CFD trading, or trading Contracts for Difference, has emerged as a popular and versatile way for investors to participate in the movement of asset prices without owning the underlying assets. Understanding what CFDs are, how CFD trading works, and how it differs from traditional investing is crucial for anyone considering this type of trading.

What are CFDs?

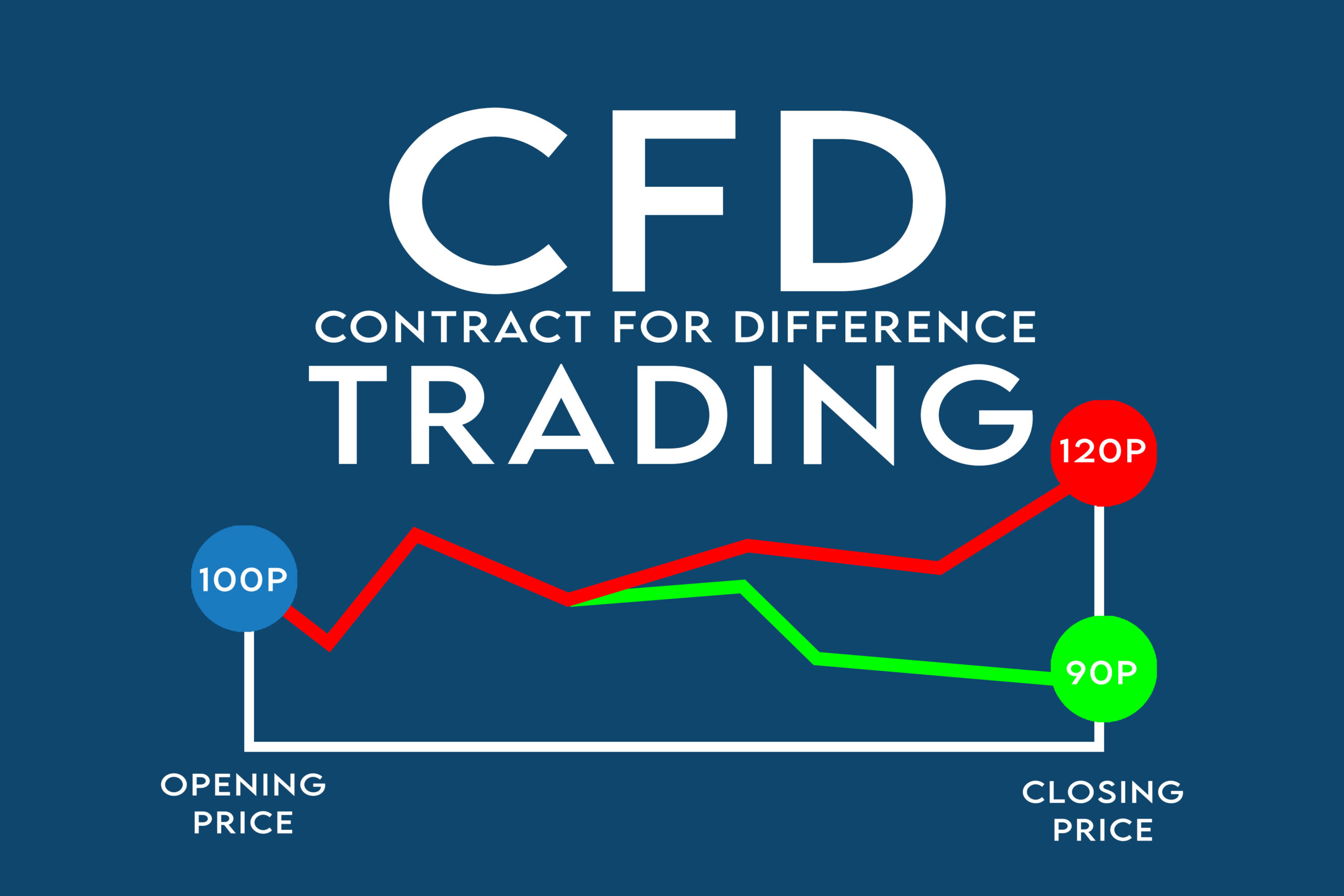

A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the rising or falling prices of fast-moving global financial markets, including indices, commodities, currencies, and shares. Essentially, CFD trading is a contract between a trader and a broker to exchange the difference in the value of an asset from the time the contract is opened to when it is closed.

