AvaTrade stands as a prominent player in the global online trading arena, offering a comprehensive suite of trading tools, platforms, and resources designed to cater to traders of all levels. From its inception, AvaTrade has committed itself to providing a secure, user-friendly, and flexible trading environment. This dedication has not only garnered a diverse global clientele but also numerous industry accolades. Understanding the offerings of AvaTrade, including the variety of AvaTrade Account Types available, is crucial for traders aiming to align their trading strategies with the right tools and conditions for success.

AvaTrade: A Brief Overview

AvaTrade, established in 2006, has grown to become a leading brokerage firm with a robust offering that includes Forex, commodities, stocks, indices, and cryptocurrencies trading. With regulatory licenses across five continents, it offers a secure trading environment, which is a critical consideration for traders. AvaTrade distinguishes itself through its commitment to providing innovative trading technologies and a customer-focused approach, ensuring that both novice and experienced traders have the tools and support they need to navigate the markets effectively.

The Significance of Choosing the Right Account Type

Selecting the appropriate account type is a pivotal step in a trader’s journey, directly influencing the trading experience, access to features, and overall success in the markets. Each account type is tailored to meet specific trader needs, including financial goals, trading volume, risk tolerance, and preferred trading platforms. Understanding the nuances of each account type allows traders to optimize their trading strategy, leverage the full potential of AvaTrade’s offerings, and manage their investments more effectively.

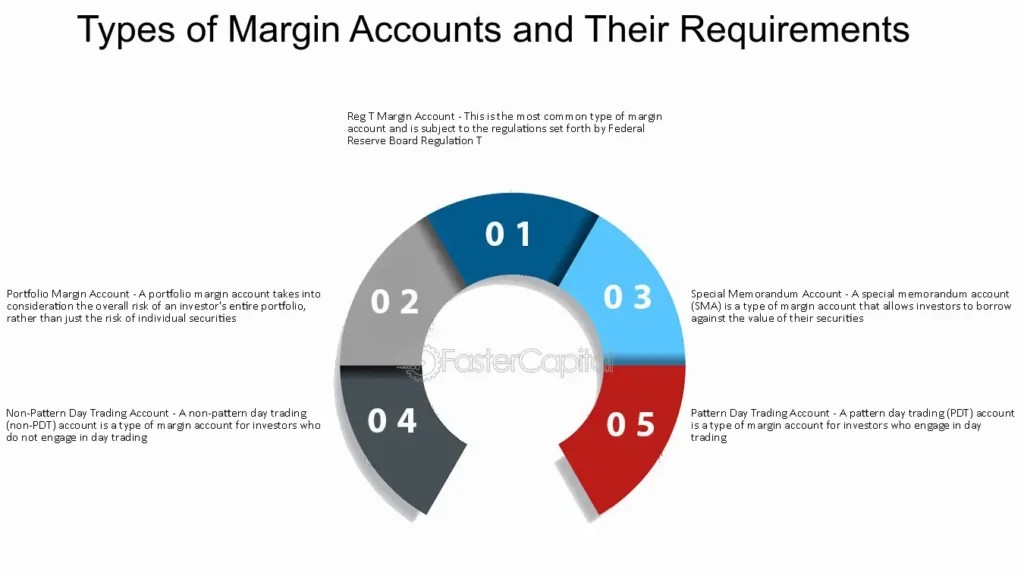

Overview of AvaTrade Account Types

AvaTrade caters to a diverse clientele by offering a variety of AvaTrade Account Types, each designed with different trader profiles in mind:

Demo Account

- Ideal for beginners or those looking to test strategies risk-free.

- Offers simulated trading conditions with virtual funds.

Retail Account

- Designed for the general public, offering access to all trading platforms and instruments.

- Comes with leverage restrictions as per regulatory guidelines to protect retail traders.

Professional Account

- For experienced traders who meet specific criteria, offering higher leverage options.

- Requires passing a qualification test, acknowledging the increased risk.

Islamic Account

- A swap-free option that complies with Sharia law, suitable for Muslim traders.

- Eliminates interest/swap charges on overnight positions.

Options Account

- Specialized for traders focusing on options trading, offering a wide range of instruments and strategies.

