Discount brokers offer a streamlined approach to investing, focusing on executing trades without providing the comprehensive advisory services typical of full-service brokers. This model allows for significantly lower fees and commissions, making discount brokers an attractive option for individual investors who prefer a do-it-yourself approach to investing. Understanding how discount brokers operate and their advantages can help investors make informed decisions on where to trade.

What Are Discount Brokers?

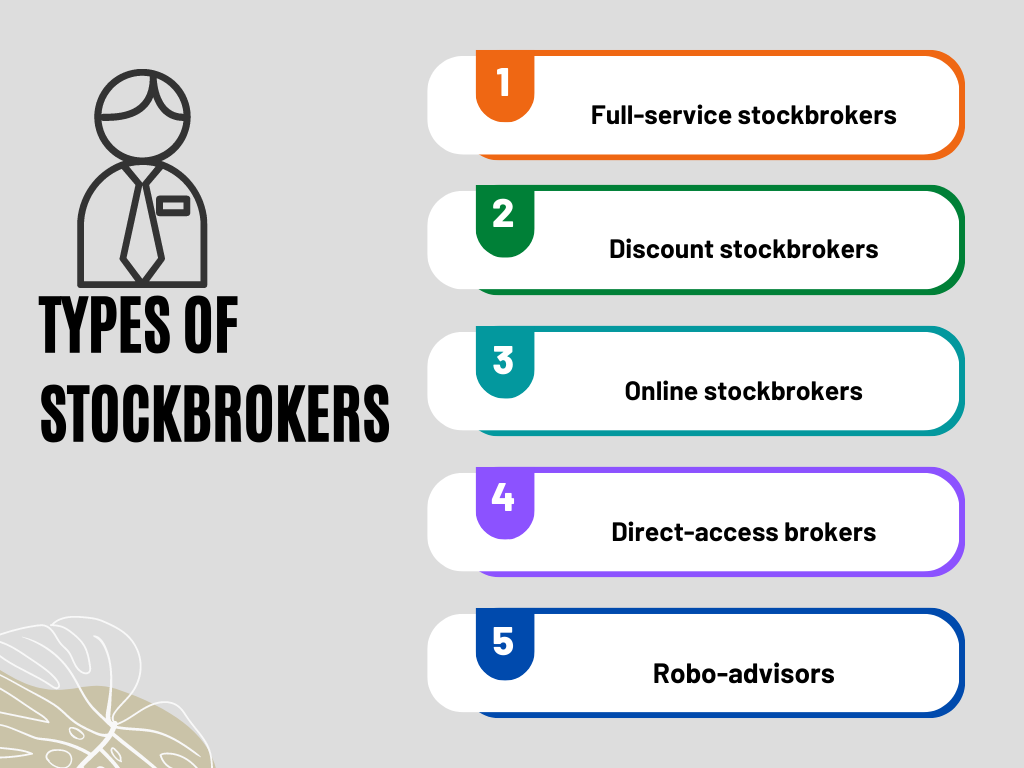

Discount brokers provide a platform for buying and selling securities, including stocks, bonds, ETFs, and mutual funds, at reduced costs. Unlike full-service brokers, they do not offer investment advice, portfolio management services, or extensive market research. The rise of discount brokers is largely attributed to the advent of the internet, which has enabled these firms to offer online trading platforms where investors can execute trades quickly and at a fraction of the cost of traditional brokerage services.

How Discount Brokers Differ from Full-Service Brokers

- Fees and Commissions: Discount brokers charge lower fees and commissions compared to full-service brokers. The savings come from the lack of personalized investment advice and portfolio management services.

- Services Offered: While full-service brokers provide a wide range of financial services including personalized advice, retirement planning, and tax assistance, discount brokers typically offer only the essential tools needed for trading.

- Trading Platforms: Discount brokers invest heavily in their trading platforms, offering sophisticated tools, charts, and resources that cater to both novice and experienced traders. These platforms are designed for investors who prefer to make their own trading decisions.

- Customer Support: Although discount brokers may offer customer support, the level of personalized service is generally less comprehensive than that offered by full-service brokers. Support is often provided through online channels, including email, chat, and FAQs.

Benefits of Using a Discount Broker

Cost Efficiency

The most apparent benefit of using a discount broker is the lower cost of transactions. The savings on commissions and fees can significantly impact an investor’s overall returns, especially for those who trade frequently or maintain a high account balance.

