limits compared to bank transfers.

Other Methods

- Pros:

- Local Access: Tailored to meet the needs of local markets, offering familiarity and ease of use.

- Potentially Lower Costs: Some local methods may offer lower fees than more traditional options.

- Cons:

- Limited Availability: Only available in specific regions.

- Variability: Terms and conditions can vary greatly depending on the provider.

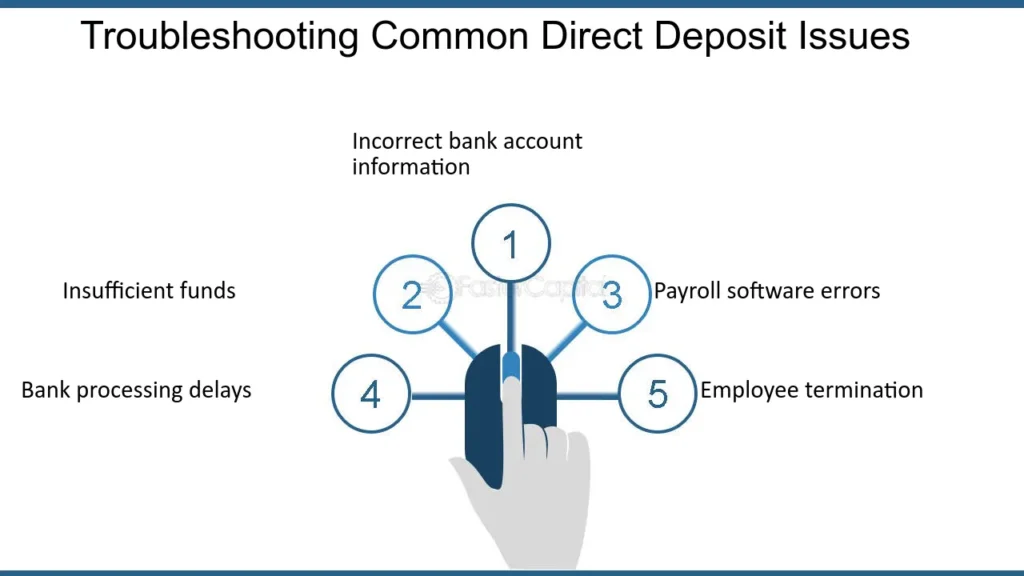

Step-by-Step Guide to Making Your First Deposit

Funding your trading account for the first time is a significant step in your trading journey. This guide provides detailed instructions on how to deposit funds into your CMC Markets account and troubleshoots common issues you might encounter during the deposit process. Whether you are using bank transfers, credit cards, or e-wallets, this guide ensures a smooth transaction.

Detailed Instructions on How to Fund Your Account

1: Log In to Your CMC Markets Account

- Access your account by logging in on the CMC Markets website or through their mobile app.

2: Navigate to the Deposit Section

- Once logged in, find and click on the ‘Funds Management’ or ‘Deposit Funds’ section typically located on the dashboard or under the account settings menu.

3: Select Your Deposit Method

- Choose the payment method you prefer (e.g., bank transfer, credit card, e-wallet). Click on the relevant option.

4: Enter Deposit Details

- For Bank Transfers: Enter your bank details and the amount you wish to deposit. You will be provided with CMC Markets’ banking information to complete the transfer from your bank’s portal.

- For Credit Cards/E-Wallets: Enter your card or e-wallet details and the amount you wish to deposit. Confirm that all details are correct.

5: Confirm and Authorize the Deposit

- Review all the information to ensure it is accurate. Depending on your bank or credit card provider, you may need to complete an authentication process to finalize the transaction.

6: Check for Confirmation

- Once the deposit is complete, you should receive a confirmation from CMC Markets either on the platform or via email. Funds typically appear in your trading account within a few minutes to several business days, depending on the deposit method.

Troubleshooting Common Issues During the Deposit Process

1 Issue: Transaction Not Showing in Account

- Solution: Check whether the funds have been debited from your payment method. If they have, but still aren’t showing up in your account after the expected time, contact CMC Markets’ customer support for assistance.

2 Issue: Deposit Rejected or Failed

- Common Causes: Incorrect payment details, insufficient funds, or restrictions placed by your bank.

- Solution: Verify all entered information and ensure sufficient funds are available. If the problem persists, contact your bank or payment provider to check if they are blocking the transaction.

3 Issue: Delayed Bank Transfer

- Solution: Bank transfers can take several business days. If the deposit takes longer than expected, confirm the transaction details were correct and check with your bank for any potential delays on their end.

4 Issue: Credit Card Security Flags

- Solution: Sometimes, banks flag transactions that do not fit your usual spending pattern. If this happens, you may need to contact your bank to authorize the transaction manually.