Each account type is structured to provide traders with the necessary tools and conditions to succeed according to their unique trading style and requirements. Whether you’re starting your trading journey or looking to refine your strategy, AvaTrade’s range of AvaTrade Account Types ensures that you have the support and resources to reach your trading objectives.

AvaTrade Account Types Overview

AvaTrade’s commitment to catering to a wide array of traders is evident in its diverse offering of AvaTrade Account Types. Each account type is designed with specific trader needs in mind, balancing benefits and limitations to create optimal trading environments for various strategies, experience levels, and compliance requirements. Understanding the nuances of each account can help traders align their trading approach with the most suitable account features, enhancing their potential for success. Let’s delve into a detailed description of each account type offered by AvaTrade, highlighting their benefits, limitations, and how to determine which account best suits your trading needs.

Demo Account

Description

The Demo Account serves as a foundational tool for beginners and a strategy-testing platform for experienced traders. It offers a simulated trading environment with virtual funds, allowing traders to familiarize themselves with the AvaTrade platform without financial risk.

Benefits

- Risk-free exploration of trading platforms and instruments.

- Opportunity to test strategies and gain market experience.

Limitations

- Does not replicate the psychological pressures of real trading.

- Market conditions and execution may differ slightly from live trading.

Retail Account

Description

The Retail Account is designed for the general trading public, offering access to a wide range of instruments and AvaTrade’s full suite of trading platforms. It adheres to regulatory leverage limits to protect retail traders.

Benefits

- Access to comprehensive educational resources and customer support.

- Protection features like negative balance protection and leverage caps.

Limitations

- Leverage is restricted according to regulatory standards, which might limit certain high-risk strategies.

Professional Account

Description

Targeted at experienced traders who meet specific criteria, the Professional Account offers higher leverage options and fewer restrictions, acknowledging the trader’s experience and capacity for risk.

Benefits

- Higher leverage, providing the potential for significant returns.

- Access to premium services and customized trading solutions.

Limitations

- Increased financial risk due to higher leverage.

- Requires meeting stringent qualification criteria.

Islamic Account

Description

The Islamic Account, also known as a swap-free account, is designed to comply with Sharia law, eliminating swap or rollover interest on overnight positions, making it suitable for Muslim traders.

Benefits

- No swap or rollover interest on overnight positions.

- Access to all trading instruments and platforms without compromising Islamic finance principles.

Limitations

- May have administration fees as an alternative to swap fees.

- Not all instruments may be available due to Sharia compliance requirements.

Options Account

Description

Specialized for options trading, this account type offers traders the opportunity to trade a wide range of options strategies, providing a platform for diversified and dynamic trading approaches.

Benefits

- Specialized platform for options trading.

- Access to a wide range of options markets and instruments.

Limitations

- Requires knowledge of options trading, which can have a steep learning curve.

- Specific market conditions or regulations may limit availability or leverage.

Determining the Best Account Type for Your Needs

Choosing the right AvaTrade account type involves assessing your trading experience, risk tolerance, and strategy requirements:

- Beginners should start with the Demo Account to gain knowledge and experience without financial risk.

- General retail traders with a focus on learning and moderate trading strategies might find the Retail Account most beneficial.

- Experienced traders looking for higher leverage and more advanced trading conditions could consider applying for a Professional Account.

- Muslim traders requiring compliance with Islamic finance principles would benefit from the Islamic Account.

- Traders specializing in options strategies should opt for the Options Account for tailored trading conditions and platforms.

Evaluating your trading goals against the benefits and limitations of each account type will guide you to the account that best aligns with your trading journey. AvaTrade’s diverse account offerings ensure that there is a fit for every type of trader, supporting your growth and success in the dynamic world of online trading.

Retail vs. Professional Accounts: A Comparative Analysis

The distinction between Retail and Professional accounts is pivotal in the context of online trading, with each offering a tailored set of features, protections, and eligibility criteria designed to suit different types of traders. Understanding these differences can help traders make informed decisions about which account type best aligns with their trading goals, experience, and risk tolerance. Let’s delve into a comparative analysis of Retail and Professional accounts, focusing on eligibility criteria, advantages, and the inherent risks associated with a Professional account.

Eligibility Criteria

Retail Account

- Accessibility: Retail accounts are available to the general public without the need for meeting specific financial criteria.

- Regulatory Protections: Designed with regulatory protections such as lower leverage limits and access to compensation schemes.

