Futures trading, a significant component of the financial markets, offers traders the opportunity to hedge against price fluctuations or speculate on the future prices of various assets. Understanding the fundamentals of futures trading and the critical role of brokers is essential for beginners. This introduction aims to demystify futures and outline how the best futures brokers facilitate access to the futures markets, providing the tools and support needed for effective trading.

Understanding What Futures Are

Futures contracts are standardized agreements to buy or sell a specific asset at a predetermined price on a specified future date. These contracts cover a wide range of assets, including commodities, currencies, indices, and more. Unlike direct ownership of the asset, futures allow traders to speculate on the asset’s future price movement without physically holding the asset.

Basics of Futures Trading

Leveraged Products

Futures are leveraged products, meaning traders can control a large contract value with a relatively small amount of capital (the margin). While leverage can amplify gains, it also increases the potential for significant losses.

Long and Short Positions

Traders can take long positions (buying contracts with the expectation that prices will rise) or short positions (selling contracts with the expectation of falling prices), offering flexibility to profit from both rising and falling markets.

Mark-to-Market and Margin Calls

Futures contracts are marked to market daily, meaning the profits or losses from the contracts are settled at the end of each trading day. Traders must maintain a minimum margin level in their accounts; failing to meet margin requirements can lead to a margin call, where the trader must deposit additional funds.

Expiry and Settlement

Futures contracts have specific expiration dates. As the expiry approaches, traders must decide whether to roll over the contract to a new expiry, close the position, or let the contract settle (which can involve physical delivery for some commodities).

The Role of Brokers in the Futures Market

Access and Execution

The best futures brokers provide access to major futures exchanges around the world, offering a platform for executing trades efficiently. They ensure that orders are executed promptly at competitive prices.

Tools and Resources

Top brokers offer sophisticated trading platforms equipped with advanced charting tools, market data, and analysis resources to help traders make informed decisions. Many also provide educational materials tailored to futures trading.

Support and Guidance

For beginners, navigating the futures market can be challenging. The best futures brokers offer comprehensive customer support, including guidance on understanding market dynamics and managing risks effectively.

Regulatory Compliance

Reputable futures brokers are regulated by financial authorities, ensuring adherence to strict financial standards and offering traders a level of protection.

Essential Features of Top Futures Brokers for New Traders

For new traders venturing into the futures market, selecting a broker that aligns with their needs is crucial. The top futures brokers for beginners offer a combination of accessibility, educational resources, sophisticated trading tools, and robust customer support. Understanding the essential features to look for can help novices make informed decisions, ensuring a supportive environment for their trading journey. Here’s what new traders should consider when choosing a futures broker.

Comprehensive Educational Resources

Beginner-Friendly Materials

Top brokers provide extensive educational resources tailored to beginners, including tutorials, articles, webinars, and glossaries that cover futures trading basics, market analysis, and risk management strategies.

Ongoing Learning Opportunities

Look for brokers that offer advanced learning materials and regular market insights to support continuous education as your trading skills evolve.

User-Friendly Trading Platform

Intuitive Interface

The trading platform should be intuitive and easy to navigate, even for those with no prior trading experience, ensuring that new traders can execute trades confidently and efficiently.

Advanced Trading Tools

While simplicity is important, the platform should also offer advanced trading tools and features, such as real-time charts, technical indicators, and analytical tools, to facilitate effective market analysis and decision-making.

Demo Account

A demo or practice account is invaluable for beginners, allowing them to familiarize themselves with the trading platform and practice trading strategies in a risk-free environment using virtual funds.

Robust Customer Support

Accessibility

The broker should provide easy access to customer support through multiple channels, including phone, email, and live chat, ensuring that help is readily available when needed.

Knowledgeable Support Team

Support staff should have a deep understanding of futures trading and be able to provide timely and helpful assistance on a wide range of issues, from platform technicalities to trading queries.

Competitive Fees and Transparency

Clear Fee Structure

Understanding the cost of trading is essential. The best futures brokers offer a transparent fee structure, clearly outlining any commissions, spreads, and additional fees, such as for account maintenance or inactivity.

Competitive Pricing

While fees should not be the sole determining factor, competitive pricing can make a significant difference in your trading costs. Compare the fees of different brokers, taking into account the value of the overall services they offer.

Regulation and Security

Regulatory Compliance

Ensure the broker is regulated by reputable financial authorities, such as the Commodity Futures Trading Commission (CFTC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. Regulation provides a layer of security and trust, ensuring the broker adheres to strict industry standards.

