Cryptocurrency trading has revolutionized the financial markets, introducing a digital asset class that operates distinctly from traditional trading mechanisms. Understanding the basics of cryptocurrency and recognizing the importance of selecting the right crypto broker are foundational steps for anyone looking to venture into this dynamic market. This introduction will cover the essentials of cryptocurrency trading and highlight why choosing among the best crypto brokers is crucial for a successful trading experience.

Basics of Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security, making it nearly impossible to counterfeit or double-spend. Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

Key Characteristics

- Decentralization: Most cryptocurrencies are managed by a decentralized network of users, contrasting with centralized banking systems.

- Limited Supply: Many cryptocurrencies have a capped supply, defined by their underlying algorithms, which can influence their value.

- Volatility: Cryptocurrencies are known for their price volatility, which can present both risks and opportunities for traders.

How Cryptocurrency Trading Differs from Traditional Trading

- Market Hours: Cryptocurrency markets operate 24/7, offering constant trading opportunities without the restrictions of traditional market hours.

- Ownership and Storage: Trading cryptocurrencies often involves taking ownership of the asset and requires digital wallets for storage, though some brokers offer derivatives that bypass the need for direct ownership.

- Regulatory Environment: The regulatory landscape for cryptocurrencies is evolving and can vary significantly between jurisdictions, affecting how assets are traded and protected.

Importance of Choosing the Best Crypto Brokers

Security

With the rise of digital assets, security is paramount. The best crypto brokers implement robust security measures, including cold storage for client assets, two-factor authentication (2FA), and encryption protocols to protect traders’ funds and information.

Regulatory Compliance

Opting for a broker regulated in reputable jurisdictions ensures a level of oversight and consumer protection, which is crucial in the relatively new and sometimes uncertain crypto market.

Trading Platform and Tools

A user-friendly trading platform equipped with advanced charting tools, real-time data, and analysis features is vital for navigating the volatile crypto market effectively.

Fees and Spreads

Understanding the fee structure, including trading fees, withdrawal charges, and spreads, is essential, as these can vary widely among brokers and impact overall profitability.

Range of Cryptocurrencies

A broad selection of cryptocurrencies offers more trading opportunities. The best crypto brokers provide access to major coins like Bitcoin (BTC) and Ethereum (ETH), along with a variety of altcoins.

Educational Resources and Support

For beginners, access to educational materials and responsive customer support can greatly enhance the learning curve and trading experience. The best brokers offer comprehensive guides, tutorials, webinars, and 24/7 support.

Key Features of Best Crypto Brokers for Beginners

Navigating the vibrant and volatile world of cryptocurrency trading can be daunting for beginners. Choosing a crypto broker that not only facilitates easy entry into the market but also ensures a secure and cost-effective trading experience is crucial. Here are the essential attributes to consider when searching for the best crypto brokers, especially tailored for those just starting their journey in cryptocurrency trading.

Security

Robust Security Measures

The paramount concern in crypto trading is security due to the digital nature of assets and the prevalence of hacking incidents. Top brokers implement rigorous security measures, including:

- Two-Factor Authentication (2FA): Adds an extra layer of security during login and withdrawal processes.

- Cold Storage of Assets: Keeps a significant portion of digital assets in offline storage to protect against hacking.

- Encryption and Network Security: Uses advanced encryption techniques to safeguard users’ information and transactions.

Regulatory Compliance

Opt for brokers regulated by reputable financial authorities. Regulation ensures that the broker adheres to specific operational standards, offering an additional layer of protection to traders.

Ease of Use

User-Friendly Platform

For beginners, a steep learning curve can be a significant barrier. The best crypto brokers offer platforms that are intuitive and easy to navigate, with clear instructions and responsive design.

- Demo Account: Some brokers provide demo accounts, allowing new traders to practice without risking real money.

- Educational Resources: Look for brokers that offer comprehensive educational materials to help beginners understand the basics of cryptocurrency and trading strategies.

