Forex trading, or foreign exchange trading, involves the simultaneous buying of one currency while selling another. This market is the largest financial market globally, characterized by high liquidity and 24-hour operation during weekdays. For beginners and seasoned traders alike, understanding the basics of forex trading and the role of spreads is crucial. Spreads are a fundamental aspect that affects the cost of trading currencies, and selecting the best low spread forex brokers can significantly impact your trading success.

Introduction to Forex Trading Basics

Forex trading is conducted in currency pairs, such as EUR/USD or USD/JPY, where the value of one currency is compared against another. The forex market is driven by global trade, economic strength, geopolitical events, and interest rates among other factors, making it highly dynamic.

Traders aim to profit from changes in currency values, speculating on whether the base currency in a pair will strengthen or weaken against the quote currency. Forex trading can appeal to various trading styles, from day trading to long-term strategic investments.

Explanation of Spreads in Forex Trading

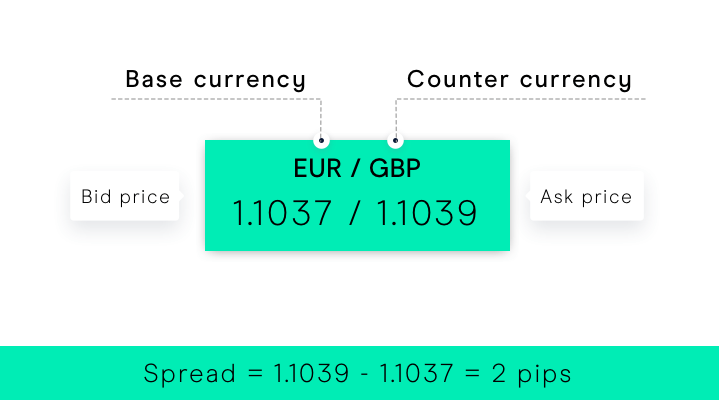

A spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair. It represents the cost of trading with a forex broker and is how most brokers make their money instead of charging direct commissions.

Importance of Spreads

- Trading Costs: The spread is essentially the cost of entry and exit from a trade. Lower spreads mean lower costs for traders, which is particularly important for those employing strategies like scalping, where numerous trades are made in a short period.

- Impact on Profits: For any trade to become profitable, the price movement must first cover the spread. Therefore, the lower the spread, the easier it is to make a profit.

- Market Conditions: Spreads can vary depending on market volatility and liquidity. Major currency pairs usually have lower spreads compared to exotic pairs.

Choosing the Best Low Spread Forex Brokers

When selecting a forex broker, considering the spread is critical, especially for traders who execute a high volume of trades. Here are factors to consider:

Regulatory Compliance

Ensure the broker is regulated by reputable financial authorities. Regulation not only adds a layer of security but also ensures more transparency in pricing, including spreads.

Spread Consistency

Look for brokers that offer consistently low spreads, even during market volatility or news events. Some brokers offer fixed spreads, while others offer variable spreads.

Trading Platform and Tools

The best low spread forex brokers provide advanced trading platforms and analytical tools that help traders make informed decisions, manage risk, and execute trades efficiently.

Additional Costs

Consider other potential costs associated with trading, such as commissions (if applicable), overnight swap rates, and fees for deposit and withdrawal. Sometimes, a broker offering slightly higher spreads but no other hidden costs can be more economical overall.

Customer Support and Education

Especially important for beginners, comprehensive educational resources and responsive customer support can greatly enhance the trading experience and success.

The Significance of Low Spread for Forex Traders

In the competitive world of forex trading, the spread is a critical factor that directly impacts a trader’s costs and profitability. Understanding the significance of low spreads is essential, especially when selecting the best low spread forex brokers. Low spreads can offer a substantial advantage, influencing the overall trading experience and effectiveness of various trading strategies.

Impact of Low Spreads on Trading Costs and Profitability

Reduced Trading Costs

The spread represents the cost paid to the broker for each trade. A lower spread means you pay less, directly reducing your trading costs. For active traders or those who trade large volumes, the savings from low spreads can be significant over time, enhancing overall profitability.

Faster Break-Even Point

A trade becomes profitable only after it covers the spread. With low spreads, the price needs to move less in your favor to reach the break-even point, making it easier to achieve profits, especially in markets with lower volatility.

Enhanced Trade Execution

Low spreads can lead to better trade execution, as orders are more likely to be filled at desired prices. In fast-moving markets, the ability to enter and exit positions swiftly at accurate prices can be crucial for capturing short-term opportunities.