Security Measures

The broker should employ advanced security measures to protect your personal and financial information, including data encryption and secure login processes.

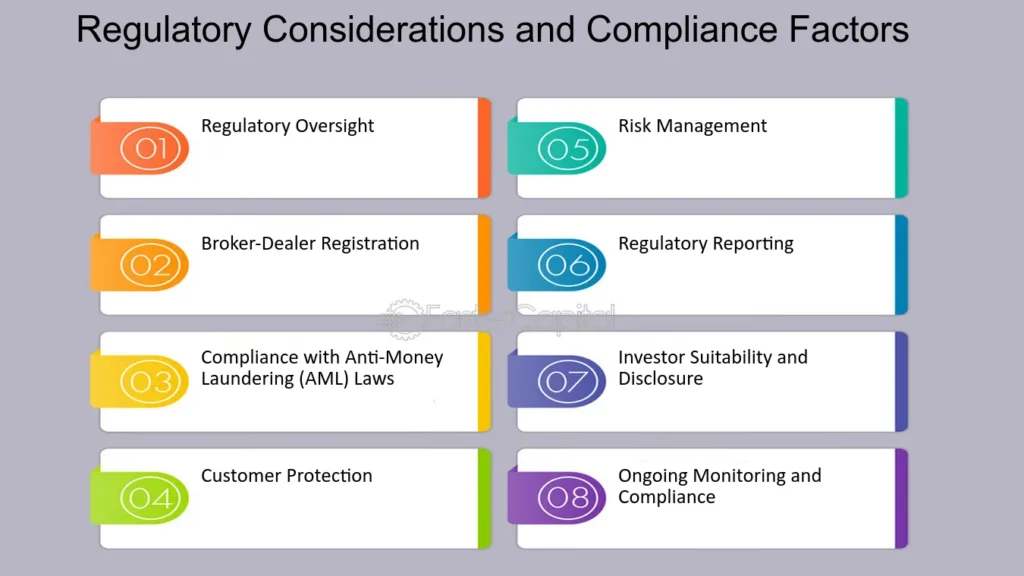

Regulatory Considerations for Futures Brokers

When venturing into futures trading, the importance of selecting a broker that adheres to strict regulatory standards cannot be overstated. Regulation ensures that trading activities are conducted fairly and transparently, providing a level of security and trust for traders. In the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) are the primary regulatory bodies overseeing futures brokers. This section delves into why choosing a broker regulated by such authorities is crucial for traders, particularly when searching for the best futures brokers.

The Role of CFTC and NFA

Commodity Futures Trading Commission (CFTC)

The CFTC is an independent federal agency established to protect market participants and the public from fraud, manipulation, and abusive practices in the commodity, futures, and options markets. Its oversight ensures that the futures market is transparent, competitive, and financially sound.

National Futures Association (NFA)

The NFA is a self-regulatory organization for the U.S. derivatives industry, including on-exchange traded futures. It develops rules, programs, and services to safeguard market integrity, protect investors, and help members meet regulatory responsibilities. Membership with the NFA is mandatory for firms and individuals conducting futures trading activities with the public.

Importance of Choosing a Regulated Broker

Protection Against Fraud and Manipulation

Regulated brokers are required to adhere to a set of guidelines and standards that protect traders from fraudulent activities and market manipulation. This includes rigorous audit processes, financial reporting, and transparency, ensuring that your trading experience is secure and fair.

Financial Integrity and Security

The best futures brokers regulated by the CFTC and NFA are subject to strict financial standards, including capital adequacy requirements. This ensures that brokers have sufficient financial resources to withstand market volatility and protect traders’ funds.

Segregation of Funds

Regulation mandates that brokers keep clients’ funds in segregated accounts, separate from the firm’s operating funds. This crucial practice protects traders’ assets in the event of the broker’s bankruptcy or financial troubles.

Dispute Resolution

Regulated brokers are part of a structured dispute resolution process. If traders have complaints or disputes, they have recourse to an impartial body to seek resolution, offering an additional layer of protection.

Market Integrity

Regulatory oversight ensures that futures markets operate smoothly, with reduced risk of systemic failures. It contributes to the overall health and integrity of the financial markets, providing a safer environment for all participants.