Mobile Trading App

A mobile app enables trading on the go, a crucial feature given the 24/7 nature of the cryptocurrency market. The app should offer full functionality, mirroring the desktop trading experience.

Fee Structure

Transparent and Competitive Fees

Understanding the cost of trading is vital. Top brokers are transparent about their fee structures, which can include:

- Trading Fees: Commissions on trades, often expressed as a percentage of the trade volume.

- Spread: The difference between the buy and sell price of cryptocurrencies.

- Withdrawal and Deposit Fees: Charges for moving funds in or out of your account.

Low or No Hidden Fees

Beware of hidden fees that can eat into your profits. The best brokers clearly outline any additional costs, such as inactivity fees or account maintenance charges.

Additional Services

Range of Cryptocurrencies

A wide selection of cryptocurrencies offers more opportunities for trading and diversification. Top brokers provide access to major coins like Bitcoin and Ethereum, as well as smaller altcoins.

Customer Support

Responsive and knowledgeable customer support is essential, especially for beginners who may need assistance navigating the platform or understanding trading concepts.

Tools and Analytics

Access to real-time data, charting tools, and analytical resources can enhance decision-making and strategy development for traders at all levels.

Understanding Cryptocurrency Regulations

The regulatory landscape for cryptocurrency trading is evolving as governments and financial authorities worldwide seek to understand and integrate these new financial instruments within their legal frameworks. This overview explains the current state of cryptocurrency regulations and underscores the importance of trading with a regulated broker, especially when looking for the best crypto brokers.

Regulatory Landscape for Best Crypto Brokers Trading

Varied Regulatory Approaches

Regulatory approaches to cryptocurrency trading vary significantly across different jurisdictions. Some countries have embraced cryptocurrencies, enacting clear regulations to foster growth and protect investors, while others have imposed restrictions or outright bans.

Key Regulatory Bodies

- United States: The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have jurisdiction over cryptocurrency trading, focusing on security tokens and derivatives, respectively.

- European Union: The EU is working towards a comprehensive regulatory framework for cryptocurrencies under the Markets in Crypto-Assets (MiCA) proposal, aiming to standardize regulations across member states.

- Asia: Countries like Japan and Singapore have established relatively crypto-friendly regulations, with clear guidelines for exchanges and traders, whereas China has taken a more restrictive approach.

Importance of Trading with a Regulated Broker

Investor Protection

Regulated brokers are required to adhere to strict standards of operation, including capital requirements, client fund segregation, and anti-money laundering (AML) practices. This provides a level of protection to investors not guaranteed in unregulated environments.

Transparency and Fairness

Regulation ensures that brokers operate with a degree of transparency and fairness, providing traders with accurate pricing, clear terms of service, and recourse in the event of disputes.

Market Integrity

By adhering to regulatory standards, brokers contribute to the overall integrity of the cryptocurrency market, reducing the risk of fraud and manipulation that can deter new investors and destabilize the market.

Confidence and Trust

For traders, especially beginners, trading with a regulated broker offers peace of mind. Knowing that the broker complies with legal and regulatory standards can build confidence in the trading environment.

Navigating the Regulatory Environment

Stay Informed

The regulatory landscape for cryptocurrencies is continually changing. Traders should stay informed about regulatory developments in their jurisdiction and globally, as these can impact trading strategies and broker selection.

Verify Broker Regulation

Before opening an account with a crypto broker, verify their regulatory status. Check which regulatory body they are registered with and confirm their registration through official websites or direct inquiries.

Consider the Global Impact

For traders interested in a range of cryptocurrencies, including those not widely available in their home country, considering international brokers that comply with reputable regulatory standards can offer access to a broader market while still providing a degree of regulatory protection.

Crypto Wallets and Security Measures

In the realm of cryptocurrency trading, the security of your digital assets is paramount. Understanding the types of wallets provided by brokers and the security practices to protect your investments is essential. The best crypto brokers offer robust security measures, including the use of hot and cold storage solutions, to ensure the safety of clients’ assets. This guide delves into the differences between hot and cold storage, along with recommended security practices for cryptocurrency investors.