Advantage of Best Low Spread Forex Brokers for Various Trading Strategies

Scalping

Scalpers benefit immensely from low spreads as this strategy involves making numerous trades to capture small price movements. Each trade’s profitability can be significantly affected by the spread, making low spreads a necessity for scalping to be viable.

Day Trading

Day traders, who open and close positions within a single trading day, also favor low spreads. Lower transaction costs allow for more flexibility in entering and exiting trades, which is critical for capitalizing on intraday price movements.

Swing Trading

While swing traders, who hold positions for several days to weeks, might not be as affected by spreads as scalpers or day traders, low spreads still contribute to reduced overall trading costs and improved entry and exit points.

Automated Trading

Automated trading systems, especially those executing high-frequency strategies, require low spreads to maintain profitability. These systems often operate on thin margins, and high spreads can erode profits or turn potentially profitable trades into losses.

Choosing the Best Low Spread Forex Brokers

When searching for the best low spread forex brokers, consider the following:

- Regulatory Compliance: Ensure the broker is regulated by a reputable authority, providing a secure trading environment.

- Spread Consistency: Look for brokers that offer consistently low spreads, even during market volatility or economic news releases.

- Additional Fees: Be aware of other potential costs, such as commissions or account maintenance fees, that could offset the benefits of low spreads.

- Trading Platform and Tools: Assess the quality of the trading platform and the availability of tools and resources that can support your trading strategy.

- Customer Support: Choose brokers known for excellent customer support, providing assistance whenever you need it.

Evaluating Forex Brokers: Beyond the Spreads

While low spreads are a crucial factor in choosing a forex broker, several other aspects are equally important to ensure a secure, efficient, and supportive trading environment. Beyond spreads, factors such as regulation, trading platform features, customer support, and additional services play a significant role in selecting the best low spread forex brokers. This comprehensive evaluation helps traders align with a broker that not only offers competitive pricing but also meets their broader trading needs and preferences.

Regulation and Security for Best Low Spread Forex Brokers

Regulation is paramount in the forex market, providing traders with a layer of protection against fraud and malpractice. The best low spread forex brokers are regulated by reputable authorities such as the Commodity Futures Trading Commission (CFTC) in the U.S., the Financial Conduct Authority (FCA) in the UK, or the Australian Securities and Investments Commission (ASIC).

Importance:

- Ensures Fair Practices: Regulated brokers adhere to strict standards that guarantee transparency and fair trading conditions.

- Protects Funds: Regulation often requires that client funds be held in segregated accounts, protecting traders’ capital from broker bankruptcy or misuse.

- Provides Recourse: In case of disputes, traders have a regulatory body to turn to for resolution.

Trading Platform and Technology

The trading platform is your gateway to the forex market, making its reliability, speed, and features critical for successful trading.

Considerations:

- User Interface: The platform should be intuitive and easy to navigate, especially for beginners.

- Tools and Analysis: Look for platforms with advanced charting tools, technical indicators, and real-time news feeds to support decision-making.

- Execution Speed: Fast order execution minimizes slippage, especially in volatile markets.

Customer Support

Effective customer support ensures that any queries or technical issues are promptly addressed, minimizing potential trading disruptions.

What to Look For:

- Availability: Support should be accessible 24/5, aligning with the forex market hours.

- Channels: Multiple support channels (live chat, phone, email) cater to different preferences and needs.

- Language: For non-English speakers, support in multiple languages can be a significant advantage.

Additional Services

Beyond the core offerings, additional services can enhance the trading experience and provide added value.

Services to Consider:

- Educational Resources: Comprehensive educational materials, including tutorials, webinars, and articles, support continuous learning.

- Research and Analysis: Access to market research, analysis, and expert insights can inform trading strategies.

- Demo Account: A demo account allows traders to practice strategies and get familiar with the platform without risking real money.

Regulatory Bodies and Their Role in Forex Trading

In the vast and decentralized forex market, regulatory bodies play a crucial role in ensuring transparency, fairness, and security for traders. These entities set and enforce rules that brokers must adhere to, providing a safeguard against fraud and malpractice. Understanding the major regulatory authorities, such as the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC), is essential for traders. This knowledge underscores the importance of choosing a regulated broker, particularly when looking for the best low spread forex brokers, to ensure a secure and reliable trading environment.

Major Regulatory Authorities

Financial Conduct Authority (FCA)

Based in the UK, the FCA is renowned for its stringent regulatory standards and comprehensive oversight of the forex market. Brokers regulated by the FCA are considered among the most reliable due to the authority’s emphasis on protecting consumer interests, enhancing market integrity, and promoting competition.