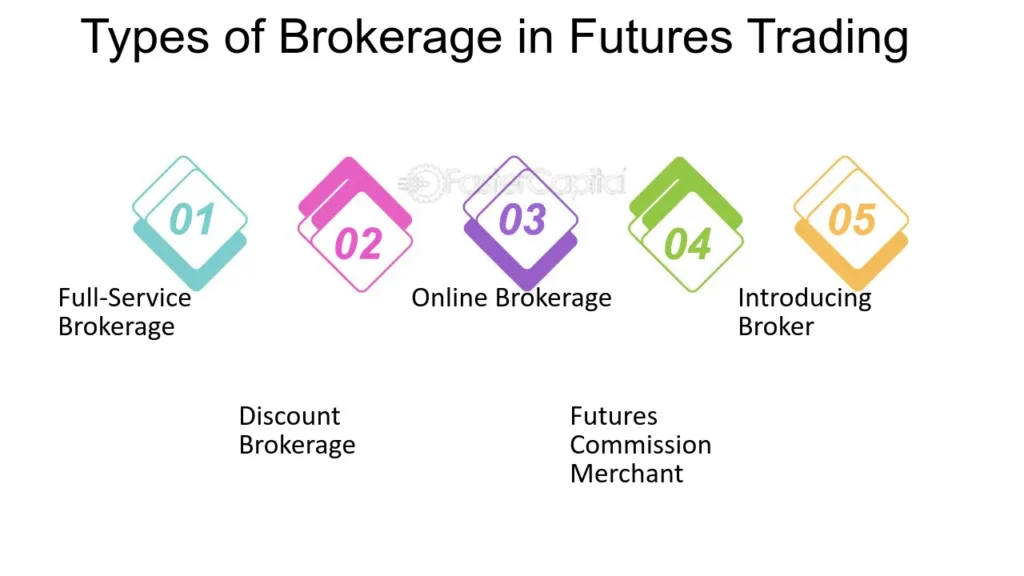

Different Types of Futures Trading Accounts

Futures trading offers a range of opportunities for investors to speculate on or hedge against future price movements of various assets. However, the diversity in trading objectives and strategies necessitates different types of futures trading accounts. Understanding these options and selecting the right one is crucial for aligning with your trading goals and risk tolerance. This exploration into the various account types available for futures trading will guide you in making an informed choice, especially when working with the best futures brokers.

Standard Trading Account

The standard trading account is the most common type available for futures traders. It offers access to major futures exchanges and a wide range of futures contracts, including commodities, currencies, and indices.

- Suitability: Ideal for individual traders with a general interest in futures markets.

- Features: Provides a broad array of trading tools, charts, and indicators necessary for analyzing and executing trades.

Individual Retirement Account (IRA) for Futures Trading

An IRA for futures trading allows investors to engage in futures trading within a retirement account, offering potential tax advantages.

- Suitability: Best for traders looking to incorporate futures trading into their long-term retirement planning.

- Considerations: Not all brokers offer futures trading in IRAs, and there may be restrictions on the types of trades or level of leverage allowed.

Managed Futures Account

Managed futures accounts are handled by professional money managers who make trading decisions on behalf of their clients, based on the clients’ risk tolerance and investment goals.

- Suitability: Ideal for investors who prefer a hands-off approach or lack the time/expertise to trade futures themselves.

- Benefits: Access to professional trading strategies and diversification of investment portfolio.

Margined or Leverage Account

These accounts allow traders to trade futures contracts by paying a fraction of the total contract value, providing the potential to magnify returns. However, leverage also increases the risk of losses.

- Suitability: Suitable for experienced traders who understand the risks associated with leveraged trading.

- Features: Requires maintaining a margin balance as collateral against the leveraged position.

Day Trading Account

Day trading accounts are designed for traders who execute a high volume of trades within a single trading day, aiming to capitalize on short-term market movements.

- Suitability: Best for active traders with the ability to monitor markets and make quick decisions.

- Considerations: These accounts may be subject to specific regulatory requirements, including minimum equity balances.

Simulated or Demo Account

Simulated accounts provide a risk-free environment for beginners to practice trading or for experienced traders to test new strategies without using real money.

- Suitability: Excellent for all levels of traders for education, practice, and strategy development.

- Benefits: Offers a realistic trading experience, helping traders gain confidence before transitioning to live trading.

Choosing the Right Account for You

When selecting a futures trading account, consider your trading experience, risk tolerance, investment goals, and the level of involvement you desire in trading decisions. Additionally, evaluate the features, tools, and support offered by brokers to ensure they meet your specific needs. Partnering with one of the best futures brokers that offer the account type aligned with your trading objectives can significantly enhance your trading experience and potential for success.

