Welcome to TradeChamp.net, your premier destination for comprehensive financial analysis and insightful broker reviews. Today, we’re diving into the world of Forex trading with a special focus on AvaTrade, a frontrunner in the industry. We’ll particularly examine the essentials for beginners, including the critical aspect of the minimum deposit required to start trading with AvaTrade. Our journey is aimed at demystifying the entry barriers and ensuring you have all the information needed to embark on your trading adventure.

Overview of AvaTrade as a Forex broker

AvaTrade stands out as a beacon for novice traders navigating the complex world of Forex. Established in 2006, it has grown to become a reputable platform recognized for its user-friendly interface, extensive educational resources, and unwavering commitment to client security and support. AvaTrade is regulated by several top-tier financial authorities, ensuring a reliable and transparent trading environment.

Why AvaTrade?

- Regulation and Security: AvaTrade is tightly regulated by major financial bodies, providing a safe haven for your trading endeavors.

- Educational Resources: From webinars to e-books, AvaTrade offers a wealth of learning materials to get you up to speed.

- User-Friendly Platform: Catering to beginners, its platform demystifies Forex trading, making it accessible to all.

Brief on the importance of choosing the right broker for Forex trading

Entering the Forex market can be daunting, but the choice of broker can significantly determine your success and growth. A broker acts as your gateway to the markets, providing the tools, resources, and support needed to navigate the trading landscape.

Why the Right Broker Matters:

- Security: Your funds need protection by a reputable, well-regulated broker.

- Education: Access to comprehensive educational materials is crucial for developing trading skills.

- Tools and Resources: The best brokers offer sophisticated, yet user-friendly tools to help you make informed decisions.

- Customer Support: As a beginner, having responsive and helpful customer support can make all the difference.

Choosing the right broker, like AvaTrade, ensures that you’re not just entering the Forex market, but setting the stage for potential success and learning. As we delve deeper into what makes AvaTrade a prime choice for beginners, remember, the right start can lead to remarkable journeys.

Understanding Minimum Deposits in Forex Trading

Navigating the world of Forex trading requires a keen understanding of various factors that can impact your trading journey, one of which is the concept of minimum deposits. Let’s dive into what minimum deposits are and how they influence Forex trading strategies, particularly for beginners.

What is a minimum deposit?

A minimum deposit in Forex trading refers to the smallest amount of money required by a Forex broker, such as AvaTrade, to open a trading account. This amount varies widely among brokers and can range from as little as $5 to several thousand dollars. The purpose of a minimum deposit is multifaceted: it ensures that traders are serious about their trading endeavors, helps brokers cover the costs associated with maintaining accounts, and aligns with the financial capabilities of different traders.

Key Points to Remember:

- Varies by Broker: Minimum deposits differ significantly across brokers, reflecting their target market and service level.

- Accessibility for Beginners: Brokers with low minimum deposits make Forex trading more accessible to beginners.

- Indicator of Commitment: It also serves as a commitment from the trader, ensuring some level of seriousness in their trading activities.

How minimum deposits affect Forex trading strategies

The size of the minimum deposit required by a broker can significantly influence a trader’s approach to the Forex market. Here’s how:

Strategy Formulation

- Risk Management: A lower minimum deposit allows for better risk management, especially for beginners learning to trade without risking a substantial amount of money.

- Leverage: Some brokers offer higher leverage to traders with higher initial deposits, which can amplify both gains and losses.

Psychological Impact

- Confidence Building: Starting with a lower minimum deposit can help build trading confidence without the fear of significant losses.

- Commitment: A higher minimum deposit might push a trader to commit more seriously to learning and developing effective trading strategies.

Diversification

- Portfolio Diversification: Traders with access to lower minimum deposits have the flexibility to spread their capital across multiple accounts or strategies, enhancing diversification.

AvaTrade, recognizing the diverse needs of its clients, offers a competitive minimum deposit requirement. This approach is designed to lower the entry barrier for beginner traders, allowing them to step into the Forex market with confidence and a solid foundation for developing their trading strategies.

