Selecting the best discount broker, especially when looking into the realm of bonds, requires careful consideration of your unique investment style, how often you plan to trade, and your long-term financial goals. With the plethora of options available, focusing on key factors can help you find a broker that not only meets your needs but also enhances your trading experience in the bond market. Here’s a comprehensive guide, including a checklist, to aid you in evaluating and choosing the Best Brokers for Bonds for your investing journey. This will ensure you’re equipped to make informed decisions, whether you’re investing in corporate, government, or municipal bonds, balancing between yield, security, and the quality of service.

Factors to Consider

Investment Style and Needs

- Active vs. Passive: Active traders need a platform with low latency, real-time data, and advanced charting tools. Passive investors might prioritize easy portfolio management and automatic rebalancing.

- Types of Investments: Whether you’re interested in stocks, bonds, ETFs, mutual funds, or cryptocurrencies, ensure the broker offers a wide selection that aligns with your investment interests.

Frequency of Trades

- Trading Volume: Consider how often you plan to buy and sell. Frequent traders benefit from low transaction costs and rebates for high volume, while occasional traders might prioritize no inactivity fees.

- Cost Structure: Understand all associated costs, including commissions, spreads, and any other fees. Even if a broker advertises commission-free trading, other fees might impact your returns.

Financial Goals

- Long-term vs. Short-term: Your investment horizon can influence the type of account and services you need. Long-term investors may value retirement accounts and educational resources, while short-term traders might prioritize advanced order types and margin trading.

Checklist for Evaluating Discount Brokers

Regulatory Compliance and Security

- [ ] Is the broker regulated by reputable authorities like the SEC and FINRA?

- [ ] Does the broker employ robust security measures, including data encryption and two-factor authentication?

Fees and Costs

- [ ] Are the broker’s fee structure and any potential hidden costs clearly outlined?

- [ ] How do the transaction fees compare for your expected trading volume?

Trading Platform and Tools

- [ ] Does the platform offer the tools and features necessary for your trading strategy?

- [ ] Is the trading platform user-friendly and accessible across multiple devices?

Investment Options

- [ ] Does the broker offer a wide range of investment products that match your interests?

- [ ] Are there limitations or restrictions on certain types of trades or investments?

Educational Resources and Customer Support

- [ ] Does the broker provide comprehensive educational materials suitable for your level of expertise?

- [ ] Is customer support readily available through multiple channels (phone, email, live chat)?

Account Types and Requirements

- [ ] Are there account types that align with your investment goals (e.g., individual, joint, retirement)?

- [ ] What are the minimum deposit requirements, and how do they fit with your financial situation?

Reviews and Reputation

- [ ] What do current and former users say about their experiences with the broker?

- [ ] Are there recurring issues mentioned in reviews that could be red flags?

Introduction to Bond Investing

Bond investing represents a fundamental component of a diversified investment portfolio, offering a balance of risk and return that is distinct from equities. Bonds are essentially loans made by an investor to a borrower (typically corporate or governmental) that pay interest over a specified period, ending with the return of the principal amount. Understanding the basics of bonds and the different types available is crucial for investors looking to incorporate this asset class into their portfolios. Let’s delve into the essentials of bond investing and explore the various types of bonds.

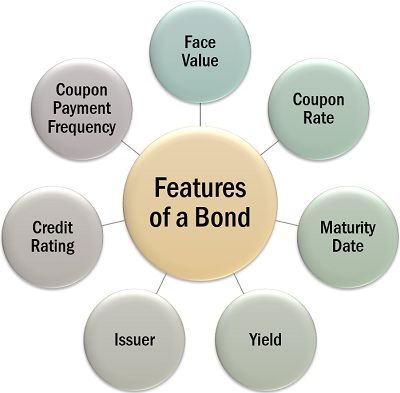

Basics of Bonds

Bonds are debt securities issued by entities such as governments, municipalities, and corporations to finance projects or operations. When you purchase a bond, you are lending money to the issuer in exchange for regular interest payments (coupons) and the return of the bond’s face value at maturity. Bonds are often considered less risky than stocks, making them an attractive investment for those seeking steady income and preservation of capital.