Understanding Fees and Commissions in Futures Trading

Navigating the costs associated with futures trading is essential for every trader, from novices to seasoned market participants. The fees and commissions can significantly impact your overall trading profitability. This guide provides a breakdown of the typical fees associated with futures trading, including commission rates and other potential charges. Knowing these costs will help you make informed decisions when selecting the best futures brokers and managing your trading activities.

Commission Rates

Commissions are fees charged by brokers for executing trades on behalf of their clients. The rates can vary widely among brokers, influenced by factors such as the level of service provided, the trading platform used, and the volume of trades.

- Per Contract: Most futures brokers charge commissions on a per-contract basis. This means you pay a set fee for each contract bought or sold.

- Tiered Pricing: Some brokers offer tiered pricing structures based on monthly trading volume, where rates decrease as the number of contracts traded increases.

Other Trading Charges

Exchange and Regulatory Fees

These are fees imposed by the futures exchanges and regulatory bodies, passed directly to traders. They are generally fixed per contract and vary by exchange and product.

Clearing and Settlement Fees

Clearing fees are charged by clearinghouses for processing trades and ensuring the financial integrity of transactions. Settlement fees cover the costs associated with settling the trades at the end of each trading day.

Data and Platform Fees

Brokers may charge fees for access to trading platforms, real-time market data, and premium analytical tools. While some brokers offer free platform access, advanced features might require a subscription.

Inactivity and Maintenance Fees

Some brokers charge monthly or quarterly fees if your account is inactive or doesn’t meet minimum usage requirements. Account maintenance fees may also apply to cover the costs of providing services.

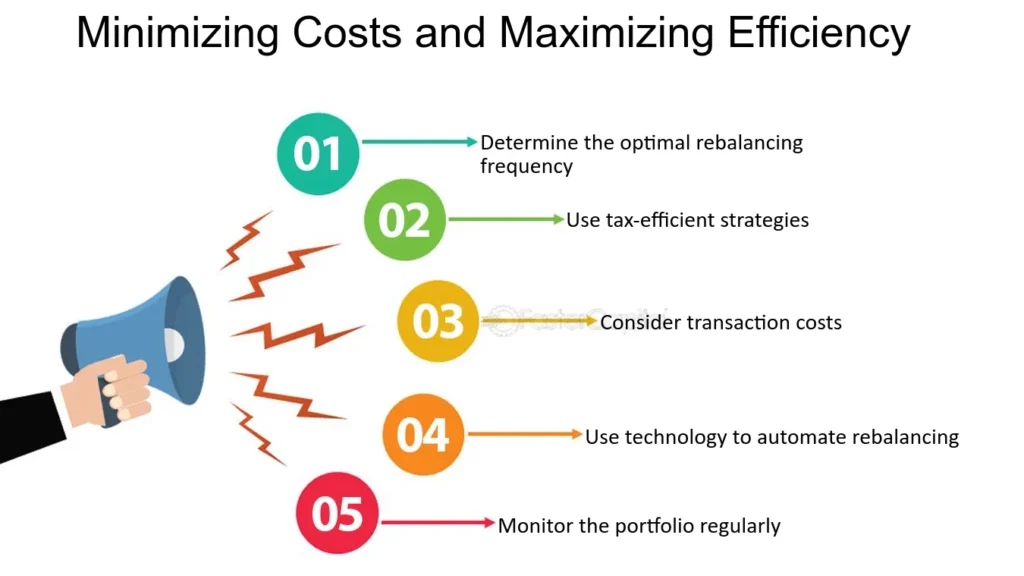

Tips for Managing and Minimizing Trading Costs

Compare Brokers

Shop around and compare the fee structures of different futures brokers. Consider all potential costs, not just the commission rates.

Understand Your Trading Style

Your trading frequency and preferred platforms/tools can influence your costs. Choose a broker whose fee structure aligns with your trading style.

Negotiate Rates

If you’re a high-volume trader, some brokers may be willing to negotiate lower commission rates or offer discounts on platform fees.

Utilize Free Resources

Take advantage of free educational materials, market analysis, and trading tools provided by brokers. This can help you avoid additional costs for third-party services.

Monitor Account Activity

Keep an eye on your account activity to avoid inactivity or maintenance fees. Ensure you’re meeting any minimum trade or balance requirements.

Choosing the Best Futures Brokers Trading Platform

Selecting an appropriate futures trading platform is a crucial decision for any trader, especially for beginners who require platforms that are not only powerful and efficient but also user-friendly and supportive of their learning curve. The best futures brokers offer platforms that cater to the needs of both novice and experienced traders, providing a range of tools and features to facilitate successful trading. This guide compares popular trading platforms for futures trading, highlighting key features beneficial for beginners.