Cyprus Securities and Exchange Commission (CySEC)

CySEC regulates forex brokers operating within Cyprus and the European Union. It ensures compliance with EU financial regulations, providing a level of security and operational standards that protect traders’ interests and contribute to a stable trading environment.

Australian Securities and Investments Commission (ASIC)

ASIC oversees financial services and markets in Australia, including forex trading. Known for its rigorous regulatory framework, ASIC aims to enhance market integrity and protect traders by ensuring that financial services firms operate transparently and fairly.

The Importance of Trading with a Regulated Broker

Trader Protection

Regulated brokers must comply with strict financial standards, including capital adequacy requirements, segregation of client funds, and transparent reporting. This protects traders from the risk of broker insolvency and ensures their funds are not used for operational purposes.

Market Integrity

Regulatory bodies monitor the activities of brokers to prevent unethical practices such as price manipulation, providing traders with a fair trading environment. This oversight helps maintain the overall integrity of the forex market.

Dispute Resolution

Regulated brokers are subject to oversight in dispute resolution, offering traders a formal avenue to resolve issues. This adds an extra layer of security, knowing that there is recourse in case of disputes.

Transparency

Regulatory compliance requires brokers to maintain a high level of transparency in their operations, including clear disclosure of trading conditions, fees, and risks associated with forex trading. This transparency is crucial for traders to make informed decisions.

Types of Forex Accounts and Their Spreads

When entering the forex market, one of the critical decisions traders face is choosing the type of trading account that best suits their strategy and goals. Forex brokers, especially the best low spread forex brokers, typically offer a variety of account types, each with its spread offerings and trading conditions. Understanding the differences between these account types—such as Electronic Communication Network (ECN), Straight Through Processing (STP), and standard accounts—can help traders optimize their trading experience by selecting the option that provides the most value. This comparison highlights the features of each account type and their typical spread offerings.

ECN Accounts

Overview

ECN accounts provide direct access to other market participants through an electronic communication network. This setup is ideal for traders looking for tight spreads and the best possible prices from various liquidity providers.

Typical Spreads

- Spreads: Usually offer the lowest spreads starting from 0.0 pips.

- Commissions: Traders are typically charged a fixed commission per trade due to the low spread environment.

Best Suited For

Traders who prefer rapid execution and are willing to pay commissions for lower spreads, including scalpers and day traders.

STP Accounts

Overview

STP accounts route orders directly to the broker’s liquidity providers for execution, bypassing the dealing desk. This ensures faster execution speeds and eliminates potential conflicts of interest.

Typical Spreads

- Spreads: Slightly wider than ECN accounts, often starting from 0.1 or 0.2 pips, without additional commissions on trades.

Best Suited For

Traders looking for fast execution and direct market access without the commissions associated with ECN accounts.

Standard Accounts

Overview

Standard accounts are the most common type offered by forex brokers, providing access to a wide range of currency pairs with a fixed or variable spread model. These accounts do not charge commissions, as costs are built into the spread.

Typical Spreads

- Spreads: Wider than ECN and STP accounts, standard account spreads can start from 1 pip upwards, depending on the currency pair and market conditions.

Best Suited For

Beginner traders and those who prefer straightforward trading costs without the complexity of commissions. Standard accounts are also suitable for traders with smaller capital.

Comparison and Selection Tips

When comparing different forex account types and their spreads, consider the following:

- Trading Volume: High-volume traders, like scalpers, might find ECN accounts more cost-effective despite the commission due to lower spreads.

- Strategy Compatibility: Ensure the account type matches your trading strategy. For example, if your strategy relies on tight spreads for small, frequent profits, an ECN account might be preferable.

- Overall Costs: Consider the total trading cost, including spreads and any commissions or additional fees. Sometimes a wider spread without commissions can be more economical than paying a commission on top of tight spreads.

- Execution Speed and Slippage: Account types offering direct market access (DMA), such as ECN and STP, typically provide faster execution speeds and lower slippage.

Tools and Resources for Best Low Spread Forex Brokers Trading

In the competitive realm of forex trading, achieving success requires not only a keen understanding of market dynamics but also leveraging the right set of tools and educational resources. This is especially true when focusing on low spread trading, where minimizing costs can significantly impact profitability. The best low spread forex brokers offer a suite of tools and resources designed to empower traders to make informed decisions and enhance their trading efficiency. This guide explores essential trading tools and educational resources beneficial for engaging in effective low spread trading.