Role in an Investment Portfolio

- Income Generation: Bonds typically provide regular, predictable income through fixed interest payments, appealing to investors seeking stable returns.

- Diversification: Adding bonds to an investment portfolio can help diversify risk, as bonds often have a low correlation with stocks.

- Risk Management: Bonds can serve as a safety net during market volatility, as they are generally less susceptible to market fluctuations compared to equities.

Different Types of Bonds

Government Bonds

- Issued By: National governments.

- Features: Considered to have the lowest risk, especially those issued by stable governments. They offer lower interest rates compared to other types of bonds.

- Examples: U.S. Treasury bonds, German Bunds, and UK Gilts.

Corporate Bonds

- Issued By: Companies and corporations.

- Features: Corporate bonds usually offer higher interest rates than government bonds due to the higher risk of default. The interest rate varies based on the issuing company’s creditworthiness.

- Examples: Bonds issued by companies like Apple, Verizon, or smaller enterprises with varying credit ratings.

Municipal Bonds

- Issued By: State, cities, or other local government entities.

- Features: Often tax-exempt on federal (and sometimes state and local) taxes, making them attractive to investors in higher tax brackets. They finance public projects such as schools, highways, and infrastructure.

- Types: General obligation bonds (backed by the issuer’s credit and taxing power) and revenue bonds (financed by specific project revenues).

Choosing the Best Brokers for Bonds

When looking to invest in bonds, selecting a broker with access to a wide range of bond types, transparent pricing, and robust research tools is essential. The best brokers for bonds offer:

- Comprehensive Bond Market Access: Including government, corporate, and municipal bonds across various geographies and credit qualities.

- Educational Resources: To help investors understand bond investing risks, returns, and strategies.

- Analytical Tools: For assessing bond performance, ratings, and interest rate risk.

- Competitive Pricing: Transparent fees and commissions for bond purchases and sales.

Understanding Best Brokers for Bonds Fees and Pricing

When investing in bonds through brokers, it’s crucial to understand how these intermediaries charge for transactions. Bond broker fees and pricing can significantly affect your investment returns, especially if you plan to buy or sell bonds frequently. Bond brokers typically charge through mark-ups, commissions, and flat fees. Let’s explore each of these fee structures and offer insights on comparing fee structures among top bond brokers.

Mark-ups

Definition: A mark-up is an additional cost added to the price of a bond when it’s sold to investors. Instead of charging a visible transaction fee, brokers may increase the bond’s price over its original purchase price.

Implications for Investors: Mark-ups can make it challenging to understand the true cost of a bond purchase. Investors might end up paying more than the bond’s market value, which could affect the investment’s yield.

Commissions

Definition: Some brokers charge a commission for bond transactions, which is a fixed percentage of the trade value or a flat rate per trade.

Implications for Investors: Commissions are more transparent than mark-ups, allowing investors to easily calculate the cost of a transaction. However, high commission rates can erode investment returns, especially for smaller trades.

Flat Fees

Definition: A flat fee is a fixed charge applied to each transaction, regardless of the bond’s value. This is more common in online discount brokerage models.

Implications for Investors: Flat fees can be cost-effective for larger transactions but may disproportionately affect the cost-effectiveness of smaller trades.

Comparing Fee Structures Among Best Brokers for Bonds

When evaluating the best brokers for bonds, consider the following:

Transparency

Look for brokers that clearly disclose their fee structures. Transparency in how fees are charged allows you to accurately assess and compare the costs of using different brokers.

Total Cost of Ownership

Calculate the total cost of buying, holding, and selling bonds, including transaction fees, potential mark-ups, and any account maintenance fees. This will give you a clearer picture of how different fee structures impact your overall investment returns.

Volume Discounts

Some brokers offer discounts for high-volume traders or for investors who hold bonds to maturity. If you plan to trade bonds actively or invest significant amounts, check if volume discounts apply.

Access to Bond Types and Markets

Consider whether a broker’s access to various bond markets (government, corporate, municipal) and the breadth of their bond offerings align with your investment strategy. Sometimes, paying slightly higher fees might be justified by better access to specific bond types or markets.