How CFD Trading Works

CFD trading enables traders to speculate on price movements without owning the actual asset. The profits or losses are determined by the difference in price between when a trade is entered and exited. CFDs are traded on margin, meaning traders can leverage their positions to control large amounts of capital with a relatively small investment. However, it’s important to note that while leverage can amplify profits, it also increases the potential for losses.

Key Features of CFD Trading:

- Leverage: CFDs provide higher leverage than traditional trading, offering the potential for significant returns from a small initial outlay. However, this also means increased risk.

- Going Long or Short: Traders can take long (buy) positions if they believe the market will rise or short (sell) positions if they believe the market will fall.

- No Ownership of the Underlying Asset: CFD traders do not own or have any rights to the underlying assets. They are merely speculating on the price movement.

Differences Between CFD Trading and Traditional Investing

While both CFD trading and traditional investing involve speculating on the price movements of assets, several key differences distinguish the two approaches.

Ownership

Traditional investing involves buying and holding assets such as stocks, bonds, or commodities, with investors owning a piece of the asset. In contrast, CFD trading does not confer ownership of the underlying asset.

Leverage

CFD trading typically offers higher leverage than traditional investing, meaning traders can control large positions with a relatively small amount of capital. While this can increase potential returns, it also heightens the risk of significant losses.

Market Access

CFD trading provides access to a broad range of markets from a single platform, including international markets, without needing to directly own the assets or navigate different market regulations.

Costs and Fees

CFD traders may face different costs, including the spread (the difference between the buy and sell price), holding costs for positions kept open overnight, and commission fees, depending on the broker. Traditional investing may involve brokerage fees, taxes, and other transactional costs tied to asset ownership.

Trading Strategies

CFD trading offers the flexibility to employ a wider range of trading strategies, including short selling, which can be more restricted in traditional investing.

Choosing a CFD Broker

When it comes to CFD trading, selecting the right broker is paramount to ensuring a successful trading experience. With a plethora of CFD brokers available, each offering different terms, platforms, and levels of service, it’s crucial to consider several key factors to make an informed choice that aligns with your trading goals and strategies. Here’s a guide to the essential considerations when choosing a CFD broker.

Regulation

Regulation should be at the forefront of your criteria when selecting a CFD broker. A regulated broker adheres to strict standards and oversight by financial authorities, providing a level of security and transparency.

- Why It Matters: Trading with a regulated broker minimizes the risk of fraud and ensures fair trading practices. It also means you have access to a regulatory body for dispute resolution if necessary.

- What to Look For: Verify the broker’s regulatory status and the jurisdictions in which it is authorized to operate. Reputable regulatory bodies include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

Spreads and Commissions

The cost of trading is a critical factor impacting your profitability. CFD brokers typically charge through spreads, commissions, or a combination of both.

- Why It Matters: Lower spreads and commissions can significantly reduce trading costs, especially for active traders. Understanding the fee structure is essential to manage your trading expenses effectively.

- What to Look For: Compare the broker’s spreads on major markets and consider any additional commissions or fees that may apply. Some brokers offer tighter spreads but may charge higher commissions or vice versa.

Trading Platform

The trading platform is your gateway to the markets; hence, its performance, reliability, and features are vital to your trading activities.

- Why It Matters: A user-friendly, stable platform with advanced charting tools, technical indicators, and seamless execution can enhance your trading experience and effectiveness.

- What to Look For: Test the broker’s platform for usability and functionality. Many brokers offer demo accounts, allowing you to evaluate the platform’s performance and features without risking real money.

Customer Support

Quality customer support can be invaluable, especially in fast-moving markets where timely assistance can make a significant difference.

- Why It Matters: Access to responsive, knowledgeable support can help quickly resolve issues, ensuring your trading activities are not unduly disrupted.

- What to Look For: Look for brokers that offer multiple channels for customer support (e.g., live chat, phone, email) and check their availability (24/5, 24/7). Reading reviews and feedback from other traders can provide insights into the broker’s customer service quality.