Control and Independence

Discount brokers cater to investors who prefer to manage their own portfolios. These platforms offer a sense of control and independence, allowing users to execute trades based on their research and analysis.

Access to Advanced Tools

Many discount brokers provide access to advanced trading tools, analytics, and educational resources. These features can enhance an investor’s ability to make informed decisions and develop sophisticated trading strategies.

Flexibility

With online and mobile access, discount brokers offer flexibility in when and where investors can trade. This convenience is particularly appealing to those with busy schedules or those who prefer to trade on the go.

Key Features of Best Discount Brokers

When selecting a discount broker, it’s crucial to weigh several key attributes that contribute to a fulfilling trading experience. The best discount brokers distinguish themselves not just through low fees but also via platform usability, customer support, and a suite of features catering to the needs of diverse investors. Here’s what to consider to ensure your chosen broker aligns well with your investment strategy and goals.

Low Fees and Commissions

One of the primary reasons investors turn to discount brokers is the promise of low trading costs. Consider the following when evaluating fees:

- Trading Fees: Look for competitive pricing on stock, ETF, and option trades. Some brokers offer commission-free trading, which can be particularly advantageous for active traders.

- No Account Minimums: Many top discount brokers do not require a minimum deposit to open an account, making investing accessible to those with limited initial capital.

- Other Fees: Be aware of potential hidden costs, such as inactivity fees, withdrawal fees, or fees for accessing premium features.

Platform Usability

A well-designed trading platform is key to a positive investing experience, especially for those new to trading. Top discount brokers offer:

- Intuitive Interfaces: The platform should be easy to navigate for traders of all experience levels.

- Advanced Tools: Even though aimed at cost-conscious traders, the platform shouldn’t skimp on research tools, charts, and data analytics that help users make informed decisions.

- Mobile Trading: With investors increasingly managing portfolios on the go, a robust mobile app is a must-have feature.

Customer Support

While discount brokers may not offer the same level of personalized investment advice as full-service brokers, quality customer support is still vital:

- Accessibility: Look for brokers that offer multiple ways to get in touch, including phone, email, and live chat support.

- Responsiveness: Prompt and helpful customer service can significantly impact your trading experience, especially when urgent issues arise.

- Educational Resources: Top brokers provide a wealth of educational content, including tutorials, webinars, and articles, to help investors learn and grow.

Range of Investment Options

Diverse investment offerings allow you to tailor your portfolio to your financial goals:

- Wide Selection of Tradable Assets: Beyond stocks and ETFs, look for access to options, mutual funds, bonds, and possibly cryptocurrencies.

- International Markets: For those interested in diversifying globally, access to international markets can be a deciding factor.

Research and Analytics

Access to quality research and analytics enables investors to make data-driven decisions:

- Market Research: Comprehensive market insights, analysis, and commentary can inform your trading strategy.

- Analytical Tools: Advanced charting capabilities and analytical tools help in evaluating investment opportunities and trends.

Security

Ensuring the safety of your investments and personal information is paramount:

- Encryption and Data Protection: Strong encryption protocols should protect your transactions and data.

- Regulatory Compliance: Choosing a broker regulated by reputable authorities like the SEC or FINRA adds an additional layer of security.

Understanding Broker Fees and Commissions

Navigating the fee structures of discount brokers is crucial for investors aiming to minimize costs and maximize returns. Discount brokers are favored for their low fees and commissions, but understanding the nuances of their fee structures is key to choosing the best platform for your investment needs. This comprehensive overview breaks down the common fees and potential costs associated with the best discount brokers.

Types of Fees and Commissions

Trading Commissions

Traditionally, brokers charge a commission for each trade executed. While many discount brokers now offer commission-free trading for stocks and ETFs, commissions may still apply for other securities like options, bonds, and mutual funds.

- Options: Fees typically include a per-contract charge.

- Mutual Funds: Some brokers charge a commission for trades outside a no-transaction-fee (NTF) mutual fund list.

Account Maintenance Fees

Account maintenance or service fees cover the costs of maintaining your account. Many discount brokers have eliminated these fees to remain competitive, but it’s still important to verify, as some may charge monthly or annual fees, especially for accounts below a minimum balance.

Inactivity Fees

Inactivity fees are charged to accounts that do not meet a minimum number of trades within a certain period. While less common in today’s competitive landscape, investors planning to trade infrequently should be aware of potential inactivity charges.