Ancillary Services and Tools

Evaluate the value of any additional services and tools provided by the broker, such as bond ladders, portfolio analysis tools, or access to bond research and ratings. These services can enhance your investment strategy and may offset higher transaction costs.

Key Features of Best Brokers for Bonds

Choosing the right bond broker is crucial for investors looking to navigate the complexities of the bond market effectively. The best brokers for bonds distinguish themselves not just through competitive fees but also by offering comprehensive access to a wide variety of bonds, advanced research tools, and exemplary customer support. These key features are essential for making informed investment decisions and managing a bond portfolio successfully. Let’s delve into the essential attributes to look for in a bond broker.

Inventory Access

Diverse Bond Offerings

Top bond brokers provide access to a broad range of bond types, including government (such as Treasuries and sovereign bonds), corporate, municipal, and international bonds. A diverse inventory allows investors to diversify their portfolios and find bonds that match their risk tolerance and investment objectives.

Depth of Market Access

The best brokers offer deep market access, allowing investors to explore both primary (new issue market) and secondary markets. This access ensures investors can find bonds with the desired yields, maturities, and credit qualities.

Research Tools

Analytical and Screening Tools

Advanced analytical tools and bond screeners help investors filter bonds based on specific criteria such as yield, maturity, rating, and issuer type. These tools are invaluable for identifying investment opportunities that align with your strategy.

Market Insights and Analysis

Access to market insights, commentary, and analysis from experienced professionals can provide investors with a deeper understanding of market dynamics and potential impacts on bond investments. This information is crucial for making well-informed decisions.

Portfolio Analysis Tools

Some brokers offer tools to analyze your bond portfolio’s performance, interest rate risk, and diversification. These tools can help you assess whether your portfolio aligns with your investment goals and risk tolerance.

Customer Support

Responsive Support

Responsive and knowledgeable customer support is essential, especially for investors who may have questions about their accounts or need assistance with trades. The availability of support via phone, email, and live chat can enhance the overall investment experience.

Educational Resources

For both novice and experienced investors, educational resources on bond investing concepts, strategies, and market trends are invaluable. Look for brokers that offer a comprehensive library of articles, webinars, and tutorials.

Personalized Services

While not available with all discount brokers, some offer access to financial advisors or bond specialists who can provide personalized advice and guidance. This service can be particularly beneficial for investors looking to make significant bond investments or those with specific investment goals.

Navigating Online Platforms for Bond Trading

In the realm of bond trading, the quality and functionality of online platforms and tools provided by brokers play a critical role in investment decisions and strategies. For investors seeking the best brokers for bonds, it’s essential to evaluate these platforms not just for the breadth of features they offer, but also for their usability and the quality of market data they provide. Here’s a closer look at what to consider when navigating online platforms for bond trading, emphasizing the importance of user-friendly interfaces and comprehensive market data.

Evaluation of Online Platforms and Tools

Range of Available Bonds

A top-tier online platform offers access to a wide variety of bonds, including government, corporate, and municipal bonds across different maturities and credit qualities. This diverse inventory ensures that investors can tailor their portfolios to their specific risk tolerance and investment goals.

Research Tools and Analysis

Analytical Tools: Platforms should offer advanced analytical tools that allow investors to perform detailed analysis on potential bond investments. This includes yield calculators, credit risk assessments, and comparative tools to evaluate different bonds.

Research Resources: Access to up-to-date research reports, bond ratings from major agencies, and market commentary can provide valuable insights into bond market trends and individual bond performance.

Real-time Market Data

Pricing Information: Real-time or near-real-time pricing information for bonds is crucial for making informed trading decisions, especially in a market known for its opacity.

Market Depth: Information on bid-ask spreads, trading volumes, and historical price data can help investors gauge market sentiment and liquidity for specific bonds.

Importance of User-Friendly Interfaces

Ease of Navigation: The platform should be intuitive, allowing users to easily find and execute trades, access their portfolio, and utilize research tools without a steep learning curve.

Customization: The ability to customize dashboards and set up personalized alerts for price changes or news related to specific bonds can significantly enhance the trading experience.