5 Issue: Limitations with E-Wallets

- Solution: Ensure that your e-wallet account is verified and that you have met any transaction limits imposed by the e-wallet service.

Fees and Charges Related to Deposits

Understanding the fees associated with depositing funds into your trading account is crucial for effective financial management. In this chapter, we will explore any fees CMC Markets may charge for deposits and provide strategies on how to minimize or avoid these costs.

Overview of Fees Charged by CMC Markets for Deposits

CMC Markets strives to make trading accessible and cost-effective for its clients. However, like most brokers, certain fees may be associated with depositing funds depending on the chosen payment method.

Types of Fees:

- Credit Card Fees: Some brokers charge a small percentage fee for deposits made via credit cards due to processing costs.

- Bank Transfer Fees: While CMC Markets typically does not charge for bank transfers, your bank might impose a fee, especially for international wire transfers.

- E-Wallet Fees: Depositing via e-wallets can incur fees, which vary depending on the e-wallet provider and the transaction amount.

CMC Markets’ Deposit Fee Policy:

- General Policy: CMC Markets generally does not charge a fee for deposits. They aim to absorb transaction costs where possible to encourage trading activities.

- Exceptions: Certain methods or high-frequency transactions may incur fees. Always check the latest fee structure on the CMC Markets website or contact their customer support for up-to-date information.

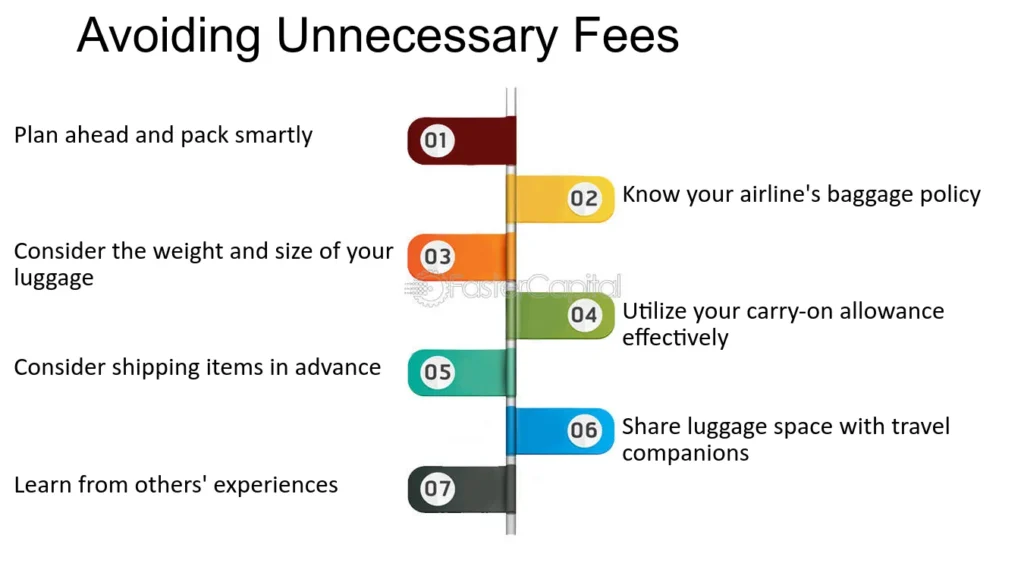

How to Minimize or Avoid Unnecessary Fees

Here are several strategies to help you reduce or avoid incurring extra costs when making deposits:

Choose the Right Payment Method:

- Low or No Fee Options: Opt for payment methods that either incur low fees or none at all. Typically, direct bank transfers (especially local ones) and major credit cards have lower fees compared to international wires and some e-wallets.

- Understand the Terms: Be aware of the terms associated with each payment method. For example, some credit cards treat deposits to trading accounts as cash advances, which can come with higher interest rates and immediate charges.

Plan Your Deposits:

- Consolidate Transactions: Instead of making multiple small deposits, consolidate your funds into fewer, larger amounts to reduce transaction fees.

- Avoid Small Deposits: Some fees are flat rates; thus, making smaller deposits more often can be proportionally more expensive.

Monitor for Promotions and Fee Changes:

- Promotions: CMC Markets may occasionally offer promotions that waive deposit fees or provide rebates on transaction costs.

- Stay Informed: Keep an eye on any updates to the fee structure. Brokers periodically review and adjust their fees.

Negotiate with Your Bank:

- Bank Fees: If you are using a bank transfer, speak with your bank about any possible fees associated with making deposits into your trading account. Some banks offer fee waivers or reduced charges for regular customers or high-value transactions.

Impact of CMC Markets Minimum Deposit on Trading Decisions

The size of your initial deposit into a Forex trading account can significantly influence your trading strategy, available options, and how you manage risk. This chapter will explore how the amount of your deposit impacts your trading approach and the risk management considerations you should keep in mind for smaller versus larger deposits.