Withdrawal and Transfer Fees

Fees may be applied to withdrawals, especially for expedited or wire transfers. Additionally, transferring your account to another broker (ACAT transfer) can incur significant fees.

Other Potential Costs

- Margin Interest: If you trade on margin (borrowing funds from the broker), you’ll be charged interest on the borrowed amount.

- Market Data Fees: Access to premium real-time market data or professional trading platforms may require a subscription fee.

- Regulatory Fees: Regulatory agencies impose small fees on sell transactions, which are passed on to traders. These are typically very low but can add up for active traders.

How to Navigate and Minimize Fees

Compare Fee Structures

Carefully compare the fee structures of different discount brokers. Look beyond commission-free trading offers to understand the full range of potential costs.

Evaluate Your Trading Habits

Consider how your trading frequency, preferred securities, and account balance align with a broker’s fee structure. Choosing a broker that matches your trading style can help minimize costs.

Look for Fee Waivers and Discounts

Some brokers offer to waive certain fees or provide discounts based on account activity or balance. Explore these options to reduce costs.

Consider the Total Value

Beyond fees, consider the overall value a broker offers, including platform usability, tools, customer support, and educational resources. Sometimes, a slightly higher fee may be justified by superior service or features.

Evaluating Trading Platforms and Tools

When choosing among the best discount brokers, the trading platform and tools they offer are crucial factors that significantly influence the trading experience and success. A platform that balances ease of use with comprehensive technical tools and mobile app availability caters to a wide range of investor needs, from beginners to seasoned traders. This analysis focuses on key aspects to consider when evaluating the trading platforms provided by discount brokers.

Ease of Use

The platform’s user interface should be intuitive and straightforward, allowing traders to navigate and execute trades efficiently without a steep learning curve. Especially for beginners, the ability to easily find and use features is critical.

- User Experience: Look for platforms with a clean, organized layout, clear labeling, and the ability to customize the interface according to your preferences.

- Onboarding Process: Some platforms offer tutorials or guided tours of their features, which can be particularly helpful for new users getting acquainted with the platform.

Technical Tools

Advanced technical tools enable traders to analyze market trends, evaluate investment opportunities, and execute strategies based on informed decisions.

- Charting Capabilities: High-quality charting tools with a variety of time frames, technical indicators (like moving averages, RSI, Bollinger Bands), and drawing tools are essential for technical analysis.

- Real-time Data: Access to real-time market data and news feeds helps traders stay informed of current market conditions and make timely decisions.

- Backtesting: Some platforms offer backtesting tools, allowing traders to evaluate the performance of their strategies against historical data before applying them in live markets.

Mobile App Availability

In today’s fast-paced trading environment, the availability of a robust mobile app is non-negotiable. A mobile app should offer full functionality, mirroring the desktop trading experience while providing the convenience of trading on the go.

- Functionality: The mobile app should include core trading features such as real-time quotes, charting tools, order placement, and account management.

- Performance: Look for apps that are reliable and fast, with minimal lag or downtime. The app should be regularly updated to maintain optimal performance and security.

- Notifications: Mobile apps that offer customizable notifications for price movements, account changes, or news alerts can provide a significant advantage, keeping traders informed no matter where they are.

Additional Features

- Paper Trading: Availability of paper trading or demo accounts for practicing trading strategies without risking real money is a valuable feature for both beginners and experienced traders looking to test new strategies.

- Educational Resources: Access to educational materials, webinars, and tutorials through the platform can support ongoing learning and skill development.

- Customer Support: Integrated customer support within the platform, offering easy access to assistance when needed, can enhance the overall trading experience.

Account Types Offered by Best Discount Brokers

Discount brokers offer a variety of investment account types to cater to the diverse financial goals and needs of investors. Understanding the differences between these account types, including individual accounts, joint accounts, and retirement accounts, is crucial for selecting the one that best aligns with your investment objectives. This overview will help you navigate the options available through the best discount brokers and guide you in choosing the right account for your needs.

Individual Accounts

Description: Individual accounts are the most common type of investment account, registered to a single person. They allow you to buy, sell, and hold securities like stocks, bonds, ETFs, and mutual funds.

Best For: Single investors who want full control over their investment decisions and account management.

