In the ever-evolving landscape of Forex trading, finding a broker that aligns with your needs as a beginner can be a daunting task. Enter AvaTrade, a globally recognized Forex broker renowned for its user-friendly platform and comprehensive educational resources. But what truly sets AvaTrade apart for novices is its demo account feature, a crucial tool for those just stepping into the trading arena. Let’s dive into why AvaTrade is a top choice for beginners and explore the ins and outs of its demo account.

AvaTrade: A Primer for Beginners

Founded in 2006, AvaTrade has positioned itself as a leader in the Forex trading sphere, catering to over 200,000 registered clients worldwide and executing more than two million trades a month. The platform’s appeal lies in its regulatory compliance across multiple jurisdictions, offering traders peace of mind regarding the security of their investments.

Why a Demo Account Matters

For beginners, the leap into Forex trading comes with its share of risks and challenges. Here’s where a demo account becomes invaluable. It serves as a risk-free sandbox for practicing trades and testing strategies without the fear of losing real money. Think of it as the trading equivalent of a flight simulator – it looks and feels real, but it’s a safe environment to learn and make mistakes.

A Closer Look at AvaTrade’s Demo Account

AvaTrade’s demo account stands out for several reasons. It mirrors the real trading environment, providing access to live market conditions with a simulated balance to trade. This allows beginners to:

- Experience Real Market Conditions: Trade in real-time with access to the latest market data and trends.

- Develop and Test Strategies: Experiment with different trading strategies to see what works best without any financial risk.

- Learn the Platform: Familiarize yourself with AvaTrade’s trading platforms and tools, making the transition to live trading smoother and more intuitive.

Features of the Demo Account

- Simulated Trading Balance: Start with a generous virtual fund to practice trades.

- Access to All Instruments: Trade a wide range of instruments, including Forex, commodities, stocks, and indices.

- Real-Time Market Data: Get live data feeds to make your practice as realistic as possible.

Limitations to Keep in Mind

While the demo account is a fantastic tool for learning, it’s important to remember its limitations. The absence of real financial risk can sometimes lead to complacency. When transitioning to live trading, the emotional and psychological aspects of trading with real money come into play, which the demo account cannot simulate.

Getting Started with the AvaTrade Demo Account

Embarking on your Forex trading journey with AvaTrade begins with a crucial first step: setting up a demo account. This chapter is a practical guide designed to navigate you through the process of signing up, configuring, and customizing your demo account for an optimal learning experience. Let’s break down the process into simple, actionable steps.

Step-by-Step Guide to Signing Up

- Visit the AvaTrade Website: Start by navigating to AvaTrade’s official site. Look for the option to register for a demo account, usually prominently displayed on the homepage.

- Fill in the Registration Form: You’ll be prompted to provide some basic information, such as your name, email address, and phone number. Rest assured, AvaTrade adheres to strict privacy policies to protect your personal information.

- Verification: Some regions may require a quick verification process to comply with financial regulations. This might involve confirming your email address or mobile number through a verification code.

- Account Activation: Once verified, your demo account will be activated. You’ll receive login details, typically via email, to access the trading platform.

Navigating the Account Setup

Upon your first login, you might feel overwhelmed by the plethora of options and settings. Here’s how to smoothly navigate through the setup process:

- Platform Choice: AvaTrade offers several trading platforms. As a beginner, you might want to start with AvaTradeGO, known for its user-friendly interface. Select the platform that best suits your needs.

- Familiarize Yourself with the Dashboard: Spend some time exploring the dashboard. Locate where to view your balance, open trades, access charts, and execute trades.

- Access Educational Resources: AvaTrade prides itself on its educational support. Look for tutorials or guides on using the platform and trading basics.

Initial Settings and Customization

Customizing your demo account settings can enhance your learning experience. Here are a few suggestions:

- Set Your Trading Balance: While the demo account comes with a default virtual balance, some platforms allow you to adjust this amount. Tailor it to match the capital you plan to invest in live trading for a more realistic practice.

- Choose Your Instruments: Focus on the instruments you’re most interested in. Whether it’s currency pairs, commodities, or indices, customizing your dashboard to display your preferred markets can streamline your practice sessions.