Accessibility: Platforms that are accessible across multiple devices, including desktops, tablets, and smartphones, ensure that investors can manage their portfolios and make trades on the go.

Comprehensive Market Data

Accuracy: The platform must provide accurate and up-to-date market data to help investors make informed decisions.

Depth: A detailed view of the bond market, including insights into market trends, interest rate movements, and economic indicators affecting bond prices, is essential for comprehensive market analysis.

Access to a Variety of Bond Markets

For investors seeking to diversify their portfolios and optimize returns, having access to a variety of bond markets through their broker is paramount. This diversity allows for strategic allocation across different types of bonds, each offering unique risk profiles, yields, and benefits. The significance of access to diverse bond markets—domestic and international, municipal, treasury, and corporate—cannot be understated, especially when looking for the best brokers for bonds.

Domestic vs. International Bonds

- Domestic Bonds provide investors with opportunities within their own country, often seen as a safer option due to familiarity with the market and lower currency risk.

- International Bonds open up a world of opportunities, allowing investors to benefit from economic growth in other regions, diversify currency exposure, and potentially capture higher yields.

Municipal Bonds

- Municipal Bonds (Munis) are issued by local or state governments and are popular for their tax-exempt status in the United States. They fund public projects like schools and infrastructure and are favored for their lower risk and tax benefits.

Treasury Bonds

- Treasury Bonds are government-issued bonds considered among the safest investments, backed by the full faith and credit of the issuing government. They include short-term T-bills, intermediate-term notes, and long-term bonds, offering a risk-free yield as a benchmark for other investments.

Corporate Bonds

- Corporate Bonds are issued by companies to fund operations, projects, or expansion. They generally offer higher yields than government securities but come with higher risk, varying significantly based on the issuing company’s creditworthiness.

The Significance of Access to Diverse Markets

Enhanced Diversification

Diversifying across different bond markets can reduce portfolio risk. Different bond types react differently to economic conditions; for example, corporate bonds might offer higher yields during economic growth, while treasuries provide safety during downturns.

Optimized Returns

Access to a broader market range allows investors to seek out the best yields and terms to suit their investment goals. International bonds, in particular, can offer attractive opportunities in emerging markets with higher growth rates.

Risk Management

Investing across various sectors and geographies can mitigate the impact of localized economic downturns, interest rate fluctuations, or sector-specific challenges. This balanced approach helps in smoothing out portfolio returns over time.

Tax Efficiency

For U.S. investors, municipal bonds offer tax-exempt income, providing an efficient investment option for those in higher tax brackets. Understanding and leveraging the tax implications of different bond types can significantly impact after-tax returns.