Additional Considerations

- Educational Resources and Research: A broker that offers comprehensive educational materials, market analysis, and research tools can be a valuable resource for traders looking to deepen their market knowledge and refine their strategies.

- Account Types and Requirements: Assess the broker’s account offerings, including minimum deposit requirements, leverage options, and any additional features that cater to different trading styles and experience levels.

Understanding Leverage in CFD Trading

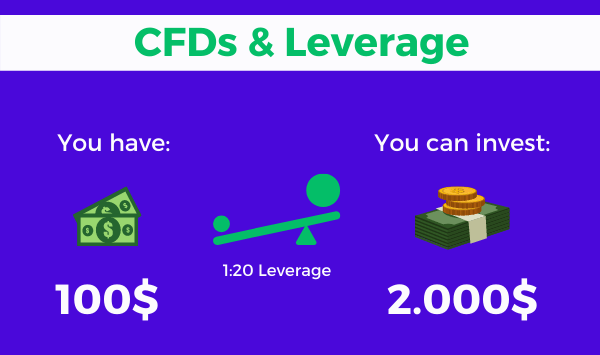

Leverage is a fundamental concept in CFD (Contract for Difference) trading, offering the ability to control a large position with a relatively small amount of capital. While leverage can magnify potential profits, it also increases the risk of significant losses, making it essential for traders to understand how it works, its impact on trading capital, and strategies for managing the associated risks.

The Concept of Trading on Margin

Trading on margin is the practice of borrowing funds from a broker to open a larger position than one’s capital alone would allow. In CFD trading, leverage is expressed as a ratio, such as 10:1, 50:1, or even higher, indicating the proportion of exposure relative to the required margin.

- Example: With a leverage ratio of 50:1, a trader can control a position worth $50,000 with just $1,000 of their own capital.

How Leverage Affects Trading Capital

Leverage has a direct impact on both potential profits and losses, amplifying them in proportion to the degree of leverage used.

Amplified Profits

When a leveraged CFD position moves in the trader’s favor, the percentage gain on their initial investment can be significantly higher compared to trading without leverage.

- Example: If a trader uses $1,000 to control a $50,000 position and the position appreciates by 2%, the profit is $1,000 (2% of $50,000), effectively doubling the initial investment, thanks to leverage.

Amplified Losses

Conversely, if the market moves against the leveraged position, losses can quickly escalate, potentially exceeding the initial investment.

- Example: Using the same $1,000 to control a $50,000 position, a 2% move in the opposite direction would result in a $1,000 loss, wiping out the trader’s initial capital.

Managing the Risks of Leverage

Given the high-risk nature of leveraged CFD trading, employing effective risk management strategies is crucial.

Use Stop-Loss Orders

Stop-loss orders can limit potential losses by automatically closing a position at a predetermined price level. This tool is essential for preventing uncontrolled losses in volatile markets.

Practice Responsible Leverage

While it might be tempting to use the highest possible leverage, opting for lower leverage ratios can help manage risk, especially for inexperienced traders or in highly volatile market conditions.

Monitor Margin Requirements

Brokers require a certain amount of funds to be kept in the account as margin. It’s vital to monitor these requirements and ensure your account has sufficient funds to avoid margin calls, which can lead to the forced closure of positions.

Continuous Education

Understanding the markets, staying informed about economic events, and continuously learning about risk management techniques can enhance your ability to make informed trading decisions and use leverage wisely.

Risk Management Strategies in CFD Trading

Effective risk management is the cornerstone of successful CFD (Contracts for Difference) trading. Given the inherent risks associated with leveraged products, employing robust risk management techniques is crucial to protect trading capital and ensure longevity in the trading world. This includes using stop losses, limit orders, and appropriate position sizing, along with maintaining a disciplined trading approach.