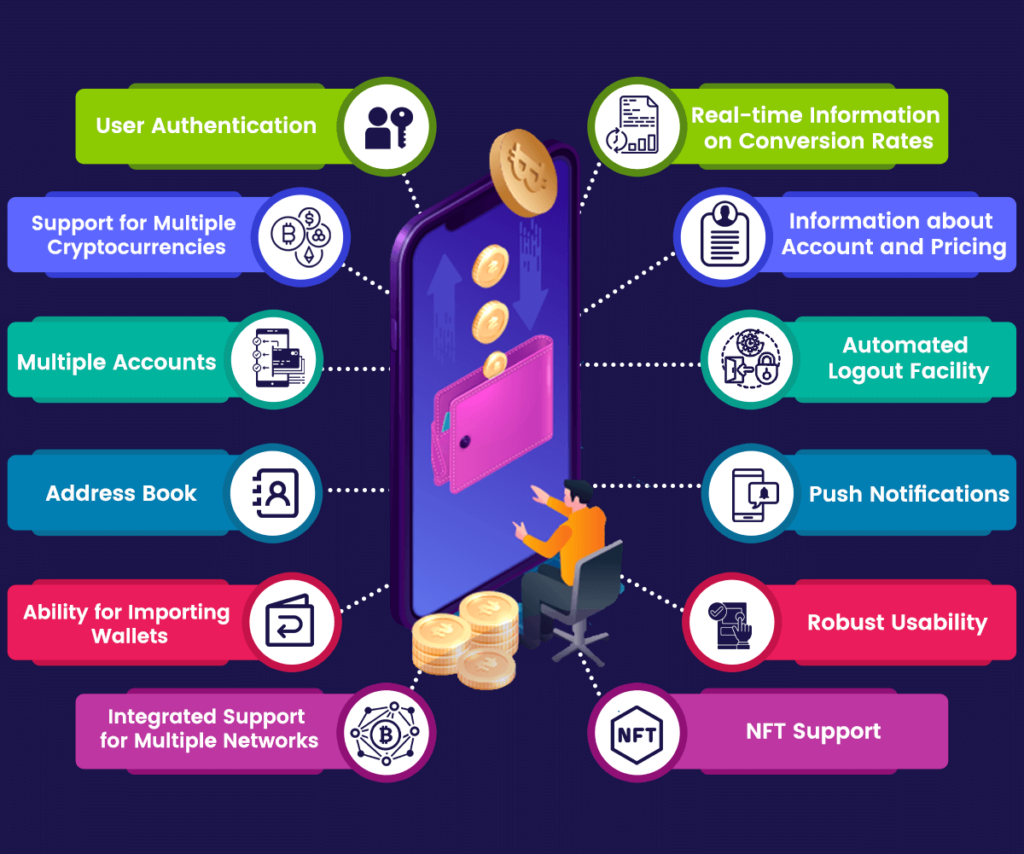

Types of Wallets Provided by Best Crypto Brokers

Hot Wallets (Online Wallets)

Hot wallets are connected to the internet, offering convenience and quick access to assets for trading or transactions. They are typically provided by brokers for ease of use within trading platforms.

- Pros: Immediate access to funds for trading; user-friendly interfaces.

- Cons: Higher risk of security breaches due to internet connectivity.

Cold Wallets (Offline Wallets)

Cold wallets store cryptocurrencies offline, providing enhanced security by making them inaccessible to online hackers. Many brokers offer cold storage solutions for the long-term safekeeping of digital assets.

- Pros: Increased security from offline storage; suitable for holding assets not needed for immediate trading.

- Cons: Less convenient for quick trading or transactions.

Security Practices to Protect Your Investments

Use Strong, Unique Passwords

For any online account related to cryptocurrency trading, use strong, unique passwords. Consider using a password manager to generate and store complex passwords securely.

Enable Two-Factor Authentication (2FA)

Always enable 2FA for an additional layer of security on your trading accounts and wallets. This requires not only your password but also a code from your mobile device to access your account.