Key Features to Look for in a Futures Trading Platform

Ease of Use

A platform’s user interface should be intuitive, making it easy for beginners to navigate, execute trades, and access essential information without overwhelming complexity.

Educational Resources

The best platforms include integrated educational resources such as tutorials, webinars, and articles that help beginners understand futures trading fundamentals and platform functionalities.

Analytical Tools

Access to comprehensive charting tools, technical indicators, and real-time market data is essential for making informed trading decisions. Beginners should look for platforms that offer a good balance between depth of analysis and simplicity.

Demo Accounts

Demo or simulated trading accounts allow beginners to practice trading strategies in a risk-free environment, using virtual funds while accessing real market data and conditions.

Customization

The ability to customize the trading environment, including layouts, charts, and watchlists, can help beginners focus on the information most relevant to their trading strategy.

Mobile Trading

A mobile trading app that mirrors the desktop experience ensures that beginners can monitor their positions and execute trades anytime, anywhere, which is crucial in the fast-paced futures market.

Customer Support

Robust customer support, including live chat, email, and phone support, is vital, especially for beginners who may need assistance navigating the platform or understanding trading concepts.

Popular Trading Platforms for Best Futures Brokers Trading

MetaTrader 5 (MT5)

MT5 is widely regarded for its advanced trading and analytical technologies, offering more technical indicators, graphical objects, and timeframe options than its predecessor, MetaTrader 4. Its support for trading stocks, forex, and futures within a single platform makes it a versatile choice.

NinjaTrader

NinjaTrader is favored for its advanced charting capabilities, simulation tools, and custom indicators. It offers a powerful yet accessible platform for futures trading, with extensive educational resources and a supportive community.

TradeStation

TradeStation combines a robust trading platform with high-quality market data and fast execution speeds. It offers customizable charting, back-testing capabilities, and a wealth of educational materials, making it suitable for beginners and experienced traders alike.

thinkorswim by TD Ameritrade

thinkorswim provides a comprehensive trading platform with professional-level analytics, real-time data, a customizable interface, and access to a range of assets, including futures. Its educational resources and trading simulator are particularly beneficial for beginners.

Leveraging Educational Resources for Futures Trading

For new futures traders, the learning curve can be steep, but it’s made considerably smoother with access to high-quality educational resources. The best futures brokers understand this necessity and go to great lengths to provide comprehensive educational materials tailored to traders at all levels of expertise. These resources, ranging from basic tutorials to in-depth analyses, play a crucial role in a trader’s development and success in the futures market. This guide highlights the importance of leveraging broker-provided education and outlines what to look for in these resources.

Importance of Best Futures Brokers Education

Building a Strong Foundation

Futures trading involves complex instruments and concepts that can be challenging for newcomers. Broker-provided educational resources offer a structured way to build a strong foundational knowledge of how futures markets work, including contract specifications, margin requirements, and risk management strategies.

Enhancing Trading Strategies

Beyond the basics, educational materials can delve into advanced trading strategies, technical analysis, and market psychology. These insights are invaluable for developing and refining trading approaches that align with market conditions and personal trading goals.

Staying Informed on Market Dynamics

The futures market is dynamic, influenced by a myriad of factors including economic indicators, geopolitical events, and market sentiment. Educational resources that cover these topics help traders stay informed and make more educated decisions.

Risk Management

One of the key aspects of successful futures trading is effective risk management. Tutorials and guides focusing on risk management techniques, such as the use of stop-loss orders and position sizing, are essential for protecting your capital.

Key Features of Quality Educational Resources

Comprehensive Coverage

Look for brokers that offer a wide range of educational content covering all aspects of futures trading, from introductory topics to advanced concepts. This ensures you have access to information relevant to your level of expertise and trading interests.

Accessibility and Format

The best futures brokers provide education in various formats to suit different learning preferences, including written articles, video tutorials, webinars, and interactive courses. Accessibility is also crucial; resources should be easily accessible online, preferably directly through the trading platform.

Practical Application

Resources that include practical examples, case studies, or demo trading opportunities allow you to apply what you’ve learned in a risk-free environment. This hands-on experience is critical for reinforcing theoretical knowledge.

Regular Updates

Given the fast-paced nature of the futures market, educational content should be regularly updated to reflect the latest market trends, strategies, and regulatory changes. This ensures the information remains relevant and valuable.

Expertise and Credibility

Educational materials should be prepared by experienced traders or industry experts with a proven track record. This ensures the advice and strategies shared are reliable and actionable.