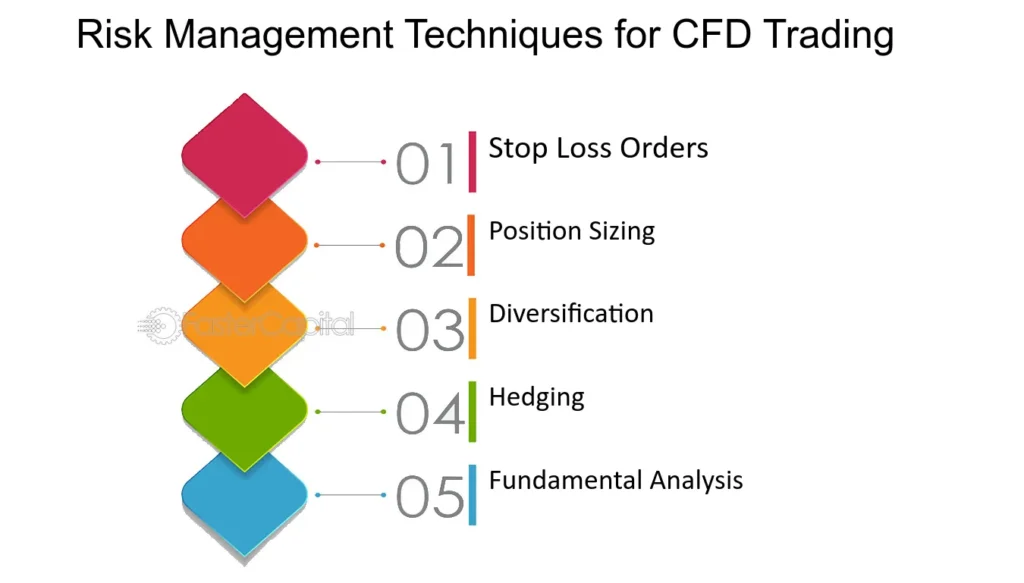

Essential Risk Management Techniques

Using Stop Losses

A stop-loss order is an automatic order placed with a broker to sell a security when it reaches a certain price. It’s designed to limit an investor’s loss on a security position.

- Benefits: Helps prevent emotional decision-making by setting predetermined exit points for losing trades.

- Application: Determine the stop-loss level before entering a trade. This can be a percentage of your trading capital or based on technical analysis, such as below a support level.

Limit Orders

Limit orders allow traders to specify the price at which they are willing to buy or sell a security. Unlike market orders, which execute at the current market price, limit orders are executed only at the specified price or better.

- Benefits: Provides price control, ensuring you enter or exit trades at your desired price levels.

- Application: Use limit orders to enter positions at a more favorable price or to take profits at a predetermined level.

Position Sizing

Position sizing involves determining the amount of capital to allocate to a specific trade, based on the risk level and the overall trading strategy.

- Benefits: Helps manage overall exposure and prevent significant losses on a single trade.

- Application: Calculate position size by considering the stop-loss level, the risk per trade (usually a percentage of your total trading capital), and the total account size.

Maintaining a Disciplined Approach to Trading

Discipline in trading involves adhering to your trading plan, strategy, and risk management rules, even in the face of market volatility or emotional stress.

Importance of Discipline

- Consistency: Discipline helps maintain consistency in applying your trading strategy, crucial for measuring its effectiveness over time.

- Emotional Control: By sticking to a plan, traders can avoid emotional reactions to market movements, such as fear and greed, which can lead to poor decision-making.

- Risk Control: A disciplined approach ensures that risk management techniques are consistently applied, protecting your trading capital.

Strategies for Enhancing Discipline

- Develop a Trading Plan: Outline your trading strategy, risk management rules, and criteria for entering and exiting trades. A clear plan provides a roadmap for disciplined trading.

- Keep a Trading Journal: Document all trades, including the rationale for entering and exiting and the emotional state. Reviewing the journal can offer insights into your trading behavior and how well you’re adhering to your plan.

- Set Realistic Goals: Setting achievable trading goals can help maintain focus and motivation, reducing the temptation to take undue risks for higher returns.

Developing a Trading Plan for CFDs

Creating a comprehensive trading plan is vital for anyone engaging in CFD (Contracts for Difference) trading. A well-structured plan not only guides your trading decisions but also helps manage emotions, ensuring you remain focused on your long-term goals rather than reacting impulsively to market fluctuations. Here, we’ll explore the essential components of a successful CFD trading plan, including market analysis, entry and exit criteria, and the risk/reward ratio. Additionally, we’ll discuss the significance of maintaining a trading journal to track performance and refine strategies.