Understanding minimum deposits is crucial for anyone looking to venture into Forex trading. It’s not just about the ability to open an account; it’s about aligning your financial capabilities with your trading objectives and strategies. As we move forward, remember that the right broker can make a significant difference in your trading journey.

AvaTrade Minimum Deposit: The Basics

Diving deeper into the specifics, let’s explore AvaTrade’s approach to minimum deposits. Understanding the nuances of AvaTrade’s requirements will help you navigate your initial steps in the Forex market more effectively. Whether you’re gearing up to open your first account or considering diversifying your trading strategies, knowing these basics is crucial.

Detailed information on AvaTrade’s current minimum deposit requirements

AvaTrade positions itself as an accessible platform for traders of all levels, particularly beginners. The broker has set its minimum deposit threshold with this inclusivity in mind. As of now, AvaTrade requires a minimum deposit of $100 to start trading. This relatively low entry barrier is designed to attract newcomers to the Forex market, providing an opportunity to trade with a regulated, reputable broker without the need for a hefty initial investment.

Key Highlights:

- Standard Minimum Deposit: $100 across various platforms and instruments.

- Accessibility: Aimed at lowering the entry barrier for novice traders.

How the minimum deposit requirement varies with account types or geographic locations, if applicable

AvaTrade tailors its services to meet the diverse needs of its global client base. While the standard minimum deposit sits at $100, there are nuances based on account types and geographic locations.

Account Types

- Demo Account: AvaTrade offers a demo account with virtual funds, allowing traders to practice strategies without any financial commitment.

- Professional Accounts: Traders who qualify for professional status may be subject to different conditions, including minimum deposit requirements, based on their experience and financial situation.

Geographic Locations

- Regulatory Influence: Regulatory requirements in different jurisdictions may influence minimum deposit levels. For example, traders in certain countries might see variations due to local financial regulations.

- Currency Conversion: It’s also worth noting that the base currency of your trading account could affect the equivalent amount needed when depositing in another currency.

AvaTrade’s approach to minimum deposits exemplifies its commitment to making Forex trading accessible while ensuring a secure and regulated trading environment. Whether you’re in Europe, Asia, or anywhere else, AvaTrade offers a straightforward path to entering the Forex market, backed by supportive educational resources and customer service.

By aligning its minimum deposit requirements with the needs of beginners and experienced traders alike, AvaTrade facilitates a welcoming and conducive trading environment for all. As you consider stepping into the world of Forex trading, remember that the right start with a broker like AvaTrade can set the tone for your trading journey.

Payment Methods Accepted by AvaTrade

For Forex traders, the journey begins with making the first deposit into their trading account. AvaTrade simplifies this process by offering a variety of payment methods, catering to the diverse preferences and needs of its global clientele. Understanding these options and any associated nuances is key to a smooth start in your trading endeavors.

Overview of all payment methods through which traders can make their minimum deposit

AvaTrade acknowledges the importance of flexibility in financial transactions, hence providing multiple channels for traders to fund their accounts. Here’s a rundown of the primary methods available:

Bank Wire Transfer

- Universal Acceptance: A traditional and widely used method for larger deposits.

- Processing Time: Can take several business days to reflect in your trading account.

Credit and Debit Cards

- Convenience: Immediate and straightforward way to fund your account.

- Widely Accepted Cards: Visa, MasterCard, and Maestro are commonly used.

E-Wallets

- Speed and Efficiency: Digital wallets like PayPal, Skrill, NETELLER, and WebMoney offer quick and easy transactions.

- Accessibility: Preferred for their global reach and instant processing times.

Other Methods

- Depending on your location, AvaTrade may offer additional options tailored to regional preferences.

Nuances related to different payment methods

While AvaTrade strives to make the deposit process as convenient as possible, there are some nuances worth noting related to different payment methods:

Time to Process

- Immediate Transactions: Credit/debit cards and e-wallets usually provide instant account funding.