Professional Account

- Experience: Traders must demonstrate significant trading activity in the financial markets (a substantial volume of trades within the last 12 months).

- Financial Status: A financial portfolio exceeding a specified threshold, typically around €500,000, not including property or cash deposits.

- Professional Status: Relevant experience in the financial services sector or evidence of professional qualification in a related field.

Advantages of a Professional Account

Professional accounts offer several advantages tailored to experienced traders who can bear the risks of higher leverage and fewer regulatory protections:

- Higher Leverage: Access to higher leverage allows professional traders to take larger positions with a smaller amount of capital, amplifying potential returns on investment.

- Fewer Restrictions: Professional accounts may offer fewer trading restrictions, allowing for more sophisticated trading strategies and faster execution.

- Access to Advanced Tools: Professional traders often gain access to more advanced trading tools, analytics, and bespoke services tailored to high-volume trading.

Risks Associated with a Professional Account

While the benefits of a Professional account are clear, they come with increased risks that traders must consider:

- Increased Financial Exposure: Higher leverage magnifies both gains and losses, increasing the risk of significant financial exposure and the possibility of losing more than the initial investment.

- Reduced Regulatory Protections: Professional accounts may opt-out of some retail client protections, such as negative balance protection, which safeguards retail traders from losing more than their account balance.

- Market Volatility: Professional traders, leveraging advanced tools and higher leverage, may be more exposed to market volatility, requiring a deep understanding of market dynamics and risk management strategies.

Making the Right Choice

Deciding between a Retail and Professional account should be based on an honest assessment of your trading experience, financial resilience, and ability to manage the increased risks associated with professional trading. While the allure of higher leverage and fewer restrictions is strong, it’s essential to weigh these against the potential for significant financial losses.

- Retail Account is suitable for the majority of individual traders seeking to limit their risk exposure while benefiting from regulatory protections.

- Professional Account caters to experienced traders with a solid understanding of financial markets and the capacity to absorb potential losses, seeking to leverage higher volumes and more sophisticated strategies.

Understanding the nuances between these AvaTrade Account Types enables traders to align their choice with their trading strategy, risk tolerance, and financial goals, setting the stage for a more informed and potentially successful trading experience.

Islamic Accounts: Features and Conditions

Islamic accounts, also known as swap-free accounts, are specially designed to comply with Islamic Sharia law, which prohibits transactions involving interest (riba). These accounts cater to Muslim traders who wish to engage in online trading without compromising their religious beliefs. Let’s delve into the specifics of Islamic accounts, their features and conditions that ensure Sharia compliance, and the process of opening an Islamic account with AvaTrade.

Understanding Islamic Accounts

Islamic finance principles prohibit earning interest on trades that stay open overnight. In the context of Forex and CFD trading, this refers to the swap or rollover interest typically charged or earned on positions held open past the daily market close. Islamic accounts remove these charges or earnings, allowing Muslim traders to participate in trading activities without violating Islamic law.

Features and Conditions of Islamic Accounts

No Swap or Rollover Interest

Islamic accounts do not incur or provide swap or rollover interest on positions held overnight, aligning with the prohibition of riba.

Immediate Transaction Settlements

Transactions within Islamic accounts are settled immediately, with no delay, ensuring that all trades are conducted within the boundaries of Islamic finance principles.

Transparent Fee Structure

While Islamic accounts remove interest-based charges, they may include other types of fees (such as administration fees) to cover the costs usually covered by swap charges. These fees are clearly outlined to ensure transparency and fairness.

No Margin Interest

Interest is not charged on trades executed using leverage, as leveraging funds in this manner would contradict Islamic principles.

Halal Trading Instruments

Islamic accounts may restrict access to certain trading instruments that are considered haram (forbidden) under Islamic law, such as companies dealing in alcohol, gambling, or usury.

Opening an Islamic Account with AvaTrade Account Types

To open an Islamic account with AvaTrade, follow these general steps, keeping in mind that specific procedures may vary based on location and regulatory requirements:

- Register for an Account: Start by registering for a standard trading account with AvaTrade through their website. The registration process involves providing personal information and completing verification steps as required by regulatory standards.

- Request Islamic Account Conversion: Once your standard account is set up and verified, contact AvaTrade’s customer support or account management team to request the conversion of your account into an Islamic account. You may need to provide documentation or information to confirm your eligibility.