- Experiment with Leverage Settings: Leverage can amplify your trading results, for better or worse. Use the demo account to understand how leverage works and find a level you’re comfortable with.

- Utilize Risk Management Tools: Practice setting stop-loss and take-profit orders. These are crucial for managing risk and protecting your capital.

Understanding the Trading Platform

Diving into the world of Forex trading with AvaTrade means getting acquainted with its trading platform – a crucial component for any trader’s success. This chapter offers a deep dive into the trading platform interface, highlights the utility of charts, indicators, and other analytical tools provided in the demo account, and compares the functionalities between the desktop and mobile app versions. Let’s navigate the digital landscape of AvaTrade’s trading platforms, ensuring you can leverage every feature to your advantage.

Navigating the Interface

At first glance, the trading platform interface might seem complex, but it’s designed for intuitive use. Here’s a breakdown of key sections you need to know:

- Dashboard/Home Screen: The hub of your trading activities, showing your balance, open positions, and quick access to various markets.

- Market View: A detailed list of all available instruments, including Forex pairs, commodities, stocks, and indices. Here, you can view real-time price movements and access trading options for each instrument.

- Order Management: This section allows you to execute trades, setting market orders, and limit or stop orders, along with defining stop-loss and take-profit levels.

Utilizing Charts and Analytical Tools

AvaTrade’s platform is equipped with robust charting features and analytical tools to help you make informed trading decisions:

- Charts: Access real-time charts for any instrument, with the ability to customize time frames, from one minute to one month. Use these charts to spot trends and patterns in the market.

- Indicators: The platform offers a variety of technical indicators, such as Moving Averages, MACD, RSI, and Bollinger Bands. These can be applied directly to the charts, assisting in the analysis of potential market movements.

- Drawing Tools: For more hands-on analysis, use drawing tools like trend lines and Fibonacci retracements to manually mark important chart levels and patterns.

Desktop vs. Mobile App Functionality

While the core functionalities remain consistent across AvaTrade’s desktop and mobile app, there are differences worth noting:

Desktop Platform:

- More Screen Real Estate: The larger display offers a comprehensive view of multiple charts and instruments simultaneously.

- Advanced Charting: Enhanced charting capabilities and a wider range of indicators are available on the desktop version.

- Complex Order Types: Executing more complex trading strategies is often easier with the desktop platform’s advanced order options.

Mobile App:

- Trading on the Go: The mobile app offers the flexibility to monitor markets and execute trades from anywhere.

- Simplified Interface: Tailored for smaller screens, the mobile app has a streamlined interface focusing on essential trading functionalities.

- Notifications and Alerts: Receive real-time notifications and alerts on market movements and trade executions directly on your phone.

Trading Instruments Available on AvaTrade Demo Account

Exploring the AvaTrade demo account reveals a wide array of trading instruments at your disposal. From the volatility of Forex pairs to the stability of commodities, and the dynamic nature of stocks and indices, AvaTrade caters to a broad spectrum of trading preferences. This chapter delves into the variety of instruments available, explains the nuances of leverage and margin requirements, and offers strategic advice for selecting the right instruments under varying market conditions.

Diverse Range of Trading Instruments

Forex Pairs

AvaTrade offers an extensive selection of currency pairs, encompassing major, minor, and exotic pairs. This includes popular pairs like EUR/USD, GBP/USD, and USD/JPY, offering traders exposure to global currency markets and the opportunity to capitalize on currency fluctuations.

Commodities

Traders looking for a hedge against inflation or currency devaluation can turn to commodities. AvaTrade’s demo account provides access to a variety of commodities, including precious metals like gold and silver, energy commodities such as oil and natural gas, and agricultural products like wheat and coffee.

Stocks

For those interested in the stock market, AvaTrade offers CFDs on a wide range of global stocks. This allows traders to speculate on the price movements of major companies without owning the actual shares, from tech giants like Apple and Amazon to automotive leaders like Tesla.