- Bank Transfers: May take several days, which is essential to consider when planning your trading activities.

Fees

- Broker Fees: AvaTrade does not charge any deposit fees, regardless of the payment method.

- Third-party Fees: However, traders should be aware of potential fees from their bank or payment service provider, especially for international transfers or currency conversion.

Currency Conversion

- Multiple Currencies: AvaTrade accepts deposits in several currencies, reducing the need for conversion for many traders.

- Conversion Fees: If a conversion is necessary, be mindful of exchange rates and fees that may apply.

Security

- Verification Processes: To comply with regulatory requirements and ensure the security of transactions, AvaTrade implements verification processes for certain payment methods.

- Data Protection: Secure encryption technologies protect your financial transactions and personal information.

By offering a broad spectrum of payment methods, AvaTrade ensures that traders can start their Forex trading journey efficiently and securely. Whether you prefer the traditional bank wire approach or the convenience of digital wallets, AvaTrade facilitates a seamless integration into the world of Forex trading.

How to Make Your First Deposit with AvaTrade

Embarking on your Forex trading journey with AvaTrade begins with making your first deposit. This step is crucial as it not only funds your account but also opens the door to a world of trading opportunities. To ensure a hassle-free experience, we’ve put together a detailed, step-by-step guide on how to fund your AvaTrade account, along with some helpful tips to streamline the process.

Step-by-step Guide on Making the Initial Deposit

1: Log in to Your AvaTrade Account

- If you don’t have an account yet, you’ll need to create one. Visit AvaTrade’s website, click on ‘Register Now,’ and follow the prompts to set up your account.

- Once your account is set up and verified, log in to your AvaTrade dashboard.

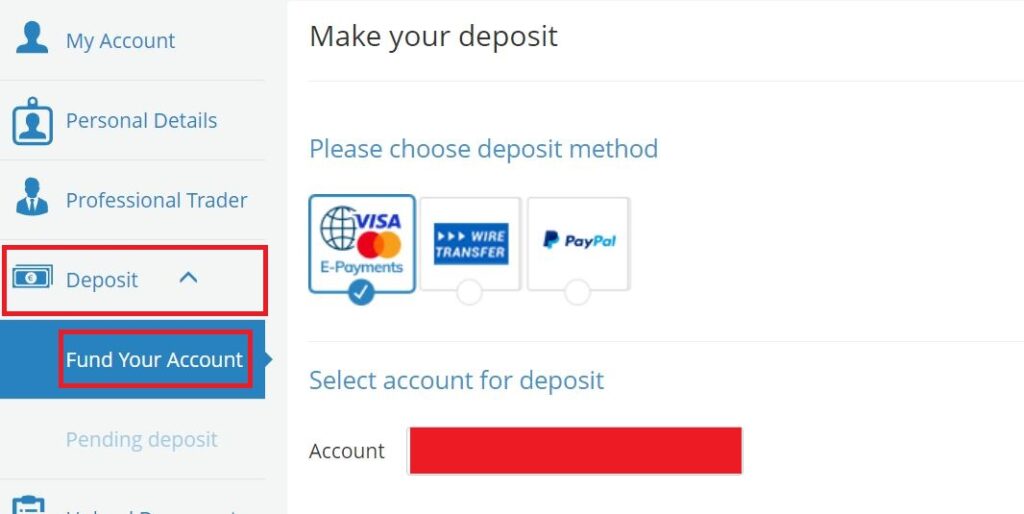

2: Access the Deposit Section

- Navigate to the ‘Deposit’ section within your account dashboard. This is typically found within the ‘My Account’ area or prominently displayed on the dashboard interface.

3: Choose Your Deposit Method

- Select your preferred payment method from the options available, including bank wire transfers, credit/debit cards, or e-wallets such as PayPal or Skrill.

4: Enter Deposit Amount

- Input the amount you wish to deposit, ensuring it meets or exceeds AvaTrade’s minimum deposit requirement of $100. Be mindful of any deposit limits specific to your chosen payment method.