- Account Conversion Review: AvaTrade will review your request to ensure it meets all requirements for an Islamic account. This process may include additional verification steps or documentation.

- Confirmation and Trading: Once your account conversion is approved, AvaTrade will notify you, and your account will be classified as an Islamic account. You can then begin trading in accordance with Islamic finance principles.

It’s advisable to review the specific features, conditions, and any potential restrictions or fees associated with Islamic accounts directly with AvaTrade or any other broker. Understanding these details ensures that your trading activities remain in harmony with your ethical and religious beliefs, providing a respectful and inclusive trading environment for Muslim traders worldwide.

Demo Accounts: A Starting Point for Beginners

For individuals embarking on their trading journey, the importance of leveraging a demo account cannot be overstated. These accounts serve as an essential educational tool, offering a risk-free environment to explore trading strategies, familiarize oneself with the trading platform, and understand market dynamics without the pressure of risking real capital. Let’s delve into the significance of demo accounts for beginners, the specific features and limitations of the AvaTrade demo account, and share practical tips on maximizing the demo trading experience.

The Importance of Using a Demo Account for Beginners

Demo accounts provide a simulated trading environment where beginners can practice trading with virtual funds. This setup is crucial for several reasons:

- Risk-Free Learning: Beginners can make trades and test strategies without the fear of losing money, making it an ideal learning environment.

- Platform Familiarity: Traders can become acquainted with AvaTrade’s platform features and functionalities, easing the transition to real trading.

- Understanding Market Movements: Demo accounts allow beginners to observe real-time market conditions and understand how various factors influence market movements.

Features and Limitations of the AvaTrade Demo Account

Features

- Simulated Market Conditions: AvaTrade’s demo account mirrors live trading conditions, providing access to real-time market data and prices.

- Virtual Funds: Traders are allocated a substantial amount of virtual funds, enabling them to practice trading without financial risk.

- Access to Trading Instruments: The demo account offers access to a wide range of trading instruments, including Forex, commodities, indices, and stocks, mirroring the diversity available in a real account.

Limitations

- Emotional Investment: Trading with virtual funds doesn’t replicate the emotional pressures associated with the potential for real financial loss or gain.

- Execution Differences: While rare, the execution of trades in a demo environment might slightly differ from live trading due to market conditions and the absence of real capital.

- Expiration: AvaTrade’s demo account is typically available for a limited period, after which traders are encouraged to transition to a real account.

Tips on Making the Most Out of Your Demo Trading Experience

To truly benefit from a demo trading experience, consider the following tips:

- Treat It Like Real Trading: Approach trading on your demo account as if you were using real money. This includes adhering to your trading plan, applying risk management strategies, and setting realistic goals.

- Practice Risk Management: Use the demo account to practice setting stop-loss and take-profit orders, understanding leverage, and managing your virtual portfolio.

- Explore Different Strategies: The risk-free nature of a demo account is perfect for testing various trading strategies to see what works best for you without the fear of making mistakes.

- Take Notes: Keep a trading journal, documenting your trades, strategies used, outcomes, and any lessons learned. This habit will be invaluable when you transition to real trading.

- Use Educational Resources: AvaTrade offers a wealth of educational materials, including webinars, tutorials, and articles. Use these resources in conjunction with your demo trading to enhance your knowledge and skills.

The AvaTrade demo account stands as an indispensable tool for beginners, providing a foundational platform for learning and growth in the world of trading. By engaging with the demo account thoughtfully and strategically, new traders can build confidence, gain valuable market insights, and develop a solid framework for future trading success.

Opening Process with AvaTrade Account Types

Opening an account with AvaTrade is a straightforward process designed to welcome new traders into the fold with ease, while ensuring compliance with regulatory standards and security measures. Whether you’re looking to dip your toes into the world of trading with a demo account or ready to dive into live trading, here’s a step-by-step guide to get you started, including the required documents and information for account verification.

Step-by-Step Guide to Opening an Account

1. Choose Your Account Type

Begin by deciding between a demo account for practice or a live trading account. Each serves different purposes, as discussed earlier.

2. Registration

Visit the AvaTrade website and click on the ‘Sign Up’ or ‘Register’ button. You will be prompted to fill in a registration form.

- For a Demo Account: Provide basic information such as your name, email address, and phone number.