Essential Trading Tools

Advanced Charting Tools

For traders aiming to capitalize on low spreads, advanced charting tools are indispensable. These tools allow traders to analyze market trends, identify potential entry and exit points, and apply technical indicators that can inform their trading strategies.

- Real-Time Data: Access to real-time forex rates and price charts ensures that traders can react promptly to market movements.

- Technical Indicators: Indicators such as moving averages, RSI, and Fibonacci retracements can help traders make more informed decisions.

- Customizable Interfaces: Being able to tailor the charting interface to personal preferences enables traders to focus on the information most relevant to their strategies.

Automated Trading Systems

Automated trading systems, or Expert Advisors (EAs), can execute trades based on predefined criteria, ensuring that opportunities for low spread trading are not missed due to manual oversight.

- Strategy Backtesting: This feature allows traders to test how their strategies would have performed in past market conditions, helping to refine and optimize approaches for low spread trading.

Economic Calendars

An economic calendar is a crucial tool for forex traders, providing a schedule of major economic events that could affect currency values. By staying informed about upcoming events, traders can better anticipate market movements and adjust their strategies accordingly.

Educational Resources

Webinars and Seminars

The best low spread forex brokers host webinars and seminars led by experienced traders and market analysts. These sessions cover a range of topics, from the basics of forex trading to advanced strategies, including how to effectively trade with low spreads.

E-books and Guides

Comprehensive e-books and guides offer in-depth insights into forex trading mechanisms, including detailed discussions on spreads, leverage, and risk management techniques.

Video Tutorials

Video tutorials provide visual and practical guidance on using trading platforms, tools, and strategies. For beginners, videos that explain how to interpret spreads and make trades based on this information can be particularly beneficial.

Demo Accounts

Demo accounts serve as a valuable educational resource, allowing traders to practice their strategies in a simulated environment without risking real money. They offer a hands-on way to understand how spreads work and how they affect trades.

How to Calculate and Compare Forex Spreads

Understanding and calculating forex spreads are crucial skills for traders, as spreads significantly impact the cost of trading and, consequently, profitability. This guide provides a straightforward approach to calculating spreads, understanding their impact on trades, and comparing the spread offerings among different brokers, particularly focusing on finding the best low spread forex brokers.

Understanding Forex Spreads

A forex spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair. It’s essentially the broker’s fee for executing a trade and can vary widely across different currency pairs and market conditions.

Calculating the Spread

The spread can be calculated in pips, which is the smallest price move a currency pair can make. For example, if the EUR/USD pair is quoted with a bid price of 1.1050 and an ask price of 1.1052, the spread is 2 pips.

Formula:

[ \text{Spread} = \text{Ask Price} – \text{Bid Price} ]

Impact on Trades

- Trading Costs: The spread represents the immediate cost to enter a trade. A trader must overcome the spread to break even and start making a profit.

- Profitability: Lower spreads generally mean lower trading costs, making it easier to achieve profitability.

- Strategy Suitability: Some trading strategies, like scalping, require low spreads to be viable due to the thin margins on each trade.

Comparing Spread Offerings Among Brokers

When searching for the best low spread forex brokers, comparing spread offerings is essential. However, it’s important to consider not just the spread but also other factors that can affect the overall trading cost and experience.

Tips for Comparing Spreads

- Look for Average Spreads: Some brokers advertise their lowest possible spreads, but average spreads provide a more realistic idea of what you’ll pay.

- Consider Variable vs. Fixed Spreads: Variable spreads can be lower during times of high liquidity but can widen significantly during volatility. Fixed spreads are generally higher but more predictable.

- Check for Additional Fees: Some low spread brokers may compensate by charging commissions on trades. Calculate the total cost of trading to compare effectively.

- Evaluate Currency Pairs: Spreads can vary widely across different currency pairs. Consider the pairs you’re most likely to trade and compare brokers’ spreads on those pairs.

- Assess Market Conditions: Spreads are affected by market liquidity and volatility. Review how spreads change during different market conditions and news events.

Additional Considerations

- Regulation and Security: Ensure the broker is regulated by a reputable authority, offering additional security and fairness in trading.

- Platform and Tools: Access to advanced trading platforms and tools can enhance trading efficiency, potentially offsetting slightly higher spreads.

- Customer Support and Education: Especially for beginners, robust customer support and educational resources are invaluable.