5: Complete Any Additional Information

- Depending on the payment method, you may be required to provide additional details, such as your card information or e-wallet login.

6: Confirm the Deposit

- Review all the information to ensure accuracy, then confirm your deposit. For credit/debit cards and e-wallets, the funds should appear in your AvaTrade account almost instantly. Bank transfers may take several business days.

Tips for a Smooth Deposit Process

- Verify Your Account: Ensure your AvaTrade account is fully verified before attempting to make a deposit. This often involves submitting identification documents and can prevent delays.

- Check for Fees: While AvaTrade doesn’t charge deposit fees, be aware of potential fees from your bank or payment provider, especially for international transactions.

- Use the Same Name: The name on your AvaTrade account should match the name on your payment method to avoid any issues with the deposit.

- Consider Currency Conversion: If depositing in a currency different from your account’s base currency, be aware of conversion rates and fees.

- Secure Connection: Always ensure you’re making deposits over a secure and private internet connection to protect your financial information.

Following these steps and tips can help ensure that your first deposit into your AvaTrade account is as smooth and stress-free as possible. This initial deposit is more than just a transaction; it’s your first step towards becoming an active participant in the Forex markets.

Benefits of Trading with AvaTrade: Beyond the Minimum Deposit

Choosing AvaTrade as your Forex broker goes beyond just meeting the minimum deposit requirement. This platform offers a rich tapestry of features, tools, and educational resources designed to enhance your trading experience and improve your chances of success. Let’s delve into the advantages of trading with AvaTrade and how the initial deposit is just a stepping stone into a world of trading opportunities.

Highlighting the Advantages of Trading with AvaTrade

Diverse Trading Platforms

AvaTrade caters to all types of traders by offering a variety of platforms, including:

- MetaTrader 4 and MetaTrader 5: Enjoy the gold standard of trading platforms, known for their robustness and comprehensive analytical tools.

- AvaTradeGO: The broker’s mobile app provides flexibility and convenience, allowing you to trade on the go with ease.

- WebTrader: For those preferring not to download software, AvaTrade’s WebTrader offers a powerful, web-based trading platform accessible from any browser.

Comprehensive Educational Resources

Education is at the heart of AvaTrade’s value proposition, with a deep commitment to empowering traders:

- Free Educational Material: Access a wide range of materials, from eBooks and articles to webinars and video tutorials, suitable for all levels of traders.

- Demo Account: Practice your trading strategies in a risk-free environment with a free demo account loaded with virtual funds.

Advanced Trading Tools

AvaTrade equips traders with tools to enhance their trading strategies:

- Autochartist: This powerful tool scans the markets to identify potential trading opportunities in real time.

- Economic Calendar: Stay ahead of market-moving events with access to a comprehensive economic calendar.

Customer Support

- 24/5 Support: AvaTrade offers round-the-clock support in multiple languages, ensuring that help is available whenever you need it.

Safety and Regulation

- Regulated Broker: AvaTrade is regulated in multiple jurisdictions, offering traders peace of mind that they are trading with a secure and transparent broker.

How the Minimum Deposit Fits into the Overall Value Proposition

The $100 minimum deposit required by AvaTrade is more than just an entry fee; it’s a gateway to a world rich with trading possibilities. This amount is carefully set to ensure accessibility for beginners without compromising on the quality of service and tools provided. It reflects AvaTrade’s commitment to making trading accessible to a wider audience while upholding high standards of security and education.

Key Takeaways:

- Accessibility: The minimum deposit lowers the barrier to entry for new traders, making it feasible for many to start their trading journey.

- Value for Money: When you combine the low minimum deposit with the extensive range of platforms, tools, and educational resources AvaTrade offers, the value proposition becomes clear. It’s not just about funding your account; it’s about investing in a partnership that supports your trading journey.

Choosing AvaTrade means stepping into a trading environment where every tool and resource is designed to help you succeed. The minimum deposit is just the beginning of what promises to be an enriching trading experience, filled with learning, growth, and the potential for success.