How the Size of Your Deposit Affects Your Trading Strategy and Options

Trading Strategy

- Smaller Deposits: With a smaller deposit, traders often focus on short-term, small-scale trades to gradually build their account balance. This approach generally involves higher frequency trading with smaller profit targets.

- Larger Deposits: A larger deposit allows for a broader range of trading strategies, including long-term and swing trading. Traders can afford to take positions with larger expected returns over longer periods, leveraging the stability provided by a substantial capital base.

Trading Options

- Market Access: Some markets or instruments may require a larger minimum position size, which might be prohibitive with a smaller deposit.

- Leverage Usage: While leverage can be a powerful tool to increase potential returns, it also amplifies risks. A larger deposit typically provides more flexibility in how leverage is applied, potentially allowing for more conservative use of leverage compared to a smaller deposit.

Risk Management Considerations for Smaller vs. Larger Deposits

Smaller Deposits

- High Relative Risk: Each trade represents a larger portion of the total account balance, which can increase the relative risk.

- Risk Per Trade: It’s crucial to keep the risk per trade low, typically suggested at 1-2% of the account balance. This can be challenging with smaller deposits, as the absolute dollar risk allowed per trade will be very low, potentially limiting trading opportunities.

- Diversification Challenges: With less capital, diversifying across different instruments or markets can be more challenging, increasing exposure to specific sector or market risks.

Larger Deposits

- Lower Relative Risk: Larger deposits can tolerate larger absolute losses without proportionally impacting the total account balance as severely as smaller deposits.

- More Flexibility in Risk Management: With more capital, traders can employ a range of risk management strategies, such as diversification across various instruments and hedging against positions.

- Potential for Lower Leverage Use: Traders with larger deposits might not need to use high leverage, reducing the risk of large losses relative to their total capital.

General Tips

- Use Stop-Loss Orders: Regardless of account size, using stop-loss orders can help manage risk by setting a predetermined level at which a losing position will be closed.

- Regular Review: Continuously monitor and adjust your risk management strategies based on the performance of your trading portfolio and changing market conditions.

- Education: Continuously educate yourself about new risk management techniques and tools. Even experienced traders can benefit from ongoing education to refine their strategies.

Bonuses and Promotions Related to Deposits

Forex brokers often use deposit bonuses and promotional offers to attract new clients and incentivize higher deposits from existing traders. This chapter will explore the types of deposit bonuses and promotions typically offered by CMC Markets, as well as the terms and conditions that govern these incentives. Understanding these can help you maximize benefits while minimizing potential misunderstandings or issues.

Information on Deposit Bonuses and Promotional Offers

Types of Bonuses

- Welcome Bonus: Often offered to new clients as a fixed amount or a percentage of their initial deposit. This type of bonus is designed to increase the trading volume by providing additional capital.

- Deposit Match: Some brokers offer to match a percentage of a trader’s deposit, which adds to the trading account balance directly proportionate to the deposit made.

- Loyalty Bonuses: Aimed at existing customers to encourage them to continue trading. These can vary in form, from additional funds to trade with, to reduced spreads and commissions.

Promotional Offers

- Risk-Free Trades: Occasionally, brokers may offer a number of risk-free trades, where losses, up to a certain amount, are reimbursed to the trader.

- Event-Driven Promotions: During significant economic events or the release of new products, brokers might offer special promotions to encourage trading activities.

It’s important to note that while CMC Markets is known for its transparency and customer focus, promotional offers may vary based on regulatory restrictions and are often subject to change.

Terms and Conditions Associated with These Incentives

Common Terms and Conditions

- Minimum Deposit Requirements: Most bonuses have a minimum deposit requirement. Failing to meet this can disqualify you from receiving the bonus.

- Trading Volume Requirements: Bonuses may come with requirements to trade a certain volume within a given time frame before the bonus can be withdrawn or used.

- Time Restrictions: Some bonuses must be utilized within a specific period after account registration or deposit.

- Withdrawal Conditions: There are often restrictions on withdrawing the bonus amount. Typically, a trader must meet several conditions, which could include trading volume and time constraints, before the bonus can be fully owned and withdrawn.

Important Considerations

- Read the Fine Print: Always read the terms and conditions associated with any bonus or promotion carefully. Understanding these can prevent surprises related to bonus withdrawals or the use of bonus funds.

- Regulatory Changes: Be aware that regulatory environments can impact the availability and type of promotions offered. For instance, brokers regulated in the EU and UK under ESMA rules are limited in the types of bonuses they can offer to retail traders.

- Impact on Trading Strategy: Consider how a bonus might affect your trading strategy. Bonuses can tempt traders into taking larger or more risky trades than they might otherwise.

Comparing CMC Markets to Other Brokers

When choosing a Forex broker, one of the critical considerations is the minimum deposit requirement. This chapter will compare CMC Markets’ minimum deposit requirements with those of its competitors and discuss what traders should consider when selecting a broker based on deposit requirements.