Be Cautious of Phishing Attempts

Be vigilant about phishing attempts through emails, messages, or suspicious links. Always verify the authenticity of communications and never disclose your private keys or sensitive information.

Regularly Update Security Software

Keep your computer’s security software, including antivirus and anti-malware programs, up to date to protect against threats that could compromise your wallet’s security.

Consider Using a Hardware Wallet

For significant investments, consider using a hardware wallet, a form of cold storage. Hardware wallets are physical devices that store your private keys offline, offering a high level of security.

Backup Your Wallet

Regularly backup your wallet, including private keys and recovery phrases, in secure locations. This ensures access to your assets in case of device failure, loss, or theft.

Educate Yourself

Stay informed about the latest security threats and best practices in cryptocurrency security. The best crypto brokers often provide educational resources to help clients understand how to protect their investments.

Comparing Fee Structures of Best Crypto Brokers

Understanding the fee structures of crypto brokers is essential for traders, as fees can significantly impact overall profitability. Cryptocurrency trading involves various fees, including maker/taker fees, withdrawal fees, and sometimes even deposit fees. This guide explains these common fees and provides insights on how to find brokers with competitive fee structures, emphasizing the search for the best crypto brokers.

Explanation of Fees in Crypto Trading

Maker/Taker Fees

- Maker Fees: Charged when you add liquidity to the market by placing a limit order under the last trade price for buys and above for sells. These fees are usually lower because maker orders help build the market depth.

- Taker Fees: Incurred when you remove liquidity from the market by placing an order that is executed against an order on the book. Taker fees are typically higher than maker fees.

Withdrawal Fees

Withdrawal fees are charged when you transfer your cryptocurrencies out of the broker’s platform to your wallet or another exchange. These fees can vary widely depending on the broker and the specific cryptocurrency.

Deposit Fees

While less common, some brokers charge fees for depositing funds or cryptocurrencies into your trading account. Always check the fee schedule before funding your account.

Other Fees

Other potential fees include inactivity fees for not trading within a certain period, account maintenance fees, or fees for using certain payment methods for deposits/withdrawals.

Finding Brokers with Competitive Fee Structures

Research and Compare

Start by researching multiple brokers and comparing their fee structures. Look for transparency in how fees are presented, ensuring you understand all potential charges involved in trading and managing your account.

Consider Your Trading Style

Your trading volume and style can influence which broker’s fee structure is most cost-effective for you. For example, if you’re a high-volume trader, looking for brokers with lower maker/taker fees or volume discounts can be beneficial. Conversely, if you plan to hold investments long-term, withdrawal fees and inactivity fees might be more relevant to you.

Check for Hidden Fees

Read the fine print to identify any hidden fees that could affect your trading costs. This includes looking into the costs of depositing and withdrawing funds, as well as any currency conversion fees if you’re trading in a currency different from your deposit currency.

Evaluate Overall Value

Beyond just the fees, consider the overall value offered by the broker. This includes the security measures, the range of cryptocurrencies available, the quality of the trading platform, and customer support. Sometimes, a slightly higher fee might be justifiable for superior service or platform features.

Reviews and Recommendations

Look for reviews and recommendations from other traders, especially those with similar trading strategies and volumes. User experiences can provide valuable insights into the actual costs and benefits of trading with a particular broker.

Promotions and Fee Discounts

Some brokers offer promotions, such as reduced fees for new customers or discounts for using certain payment methods. Keep an eye out for these opportunities to reduce your trading costs.