Components of a Successful CFD Trading Plan

Market Analysis

Your trading plan should start with a clear framework for analyzing the markets. This could involve a combination of fundamental analysis to gauge the broader economic environment and technical analysis to identify specific entry and exit points.

- Fundamental Analysis: Understand the economic indicators, news events, and geopolitical developments that can affect market sentiment and price movements.

- Technical Analysis: Utilize charts, patterns, and indicators to identify trends and potential turning points in the market.

Entry and Exit Criteria

Defining clear criteria for entering and exiting trades is crucial. This helps remove ambiguity and allows for consistent decision-making.

- Entry Criteria: Specify what conditions must be met for you to open a position. This could include technical indicators, a certain news event, or reaching a specific price level.

- Exit Criteria: Just as important as knowing when to enter a trade is knowing when to exit, whether in profit or loss. Set clear rules for closing positions, including stop-loss and take-profit levels.

Risk/Reward Ratio

The risk/reward ratio is a key metric that helps traders assess the potential return of a trade relative to its risk. A favorable risk/reward ratio ensures that potential gains outweigh possible losses over time.

- Setting Ratios: A common approach is to aim for a risk/reward ratio of at least 1:2, meaning you stand to gain twice what you are risking on a trade.

- Risk Management: Determine the maximum percentage of your trading capital you are willing to risk on a single trade. A general guideline is to risk no more than 1-2% of your capital on any one trade.

The Significance of a Trading Journal

A trading journal is a critical tool for any CFD trader. It serves as a record of all trades, including the strategy used, entry and exit points, the outcome, and any relevant observations about market conditions or emotional states.

Tracking Performance

- Review and Adjust: Regularly reviewing your trading journal allows you to analyze your trading performance, identify patterns in your trading behavior, and adjust your strategy as needed.

- Learning from Mistakes: Documenting not just your successes but also your losses can provide valuable lessons, helping you refine your trading approach.

Refining Strategies

- Strategy Development: By keeping a detailed record of market conditions and how your trades perform under various scenarios, you can develop and test new strategies more effectively.

- Emotional Discipline: Recording your emotional state for each trade can help you understand the impact of emotions on your trading decisions, fostering greater emotional discipline over time.

Analyzing Markets for CFD Trading

Successful CFD trading hinges on the ability to analyze and interpret market movements accurately. Traders utilize a blend of fundamental and technical analysis tools tailored to the nuances of CFD trading, enabling them to make informed decisions based on market indicators and chart patterns. This comprehensive approach to market analysis not only aids in predicting future price movements but also in identifying trading opportunities. Let’s delve into the fundamental and technical analysis tools specific to CFD trading and explore how to use market indicators and charts effectively.

Fundamental Analysis in CFD Trading

Fundamental analysis in the context of CFD trading involves evaluating economic indicators, corporate earnings reports, and geopolitical events to assess the underlying value and potential future movement of a financial instrument.

Economic Indicators

Economic indicators such as GDP growth rates, employment data, inflation rates, and central bank interest rate decisions can significantly impact market sentiment and, consequently, asset prices in CFD trading.

- Interpretation: Positive economic data may boost market confidence, leading to bullish movements in related CFDs, while negative data can have the opposite effect.

Corporate Earnings and News

For CFDs tied to company stocks, earnings reports and corporate news play a critical role in driving price volatility.

- Application: Analyzing earnings performance relative to market expectations can provide insights into a company’s health and its stock’s potential direction.

Geopolitical Events

Geopolitical developments and global events can cause swift and substantial market movements, affecting a wide range of CFDs from indices to commodities.

- Monitoring: Staying informed about geopolitical events and understanding their potential impact on different markets is crucial for timely and effective decision-making.

Technical Analysis in CFD Trading

Technical analysis involves examining historical price data and trading volumes to forecast future market movements. This approach is particularly well-suited to CFD trading, given its focus on price actions.

Market Indicators

Market indicators such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are widely used to analyze trends, momentum, and potential reversal points.

- Usage: Incorporating these indicators into your analysis can help identify entry and exit points, as well as gauge the strength of market trends.

Chart Patterns

Chart patterns, including head and shoulders, double tops and bottoms, and various triangles, are critical tools for technical analysts.