The Benefits of Demo Accounts in Best Futures Brokers Trading

Demo accounts are an indispensable tool offered by the best futures brokers, designed to simulate real trading environments without the risk of financial loss. For newcomers to futures trading, these accounts provide a safe space to learn the ropes, test strategies, and gain confidence before committing to live trades. This guide explores the myriad benefits of practicing with demo accounts and how they can prepare you for the complexities of real trading scenarios.

Risk-Free Learning Environment

Demo accounts allow you to trade futures contracts with virtual money, offering a risk-free environment to explore the futures market. This setup is invaluable for beginners, providing the opportunity to:

- Understand Market Mechanics: Learn how futures contracts work, including buying and selling, without the pressure of real financial stakes.

- Familiarize With Trading Platforms: Get to know the functionalities, tools, and features of the trading platform provided by your broker.

Strategy Development and Testing

Developing a solid trading strategy is crucial for success in futures trading. Demo accounts offer the perfect platform to:

- Test Trading Strategies: Experiment with different approaches to find what works best for you, without risking actual capital.

- Refine Techniques: Fine-tune your strategies based on the outcomes of your trades in a simulated environment.

Practice Risk Management

Effective risk management is essential in trading, and demo accounts provide a conducive environment to practice and understand risk management tools, such as:

- Stop-Loss and Take-Profit Orders: Learn how to set and adjust these orders to manage risks and protect potential profits.

- Position Sizing: Practice determining the appropriate trade size relative to your virtual account balance to mimic managing real capital.

Building Confidence

Confidence plays a significant role in trading decisions. By trading in a demo account, you can:

- Gain Confidence: Build up your confidence in making trade decisions and executing orders without the fear of making costly mistakes.

- Reduce Emotional Trading: Practice staying disciplined and sticking to your trading plan, minimizing emotional responses to market movements.

Transition to Live Trading

Demo accounts are a stepping stone to live trading, helping you to:

- Understand Real Trading Dynamics: Although demo accounts simulate real market conditions, experiencing the emotional aspect of using real money can differ. Practicing in a demo account helps bridge this gap.

- Develop a Trading Routine: Establish and refine a daily trading routine, including market analysis, trade execution, and review, which can be seamlessly transitioned into real trading.

Choosing the Right Broker

When selecting among the best futures brokers, consider those offering demo accounts with:

- Realistic Market Conditions: The more realistic the trading conditions of the demo account, the better prepared you’ll be for live trading.

- Comprehensive Educational Resources: Access to tutorials, webinars, and guides enhances the learning experience.

- Easy Transition to Live Accounts: Look for brokers that make it straightforward to transition from demo to live trading, ideally with the same platform interface.

Making Your First Best Futures Brokers Trade

Embarking on your first futures trade can be an exhilarating yet daunting process. With proper planning and execution, along with effective risk management, you can navigate this complex market. This guide provides essential steps and tips for making your first futures trade, helping you to avoid common pitfalls and ensuring a smoother experience with the best futures brokers.

Planning Your First Trade

Choose a Reputable Broker

Start by selecting one of the best futures brokers, ensuring they are regulated, offer a user-friendly trading platform, and provide robust educational resources and customer support.

Educate Yourself

Before entering the market, familiarize yourself with the basics of futures trading, including how contracts work, market terminology, and the underlying assets you’re interested in trading.

Practice with a Demo Account

Utilize a demo account to simulate trading conditions. This practice allows you to test strategies, get comfortable with the trading platform, and understand market dynamics without risking real money.

Develop a Trading Plan

A comprehensive trading plan should outline your trading goals, risk tolerance, entry and exit strategies, and criteria for selecting contracts. Stick to your plan to maintain discipline and focus.

Executing Your Trade for Best Futures Brokers

Start Small

For your first live trade, consider starting small. This approach helps manage risk while you gain real-market experience.

Monitor the Market

Keep abreast of market trends, news, and economic indicators that could impact the futures market. Use this information to make informed decisions.

Choose Your Contract

Select a futures contract that aligns with your market analysis and trading plan. Pay attention to the contract size, expiration date, and underlying asset.

Place Your Order

Decide whether you’re taking a long (buying) or short (selling) position based on your market analysis. Use the trading platform to place your order, specifying the type (e.g., market, limit) and any conditions.

Set Stop-Loss and Take-Profit Orders

To manage risk effectively, set stop-loss orders to limit potential losses and take-profit orders to secure gains at predefined levels.