Indices

Indices aggregate the performance of a group of stocks, providing a snapshot of a particular market or sector. With AvaTrade, you can trade CFDs on leading indices such as the S&P 500, NASDAQ, FTSE 100, and the Nikkei 225.

Leverage and Margin Requirements

Leverage is a powerful tool that allows traders to control a large position with a relatively small amount of capital. However, it also increases risk. AvaTrade offers varying leverage levels, depending on the instrument and the trader’s account type.

- Forex Pairs: Typically have higher leverage options due to their liquidity and market volume.

- Commodities and Indices: May offer lower leverage compared to Forex, reflecting their volatility and risk profile.

- Stocks: Tend to have the lowest leverage levels, mirroring the risk of individual company performances.

Margin requirements, or the amount of capital needed to open and maintain a position, also vary by instrument and leverage. Understanding these requirements is crucial to manage risk effectively.

Choosing the Right Instruments

Selecting the right instruments to trade depends on several factors, including your risk tolerance, market knowledge, and current economic conditions. Here are some tips:

- Stay Informed: Keep abreast of global economic news and events that could impact different markets. Use this information to guide your instrument selection.

- Assess Volatility: Some traders thrive on volatility, while others prefer more stable markets. Choose instruments that match your trading style and risk tolerance.

- Diversify: Don’t put all your eggs in one basket. Diversifying your trades across different instruments can reduce risk.

Practicing Trading Strategies

Mastering the art of trading requires not just understanding the markets, but also rigorously practicing and refining your trading strategies. The AvaTrade demo account is a perfect sandbox for this purpose, offering a risk-free environment to experiment with various strategies, understand risk management, and learn how to effectively set stop-loss and take-profit orders. This chapter will guide you through using the demo account to hone your trading skills and explore both basic and advanced strategies.

Leveraging the Demo Account for Practice

Simulating Real Trading Conditions

The AvaTrade demo account mirrors live market conditions, allowing you to experience the dynamics of real trading without the risk. This is invaluable for understanding how different strategies perform under various market conditions.

Experimentation is Key

Use the demo account to experiment with different approaches. Try out various time frames, from short-term day trading to long-term swing trading strategies. Pay attention to how market news and events affect your trades and adjust your strategies accordingly.

The Cornerstone of Trading: Risk Management

Risk management is critical to successful trading. The demo account provides a platform to practice setting stop-loss and take-profit orders, essential tools for managing risk.

Setting Stop-Loss Orders

A stop-loss order automatically closes an open position at a predetermined price level, limiting your potential losses. Practicing with stop-loss orders helps you learn how to set realistic exit points based on your risk tolerance and market analysis.

Implementing Take-Profit Orders

Similarly, take-profit orders close your position once it reaches a certain profit level. This is crucial for securing profits, especially in volatile markets where gains can quickly reverse.

Exploring Trading Strategies

The demo account is your laboratory for testing both basic and advanced trading strategies. Here are a few to consider:

Basic Strategies

- Trend Following: This strategy involves identifying and following the market’s direction, buying in uptrends and selling in downtrends.

- Range Trading: Suitable for markets that aren’t trending, this strategy focuses on buying at support levels and selling at resistance levels.

Advanced Strategies

- Scalping: A strategy that involves making numerous small trades to capture minor price changes, requiring quick decision-making and execution.

- Carry Trade: Involves borrowing in a currency with a low interest rate and investing in a currency with a high interest rate, capitalizing on the differential.

Technical and Fundamental Analysis

Navigating the financial markets requires a blend of art and science, intuition, and analysis. Two pillars of market analysis—technical and fundamental—provide traders with insights to make informed decisions. This chapter introduces these essential analyses and explains how to apply them using the AvaTrade demo account tools, illustrated with real-world examples.

Introduction to Market Analysis

Market analysis can be broadly categorized into two types: technical and fundamental. Each offers a unique perspective on market movements and potential trading opportunities.

Technical Analysis

Technical analysis focuses on price movements and trading volumes, using historical data to predict future trends. It relies on charts, patterns, and indicators to identify trading signals and trends.

Fundamental Analysis

In contrast, fundamental analysis looks at economic, social, and political factors that may affect the value of a financial instrument. For currencies, this might include interest rates, inflation rates, and political stability.