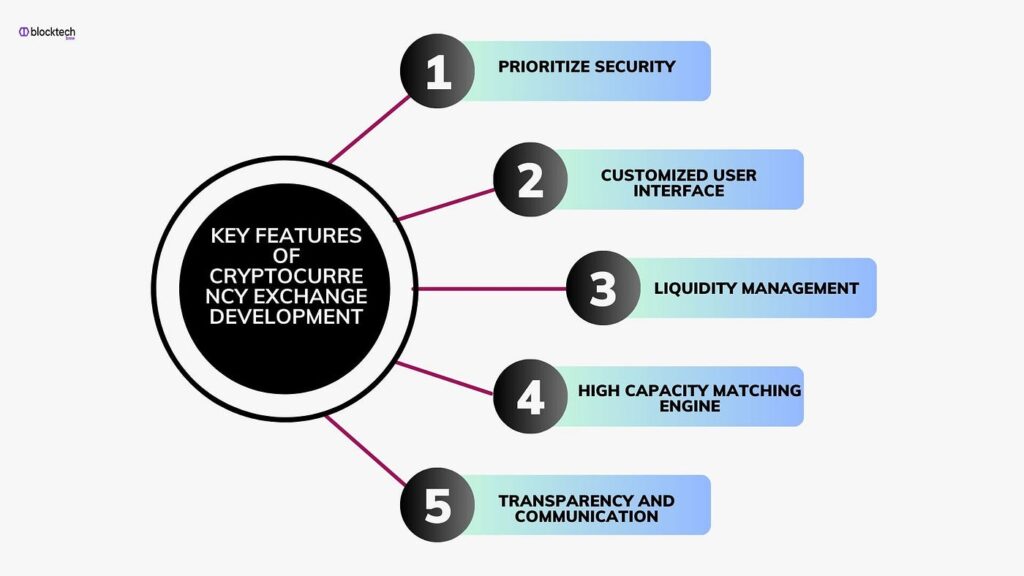

Navigating Crypto Trading Platforms

For both novice and experienced traders, the choice of a trading platform plays a pivotal role in cryptocurrency trading. User-friendly platforms that balance comprehensive features with ease of use can significantly enhance trading efficiency and experience. This guide delves into the key features of user-friendly trading platforms for beginners and compares the pros and cons of desktop versus mobile trading platforms, emphasizing criteria to help find the best crypto brokers.

Key Features of User-Friendly Trading Platforms for Beginners

Intuitive Interface

A clean, well-organized interface that is easy to navigate is crucial for beginners. Platforms should clearly display essential information such as account balance, asset prices, and open positions, without overwhelming users with too much data at once.

Real-time Data and Charting Tools

Access to real-time market data and intuitive charting tools is essential for making informed trading decisions. Beginners should look for platforms that offer basic charting capabilities, including the ability to view different time frames and apply fundamental technical analysis indicators.

Educational Resources

The best crypto brokers offer platforms that integrate educational materials directly into the trading environment. Look for platforms that provide tutorials, guides, and webinars to help you understand trading strategies, market analysis, and platform features.

Security Features

Security is paramount in crypto trading. User-friendly platforms incorporate robust security features, including two-factor authentication (2FA), encryption, and the option to set withdrawal whitelist addresses, enhancing the safety of your funds.

Demo Trading Account

A demo or simulated trading account allows beginners to practice trading with virtual money, offering a risk-free environment to learn how the platform works and to test trading strategies.

Customer Support

Easy access to responsive customer support is essential, especially for beginners encountering issues or having questions. Preferred platforms offer multiple support channels, such as live chat, email, and phone support.

Desktop vs. Mobile Trading Platforms

Desktop Trading Platforms

Pros:

- Comprehensive Features: Desktop platforms often offer more advanced trading tools and features compared to their mobile counterparts.

- Larger Display: The larger screen size makes it easier to analyze charts, view multiple assets simultaneously, and manage trades.

- Higher Performance: Desktop applications can handle more data and complex analyses without significant performance issues.

Cons:

- Less Mobility: Trading is restricted to where your computer is located, limiting the ability to trade on the go.

- Setup Time: Desktop platforms may require installation and regular updates.

Mobile Trading Platforms

Pros:

- Convenience: Mobile platforms offer the flexibility to trade anytime, anywhere, as long as you have an internet connection.

- Instant Notifications: Mobile apps can send push notifications for price alerts, trade executions, and news updates, helping you stay informed in real-time.