Considerations: Only the account holder can access the account and execute trades, making it essential for individual investors to actively manage their investments or set up automated strategies.

Joint Accounts

Description: Joint accounts are owned by two or more individuals, typically used by spouses, family members, or business partners. They allow multiple people to manage the investments and contribute to the account.

Best For: Couples or partners looking to combine their investment efforts. It’s also beneficial for estate planning purposes, as it can ease the transfer of assets between owners.

Considerations: All account holders have equal rights to manage and access the account. Communication and agreement on investment decisions are crucial to prevent conflicts.

Retirement Accounts (IRAs, Roth IRAs, 401(k)s)

Description: Retirement accounts offer tax advantages to encourage long-term saving for retirement. Types include Traditional IRAs, Roth IRAs, and employer-sponsored 401(k)s. These accounts may have specific rules regarding contributions, withdrawals, and taxes.

Best For: Individuals planning for retirement who want to take advantage of tax benefits to maximize their savings and investment growth over time.

Considerations: Retirement accounts have annual contribution limits and often penalties for early withdrawals. Understanding the tax implications and rules of each retirement account type is essential.

How to Choose the Right Account Type

- Define Your Financial Goals: Whether saving for retirement, investing for short-term gains, or planning for future expenses will influence the best account type for your needs.

- Consider Your Tax Situation: Evaluate how different account types impact your current and future tax liabilities. Retirement accounts, for example, offer various tax advantages that can be beneficial depending on your income and retirement plans.

- Account for Ownership Needs: Decide if you will be the sole investor or if you’ll be investing with a partner or spouse. This decision can guide you towards either an individual or joint account.

- Review Contribution and Withdrawal Rules: Especially for retirement accounts, be aware of the rules surrounding contributions, withdrawals, and penalties to ensure they align with your investment timeline and financial plans.

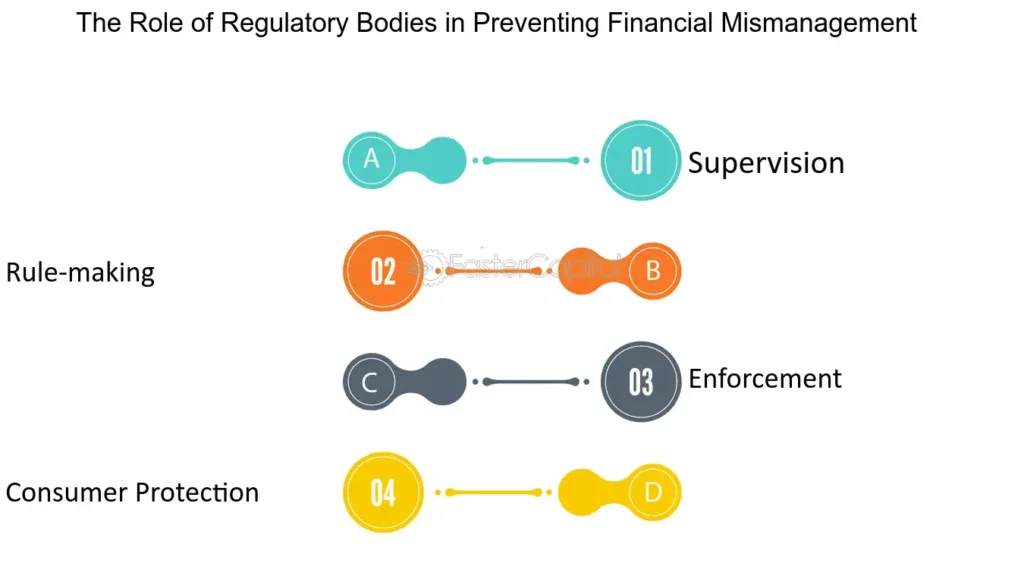

The Importance of Regulation and Security

In the world of investing, the safety of your assets and personal information is paramount. Trading with a broker regulated by reputable authorities, such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), offers a level of protection and peace of mind that cannot be overstated. This underscores the importance of choosing among the best discount brokers that prioritize not only cost-efficiency but also stringent regulation and security practices. Here’s an overview of why regulation and security are critical in selecting a discount broker.

Regulation by Reputable Authorities

SEC (Securities and Exchange Commission)

The SEC oversees and regulates the securities markets in the United States, ensuring transparency, fairness, and the protection of investor interests. It requires brokers to register, maintain adequate capitalization, and adhere to strict reporting and conduct standards.