- For a Live Account: The registration form will require more detailed information, including your full name, contact details, and financial background.

3. Account Verification

After registration, you’ll need to verify your account to comply with regulatory requirements. This involves submitting documents that confirm your identity and residence.

- Identity Verification: A valid government-issued identification document, such as a passport or driver’s license.

- Proof of Residence: A recent utility bill, bank statement, or any official document indicating your current address, dated within the last three months.

4. Deposit Funds

Once your account is verified, you can deposit funds into your live trading account. AvaTrade offers various funding methods, including bank wire transfers, credit/debit cards, and e-wallets. Select the method that best suits your needs.

5. Platform Access

With your account funded, you can access the trading platform. AvaTrade offers several platforms, including MetaTrader 4 and 5, WebTrader, and AvaTradeGo. Choose the platform that aligns with your trading preferences and needs.

6. Start Trading

You’re now ready to begin trading. Utilize the resources and tools available on AvaTrade to support your trading activities.

Required Documents and Information for Verification

The verification process is a crucial step to ensure the security of your account and compliance with financial regulations. The required documents typically include:

- A clear color copy of a valid government-issued ID (passport, national ID card, or driver’s license).

- Proof of residence, such as a utility bill or bank statement.

Understanding Compliance and Security Measures

AvaTrade adheres to strict regulatory standards to ensure the safety and security of its clients’ funds and personal information. These measures include:

- Regulatory Compliance: AvaTrade is regulated in multiple jurisdictions, adhering to high standards of accountability and transparency.

- Data Security: The use of advanced encryption technologies protects personal and financial information during transmission and storage.

- Client Fund Protection: Client funds are held in segregated accounts, ensuring they are not used for any other purposes.

Opening an account with AvaTrade is a gateway to the global financial markets, providing access to a wide range of instruments and trading opportunities. By following the steps outlined above and complying with the verification requirements, you can embark on your trading journey with confidence, supported by the robust security and regulatory framework that AvaTrade offers.

Deposit and Withdrawal Methods for AvaTrade Account Types

AvaTrade offers a variety of deposit and withdrawal methods tailored to accommodate the preferences and needs of its diverse clientele. Understanding these methods, along with associated minimum requirements, limits, processing times, and potential fees, is crucial for effective account management. While specific options might slightly vary by region due to local regulations and availability, here’s a comprehensive overview applicable to most AvaTrade account types.

Available Deposit and Withdrawal Methods

AvaTrade aims to provide convenient, secure, and efficient transaction methods for its users, including:

- Credit/Debit Cards: Visa, MasterCard, and other major cards are widely accepted for both deposits and withdrawals.

- Bank Wire Transfers: A traditional method for transferring funds directly from your bank account to your AvaTrade account and vice versa.

- E-Wallets: Popular options include PayPal, Skrill, NETELLER, and WebMoney, offering an efficient way to manage transactions.

Minimum Deposit Requirements and Withdrawal Limits

Minimum Deposit Requirements

- The minimum deposit amount at AvaTrade generally starts from $100 or equivalent in your local currency, which may vary based on the deposit method or region.

Withdrawal Limits

- Minimum Withdrawal: There’s usually no minimum withdrawal amount for credit/debit cards and e-wallets, but bank wire transfers might have a set minimum, often around $100 or equivalent.

- Maximum Withdrawal: Maximum limits are typically determined by the payment method’s restrictions or the available balance in your trading account.

Processing Times

Deposits

- Instant Processing: Credit/debit card and e-wallet deposits are often processed instantly, allowing traders immediate access to funds.

- Bank Wires: May take 2-5 business days, depending on the banks involved and their respective locations.

Withdrawals

- Withdrawal requests are usually processed by AvaTrade within 1-2 business days. However, the time it takes for funds to appear in your account will depend on the withdrawal method:

- Credit/Debit Cards and E-Wallets: May take up to 5 business days.

- Bank Wires: Can take longer, sometimes up to 10 business days.

Potential Fees for Transactions

- Deposits: AvaTrade generally does not charge any fees for deposits. However, your bank or payment provider may impose transaction fees.

- Withdrawals: While AvaTrade strives to keep withdrawal fees low or non-existent, it’s important to check if any fees apply, especially for bank wire transfers, which are more likely to incur fees from the banks’ side.