Frequently Asked Questions (FAQs) about AvaTrade’s Minimum Deposit

When considering AvaTrade as a Forex broker, many traders, especially those new to the Forex market, have questions regarding the minimum deposit. Understanding these concerns is crucial for making an informed decision. Below, we address some of the most frequently asked questions about AvaTrade’s minimum deposit requirements.

1. What is the minimum deposit required to start trading with AvaTrade?

The minimum deposit required to open a trading account with AvaTrade is $100. This amount is designed to make Forex trading accessible to beginners without a significant initial investment.

2. Can I deposit in currencies other than USD?

Yes, AvaTrade accepts deposits in several different currencies. The equivalent amount to the $100 minimum deposit will be based on the current exchange rates for the currency you choose to deposit in. Be sure to check the specific currencies accepted and any potential conversion fees or rates.

3. Are there any fees associated with making a deposit?

AvaTrade does not charge any fees for depositing funds into your trading account. However, it’s important to note that your bank or payment provider might impose transaction fees, especially for international transfers or currency conversions.

4. How quickly are deposits processed?

The processing time for deposits can vary depending on the payment method:

- Credit/debit cards and e-wallets typically offer instant deposits, allowing you to start trading almost immediately.

- Bank wire transfers may take several business days to process.

5. Is it possible to start trading with less than the minimum deposit?

The minimum deposit of $100 is required to start trading with AvaTrade. This ensures that traders have enough capital to execute trades and manage their accounts effectively, adhering to proper risk management practices.

6. How does the minimum deposit affect my trading leverage?

The minimum deposit does not directly affect your trading leverage. AvaTrade offers various leverage options, but these are primarily determined by the instrument you choose to trade, your account type, and regulatory restrictions in your jurisdiction.

7. Can I increase my minimum deposit after opening my account?

Absolutely! You can deposit more funds into your AvaTrade account at any time. Increasing your capital can offer more flexibility in your trading strategies and potential for higher profits, but it’s essential to consider the associated risks.

8. What happens if I lose my initial deposit? Can I deposit again?

Yes, if you lose your initial deposit, you can deposit more funds into your AvaTrade account. It’s crucial to analyze what went wrong and perhaps utilize AvaTrade’s educational resources to refine your trading strategy before reinvesting.

9. Are there bonuses for making a larger initial deposit?

AvaTrade occasionally offers promotions and bonuses for new and existing clients. It’s best to check the AvaTrade website or contact their customer service for current offers.

10. How can I make a deposit into my AvaTrade account?

To make a deposit, log in to your AvaTrade account, navigate to the deposit section, select your preferred payment method, enter the amount, and follow the instructions to complete the transaction.

These FAQs aim to clarify common queries about AvaTrade’s minimum deposit requirement, helping you make a well-informed decision about starting your Forex trading journey with AvaTrade. If you have more questions or need further assistance, AvaTrade’s customer support team is available 24/5 to help.

Comparison: AvaTrade vs. Other Forex Brokers’ Minimum Deposits

In the vast ocean of Forex trading, choosing the right broker can significantly impact your trading journey. One of the critical factors to consider is the minimum deposit requirement, as it dictates not only your entry point but also how comfortable you are with your initial investment. Let’s compare AvaTrade’s minimum deposit to those of its competitors and discuss the factors you should consider when comparing brokers.

How AvaTrade’s Minimum Deposit Stacks Up Against Its Competitors

AvaTrade sets its minimum deposit at $100, positioning itself as an accessible option for beginners and those looking to trade with a moderate initial investment. Here’s how this compares with other popular Forex brokers:

- Broker A: Might have a lower minimum deposit requirement, say $50, appealing to those with a tighter budget or wanting to test the waters with minimal financial commitment.

- Broker B: Requires a minimum deposit of $200 or more, targeting perhaps a more experienced audience or traders looking to start with a larger capital base.

- Broker C: Offers a tiered account system where minimum deposits can range from $100 to several thousand dollars, depending on the account type and services provided.