FINRA (Financial Industry Regulatory Authority)

FINRA is a non-governmental organization that regulates member brokerage firms and exchange markets. It focuses on safeguarding the investing public against fraud and bad practices, ensuring the integrity of the brokerage industry through enforcement of its rules and regulations.

Importance of Regulation

- Investor Protection: Regulatory bodies enforce rules that protect investors from fraud, misleading practices, and unethical behavior by brokers.

- Market Integrity: Regulations ensure that the markets operate efficiently and transparently, maintaining investor confidence in the financial system.

- Dispute Resolution: Regulated brokers are subject to oversight in handling customer complaints and disputes, providing an avenue for resolution and recourse for investors.

Overview of Security Practices

Data Encryption

Top discount brokers use advanced encryption technologies to protect sensitive data transmitted between clients and servers, ensuring that personal and financial information is secure from unauthorized access.

Two-Factor Authentication (2FA)

2FA adds an additional layer of security by requiring a second form of verification, typically a code sent to your mobile device, in addition to your password when accessing your account.

Biometric Security

Some brokers incorporate biometric security measures, such as fingerprint or facial recognition, providing a secure and convenient way to access trading accounts.

Regular Security Audits

Conducting regular security audits helps brokers identify and address potential vulnerabilities, ensuring the ongoing protection of client assets and information.

Cold Storage for Digital Assets

For brokers dealing in cryptocurrencies, the use of cold storage (offline storage solutions) for a significant portion of digital assets protects against online hacking attempts and unauthorized access.

Accessing Educational Resources and Support

In the journey of investing, particularly for beginners, the availability and quality of educational materials and customer support play pivotal roles in enabling informed trading decisions. The best discount brokers not only provide platforms for executing trades but also prioritize educating their clients and offering robust support. This comprehensive approach to trader education and support can significantly impact a beginner’s ability to navigate the markets effectively and develop confidence in their trading strategies.

The Role of Educational Materials for Best Discount Brokers

Building a Strong Foundation

For novice traders, understanding the basics of the stock market, investment strategies, and risk management is crucial. High-quality educational content—from articles and eBooks to webinars and video tutorials—serves as the foundation for this learning, covering everything from fundamental concepts to more advanced trading techniques.

Enhancing Trading Strategies

Beyond the basics, educational resources can help traders refine their strategies. Through case studies, market analysis, and expert insights, traders can learn how to analyze market trends, interpret financial news, and apply technical analysis tools, thereby enhancing their decision-making process.

Staying Informed on Market Developments

The financial markets are dynamic, with new products, regulations, and economic factors continually emerging. Ongoing education through updated materials and market commentary helps traders stay informed and adapt their strategies to changing market conditions.

The Importance of Customer Support

Guidance for Platform Use

Especially for beginners, navigating a trading platform can be daunting. Customer support plays a crucial role in assisting with platform-related queries, helping traders utilize the full range of features and tools available to them.

Problem-Solving and Account Management

Issues ranging from account setup difficulties to transaction errors can arise. Access to responsive and knowledgeable customer support ensures these problems are promptly addressed, minimizing potential disruptions to trading activities.

Personalized Assistance

While educational resources provide the groundwork for trading knowledge, personalized support can help apply this knowledge to individual trading scenarios. Some discount brokers offer access to financial advisors or trading specialists, providing tailored advice that can be invaluable for making informed decisions.

Choosing a Discount Broker: Educational Resources and Support

When evaluating the best discount brokers, consider the following:

- Quality and Range of Educational Content: Look for brokers that offer a comprehensive suite of educational materials suitable for various learning styles and experience levels.

- Accessibility of Learning Resources: Ensure that educational content is easily accessible, ideally integrated within the trading platform for seamless learning.

- Customer Support Availability: Consider the availability of customer support, including hours of operation and communication channels (phone, email, live chat).

- Personalized Support Options: While not available with all discount brokers, the option for personalized support or advice can be a significant advantage for traders seeking tailored guidance.

The Pros and Cons of Using Best Discount Brokers

Discount brokers have democratized investing, making financial markets more accessible to the general public. They offer a streamlined approach to trading, focusing on executing trades with minimal fees. However, like any financial service, using discount brokers comes with its own set of advantages and potential drawbacks, including the lack of personalized investment advice. Here’s a detailed look at the pros and cons of using discount brokers.