- Currency Conversion: If your deposit or withdrawal involves currency conversion, a conversion fee may apply. AvaTrade’s website or customer service can provide specifics based on the currencies involved.

It’s advisable to consult AvaTrade’s official website or contact their customer support for the most current information regarding deposit and withdrawal methods, processing times, and any potential fees specific to your region. Proper understanding and planning regarding these transactions can enhance your trading experience by ensuring smooth financial management of your trading account.

Leverage and Margin Requirements

Understanding leverage and margin is crucial for traders at all levels, as these mechanisms significantly impact the potential for profit as well as the risk of loss. Leverage allows traders to control a large position with a relatively small amount of capital, while margin is the amount of capital required to open and maintain a leveraged position. Let’s explore how leverage and margin apply to different AvaTrade Account Types, the prudent use of leverage, the risks involved, and how margin requirements may vary.

Understanding Leverage and Margin

Leverage

Leverage is expressed as a ratio, such as 50:1, 100:1, or 500:1, indicating how much larger a trader’s position is compared to their actual investment. For instance, with 100:1 leverage, you can control a position worth $100,000 with only $1,000 of your own capital.

Margin

Margin is the percentage of the position size that you need to have in your account to open a trade. It is essentially a good faith deposit, ensuring you have enough funds to cover potential losses on a leveraged position.

Using Leverage Wisely

Understand the Risks

While leverage can amplify profits, it also increases the potential for losses, which can exceed the initial investment if a trade moves against you. Therefore, it’s crucial to understand the risks involved and use leverage wisely.

Risk Management

Implement risk management strategies, such as setting stop-loss orders to limit potential losses. It’s also important to not over-leverage by using the maximum available leverage without considering the volatility of the market and the size of your account.

Start Small

Especially for beginners, starting with lower leverage can help you get accustomed to the impact of leverage on your trading without taking on excessive risk.

Differences in Margin Requirements Between AvaTrade Account Types

Retail vs. Professional Accounts

- Retail Accounts typically have lower leverage limits due to regulatory protections designed to minimize risk exposure for retail traders. For example, leverage may be capped at 30:1 for major currency pairs.

- Professional Accounts may offer higher leverage, such as 400:1 or 500:1, acknowledging the trader’s experience and capacity to handle higher risk. However, this comes with the caveat of reduced regulatory protections.

Islamic Accounts

- Islamic accounts follow the same margin requirements as their conventional counterparts but must also comply with Islamic finance principles. The key difference lies in how overnight positions are handled, as they can’t incur or earn interest.

Margin Requirements Across Instruments

Margin requirements can also vary significantly across different instruments due to differences in market volatility and liquidity. For example, major Forex pairs often have lower margin requirements compared to exotic pairs or volatile commodities.

Key Takeaways:

- Leverage allows traders to control large positions with a small investment, while margin is the actual amount required to open such positions.

- Wise use of leverage involves understanding its risks, employing sound risk management strategies, and starting with lower leverage to gauge its impact on your trading strategy.

- Margin requirements vary between account types, with professional accounts typically offering higher leverage (and thus lower margin percentages) compared to retail accounts, reflecting a higher risk tolerance and trading experience. It’s essential to consult with AvaTrade for the specific leverage and margin requirements applicable to your account type and the instruments you wish to trade.

Tools and Resources Available for Each Account Type at AvaTrade

AvaTrade provides a comprehensive suite of tools, platforms, and resources designed to enhance the trading experience for traders of all levels. From cutting-edge trading platforms to in-depth educational materials, the broker tailors its offerings to meet the diverse needs of its clientele, ensuring access to valuable resources regardless of account type. Here’s an overview of the key tools and resources available across different AvaTrade Account Types, highlighting any custom features or exclusive services provided to certain account categories.

Trading Platforms and Analytical Tools

All Account Types

- MetaTrader 4 and MetaTrader 5: Access to the industry-standard MetaTrader platforms, offering powerful charting tools, automated trading through Expert Advisors (EAs), and extensive analytical capabilities.

- AvaTradeGO: AvaTrade’s proprietary mobile trading app, featuring an intuitive interface, multi-faceted market analysis, and advanced management tools.

- Trading Central: A third-party analysis tool available to all traders, providing expert market insights, trading signals, and technical analysis.