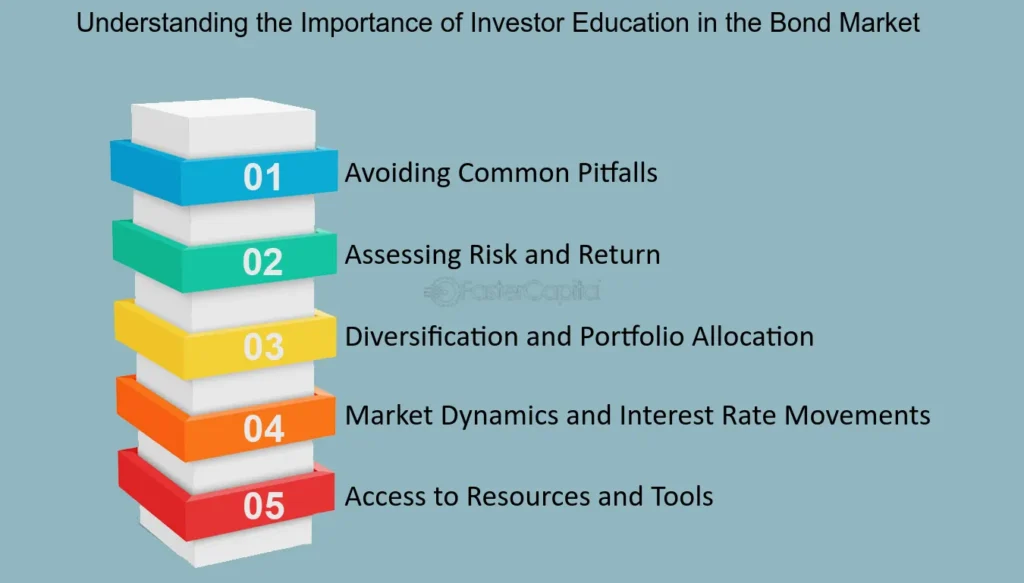

The Role of Educational Resources in Bond Investing

In the realm of bond investing, the complexities of market dynamics, interest rate risks, and the myriad types of bonds available can be daunting, especially for novice investors. This underscores the critical importance of educational resources provided by brokers. The best brokers for bonds distinguish themselves not only by the variety of bonds they offer but also by empowering their clients with knowledge. High-quality educational content can demystify bond investing, highlighting strategies, risks, and potential rewards. Here’s an overview of the role these resources play in making informed bond investment decisions.

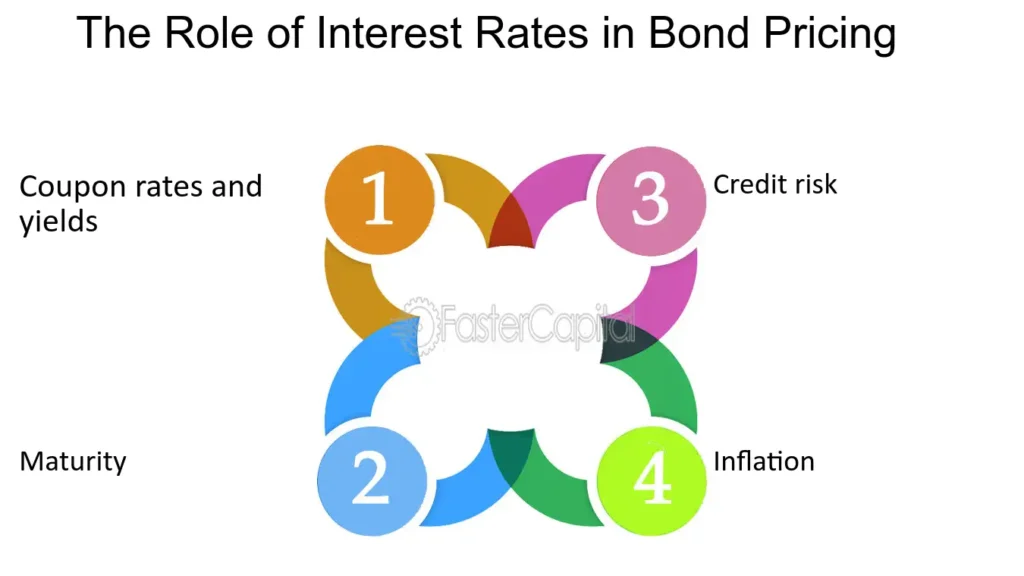

Enhancing Understanding of Bond Market Dynamics

Broker-provided education plays a pivotal role in elucidating the factors that influence bond prices and yields, such as changes in interest rates, inflation expectations, and economic indicators. By understanding these dynamics, investors can make more informed decisions about when to buy or sell bonds.

Clarifying the Types and Features of Bonds

A comprehensive educational suite can help investors grasp the differences between various bond types (government, corporate, municipal, etc.), including their risk profiles, tax implications, and typical yields. This knowledge is crucial for building a diversified bond portfolio aligned with one’s investment goals and risk tolerance.

Highlighting Bond Investment Strategies

Educational resources can introduce investors to a range of bond investment strategies, from basic buy-and-hold approaches to more advanced tactics like laddering or barbelling portfolios. These strategies can help investors manage risk, optimize returns, and achieve specific financial objectives.

Identifying and Mitigating Risks

Understanding the risks associated with bond investing is paramount. Education on credit risk, interest rate risk, and liquidity risk, among others, allows investors to make better risk-adjusted investment choices. Broker-provided education should offer insights into how to assess and mitigate these risks effectively.