- Identification: Learning to recognize these patterns can provide valuable clues about future market movements, enabling traders to capitalize on potential price breakouts or reversals.

Candlestick Patterns

Candlestick patterns offer insights into market sentiment and potential short-term price movements, making them invaluable for CFD traders looking to make quick, informed decisions.

- Application: Mastering the interpretation of candlestick formations like doji, hammer, and engulfing patterns can enhance your ability to predict market reactions to news events or economic data releases.

The Psychological Aspects of CFD Trading

CFD (Contracts for Difference) trading, while offering significant opportunities for profit, also presents unique psychological challenges. The high leverage associated with CFDs can amplify both gains and losses, often leading to intense emotional pressures. Recognizing and managing these emotions is crucial for making rational trading decisions and developing a strong trading mindset. Let’s explore the psychological aspects of CFD trading and outline strategies for maintaining emotional control.

Understanding Psychological Pressures

Fear and Greed

Fear and greed are powerful emotions that can distort traders’ judgment, leading to irrational decisions. A fear of losing money often results in closing positions prematurely or avoiding adequate risks. On the other hand, greed can drive traders to hold on to winning positions for too long, hoping for even higher profits, which may not materialize. Conversely, greed can result in holding onto positions for too long in the hope of higher profits or over-leveraging.

Overconfidence

After a series of successful trades, traders may become overconfident, leading to complacency and increased risk-taking without proper analysis or regard for risk management principles.

The Impact of Losses

Losses, an inevitable part of trading, can have a profound psychological impact, often leading to “revenge trading” where traders hastily enter new trades without adequate analysis in an attempt to recover losses quickly.

Strategies for Managing Emotions

Establish a Trading Plan

A well-defined trading plan, including clear entry, exit, and risk management strategies, can help maintain focus and discipline, reducing the influence of emotions on trading decisions.

Set Realistic Goals

Setting realistic trading goals based on a thorough understanding of the markets and one’s own trading skills can prevent frustration and disappointment, which may lead to emotional decision-making.

Practice Mindfulness and Stress Reduction

Mindfulness practices and stress reduction techniques, such as meditation or regular physical exercise, can enhance emotional regulation, helping traders remain calm and focused under pressure.

Maintain a Trading Journal

A trading journal that records not only trades but also emotional states can be invaluable for identifying patterns in emotional responses and decision-making. Reflecting on these patterns can facilitate more disciplined trading.

Developing a Strong Trading Mindset

Continuous Learning

The markets are constantly evolving, and so should traders’ skills and knowledge. Continuous learning helps build confidence and reduces the fear of the unknown.

Acceptance of Losses

Accepting that losses are a natural part of trading enables traders to view them as learning opportunities rather than personal failures, reducing emotional distress and the temptation for revenge trading.

Seek Support

Participating in trading communities or seeking mentorship can provide emotional support, encouragement, and valuable perspectives, reinforcing a positive trading mindset.

Focus on Process Over Outcomes

Concentrating on executing your trading plan flawlessly, rather than obsessing over individual trade outcomes, can shift the focus from short-term gains or losses to long-term growth and development.

Practical Tips for Starting with CFD Trading

Entering the world of CFD (Contracts for Difference) trading can be both exciting and daunting for beginners. With the potential for significant profits comes the risk of substantial losses, especially when you’re new to trading. Here are practical steps to making your first CFD trade, accompanied by advice on avoiding common pitfalls, to set a solid foundation for your trading journey.

Steps to Making Your First CFD Trade

Educate Yourself Thoroughly

Before placing your first trade, ensure you have a strong understanding of how CFD trading works, including the mechanics of trading on margin and the implications of leverage. Familiarize yourself with financial markets and instruments you plan to trade.

Choose a Reputable CFD Broker

Selecting the right broker is crucial. Look for a broker that is well-regulated, offers competitive spreads, a user-friendly trading platform, and excellent customer support. A demo account feature is also beneficial for practice without financial risk.

Start with a Trading Plan

A solid trading plan should outline your trading goals, risk tolerance, strategies, and criteria for entering and exiting trades. This plan serves as your roadmap and helps to keep emotions at bay.