Key Takeaways:

- AvaTrade’s $100 minimum deposit sits comfortably in the middle, offering a balanced entry point for most traders.

- The variance in minimum deposits reflects the diverse strategies and target audiences of different Forex brokers.

Factors to Consider When Comparing Brokers

While the minimum deposit is a significant factor, it’s essential to look at the broader picture when choosing a Forex broker. Consider the following:

1. Regulatory Compliance

- Ensure the broker is regulated by reputable financial authorities. This adds a layer of security and trust to your trading experience.

2. Trading Platforms and Tools

- Evaluate the trading platforms and tools offered by the broker. Look for user-friendly interfaces, technical analysis tools, and automated trading options.

3. Educational Resources

- For beginners, a broker that offers comprehensive educational materials can be a game-changer. Check if the broker provides webinars, tutorials, and other learning resources.

4. Customer Support

- Reliable customer support is crucial, especially for new traders. Look for brokers offering 24/5 support with multiple contact options.

5. Fees and Spreads

- Compare the fees, spreads, and any other charges. These can significantly affect your profitability, especially if you plan to trade frequently or with significant volume.

6. Account Types and Services

- Some brokers offer different account types with varying services, leverage options, and spreads. Consider what fits your trading style and experience level best.

7. Payment Methods and Withdrawal Processes

- Check the available payment methods and the ease of withdrawing your funds. Look for brokers that offer quick, simple, and low-cost withdrawal processes.

8. Bonuses and Promotions

- While not a primary factor, bonuses and promotions can offer additional value. However, read the terms and conditions carefully.

When comparing AvaTrade with other brokers, it’s clear that the minimum deposit is just one piece of the puzzle. The overall value proposition, including the blend of security, resources, tools, and support, is crucial. AvaTrade’s balance of a reasonable minimum deposit with a comprehensive suite of services makes it a competitive option for many traders.

Deciding on a Forex broker is a significant step in your trading journey. Take the time to research and compare based on the factors above to find the broker that best meets your needs and trading goals.

Case Studies: Success Stories with Minimum Deposit Accounts at AvaTrade

The journey to Forex trading success is as diverse as the traders themselves. Starting with a minimum deposit account, several traders have navigated the complexities of the markets to carve out success stories worth sharing. These narratives not only inspire but also provide valuable insights and lessons for those considering or starting their trading journey with AvaTrade. Here, we explore a couple of such stories, highlighting the strategies, challenges, and key takeaways from their experiences.

Case Study 1: The Conservative Strategist

Background

John, a university student with a keen interest in finance, decided to venture into Forex trading. With limited disposable income, he started with AvaTrade’s minimum deposit of $100. His strategy focused on conservative trading, prioritizing risk management and steady growth over high-risk, high-reward trades.

Strategy

- Risk Management: John never risked more than 1% of his account balance on a single trade.

- Education: He leveraged AvaTrade’s educational resources to understand market analysis and trading psychology.

- Consistency: Instead of chasing big wins, John aimed for consistent, small gains, compounding his success over time.

Outcome

After a year of disciplined trading, John managed to grow his account significantly, learning valuable lessons in patience and risk management.

Insights and Lessons

- Start Small: You don’t need a large deposit to start trading. Even with minimum deposits, strategic planning and discipline can lead to success.

- Educate Yourself: Continuously learning and adapting is crucial in Forex trading.

- Risk Management: Protecting your capital is key to long-term success in the Forex market.

Case Study 2: The Tech-Savvy Trader

Background

Sarah, with a background in tech, was drawn to Forex trading out of curiosity and the potential for applying her analytical skills. Starting with the minimum deposit, she focused on using technical analysis and trading automation to make informed trading decisions.

Strategy

- Technical Analysis: Sarah used AvaTrade’s advanced charting tools to identify trading opportunities.

- Automated Trading: She experimented with automated trading systems to execute trades based on predefined criteria, reducing emotional decision-making.

- Leverage and Diversification: While using leverage cautiously, Sarah diversified her trades across different currency pairs to spread risk.