Risk Management Tips for Best Futures Brokers

Use Leverage Cautiously

Leverage can amplify both gains and losses. Understand how leverage works and use it judiciously, considering your risk tolerance.

Monitor and Adjust Your Positions

Regularly review your open positions and market conditions. Be prepared to adjust your strategies as needed to respond to market movements.

Keep Emotions in Check

Avoid emotional trading by adhering to your trading plan. Don’t let fear or greed drive your decisions.

Avoiding Common Mistakes for Best Futures Brokers

Overtrading

Resist the temptation to trade too frequently. Focus on quality trades that align with your strategy rather than the quantity of trades.

Ignoring Transaction Costs

Account for all associated costs, including commissions and fees, in your trading strategy. These can impact your overall profitability.

Neglecting Education

Continuously seek to expand your knowledge. Leverage the educational resources provided by your broker to stay informed about market developments and trading strategies.

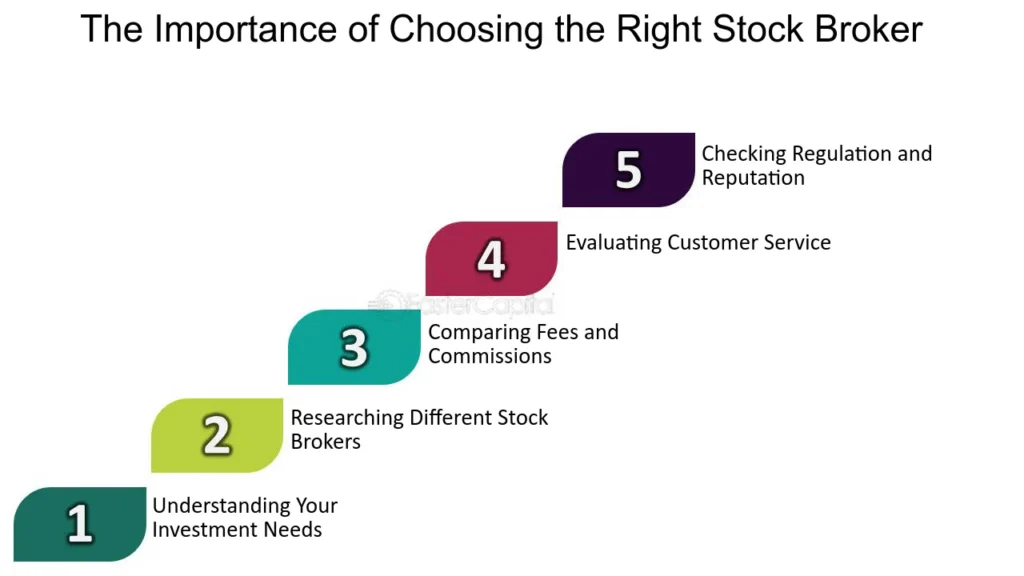

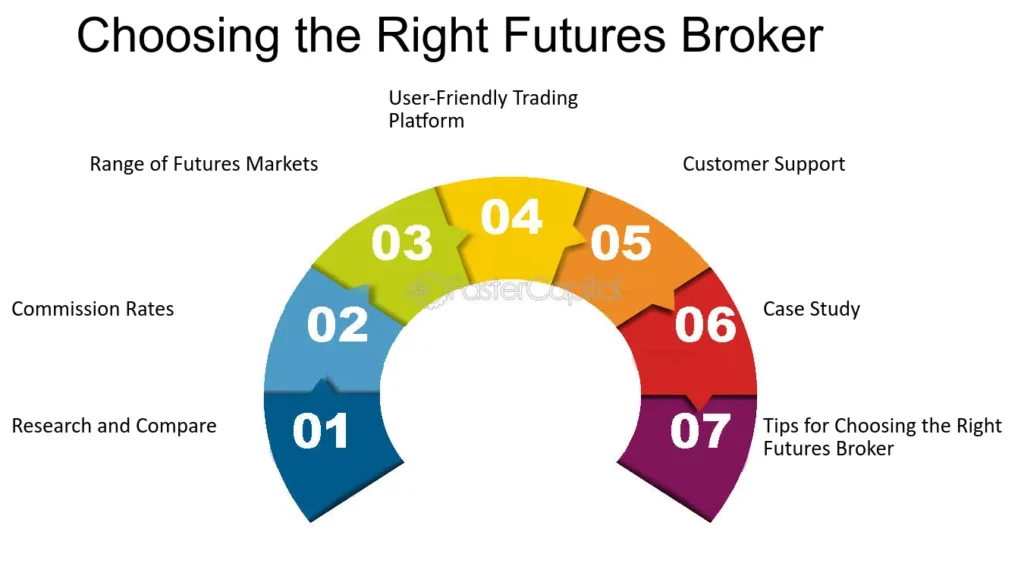

Selecting Your First Best Futures Brokers

Choosing your first futures broker is a crucial decision that lays the foundation for your trading journey. For beginners, the right broker can significantly enhance the learning experience, offering the necessary tools, resources, and support to navigate the futures market. This comprehensive guide provides criteria for evaluating and selecting a futures broker that meets beginner needs and includes recommendations based on in-depth analysis and reviews.