Strategies for Trading with Best Low Spread Forex Brokers

Trading with low spreads can significantly reduce transaction costs, making it a coveted feature for many traders. However, to fully capitalize on low spreads, one must adopt strategies and risk management techniques suited to these conditions. This discussion explores trading strategies that benefit the most from low spreads and outlines how to manage risks effectively, aiming to maximize the advantages offered by the best low spread forex brokers.

Beneficial Trading Strategies for Best Low Spread Forex Brokers

Scalping

Scalping involves making numerous trades throughout the day, aiming for small profits from minor price changes. Low spreads are crucial for scalping as the strategy operates on thin margins. The reduced transaction costs allow scalpers to accumulate small gains into substantial profits over time.

High-Frequency Trading (HFT)

Similar to scalping, HFT relies on executing a large volume of transactions at very high speeds. Low spreads reduce the cost per trade, which is essential for the profitability of HFT strategies, where each trade’s profit potential is minimal.

Day Trading

Day traders benefit from low spreads, as they open and close multiple positions within a single trading day. Low spreads help minimize the costs associated with frequent trading, improving overall profitability.

News Trading

News traders capitalize on the volatility caused by economic news releases. Low spreads are advantageous in news trading, allowing traders to enter and exit the market more cost-effectively during periods of high volatility.

Managing Risks While Trading with Best Low Spread Forex Brokers

While low spreads can enhance trading strategies, it’s essential to implement robust risk management practices to protect against potential losses.

Use Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. This is crucial for strategies like scalping and day trading, where the high volume of trades increases the exposure to market risk.

Monitor Leverage

Leverage can magnify profits but also losses, especially in strategies that capitalize on small price movements. Manage leverage carefully, considering the size of your positions relative to your account balance.

Stay Informed

Keep abreast of market news and economic events that can cause volatility. Sudden market movements can lead to spread widening, impacting the cost-effectiveness of trading with low spreads.

Practice Discipline

Adhere strictly to your trading plan, avoiding impulsive decisions based on short-term market movements. Discipline ensures that trading strategies are executed effectively, maximizing the benefits of low spreads.

Diversify

Consider diversifying your trading strategies and not relying solely on methods that benefit from low spreads. Diversification can help manage risks associated with specific market conditions where spreads may widen.

Choosing Your Low Spread Forex Broker

Selecting a forex broker with competitive spreads is crucial for traders looking to minimize trading costs and maximize profits. However, low spreads should not be the only criterion. This step-by-step guide provides a comprehensive approach to choosing your low spread forex broker, including a checklist for evaluating brokers beyond just the spread.

Step 1: Define Your Trading Needs

Before you start looking for a broker, clearly understand your trading style, strategy, and what you need from a broker. Consider factors like the currency pairs you intend to trade, your preferred trading platform, leverage requirements, and the importance of educational and analytical tools.

Step 2: Research and Compile a List of Brokers

Start by researching and compiling a list of forex brokers known for offering low spreads. Utilize online forums, reviews, and comparison websites to find brokers that cater to your trading preferences.

Step 3: Verify Regulatory Compliance

Ensure that the brokers on your list are regulated by reputable financial authorities (e.g., FCA, CySEC, ASIC). Regulation is critical for ensuring that the broker operates under strict guidelines, providing a layer of security for your investments.

Step 4: Compare Spread Offerings

Analyze and compare the spread offerings of the brokers on your list. Look for average spreads on the major currency pairs, and consider how spreads fluctuate during different market conditions. Remember, some brokers might offer low spreads but compensate with other fees.

Step 5: Evaluate Trading Platforms and Tools

The trading platform is your primary tool for executing trades. Test the platforms offered by the brokers to ensure they are user-friendly and equipped with the necessary tools and indicators that suit your trading strategy. Many brokers offer demo accounts for this purpose.

Step 6: Assess Additional Costs

Look beyond spreads and examine other potential costs associated with trading, such as commissions, overnight financing fees (swap rates), and any account maintenance fees. Calculate the overall cost of trading to make an informed decision.

Step 7: Consider Educational and Analytical Resources

The best low spread forex brokers provide valuable educational content and analytical tools to help traders make informed decisions. Assess the quality and availability of these resources, especially if you’re a beginner.

Step 8: Review Customer Support Services

Good customer support can be invaluable, especially in resolving issues promptly. Test the responsiveness and helpfulness of the broker’s customer service team through various channels like live chat, email, and phone.