Cons:

- Limited Features: While improving, mobile platforms may still lack some of the advanced features and tools available on desktop versions.

- Smaller Screen: The compact display can make chart analysis and viewing detailed information more challenging.

Educational Resources for Best Crypto Brokers Trading Beginners

For newcomers to the volatile and complex world of cryptocurrency trading, access to high-quality educational resources is a cornerstone of success. Broker-provided education plays a crucial role in demystifying the market, equipping beginners with the knowledge and skills needed to navigate trading confidently. This guide delves into the significance of educational offerings by brokers and provides criteria for evaluating the quality and accessibility of such content, focusing on services provided by the best crypto brokers.

The Role of Broker-Provided Education

Foundation Building

Educational resources offered by brokers serve as building blocks for understanding the fundamentals of cryptocurrency trading, including how the market operates, analysis techniques, and the basics of blockchain technology.

Strategy Development

Beyond basic knowledge, quality educational content helps beginners develop and refine trading strategies. From risk management to technical analysis, the right resources can guide new traders in creating approaches tailored to their goals and risk tolerance.

Continuous Learning

The crypto market is dynamic, with new developments and technologies emerging regularly. Educational materials should offer ongoing learning opportunities to help traders stay updated and adapt their strategies accordingly.

Evaluating the Quality and Accessibility of Educational Content

Comprehensive Coverage

Good educational resources should cover a wide range of topics, from the very basics of cryptocurrency trading to advanced strategies and market analysis. The best crypto brokers provide a curriculum that caters to both beginners and experienced traders.

Diverse Formats

Everyone learns differently, and brokers should accommodate various learning styles. Look for a mix of educational formats, including:

- Video Tutorials: Visual and auditory explanations of complex concepts.

- Webinars and Live Workshops: Interactive sessions with experts for real-time learning and Q&A.

- E-books and Articles: In-depth written materials for study at your own pace.

- Infographics and Cheat Sheets: Quick references for key concepts and strategies.

Expertise and Credibility

The quality of education is only as good as the expertise behind it. The best brokers offer content created by experienced traders, market analysts, and financial educators with proven track records in cryptocurrency trading.

Accessibility

High-quality educational content should be easily accessible, preferably directly through the broker’s platform. This includes:

- Free Access: Educational resources should be freely available to registered users, without hidden costs.

- User-Friendly Interface: The platform should make it easy to find and navigate educational materials.

- Language Options: For non-English speakers, availability of content in multiple languages is a plus.

Practical Application

The best educational resources not only teach theory but also encourage practical application. This can include:

- Demo Accounts: Allowing traders to practice strategies in a simulated environment.

- Case Studies and Real-World Examples: Illustrating how concepts apply in actual trading scenarios.

- Interactive Quizzes and Assessments: Helping reinforce learning and gauge progress.

Using Demo Accounts for Practice

Demo accounts serve as a vital tool for both novice and experienced traders in the cryptocurrency market. They simulate real trading environments without exposing users to financial risk, allowing for a hands-on learning experience. Understanding the benefits of practicing with demo accounts and how to effectively transition from demo to live trading is crucial. The best crypto brokers provide robust demo accounts to help traders refine their strategies and gain confidence. Here’s how to make the most of these accounts.

Benefits of Practicing with Demo Accounts

Risk-Free Learning Environment

Demo accounts use virtual funds, enabling traders to experiment with different strategies and learn the nuances of the crypto market without the fear of losing money. This risk-free environment is ideal for beginners to understand market dynamics.

Familiarization with Trading Platforms

They allow traders to become acquainted with the broker’s trading platform. Users can learn how to execute trades, set stop-loss and take-profit orders, and use various analytical tools and charts provided by the broker.

Strategy Development and Testing

Traders can test and refine trading strategies in real-time market conditions without financial risk. This includes experimenting with leverage, exploring different crypto assets, and practicing technical and fundamental analysis techniques.

Psychological Preparation

Trading in a simulated environment helps traders manage emotions and develop discipline, which are critical for success in the volatile crypto market. It offers a glimpse into the psychological challenges of trading, such as dealing with loss and making swift decisions.