Pros of Using Discount Brokers

Cost Efficiency

Advantage: Discount brokers typically offer lower trading fees and commissions compared to full-service brokers. This cost efficiency is particularly beneficial for active traders and those with smaller account balances, as it allows for more of their capital to be invested rather than spent on fees.

Flexibility and Control

Advantage: Investors have complete control over their investment choices and trading decisions. This autonomy is ideal for those who prefer a hands-on approach to managing their portfolios and making their investment decisions.

Advanced Trading Tools and Resources

Advantage: Many discount brokers provide sophisticated trading platforms equipped with advanced charting tools, technical analysis resources, and real-time market data. These features empower traders to conduct their research and analysis, enhancing their ability to make informed trading decisions.

Accessibility

Advantage: The rise of online and mobile trading platforms has made it easier than ever to access financial markets. Investors can trade from anywhere at any time, providing unparalleled convenience.

Cons of Using Discount Brokers

Lack of Personalized Investment Advice

Drawback: One of the primary drawbacks of using a discount broker is the absence of personalized financial advice and planning services. Investors are responsible for their research and decision-making, which may be daunting for beginners or those with limited market knowledge.

Potential for Overtrading

Drawback: The low cost of trades and ease of access can sometimes encourage overtrading. Investors may make impulsive decisions without thorough research, potentially leading to unnecessary risk and loss.

Learning Curve

Drawback: Despite the availability of educational resources, there’s still a learning curve associated with using trading platforms and understanding financial markets. Beginners may find the array of tools and data overwhelming without guidance.

Customer Support Limitations

Drawback: While discount brokers offer customer support, the level of service may not be as comprehensive or personalized as that provided by full-service brokers. This can be a significant disadvantage during urgent or complex issues.

How to Open an Account with a Discount Broker

Opening an account with a discount broker is a straightforward process that marks the beginning of your investing journey. By choosing a discount broker, you’re opting for a cost-effective way to trade stocks, bonds, ETFs, and possibly other securities. Here’s a step-by-step guide to selecting and opening an account with a discount broker, including the verification and funding processes.

Step 1: Research and Select a Discount Broker

1.1 Compare Broker Features: Evaluate various discount brokers based on their fee structures, available account types, trading platforms, educational resources, and customer support. Use online reviews and comparisons to identify the best discount brokers that meet your needs.

1.2 Check Regulatory Compliance: Ensure that the broker is regulated by reputable authorities like the SEC and FINRA. This ensures a level of security and credibility.

Step 2: Choose the Right Account Type

2.1 Understand Account Options: Discount brokers typically offer various account types, including individual, joint, and retirement accounts (IRAs). Determine which type aligns with your investment goals and financial situation.

2.2 Consider Your Investment Strategy: Whether you’re saving for retirement or trading actively, choose an account type that supports your strategy and offers the necessary features.

Step 3: Complete the Application Process

3.1 Fill Out the Application Form: Visit the broker’s website and complete the online application form. You’ll need to provide personal information, including your name, address, Social Security number, employment information, and financial situation.

3.2 Understand the Terms and Conditions: Carefully read and understand the broker’s terms of service, fee schedule, and any agreements required to open an account.

Step 4: Verify Your Identity

4.1 Submit Required Documentation: You may need to provide identification documents, such as a driver’s license or passport, to verify your identity. This step is necessary for compliance with regulatory requirements and to protect against fraud.

4.2 Complete Any Additional Verification Steps: Some brokers may require additional steps for verification, such as answering security questions or using two-factor authentication for account access.

Step 5: Fund Your Account

5.1 Choose a Funding Method: Most brokers offer several ways to fund your account, including bank transfers, wire transfers, and sometimes checks. Select the method that is most convenient and cost-effective for you.

5.2 Initiate the Deposit: Follow the broker’s instructions to initiate your first deposit. Be aware of any minimum deposit requirements and funding times, which can vary depending on the method used.

Step 6: Set Up Your Trading Environment

6.1 Explore the Trading Platform: Familiarize yourself with the broker’s trading platform. Look for tutorials or demo accounts to practice navigating the platform and making trades.

6.2 Customize Your Experience: Many platforms allow you to customize dashboards, create watchlists, and set up notifications. Tailor the platform to fit your trading style and preferences.