Criteria for Evaluating Futures Brokers

Regulatory Compliance

The foremost criterion is ensuring the broker is regulated by reputable authorities, such as the Commodity Futures Trading Commission (CFTC) in the U.S., the Financial Conduct Authority (FCA) in the U.K., or equivalent bodies in other regions. Regulation ensures the broker adheres to stringent financial and ethical standards, offering traders a level of protection and security.

Trading Platform

The trading platform is your primary tool for market access. Look for platforms that are intuitive yet offer robust analysis tools, real-time data, and seamless execution. A good platform should cater to the needs of beginners without overwhelming them with complexity.

Educational Resources and Support

Top futures brokers for beginners offer extensive educational materials, including webinars, tutorials, guides, and demo accounts. These resources are invaluable for learning the basics of futures trading and developing effective strategies. Additionally, responsive customer support is essential for addressing queries and technical issues.

Account Types and Minimum Deposits

Beginners might not be ready to commit large sums of money upfront. Therefore, a broker that offers low minimum deposit requirements and various account types, including those with lower risk levels suitable for beginners, can be more appealing.

Fees and Commissions

Understanding the cost structure is crucial as fees and commissions can eat into your trading profits. Opt for brokers with transparent pricing, competitive commissions, and low or no hidden fees. Also, be aware of margin requirements and the cost of leverage, as these can significantly affect your trading capital.

Market Access

Access to a wide range of futures contracts across different markets (commodities, indices, currencies, etc.) allows for diversified trading strategies. Brokers providing comprehensive market access give traders the flexibility to explore various trading opportunities.

Recommended Best Futures Brokers for Beginners

TD Ameritrade

TD Ameritrade is highly regarded for its comprehensive educational offerings, user-friendly trading platforms (including thinkorswim), and extensive market research. It’s regulated by top-tier authorities, making it a secure option for beginners.

E*TRADE

E*TRADE offers a combination of advanced tools and a vast array of educational resources, making it suitable for beginners. Its trading platform is intuitive, and it provides access to a wide range of futures products.

Interactive Brokers

Known for its vast market access and depth of available instruments, Interactive Brokers caters to beginners with its extensive educational library, competitive pricing, and robust trading platform.

Charles Schwab

Charles Schwab stands out for its trader development programs, quality customer service, and robust trading tools. It’s an excellent choice for beginners looking for comprehensive support and a wide range of trading resources.

FAQs:

- What Are Futures Contracts?

- Futures contracts are agreements to buy or sell a particular asset at a predetermined price at a specific time in the future.

- Why Is It Important for Beginners to Choose the Right Futures Broker?

- The right broker can provide the necessary educational resources, trading tools, and support to help beginners navigate the complexities of futures trading.

- What Types of Fees Are Associated with Futures Trading?

- Traders might encounter commissions, exchange fees, and other charges that can vary widely among brokers.

- How Are Futures Brokers Regulated?

- In the US, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) regulate futures brokers, ensuring financial integrity and trader protection.

- Can I Start Trading Futures with a Small Investment?

- Yes, some brokers offer accounts with low minimum deposit requirements, but it’s essential to understand the high risk associated with leveraged products like futures.

- How Do I Open a Futures Trading Account?

- Choose a regulated broker, complete their application process, submit the required documentation, and deposit funds to start trading.

- Why Should I Use a Demo Account Before Trading Futures?

- Demo accounts allow you to practice trading strategies and get familiar with the trading platform without risking real money.

- What Should I Look for in a Futures Trading Platform?

- Essential features include real-time data, robust analytical tools, educational content, and user-friendly interface, especially for beginners.

- How Can I Ensure My Futures Broker Is Trustworthy?

- Check their regulatory status, review user testimonials, and assess their transparency regarding fees and trading conditions.

- When Is the Right Time to Transition from Demo to Live Trading?

- Move to live trading when you’re comfortable with the platform, have tested your strategies in different market conditions, and understand the risks involved in futures trading.