Transitioning from Demo to Live Trading

Start Small

When you’re ready to move to live trading, start with a small amount of capital. This approach helps manage risk as you adapt to the emotional aspects of trading with real money.

Apply Learned Strategies

Implement the strategies that worked well in the demo account. However, be prepared for the psychological shift when real funds are at stake and remain disciplined in your approach.

Gradual Transition

Consider using a hybrid approach by trading simultaneously in both demo and live accounts. This strategy allows you to test new ideas in the demo account while gradually increasing your exposure in the live market.

Monitor and Adjust

Continuously monitor the performance of your live trades and compare them with outcomes in the demo account. Use insights gained from this analysis to adjust your strategies and risk management practices as needed.

Utilize Educational Resources

Leverage the educational resources provided by your broker to enhance your knowledge and skills. Ongoing learning is vital to staying informed about market trends and improving your trading strategy.

Choosing the Right Broker

When selecting a broker, consider their demo account offerings alongside other factors such as regulatory compliance, fee structure, platform features, and customer support. The best crypto brokers offer demo accounts that closely mimic their live trading environment, providing a valuable learning tool for traders at all levels.

Making Your First Cryptocurrency Trade

Embarking on your first cryptocurrency trade is an exciting step into a dynamic market known for its volatility and potential rewards. Proper planning, execution, and risk management are crucial to navigate this space effectively. Partnering with the best crypto brokers can provide the necessary tools and support for a successful trading journey. This guide offers a step-by-step approach to making your first cryptocurrency trade, along with tips for managing risk.

Planning Your First Trade

1. Choose a Reputable Broker

Select one of the best crypto brokers that offers a user-friendly platform, robust security measures, and comprehensive educational resources. Ensure the broker is regulated by reputable authorities.

2. Educate Yourself

Take advantage of the educational materials provided by your broker to understand the basics of cryptocurrency trading, market trends, and analysis techniques.

3. Practice with a Demo Account

Use a demo account to familiarize yourself with the trading platform and test your trading strategies without risking real money.

4. Develop a Trading Strategy

Identify your trading goals, risk tolerance, and preferred trading style (day trading, swing trading, etc.). Develop a strategy that aligns with these factors, including criteria for entering and exiting trades.

5. Start Small

When you’re ready to trade with real funds, begin with a small investment. This approach allows you to gain experience while minimizing potential losses.

Executing Your First Trade

1. Research and Choose Your Cryptocurrency

Select a cryptocurrency to trade based on thorough research. Consider factors like market cap, liquidity, recent news, and technical analysis.

2. Analyze the Market

Use charting tools and indicators to analyze market trends and identify potential entry and exit points for your chosen cryptocurrency.

3. Place Your Order

Decide on the type of order you want to place (e.g., market, limit, stop order). Use the trading platform to execute your trade according to your strategy.

4. Monitor Your Trade

Keep a close eye on the market and your open position. Be prepared to adjust your strategy based on market developments.

Tips for Risk Management

1. Use Stop-Loss Orders

Set stop-loss orders to automatically close your position at a predetermined price, limiting potential losses.

2. Diversify Your Portfolio

Spread your investment across different cryptocurrencies to mitigate risk. Avoid putting all your capital into a single asset.

3. Stay Informed

Follow cryptocurrency news and market trends. Staying informed can help you make timely decisions and adjust your strategy accordingly.

4. Manage Your Emotions

Cryptocurrency markets can be highly volatile. It’s crucial to stay disciplined, stick to your trading plan, and avoid making decisions based on emotions.

5. Continuously Learn

The crypto market is constantly evolving. Engage in ongoing education to refine your trading skills and stay ahead of market changes.

Choosing Your First Best Crypto Brokers

Selecting your first crypto broker is a pivotal decision that can significantly impact your trading journey. For beginners, it’s crucial to choose a broker that not only offers competitive trading conditions but also provides the necessary educational resources and support to navigate the cryptocurrency market confidently. This guide outlines the essential criteria for evaluating and selecting a crypto broker, along with recommendations for beginner-friendly crypto brokers based on thorough reviews.