Step 7: Begin Trading

7.1 Start with a Plan: Develop a trading strategy based on your goals, risk tolerance, and market research. Consider starting with small trades to get a feel for the market and the platform.

7.2 Monitor and Adjust: Regularly review your portfolio’s performance, stay informed about market developments, and be prepared to adjust your strategy as needed.

Choosing the Best Discount Broker for Your Needs

Selecting the best discount broker requires careful consideration of your unique investment style, how often you plan to trade, and your long-term financial goals. With the plethora of options available, focusing on key factors can help you find a broker that not only meets your needs but also enhances your trading experience. Here’s a comprehensive guide, including a checklist, to aid you in evaluating and choosing the best discount broker for your investing journey.

Factors to Consider

Investment Style and Needs

- Active vs. Passive: Active traders need a platform with low latency, real-time data, and advanced charting tools. Passive investors might prioritize easy portfolio management and automatic rebalancing.

- Types of Investments: Whether you’re interested in stocks, bonds, ETFs, mutual funds, or cryptocurrencies, ensure the broker offers a wide selection that aligns with your investment interests.

Frequency of Trades

- Trading Volume: Consider how often you plan to buy and sell. Frequent traders benefit from low transaction costs and rebates for high volume, while occasional traders might prioritize no inactivity fees.

- Cost Structure: Understand all associated costs, including commissions, spreads, and any other fees. Even if a broker advertises commission-free trading, other fees might impact your returns.

Financial Goals

- Long-term vs. Short-term: Your investment horizon can influence the type of account and services you need. Long-term investors may value retirement accounts and educational resources, while short-term traders might prioritize advanced order types and margin trading.

Checklist for Evaluating Discount Brokers

Regulatory Compliance and Security

- [ ] Is the broker regulated by reputable authorities like the SEC and FINRA?

- [ ] Does the broker employ robust security measures, including data encryption and two-factor authentication?

Fees and Costs

- [ ] Are the broker’s fee structure and any potential hidden costs clearly outlined?

- [ ] How do the transaction fees compare for your expected trading volume?

Trading Platform and Tools

- [ ] Does the platform offer the tools and features necessary for your trading strategy?

- [ ] Is the trading platform user-friendly and accessible across multiple devices?

Investment Options

- [ ] Does the broker offer a wide range of investment products that match your interests?

- [ ] Are there limitations or restrictions on certain types of trades or investments?

Educational Resources and Customer Support

- [ ] Does the broker provide comprehensive educational materials suitable for your level of expertise?

- [ ] Is customer support readily available through multiple channels (phone, email, live chat)?

Account Types and Requirements

- [ ] Are there account types that align with your investment goals (e.g., individual, joint, retirement)?

- [ ] What are the minimum deposit requirements, and how do they fit with your financial situation?

Reviews and Reputation

- [ ] What do current and former users say about their experiences with the broker?

- [ ] Are there recurring issues mentioned in reviews that could be red flags?

FAQs:

- What Is a Discount Broker?

- A discount broker offers lower commission rates and fewer personalized services compared to full-service brokers, catering to self-directed investors.

- Why Are Broker Fees and Commissions Important?

- Lower fees and commissions can significantly impact overall investment returns, especially for active traders.

- How Do I Choose Between Different Trading Platforms?

- Consider platform ease of use, available trading tools, mobile app functionality, and whether it meets your trading needs.

- Are Discount Brokers Regulated?

- Yes, reputable discount brokers are regulated by financial authorities like the SEC and FINRA to protect investors.

- What Should I Look for in Terms of Customer Support?

- Look for brokers offering comprehensive support through multiple channels (phone, email, chat) and during extended hours.

- Can I Trade All Types of Securities with a Discount Broker?

- Most discount brokers offer a wide range of securities, including stocks, bonds, ETFs, and mutual funds, but offerings can vary.

- What Are the Drawbacks of Using a Discount Broker?

- The main drawback is the lack of personalized financial advice and planning services, making them better suited for experienced investors.

- How Secure Are My Investments with a Discount Broker?

- Investments with regulated brokers are secure, but ensure the broker uses advanced security measures to protect your account.

- How Quickly Can I Start Trading After Opening an Account?

- Account opening times vary, but with online verification processes, trading can often begin within a few days after funding your account.

- How Do I Know Which Discount Broker Is Best for Me?

- Consider your trading and investment needs, desired features, and compare fees and services across several brokers to make an informed decision.