Custom Features for Specific Account Types

- Professional Accounts may receive access to more sophisticated analytical tools and plugins designed for high-volume trading, such as advanced charting software or custom indicators.

- Islamic Accounts are provided with swap-free conditions aligned with Islamic finance principles, without specific analytical tools modifications.

Educational Resources

AvaTrade places a strong emphasis on trader education, offering a wide array of learning materials suitable for both beginners and experienced traders.

All Account Types

- Webinars and Online Courses: Covering various trading topics, from fundamentals to advanced strategies.

- E-books and Articles: A library of written materials designed to deepen your understanding of trading concepts and market dynamics.

- Video Tutorials: Step-by-step guides on using AvaTrade’s platforms, tools, and executing trades.

Custom Features for Specific Account Types

- One-on-One Coaching: Professional and some premium account holders might have the opportunity for personalized coaching sessions with experienced traders or account managers.

- Exclusive Webinars and Workshops: Certain account types may receive invitations to exclusive educational events and advanced strategy sessions.

Customer Support and Account Management Services

All Account Types

- 24/5 Customer Support: AvaTrade offers dedicated customer support via live chat, email, and phone, ensuring traders can get assistance whenever the markets are open.

- FAQ and Help Center: A comprehensive resource for immediate answers to common questions and troubleshooting.

Custom Features for Specific Account Types

- Dedicated Account Managers: Traders with Professional, Premium, or certain tiered accounts might be assigned a dedicated account manager for personalized service and support.

- Priority Support: Higher-tier account holders may benefit from priority customer service, ensuring faster response times and direct access to senior support personnel.

Conclusion: Choosing the Right AvaTrade Account for You

Selecting the most suitable AvaTrade account is a critical decision that can significantly impact your trading journey. With a range of AvaTrade Account Types designed to cater to various trader needs, preferences, and levels of experience, AvaTrade ensures that every trader can find a compatible trading environment. To make this crucial decision, consider the following key points, evaluate your trading style and goals, and remember the importance of continuous education in the fast-paced world of forex trading.

Key Points to Consider

- Account Types: Understand the differences between Demo, Retail, Professional, Islamic, and Options accounts. Each has its own set of features tailored to different trading needs and objectives.

- Leverage and Margin Requirements: Consider how leverage aligns with your risk tolerance and trading strategy. Remember, higher leverage increases both potential returns and potential risks.

- Tools and Resources: Assess the trading platforms, analytical tools, and educational resources available for each account type. Ensure they match your trading style and level of experience.

- Custom Features and Services: Be aware of any custom features or exclusive services provided to certain account types, such as one-on-one coaching or advanced trading tools, which could enhance your trading experience.

- Customer Support and Account Management: Consider the level of customer support and account management services you might need. Premium services could offer significant value through personalized assistance and advice.

Evaluating Your Trading Style, Experience, and Financial Goals

- Trading Style and Experience: Reflect on your trading style (e.g., day trading, swing trading, scalping) and experience level. Beginners may benefit from starting with a Demo account, while more experienced traders might consider a Professional account to access higher leverage and advanced tools.

- Financial Goals: Align your account choice with your financial goals. Consider whether you’re trading to supplement your income, hedge other investments, or as a professional activity.

- Risk Tolerance: Your risk tolerance is a key factor in deciding the right account type. Retail accounts offer more protections, making them suitable for those with a lower risk tolerance, while Professional accounts cater to those willing to take on more risk for potentially greater rewards.

The Importance of Continuous Education

- Stay Informed: The forex market is dynamic, with constant changes in regulations, market conditions, and trading technologies. Continuously educating yourself on these aspects can significantly impact your trading success.

- Leverage Educational Resources: Take full advantage of AvaTrade’s educational resources, regardless of your account type. Knowledge is power in forex trading, and continuous learning is essential for refining your strategies and adapting to new market conditions.

- Practice and Reflect: Use your account’s features to practice and refine your trading strategies. Reflection and adaptation are key components of growth and improvement in trading.

Choosing the right AvaTrade account is a foundational step in your trading career. By carefully considering your needs, evaluating your trading style, experience, and goals, and committing to continuous education, you can select an account that not only aligns with your current requirements but also supports your growth as a trader. Remember, your choice of account is not static; as you evolve as a trader, AvaTrade’s range of accounts is there to meet your changing needs.