Criteria for Evaluating Crypto Brokers

Regulatory Compliance

A broker’s regulatory status is a primary consideration, providing an assurance of security and fair trading practices. Look for brokers regulated by reputable financial authorities, which can vary by region but may include bodies like the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC).

Security Measures

Given the digital nature of cryptocurrencies, a broker’s security measures are paramount. Opt for brokers that employ robust security protocols such as two-factor authentication (2FA), cold storage for client assets, encryption, and regular security audits.

User-Friendly Platform

For beginners, a user-friendly trading platform is essential. It should offer an intuitive interface, real-time data, technical analysis tools, and seamless order execution. Accessibility across desktop and mobile devices is also a key factor.

Fee Structure

Understand the broker’s fee structure, which can include trading fees (maker/taker fees), withdrawal and deposit fees, and any other associated costs. Competitive fees can significantly affect overall profitability, especially for active traders.

Educational Resources

Quality educational resources can dramatically shorten the learning curve. Look for brokers that provide comprehensive learning materials, such as tutorials, webinars, articles, and glossaries, tailored to traders at different levels of expertise.

Customer Support

Responsive and knowledgeable customer support is crucial, particularly for beginners who may encounter queries or issues. Ensure the broker offers support through various channels and during hours that align with your trading activity.

Variety of Cryptocurrencies

Access to a wide range of cryptocurrencies allows for diversification and exploration of different market opportunities. While most brokers offer major cryptocurrencies like Bitcoin and Ethereum, the availability of altcoins may vary.

Recommendations for Beginner-Friendly Best Crypto Brokers

eToro

eToro is known for its social trading feature, allowing beginners to copy the trades of more experienced investors. It’s regulated in multiple jurisdictions and offers an intuitive platform with access to a variety of cryptocurrencies.

Coinbase

Coinbase is renowned for its user-friendly interface, making it an excellent choice for beginners. It provides a secure trading environment with comprehensive educational resources to help new traders get started.

Binance

While Binance caters to traders of all levels, it also offers features beneficial to beginners, such as a basic trading interface, extensive range of cryptocurrencies, and competitive fees.

Kraken

Kraken balances advanced trading features with user accessibility, making it suitable for beginners eager to learn. It emphasizes security and offers a wide selection of cryptocurrencies with relatively low fees.

FAQs:

- What Is Cryptocurrency Trading?

- Cryptocurrency trading involves buying and selling digital currencies on exchanges or through brokers to profit from price fluctuations.

- Why Is Choosing the Right Crypto Broker Important?

- The right broker provides secure trading platforms, reasonable fees, and valuable educational resources, essential for navigating the volatile crypto market.

- How Do Crypto Broker Fees Work?

- Fees can include transaction fees (maker/taker), withdrawal fees, and sometimes, overnight financing fees, varying widely among brokers.

- What Regulations Apply to Crypto Brokers?

- Regulations vary by country but may include requirements for anti-money laundering (AML) and know your customer (KYC) procedures.

- Should I Use a Broker’s Wallet or an External Wallet?

- While brokers offer convenience, an external wallet can provide additional security for storing large amounts of cryptocurrencies.

- How Do I Open a Crypto Trading Account?

- Select a regulated broker, complete their application process, verify your identity, and fund your account to start trading.

- Why Should I Use a Demo Account in Crypto Trading?

- Demo accounts offer a risk-free way to familiarize yourself with the trading platform and practice strategies without real money.

- What Should I Look for in a Crypto Trading Platform?

- Essential features include ease of use, robust security measures, real-time data, and analytical tools.

- How Can I Ensure My Chosen Broker Is Reliable?

- Check their regulatory status, read user reviews, and assess their security measures and customer support quality.

- When Is the Best Time to Start Live Trading?

- After gaining confidence through education, practice, and understanding market risks, you can transition to live trading with a well-considered strategy.