Outcome

Sarah’s approach paid off, allowing her to slowly but steadily build her trading portfolio and gain a deeper understanding of the markets.

Insights and Lessons

- Leverage Technology: Utilizing available technologies and trading tools can enhance decision-making and strategy execution.

- Emotion Management: Automated trading can help manage emotions by sticking to a predetermined strategy.

- Continuous Improvement: The success in Forex trading comes from not just winning trades but also from learning from losses and continuously refining your strategies.

Key Takeaways from Success Stories

- Starting Point: Success in Forex trading doesn’t hinge on starting with a large deposit. Strategic, informed trading can lead to growth, even from a minimum deposit.

- Learning Curve: Both success stories emphasize the importance of education, strategy, and risk management as pillars of successful trading.

- Patience and Discipline: Above all, patience and discipline stand out as critical virtues, guiding traders through the ups and downs of their trading journey.

These stories of traders who began with AvaTrade’s minimum deposit highlight that, with the right approach, the Forex market offers substantial opportunities for growth and learning. Whether you’re a student like John or a tech enthusiast like Sarah, AvaTrade provides the platform, tools, and resources to support your trading aspirations.

Concluding Thoughts and Getting Started with AvaTrade

The world of Forex trading is vast and filled with opportunities for those willing to dive into its depths. A crucial step in this journey involves selecting a broker that not only suits your trading style and goals but also makes the path to entry as smooth as possible. The concept of minimum deposits plays a significant role here, serving as a gateway for many to the Forex markets. AvaTrade, with its approachable minimum deposit requirement, stands out as a compelling choice for traders at all levels.

The Importance of Understanding Minimum Deposits

Understanding the implications of minimum deposits is more than just a financial consideration; it’s about recognizing the balance between accessibility and responsibility in trading. A minimum deposit:

- Lowers Barriers: By keeping the entry barrier low, AvaTrade encourages a broader spectrum of individuals to explore Forex trading.

- Encourages Learning: Starting with a smaller investment allows traders to learn the ropes without the pressure of having a significant amount of capital on the line.

- Facilitates Risk Management: It serves as a practical introduction to managing risk, encouraging traders to adopt strategies that protect their investment.

In essence, the minimum deposit concept underscores a broker’s commitment to making Forex trading accessible, while also highlighting the importance of prudent trading practices.

Steps to Take Next for Interested Traders

For those considering AvaTrade as their bridge to the Forex markets, here’s how to get started:

1: Research and Education

- Begin with exploring AvaTrade’s extensive library of educational resources. Knowledge is your most valuable asset in Forex trading.

2: Open an Account

- Visit AvaTrade’s website and follow the process to open an account. Ensure you have all necessary documents ready for a smooth verification process.

3: Make Your First Deposit

- Once your account is set up, proceed to make your first deposit. Remember, with AvaTrade, you can start with as little as $100.

4: Explore the Platform

- Familiarize yourself with the trading platforms available on AvaTrade. Consider starting with a demo account to practice your strategies without any risk.

5: Develop a Trading Plan

- Before diving into live trading, develop a comprehensive trading plan. Decide on your trading style, preferred currency pairs, risk management strategies, and goals.

6: Begin Trading

- With your account funded and a plan in hand, you’re ready to begin trading. Start small, be patient, and continuously learn from your experiences.

7: Continuous Learning and Adaptation

- The Forex market is dynamic. Stay committed to learning and adapting your strategies as you gain more experience.

Final Thoughts

AvaTrade represents a blend of accessibility, educational support, and trading technology designed to empower traders. The minimum deposit is but the first step in a potentially rewarding journey. As you embark on this path, remember that success in Forex trading is not about the destination but the knowledge, experiences, and growth you accumulate along the way.

Interested in beginning your trading journey with AvaTrade? Embrace the opportunity to transform your understanding of the Forex markets into tangible trading strategies and success stories. Welcome to the world of Forex trading, where the potential for growth and learning is boundless.