Applying Analyses Using AvaTrade Demo Account

The AvaTrade demo account provides access to tools and resources for both technical and fundamental analysis.

For Technical Analysis:

- Charts: Use the demo account to access real-time charts for various instruments, applying different time frames and technical indicators like Moving Averages, RSI, and MACD.

- Drawing Tools: Leverage tools like trend lines and Fibonacci retracements to analyze price movements and identify potential support and resistance levels.

For Fundamental Analysis:

- Economic Calendar: Keep an eye on the economic calendar available on AvaTrade. It lists significant upcoming economic events that could influence the markets, such as interest rate decisions or employment reports.

- News Feeds: Stay updated with the latest financial news directly through the platform. Market sentiment can be heavily influenced by news events, making them an integral part of fundamental analysis.

Real-world Examples

Let’s explore how both analyses lead to trading decisions:

Technical Analysis Example

Imagine you’re analyzing the EUR/USD pair and notice a consistent pattern of higher lows and higher highs on the 4-hour chart, indicating an uptrend. A Moving Average crossover might further suggest bullish momentum. Based on this technical analysis, you might decide to enter a long position, setting a stop-loss just below the recent swing low to manage risk.

Fundamental Analysis Example

Suppose you’re tracking the USD/JPY pair and an upcoming U.S. Federal Reserve meeting is expected to raise interest rates. Higher interest rates typically strengthen the currency, in this case, the USD. Combining this insight with a stable political climate in the U.S., you might predict a stronger USD against the JPY and decide to go long on USD/JPY.

Using Expert Advisors and Automated Trading

The realm of Forex trading has been revolutionized by the advent of Expert Advisors (EAs) and automated trading systems, which enable traders to automate their strategies and capitalize on market opportunities around the clock. This chapter provides a comprehensive guide on setting up Expert Advisors on the AvaTrade demo account, explores the advantages and disadvantages of automated trading, and outlines best practices for testing and optimizing EAs.

Setting Up Expert Advisors on AvaTrade Demo Account

To harness the power of EAs in your trading strategy, follow these steps to set them up on your AvaTrade demo account:

- Choose a Compatible Trading Platform: Ensure that your chosen trading platform, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), supports EAs. AvaTrade offers these platforms, known for their EA compatibility.

- Select or Develop an EA: You can choose from a wide range of pre-existing EAs available in the platform’s marketplace or develop your own using the MQL programming language.

- Install the EA: Once selected, install the EA by copying its files into the ‘Experts’ or ‘Indicators’ folder of your trading platform directory. Restart the platform to see the EA in your navigator window.

- Configure Settings: Attach the EA to the desired chart and customize its settings according to your trading strategy, including risk management parameters and specific indicators it should follow.

- Test the EA: Utilize the back-testing feature available on MT4 or MT5 to see how your EA would have performed based on historical data. This step is crucial to evaluate its potential effectiveness.

Pros and Cons of Automated Trading

Advantages

- Efficiency and Speed: EAs can monitor and execute trades faster than manual trading, capitalizing on opportunities the moment they arise.

- Emotionless Trading: Automated systems eliminate emotional decision-making, sticking strictly to the strategy’s rules.

- 24/5 Trading: EAs can operate continuously, taking advantage of global Forex market hours without the need for sleep.

Disadvantages

- Market Sensitivity: Automated systems might not respond well to sudden market changes or unique events that a human trader might navigate more adeptly.

- Over-Optimization: There’s a risk of ‘curve-fitting’ an EA to past data, making it ineffective in future market conditions.

- Technical Failures: Dependency on technology means that hardware or software failures can impact trading activities.

Best Practices for Testing and Optimizing EAs

- Back-Testing: Use the back-testing capabilities of your trading platform extensively to test the EA against historical data. However, remember that past performance is not always indicative of future results.

- Forward Testing: Run the EA on a demo account in real-time market conditions to assess its performance without financial risk.

- Parameter Adjustments: Regularly review and adjust the EA’s parameters to fine-tune its performance. Market conditions evolve, and so should your EA.