Checklist for Evaluating Brokers Beyond Just the Spread

- [ ] Regulatory compliance and security measures

- [ ] Competitive spread offerings on major and minor currency pairs

- [ ] Transparency about additional trading costs and fees

- [ ] Quality and user-friendliness of the trading platform

- [ ] Availability of necessary trading tools and indicators

- [ ] Quality and accessibility of educational materials

- [ ] Analytical resources, including market analysis and news

- [ ] Responsive and helpful customer support

- [ ] Positive reviews and testimonials from existing users

Getting Started with Your Chosen Best Low Spread Forex Brokers

Selecting a low spread forex broker is a critical step towards successful trading. Low spreads can significantly reduce your trading costs, making it easier to achieve profitability. However, beginning your journey with your chosen broker involves more than just enjoying the benefits of low spreads. This guide provides steps on opening an account, making the most of low spread trading, and highlights common pitfalls beginners should avoid.

Opening an Account

Step 1: Research and Verification

Before opening an account, ensure you’ve thoroughly researched your chosen broker. Confirm that they’re regulated by reputable authorities and check for reviews from other traders.

Step 2: Account Application

Visit the broker’s website and follow the process to apply for a new account. This typically involves filling out an online form with your personal and financial information.

Step 3: Documentation

You’ll be asked to provide identification documents for verification purposes. This usually includes a government-issued ID and proof of residence, such as a utility bill.

Step 4: Account Funding

Once your account is approved, you’ll need to deposit funds. Check the broker’s deposit methods and choose the one that’s most convenient for you. Be mindful of any associated fees or minimum deposit requirements.

Step 5: Familiarize Yourself with the Trading Platform

Spend time getting to know the trading platform. Many brokers offer tutorials or demo accounts, which are invaluable for learning how to execute trades, set stop-loss orders, and use other essential features.

Making the Most of Low Spread Trading

Leverage Educational Resources

The best low spread forex brokers offer extensive educational resources. Take advantage of tutorials, webinars, and guides to enhance your understanding of forex markets and trading strategies.

Utilize Tools and Analysis

Make full use of the trading tools and market analysis provided. These can include technical indicators, economic calendars, and news feeds, which are crucial for making informed trading decisions.

Practice Risk Management

Low spreads can encourage frequent trading, but it’s essential to practice sound risk management. Set stop-loss orders to protect against market volatility and only risk a small percentage of your account on any single trade.

Common Pitfalls to Avoid for Best Low Spread Forex Brokers

Overtrading

Low spreads can tempt traders into making too many trades. Be disciplined and only trade when it aligns with your strategy to avoid eroding your capital with transaction costs.

Neglecting a Trading Plan

Even with low spreads, trading without a plan is a common mistake. Develop a trading strategy that includes entry and exit rules, risk management techniques, and financial goals.

Ignoring Swap Rates

If you hold positions overnight, be aware of swap rates or overnight fees, which can impact profitability. These fees can sometimes offset the benefits of low spreads.

Forgetting About Additional Costs

While spreads might be low, other costs, including withdrawal fees, account inactivity fees, or platform fees, can add up. Always consider the total cost of trading with a broker.

FAQs:

- What is a Spread in Forex Trading?

- The spread is the difference between the bid and ask prices of a currency pair, representing the broker’s fee for each trade.

- Why Are Low Spreads Important in Forex Trading?

- Low spreads can significantly reduce trading costs, especially for strategies that involve frequent trading, like scalping.

- Can Spreads Affect Trading Profits?

- Yes, lower spreads mean lower trading costs, which can lead to higher net profits from trading activities.

- How Do Brokers Offer Low Spreads?

- Brokers may offer low spreads by connecting traders directly to liquidity providers or by reducing their mark-up on spreads.

- What Should I Look for in a Low Spread Forex Broker?

- Beyond low spreads, consider regulation, execution speed, platform quality, and customer support.

- Are Low Spreads Available on All Account Types?

- Not always. ECN and STP accounts typically offer lower spreads compared to standard accounts but may involve commissions.

- How Do I Calculate Forex Spreads?

- Subtract the bid price from the ask price of a currency pair to find the spread.

- Is It Possible to Trade with Zero Spread?

- Some brokers offer zero spread accounts, but these may involve commissions or other fees.

- What Trading Strategies Benefit Most from Low Spreads?

- Strategies involving frequent trading, like day trading and scalping, benefit most from low spreads due to reduced costs.

- How Can I Start Trading with a Low Spread Broker?

- Research and compare brokers, open an account that suits your trading style, and start trading with a strategy that capitalizes on low spreads.

This guide aims to educate beginners on the critical aspect of spreads in forex trading and how to select a broker that offers competitive spreads, enhancing their trading journey from the start.