Exploring the Rewards of Bond Investing

While much focus is placed on risk, educational resources should also highlight the potential rewards of bond investing, including stable income, capital preservation, and portfolio diversification. Clear, well-structured content can help investors balance the risk-reward equation in their portfolios.

Components of Effective Educational Resources

- Tutorials and Guides: Step-by-step instructions and explanations of bond investing basics and advanced concepts.

- Webinars and Seminars: Interactive sessions with industry experts offering market insights and answering investor queries.

- Analytical Tools and Calculators: Practical tools to analyze bond investments, assess yields, and simulate portfolio strategies.

- Glossaries: Definitions of key terms and jargon to help investors navigate the bond market more confidently.

Evaluating Customer Support and Advisory Services

For bond investors, particularly those who are new to the market or looking to refine their strategies, the availability and quality of customer support and advisory services from their brokers can be a pivotal factor in their investment journey. Effective customer support ensures that investors can navigate the complexities of bond investing with confidence, while advisory services can offer tailored guidance to help achieve specific financial goals. Here’s how to evaluate the customer support and advisory services provided by brokers, highlighting their importance for bond investors.

Availability and Quality of Customer Support

Responsiveness

- Timeliness: How quickly does the broker respond to inquiries? Fast response times are crucial, especially in dynamic market conditions where timely information can impact investment decisions.

- 24/7 Support: Is support available around the clock? Considering the global nature of bond markets, having access to assistance at any time can be highly beneficial.

Communication Channels

- Multiple Platforms: Does the broker offer various ways to get in touch, such as live chat, email, phone support, and social media? Multiple channels ensure that investors can seek help in the manner most convenient for them.

- Accessibility: Consider how easy it is to reach a support representative. Are there long wait times, or is it straightforward to get the assistance you need?

Expertise

- Knowledgeable Staff: The quality of support is as important as its availability. Representatives should be well-versed in bond investing and capable of providing accurate, helpful advice.

Advisory Services

Tailored Investment Advice

- Personalization: Evaluate whether the broker offers personalized investment advice. Advisory services that consider your specific financial situation, goals, and risk tolerance can be invaluable in building a successful bond portfolio.

- Certified Professionals: Check if the advice is given by certified financial planners or investment advisors. Their expertise can offer insights beyond general customer support, helping you to navigate more complex financial decisions.

Strategy Development

- Holistic Approach: Good advisory services will take a holistic view of your portfolio, considering both your bond investments and other assets to ensure a well-balanced and diversified investment strategy.

- Strategic Guidance: From constructing a bond ladder to optimizing the tax efficiency of your investments, the strategic guidance offered by advisory services can enhance the performance of your bond portfolio.

Cost vs. Benefit

- Fees: Understand the fees associated with advisory services. While personalized advice can offer significant benefits, it’s important to weigh these against the costs to determine if the service offers value for your investment strategy.

- Value Addition: Consider the potential return on investment from using advisory services. The right advice can potentially lead to better-informed investment decisions and improved portfolio performance.

Regulation and Security in Bond Trading

When engaging in bond trading, the importance of partnering with a broker that is both highly regulated and committed to offering secure trading practices cannot be overstated. Regulatory oversight ensures that brokers operate within established legal and ethical frameworks, protecting investors from fraud and malpractice. Meanwhile, robust security practices safeguard investors’ funds and personal information. This combination of regulation and security is fundamental to maintaining trust and integrity in the bond market. Here’s why it’s crucial to prioritize these aspects when choosing the best brokers for bonds.

Regulatory Oversight

Regulated brokers are subject to scrutiny by governmental and independent regulatory bodies, which enforce standards designed to protect investors and ensure fair trading practices. Key regulatory authorities include:

- Securities and Exchange Commission (SEC): Oversees and regulates the U.S. securities markets, ensuring transparency and protecting investors from fraudulent activities.

- Financial Industry Regulatory Authority (FINRA): A non-governmental organization authorized by Congress to protect America’s investors by ensuring the broker-dealer industry operates fairly and honestly.

- Commodity Futures Trading Commission (CFTC): Regulates the U.S. derivatives markets, including futures, options, and swaps.