- Risk Management: Implement strict risk management rules within your EA to protect your account from significant losses.

Transitioning from Demo to Real Account

The journey from demo trading to engaging with a real account is a pivotal step in a trader’s journey, marking the transition from practice to real-world application. This chapter will guide you through the right timing for making the switch, delve into the psychological adjustments required when trading with real money, and provide insights on how to fine-tune your trading strategy for the live markets.

When to Make the Switch

The decision to transition from a demo to a real account should be based on several key factors:

- Consistent Performance: Have you consistently achieved your trading goals over a significant period on your demo account? Consistency here is more important than short-term success.

- Familiarity with the Platform: Ensure you are comfortable with all the tools and features of your trading platform. Mistakes in a live environment can be costly.

- Understanding of Risk Management: It’s crucial that you’ve practiced implementing effective risk management strategies in the demo environment before exposing yourself to real market risks.

Psychological Adjustment to Real Trading

Trading with real money introduces a new set of emotional and psychological challenges:

- Fear of Loss: The possibility of real financial loss can lead to conservative trading or, conversely, to overtrading in an attempt to recover losses. It’s important to stick to your trading plan and accept losses as part of the process.

- Pressure to Perform: The pressure of making profitable trades can be overwhelming. It’s essential to maintain discipline and not let emotions drive your trading decisions.

- Overconfidence: Success in a demo account does not guarantee success in live trading. Overconfidence can lead to taking unnecessary risks, so humility and continuous learning are key.

Adjusting Your Strategy for Live Trading

Transferring your strategy from a demo to a real account requires careful consideration and adjustment:

- Start Small: Begin with smaller trades to get a feel for the emotional aspect of trading with real money. This can also help you understand the nuances of how orders are executed in a live environment.

- Slippage and Execution: Be prepared for differences in order execution. Slippage (the difference between the expected price and the price at which the trade is executed) can occur in volatile markets.

- Risk Management: Reassess your risk management strategies. What worked in the demo account might need adjustments due to the psychological factors at play in real trading.

- Keep a Trading Journal: Documenting your trades, including the strategy, outcome, and emotional state, can provide invaluable insights and help improve your approach.

Common Pitfalls to Avoid When Using Demo Accounts

Demo accounts serve as an essential learning tool for new traders, offering a risk-free environment to practice trading strategies, understand market movements, and familiarize oneself with a trading platform. However, there are common pitfalls associated with demo trading that, if not addressed, can lead to skewed expectations and challenges when transitioning to real trading. This chapter highlights these pitfalls and offers guidance on how to navigate them effectively.

Common Mistakes and How to Avoid Them

Overleveraging

- Pitfall: Demo accounts often come with a high virtual balance, leading traders to take on larger positions than they would with real money, risking a disproportionate amount of their account on single trades.

- Avoidance: Practice with a balance similar to what you plan to start your real trading account with and adhere to realistic trade sizes and risk management strategies.

Ignoring Risk Management

- Pitfall: The absence of real financial loss in demo trading can lead to neglecting risk management principles, such as setting stop-loss and take-profit orders.

- Avoidance: Use every trade as an opportunity to practice sound risk management, just as you would in a live trading environment.

Unrealistic Trading

- Pitfall: Trading in a manner that is not reflective of how one would trade with real money, such as making impulsive, high-risk trades.

- Avoidance: Treat your demo account as you would a real account, with discipline in your trading decisions, strategy, and risk management.

Psychological Differences and Their Impact

The transition from demo to real trading involves significant psychological adjustments due to the introduction of real financial risk. The thrill of potential gains or the fear of loss can profoundly affect decision-making, leading to deviations from one’s trading plan. Recognizing these emotional factors and learning to manage them in the demo stage can help smooth the transition to real trading.

The Importance of Keeping a Trading Journal

A trading journal is an invaluable tool for both demo and real trading, offering several benefits:

- Reflection: It allows for reflection on both successful and unsuccessful trades to understand what worked and what didn’t.

- Emotional Awareness: Recording your emotional state for each trade can help identify emotional patterns that affect your trading decisions.