How CMC Markets’ Minimum Deposit Stacks Up Against Competitors

CMC Markets is known for its competitive and accessible minimum deposit requirements, which tend to be favorable when compared to other major players in the industry. Here’s how CMC Markets stands in comparison:

Comparison with Other Brokers

- CMC Markets: Typically offers a low minimum deposit requirement, making it accessible for beginners and those with limited capital.

- Competitor A (e.g., IG Markets): May have a slightly higher minimum deposit, but also offers extensive educational resources and trading tools.

- Competitor B (e.g., Forex.com): Could have a lower or similar minimum deposit requirement, often aimed at aggressively attracting a broader base of retail traders.

- Competitor C (e.g., Saxo Bank): Generally targets more serious traders with a significantly higher minimum deposit requirement, reflecting its focus on advanced traders and high net worth individuals.

This variation highlights the diversity in the industry, catering to different types of traders from beginners to seasoned professionals.

What Traders Should Consider When Choosing a Broker Based on Deposit Requirements

Financial Commitment

- Risk Tolerance: Understand your own risk tolerance and financial capability. Opting for a broker with a lower minimum deposit requirement might be prudent if you are new to trading or cautious about your initial investment.

- Return Expectations: Consider what return you expect on your trading capital. Higher deposits might provide access to better trading conditions and potentially higher returns.

Broker Features and Services

- Trading Platforms and Tools: Sometimes, a higher deposit might give you access to more advanced trading platforms and professional trading tools.

- Customer Support and Education: Evaluate whether the level of customer support and educational resources justifies a higher minimum deposit. Some brokers provide extensive support and professional-grade education for higher deposits.

Regulatory Environment

- Safety and Security: Consider the regulatory environment of the broker. Well-regulated brokers might require higher minimum deposits but provide greater security and peace of mind.

- Compliance Costs: Understand that brokers in heavily regulated jurisdictions might pass on the cost of compliance to traders in the form of higher minimum deposits.

Market Access

- Product Offerings: A higher deposit might be worth it if the broker offers access to a wider range of markets and trading instruments.

- Spreads and Fees: Compare how the spreads and fees relate to the minimum deposit. In some cases, paying a higher deposit could mean lower trading costs overall.

FAQs and Tips for New Traders

For new traders, starting out with a Forex broker like CMC Markets involves understanding the basics of funding an account and managing trading funds effectively. This chapter addresses common questions about funding CMC Markets accounts and offers best practices for managing your trading funds to help you maintain financial health and improve trading performance.

Common Questions About Funding CMC Markets Accounts

How do I fund my CMC Markets account?

To fund your account, log in to the CMC Markets platform, navigate to the ‘Account’ section, and select ‘Deposit Funds’. You can choose from various payment methods such as credit cards, bank transfers, or e-wallets. Follow the prompts to enter the necessary payment details and complete the transaction.

What is the minimum deposit required to start trading?

The minimum deposit at CMC Markets varies depending on the region and account type but is generally set to be accessible for most traders, especially beginners. Check the specific requirements for your region on the CMC Markets website or contact customer support.

Are there any fees for depositing funds?

CMC Markets typically does not charge fees for deposits. However, your payment provider, such as your bank or credit card company, may levy a fee. It’s advisable to check with them beforehand to understand any potential charges.

How long does it take for my deposit to be reflected in my account?

Deposits are usually processed quickly. Credit card and e-wallet payments often reflect within a few minutes, while bank transfers may take several business days depending on your bank and country.

Can I fund my account in different currencies?

Yes, CMC Markets accepts various major currencies for funding your account. Ensure you select your preferred currency when setting up your account to avoid conversion fees.

Best Practices for Managing Your Trading Funds Effectively

Start with a Budget

Determine how much money you can afford to allocate to trading without impacting your essential financial obligations. This helps in managing the risk and setting realistic expectations.

Understand and Manage Risks

Utilize risk management tools such as stop-loss orders to protect your capital. Determine the maximum percentage of your balance that you are willing to risk on a single trade, commonly recommended to be no more than 1-2%.

Keep Records

Maintain detailed records of your deposits, withdrawals, wins, and losses. This not only helps in monitoring your financial performance but also in refining your strategies over time.

Separate Trading Funds

Keep your trading funds separate from your personal finances. Use a dedicated bank account or payment method for trading-related transactions to ensure better control and oversight.

Regularly Review and Adjust

Periodically review your trading budget and strategy in light of your trading performance and life changes. If you are consistently losing money, reconsider your investment, reduce the trading budget, or enhance your trading skills and strategies.

Educate Continuously

Invest in your trading education. The more you understand the market and trading techniques, the better you will manage your funds. Take advantage of educational resources provided by CMC Markets.