Practice on a Demo Account

Before trading with real money, practice on a demo account to gain familiarity with the trading platform and to test your trading strategy in a risk-free environment. This step is invaluable for building confidence.

Understand and Manage Risks

Implement risk management strategies from the start. Use stop-loss orders to limit potential losses, and never invest more than you can afford to lose. Be mindful of the leverage effect and its potential to amplify both gains and losses.

Make Your First Trade

When you feel ready, make your first CFD trade. Start small, and choose a market you’re familiar with. Monitor the trade closely, and remember to adhere to your trading plan and risk management rules.

Common Pitfalls and How to Avoid Them

Overleveraging

One of the most common pitfalls in CFD trading is using excessive leverage. While leverage can increase profits, it can also lead to significant losses, often faster than you might expect.

- How to Avoid: Use leverage cautiously. Start with lower leverage ratios until you’re more experienced and always be aware of the total exposure of your trades.

Lack of Risk Management

Failing to implement risk management strategies is a critical mistake that can deplete your trading capital quickly.

- How to Avoid: Always use stop-loss orders to limit potential losses on every trade, and consider setting take-profit levels to secure profits. Avoid risking more than a small percentage of your capital on a single trade.

Trading Based on Emotions

Allowing emotions like fear, greed, or excitement to drive trading decisions can lead to irrational and often detrimental trading behaviors.

- How to Avoid: Stick to your trading plan, and make decisions based on analysis rather than emotions. Take breaks if you find yourself becoming too emotionally invested in your trades.

Neglecting Education and Research

Underestimating the importance of continuous education and market research can hinder your ability to make informed trading decisions.

- How to Avoid: Dedicate time regularly to learning more about financial markets, analysis techniques, and new trading strategies. Stay updated with market news and economic events that could impact your trades.

The Legal and Tax Implications of CFD Trading

Contracts for Difference (CFD) trading, while offering flexibility and the potential for high returns, comes with its own set of legal and tax implications. These implications can vary significantly across different jurisdictions, making it crucial for traders to understand the regulatory environment and tax considerations associated with CFD trading in their country. This knowledge not only ensures compliance with laws and regulations but can also help in optimizing tax obligations.

Regulatory Environment for CFD Trading

The legal framework governing CFD trading differs from one country to another, with some jurisdictions having strict regulations and others more lenient.

Regulatory Bodies

In many countries, financial regulatory authorities oversee CFD providers and trading activities to protect investors and ensure market integrity. For example:

- In the United States, the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) regulate forex and securities trading, respectively. However, CFD trading is not permitted for U.S. residents.

- In the United Kingdom, the Financial Conduct Authority (FCA) oversees CFD trading, ensuring that firms meet specific standards and provide a certain level of protection to traders.

- The Australian Securities and Investments Commission (ASIC) regulates CFD trading in Australia, offering guidelines to protect investors.

Compliance and Protections

Regulated CFD brokers are required to comply with a range of requirements, including capital adequacy, client fund protection, and transparent trading practices. Traders should always choose a regulated broker to benefit from these protections.

Tax Considerations for CFD Traders

Tax treatment of profits and losses from CFD trading can be complex and varies by jurisdiction. It’s essential to understand the basic tax considerations and seek professional advice for your specific situation.

Tax Treatment

- Capital Gains Tax (CGT): In many jurisdictions, profits from CFD trading are subject to capital gains tax. Traders must report gains and losses on their tax returns, with the net result affecting their tax liability.

- Income Tax: Depending on the country and the trader’s circumstances, profits from CFD trading may be considered regular income and taxed accordingly.

- Deductions and Losses: Traders may be able to deduct trading-related expenses and offset losses against other capital gains, depending on local tax laws.

Keeping Records

Maintaining detailed records of all CFD transactions is critical for tax purposes. This includes dates of trades, amounts invested, profits, losses, and any associated costs. Accurate record-keeping simplifies the process of reporting gains and losses and determining tax liabilities.

Strategies for Tax Efficiency

- Utilize Tax Allowances: Some jurisdictions offer tax-free allowances or thresholds for capital gains, which can be utilized to minimize tax liabilities.

- Offsetting Losses: In certain cases, losses from CFD trading can be offset against other capital gains or carried forward to future years, reducing overall tax obligations.