- Strategy Refinement: Keeping a detailed log of your strategies and their outcomes enables you to fine-tune your approach based on empirical evidence rather than intuition.

Documenting your demo trading journey prepares you for the discipline required in real trading, where keeping a detailed record becomes even more critical due to the financial implications of each decision.

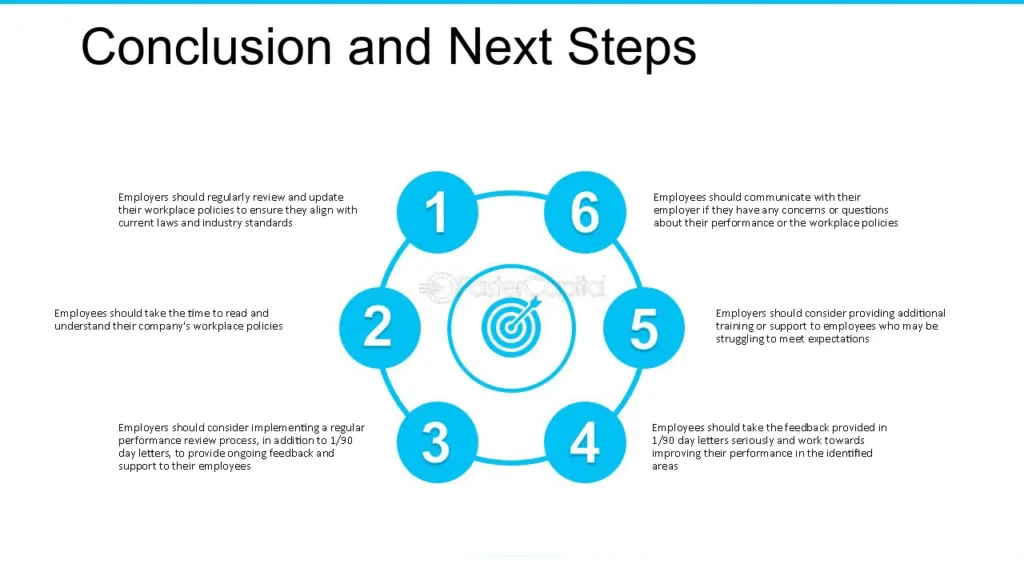

Conclusion and Next Steps

As we conclude our exploration of using the AvaTrade demo account, it’s essential to reflect on the key takeaways and consider the next steps in your trading journey. The demo account experience offers invaluable lessons, not only in the mechanics of trading but also in the psychological adjustments required when transitioning to real-world trading. Let’s recap the crucial insights gained and outline resources for continuous learning and improvement.

Key Takeaways

- Realistic Practice: The importance of treating the demo account as closely to a real account as possible cannot be overstated. This involves practicing with a realistic balance, adhering to sound risk management principles, and maintaining the discipline in trading decisions.

- Psychological Preparation: Transitioning to real trading involves significant psychological challenges, including dealing with the fear of loss and the pressure to perform. The demo account phase is crucial for developing emotional resilience and a disciplined mindset.

- Continuous Learning: The use of a demo account is just the beginning. Continuous education on market analysis, trading strategies, and risk management is essential for long-term success.

Additional Resources for Continuous Learning

- Educational Content: AvaTrade and many other platforms offer a wealth of educational resources, including webinars, e-books, and tutorial videos covering various aspects of trading.

- Trading Communities: Joining trading forums or communities can provide support, insights, and advice from more experienced traders.

- Professional Courses: Consider investing in professional trading courses or workshops to deepen your understanding of the markets and advanced trading strategies.

Applying Knowledge to Real-World Trading

The transition from a demo to a real account is a significant milestone in your trading journey. Armed with the knowledge and experience gained through the demo account, you’re now better equipped to navigate the complexities of the real markets. Remember:

- Start Small: Begin with a small investment and gradually increase your exposure as you gain confidence and experience.

- Stay Disciplined: Apply the trading plan, risk management strategies, and psychological resilience you developed during your demo trading experience.

- Embrace Continuous Improvement: Trading is a journey of lifelong learning. Embrace both successes and setbacks as opportunities for growth.