Regulation ensures that brokers maintain high standards of integrity, financial responsibility, and customer protection. It also provides a framework for dispute resolution and recourse for investors in case of misconduct.

Security Practices

In today’s digital world, the security of online trading platforms is paramount. Top brokers for bonds implement a range of security measures to protect investor assets and personal information, including:

- Data Encryption: Uses advanced encryption technologies to secure data transmissions between clients’ devices and brokers’ servers, ensuring that sensitive information remains confidential.

- Two-Factor Authentication (2FA): Requires a second form of verification in addition to a password when logging in to trading accounts, significantly reducing the risk of unauthorized access.

- Firewalls and Anti-Virus Protection: Protects the integrity of trading platforms and client data from cyber threats and attacks.

- Cold Storage for Digital Assets: Some brokers dealing in digital or crypto bonds use cold storage to keep a significant portion of digital assets offline, minimizing the risk of hacking.

The Benefits of Regulation and Security

- Investor Confidence: Knowing that a broker is regulated and adheres to strict security practices gives investors peace of mind, fostering trust in the trading platform and the broker.

- Market Integrity: Regulation helps to maintain orderly markets, ensuring that trading activities are conducted transparently and fairly, which is essential for the functioning of the bond market.

- Protection of Assets: Robust security measures guard against the loss or theft of funds and personal data, crucial for investor protection in an increasingly digital trading environment.

Opening an Account for Bond Trading

Opening an account with a bond broker is the first step towards entering the world of bond trading. This process involves selecting a broker, providing necessary documentation for verification, and meeting initial funding requirements. By choosing one of the best brokers for bonds, you can ensure access to a wide range of bond markets and benefit from competitive fees, robust trading platforms, and valuable educational resources. Here’s a step-by-step guide to opening an account for bond trading.

Step 1: Choose a Best Brokers for Bonds

Research: Start by researching brokers that specialize in or offer extensive bond trading options. Compare their fees, platform features, bond market access, educational resources, and regulatory standing.

Regulation and Security: Ensure the broker is regulated by reputable authorities like the SEC and FINRA, and assess their security measures to protect your investments and personal information.

Step 2: Gather Required Documentation

Personal Identification: Prepare government-issued identification such as a passport or driver’s license. This is required for identity verification purposes.

Proof of Residence: Utility bills or bank statements may be needed to verify your address, especially if the broker operates in jurisdictions with strict financial regulations.

Tax Information: In some countries, you may need to provide a tax identification number (TIN) or social security number (SSN) as part of the account opening process.

Financial Information: Be ready to provide information about your financial situation, including employment status, annual income, and investment experience. This helps brokers assess suitability and compliance with regulations.

Step 3: Complete the Application Form

Online Application: Visit the broker’s website to complete the online application form. Fill in your personal, financial, and tax information accurately to avoid delays in the verification process.

Review Terms and Conditions: Carefully read and understand the broker’s terms of service, fees, and data privacy policies before submitting your application.

Step 4: Verify Your Identity

Submit Documentation: Upload or send the required documents for identity and residence verification. Some brokers may use electronic verification methods to streamline this process.

Compliance Checks: The broker will perform necessary compliance checks to meet anti-money laundering (AML) and know your customer (KYC) requirements.

Step 5: Fund Your Account

Initial Funding: Once your account is approved, proceed with funding it through one of the available methods, such as bank transfer, wire transfer, or cheque. Consider the broker’s minimum deposit requirements and funding times.

Understand Fees: Be aware of any fees associated with deposits or withdrawals and how they might impact your initial investment.

Step 6: Start Trading Bonds

Platform Familiarization: Take some time to familiarize yourself with the trading platform’s features, tools, and bond offerings. Use any demo accounts or tutorials provided by the broker.

Educational Resources: Leverage the broker’s educational materials to enhance your understanding of bond trading strategies, risks, and market analysis.

Place Your First Trade: With your account funded and a solid understanding of the platform and bond markets, you’re ready to make your first bond trade.