Continuing Your Education in CFD Trading

The path to becoming proficient in CFD trading is ongoing. Markets evolve, strategies adapt, and new tools emerge. For traders, continuous education is not just beneficial; it’s essential for staying competitive and enhancing profitability. Below, we explore key resources for further learning and underscore the importance of keeping abreast with financial news and market trends in the realm of CFD trading.

Resources for Further Learning and Improvement

Online Courses

A wealth of online courses caters to both beginners and experienced traders, covering various aspects of CFD trading—from fundamentals and strategies to risk management and psychological aspects.

- How to Choose: Look for courses that offer comprehensive coverage relevant to your trading level and interests. Prioritize those with positive reviews and credentials from reputable instructors or organizations.

Webinars

Webinars provide an interactive platform to learn from trading experts and industry professionals. They often cover market analysis, trading techniques, and live trading sessions, offering insights into practical trading applications.

- Benefits: The real-time nature of webinars allows for Q&A sessions, giving you the opportunity to clarify doubts and gain direct insights from trading professionals.

Trading Communities and Forums

Joining trading communities or forums can be incredibly valuable. These platforms enable traders to share experiences, strategies, tips, and advice. They also serve as a support network, especially useful during challenging trading periods.

- Engagement: Actively participate in discussions, but remain critical of the advice given. Use these communities to exchange knowledge rather than follow recommendations blindly.

Staying Updated with Financial News and Market Trends

The importance of staying informed about financial news and market trends cannot be overstated in CFD trading. Market sentiment can change rapidly based on economic data releases, geopolitical events, and financial news, affecting asset prices and trading opportunities.

Financial News Websites and Platforms

Regularly follow reputable financial news websites and platforms that provide up-to-date reports, analysis, and commentary on global economic events and market trends.

- Actionable Insights: Use these insights to anticipate market movements and adjust your trading strategies accordingly.

Economic Calendars

Economic calendars are crucial tools for CFD traders, listing upcoming economic data releases, earnings reports, and central bank meetings.

- Strategic Planning: Incorporate economic calendar events into your trading plan to manage around periods of potential high volatility and market-moving events.

Continuing Education Platforms

Dedicated financial education platforms offer courses, articles, tutorials, and more, catering to traders at all levels. These resources can deepen your understanding of market analysis, trading psychology, and strategy development.

- Lifelong Learning: Commit to a habit of lifelong learning. The more you understand the markets and trading strategies, the better equipped you’ll be to navigate the complexities of CFD trading.

FAQs:

- What Is CFD Trading?

- CFD trading is a form of speculative trading that allows you to speculate on the price movement of various financial instruments without owning the underlying assets.

- How Do I Choose a CFD Broker?

- Look for a regulated broker with competitive spreads/commissions, a user-friendly trading platform, robust customer support, and educational resources.

- What Does Trading on Margin Mean?

- Trading on margin means borrowing money from your broker to open a larger position than your available capital would otherwise permit, amplifying both potential profits and losses.

- How Can I Manage Risks in CFD Trading?

- Employ risk management strategies like setting stop-loss orders, never risking more than a small percentage of your capital on a single trade, and avoiding excessive leverage.

- What Is the Importance of a Trading Plan?

- A trading plan helps you make objective decisions based on pre-defined criteria, keeping emotions at bay and improving consistency in trading.

- Should I Use Technical or Fundamental Analysis?

- Both can be valuable. Technical analysis helps predict future movements based on past price action, while fundamental analysis looks at economic indicators, industry conditions, and company financials.

- How Do Emotions Affect CFD Trading?

- Emotional decision-making can lead to impulsive actions and increased risk-taking. Developing a disciplined trading approach is crucial for success.

- What Are the Common Mistakes in CFD Trading?

- Common mistakes include overleveraging, neglecting risk management, letting emotions drive trading decisions, and failing to research and plan trades.

- What Are the Tax Implications of CFD Trading?

- Tax treatment of CFD trading varies by country and may depend on whether it’s considered capital gain or trading income. Consult a tax professional for advice.

- How Can I Continue Learning About CFD Trading?

- Engage with online trading communities, attend webinars and seminars, and practice your strategies using demo accounts to gain experience without risk.