Choosing the Best Brokers for Bonds Investing Needs

Selecting the best broker for bond investing is a critical decision that hinges on various factors including your investment goals, the types of bonds you’re interested in, and how frequently you plan to trade. A broker that aligns well with your needs can significantly enhance your investment experience and potentially your returns. Here’s a detailed guide, including a checklist, to help you evaluate and choose the best bond broker for your specific requirements.

Factors to Consider

Investment Goals

- Income vs. Capital Gains: Determine if you’re investing in bonds primarily for regular income or capital appreciation. This can influence the types of bonds you’ll focus on and, consequently, the broker that can best meet those needs.

- Risk Tolerance: Assess your risk tolerance to decide between high-yield bonds with higher risk or investment-grade bonds with lower risk.

Preferred Bond Types

- Government, Corporate, or Municipal Bonds: Each type of bond comes with its own set of characteristics and risks. Ensure the broker offers a broad selection of the bond types you’re interested in.

- Domestic vs. International Bonds: If diversifying globally is part of your strategy, look for brokers with access to international bond markets.

Trading Frequency

- Active vs. Passive Trading: Your trading frequency impacts the importance of transaction costs. Active traders need a broker with lower transaction fees, while passive investors might prioritize other features such as research and educational tools.

Checklist for Evaluating Best Brokers for Bonds

Range of Bond Offerings

- [ ] Does the broker offer a wide variety of bond types, including government, corporate, and municipal bonds?

- [ ] Can you access both domestic and international bond markets through the broker?

Fees and Costs

- [ ] What are the transaction fees for bond trades, and how do they compare across brokers?

- [ ] Are there any hidden costs, such as account maintenance fees or inactivity fees?

Trading Platform and Tools

- [ ] Does the broker provide a user-friendly and robust trading platform suitable for bond trading?

- [ ] Are there advanced tools available for bond analysis, such as yield calculators, credit ratings, and market data?

Research and Educational Resources

- [ ] Does the broker offer comprehensive research and educational materials specific to bond investing?

- [ ] Are there tools or services provided to help you stay informed about market trends and opportunities?

Customer Support

- [ ] What level of customer support is available, and through which channels (phone, email, live chat)?

- [ ] Is the support staff knowledgeable about bond markets and investing?

Regulatory Compliance and Security

- [ ] Is the broker regulated by reputable authorities such as the SEC and FINRA?

- [ ] What security measures are in place to protect your investments and personal information?

Additional Services

- [ ] Does the broker offer advisory services or portfolio management options for those seeking guidance?

- [ ] Are there any value-added services, such as access to initial bond offerings or automated investment plans?

FAQs:

- What Are Bonds and Why Invest in Them?

- Bonds are fixed-income investments where the investor loans money to an issuer (corporate or government) in exchange for periodic interest payments plus the return of the bond’s face value at maturity.

- How Do Brokers Charge for Bond Transactions?

- Fees can vary, including mark-ups on the bond price, flat transaction fees, or commissions based on the trade value.

- What Should I Look for in a Bond Broker?

- Look for competitive fees, access to a wide range of bond types, robust research tools, and quality customer support.

- Can I Trade Bonds Online?

- Yes, many brokers offer online platforms that allow investors to buy and sell bonds directly.

- How Important Is Access to Different Bond Markets?

- Access to various bond markets can provide more opportunities for diversification and potentially better returns.

- What Educational Resources Are Helpful for Bond Investors?

- Resources that cover bond fundamentals, investment strategies, market analysis, and risk assessment are particularly beneficial.

- Should I Consider a Broker’s Advisory Services?

- If you’re new to bond investing or prefer a guided approach, consider brokers that offer advisory services or managed portfolios.

- How Do I Ensure My Bond Investments Are Secure?

- Trade with regulated brokers that implement strong security measures to protect your account and personal information.

- What Is the Process for Opening a Bond Trading Account?

- Similar to opening a stock trading account, you’ll need to provide personal information, financial details, and possibly undergo a verification process.

- How Do I Choose Between Brokers When Investing in Bonds?

- Assess your needs in terms of bond types, pricing, platform functionality, educational content, and customer service to find a broker that matches your requirements.